2025 USD Time Deposit Latest Introduction and FAQs

Image Source: unsplash

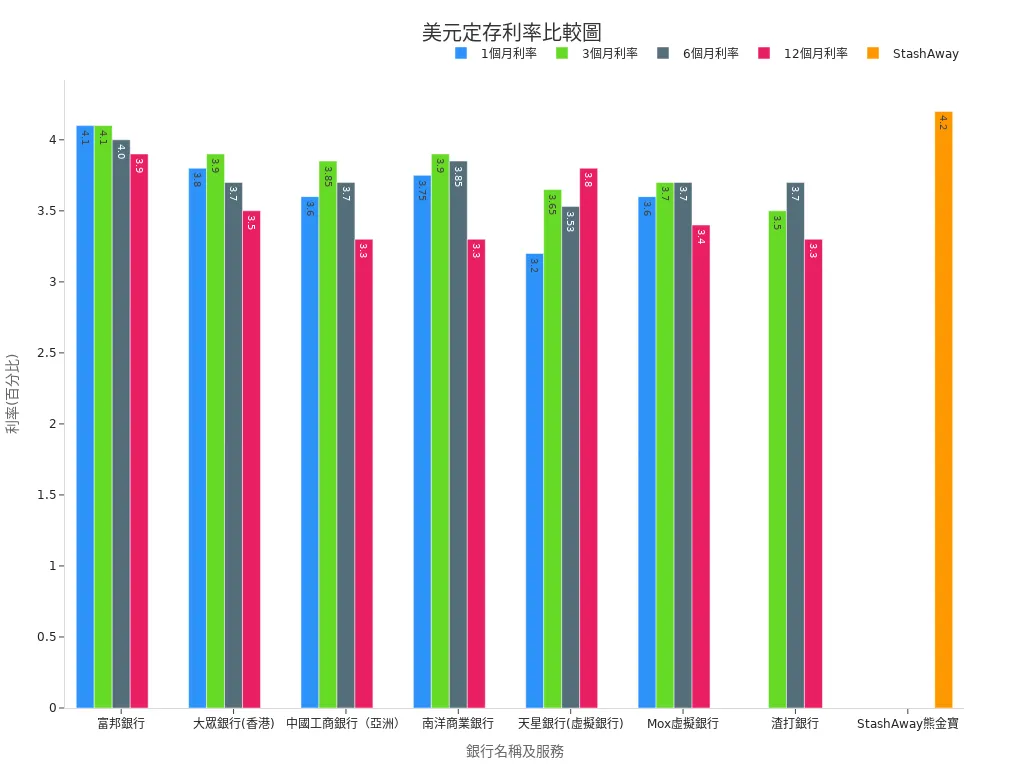

Are you looking for a high-interest yet stable wealth management option? In 2025, USD time deposit rates offered by many Hong Kong banks and virtual banks are significantly higher than HKD rates, with some platforms like StashAway Bear Gold offering up to 4.2% annualized yield and high flexibility. The table below allows you to compare the latest rates and minimum deposit amounts of different banks at a glance:

| Bank Name | 1-Month Rate | 3-Month Rate | 6-Month Rate | 12-Month Rate | Minimum Deposit |

|---|---|---|---|---|---|

| Fubon Bank | 4.10% | 4.10% | 4.00% | 3.90% | USD 65,000 |

| Public Bank (Hong Kong) | 3.80% | 3.90% | 3.70% | 3.50% | None |

| ICBC (Asia) | 3.60% | 3.85% | 3.70% | 3.30% | USD 15,000 |

| Standard Chartered Bank | N/A | 3.50% | 3.70% | 3.30% | USD 2,000 |

| Nanyang Commercial Bank | 3.75% | 3.90% | 3.85% | 3.30% | HKD 100,000 |

| Airstar Bank (Virtual Bank) | 3.20% | 3.65% | 3.53% | 3.80% (360 days) | None |

| Mox Virtual Bank | 3.60% | 3.70% | 3.70% | 3.40% | USD 1 |

You can flexibly choose the most suitable USD time deposit plan based on your fund size and liquidity needs.

Key Points

- In 2025, USD time deposit rates at many Hong Kong banks are generally higher than HKD rates, with some traditional banks offering rates above 3.9%, suitable for those with ample funds seeking high returns.

- Virtual banks offer flexible USD time deposit plans with no minimum deposit requirements and convenient withdrawals, suitable for those prioritizing fund liquidity.

