- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Latest GCash Account Deletion Tutorial

Image Source: pexels

Closing your GCash account may seem complicated, but it can be completed in just a few simple steps. Whether for security reasons or because you no longer use the service, the account deletion process must strictly follow the platform’s regulations to ensure the safety of your personal information and prevent misuse of account data. Through this article, you will learn how to quickly and securely complete account deletion to avoid unnecessary troubles.

Key Points

- Ensure your GCash account balance is zero before deletion to avoid losses from unpaid bills.

- Unlink all services associated with your GCash account to prevent third-party access to personal data after deletion.

- Backup important transaction records for future reference and ensure financial security.

- After deletion, clear GCash-related data from your devices to protect personal privacy and avoid information leakage.

- Consider using safer and more convenient payment platforms like BiyaPay to optimize financial management and transaction experience.

When Should You Delete Your GCash Account?

No Longer Using GCash Services

If you have stopped using GCash, deleting your account is a wise choice. Many people may switch to other tools or payment methods after completing specific payment needs. For example, you might have used GCash for daily shopping or bill payments, but these functions no longer suit your needs due to changes in lifestyle. Closing your account helps avoid unnecessary account management and reduces the risk of personal information leakage.

Switching to Other Payment Platforms

When you find other payment platforms more suitable for your needs, deleting your GCash account may be necessary. For example, platforms like PayPal, BiyaPay, which offer global payment and investment services. If you need real-time conversion of multiple currencies or participation in international market investments, BiyaPay may be a better choice. By switching to more advanced platforms, you can optimize financial management and enjoy more efficient services.

Security Issues or Account Theft

If your GCash account encounters security issues, such as theft or unauthorized transactions, immediately closing your account can protect your funds and personal information. Security issues can occur in any region, whether in Asian, European, or North American markets. After deleting your account, you can reassess your payment tools and choose safer alternatives. Ensuring account security is a top priority for every user, especially in the digital payment field.

Personal Information Protection Needs

Protecting personal information is a critical consideration when deleting a GCash account. Your account may store sensitive data, including name, address, contact information, and transaction records. If not properly handled, this information could be exploited by malicious actors, leading to financial losses or privacy breaches.

Before deleting your account, ensure all personal data is cleared or backed up. First, check if important transaction records or files are stored in the account. If so, export and securely save these data. Second, confirm that all associated services, such as automatic payment functions or third-party app authorizations, have been unlinked. These associated services may continue to access your account data even after deletion.

Additionally, your personal information may still be retained in GCash’s database after deletion. To ensure data security, you can contact GCash customer service to request complete deletion of account-related information. Many payment platforms, including well-known services in North American and European markets, offer similar functions to help users protect their privacy.

Globally, personal information protection regulations are becoming increasingly strict. For example, the EU’s General Data Protection Regulation (GDPR) requires companies to delete personal data upon user request. You can refer to these international standards to make clear privacy protection demands of GCash.

Finally, when choosing an alternative payment platform, prioritize providers that prioritize data security. For example, BiyaPay uses advanced encryption technology and strict privacy protection policies to ensure user data is not misused. By choosing a more secure platform, you can further reduce the risk of personal information leakage.

Preparations Before Deleting Your GCash Account

Before deleting your GCash account, you need to complete several necessary preparations to ensure a smooth process and avoid subsequent issues. Here are the key points to note:

Ensure Account Balance is Zero

Before deleting your account, you must ensure your account balance is zero. This is not only a basic platform requirement but also a crucial step to protect your funds. Here are specific operational recommendations:

- Log in to the GCash app and check if your account balance is zero.

- If there is still a balance, you can choose to:

- Transfer funds to another account.

- Withdraw to a linked bank account.

- Check for unpaid bills or automatically renewed subscription services to avoid deductions after deletion.

Tip: Refer to the operational experience of other platforms, such as the AWS account deletion process, where users must settle unpaid bills and check automatic renewal services to ensure the account balance is not negative.

Unlink All Associated Services and Accounts

Before deleting your account, you need to unlink all services and accounts associated with your GCash account. This step prevents third-party services from accessing your account data after deletion. Here are common associated services:

- Automatic Payment Functions: Check for bound utility bills, phone bills, and other automatic payment items.

