- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

GCash International Number Registration Guide: Detailed Steps for Cross - border Remittance and Receipt

Image Source: pexels

You can complete GCash international number registration using an international phone number. The system supports receiving and remitting, especially between mainland China and overseas. You need to meet age and identity requirements and prepare relevant documents. You only need to follow the process, and registration is simple. The following content will explain each step in detail.

Key Points

- GCash international number registration allows users to use international phone numbers without needing a local Philippine number, simplifying the registration process.

- During registration, you must be at least 18 years old and prepare valid identification, such as a passport or visa, to ensure smooth identity verification.

- After registration, users can enjoy fast cross-border remittance and receiving services, with funds typically arriving within 1-2 business days.

- When using GCash for cross-border remittances, pay attention to fees and limits to ensure each transaction stays within the specified amount.

- Regularly check account security, update payment passwords promptly, and protect personal information to ensure fund safety.

Feasibility and Support

International Number Registration for GCash

You can easily open a GCash account through international number registration. GCash has officially opened registration for multiple international phone numbers, eliminating the need for a local Philippine number. You only need to prepare a valid international phone number and relevant documents to complete registration. GCash international number registration makes receiving and remitting between China/mainland China and overseas more convenient. You don’t need to travel to the Philippines or have a local Philippine address.

Supported Countries and Regions

Currently, GCash international number registration supports phone numbers from the following countries and regions:

| Country/Region |

|---|

| United States |

| Canada |

| Italy |

| United Kingdom |

| Australia |

| Japan |

| United Arab Emirates |

| Saudi Arabia |

| Kuwait |

| Qatar |

| South Korea |

| Taiwan |

| Singapore |

| Hong Kong |

| Spain |

| Germany |

You can use local phone numbers in these countries and regions for GCash international number registration. This way, you can smoothly open an account in China/mainland China, Hong Kong, Singapore, and other supported regions.

Cross-Border Remittance and Receiving Functions

After GCash international number registration, you can enjoy various cross-border remittance and receiving services:

- You can directly receive funds into your GCash account through partnerships with international remittance agencies like Western Union and MoneyGram.

- You can receive remittances from the Philippines in real-time, with fast and secure delivery.

- As long as your GCash account is verified, you can start receiving cross-border remittances.

- You can also transfer funds from GCash to licensed Hong Kong bank accounts, facilitating fund movement in China/mainland China or other regions.

Tip: GCash international number registration not only supports receiving but also meets diverse funding needs for living, studying, or working overseas.

Registration Requirements

Age and Identity Requirements

When applying for GCash international number registration, you must be at least 18 years old. You need to prepare valid identification documents. Common identification includes a passport and a valid visa. If you are an overseas Filipino worker, you can also use an OFW ID. You must ensure all documents are authentic and valid. GCash will verify your identity based on the submitted materials. Only after passing verification can you successfully open an account.

Phone Number Type

You must use a local Philippine phone number to complete GCash international number registration. The system will send a verification code to your Philippine phone number. You cannot register a GCash account with phone numbers from China/mainland China, Hong Kong, or other countries. GCash currently does not support registration with foreign phone numbers. You need to prepare a local Philippine phone number in advance and ensure it can receive SMS normally.

Tip: You don’t need to travel to the Philippines, but you must have a local Philippine phone number. The registration process can be completed remotely from China/mainland China or other regions, as long as your phone number meets the requirements.

- GCash requires users to have a local Philippine phone number to complete registration.

- Registering GCash with a foreign phone number is not possible.

- Registering GCash requires a local Philippine phone number to receive the verification code and complete the process.

Required Documents

You need to prepare the following documents to successfully complete GCash international number registration:

| Document Type | Description |

|---|---|

| Identification | Passport, valid visa, and (if applicable) OFW ID, used to verify identity. |

| Proof of Address | Utility bill, bank statement, lease agreement, or employer letter, used to verify residential address. |

| Bank Information | If you wish to link your GCash account to an existing bank account, provide a copy of a check or bank statement. |

You also need a commonly used email address to receive notifications and account information. All documents must be authentic and clear for verification. You can choose to link your GCash account to a licensed Hong Kong bank account, facilitating receiving and fund movement in China/mainland China or overseas. All amounts are settled in USD, making international remittances and receiving convenient.

