Trump's violent tax hikes continue to cause panic in the US stock market! Which option strategies can hedging a sharp drop?

Global markets have been in violent turmoil recently due to tariff clouds, changes in economic policies, and macroeconomic expectations.

Trump’s “reciprocal tariffs” are coming! US stocks continue to panic!

On April 2nd local time, Trump signed an Executive Order on so-called “reciprocal tariffs” at the White House, announcing that the US would impose a 10% “minimum benchmark tariff” on trading partners and impose personalized higher “reciprocal tariffs” on the country with the largest US trade deficit. After Trump announced the tariffs, the US stock futures index plummeted. The Nasdaq 100 ETF QQQ fell 4.19%.

On April 4th, Trump stated that his economic policies “will never change”, despite the continued impact of his widespread tariffs on the global economy. Trump said on social media on Friday: " For those investors who have poured into the US and invested huge amounts of money, my policies will never change. Now is a great time to get rich, and it is easier than ever to get rich!!!"

The latest data shows that the US non-farm payroll increased by 228,000 in March. In another social media post, Trump wrote: “The employment data is very good, far exceeding expectations. It has started to take effect.” Trump also retweeted a TikTok video from a user who claimed he “deliberately caused the market to crash” to force the Federal Reserve to lower interest rates.

The flurry of comments was another sign of Mr. Trump’s muddled signals over his willingness to negotiate with foreign governments and business leaders about reducing the size and scope of tariffs. The new round of tariffs announced by Mr. Trump on Wednesday raised US tariffs to their highest level in more than a century The day before, Mr. Trump said he was willing to lower tariffs if other countries offered “amazing” returns.