- Third-Party App Authorizations: For example, you may have logged into certain shopping or subscription platforms via your GCash account.

- Linked Bank Cards or Credit Cards: Ensure all associated payment tools are unlinked.

Unlinking these services can effectively reduce the risk of personal information leakage and avoid service interruptions caused by account deletion.

Check for Uncompleted Transactions or Disputes

Before deleting your account, confirm whether there are uncompleted transactions or disputes. These issues may affect the account deletion process and even lead to financial losses. Here are common checks:

- Uncompleted Transactions: Review recent transaction records to ensure all transactions are successfully completed.

- Dispute Handling: If you have previously submitted a dispute application, confirm that the dispute has been resolved.

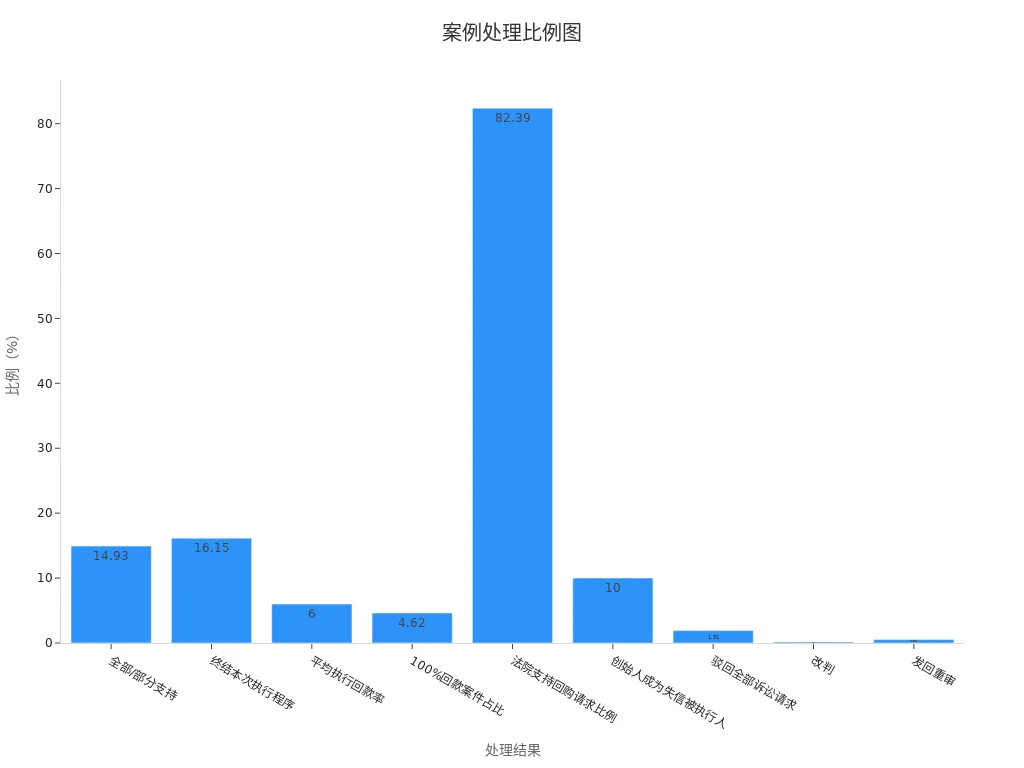

According to relevant data, the proportion of different processing results is as follows:

| Processing Result | Proportion |

|---|---|

| All/Partial Support | 14.93% |

| Terminate This Enforcement Procedure | 16.15% |

| Average Enforcement Repayment Rate | ~6% |

| Proportion of 100% Repayment Cases | ~4.62% |

| Court Support for Repurchase Requests | ~82.39% |

| Founders Listed as Dishonest Executables | ~10% |

| All Litigation Requests Rejected | 1.91% |

| Reversal of Judgment | 0.17% |

| Remand for Retrial | 0.52% |

By checking transaction and dispute statuses, you can avoid deletion failures or fund losses due to incomplete matters.