GCash International Number Registration Process

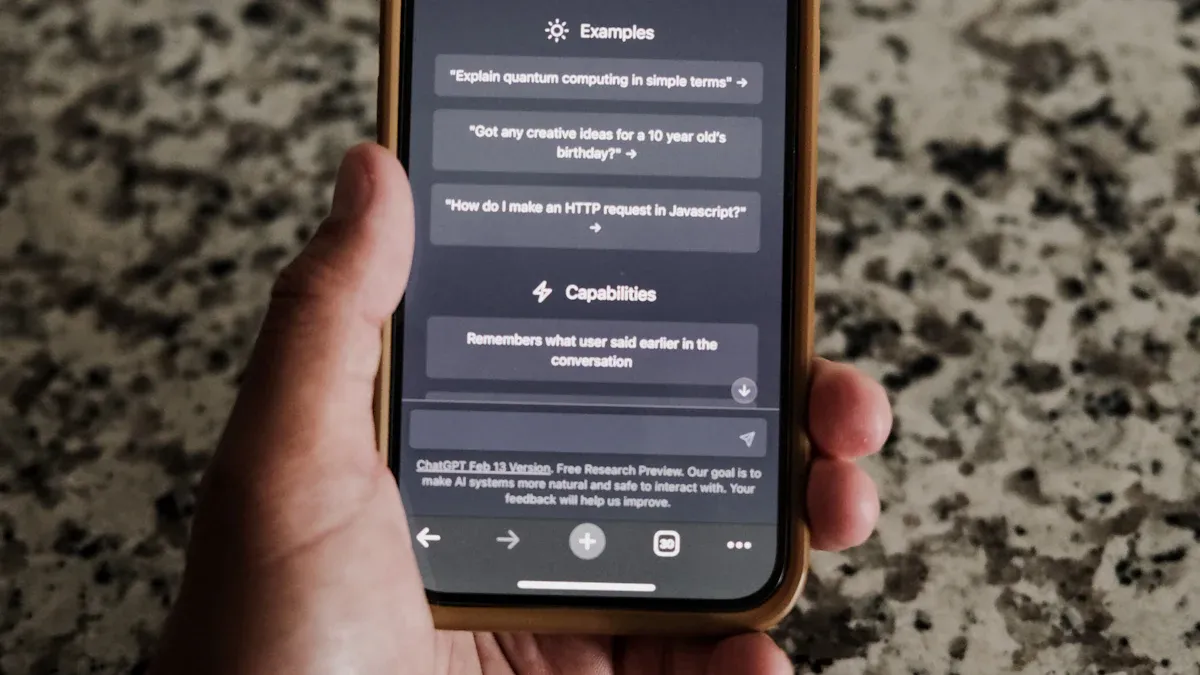

Image Source: unsplash

The GCash international number registration process is very clear. You only need to follow the steps below to successfully open a GCash account and enjoy cross-border remittance and receiving services. The entire process is suitable for users in China/mainland China and other supported countries and regions.

Download the GCash App

You can download the GCash app through your phone’s app store. Whether you use an Android or iOS device, you can easily obtain the official GCash app.

- Open your phone and go to Playstore or App Store.

- Search for “GCash,” find the official app, and download and install it.

- After installation, click the icon to open the GCash app.

Tip: Before downloading, ensure your phone’s system is updated to the latest version to avoid compatibility issues.

Select International Number Registration

After opening the GCash app, you need to select the international number registration option. The system will ask you to choose the country of your SIM card. You can find supported regions like China/mainland China, Hong Kong, and Singapore in the dropdown menu.

- Select your country or region.

- Enter your local phone number.

- Click “Next” to proceed to the verification step.

Note: Ensure the phone number you enter is valid and can receive SMS verification codes.

Enter Information and Verify

The system will send a 6-digit verification code (OTP) to the phone number you entered. You need to input the code within the specified time to complete number verification.

- Enter the 6-digit OTP code received.

- Click “Submit.”

- Fill in personal information, including name, date of birth, email, etc.

- Click “Next” to proceed to the next step.

Tip: If you don’t receive the verification code, check your phone signal or request a resend. Some regions may experience SMS delays.

Identity Verification

Identity verification is a critical step in GCash international number registration. You need to upload valid identification documents, such as a passport, valid visa, or OFW ID. The system will require you to upload photos of the documents and perform facial recognition.

- Upload photos of identification documents as prompted.

- Complete facial recognition to ensure identity consistency.

- Wait for system review, which typically takes 1-2 business days.

| Step | Description |

|---|---|

| Upload Documents | Photos of passport, visa, or OFW ID |

| Facial Recognition | Complete selfie verification as prompted by the app |

| Review Time | Generally 1-2 business days |

Note: All uploaded materials must be clear and authentic. If the review fails, the system will notify you via SMS to provide additional materials.

Account Setup

After passing identity verification, you can set up your GCash account’s security information. You need to set an MPIN (payment password) to protect account security.

- Enter and confirm your MPIN.

- Verify that all personal information is correct.

- Click “Confirm” to complete registration.

After successful registration, you will receive an SMS notification confirming that GCash international number registration is complete. You can immediately use GCash for cross-border remittances and receiving. The account supports linking with licensed Hong Kong bank accounts, facilitating fund movement in China/mainland China or other regions, with all amounts settled in USD.

