Europe’s Best Online Banks for Expats and Travelers

Image Source: unsplash

If you move around Europe or plan to settle in a new country, you want banking that works wherever you go. Online banks give you this freedom, and more and more people use them. Eurostat reports that 59% of European internet users now rely on online banking, showing just how popular it has become in Europe. You probably need simple online account opening, multi-currency features, and low fees. Many expats and travelers look for online banks with easy global access, strong customer support, and flexible options. The Best online banks in Europe help you manage your money on the move and keep things stress-free.

Key Takeaways

- Online banks in Europe offer easy account opening, multi-currency support, and low fees, making them ideal for expats and travelers.

- Top banks like Revolut, N26, Wise, and Monzo provide features such as free ATM withdrawals, budgeting tools, and strong security.

- Choose a bank based on your travel habits, currency needs, and fee preferences to get the best fit for your lifestyle.

- Prepare your ID and documents before applying to speed up account opening and avoid delays.

- Use online banking apps to manage money on the go, track spending, and keep your accounts secure with features like two-factor authentication.

Best Online Banks in Europe

Image Source: pexels

Quick List

If you want to find the best online banks in europe, you have many great choices. Here are the top online banks that expats and travelers in europe often pick:

- Revolut

- N26

- Wise

- Monzo

- Bunq

- Starling Bank

- Tomorrow

- Monese

These banks make it easy for you to open an account online, manage your money in different countries, and spend in many currencies. You can use their apps anywhere in europe, so you always have control of your money.

Key Features

You probably want to know what makes each of these online banks special. The best online banks in europe stand out because they offer features that fit your lifestyle. Take a look at this table to compare the main options:

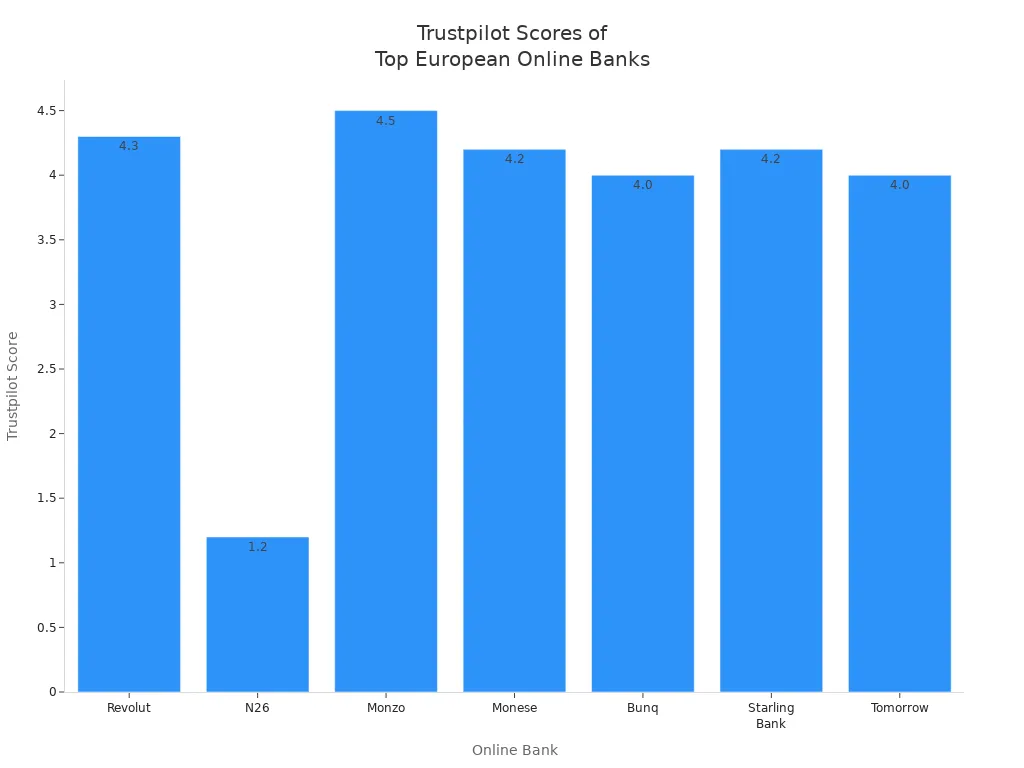

| Online Bank | Key Features | Best For | Trustpilot Score |

|---|---|---|---|

| Revolut | Multi-currency accounts, 24/7 support, joint and under 18 accounts, interest | Multi-currency spending | 4.3 |

