- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Don't Just Watch the Fun! Stock Splits and Reverse Splits, Will Your Wallet Rise or Fall?

Image Source: unsplash

Many investors wonder whether stock splits or reverse splits will immediately increase or decrease their wealth. In reality, these actions do not directly alter your total assets. The market value of your holdings typically remains unchanged immediately after a split or reverse split.

Stock splits and reverse splits may have indirect effects, such as:

- Increased liquidity (trading volume)

- Reduced queue times

- Narrower bid-ask spreads

- Decreased dark pool trading

- Lower price volatility

These changes may impact your investment experience but won’t instantly increase or decrease your market value.

Key Highlights

- Stock splits and reverse splits do not directly change your total assets. Focus on the company’s fundamentals rather than just changes in stock quantity.

- Splits typically enhance liquidity, attracting more investors, while reverse splits may signal financial distress, requiring careful evaluation of the company’s health.

- Approach splits or reverse splits rationally, avoiding impulsive decisions, and ensure choices align with your investment goals and risk tolerance.

- Understand the tax and cost implications of splits and reverse splits to avoid unnecessary expenses.

- Monitor company announcements and disclosures to stay informed about critical timelines and details to seize investment opportunities.

Stock Splits and Reverse Splits Overview

Image Source: unsplash

What Is a Stock Split?

A stock split occurs when a company divides its existing shares into a greater number of shares, typically to lower the per-share price and attract more investors. The U.S. financial regulatory framework provides clear definitions for stock splits. The table below summarizes the standard definition:

| Type | Definition |

|---|---|

| Stock Split | A company divides its existing shares into more shares, usually to reduce the per-share price to attract more investors. |

After a stock split, you hold more shares, but the price per share decreases proportionally. Your total asset value remains unchanged. The U.S. Securities and Exchange Commission (SEC) oversees the compliance of stock splits, requiring companies to notify shareholders in specific cases. The Financial Industry Regulatory Authority (FINRA) handles related processes but does not directly approve these actions.

What Is a Reverse Stock Split?

A reverse stock split, or consolidation, merges existing shares into fewer shares, typically to increase the per-share price to meet listing requirements. The table below provides the standard definition:

| Type | Definition |

|---|---|

| Reverse Stock Split | A company consolidates its existing shares into fewer shares, usually to increase the per-share price to maintain listing eligibility. |

After a reverse split, you hold fewer shares, but the price per share rises. Your total value and the company’s market capitalization remain unchanged.

Stock splits and reverse splits don’t immediately increase or decrease your wealth. They adjust the stock’s structure, affecting share count and price proportion, not your total assets.

Impact on Your Wallet

Image Source: unsplash

Market Value Changes

Your primary concern is whether stock splits or reverse splits affect your total assets. Neither action changes your total market value, as the company adjusts the number of shares and their price proportionally, keeping your holdings’ value constant.

The table below summarizes the impact on your total market value:

| Split Type | Impact Description |

|---|---|

| Stock Split | Post-split, you hold more shares at a lower price, but total value remains unchanged. |

| Reverse Split | Post-reverse split, you hold fewer shares at a higher price, but total value remains unchanged. |

For example, if you hold 100 shares of a U.S. company at $100 per share, your total market value is $10,000. After a 2-for-1 stock split, you hold 200 shares at $50 each, still totaling $10,000. In a reverse split, the opposite occurs—fewer shares at a higher price, with the total value unchanged.

Share Count and Stock Price

Stock splits and reverse splits directly affect your share count and per-share price. In a split, your share count increases, and the price per share drops. In a reverse split, your share count decreases, and the price rises. In both cases, your total asset value remains constant.

The table below illustrates the mathematical relationship between share count, price, and total value:

| Shares | Price | Total Value |

|---|---|---|

| 200 | $50 | $10,000 |

| 100 | $100 | $10,000 |

Here’s how it works:

- Assume a company announces a 2-for-1 stock split, and you hold 200 shares at $50 each.

- Post-split, you hold 400 shares at $25 each.

- Your total market value remains $10,000.

Many U.S. companies, such as Amazon in 1999, Apple in 2000, and Netflix in 2004, have executed stock splits. These actions didn’t directly increase or decrease investors’ total assets but adjusted the stock structure to improve market liquidity.

Stock splits and reverse splits don’t directly make your wallet grow or shrink. Focus on the company’s fundamentals and market conditions, not just changes in share count.

