- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Straddle Options vs Strangle Options: Which is Better? 2025 Advanced Comparison and Practical Guide for Bidirectional Layouts

Aimed at intermediate to advanced traders who have mastered the basics of options (calls/puts, IV, Greeks), this article takes “scenario selection” as the main thread, systematically comparing the differences between straddle and strangle in terms of costs, Greeks exposure, post-event IV Crush, seller margin and assignment risks, execution and liquidity, and provides implementable parameter frameworks and risk reminders. The entire article is for educational purposes only and does not constitute investment advice. All external materials indicate the publication/update year, unified retrieval date: 2025-10-16.

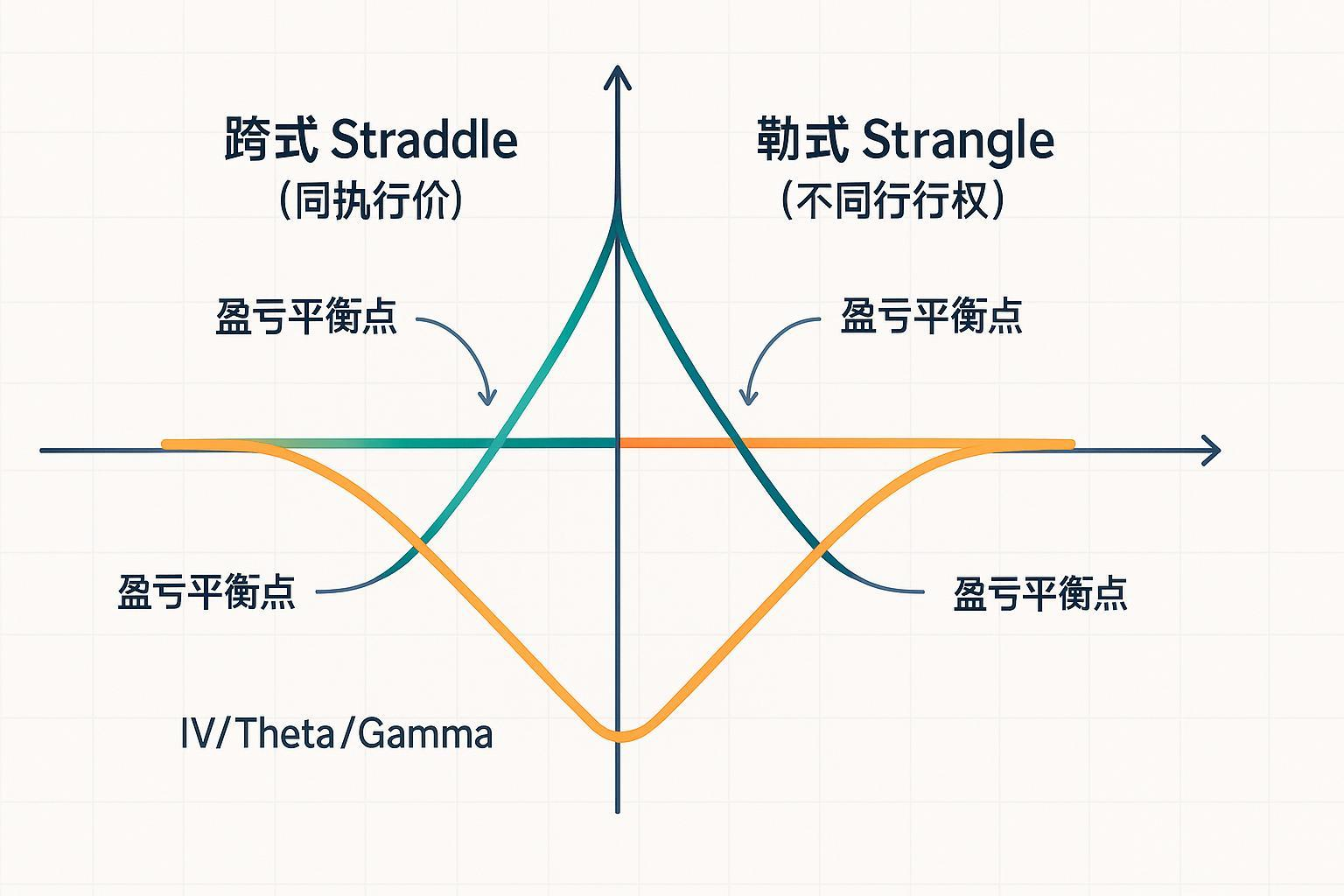

I. What Exactly is the Difference Between the Two Structures? (Definitions and Breakeven Points)

- Straddle: Same expiration, same strike price, simultaneously buying (or selling) calls and puts, often centered on ATM. This structure is suitable for scenarios where the direction is uncertain but significant volatility is expected. The definition can refer to Moomoo’s overview explanation, see its entry on the differences between straddle and strangle in the explanation of bidirectional strategies (2025): “Basic Differences Between Straddle and Strangle” Explanation (Moomoo Learning 2024/2025).