| N26 | Multiple account plans, virtual card, 24/7 online support, free ATM withdrawals | Spending money in the eurozone | 1.2 |

| Monzo | Automated bill splitting, custom savings Pots, spending insights, interest | Flexible digital account options | 4.5 |

| Monese | Accounts across EEA, budgeting tools, linked Avios and PayPal, contactless card | Budgeting and spending insights | 4.2 |

| Bunq | Quick account opening, multi-country account details, interest on savings | Receiving money in multiple countries | 4.0 |

| Starling Bank | Spending management app, Easy Saver account, money organisation tools | Managing and organising money | 4.2 |

| Tomorrow | Free Visa debit card, cash deposits at partner stores, sustainable banking | Sustainable banking | 4.0 |

You can see that each online bank has its own strengths. Revolut is great if you need to spend in many currencies. N26 works well if you spend a lot in the eurozone. Monzo and Monese help you with budgeting and flexible accounts. Bunq gives you account details for different countries. Starling Bank is strong for money management. Tomorrow is perfect if you care about sustainability.

If you want even more flexibility, Wise is another top choice. Wise is not a bank, but it lets you hold and spend over 50 currencies. You get local bank details in several countries, which is very useful if you work or travel across europe.

When you look for the best online banks, think about what you need most. Do you want low fees, easy account opening, or strong multi-currency support? The best online banks in europe give you all these options, so you can pick the one that fits your life.

What Makes a Bank Ideal for Expats

Image Source: pexels

Account Opening

When you move to a new country in Europe, you want an online bank that makes account opening easy. Some banks ask for a lot of documents, like a valid ID, proof of address, and sometimes a local tax number. You may also need a local phone number for verification. Many online banks in Europe let you open an account with just your ID and a selfie. This is much faster than traditional banks. Some banks, like those in Georgia or the Crown Dependencies, offer remote account opening for expats. You can often finish the process online without visiting a branch. Still, always check the requirements because they can change by country and bank.

Tip: Prepare your documents before you start the online application. This helps you avoid delays or denials.

Multi-Currency

If you travel or work across Europe, you need an online bank with strong multi-currency support. Wise lets you hold money in over 50 currencies and gives you local bank details in several countries. Revolut and Monese also offer multi-currency accounts, but Wise stands out for international transactions. N26 gives you euro accounts in many countries and good exchange rates. With these online banks, you can spend, send, and receive money in different currencies without high fees.

Fees

Nobody likes hidden fees. Traditional banks in Europe often charge $30 or more for international transfers, plus extra costs for currency exchange. Online banks usually have lower fees. For example, online providers like Wise charge between 0.4% and 2% of the transfer amount. SEPA transfers within Europe are often as cheap as local transfers. Always check the fee table before you choose an online bank, so you know what to expect.

| Provider Type | Typical International Transfer Fees |

|---|---|

| Traditional Banks | $30+ per transfer, 5-7% exchange margin |

| Online Providers | 0.4% - 2% of amount, low fixed fees |

| SEPA Transfers | Often free or same as local transfer |

ATM Access

You want to get cash easily when you travel in Europe. Online banks like Revolut give you $200 per month in free ATM withdrawals. N26 offers three free withdrawals each month in the eurozone. Monzo lets you withdraw cash for free in the EEA. Wise gives you two free ATM withdrawals up to $100 per month. After you reach the limit, small fees apply. Always check your online bank’s ATM policy before you travel.

App Experience

A good online banking app makes life easier. You want an app that is fast, reliable, and easy to use. Revolut and Bunq have top-rated apps in Europe. These apps help you manage your money, track spending, and get instant notifications. Forrester’s review found that Revolut’s app is one of the best for usability and reliability. You can open accounts, send money, and control your cards all from your phone. This is why so many expats in Europe choose online banks for their daily needs.