- USD time deposits offer advantages such as higher interest rates, principal protection, and stable exchange rates, helping combat inflation and manage overseas fund needs.

- When choosing USD time deposits, you should be aware of exchange rate fluctuations, early withdrawal restrictions, and conversion fees to avoid losing interest due to urgent fund needs.

- Comparing bank rates, minimum deposit amounts, and service quality, and regularly monitoring market promotions, helps select the most suitable USD time deposit plan.

USD Time Deposit Rates and Bank Comparison

Image Source: pexels

Major Bank Rates

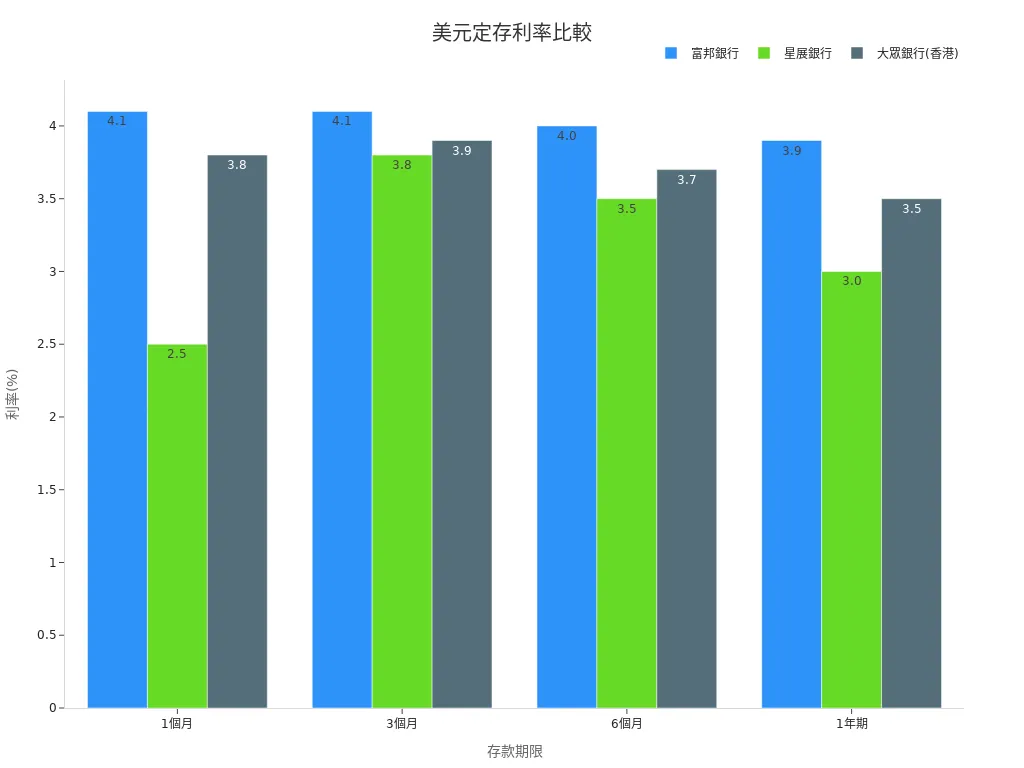

When choosing USD time deposits, you will find that many traditional Hong Kong banks offer higher rates. For example, in 2025, Fubon Bank’s 1-year USD time deposit rate is approximately 3.90%, while other traditional banks’ rates range from 3.00% to 3.95%. These banks typically require higher minimum deposit amounts, such as USD 65,000 for Fubon Bank, with others ranging from USD 1,000 to USD 1,000,000. Traditional banks’ USD time deposit products often have lock-in periods with stricter withdrawal restrictions. If you have ample funds and seek higher rates, traditional banks would be your top choice.

Tip: USD time deposit rates are generally higher than HKD time deposits, especially during U.S. rate hike cycles, making USD products more attractive. You can leverage this to boost fund returns.