Effects of Stock Splits and Reverse Splits

Short-Term Effects

Stock splits and reverse splits can significantly impact stock prices and market performance in the short term. Many U.S. large-cap companies experience price increases after announcing stock splits. For example, Alphabet’s stock rose 7.5% after announcing a split plan. After Apple’s 4-for-1 split, weekly purchases increased from $1.5 billion to $10 billion. Nasdaq research shows an average 2.5% price increase post-split. The table below summarizes short-term performance for select companies:

| Company | Split Type | Price Change |

|---|---|---|

| Alphabet | Planned Split | Up 7.5% |

| Apple | 4-for-1 Split | Weekly purchases rose from $1.5B to $10B |

| Nasdaq Study | Average Increase | 2.5% |

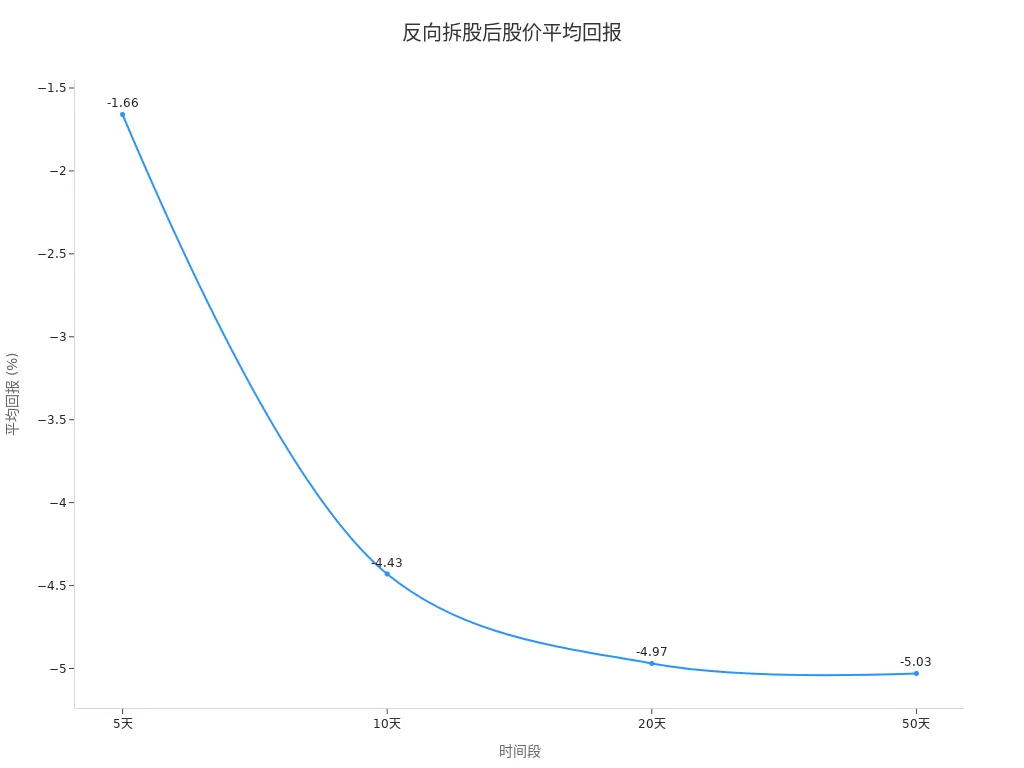

Reverse splits, however, often have negative short-term effects. Data shows average returns of -1.66% within 5 days, -4.43% within 10 days, and -5.03% within 50 days post-reverse split, with win rates below 50%. The chart below illustrates average return changes post-reverse split:

Long-Term Effects

Long-term effects depend on the company’s fundamentals and market conditions. Stock splits can enhance accessibility, attracting more investors and boosting liquidity. However, long-term investors should focus on financial performance, revenue growth, and business strategy. Reverse splits, without operational improvements, may erode investor confidence. Companies may issue new shares post-reverse split, diluting existing shareholders’ value. Research indicates reverse splits often occur in underperforming companies, and without a turnaround, stock prices may remain under pressure.

Market Sentiment

Market sentiment significantly influences the impact of splits and reverse splits. Stock splits are typically viewed as positive signals, boosting investor confidence and attracting new buyers. Reverse splits are often seen as negative signals, suggesting financial distress, leading to cautious investor sentiment. Studies link reverse split announcements to future earnings changes, as investors adjust expectations based on the news. Splits increase retail investor participation and liquidity, but long-term liquidity gains may not persist.

