How to Easily Send Money via Venmo: Detailed Steps and Usage Guide

Image Source: pexels

Have you heard of Venmo? It is a very popular social payment tool among young people in the United States. Sending money easily via Venmo is as simple as texting a friend. Its popularity can be seen from its massive transaction volume:

- It is projected that by 2025, its annual total payment volume will reach $342 billion.

Don’t worry that getting started will be complicated. You will find that the entire process of easily sending money with Venmo is very straightforward.

Key Takeaways

- Venmo is a popular social payment tool that makes sending money as simple as texting.

- Before using Venmo, you need to download the app, create an account, link a payment method, and complete identity verification.

- You can easily pay friends, receive money from others, split bills, and manage privacy settings for each transaction.

- Venmo balance can be withdrawn via free standard transfer or instant transfer with a fee; using a credit card for payment incurs a 3% fee.

- For fund security, enable multi-factor authentication, stay vigilant against scams, and know how to handle erroneous transfers.

Getting Started with Venmo

Image Source: unsplash

Before starting transfers, you need to complete a few simple preparation steps. This process is very quick and can be done in just a few minutes.

Download the App and Create an Account

First, you need to download the Venmo app from the official app store. You can get it via the official link in the Apple App Store or by searching for “Venmo” in the Google Play Store.

After downloading, open the app and start creating an account. You will need to prepare the following information:

- A U.S. phone number: This number must be able to receive text messages and must not have been used to register another Venmo account before.

- Your legal name: Venmo is a regulated financial service, so your legal name is required to initiate identity verification. You can set a publicly displayed username afterward.

Follow the on-screen instructions, enter your name, email, phone number, and set a password to complete account creation.

Link Payment Methods

After creating the account, you need to link a payment source to send money. Go to the “Me” page, tap the “Settings” icon, and then select “Payment Methods.”

Venmo supports multiple payment methods:

- Bank account

- Debit Card

- Credit Card, including Visa, Mastercard, American Express, and Discover

Tip: You can link one bank account to up to two different Venmo accounts. If you share a bank account with family or a partner, both of you can use it for Venmo payments or withdrawals.

When linking a bank account, you have two verification options:

- Instant Verification: Through the Plaid service, enter your online banking login information to complete verification immediately.

- Micro-Deposit Verification: Venmo will send two small deposits to your bank account (usually arriving within 1-3 business days). After receiving them, return to the Venmo app and enter the amounts of these two deposits to complete verification.

Complete Identity Verification

To unlock more features and enhance account security, you need to complete identity verification. After verifying your identity, you can enjoy higher transaction limits and use advanced features like direct payroll deposit.

According to U.S. federal law, Venmo needs to verify user identities. You will need to provide some personal information, such as:

- Legal full name

- Home address

- Date of birth

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

In some cases, Venmo may also require you to upload supporting documents, such as a valid U.S. driver’s license, passport, or utility bill, to confirm your identity information. This process ensures the security of your funds and those of other users.

Easily Send Money with Venmo: Core Features

Image Source: unsplash

After completing account setup, you can start experiencing Venmo’s core features. You will find that the process of easily sending money with Venmo is very intuitive, as simple as chatting with friends.

How to Pay a Friend

Paying a friend is Venmo’s most commonly used feature. The entire process takes just a few simple steps.

- Initiate Payment: Open the Venmo app and tap the blue “Pay or Request” button in the bottom right corner of the home screen.

- Find the Recipient: You have multiple ways to find your friend.

- Search Information: In the search bar at the top, you can enter the other party’s username, phone number, or email.

- Select from Contacts: If your friend is already in your contacts list, you can select them directly from the list.

- Scan QR Code: If you are with your friend, this is the fastest way. Tap the QR code icon next to the search bar, point your phone camera at your friend’s Venmo QR code. You can also scan a saved QR code image from your photo album.

- Enter Amount: After selecting the recipient, enter the amount you want to pay.

- Add a Note: This is where Venmo’s social nature shines. In the “What’s it for?” field, you can write a note, such as “Last night’s dinner 🍕” or “Movie ticket money 🎬”. Fun notes make transfers more personal.

- Choose Privacy Settings: Above the payment button, you can select the visibility range for this transaction.