Comparison Table

Account Requirements

When you want to open an online bank account in Europe, you need to know what documents to prepare. Most online banks ask for a valid passport or ID card and proof of address. Some banks may also want a signature or a selfie for security. If you are a resident, you usually need to show a local address. Non-residents face more rules, and some banks only accept people who live in certain countries. The table below shows what you might need:

| Applicant Type | Residency Needed | Documents Needed | Extra Steps | Initial Deposit (USD) |

|---|---|---|---|---|

| Resident (foreign national) | Yes (local address) | Passport/ID, proof of address, signature | Student proof, tax notice | $0 - $330 |

| Non-resident | Often required | Passport/ID, proof of address, signature | Residence permit, job proof | $0 - $330 |

| Undocumented | Harder to open | Photo ID, proof of address | Not always accepted | $0 - $330 |

Tip: Always check your online bank’s website for the latest rules before you start.

Currency Support

If you travel or work in different countries, you want an online bank that lets you use many currencies. Wise stands out because you can hold, send, and spend over 40 currencies at once. You also get local bank details in 10 currencies. Other online banks like N26 and bunq offer multi-currency features, but Wise gives you the most options. This makes it easy to pay or get paid in the currency you need.

Fees and Access

Online banks often have lower fees than traditional banks. You may pay a small monthly fee, but many accounts are free if you meet simple rules. International transfers with online banks like Wise cost between 0.4% and 2% of the amount. Some banks let you withdraw cash for free at ATMs, but others charge after a limit. Here is a quick look:

| Bank | Monthly Fee (USD) | International Transfer Fee | Free ATM Withdrawals | Unique Perks |

|---|---|---|---|---|

| Wise | $0 | 0.4% - 2% | 2x/month up to $100 | 40+ currencies, local details |

| N26 | $0 - $10 | Low, varies by plan | 3x/month (eurozone) | Virtual card, budgeting |

| Revolut | $0 - $17 | Low, varies by plan | $200/month | Crypto, stocks, junior accounts |

| Bunq | $3 - $20 | Low, varies by plan | 10x/month | Eco-friendly, multi-country |

| Monzo | $0 | Low, varies by plan | Free in EEA | Pots, spending insights |

You can see that online banks give you more freedom and lower costs, especially if you travel often.

Bank Reviews

Revolut

Revolut stands out as one of the best online banks for expats and travelers. You can open an account quickly with just your ID and a selfie. The app lets you hold and exchange 36 currencies, which is perfect if you travel often or get paid in different countries. You get competitive exchange rates during the week, but watch out for a 1% fee on weekends or for exotic currencies.

Advantages:

- All-in-one platform for currency exchange, budgeting, and even investments.

- Instant, free transfers between Revolut users worldwide.

- Multiple card options, including virtual cards for extra security.

- Travel perks like insurance and airport lounge access on premium plans.

- Advanced budgeting tools and spending analytics.

Disadvantages:

- Free plan has low limits for spending and ATM withdrawals. You pay fees if you go over.

- Some features only come with paid subscriptions, which can cost up to $20 per month.

- Customer service is mostly in-app chat, and some users report slow responses.

- Account freezes can happen during compliance checks.

Tip: If you travel a lot, consider a paid plan for better limits and travel perks.

