A Comprehensive Guide to Purchase Orders: From Execution to Efficient Payment

Image Source: unsplash

The purchase order definition is simple: it is an official commercial document you as the buyer send to the seller to confirm the intent, quantity, and price for purchasing goods or services.

This document is the core of business activities. It is not only the starting point of transactions but also a key voucher to ensure transparency and control in the procurement process. Deeply understanding the purchase order definition is the first step to help you optimize the entire process from procurement to efficient payment.

Key Highlights

- A purchase order (PO) is a formal document issued by the buyer to the seller, confirming the purchase intent, quantity, and price.

- PO is an important legal document that clarifies transaction details, protects the rights of both buyers and sellers, and helps companies control budgets.

- PO differs from invoices; PO is issued by the buyer at the start of the transaction for placing orders, while invoices are issued by the seller after delivery for payment.

- A complete procurement process includes purchase requisition, PO creation, sending confirmation, goods receipt and inspection, and “three-way matching” to trigger payment.

- Companies can improve procurement efficiency through standardized processes, digital management, system integration, and automated payments.

Purchase Order Definition and Core Value

Image Source: unsplash

After understanding the purchase order definition, you will find it is far more than a simple form. It is a blueprint containing precise details and safeguarding the interests of both parties in the transaction.

Key Information in a PO

A clear and complete purchase order can avoid miscommunication and potential future disputes. To ensure your purchase order is professional and effective, it typically needs to include the following key information:

- Unique PO Number: For easy tracking and reference.

- Buyer and Seller Information: The legal company names, addresses, and contact details of you and your supplier.

- Key Dates: Order creation date and expected delivery date.

- Goods/Services Details: Accurate description of the goods or services purchased, including model, quantity, unit price, and total price.

- Delivery and Shipping Information: Clear receiving address, shipping method, and terms.

- Payment Terms: Agreed payment conditions, such as “Net 30” (net 30 days), meaning payment within 30 days after invoice issuance.

- Authorization Signature: Signed by personnel in your company with procurement authority to make it officially effective.

Why Do Businesses Need POs?

You might ask, why not just place an order by phone or email? Using standardized purchase orders brings you four core business values:

- Clarify Transactions: It clearly lists all transaction details in writing, setting clear expectations for you and the supplier.

- Provide Legal Protection: Once the supplier accepts your purchase order, it becomes a legally binding contract, protecting the rights of both parties.

- Control Budgets: POs allow you to track committed expenses in real time. Your finance team can clearly see future cash outflows, effectively preventing over-budget purchases.

- Simplify Audits: Clear purchase order records provide complete written evidence for every procurement action, making financial audits simple and efficient.

Core Differences Between PO and Invoice

Many people confuse purchase orders (PO) with invoices. Although both relate to payments, their functions and timing are completely different. Simply put, the purchase order defines “what to buy,” while the invoice defines “how much to pay.”

You can quickly understand their core differences through the table below:

| Feature | Purchase Order (PO) | Invoice |

|---|---|---|

| Creator | You (Buyer) | Your Supplier (Seller) |

| Issuance Timing | At transaction start, for placing order | After delivering goods or services, for payment |

| Core Function | Issues purchase offer, serves as contract basis | Issues payment request, serves as settlement basis |

In summary, you use PO to initiate and confirm a purchase, while your supplier uses an invoice to request payment from you.