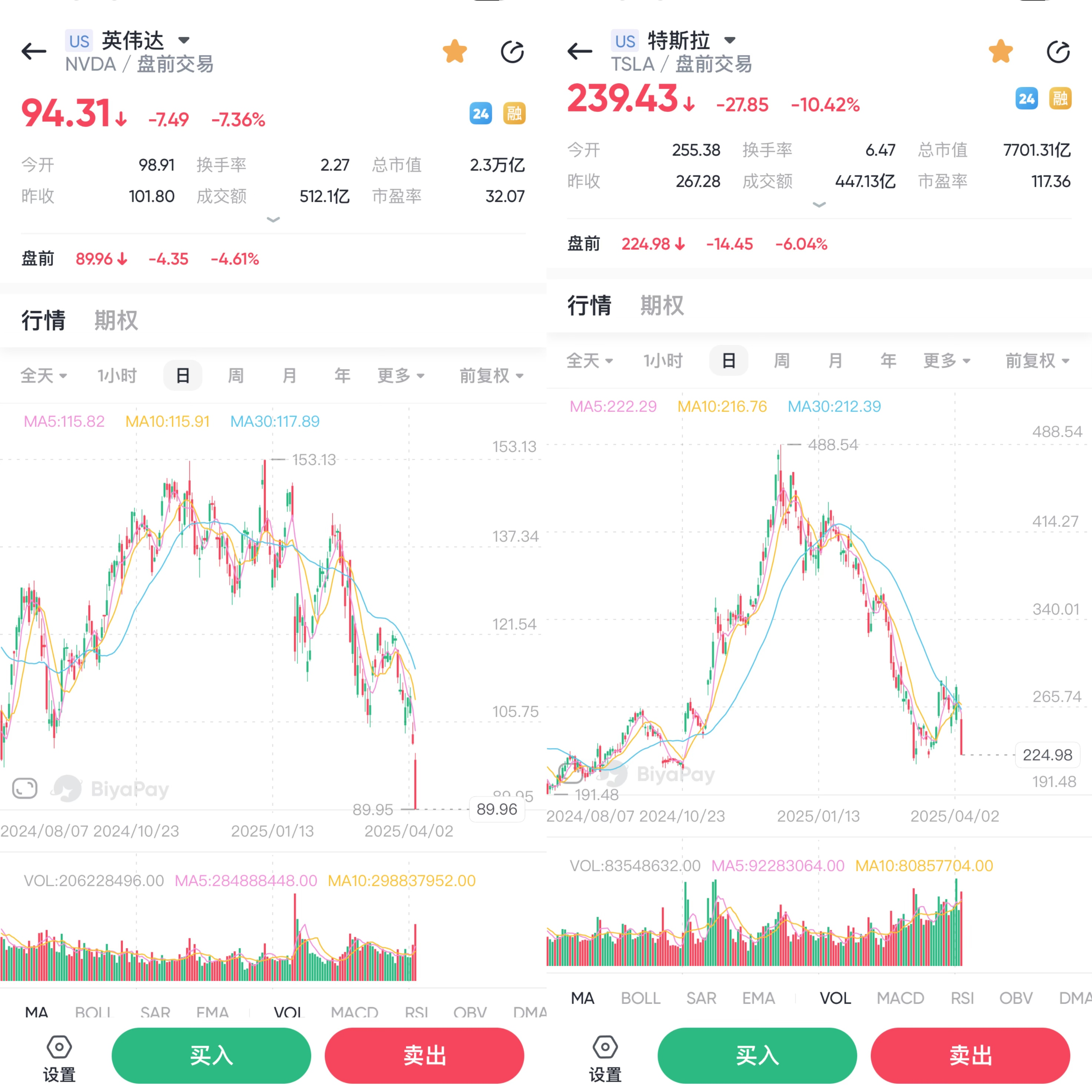

On April 4th, the US stock market continued to enter a plunge mode. The Dow Jones index plummeted 1000 points, the Nasdaq composite index plummeted more than 3%, The Nasdaq fell 22% from its historical high and entered a technical bear marketTechnology stocks continued to “bleed like a river” on Friday, with Nvidia falling 7.36% and Tesla’s stock price falling 10.42%.

Looking back at the three months since Trump took office, his tariff policy has almost become one of the most difficult variables to predict in the global market. Whether it is the short-term correction of the US stock market or the skyrocketing gold price, both are closely related to the changes in Trump’s tariff policy.

So, how will this “reciprocal tariff” affect the direction of subsequent assets?

Let’s take a look at several types of assets that are significantly affected by tariff policies.

1. US stocks: After a short-term correction, the cost-effectiveness has improved, and the allocation value is relatively high

Under the implementation of the “reciprocal tariff” policy, the first to bear the brunt may still be global risk assets. Since the beginning of the year, the impact of tariffs combined with market concerns about the decline of the US economy has caused a correction in US stocks, especially technology stocks.

In the short term, there is still uncertainty about Trump’s policy outlook, and the US stock market may continue to fluctuate. It is necessary to pay attention to the valuation adjustment under the influence of market sentiment. In the medium and long term, although economic data has weakened, the probability of a substantial recession in the US is not high, and US technology companies have strong profitability. Considering that the Federal Reserve still has some policy easing space, US technology stocks may perform well in the medium and long term.

2. Gold: Safe-haven sentiment may push up gold prices and continue to rise

Since the beginning of the year, the continuous changes in Trump’s tariff policy have boosted market risk aversion, and the international gold price has soared to over $3,100 per ounce, with a year-on-year increase of over 18%.

As the “top stream in the safe-haven world”, gold deserves to be one of the assets that benefit the most from Trump’s transactions. In the short term, geopolitical factors will also support the demand for gold as a safe-haven asset. Coupled with the support of global central bank gold purchases and other behaviors, the price of gold may continue to rise, but it also needs to be cautious about the risk of its high-level correction.

3. USD: High policy uncertainty, USD may continue to strengthen

Since the beginning of the year, the US dollar index has fallen back to around 104 from the high point at the beginning of the year, mainly affected by the expectation of recession and interest rate cuts. In theory, Trump’s proposal to impose tariffs will push up the demand for funds to flow back to the US, and the uncertainty of his trade policy has also increased the safe-haven demand for the US dollar. In the future, the US dollar may continue to strengthen.

4. Commodity futures: market volatility increases, which may benefit CTA strategies

In terms of the commodity market, in the past two months, overseas economic expectations and macro factors such as tariffs have driven the continuous upward trend of gold and copper, but most commodity varieties have shown weak and volatile trends. If there are fluctuations in subsequent tariff policies, the volatility of the commodity market may increase, which may benefit the performance of CTA strategies.

Therefore, in such an uncertain and volatile market environment, our emotional management is particularly important. As investors, we should analyze market changes rationally, avoid being influenced by panic or greed, and seize investment opportunities that may arise during a crash through the multi-asset trading wallet BiyaPayApp. For example, we can choose stocks and industries that are undervalued or have strong resistance to falls, and invest in these safe-haven stocks through BiyaPay. This not only benefits us, but also facilitates our trading of US stocks and reasonable investment in diversified asset classes to cope with market fluctuations.

What options strategies can investors use to hedging a sharp drop?

Against the backdrop of a market crash, what investors need most are suitable hedging and short selling methods, especially option strategies, which are important tools to achieve this goal. The following lists six commonly used hedging methods to help investors manage risks and profit layout in different situations.

Buy put options (Protective Put)

Buying put options is a direct put strategy, with two main functions:

- Short selling function: When traders expect asset prices to fall, they can simply buy put options to capture downside gains.

- Risk management:For investors holding stocks or other assets, buying put options as protective puts can provide insurance against asset declines, limiting potential losses.

This strategy is not only applicable to stocks, but also to multiple markets such as currencies, commodities, and indices, helping investors protect themselves when prices fall.

