- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose the Right Cross-Border Payment Platform for Foreign Trade? Practical Tips Shared

Image Source: pexels

When selecting a cross-border payment platform for foreign trade, you need to focus on several key points. Security is the primary consideration, as it directly impacts transaction reliability. Fees and withdrawal speed determine your costs and cash flow efficiency. According to a report by Swift, the share of RMB in global payments is expected to reach 4.33% by 2025, indicating a growing demand for cross-border payment platforms. Additionally, LianLian Digital’s financial report shows its digital payment business reached a total of 3.3 trillion yuan, with a growth rate of 64.7%. These data highlight the importance of choosing the right platform to enhance business competitiveness.

Core Factors for Selecting a Cross-Border Payment Platform for Foreign Trade

Image Source: pexels

Platform Security

When choosing a cross-border payment platform for foreign trade, security is one of the most important factors. You need to ensure the platform has robust anti-fraud mechanisms and data encryption technology to protect transaction security. Many platforms use advanced SSL encryption technology and two-factor authentication to reduce the risk of information leaks. Security not only affects the safety of funds but also relates to customer trust. A secure and reliable platform can help you build a strong brand image and attract more customers.

Withdrawal Speed and Fees

Withdrawal speed and fees directly impact your cash flow efficiency and costs. Fast withdrawals can help you better manage cash flow, especially during business expansion phases. Fee structures vary significantly across platforms, including service fees, interest rates, and withdrawal fees. Below are some key points:

- Merchants should compare the fee standards of different platforms and choose those with transparent rates to reduce transaction costs.

- The convenience of the withdrawal process is also an important reference point. User-friendly withdrawal methods can provide merchants with a better experience.

| Withdrawal Speed | Fees |

|---|---|

| Fast withdrawals improve cash flow efficiency | Service fees and interest rates vary significantly across platforms |

Supported Countries and Currencies

For cross-border e-commerce, the range of supported countries and currencies is critical. You need to choose a platform that covers your main markets and the regions where your customers are located to ensure smooth business operations. For example, if your target markets include Europe and North America, whether the platform supports euros and US dollars will directly affect transaction convenience. Support for Chinese currency types is also very important, as it helps you better manage domestic and international fund flows.

E-Commerce Platform Compatibility

The compatibility of a cross-border payment platform determines whether it can seamlessly integrate with mainstream e-commerce platforms. You need to ensure the selected platform supports the e-commerce tools you are using, such as Shopify, Amazon, or eBay. Platforms with good compatibility can reduce technical issues and improve transaction efficiency. Some platforms also provide API interfaces, making it easier for developers to implement customized settings.

Customer Service and Localized Support

High-quality customer service and localized support can significantly enhance the user experience. You need to choose a platform that offers multilingual support to better serve customers in different regions. Whether the platform provides 24-hour online customer service is also an important consideration. For Chinese sellers, selecting a platform that offers Chinese-language services will be more convenient.

Recommended Cross-Border Payment Platforms for Foreign Trade

Image Source: pexels

PayPal: Globally Renowned, Supports Multiple Currencies

PayPal is one of the most well-known cross-border payment platforms globally. It supports over 25 currencies and covers more than 200 countries and regions. You can easily complete international transactions through PayPal without worrying about currency conversion issues. PayPal also offers high security, using advanced encryption technology to protect user data. For small businesses and individual sellers, PayPal is simple to use and user-friendly.

Stripe: Ideal for E-Commerce Platforms, Developer-Friendly

Stripe focuses on providing payment solutions for e-commerce platforms. Its API interface is highly flexible, making it suitable for developers to create customized solutions. If you use e-commerce tools like Shopify or WooCommerce, Stripe can seamlessly integrate, enhancing transaction efficiency. Stripe supports multiple payment methods, including credit cards, Apple Pay, and Google Pay, meeting the needs of diverse customers.

Payoneer: Supports Multi-Country Accounts, Convenient Withdrawals

Payoneer is a popular choice for cross-border e-commerce sellers. It supports bank accounts in multiple countries, making it convenient to manage funds globally. Payoneer offers fast withdrawal speeds and transparent fees, ideal for businesses needing frequent cash flow. You can also use Payoneer to directly pay suppliers, simplifying business processes.