- Strangle: Same expiration, different strike prices, simultaneously buying (or selling) calls and puts, often selecting out-of-the-money (OTM) strike prices at both ends. Refer to Moomoo’s breakdown explanation of the “wide straddle/strangle strategy” (2024/2025): “Structure and Applicability of Strangle (Wide Straddle) Strategy”.

Breakeven points (for buyers as an example):

- Long Straddle: Upper breakeven = Strike price + Total premium; Lower breakeven = Strike price − Total premium. This formula has a standardized expression in futures company textbooks, such as Nanhua Futures’ “Options Trading Guide” (2023) which provides a clear definition and derivation of the straddle breakeven points, see its relevant chapters: “Breakeven Point Formula for Straddle Combinations” Explanation (Nanhua Futures 2023).

- Long Strangle: Upper breakeven = Call strike price + Total premium; Lower breakeven = Put strike price − Total premium. Moomoo’s strategy page (2024/2025) also has an intuitive illustration of the strangle’s profit and loss structure: “Profit and Loss Structure and Key Points of Strangle Strategy”.

Key summary: Long straddle has higher costs but is closer to breakeven points; Long strangle has lower costs but requires larger underlying volatility amplitude to surpass the breakeven points at both ends.

II. Costs vs Required Volatility: Which Has Higher “Cost-Effectiveness”?

- Long Straddle (ATM-ATM):

- Advantages: More sensitive to price changes and IV increases, smaller underlying movements can reach the breakeven zone; If IV rises before an event, the position is more likely to benefit during holding.

- Disadvantages: Larger net debit, heavier Theta (time value decay); If the underlying does not have sufficient volatility or IV falls back, it is easier to incur losses.

- Long Strangle (OTM-OTM):

- Advantages: Lower initial costs, relatively smaller Theta pressure; Convenient for small funds to engage in volatility bets or staggered position building.

- Disadvantages: Requires larger actual volatility to possibly surpass the upper/lower breakeven zones; Elasticity to IV positives is slightly lower than straddle.

In practical evaluation, you can compare “expected realized volatility (Expected Move/historical volatility)” with “total premium + potential IV changes” to judge how much price movement is needed to hopefully cover costs and the impact of IV fallback.

III. In-Depth Comparison of Greeks: Vega/Theta/Gamma and DTE

- Gamma: ATM options have the highest Gamma peak, the shorter the DTE, the more concentrated the Gamma, and the greater the impact of small price changes on Δ. Therefore, straddle built with ATM has stronger Gamma sensitivity. Refer to Moomoo’s systematic explanation of Greeks (2025) in the description of Gamma: “Amplification Effect of Gamma at ATM and Short DTE” (Moomoo 2025).

- Theta: ATM has larger absolute time value decay, accelerating as expiration approaches; Straddle (mostly ATM) bears more obvious Theta losses under short DTE. Related basic concepts can also be seen in its “What are Options” introductory page (2025): “Basic Rule of Theta Accelerating Decay as Expiration Approaches” (Moomoo 2025).

- Vega: Longer DTE and ATM can amplify Vega sensitivity more; Strangle’s both ends are mostly OTM, single leg Vega is lower than ATM, so the overall long strangle’s sensitivity to IV changes is usually slightly lower than long straddle.

- 0DTE Characteristics: Intraday Gamma is extremely high, Theta quickly goes to zero; Buyers bear the disadvantage of time decay especially severely, sellers can collect time value but expose to extreme Gamma risks. Moomoo’s educational materials on volatility and IV near earnings/expiration (2025) emphasize the characteristics of short-term trading: “IV Changes Near Earnings and Key Points of Short-Term Trading” (Moomoo 2025).

IV. Event-Driven and IV Crush: Who is More Resistant to Falls?

- Common Tendency: Before major events, IV rises; After the event lands, uncertainty dissipates, IV often falls back quickly (IV Crush). According to Moomoo’s teaching article in 2025, the phenomenon of “implied volatility fallback squeezing premiums” after earnings is quite common in practice, see its special entry on “IV Crush”: “Common Mechanisms and Impacts of IV Crush After Earnings” (Moomoo 2025).

- For Buyer Structures: Long straddle/long strangle if the underlying’s actual movement is insufficient to cover “total premium + premium shrinkage caused by IV fallback + Theta”, it is easy to experience “correct direction but still loss”. Straddle, due to higher Vega, is often more sensitive to IV Crush.

- For Seller Structures: Short straddle/short strangle if the price remains within the range after the event and IV falls back, may benefit; But once it breaks out unilaterally, losses may amplify sharply.