Reminder: Regularly change your MPIN to ensure account security. If you encounter any issues during registration, contact GCash’s official customer service.

Cross-Border Remittance and Receiving

Image Source: pexels

Remittance Channel Selection

You can transfer funds to your GCash account through various international banks and partners. GCash collaborates with globally recognized remittance agencies like Western Union, supporting cross-border remittances from over 200 countries. In China/mainland China, the US, Canada, Australia, and other regions, you can choose local partners to complete remittances. The table below shows major partner channels for select countries and regions:

| Country | Partners |

|---|---|

| Australia | Panda Remit, Remitly, Rocket Remit, Skrill, Wirebarley, WorldRemit, Ria, Homesend, MoneyGram, Perahub, Ria Money, Taptap Send, Terrapay, Thunes, Tranglo, Western Union, World First Singapore, World Remit/Send Wave, Zepz, Xendit |

| Canada | Viamericas, Sendwave, WorldRemit, Ria, Telcoin, Xoom, Wirebarley, Remitly, Canada, OTT Remit, Hanpass, Homesend, MoneyGram, Perahub, Ria Money, Taptap Send, Terrapay, Thunes, Tranglo, Western Union, World First Singapore, World Remit/Send Wave, Zepz, Xendit |

| United States | BC Remit, LBC USA, Meridian, MoneyGram, Panda Remit, Perahub, Pomelo, Remitly, Ria, Ria Money, Skrill, Smallworld, Taptap Send, Terrapay, Thunes, Trangmit, Uniteller, Viamericas, Visa Direct, Wave/Zepz, Western Union, Wirebarley, World First Singapore, World Remit/Send, WorldRemit, Xendit, Xoom |

You can select the appropriate partner based on your country. Many partners support online operations, while some also offer offline counter remittances. You only need to provide the recipient’s GCash account information to complete the cross-border transfer.

Tip: After GCash international number registration, you can receive funds directly through these channels without needing a local Philippine bank account.

Fees and Limits

When receiving funds with a GCash international number, you need to pay attention to fees and limits. Fees vary slightly depending on the partner, and the specific amount is displayed during the remittance. You can check the fees on the partner’s platform in advance. GCash sets clear limits for cross-border remittances, as follows:

| Type | Limit (in PHP, settled in USD) |

|---|---|

| Maximum Amount per Transaction | 50,000 PHP per recipient per day (30,000 PHP for first-time transfers to a GCash account) |

| Recipient’s Monthly Income Limit | 100,000 PHP per recipient |

| Recipient’s Wallet Limit | 100,000–500,000 PHP per GCash account |

When receiving funds in China/mainland China or other countries, ensure single transactions and monthly amounts stay within these limits. Some partners may have additional per-transaction or daily limits, so check details before transferring.

Note: GCash adjusts wallet limits based on account verification levels. You can increase your receiving limit by upgrading your verification level.

Delivery Speed

After completing a cross-border remittance, funds typically arrive within 1-2 business days. In some cases, delivery may take up to 5 days or longer. Delivery speed depends on the remittance method chosen:

- Bank transfers may take longer to process.

- Remittance centers or online partners typically offer faster delivery.

You can track remittance progress in real-time on the partner’s platform. GCash will notify you via SMS or the app once the funds arrive.

Tip: Delivery times may be delayed during holidays or special periods. Plan fund movements in advance to avoid delays affecting usage.

Receiving and Remittance Operations

You can follow these steps to complete cross-border receiving and remittance with a GCash international number:

- Determine the remittance amount and select a suitable international partner.

- Enter the recipient’s GCash account details (typically the phone number).

- Choose a payment method (e.g., bank transfer, credit card, cash, etc.).

- After completing the remittance, save the transaction receipt and track the transfer status on the partner’s platform.

- Once the recipient receives the funds, they can check the balance via the GCash app and choose to withdraw to a licensed Hong Kong bank account or use for other transactions.

After GCash international number registration, you can check receiving records and balances anytime via the app. GCash supports multiple withdrawal methods, making it convenient to manage funds flexibly in China/mainland China or overseas.

Reminder: To ensure account security, regularly review receiving records. Contact GCash customer service promptly if you encounter suspicious transactions.

Common Issues and Precautions

Number Change

When using a GCash international number, you may need to change your phone number. Note the following:

- You can only transfer your account and services to a new number if the old phone number is fully verified.

- Transaction history, GScore, GForest, and Piggy Bank services from the old number will not transfer to the new number.

- The old number will be deactivated, and you will no longer have access to that account.

Tip: Before changing numbers, back up important information and ensure the new number can receive verification codes.

Notifications and SMS

After registering a GCash international number, the system will notify you of account changes and transaction information via SMS and the app. You need to ensure your phone number is active and can receive verification codes and notifications promptly. If you are in China/mainland China or other regions, some SMS may be delayed due to carrier restrictions. You can prioritize the app’s notification function to avoid missing important information.

