Stop Making One-Sided Bets! Vertical Spread is the Advanced Path in Options Trading

Image Source: unsplash

Have you suffered heavy losses from one-sided options bets? Market volatility can make risk management tough. Why do simple call or put purchases often lead to losses? Vertical spreads, by combining options with different strike prices, offer better risk control. Ideal for investors seeking higher returns with managed risk, vertical spreads could be your next step in options trading.

Key Points

- Vertical spreads control risk, cap maximum losses, and reduce the emotional stress of one-sided bets.

- Simultaneously buying and selling options at different strike prices creates clear profit and loss structures, calculable in advance.

- Suited for moderate market trends, vertical spreads enhance capital efficiency, delivering similar profit potential with less capital.

- Choose vertical spreads based on market conditions and your risk tolerance, pairing strike prices thoughtfully.

- Practicing in a demo account is an excellent way to learn vertical spreads, minimizing real trading risks.

Risks of One-Sided Bets vs. Vertical Spread Advantages

Image Source: pexels

Limitations of One-Sided Bets

You might opt for one-sided bets in options trading, such as buying a call expecting a U.S. stock to rise or a put anticipating a fall. These seem simple but carry high risks. Markets are unpredictable, and without significant price movement, time decay can erode your position, leading to losses.

One-sided bets expose you to full market risk, requiring constant price monitoring and causing significant stress.

Many investors lose capital due to misjudged market moves. The profit-loss structure is asymmetric: losses can accrue quickly, while profits demand sharp market shifts. One-sided bets suit those with high risk tolerance and strong market conviction, but most struggle to profit consistently.

Risk Control with Vertical Spreads

Vertical spreads are an advanced options strategy. You buy and sell options with the same expiration but different strike prices, offsetting the cost of the purchased option with the premium from the sold option.

- You lock in maximum losses, making your risk predictable regardless of market swings.

- Selling an option generates premium income, reducing overall position costs.

- Vertical spreads provide a clear profit-loss structure, with both maximum gains and losses calculable upfront.

For example, if you expect a U.S. stock to rise moderately within a month, you can buy a lower-strike call and sell a higher-strike call. You pay a net premium, and if the stock reaches your target range, you earn limited but reliable profits. If it doesn’t rise, your loss is capped.

Vertical spreads manage risk while boosting capital efficiency, sparing you the uncertainty of full market exposure.

This strategy promotes rational trading, minimizing emotional decisions and suiting investors who value stability and risk management.

Types of Vertical Spread Strategies

You can choose from various vertical spread strategies, each suited to specific market conditions. Whether a beginner or experienced, you can select a strategy based on your market outlook.

Bull Call Spread

A bull call spread suits a moderately bullish outlook. You buy a call with a lower strike price and sell a call with a higher strike price, participating in an uptrend with lower costs.

For instance, expecting a modest rise in a U.S. stock, you buy a $50 strike call and sell a $55 strike call. Your maximum loss is the net premium paid, and your maximum gain is the strike price difference minus the net premium.

Bear Put Spread

A bear put spread fits a moderately bearish view. You buy a higher-strike put and sell a lower-strike put, capturing profits in a downtrend with defined risk.

For example, anticipating a slight decline in a U.S. stock, you buy a $55 strike put and sell a $50 strike put. Your maximum loss and gain are predefined.

Call Spread

A call spread uses call options to build a vertical spread, capturing limited gains in an uptrend.

- Ideal when you expect a moderate rise but not extreme moves.

- Lowers position costs and caps maximum risk.

Put Spread

A put spread uses put options to target gains in a downtrend.

- Suitable for expecting a moderate decline without sharp drops.

- Offers a clear risk-reward structure with smaller capital outlay.

All four vertical spread types are straightforward and versatile, allowing risk control and capital efficiency based on your market judgment.

Profit-Loss Structure and Risk-Reward

Image Source: pexels

Maximum Risk

With vertical spreads, you know your maximum risk upfront. By buying one option and selling another at a different strike, losses are capped.

Calculate maximum risk by subtracting the net premium received (or paid) from the strike price difference. For a bull call spread, buying a $130 strike call and selling a $134 strike call with a $400 net premium paid, your maximum risk is $400.