Reminder: In recent years, there are fewer authoritative Chinese statistics with quantitative amplitudes, this article presents “common market tendencies” based on broker education and practical common sense, and in trading, verify with your own statistics or backtesting.

V. Seller Structures: Margin, Assignment, and Risk Management

- Risk Profile: Short straddle/short strangle are negative Gamma, positive Theta, maximum profit is the collected total premium, potential losses theoretically unlimited (unilateral extreme volatility). Broker educational materials generally emphasize this point, traders need self-discipline to set risk controls.

- Portfolio Margin and Models:

- Futures and derivatives exchanges often use SPAN/improved models to assess margin at the portfolio level; For example, CME’s new framework provides more refined depiction of portfolio risks (2023/2025), see its official document: “CME SPAN 2 Margin Framework (Chinese Version)” (CME Group 2023/2025).

- Chinese exchanges also provide hedging/portfolio margin discounts and guidelines, Zhengzhou Commodity Exchange has clear documents on related rules (2023): “Hedging Position Portfolio Margin Discount Guidelines” (Zhengzhou Commodity Exchange 2023).

- Hong Kong US stocks broker side usually distinguishes Reg-T and Portfolio Margin, and dynamically adjusts occupancy with volatility; Refer to Futu’s index options and portfolio margin support page (2023-2025): “Key Points of Portfolio Margin/Index Options Margin Rules” (Futu Support 2023-2025).

- Assignment and Delivery: American options can be exercised early, deep in-the-money or near ex-dividend calls are more likely to trigger early assignment; Sellers need to monitor in-the-money degree, roll or close positions to manage, and ensure deliverable assets or sufficient funds. Futu’s support center has standardized explanations of exercise and delivery processes and precautions (2023-2025), which can be used as operational reference: “Key Points of Exercise/Assignment and Delivery Processes” (Futu Support 2023-2025).

Risk Reminder: Margin rules dynamically change in different markets, brokers, underlyings, and volatility environments, must be based on the exchange and broker’s current caliber, leave sufficient liquidity and margin buffer to reduce passive position reduction and forced liquidation risks.

VI. Execution and Liquidity: Spreads, Slippage, and Order Placement Methods

- ATM double legs (straddle) usually have deeper order books, narrower spreads; Strangle’s both ends OTM natural spreads may be wider, execution efficiency more dependent on limit orders and split matching.

- Best Practices:

- Choose expiration and strike levels with active trading, try to use limit orders;

- Place orders by legs or combinations, split executions if necessary, reduce leg mismatches;

- Avoid chasing prices when events approach and volatility amplifies, control single order size when order books are thin;

- Pay attention to instantaneous spread widening between contracts bringing additional margin or risk control pressure.

- Refer to broker/futures company’s trading tools and help documents for definitions and guidelines on slippage and order placement methods, such as Guotai Junan’s OptionsPal help document (2023-2024): “Operational Key Points of Slippage, Spreads, and Order Placement Methods” (Guotai Junan 2023/2024).

VII. How to Choose Based on Scenarios? (No Absolute Winner)

The following are tendency suggestions for common scenarios, all need to be secondarily judged in combination with your own risk control, account permissions, and current IV percentile.

- 3–10 Days Before Earnings/Major Events:

- If judging that “realized volatility” after the event is sufficiently large and current IV is not at extreme highs, optional long straddle or long strangle; Those with tighter funds or wanting to reduce Theta pressure lean towards long strangle.

- If judging IV is too high, likely to fall back after landing, and have strict risk control and buy wing/rolling capabilities, consider short straddle/short strangle (high risk).

- Normal Volatility and Low IV:

- Preferring IV rise elasticity and sensitivity to small volatility, optional long straddle;

- Smaller budget, tolerating larger required volatility, optional long strangle.

- High IV Percentile Environment:

- Be cautious with buyer structures;

- Sellers prefer short strangle to obtain wider profit zones, but must cooperate with buy wings to cap tail risks, or reserve larger safety margins and strictly execute stop losses/rolls.

- Short DTE/0DTE:

- Buyers more susceptible to Theta drag, generally not advantageous;

- Sellers can collect time value, but Gamma risks extreme, need dynamic hedging and limited risk structures (like iron condor/iron butterfly).

- Strike Price Spacing and Parameters:

- Popular in the market to use “expected volatility range (Expected Move)” “IV Rank/Percentile” or target execution probability to set strangle’s two legs spacing;

- In English practice, common experience of “select strangle wings by Δ≈0.20–0.25”, but the author did not retrieve clear recommendations on authoritative Chinese pages, suggest mainly based on Expected Move and IV percentile, Δ threshold only as reference reminder.