Sell bullish options strategy (Covered Call)

For investors who already hold stocks, selling bullish options (Covered Call) is a strategy that can both generate additional profits and play a hedging role. When the market fluctuates, this strategy can partially offset the losses caused by the decline in asset prices. Especially when investors expect stocks to not rise or fall sharply in the near future, selling bullish options within or outside the normal price can provide a hedging effect similar to buying put options.

Bear spread strategy

The bear spread strategy is designed for situations where the underlying asset price is expected to fall, and constructs short positions by combining bullish or put options while controlling risk.

- Bear market call spread: buy bullish options at a higher exercise price and sell bullish options with the same expiration date at a lower exercise price.

- Bear put spread (Bear Put Spread): buy a put option at a specific exercise price and sell the put option at a lower exercise price at the same time.

The advantage of this strategy is that it can reduce the unlimited risk of shorting stocks directly, while controlling costs and capturing some profits when the market goes down.

Inverse ratio spread

The disadvantage of the traditional spread method is that when going long or short, although the risk is limited, the upward and downward profits are also limited. Using ratio inverse spread can solve this problem, achieving unlimited profits and limited risks.

In the ratio spread strategy, traders buy bullish options or put options with at-the-money ATM or out-of-the-money OTM, and then sell at least two or more identical OTM options. If traders put, they will use the put ratio spread.

The bearish inverse ratio spread, also known as the defensive bear market spread strategy, involves selling one put option with a higher exercise price in a 2:1 ratio and purchasing two put options with the same expiration date but lower exercise price. If the stock price drops significantly, this strategy can accelerate investors’ profits, and if the stock price rises rapidly, it can also bring certain profits. Therefore, this strategy is suitable for investors who have pessimistic expectations for market trends.

Collar strategy

The leading strategy combines the dual advantages of buying protective put options and selling Covered Call. While holding stocks, it prevents downside risks by buying out-of-the-money put options and partially offsets the cost of put options by selling out-of-the-money bullish options. This strategy can effectively lock in the stock’s return range, limiting downside risks and retaining upward space to some extent.

When the cost of a put option is fully covered by selling a bullish option, this is called a zero-cost lead strategy.

Volatility VIX and Leveraged ETF Strategies

Investors often get the latest readings from the S & P 500 Volatility Index (VIX) in volatile markets to feel the market sentiment. The VIX is also often referred to as the “panic index” because it usually rises sharply when the market falls sharply. Investors can also trade futures and options on the VIX for hedging.

If investors believe that the market will further decline sharply in the future, they can adopt the method of buying VIX bullish options for hedging. Conversely, if investors believe that the market will stabilize and rebound in the future, they can also profit by shorting VIX through options. They can also use relevant options of leveraged ETFs to enhance their hedging effect. In addition, for those who want to invest in options, it is very important to choose a suitable platform. A user-friendly platform is not only smooth to use and has accurate values, but also has high security. For example, you can choose a more reliable securities firm for investment, such as Jiaxin Wealth Management and Interactive Brokers, which are well-known global investment securities firms. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities or Interactive Brokers to invest in US stocks and US stock options. Of course, you can also directly invest in options on BiyaPay, choose suitable US stock targets, click on options, and you can see the option chain.

Strategy selection and risk management

Overall, when investors expect the market to continue to plummet, buying put options, reverse ratio spreads, bear market spreads, and buying VIX bullish options are ideal hedging tools. Reverse ratio spreads have limited risk but unlimited profit potential, bear market spreads can achieve short positions while controlling costs, and buying VIX bullish options can provide the best hedging effect in specific situations.

If investors believe that the market will only slightly decline or stabilize, they can consider adopting the strategy of selling bullish options or the leading strategy. These two strategies respectively retain a large profit space when the stock is rising and take into account the upward opportunity while locking in the Downside Risk.

In times of intense market volatility, rational emotional management and strict risk control are particularly important. Investors should not only pay attention to changes in market fundamentals and Technical Fundamentals, but also protect assets through scientific derivative strategies and capture potential investment opportunities during a sharp decline.

Finally

Against the backdrop of the sharp drop in the US stock market and the continuous rise in global economic uncertainty, a reasonable hedging derivative strategy is particularly crucial. Whether it is directly buying put options or using combination strategies such as collar strategies and reverse ratio spreads, investors need to develop corresponding trading plans based on their own risk preferences and market judgments. Only through scientific strategy combinations and rigorous risk management can stable income opportunities be found in volatile markets and effectively resist the risks brought by unfavorable market environments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

A-Share Beginner’s Guide: Master Market Hours and Trading Rules in One Article

How to Wire Transfer USD from Industrial and Commercial Bank of China to OCBC Singapore? This Guide is All You Need

Beginner’s Guide: What to Do When a Stock Hits Limit-Down? Can You Still Trade?

In-Depth Review: After ChiNext Dropped Over 1% and Rebounded, Who Will Be Tomorrow’s A-Share Leader?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.