- Confirm and Pay: Finally, check your payment source (bank account, debit card, or Venmo balance), then tap the blue “Pay” button to complete.

Operation Tip: Before paying, be sure to carefully verify the recipient’s information and payment amount to ensure everything is correct.

How to Receive Money from Others

When someone needs to pay you, you can proactively initiate a payment request to remind them.

The steps are equally simple:

- Tap the “Pay or Request” button on the home screen.

- Select one or more people who need to pay you.

- Enter the amount you wish to receive.

- Explain the reason for the request in the note, such as “Lunch from last Friday”.

- Tap the blue “Request” button, and the other party will receive your payment request notification.

This feature is perfect for reminding friends to pay what they owe you, avoiding the awkwardness of asking in person.

Split Bills

When dining out, traveling, or sharing rent with friends, splitting expenses is always a hassle. Venmo’s group feature can help you solve this easily.

You can create a group to manage shared expenses. For example, you can create a dedicated group for your “roommate group” or “weekend travel squad.”

The process for splitting bills in a group is as follows:

- First, go to the “Me” page and find and tap the “Groups” tab.

- Create a new group and invite all relevant members to join.

- When a shared expense occurs, any group member can tap “Add an expense”, enter the total amount and purpose.

- Venmo will automatically calculate the amount each person needs to pay. Group members can view bill details and complete payments anytime.

Although Venmo itself does not offer complex bill-splitting features like professional splitting apps (such as proportional splitting), it makes going Dutch unprecedentedly simple through free and convenient transfers. Completing easy money transfers with Venmo, settling bills is just a tap away.

Make Good Use of Notes and Privacy Settings

Every Venmo transaction is like a social feed post. Therefore, understanding how to manage your privacy is crucial.

Venmo offers three privacy setting options, which you can set individually for each transaction:

| Privacy Setting | Description |

|---|---|

| Public | Anyone on the internet may see the payer, payee, and note for this transaction. |

| Friends | Only your Venmo friends and the other party’s Venmo friends can see this transaction. |

| Private | Only you and the other party in the transaction can see it. |

Important Rule: Venmo adopts the stricter privacy setting between the two parties in the transaction. For example, even if you set a payment to “Public,” if the recipient’s default setting is “Private,” the transaction will ultimately be visible only to the two of you.

To better protect personal privacy, it is recommended to change your default privacy setting to “Private”.

Steps to set default privacy options:

- Go to the “Me” tab.

- Tap the “Settings” gear icon in the top right corner.

- Select “Privacy”.

- Under “Default Privacy Setting,” choose “Private”.

This way, all your future transactions will default to private, providing you with the maximum level of privacy protection.

Fund Management and Fee Details

Understanding how to manage your Venmo balance and related fees can help you use this tool more efficiently and cost-effectively. Below, we will detail balance withdrawals, fee structures, and account limits.

Withdraw Venmo Balance

When you receive a transfer from a friend, the money will be deposited into your Venmo balance. You can withdraw this money to your linked bank account at any time.

The steps are as follows:

- In the Venmo app, go to the “Me” tab.

- In the “Wallet” section, tap the “Transfer Balance” button.

- Enter the amount you wish to withdraw.

- Choose your withdrawal method (standard or instant transfer).

- After confirming the receiving bank account and amount are correct, tap the green “Transfer” button to complete the operation.