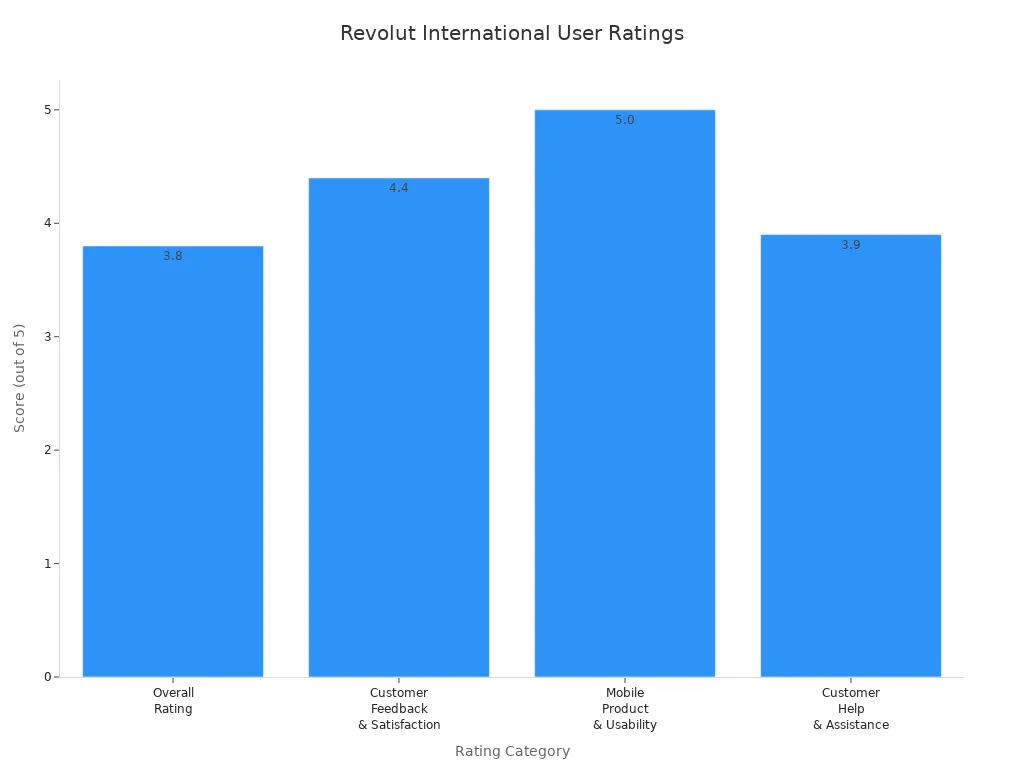

Customer Experience Table:

| Category | Score/Notes |

|---|---|

| App Usability | 4.5/5 (Google Play), 4.7/5 (Apple App Store) |

| Customer Support | 3.9/5, mostly in-app chat, no phone or email |

| Fees | No foreign transaction fees, but weekend markups apply |

| ATM Access | Free up to $200/month, then 2% fee |

| Unique Perks | Crypto, stocks, junior accounts, travel insurance |

N26

N26 is another top choice if you want a simple online bank account in Europe. You can open your account fully online, and the process is available in English. N26 gives you a euro account with a German banking license, so your money is protected up to $110,000 (about €100,000).

Key Features:

- Unlimited free card payments worldwide with no foreign transaction fees.

- Free ATM withdrawals in local currencies for Go and Metal plans.

- Real-time exchange rates for international transfers.

- Instant payment notifications and full card control in the app.

- Travel insurance included with some plans.

Drawbacks:

- Higher fees for international ATM withdrawals on some plans.

- N26 is not available in every country. It has left the US and UK.

- Customer support can be slow, and there are no physical branches.

- Some users have reported security concerns in the past, but N26 has improved its app security.

Note: N26 is great if you spend a lot in the eurozone and want a secure, easy-to-use app.

Wise

Wise is not a bank, but it is one of the best online banks for cross-border money management. You can open an account online in minutes. Wise lets you hold and convert over 40 currencies and gives you local bank details in 10 countries.

Why Wise Works for Expats and Travelers:

- You see all fees and exchange rates upfront. Wise uses the real mid-market rate, so there are no hidden markups.

- You can send money to local bank accounts worldwide, and the recipient does not need a Wise account.

- Wise offers a debit card for spending in multiple currencies with no annual fee.

- Transfers are fast, with most arriving instantly or within 24 hours.

- Wise is regulated and uses strong security to protect your money.