Airwallex: Low Fees, Suitable for SMEs

Airwallex is known for its low fees and high efficiency, making it highly suitable for small and medium-sized enterprises. It supports multiple currencies and countries, helping you reduce cross-border transaction costs. Airwallex also offers virtual account features, allowing you to easily manage fund flows across different markets. According to market data, the Southeast Asian e-commerce market is growing at the fastest rate globally, and Airwallex’s services can help you seize this opportunity.

WorldFirst: Supports Multiple E-Commerce Platforms, Professional and Reliable

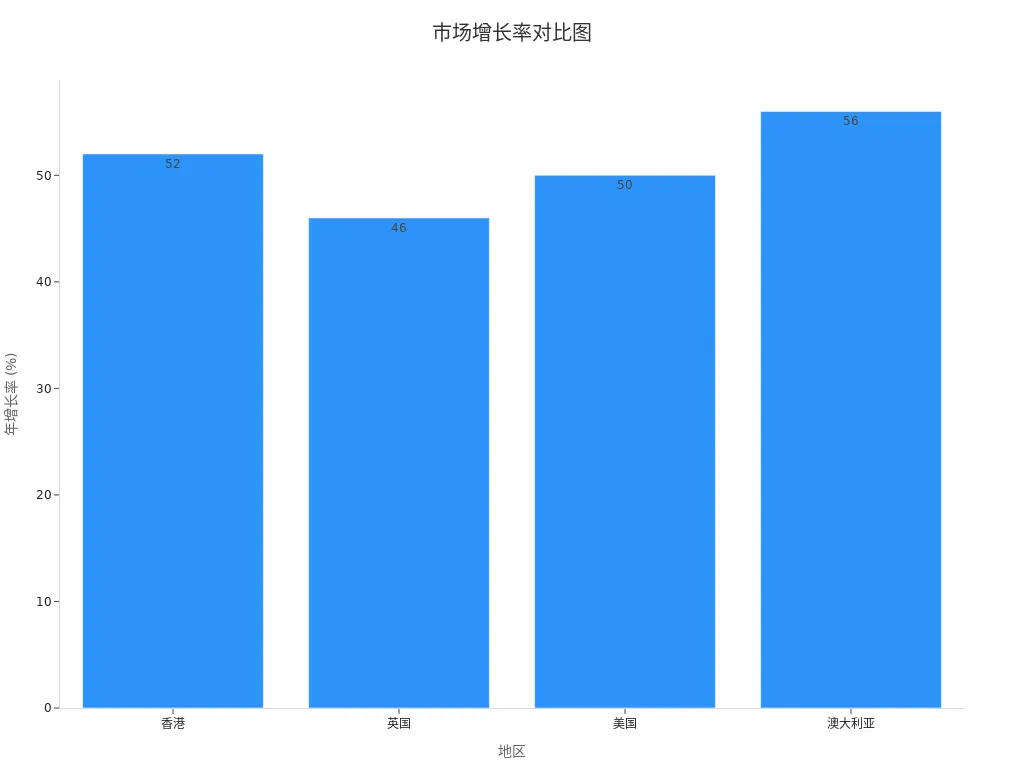

WorldFirst specializes in providing professional payment solutions for cross-border e-commerce. It supports mainstream e-commerce platforms like Amazon and eBay, enabling fast payment collection. WorldFirst offers transparent fees and stable services, making it a top choice for many businesses. The Hong Kong e-commerce market is expected to grow by 52% by 2029, and WorldFirst’s services can help you gain an advantage in this market.

PingPong: Recommended Tool for Small and Medium-Sized Cross-Border E-Commerce Sellers

PingPong is designed specifically for small and medium-sized cross-border e-commerce sellers, offering convenient payment collection and withdrawal services. It supports multiple currencies and countries, helping you quickly enter international markets. PingPong’s fees are low, and withdrawal speeds are fast, making it a recommended tool for many sellers.

XTransfer: One-Stop Service for B2B Foreign Trade Enterprises

XTransfer is dedicated to providing one-stop payment solutions for B2B foreign trade enterprises. It supports multiple currencies and countries, helping businesses optimize cash flow efficiency. XTransfer’s services are secure and reliable, suitable for enterprises handling large transactions.

Tencent Smart Goose: Compliant and Secure Cross-Border Payment Platform for Enterprises

Tencent Smart Goose is a high-quality choice for Chinese enterprises engaging in cross-border payments. It provides compliant and secure payment services, helping businesses easily complete international transactions. Smart Goose supports multiple currencies and countries, ideal for enterprises needing efficient fund management.