Backup Important Transaction Records and Data

Backing up important transaction records and data is a critical step that cannot be overlooked before deleting your GCash account. This helps you preserve financial history and provide necessary references in the future. Here are specific suggestions to help you efficiently complete the backup:

Why is Backing Up Transaction Records Crucial?

Transaction records include your payment history, transfer details, and bill payment information. This data may play an important role in the following scenarios:

- Tax Filing: Some countries require individuals or businesses to provide detailed payment records to complete tax filings.

- Dispute Resolution: If a transaction dispute arises with a merchant or service provider in the future, backed-up records can serve as strong evidence.

- Financial Planning: By analyzing historical transaction data, you can better plan future expenses and investments.

How to Backup Transaction Records?

To ensure data security and integrity, you can use the following backup methods:

- Export Electronic Records

Log in to the GCash app, go to the transaction history page, and select the export function. Save the records as PDF or Excel files and store them on secure devices, such as encrypted USB drives or cloud storage services. - Print Paper Copies

For important transaction records, it is recommended to print paper copies and store them properly. This provides an additional safeguard in case of electronic device damage or data loss. - Regularly Update Backups

It is recommended to check and update backup files monthly to ensure all new transactions are recorded. For users who frequently use payment platforms, weekly backups are more appropriate.

Tip: Refer to best practices in the data security field and consider adopting a “full backup + incremental backup” strategy. For example, a large supermarket chain performs full backups weekly and incremental backups daily to ensure data security. This method is also suitable for individual users.

Data Storage Security Recommendations

After completing backups, the security of data storage is equally important. Here are practical suggestions:

- Use Encryption Technology: Store backup files on encrypted devices or cloud services to prevent unauthorized access.

- Distributed Storage: Avoid storing all backups in the same location. Choose multiple storage media, such as local hard drives and cloud storage.

- Regularly Check Backup Validity: Ensure backup files can be opened and read normally to avoid data loss due to file corruption.

Risks and Prevention of Data Leakage

Improper backup and storage of transaction records may lead to data leakage. The following cases illustrate the importance of data security:

- A supermarket had serious vulnerabilities in data security, with 90% of supermarkets failing to take effective measures.

- A large supermarket chain’s database stored over 1 billion customer records and suffered a data breach, threatening customers’ property.

- Data breaches can not only cause financial losses to individuals but also put enterprises under financial pressure and damage brand reputation.

By regularly backing up and securely storing data, you can effectively reduce the risk of data leakage and protect personal privacy and financial security.

Next Steps After Backup

After completing the backup, you can confidently proceed with other account deletion steps. Ensure backup files are stored securely and regularly check their integrity. If you need to reference these records in the future, you can easily access and use them.

Specific Steps to Delete a GCash Account

Image Source: pexels

Log in to the GCash App

To start the deletion process, first log in to your GCash app. Ensure you are using the latest version of the app to avoid functional limitations or operational errors due to outdated software. Here are the specific steps:

- Open your mobile device, find and click the GCash app icon.

- Enter your registered phone number and password to log in. If you have enabled two-factor authentication, follow the prompts to enter the verification code to complete login.

- After successful login, you will enter the main interface displaying your account balance and recent transaction records.

Tip: If you forget your password, you can reset it by clicking the “Forgot Password” option. The system will send a verification code via SMS to your registered phone number; follow the prompts to complete the reset.

Access Account Settings

After logging in, you need to enter the account settings page, which is one of the key steps in deleting your account. Here’s how:

- Find the “Menu” icon (usually three horizontal lines or a gear icon) in the upper right corner of the main interface. Click to enter the menu page.

- In the menu, find and click the “Settings” option.

- After entering the settings page, you will see multiple options, including personal information, payment settings, and security settings.

Note: Users of different app versions may see slightly different menu layouts. If you cannot find the “Settings” option, use the search bar at the top of the page to enter “Settings” for quick location.

Locate and Select the “Delete Account” Option

In the settings page, you need to find the “Delete Account” option and submit the application. Here are the specific steps:

- Scroll down to the “Account Management” section in the settings page.

- After clicking “Account Management,” you will see multiple options, including “Change Password,” “Update Personal Information,” and “Delete Account.”