Company Image

Stock splits and reverse splits affect a company’s image. Splits, often executed during strong performance, signal optimism, enhancing the company’s reputation. Reverse splits may be perceived as signs of financial instability or poor management, damaging investor confidence. Some view reverse splits as a “desperate measure,” negatively impacting the company’s image. Companies must consider market perceptions and investor psychology when planning these actions.

Investor Considerations

Operational Risks

When facing splits or reverse splits, carefully assess their impact on your portfolio. Impulsive decisions based on market hype can lead to unnecessary risks.

- Investigate why a company is conducting a reverse split to determine if it supports long-term growth.

- Assess whether the split meets exchange requirements, attracts new investors, or improves liquidity to make informed decisions.

- Reverse splits may enhance a company’s market image and attract institutional investors but can also increase price volatility.

- Consider the impact of reverse splits on convertible bonds, warrants, or other securities.

- In some cases, fractional shares from a reverse split may be cashed out, potentially causing price fluctuation losses for small shareholders.

Combine your investment goals and risk tolerance to analyze the implications of splits and reverse splits, avoiding hasty decisions driven by market sentiment.

Tax and Cost Implications

Stock splits and reverse splits typically don’t directly affect your total assets but may involve tax and cost considerations.

- Reverse splits reduce share count and increase price, but total value remains unchanged.

- If fractional shares are cashed out, compare the cash received to the original cost basis to determine capital gains or losses.

- Selling shares within 90 days post-split may incur administrative fees to cover corporate action costs.

- Fees are typically disclosed upfront, and some platform members may be exempt.

Review tax regulations and trading costs to avoid unexpected expenses.

Information Disclosure

Companies must adhere to strict disclosure requirements for splits and reverse splits. Monitor announcements to stay informed.

| Disclosure Item | Description |

|---|---|

| Board & Shareholder Approval Date | Date of reverse split approval |

| Split Ratio | Specific ratio of the reverse split |

| New CUSIP Number | New identifier for post-split shares |

| DTC Eligibility | Proof of new CUSIP certification by Depository Trust Company |

| Public Disclosure Draft | Draft announcement released at least 2 business days before effective date |

| Submission Deadline | Full corporate action notice due by 12:00 PM ET before effective date |

Review company announcements and filings to grasp critical timelines and details, reducing risks from information asymmetry.

Stock splits and reverse splits don’t directly increase or decrease your wealth. Make decisions based on your goals and risk tolerance.

- Ensure stock splits align with the company’s growth plans and analyze capital structure and debt levels.

- Reverse splits are often negative signals, so evaluate the company’s financial health and long-term potential.

- Stock splits don’t directly increase total value; don’t mistake more shares for wealth growth.

FAQ

What do investors need to do after a stock split?

You typically don’t need to take action. Your broker automatically adjusts your share count and price. Verify your account to ensure accuracy.

Splits don’t affect your total market value, and the process is automatic.

Can a reverse split force a stock sale?

In some cases, fractional shares from a reverse split are cashed out. You may receive cash compensation, but most shares are adjusted automatically.

Do splits or reverse splits affect dividends?

Total dividend amounts remain unchanged. Companies adjust per-share dividends based on the new share count, keeping your total dividends constant.

Do splits or reverse splits affect tax filings?

Splits and reverse splits are generally non-taxable. Cash compensation for fractional shares may trigger capital gains tax.

Will stock prices always rise after a split?

Short-term price increases are possible, but long-term performance depends on fundamentals and market conditions. Don’t base decisions solely on splits.

Grasping the impact of stock splits and reverse splits equips you to navigate their effects on your portfolio, yet high cross-border fees, currency volatility, and offshore account complexities can hinder seizing liquidity boosts from splits or mitigating reverse split risks, especially in fast-moving U.S. markets. Picture a platform with 0.5% remittance fees, same-day global transfers, and zero-fee contract limit orders, enabling swift responses to split-driven signals via one account?

BiyaPay is crafted for U.S. stock investors, offering instant fiat-to-digital conversions to capitalize on post-split liquidity or pre-reverse-split adjustments. With real-time exchange rate query, track USD trends and remit at optimal moments to cut costs. Covering most regions with instant arrivals, it powers quick plays in split受益 stocks like Apple or Google. Standout: trade U.S. and Hong Kong stocks through a single account, leveraging zero-fee contract limit orders for announcement-based limit strategies.

Whether chasing split-driven surges or dodging reverse split risks, BiyaPay fuels your edge. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven investing. Join global investors and turn splits into strategic wins!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.