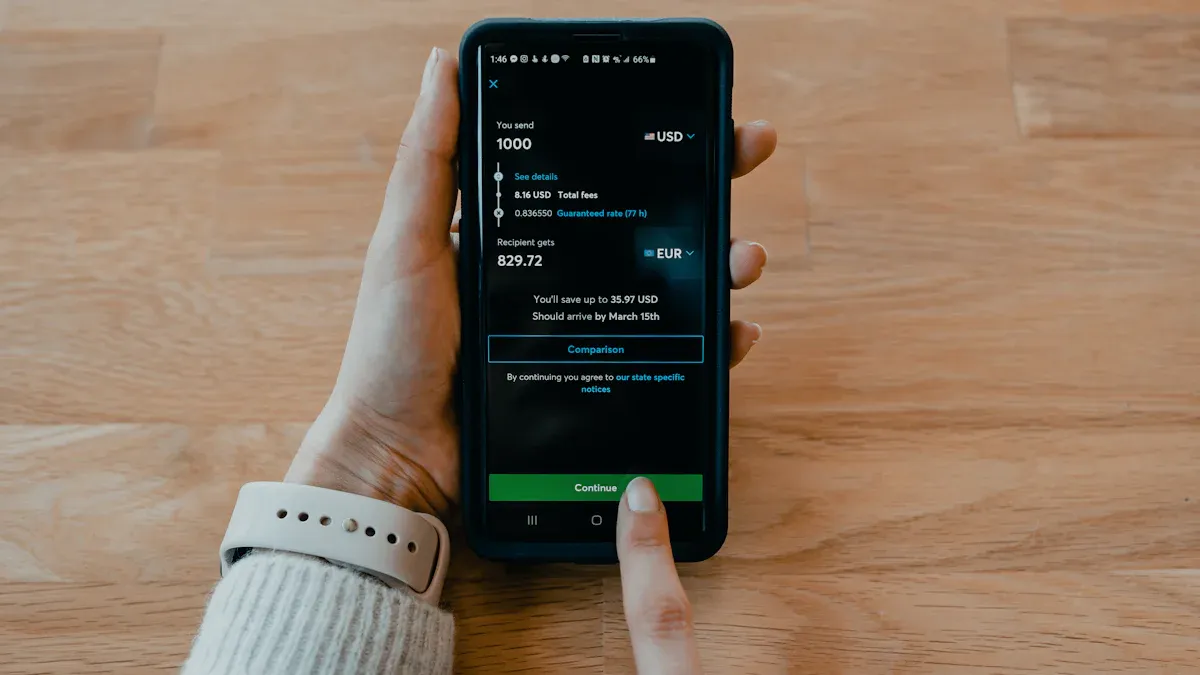

Standard vs. Instant Transfer

Venmo offers two ways to transfer your balance to a bank, differing in speed and fees.

Standard Transfer: This method is completely free, and funds typically arrive in your bank account within 1-3 business days. Transfers are processed through the Automated Clearing House (ACH) network, and weekends and bank holidays may affect arrival time.

Instant Transfer: If you need money urgently, you can choose this option. Funds usually arrive at your linked debit card or bank account within 30 minutes. This service charges a 1.75% fee (minimum fee of $0.25, maximum of $25).

Set Up Direct Payroll Deposit

You can even set Venmo as your paycheck receiving account and enjoy free direct deposit service.

The setup method is very simple:

- In the Venmo app, go to “Settings” and then tap “Direct Deposit”.

- The app will provide you with a dedicated bank account number and routing number.

- Provide this information to your employer or payer.

According to Venmo’s rules, receiving funds into your Venmo account via direct deposit is completely free.

Understand Fees and Limits

While many of Venmo’s core features are free, fees apply in certain cases. Understanding these can help you avoid unnecessary expenses.

| Transaction Type | Fee |

|---|---|

| Pay using bank account, debit card, or Venmo balance | Free |

| Pay using credit card | 3% |

| Standard withdrawal (1-3 business days) | Free |

| Instant withdrawal (within 30 minutes) | 1.75% (minimum $0.25, maximum $25) |

Additionally, your account has weekly transaction limits. Completing identity verification can significantly increase these limits.

- Unverified Account: The weekly payment limit is usually $299.99.

- Verified Account: The weekly payment limit increases to $6,999.99.

Therefore, completing identity verification not only enhances account security but also allows you to use Venmo more freely for large transfers.

Account Security and Scam Prevention Guide

Using Venmo to easily send money is very convenient, but protecting your fund security is equally important. You should understand some basic security measures and scam prevention tips to ensure every transaction is safe.

Set Up Multi-Factor Authentication

The good news is that Venmo has already handled the most important step for you. All Venmo accounts are protected by multi-factor authentication (MFA) by default, and you do not need to enable it manually.

This means that when you log in to your account, Venmo will send a verification code to your registered phone number. You must enter this code to log in, effectively confirming your identity. For stronger protection, you can also choose to use an authenticator app. Such apps generate time-sensitive verification codes, providing you with additional security.