You avoid the fear of massive losses from sharp market moves, as your risk is defined before trading.

This clarity helps you stay calm in volatile markets, focusing on strategy rather than unexpected capital loss.

Maximum Profit

Maximum profit is also calculable. It’s the difference between the two strike prices minus the net premium paid.

For a $130/$134 bull call spread, the strike difference is $4, or $400 for a 100-share contract. If you paid a $400 net premium, the maximum profit is $400 minus $400, or $0, but receiving a net premium increases profit.

Vertical spreads offer limited but stable gains, achievable without extreme market moves, as long as the price stays within your expected range.

Pre-calculating profits helps set realistic trading goals, avoiding greed-driven high-risk bets.

Capital Efficiency

Capital efficiency is critical in options trading, and vertical spreads excel here.

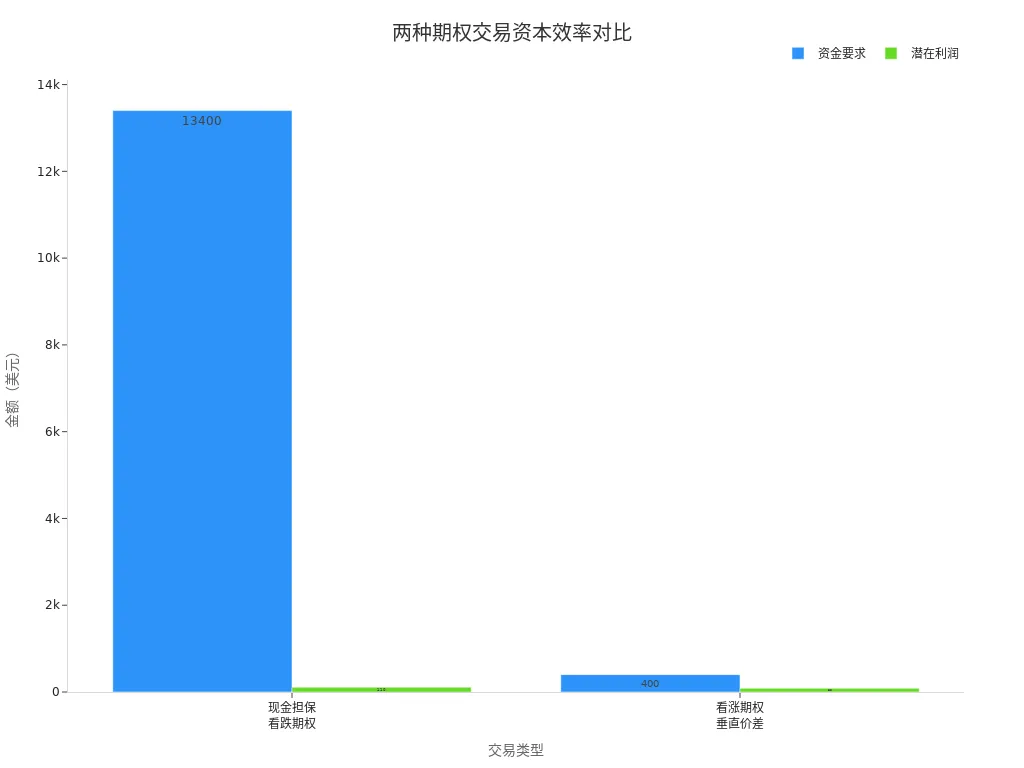

U.S. market data comparison:

| Trading Type | Capital Required (USD) | Potential Profit (USD) |

|---|---|---|

| Cash-Secured Put ($134) | $13,400 | $110 |

| Call Vertical Spread ($134/$130) | $400 | $85 |

Vertical spreads require far less capital than single-option trades, yielding comparable profits. This lets you diversify across more opportunities with the same capital.

Vertical spreads optimize capital use, enabling higher returns with less investment.

You can allocate funds flexibly, balancing risk and enhancing trading stability and sustainability.