- Select the “Delete Account” option, and the system will pop up a confirmation window prompting you to read the relevant terms and confirm the deletion.

- Click “Continue,” and the system will require you to complete identity verification, such as entering a verification code from your registered phone number or uploading ID photos.

Case Study: In the North American market, similar payment platforms typically require users to complete multiple layers of identity verification to ensure the legitimacy of account deletion. For example, a well-known U.S. payment platform requires users to upload passport photos and answer security questions. In the European market, some platforms use biometric technology, such as fingerprint or facial recognition, to further enhance security.

After completing identity verification, the system will prompt you to confirm the final deletion application. Click “Confirm,” and your application will be submitted to GCash’s backend for processing.

Tip: After submitting the deletion application, it usually takes 1-3 working days for review. During this period, avoid attempting to log in again to prevent affecting the deletion process.

Complete Identity Verification as Prompted

Completing identity verification is a key step in deleting a GCash account. The purpose of identity verification is to ensure that the account holder is the legitimate operator and prevent unauthorized deletions. Here is the specific verification process:

- Submit Personal Information

The system will request personal information bound to the account, such as the registered phone number or email address. Ensure the entered information matches that registered with the account to avoid verification failures. - Upload Proof of Identity Documents

Upload valid proof of identity documents, such as passport, driver’s license, or ID photos, as prompted. Documents must be clear and visible to avoid verification delays due to blurriness or incomplete information. - Real-Time Face Recognition

Some payment platforms use real-time face recognition technology to enhance verification security. You need to follow on-screen prompts to complete actions such as blinking or turning your head to prove the operation is performed by the account holder. - Enter Dynamic Verification Code

The system will send a dynamic verification code to your registered phone number. Enter the verification code to proceed to the final stage of verification.

Tip: You can view statistics on verification pass rates and common issues through the financial-level real-person authentication console here. Use the “Data Statistics” and “Data Analysis” functions in the left navigation bar to obtain detailed authentication data. These functions help you understand the reasons for verification failures and make timely adjustments.

Common Issues and Solutions

During identity verification, you may encounter the following problems:

- Verification Failed: This may be due to unclear ID documents or mismatched information. Re-shoot the documents and ensure they are complete.

- Dynamic Verification Code Not Received: Check the phone number for accuracy or contact your carrier to confirm SMS service is normal.

- Face Recognition Failed: Ensure the operation is performed in a well-lit environment and avoid wearing glasses or hats.

By following the above steps, you can successfully complete identity verification and prepare for account deletion.

Confirm and Submit the Deletion Application

After completing identity verification, you need to confirm and submit the deletion application to GCash’s backend for processing. Here are the specific steps:

- Read Deletion Terms

The system will pop up an account deletion terms document detailing the impact of deletion, such as account data handling and non-recoverable functions. Read carefully and ensure you understand all content. - Confirm Deletion Intent

The system will ask again if you are sure you want to delete the account. This is to prevent accidental deletions. Click the “Confirm” button to officially submit your application. - Await Review Results

After submitting the application, GCash’s backend will review your deletion request. Review typically takes 1-3 working days. Upon approval, you will receive a confirmation SMS or email notifying you that the account has been successfully deleted.

Note: Do not attempt to log in or perform other operations during the review period. This may interrupt or delay the deletion application.

Deletion Application Processing Time

The processing time for cancellation applications may vary across different payment platforms. For example:

- North American Market: A renowned payment platform takes 2 working days for cancellation review, and users can track the progress in real time via email.

- European Market: Some platforms employ automated review systems, usually completing cancellations within 24 hours.

- Asia-Pacific Region: A payment service provider may require users to submit additional identity verification documents, extending the review time to 5 working days.

By understanding these processing times, you can better plan the timeline for canceling your account.

Post-Submission Precautions

After submitting the cancellation application, it is recommended to pay attention to the following:

- Check Confirmation Notifications: Ensure you receive a notification of successful cancellation. If not, contact GCash customer service.

- Avoid Repeated Submissions: Repeated submissions may cause system misjudgment and prolong the review time.