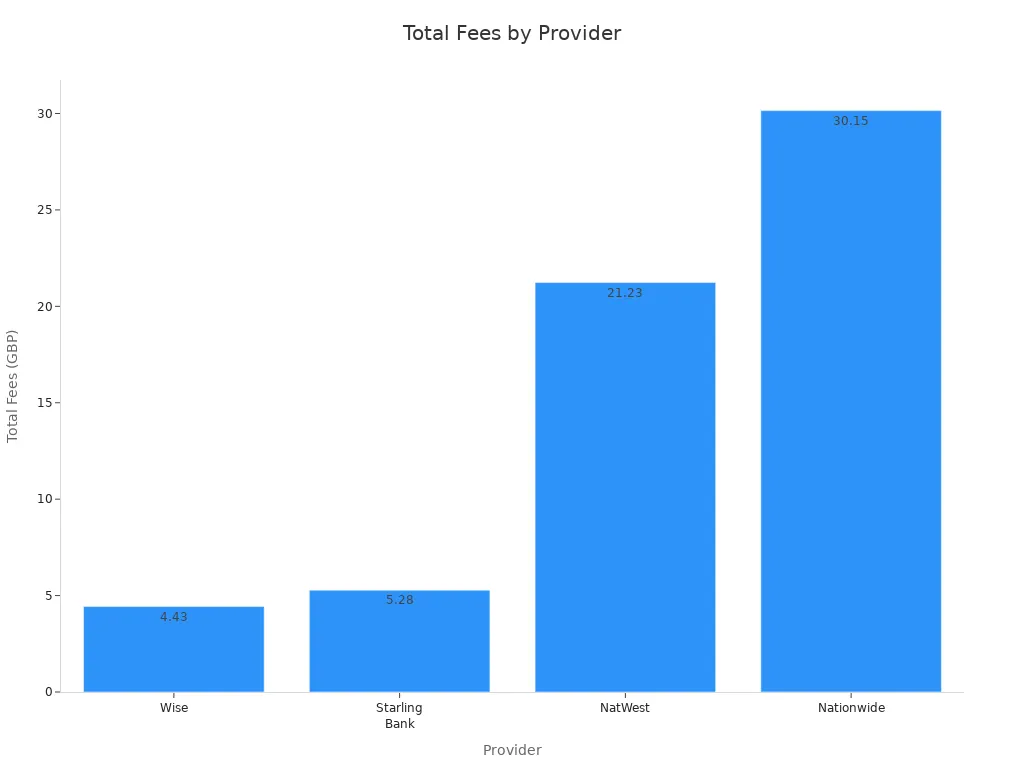

Fee Comparison Table:

| Provider | Transfer Fee | Exchange Rate Type | Total Fees | Notes |

|---|---|---|---|---|

| Wise | $5.60 | Mid-market rate, no hidden fees | $5.60 | Transparent fees, no markups, no hidden charges |

| Starling Bank | $2.90 | Includes hidden fees (~$3.80) | $6.70 | Higher total cost due to hidden fees and exchange rate markups |

| NatWest | $0 | Includes hidden fees (~$27.00) | $27.00 | Significant hidden fees and exchange rate markups |

| Nationwide | $25.00 | Includes hidden fees (~$12.70) | $37.70 | High upfront fee plus hidden fees and exchange rate markups |

Wise is a smart pick if you want low fees, fast transfers, and clear pricing for international money moves.

Monzo

Monzo is a favorite among travelers and expats who want a flexible online bank. You can open an account online with just your ID. Monzo’s app is easy to use and packed with features that help you manage your money on the go.

Top Features for Travelers:

- No international transaction fees, so you save money when you spend abroad.

- Free ATM withdrawals in the EEA up to $320 every 30 days for standard users.

- Real-time notifications for every transaction.

- Savings Pots let you set aside money for travel and even earn interest.

- Bill splitting and Shared Tabs make it easy to manage group expenses.

- 24/7 customer support through the app.

- Upgrade to Monzo Max for travel insurance and extra perks.

| Feature | Details |

|---|---|

| ATM Withdrawals in EEA | Free up to $320 every 30 days for standard users; unlimited for Plus or Premium users. |

| ATM Withdrawals Outside EEA | Fee-free withdrawals between $250-$750 monthly depending on plan; 3% fee after limit. |

| Exchange Rates | Uses Mastercard’s exchange rate with no hidden fees or markups. |

| Savings Pots | Lock or hide funds for travel, earn interest, and avoid accidental spending. |

| Card Security | Freeze or unfreeze your card instantly in the app. |

Monzo is a great choice if you want a user-friendly app, strong budgeting tools, and easy travel spending.

Bunq

Bunq is one of the best online banks in europe if you care about sustainability and flexibility. You can open an account online and get multi-country account details. Bunq’s app is colorful and easy to use.

What Makes Bunq Special:

- Bunq plants a tree for every $110 you spend with its Green Card.

- The bank aims for carbon-neutral operations and promotes paperless banking.

- You can choose where your money is invested.

- Bunq offers a Green Card with extended warranty and shopping insurance.

- Multi-currency accounts and quick account opening.