Beware of Common Transaction Scams

Scammers use various tactics to try to steal your money. You need to stay vigilant and recognize these common scams.

Important Reminder: Venmo’s primary purpose is for transfers between friends and family you know and trust. Please avoid transactions with strangers.

Here are some common scam types:

- Fake Payments: When buying goods online from a stranger, the other party may send a forged payment screenshot, claiming they have paid, and urge you to ship the item.

- Accidental Transfer: You may receive an “accidental” transfer from a stranger, and then the other party contacts you requesting a refund. This money may come from a stolen credit card, and if you refund it, you may ultimately lose your own money.

- Phishing: You receive emails or texts that appear to be from Venmo officially, asking you to click a link or provide account information. Remember, Venmo’s official email addresses always end with

@venmo.com. - Prize Scams: Scammers claim you have won a big prize but need to pay a small “handling fee” first to claim it.

How to Handle Erroneous Transfers

Sending money to the wrong person can happen. Knowing the correct way to handle it is crucial.

First, you need to know Venmo’s official policy: Once a payment is successfully sent to an existing Venmo account, it generally cannot be canceled.

However, you can take remedial measures depending on the situation:

- Transfer to a Friend: If you accidentally send the wrong amount or duplicate a transfer, the best way is to directly initiate a payment request for the same amount to your friend and briefly explain the situation in the note.

- Transfer to a Stranger: If you mistakenly send money to someone you don’t know, do not try to resolve it privately. You should immediately contact Venmo’s customer support team. You can find contact information via “Me” > “Get Help” in the app. Support will guide you through the next steps.

- Payment in Pending Status: If you send money to a phone number or email address that has not yet registered for Venmo, the transaction will show as “pending.” In this case, you can directly find it in the transaction history and “Take back” the payment.

Congratulations! You have now mastered the core usage of Venmo. The entire process of easily sending money with Venmo can be summarized in three simple steps:

- Link your payment method.

- Find your friend.

- Enter the amount and send.

Venmo’s charm lies in its unique social attributes, making transfers between friends as fun as sharing updates. When you use a bank account or debit card, transfers are completely free. Now follow this guide, download and start your Venmo easy money transfer journey, and enjoy seamless payment fun!

FAQ

Can I use Venmo in mainland China?

You currently cannot use Venmo in mainland China. This service requires a U.S. phone number and a U.S. bank account to register and use. Venmo primarily serves users within the United States.

If your needs center on overseas online payments, subscriptions, or occasional cross-border expenses, you can complement the safety tips in this guide with a neutral toolchain: estimate costs first, add a virtual card for international charges when needed, and use compliant channels for cross-border funding.

Practically, start with BiyaPay’s free Exchange Rate Comparison to gauge real-time pricing and FX markups; if you don’t have an accepted international payment card, submit a Virtual Card application and set it as a funding method—this works alongside Venmo’s “use balance first, then card” flow; where compliant person-to-person transfers are required, consider BiyaPay Remittance after reviewing fees and settlement times.

BiyaPay is a multi-asset wallet that supports flexible conversion between multiple fiat currencies and digital assets and operates under a compliance framework (e.g., U.S. MSB, New Zealand FSP). For capabilities and disclosures, see the website.

Does using Venmo cost money?

Venmo’s core features are free. You do not incur fees when paying with a bank account, debit card, or Venmo balance. Only when you pay with a credit card does the platform charge a 3% transaction fee.

What if I send money to the wrong person?

If you accidentally transfer to a friend, you can initiate a payment request to get the funds back. If you sent it to a stranger, you should immediately contact Venmo support for help and not resolve it privately.

Can I cancel a payment?

You cannot cancel a payment that has been sent to an existing Venmo user. Only if the recipient has not yet registered for Venmo and the payment is in “pending” status can you take it back from the transaction history.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Understand the Core Differences Between the Nasdaq Composite Index and Nasdaq 100 Index in One Article

Want to Invest in the Chinese Stock Market? Start by Understanding the Shanghai Composite Index

2026 China Stock Market Investment Guide: Spotlight on 5 Must-Watch Leading Tech Stocks

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.