- Record Cancellation Voucher: Save the cancellation confirmation SMS or email for future reference.

After completing the above steps, your account cancellation process will be officially concluded.

Post-Cancellation Precautions

Confirm Successful Account Cancellation

After completing the cancellation application, you need to confirm whether the account has been successfully canceled. This is a key step to ensure account data is no longer used. Typically, GCash will notify you of the cancellation result via SMS or email. Carefully check these notifications to ensure the account status is updated to “Canceled”. If no confirmation is received, you can verify by the following methods:

- Log in to the GCash app to check if the account is locked or inaccessible.

- Contact GCash customer service, provide the account information, and request confirmation of the cancellation status.

Additionally, it is recommended to save relevant records of the cancellation confirmation, such as SMS screenshots or emails. These records can serve as evidence for future inquiries or dispute resolution.

Clear GCash-Related Data on Devices

After canceling the account, you need to clear GCash-related data on your devices to prevent privacy leaks or misuse. Here are specific operational recommendations:

- Uninstall the Application: Uninstall the GCash app from your mobile phone or tablet. This frees up storage space and reduces potential security risks.

- Delete Cache and Data: Before uninstalling the app, go to your device’s “Settings” page, find the GCash app, and select “Clear Cache” and “Clear Data”. This ensures all locally stored data is completely deleted.

- Check Other Devices: If you have used the GCash account on other devices, such as tablets or spare phones, ensure the data on these devices is also cleared.

By clearing device data, you can further protect personal information and avoid security issues caused by residual data.

Understand Account Recovery Possibility and Process

In some cases, you may need to recover a canceled account. For example, accidental cancellation or a decision to reuse GCash services. Understanding the possibility and process of account recovery can help you better handle such situations.

Here are common account recovery policies:

- Email Service Provider Policies: Some platforms offer a grace period during which you can apply for account recovery. After the grace period, account data may be permanently deleted.

- Enterprise Data Retention Policies: Enterprises typically determine the feasibility of account recovery based on their data retention policies. For example, some payment platforms retain account data for 30 days after cancellation to allow users to apply for recovery.

If you need to recover an account, you can try the following steps:

- Contact GCash customer service, explain the recovery need, and provide account information.

- Submit necessary identity verification documents, such as an ID card or registered phone number.

- Complete the recovery process as guided by customer service.

Note that the success rate of account recovery depends on the platform’s policies and technical capabilities. It is recommended to carefully assess your needs before cancellation to avoid unnecessary troubles.

Check if Other GCash-Related Services Are Affected

Before canceling your GCash account, you need to carefully evaluate whether other services associated with it will be affected. These may include automatic payments, subscription services, and third-party platform account bindings. Neglecting this may lead to service interruptions or additional fees.

Automatic Payment Functions

Many users use GCash accounts for automatic payment of utility bills, phone bills, and other items. After canceling the account, these payment functions will no longer work. To avoid service interruptions, you need to take the following precautions in advance:

- Log in to the GCash app to view set automatic payment items.

- Contact service providers to update payment methods or cancel automatic payment functions.

- Confirm all bills are paid to avoid extra penalties for unpaid bills.

Tip: In the North American market, some payment platforms offer export functions for bill payment history, facilitating users to retain records when switching payment methods. You can refer to similar functions to ensure complete bill information.

Third-Party Platform Account Bindings

GCash accounts may be bound to multiple third-party platforms, such as shopping websites, subscription services, or social media accounts. After canceling the account, these platforms may not be able to use related functions normally. Here are specific suggestions:

- Check all third-party platform accounts bound to GCash.

- Update payment methods or unbind GCash accounts.

- Confirm the new payment method is successfully bound and test its functionality.

International Case Studies

In the European market, a renowned streaming platform requires users to re-verify account information when changing payment methods. Similarly, an Asian e-commerce platform temporarily freezes account functions after users unbind payment accounts until verification is completed. Therefore, you need to plan ahead to avoid service interruptions caused by payment method changes.

Through the above steps, you can effectively manage the impact of GCash account cancellation on other services and ensure smooth transition of all functions.