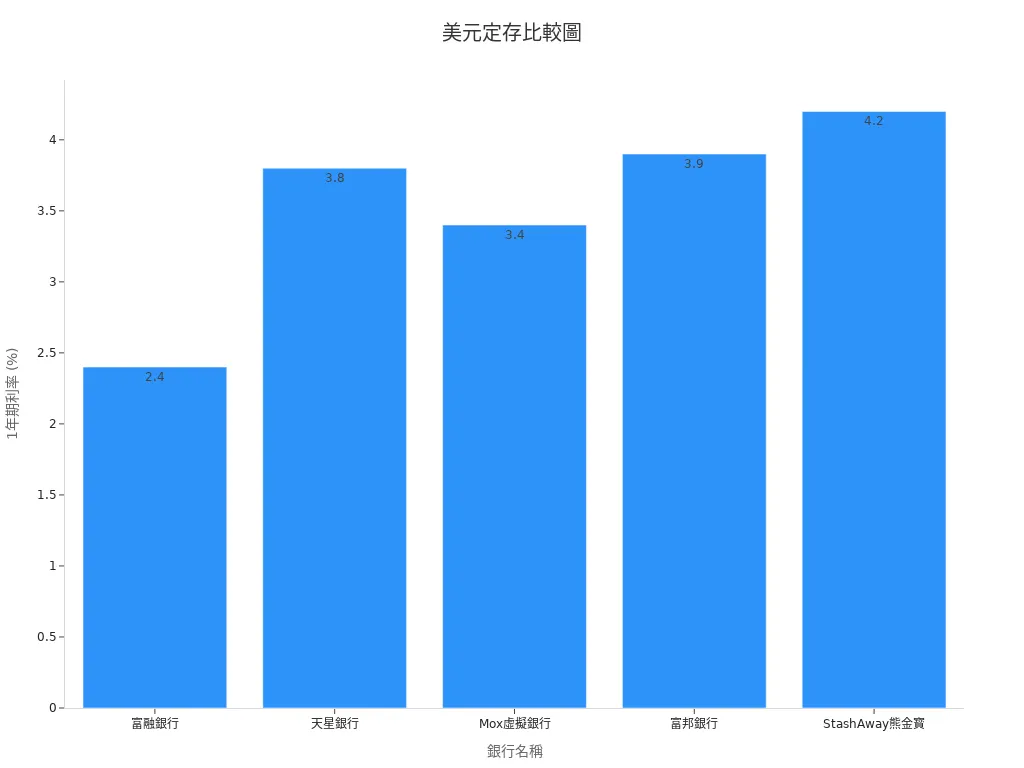

Virtual Bank Plans

Virtual banks have grown rapidly in Hong Kong in recent years, offering you more flexible USD time deposit options. Airstar Bank, Mox Virtual Bank, and Fusion Bank offer 1-year USD time deposit rates ranging from approximately 2.40% to 3.80%. Although rates are slightly lower than some traditional banks, these platforms often have no minimum deposit requirements, with some allowing accounts to be opened with just USD 1. You can withdraw funds anytime without worrying about lock-in periods. This is highly convenient for those with high liquidity needs.

| Bank Type | Bank Name | 1-Year USD Time Deposit Rate | Minimum Deposit | Flexibility and Terms |

|---|---|---|---|---|

| Virtual Bank | Fusion Bank | Approx. 2.40% | None | Mostly no lock-in period, flexible withdrawals |

| Virtual Bank | Airstar Bank | Approx. 3.80% | None | Mostly no lock-in period, flexible withdrawals |

| Virtual Bank | Mox Virtual Bank | Approx. 3.40% | USD 1 | Mostly no lock-in period, flexible withdrawals |

| Traditional Bank | Fubon Bank | Approx. 3.90% | USD 65,000 | Usually has lock-in period, stricter withdrawal restrictions |

| Traditional Bank | Other Traditional Banks | Approx. 3.00%-3.95% | USD 1,000-1,000,000 | Usually has lock-in period, stricter withdrawal restrictions |

| Investment Portfolio | StashAway Bear Gold | Approx. 4.2% p.a. | None | No lock-in period, flexible withdrawals and transfers |

You can refer to the chart below to visually compare the 1-year USD time deposit rates of different banks and platforms:

Deposit Terms and Minimum Amounts

When choosing USD time deposits, you should pay attention to the deposit terms and minimum amount requirements of different banks. Traditional banks typically offer terms ranging from 1 month to 12 months, with minimum deposits from USD 1,000 to USD 65,000 or higher. Virtual banks provide more flexible options, with some platforms having no minimum deposit requirements, and deposit terms can be adjusted or withdrawn early. This allows you to flexibly arrange USD time deposits based on your financial planning and liquidity needs.

Note: If you seek high rates, traditional banks’ long-term USD time deposits are more advantageous. However, if you value flexible fund usage, virtual banks or investment portfolio platforms are more suitable.