Function Restrictions

Some functions of a GCash international number account differ from those of a local Philippine SIM card account. Refer to the table below for specific services:

| Account Type | Available Services |

|---|---|

| Philippine-Issued SIM Card Account | All app services, including sending money, bank transfers, top-ups, bill payments, cash-ins, GSave, GInsure, GLoan, GGives, GLife |

| International-Issued SIM Card Account | Sending money, bank transfers, top-ups, bill payments, cash-ins (more services to be added in the future) |

You can use basic functions like sending money, bank transfers, top-ups, and bill payments. Some advanced services like GSave and GLoan are not yet available but may be introduced in the future.

Account Security

When managing a GCash international number account, security is critical. GCash has a large user base, with high market exposure risks. You can take the following measures to enhance account security:

- Follow security policies to avoid operational risks.

- Learn to identify phishing and other cyber threats.

- Enable multi-factor authentication to increase account protection.

- Regularly conduct account security checks to detect anomalies promptly.

- Stay updated with official security announcements and maintain communication during security incidents.

Tip: Regularly change your payment password and avoid sharing personal information.

Customer Support

If you encounter issues, you can contact GCash customer support through multiple channels. The table below lists common support methods:

| Support Channel | Description |

|---|---|

| Phone Number | From overseas: +63-2-7739-2882 (international call rates apply) |

| Alternative Method | Use internet calling apps to save on costs |

You can also visit the GCash website’s help center to find frequently asked questions. You can submit a support ticket through the official website, and customer service will respond. You can also send messages via social media platforms (e.g., Facebook and Twitter) for assistance. For urgent issues, prioritize calling the hotline.

Tip: When using GCash in China/mainland China or overseas, prefer online customer service channels to save on international call costs.

The GCash international number registration process is simple, typically taking 10-15 minutes to complete. You only need to download the app, enter information, upload documents, and set up your account to enjoy convenient cross-border remittance and receiving services. Pay attention to the following key steps:

- Download and open the GCash app.

- Enter your name, phone number, and email.

- Upload a valid passport or other identification.

- The account can be topped up and transferred via multiple methods.

| Feature | GCash | Other E-Wallets |

|---|---|---|

| Registration Process | Simple and fast | More complex |

| Transaction Fees | Low | Potentially higher |

| Cross-Border Receiving Methods | Diverse | Limited |

You can easily receive funds from overseas through GCash, with funds flexibly transferable to licensed Hong Kong bank accounts. Follow the process strictly and stay updated with GCash’s latest official policies to ensure account security and efficient fund movement.

FAQ

How can I remotely register a GCash international number in China/mainland China?

You can download the GCash app in China/mainland China and select international number registration. You only need valid documents and a supported country’s phone number, with no need to travel to the Philippines.

Which banks can a GCash international number account be linked to?

You can link your GCash account to licensed Hong Kong banks. This allows you to conveniently withdraw funds to a Hong Kong bank account, with settlements in USD.

Is there a fee for registering a GCash international number?

Registering a GCash international number is free. You only need to prepare relevant documents and a supported country’s phone number, and the registration process is completely free.

How can I withdraw funds after a cross-border remittance arrives?

You can use the withdrawal function in the GCash app to transfer funds to a licensed Hong Kong bank account. The system settles in USD, and the process is simple and fast.

What should I do if I lose my phone number and need to recover my GCash account?

You can apply to recover your account through GCash’s official customer service. Provide identity information and registration materials, and the support team will assist with verification and account recovery.

When registering GCash with international numbers for cross-border remittances, you may value its support for 16 countries’ SIMs (e.g., US, Canada, Hong Kong) and partnerships like Western Union, yet face hurdles: limited to Filipinos requiring passport verification, restricted features for international accounts (no GSave/GLoan), daily limits of 50,000 PHP (first-time 30,000 PHP), 1-2 day arrivals, and no China mainland phone support necessitating Philippine SIM workarounds—particularly amid 13 million overseas Filipinos’ 2025 remittance needs, complicating non-Filipino access and costs.

BiyaPay emerges as a premier cross-border finance platform, addressing these challenges comprehensively. Our real-time exchange rate query delivers instant mid-market rates to sidestep markups. With fees as low as 0.5%, it supports conversions across 30+ fiat currencies and 200+ digital assets, covering multiple global destinations with same-day delivery. Uniquely, BiyaPay’s single platform supports direct US and Hong Kong stock trading without separate overseas accounts, with zero fees on contract orders, seamlessly turning remittances into investment opportunities. Licensed under US MSB and equivalents, fortified by 256-bit encryption and real-time fraud detection for unmatched compliance and security.

Sign up at BiyaPay today for low-rate, rapid transfers and integrated investing, elevating your cross-border remittances to greater efficiency and safety!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.