Trading Process and Example

Contract Selection

When trading vertical spreads, start by selecting appropriate option contracts. Suppose you’re using a Hong Kong-licensed bank’s account to trade U.S. copper options. Follow these steps:

- Determine Market Direction

You predict a moderate copper price rise in the next month, favoring a bull call spread. - Choose Contract Month

Select contracts expiring in 1-2 months for easier trend capture.

Tip: Shorter expirations mean faster time decay, making risk and reward easier to calculate.

- Pick Liquid Contracts

Choose options with high volume and tight bid-ask spreads to reduce costs and improve execution.

| Step | Key Focus | Considerations |

|---|---|---|

| Direction Judgment | Bullish/Bearish | Use market analysis |

| Contract Month | 1-2 months | Time decay impact |

| Liquidity Selection | High volume, low spread | Lower trading costs |

Strike Price Pairing

For a bull call spread:

- Buy Lower Strike Option

Purchase a $3.80 strike call option. - Sell Higher Strike Option

Sell a $4.00 strike call option.

This creates a bull call spread with a net premium paid, capping risk at the net premium and profit at the strike difference minus the net premium.

Note: Avoid overly wide strike price gaps to maintain stable risk-reward. Choose strikes based on risk tolerance and market outlook.

Practice in a demo account to master the process before live trading, ensuring effective risk control and capital efficiency.

Applicable Scenarios and Investor Types

Market Conditions

Consider market conditions when choosing vertical spreads. If you have confidence in market direction but want to limit risk, vertical spreads are ideal. U.S. markets often see volatility around major economic data releases. If you expect price movement within a range, vertical spreads lock in risk and reward, outperforming one-sided bets in choppy or moderate trends.

Investor Suitability

Vertical spreads suit investors prioritizing risk control and steady gains. If you dislike the stress of one-sided bets, vertical spreads offer predefined maximum loss and gain. You can participate in U.S. options markets with less capital, boosting efficiency. Suitable for both beginners and experienced traders who value risk management.

Common Pitfalls

You may encounter pitfalls. Some believe vertical spreads eliminate all losses, but every strategy has risks. Monitor market volatility and choose appropriate strikes and expirations. Avoid the one-sided bet mindset, which ignores risk control and leads to heavy losses. Vertical spreads reduce but don’t eliminate risk. Practice in a demo account to avoid following trends blindly.

Vertical spreads offer clear advantages over one-sided bets, capping risk and reward upfront. Combine with your trading experience to apply them in U.S. markets. Focus on risk management and avoid pitfalls for rational, effective trading.

FAQ

What market conditions suit vertical spreads?

Use vertical spreads in U.S. markets during moderate uptrends or downtrends to lock in risk and reward.

Can vertical spreads lose money?

Yes, losses are possible, but capped at the net premium paid if the market moves against your prediction.

Are capital requirements high for vertical spreads?

No, vertical spreads require less capital (e.g., a bull call spread costs only the net premium, far less than one-sided bets).

Can I practice vertical spreads in a demo account?

Yes, U.S. market demo accounts let you practice vertical spreads, familiarizing you with the process and reducing live trading risks.

Vertical spreads offer options traders a more robust strategy, moving beyond the high risks of single-leg bets to achieve controlled, predictable returns. However, global options trading often faces challenges like high cross-border remittance fees, exchange rate uncertainties, and platform complexities, which can reduce efficiency or increase costs.

BiyaPay provides a seamless financial platform to address these hurdles. Our real-time exchange rate queries give you instant access to fiat and digital currency conversion rates across various currencies, ensuring transparency and efficiency. With remittance fees as low as 0.5%, covering most countries globally and supporting same-day transfers, BiyaPay streamlines your options trading with swift fund access. Plus, you can trade US and Hong Kong stocks via our stocks feature without needing an overseas account, enhancing your vertical spread strategies. Sign up with BiyaPay today to boost your trading efficiency and embark on the path to advanced profitability!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2025 Latest US Stock Account Opening Tutorial: Complete Online Application in 5 Steps

Best Free Real-Time US Stock Quote Websites Besides Yahoo Finance

Profit Expansion is the Core Driver: Analyzing the Growth Engines of the US Stock Market in 2026

In-Depth Analysis of US Stock Pre-Market Trading: Unveiling the Secrets of the Market Before Opening

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.