If you want your banking to help the planet, Bunq is a top pick among the best online banks.

Starling Bank

Starling Bank is a strong choice for international travelers who want fee-free spending and ATM withdrawals. You can open your account online, and the app is simple to use.

Standout Features:

- Spend and withdraw cash abroad with no fees from Starling Bank.

- Uses Mastercard’s real exchange rate with no hidden markups.

- Instant card lock/unlock and real-time spending notifications.

- 24/7 human customer support in the app.

- Tools like Spaces and Round Ups help you budget and save for travel.

- Bill splitting and Nearby Payments make group travel easier.

Starling Bank is perfect if you want global acceptance, strong security, and easy money management while traveling.

Tomorrow

Tomorrow is a unique online bank for eco-conscious expats and travelers. You can open an account if you live in one of 19 supported European countries.

Why Choose Tomorrow:

- Focus on sustainability and ethical investments.

- Automatic CO₂ offsetting for every purchase.

- Stylish wooden debit card.

- Unlimited free ATM withdrawals across Europe.

- Real-time Climate Impact dashboard tracks your carbon footprint.

- User-friendly app with budgeting tools and spending insights.

- Deposit protection up to $110,000 (about €100,000).

Tomorrow is a great fit if you want your banking to support the environment and offer modern online features.

Monese

Monese is a flexible online bank for non-residents, expats, and freelancers in Europe. You can open an account without proof of address or credit history, which makes it very accessible.

| Benefits | Limitations |

|---|---|

| Easy and fast account opening without proof of address or credit history | Not a traditional bank but an electronic money institution (no FSCS deposit guarantee) |

| Multi-currency accounts (USD, EUR, GBP) | Balance limit of $55,000 |

| Spend, transfer, and withdraw money across Europe | No overdraft facility |

| No credit checks or fixed income requirements | Slower product development compared to some competitors |

| Instant notifications, Apple Pay & Google Pay, joint accounts | Pricing plans vary with different fees and limits |

| Competitive exchange rates and cost-effective fee structure | N/A |

- Monese offers accounts in USD, EUR, and GBP.

- You get instant notifications, joint accounts, and mobile payment options.

- Debit and travel cards work worldwide where Mastercard is accepted.

- Pricing plans range from free to paid, with different limits and fees.

Monese is a smart choice if you want easy account setup and multi-currency features without the hassle of paperwork.

Choosing the Right Bank

Travel Patterns

Your travel habits shape which online bank fits you best. If you move between countries often, you want a bank that works across borders. Some banks let you open an account before you arrive in a new country. Others need a local address or a visit to a branch. Here are some things to check when you compare online banks:

- See if your current bank offers international services or has branches abroad.

- Look for banks with a wide ATM network, so you can get cash easily.

- Make sure the online banking system is easy to use on your phone.

- Check if you need extra documents to open an account in a new country.

- Think about keeping your old bank account open for a while for convenience.

If you plan to stay in one country for a long time, opening a local account can help you avoid currency conversion fees and build a credit history.

Feature Priorities

Everyone has different needs. You might want low fees, strong multi-currency support, or fast account opening. Some people care most about customer support or budgeting tools. Make a list of your top priorities before you choose an online bank. Here are some features to consider:

- Multi-currency accounts for spending and saving in different countries.

- Free or low-cost international transfers.

- Easy-to-use apps with instant notifications.

- Good customer support, available in your language.

- Access to a large ATM network.

Tip: Pick the online bank that matches your travel style and financial habits.

Security

You want your money to stay safe, no matter where you go. European online banks follow strict security rules. They use two-factor authentication and send you alerts for every transaction. This keeps your account protected from cyber threats. For example, Monzo gives you full deposit protection and smart money tools. Revolut uses advanced login steps and two-factor authentication, but it does not have FSCS protection in the UK yet. Starling Bank is known for strong security and customer care.

| Bank | Security Features | International Suitability |

|---|---|---|

| Revolut | Two-factor authentication, safeguarding (no FSCS in UK) | Works in 33 countries, app-managed |

| Monzo | Two-factor authentication, FSCS protection, smart tools | Card works worldwide, low fees |

| Starling | Award-winning security, strong customer support | Great for business and personal accounts |

Always check the security features of any online bank you consider. Your peace of mind matters most.