CoGoLinks: Solutions to Optimize Cash Flow Efficiency

CoGoLinks focuses on optimizing cash flow efficiency. Its services cover multiple countries and regions, helping businesses reduce transaction costs. CoGoLinks is stable and reliable, serving as a long-term partner for many enterprises.

According to market data, the U.S. e-commerce industry is expected to grow by 50% by 2029, reaching $1.8 trillion. Choosing the right cross-border payment platform can help you capitalize on this growth opportunity.

How to Choose the Right Cross-Border Payment Platform Based on Your Needs

Define Your Needs: Transaction Volume, Target Market, etc.

Before selecting a payment platform, you need to clearly define your business needs. Transaction volume is an important reference point. If you have a high transaction volume, choosing a platform with lower fees can effectively reduce costs. The target market is equally critical, as market demands and payment habits vary by region. For example, the Asia-Pacific region accounted for 62.6% of global e-commerce sales in 2020, highlighting its potential as a major cross-border e-commerce market. China accounted for 29% of global e-commerce sales, further underscoring its importance in international markets. If your target market includes Southeast Asia, platforms like Lazada and Shopee perform strongly, reflecting the region’s user base and growth potential.

Compare Features and Fees of Different Platforms

After defining your needs, you need to compare the features and fees of different platforms. Below are some key points:

- Feature Comparison: Check whether the platform supports multiple payment methods, currencies, and countries. The more comprehensive the features, the better it can meet diverse customer needs.

- Fee Analysis: Focus on service fees, withdrawal fees, and exchange rate differences. A transparent fee structure helps you better control costs.

| Platform Features | Fee Transparency |

|---|---|

| Supports multiple payment methods and currencies | Clear fees, facilitating budget management |

By comparing these factors, you can gain a clearer understanding of which platform best suits your business needs.

Test and Evaluate Actual Performance

Before making a final decision, testing the payment platform is a wise choice. Many platforms offer free trials or low-cost initial services. Through testing, you can evaluate the platform’s user experience, operational convenience, and customer service quality. Observe whether withdrawal speeds meet expectations and whether features satisfy daily needs. If possible, communicate with the platform’s customer service team to assess their response speed and professionalism. Feedback from the trial phase can help you make a more informed choice.

Tip: During testing, document the experience at each step, such as the registration process, payment operations, and withdrawal efficiency. These details can provide strong support for your final decision.

When selecting a payment platform, you need to focus on security, fees, and withdrawal speed. Security directly impacts transaction reliability; for example, eBay Payments uses an intelligent risk control system to monitor transaction safety in real time. Platforms with transparent fees help you better control costs and avoid hidden charges. Platforms with same-day withdrawal speeds can significantly enhance cash flow flexibility. After defining your needs, try different platforms to find the most suitable solution, ensuring efficient and secure transactions.

FAQ

1. How to Ensure the Security of a Cross-Border Payment Platform?

- Check whether the platform uses SSL encryption technology.

- Confirm if it has two-factor authentication.

- Choose platforms with positive user reviews.

Tip: Security is the top priority. When selecting a platform, prioritize its anti-fraud mechanisms and data protection capabilities.

2. How Are Fees Calculated for Cross-Border Payment Platforms?

Fees typically include service fees, withdrawal fees, and exchange rate differences. You can check the platform’s fee schedule or consult customer service for specific details.

3. Which Platforms Should I Choose If My Target Market Is Southeast Asia?

- Recommended Platforms: Airwallex, PingPong.

- Reason: Support Southeast Asian currencies, low fees, and fast withdrawals.

Note: The Southeast Asian market is growing rapidly; choosing platforms suited to the region can enhance transaction efficiency.

Selecting a cross-border payment platform often involves tackling high fees, withdrawal delays, and security risks. BiyaPay offers an efficient solution, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. BiyaPay ensures fund safety and accelerates processing to meet Southeast Asia and Western market needs. Join BiyaPay now to optimize your cross-border payment experience! You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, enhancing capital efficiency. Idle funds can earn a 5.48% APY through current investment products, backed by BiyaPay’s U.S. MSB and SEC licenses. Sign up with BiyaPay for secure, efficient global payments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.