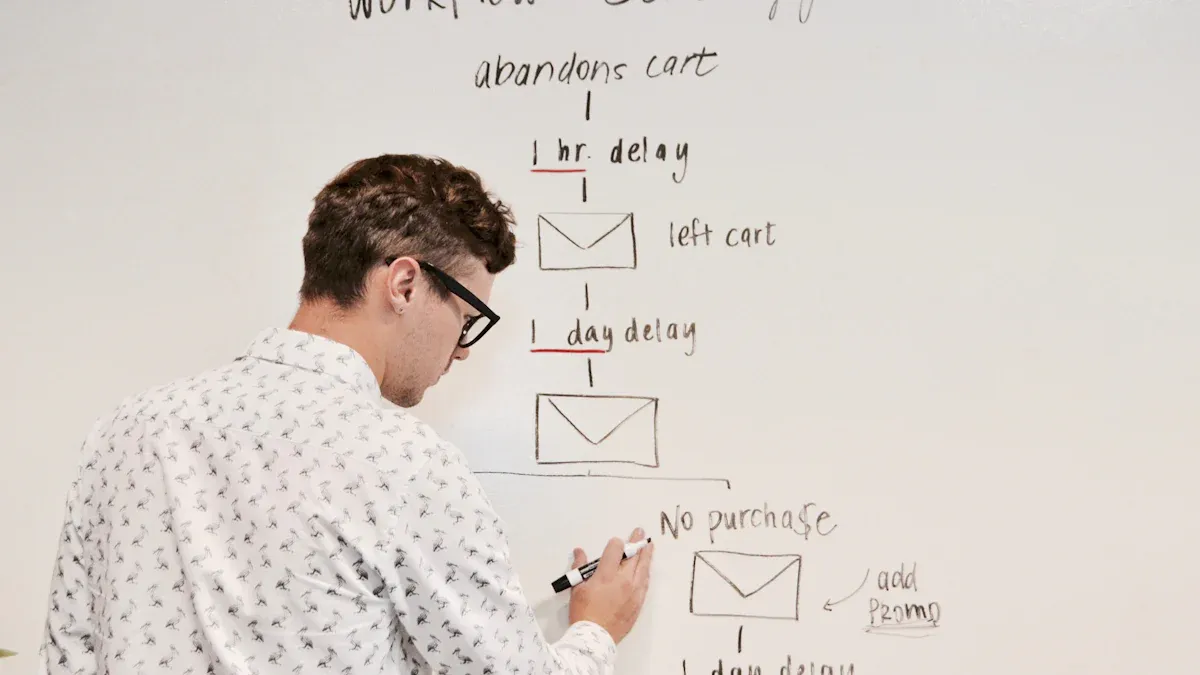

Full PO Process: From Purchase Requisition to Payment

Image Source: pexels

Now that you have mastered the definition and value of purchase orders, it is time to delve into how they operate in actual business. A purchase order does not exist in isolation; it is a key link in the complete “Procure-to-Pay” (P2P) process. This process ensures every purchase is documented and follows procedures.

From Purchase Requisition to PO Creation

Before creating a purchase order, everything starts with an internal need. This need is formally proposed through an internal document called a “Purchase Requisition” (PR). You can think of it as an internal “request” to initiate procurement.

This requisition is an absolute prerequisite for generating a PO. It starts an internal approval process, usually including the following steps:

- Submit Purchase Requisition: Employees needing goods or services fill out the requisition, detailing needs, quantity, budget, etc..

- Hierarchical Approval: The requisition automatically routes to relevant approvers. Department managers verify the reasonableness of the need, while budget owners confirm available funds.

- Procurement Department Review: Finally, procurement specialists review the requisition to ensure it complies with company procurement policies.

Only after the purchase requisition obtains all necessary internal approvals will the key information it contains be formally transferred to create an external purchase order. This ensures every externally committed expense undergoes strict internal review.

For example, the goods details, quantity, supplier information, and expected delivery date confirmed in the purchase requisition become accurate data you can directly use when creating the PO.

Sending, Confirmation, and Acknowledgment

Once your purchase order is created and authorized, the next step is to send it to the supplier. Sending methods vary from traditional to modern, each with advantages:

- Email: The most common and direct method, suitable for most small and medium transactions.

- Supplier Portal: Many large enterprises establish a collaboration platform where you and the supplier manage and track all orders on a shared dashboard.

- EDI (Electronic Data Interchange): This is a fully automated system-to-system communication method. Your procurement system directly sends order data to the supplier’s system without manual input, greatly improving efficiency and reducing errors.

After issuing the PO, a crucial step is waiting for the supplier’s “Purchase Order Acknowledgment” (PO Acknowledgement).

This acknowledgment is a written confirmation from the supplier indicating they have received and accepted your order terms. Note that this is not just a courteous reply. Once the supplier issues the acknowledgment, your purchase order transforms from an “offer” into a legally binding contract. It locks in price, quantity, and delivery date, providing legal protection for both parties.

Goods Receipt, Inspection, and Verification

When the supplier ships according to the agreement, the process enters the physical operation stage. Your warehouse or receiving team needs to do more than just sign for receipt.

Upon goods arrival, your team creates an internal document called a “Goods Receipt Note” (GRN). This document is the official record confirming receipt of goods, detailing the received items, quantity, and condition.

To ensure accuracy, the receiving team strictly verifies against the PO:

- Verify Goods: Do the received item models and specifications match the PO?

- Count Quantity: Does the received quantity match the ordered quantity?

- Inspect Quality: Are there any damages in transit or visible defects?

If any issues are found, such as short quantity or damaged goods, your team needs to immediately document them (usually with photos as evidence) and communicate promptly with the supplier to resolve. This step is crucial for cost control and inventory accuracy.

Three-Way Matching and Triggering Payment

This is the final and most critical financial control step in the process—“Three-Way Matching.”

Before paying the supplier’s invoice, your finance team cross-verifies three key documents to ensure all information matches perfectly. These three documents are:

- Your Issued Purchase Order (PO): Records what you agreed to buy and at what price.

- Your Warehouse’s Goods Receipt Note (GRN): Proves what you actually received and how much.

- Supplier’s Invoice: Records how much the supplier requests you to pay.

During matching, the finance team carefully compares the following fields:

| Verification Item | Purchase Order (PO) | Goods Receipt Note (GRN) | Supplier Invoice |

|---|---|---|---|

| Goods/Services | ✓ | ✓ | ✓ |

| Quantity | ✓ | ✓ | ✓ |

| Unit Price/Total Price | ✓ | ✓ |

Why is three-way matching so important? Studies show that companies failing to effectively implement three-way matching may lose up to 5% of annual revenue due to fraud or erroneous payments. For example, a company with $150 million annual revenue could lose up to $750,000 over five years due to duplicate payments. Price errors, incorrect tax calculations, or duplicate invoices can cause these losses. Three-way matching is a solid defense against these financial vulnerabilities.