Best Online Banks Decision Guide

For Travelers

If you travel a lot, you want a bank that works everywhere. Look for banks that let you use your card in many countries without extra fees. Starling Bank and Monzo both give you free ATM withdrawals in the EEA. Revolut also helps you pay in different places with good exchange rates. You can use their apps to freeze your card if you lose it. This makes your money safer when you move from country to country.

Tip: Always check if your bank has limits on free ATM withdrawals before you leave for your trip.

For Multi-Currency

Do you get paid in different currencies or shop online from other countries? Wise is a top choice for holding and spending in over 40 currencies. Revolut and Bunq also let you keep money in several currencies. You can switch between them in the app. This helps you avoid bad exchange rates and extra charges. If you work with people in different countries, these banks make it easy to send and receive money.

| Bank | Currencies Supported | Local Account Details |

|---|---|---|

| Wise | 40+ | 10 |

| Revolut | 36 | 3 |

| Bunq | 15+ | 5 |

For Low Fees

Nobody likes paying high fees. Wise shows you all costs before you send money. Monese and N26 also have low or no monthly fees for basic accounts. You can save money on transfers and ATM withdrawals. Always read the fee table before you sign up. Some banks charge after you reach a limit, so keep an eye on your usage.

Note: SEPA transfers in Europe are often free with online banks.

For Easy Setup

If you want to open an account fast, choose an online bank with simple steps. Monese lets you sign up without proof of address. N26 and Revolut only need your ID and a selfie. You can finish everything on your phone. This is great if you just moved or do not have all your documents yet.

- Prepare your ID before you start.

- Use the app to upload your documents.

- Follow the steps and get your card by mail.

You can start using your account in minutes.

You have many great online banks to choose from in Europe. Each one offers something special for expats and travelers. Think about what matters most to you—like multi-currency support, low fees, or easy setup. Before you open an account, follow these steps:

- Pick a bank that matches your needs and check if you are eligible.

- Gather your ID and proof of address.

- Apply online and complete any security checks.

- Deposit funds to start using your new account.

Take time to compare your options. The right bank will make your life abroad much easier.

FAQ

Can I open a European online bank account before I arrive?

Yes, you can. Many online banks let you sign up with just your passport and a selfie. You do not need a local address for some banks. Always check the requirements on the bank’s website before you apply.

Are online banks safe for expats and travelers?

Online banks in Europe use strong security. You get two-factor authentication and instant alerts for every transaction. Your money stays protected by strict European rules. For extra peace of mind, choose banks with deposit insurance.

How do I avoid high ATM fees while traveling?

Pick an online bank that offers free ATM withdrawals each month. For example, Revolut gives you $200 in free withdrawals. After you reach the limit, small fees apply. Always check your bank’s ATM policy before you travel.

Can I use my online bank card in China or Hong Kong?

Most European online bank cards work worldwide, including China and Hong Kong. You can pay in local shops or withdraw cash at ATMs. Some places may not accept foreign cards, so carry some cash as a backup.

Online banks like Revolut, N26, and Wise simplify banking for expats and travelers in Europe, offering multi-currency accounts, low fees (0.4%-2%), and user-friendly apps. Eurostat notes 59% of European internet users rely on online banking for convenience. For seamless global transactions in 2025, enhance your banking with BiyaPay. BiyaPay provides transfer fees as low as 0.5%, undercutting traditional bank charges ($30+), with real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries. Its Biya EasyCard, a virtual card with no annual fee, supports Amazon, eBay, and PayPal, perfect for spending in 190+ countries. Whether paying international suppliers or managing travel expenses, BiyaPay ensures same-day transfers and easy setup with ID verification. Licensed in the U.S. and New Zealand, it guarantees secure, compliant transactions. Pair BiyaPay with your favorite online bank for cost-effective, borderless financial freedom. Join BiyaPay today to elevate your global banking experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

Breaking News: Nasdaq Confirms Advancement of All-Day Stock Trading Plan

US Stock Market Holiday Countdown: How Investors Should Position for Next Week's Trading

How Beginners Can Invest in the Three Major US Stock Index ETFs: Understanding How to Choose SPY, DIA, and QQQ

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.