USD Time Deposit Operations and Pros/Cons

Image Source: pexels

Basic Operations

When you choose a USD time deposit, the process is similar to an HKD time deposit. You only need to open a USD account at a Hong Kong bank or virtual bank and transfer funds into a time deposit product. You can choose different deposit terms, such as 1 month, 3 months, 6 months, or 12 months. Upon maturity, you will receive the principal and interest. If you need to withdraw early, some banks may charge fees or adjust interest.

The main difference between USD time deposits and HKD time deposits lies in the currency type and interest rate levels. As a major global currency, USD has high liquidity and relatively stable exchange rates. You can use USD time deposits as a tool for savings, travel, or overseas investment fund management.

Advantages Analysis

By choosing USD time deposits, you can enjoy several clear advantages:

- Higher Interest Rates: In 2025, USD time deposit rates at many Hong Kong banks are generally higher than HKD time deposits. For example, Fubon Bank’s 1-year USD time deposit rate reaches up to 3.90%, and Public Bank (Hong Kong) offers 3.50%. You can refer to the table below to understand USD time deposit rates at different banks:

Bank Name 1-Month Rate 3-Month Rate 6-Month Rate 1-Year Rate Fubon Bank 4.10% 4.10% 4.00% 3.90% DBS Bank 2.50% 3.80% 3.50% 3.00% Public Bank (Hong Kong) 3.80% 3.90% 3.70% 3.50% - Stable Exchange Rates: USD is a major global trading currency with relatively low exchange rate fluctuations. You can reduce risks from exchange rate changes, especially suitable for those with overseas spending or investment needs.

- Principal Protection: Most Hong Kong banks are regulated by deposit protection schemes, ensuring the safety of your principal.

- Inflation Resistance: USD maintains strong purchasing power over the long term, helping you combat inflation.

You can refer to the chart below to visually compare USD time deposit rates across multiple banks:

Tip: If you have USD income, overseas tuition, or travel needs, USD time deposits can help you lock in exchange rates and interest, reducing future conversion pressures.

Risk Warnings

When choosing USD time deposits, you should also be aware of potential risks:

- Exchange Rate Fluctuations: Although USD exchange rates are relatively stable, if you need to convert back to HKD, you may still incur losses due to exchange rate changes.

- Early Withdrawal Restrictions: Most banks impose strict limits on early withdrawals, potentially deducting interest or charging fees. You should reserve sufficient liquid funds to avoid losing interest due to urgent needs.

- Conversion Fees: When converting HKD to USD, banks charge conversion fees. You should compare conversion costs across banks to minimize unnecessary expenses.

- Interest Rate Change Risks: Market rates fluctuate with U.S. Federal Reserve policy adjustments. When choosing long-term time deposits, you should consider the impact of future rate changes on returns.

Note: You should carefully select USD time deposit products based on your wealth management goals and risk tolerance, and regularly review market rates and bank promotions.

USD Time Deposit Selection Tips

Bank and Platform Selection

When choosing USD time deposits, you should first compare rates, minimum deposit amounts, and promotional offers across different banks and platforms. The table below lists the latest promotional rates and minimum deposit requirements of multiple Hong Kong banks for easy reference:

| Bank Name | Promotional Rate Range (Annual %) | Minimum Deposit (USD) |

|---|---|---|

| Standard Chartered Bank | Approx. 3.30% - 3.70% | 2,000 |

| ICBC (Asia) | Approx. 3.30% - 3.95% | 15,000 - 1,000,000 |

| Fubon Bank | Approx. 3.90% - 4.30% | 65,000 |

| Bank of East Asia | Approx. 3.25% - 3.80% | 1,000 |

| Hang Seng Bank | Approx. 3.00% - 3.80% | 2,000 |

| Chong Hing Bank | Approx. 0.25% | 1,000 - 10,000 |

| Nanyang Commercial Bank | Approx. 3.30% - 3.90% | 100,000 (HKD) |

| China Merchants Wing Lung Bank | Approx. 3.40% - 3.90% | 1,000 - 50,000 |

| Shanghai Commercial Bank | Approx. 2.93% - 3.63% | 10,000 |

| DBS Bank | Approx. 2.50% - 3.80% | 6,000 |

| Public Bank (Hong Kong) | Approx. 3.50% - 3.90% | No limit |

You can choose the appropriate bank or platform based on your fund size and liquidity needs. StashAway Bear Gold offers a cash management plan with no lock-in period and no minimum threshold, with an annualized yield of approximately 4.2%, highly flexible and suitable for those seeking fund elasticity.

Tip: You shouldn’t focus only on rates but also consider service quality. The reliability, response speed, security, and interface usability of banks and platforms impact your experience. Studies show that service quality is closely related to customer satisfaction and loyalty.