VIII. Seller’s Risk Hedging and Alternative Structures

- Buy Wing Protection: Short straddle/short strangle outside each buy far-end legs, forming iron butterfly/iron condor, capping tail risks, sacrificing part of premium income in exchange for known worst outcome.

- Gamma Hedging (Gamma scalping): Maintain near Δ neutrality through underlying directional hedging, but execution complex, high trading frequency and costs, suitable for professional traders with mature processes.

IX. Comparison Quick View Table (Structural Symmetry, Easy for Review)

| Dimension | Long Straddle (ATM-ATM) | Long Strangle (OTM-OTM) |

|---|---|---|

| Initial Cost | Higher (Large net debit) | Lower (Small net debit) |

| Breakeven | Closer to spot price | Farther from spot price (needs larger volatility) |

| Vega | Higher (More sensitive to IV) | Slightly lower |

| Theta | Larger absolute value (More disadvantageous in short DTE) | Relatively smaller |

| Gamma | More concentrated (More sensitive to small volatility) | More dispersed |

| Post-Event IV Crush | Greater impact | Relatively moderated but still significant |

| Execution and Liquidity | Usually better (ATM more active) | OTM spreads wider, need precise ordering |

Seller (short straddle/short strangle) common features: Positive Theta, negative Gamma, theoretically unlimited losses; Margin and risk control are the top priorities.

X. Common Misconceptions and Checklist

- Only Looking at Direction Without IV: Buyer structures often bet on “direction + IV” simultaneously, IV fallback after events easily swallows profits.

- Underestimating Theta and DTE Impact: Closer to expiration, buyers more disadvantaged, sellers’ Gamma more dangerous.

- Ignoring Liquidity and Slippage: Strangle’s OTM legs if wide spreads, large slippage, will significantly raise actual costs.

- Ignoring Assignment and Delivery Arrangements: Sellers especially need to pay attention to American early assignment and ex-dividend schedules, preset response plans.

Conclusion: Use Scenarios to “Choose Right”, Not Choose “Absolute Winner”

- If you value sensitivity to small volatility more, hope to maximize IV rise elasticity, and can bear higher time decay and initial costs, straddle is more suitable.

- If you have limited budget or hope to reduce time decay impact, willing to exchange larger target volatility for lower costs, strangle is more fitting.

- Seller strategies must put “risk capping” and “liquidity management” first, prioritize limited risk variants and strictly execute risk control discipline.

— Educational Use Statement: This article does not constitute any investment advice. Options are high-risk instruments, seller strategies may face significant losses or even risks exceeding account funds. Margin, exercise, and delivery rules are subject to the exchange and broker’s current announcements.

References and Extended Reading (all one-time citations, retrieval date: 2025-10-16):

- Definitions and Differences (2024/2025): Moomoo “Basic Differences Between Straddle and Strangle”

- Strangle Structure and Profit/Loss (2024/2025): Moomoo “Structure and Applicability of Strangle (Wide Straddle) Strategy”

- Straddle Breakeven Formula (2023): Nanhua Futures “Options Trading Guide” Relevant Chapters

- Greeks Key Points (2025): Moomoo “Options Greeks Overview”

- 0DTE/IV Crush (2025): Moomoo “Common Mechanisms and Impacts of IV Crush After Earnings”

- Portfolio Margin (2023/2025): CME “SPAN 2 Margin Framework (Chinese Version)”

- Broker Margin and Exercise Processes (2023-2025): Futu “Key Points of Portfolio Margin/Index Options Margin Rules”, Futu “Key Points of Exercise/Assignment and Delivery Processes”

- Execution and Slippage (2023/2024): Guotai Junan “OptionsPal Help Document”

After delving into the pros and cons of straddle versus strangle options strategies, real-world trading often hinges on efficient capital management and asset conversions. Many traders struggle with high remittance fees, unreliable exchange rates, and the hassle of switching platforms, particularly when dealing with global options, stocks, or crypto assets that demand seamless cross-border solutions to minimize costs and maximize speed.

BiyaPay stands out as an all-in-one financial platform designed to address these challenges. It offers real-time exchange rate queries and conversions, supporting over 30 fiat currencies and 200+ cryptocurrencies for effortless swaps. With remittance fees as low as 0.5%, coverage across most countries and regions worldwide, and same-day transfers, it ensures your funds move swiftly post-IV Crush or event-driven volatility.

Best of all, on BiyaPay, you can trade US and Hong Kong stocks on the same platform without needing an overseas account, plus zero fees for contract order placements, streamlining your shift from options to equities. Whether you’re setting up a long straddle for sensitivity to minor moves or a long strangle for wider ranges, BiyaPay’s quick signup gets you started seamlessly. Take the next step today—sign up for BiyaPay and unlock streamlined financial tools to enhance your options trading journey. Don’t let funding hurdles cap your strategic potential; discover more now.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.