The Best Alternative: BiyaPay

Image Source: pexels

BiyaPay’s Alternative Payment Solutions

BiyaPay is a powerful multi-asset transaction wallet that meets your diverse needs in global payments and investments. It supports real-time conversion of over 30 major fiat currencies and 200+ digital currencies. Whether you need international money transfers or investments in US or Hong Kong stocks, BiyaPay provides efficient solutions.

BiyaPay’s handling fees are low and transparent, charging only a small fee to help you save costs. It uses local transfer methods with no amount limits, and remittances arrive on the same day. For users needing quick fund processing, this efficiency is undoubtedly a significant advantage.

Additionally, BiyaPay supports conversion between digital currencies and fiat currencies, allowing you to directly participate in investments across multiple markets. You can manage multiple assets through a single account, easily achieving global financial planning.

BiyaPay’s Security and Convenience

Security is a top priority when choosing a payment platform. BiyaPay uses advanced encryption technology to ensure your transaction data and personal information are not leaked. Its privacy policies strictly comply with international standards, such as the EU’s General Data Protection Regulation (GDPR).

In terms of convenience, BiyaPay’s registration process is fully online and takes only 1 minute to complete. You do not need to apply for complex overseas bank accounts—simply complete identity verification to start using the service. After recharging USD, HKD, or other currencies, you can immediately participate in real-time trading of US or Hong Kong stocks, truly achieving “one account to invest in global premium stocks.”

In the North American market, similar payment platforms typically take days to complete account registration and verification. BiyaPay’s fast registration process clearly aligns better with modern users’ needs. Users in the Asia-Pacific region can also enjoy fast remittance services through local transfers, further enhancing the user experience.

How to Manage Your Payment Needs via BiyaPay

Through BiyaPay, you can manage payment needs more efficiently. Here are its main advantages:

- Low handling fees to help you save transaction costs.

- Fast fund arrival to ensure timely fund availability.

- Support for multi-currency transactions to meet global needs.

- Real-time exchange rate queries to keep you updated on market trends.

- Secure and compliant operations to protect your personal information and funds.

For example, many users in the European market use BiyaPay for cross-border remittances, enjoying the convenience of same-day arrival. In the Asia-Pacific region, corporate users optimize financial planning using its multi-asset management functions. Whether you are an individual user or an enterprise client, BiyaPay provides professional solutions to help you easily handle complex payment scenarios.

By choosing BiyaPay, you can not only simplify payment processes but also improve fund management efficiency, laying a solid foundation for future financial planning.

Canceling a GCash account is not complicated. Just follow the steps provided in this article to complete the process easily. Before canceling, clear your account balance, unlink all associated services, and ensure no uncompleted transactions or disputes. After cancellation, promptly clear device data to avoid privacy leaks. If you are looking for a safer and more convenient payment platform, BiyaPay is a worthwhile consideration. It not only supports multi-currency transactions but also provides global payment and investment services to help you manage assets efficiently.

FAQ

1. Will my personal data be permanently deleted after canceling my GCash account?

GCash typically retains user data for a period to meet legal requirements. You can contact GCash customer service to explicitly request deletion of all account-related data. Under different regions’ privacy regulations, such as the General Data Protection Regulation (GDPR), enterprises are obligated to delete data upon user request.

2. Can I cancel my account if there are uncompleted transactions?

You need to complete all transactions or resolve disputes before canceling your account. Uncompleted transactions may cause cancellation requests to be rejected. It is recommended to check transaction records and contact relevant parties to ensure all matters are resolved.

3. Can I re-register for GCash after canceling my account?

Yes. You can re-register a new account using the same phone number or email. However, transaction records and account data from before cancellation cannot be recovered. It is recommended to back up important data before cancellation.

4. Will canceling my GCash account affect my bound bank card?

No. Your bound bank card will remain usable after canceling your GCash account. Just ensure the GCash account is unlinked to avoid unnecessary deductions or association issues.

5. Can I still use other GCash services after cancellation?

After canceling your account, you will no longer be able to use any GCash services. If you need to reuse them, you can regain access by registering a new account. It is recommended to assess any uncompleted service needs before cancellation.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.