Conversion and Account Opening Notes

Before opening a USD time deposit, you should pay attention to foreign currency conversion fees and the account opening process. Differences in conversion fees and exchange rates across banks affect your actual returns. You can compare conversion costs across multiple banks and choose platforms with lower fees. When opening an account, some banks require proof of address and identity documents, while virtual banks may support online account opening, simplifying the process.

- Conversion Fees: You should inquire about the bank’s real-time exchange rates and fees.

- Account Opening Process: You can choose banks that support online applications to save time.

- Fund Source: You need to ensure the fund source is clear to avoid review delays.

Note: Promotional offer rates often have time limits, and banks may not disclose validity periods. You should regularly monitor the latest promotions to avoid missing high-rate opportunities.

Early Withdrawal Terms

When choosing USD time deposits, you must understand the terms for early withdrawal. Most banks deduct interest or charge fees for early withdrawals. You should carefully read contract details to ensure you can accept the restrictions. If you need higher liquidity, consider cash management plans with no lock-in periods, such as StashAway Bear Gold, which allows you to withdraw funds anytime.

- Early Withdrawal: You may lose part or all of the interest.

- Fees: Some banks charge additional fees.

- Liquidity: You should reserve sufficient liquid funds to avoid losing returns due to urgent needs.

Suggestion: You should choose the most suitable USD time deposit plan based on your wealth management goals and risk tolerance. Regularly reviewing market rates and bank promotions helps improve your fund returns.

When choosing time deposits, you should prioritize interest rates, liquidity, and principal protection. According to early June 2025 statistics, 1-year USD rates at many Hong Kong banks remain between 3.4% and 3.9%, with some platforms like StashAway Bear Gold offering 4.2% annualized yield and high flexibility.

You should be mindful of exchange rate fluctuations and early withdrawal terms and choose a suitable plan based on your wealth management goals. Market rates continue to fluctuate, so it’s recommended to regularly review bank promotions. USD time deposits are a stable wealth management tool, suitable for those seeking steady returns.

FAQ

Who is suitable for choosing USD time deposits?

If you have USD income, plan overseas studies, travel, or investments, you can consider USD time deposits. If you seek stable returns and principal protection, this product is also suitable.

How is USD time deposit interest calculated?

After you deposit the principal, the bank calculates interest based on the annual rate and deposit term. You receive the principal plus interest upon maturity. You can refer to the bank’s interest calculator.

What are the impacts of early withdrawal?

If you withdraw early, the bank typically deducts part or all of the interest and may charge fees. You should carefully read contract terms to avoid unnecessary losses.

Are there risks with USD time deposits?

You face risks such as exchange rate fluctuations, interest rate changes, and losses from early withdrawal. You should choose suitable products based on your needs and risk tolerance.

How to compare USD time deposit plans across banks?

You can compare annual rates, minimum deposit amounts, deposit terms, and conversion fees. You should also consider the bank’s service quality and promotional offers. The table below can serve as a reference:

| Comparison Item | Example (Hong Kong Banks) |

|---|---|

| Annual Rate | 3.5% - 4.2% |

| Minimum Deposit | USD 1 - USD 65,000 |

| Deposit Term | 1 month to 12 months |

| Conversion Fees | Based on bank fee standards |

Hong Kong’s 2025 USD fixed deposits offer 3.9%–4.1% rates, but high swap fees (USD 2–3) and minimums limit accessibility. BiyaPay optimizes your investments with a user-friendly platform, enabling HKD-to-USD conversions at just 0.5% fees, beating bank charges. Real-time rates minimize exchange losses, supporting HKD, USD, and crypto conversions. BiyaPay’s 5.48% annualized return product outperforms bank deposits (3.4%–3.9%) and StashAway’s 4.2%.

Compliance-registered as FSP (New Zealand) and MSB (the US), regulated by regulatory authorities of both regions, it ensures secure transactions. Set up in minutes to seize high-yield opportunities. Join BiyaPay now to boost your returns! Sign up today to grow your wealth in 2025.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Will AI Drive Taiwan Stock Market to New Highs Again? Analyzing 2026 Index Trends and Investment Strategies

Hong Kong Stock Market Analysis: Five Key Themes Investors Must Watch in 2025

Beginner's Guide to the Hang Seng Index: Essential Introduction and Its Connection to the Hong Kong Economy

Want to Invest in US Stocks But Don't Know Where to Start? Sina Finance App Teaches You Step by Step

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.