Only when the information on these three documents perfectly matches will the finance team approve payment. Once matching succeeds, the payment process is triggered, and your company pays the supplier through the designated bank (for example, a licensed bank in Hong Kong), completing the entire procurement cycle.

Achieving Efficient Operations with POs

Understanding and optimizing the purchase order process is key to transforming your procurement department from a cost center to a value creation center. By implementing the following four strategies, you can significantly enhance overall operational efficiency using POs.

Process Standardization

Standardized processes are the foundation for achieving efficient operations. When you establish a unified set of rules for purchase order creation, approval, and sending in your company, you immediately gain multiple benefits:

- Improve Accuracy: Reduce communication errors through clear requirements, ensuring order quality.

- Strengthen Budget Control: Clearly track every committed expense for effective budget management.

- Simplify Audit Work: Standardized records provide a clear audit trail, making compliance checks simple.

Practical Tip: You can create several standardized PO templates based on different procurement needs. For example, create a “Standard Purchase Order” for one-time purchases, and a “Blanket Purchase Order” for long-term recurring purchases, significantly reducing repetitive work.

Digital Management

Say goodbye to paper documents and spreadsheets; digitizing purchase order management is the second step to improving efficiency. Digitization automates many repetitive tasks, reducing human errors. Studies show that automation can significantly lower error rates caused by manual data entry.

You can use professional procurement management software (such as Precoro, Sage Intacct) to create, send, and track all purchase orders. These tools centralize all information in one place, allowing your team to collaborate in real time and stay updated on order status anytime.

System Integration

After digitizing purchase order management, the next step is integrating it with your company’s core systems. Connecting the procurement system with your Enterprise Resource Planning (ERP) system creates a seamless workflow.

This integration consolidates all procurement data into a centralized database, providing a “single source of truth” for spending. When the procurement system integrates with financial software, your finance team gains 360-degree visibility into budgets and expenses, enabling more accurate financial forecasting and decision-making.

Once systems are integrated, payment control and spend visibility also benefit from dedicated tooling. BiyaPay, a multi-asset trading wallet, offers a unified account with policy controls to centralize procurement-related spending: before committing a PO, finance can use the free Exchange Rate Checker to price multi-currency costs; for small, subscription, or ad-hoc purchases, issue Virtual Cards with limits and purpose tags so card spend maps cleanly to PO/GRN/invoice for matching; for account and compliance details, see the BiyaPay website.

Operating with regulatory registrations in multiple jurisdictions (e.g., US MSB, NZ FSP), BiyaPay adds transparent, auditable payment records without changing your existing three-way-match and approval chain.

Payment Automation

Payment is the final link in the procurement process and often the biggest bottleneck. By automating “three-way matching” and payment approval processes, you can completely transform this situation.

Automated systems can automatically verify purchase orders, goods receipt notes, and invoices, pushing successfully matched invoices directly to approvers. This not only shortens invoice processing time by up to 70% but also helps capture early payment discounts offered by suppliers, turning the accounts payable department from a processing center into a profit center.

Now you understand that a purchase order is far more than a form. It is the key bridge connecting your company’s procurement needs with efficient financial settlement. By implementing strategies of standardization, digitization, integration, and automation, you can significantly enhance the efficiency and transparency of the procurement process.

Take Action Now: Start reviewing and optimizing your procurement process today. Treat it as a strategic tool, and like many successful companies, you can shorten procurement cycles by 30% and effectively reduce invoice processing time, ultimately improving overall operational efficiency.

FAQ

Can I Change a Purchase Order After Sending It?

Yes, but you need to communicate with the supplier and obtain their agreement. Any modifications should be confirmed in writing, such as through a revised purchase order. This ensures both parties have a consistent understanding of the new terms and avoids future disputes.

Key Tip: Verbal agreements are insufficient for protection. Always update your written records.

Do All Purchases Require a Purchase Order?

Not necessarily. For low-value, low-risk purchases, many companies use simpler methods to improve efficiency.

- Procurement Card (P-Card): Employees can use company credit cards to directly purchase small items like office supplies.

- Expense Reimbursement: Employees pay out-of-pocket first, then recover funds through the reimbursement process.

What If the Invoice Does Not Match the Purchase Order?

Your finance team should not pay the invoice. This is a typical scenario where issues are found in the “three-way matching” process. You should immediately contact the supplier, point out discrepancies on the invoice (such as price or quantity errors), and request they issue a correct invoice.

Core Principle: Never pay unverified invoices.

What If the Supplier Does Not Respond After Receiving the PO?

If the supplier does not issue written confirmation (i.e., purchase order acknowledgment), a legally binding contract is not formally established. You should proactively contact the supplier to confirm if they accept the order. If they do not accept, you need to find another supplier.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Must-Read for Investing in US Stocks in 2025: 5 Technical Indicator Tips for Analyzing Real-Time Quotes

BiyaPay Secures Sumsub's Highest Security Certification: Building a Rock-Solid Foundation for a Global Integrated Financial Platform with Zero-Tolerance Risk Controls

In-Depth Analysis of US GDP: Comprehensive Insights from Consumption to Investment

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.