- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Boxypay: How to Meet Global Remittance Needs and Ensure Security?

Image Source: unsplash

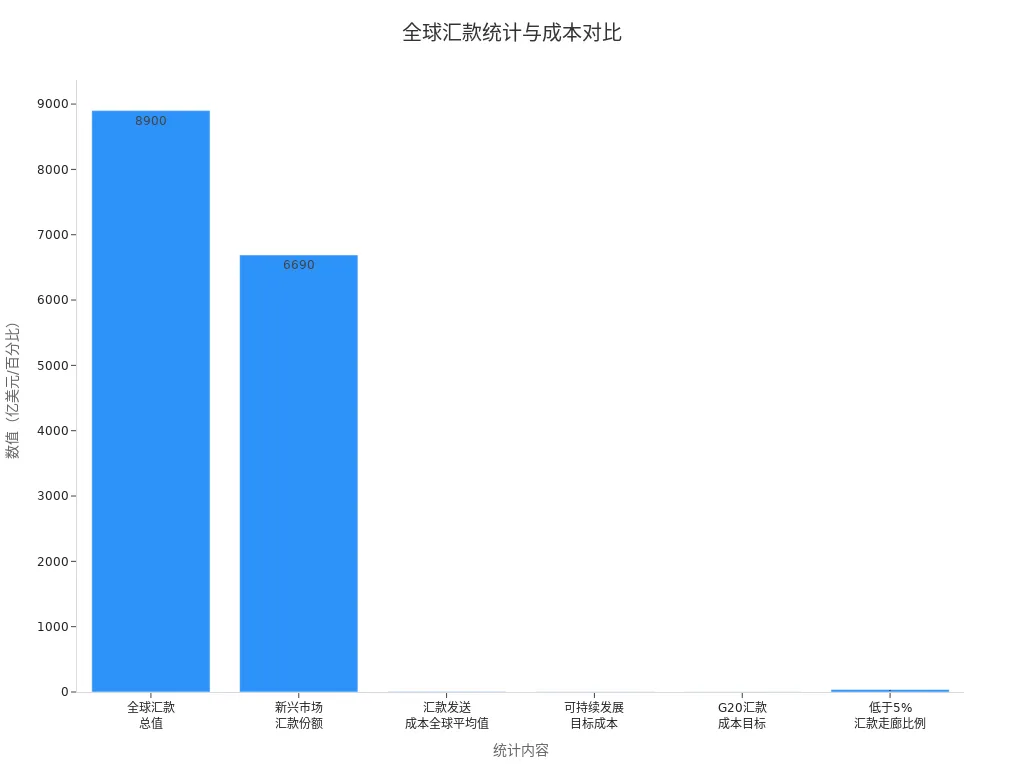

When making cross-border transfers, you may be most concerned about fees and delivery speed. Global remittance demand continues to grow, with data showing that the total value of global remittances has reached $890 billion, but the average remittance cost is as high as 6.35%, with some corridors even requiring $100 in fees for every $200 sent. Boxypay offers you low fees, real-time exchange rates, and fast delivery, along with seamless currency conversion and 24/7 customer support to address your questions anytime.

| Statistic | Value |

|---|---|

| Global Remittance Total | $890 billion |

| Emerging Markets Remittance Share | $669 billion |

| Global Average Remittance Cost | 6.35% |

| Sustainable Development Goal Remittance Cost Target | 3% |

| G20 Remittance Cost Target | 5% |

| Proportion of Remittance Corridors Below 5% | 37% |

| Remittance Cost in Certain Cross-Border Corridors | $100 in fees for $200 sent |

Key Points

- Boxypay provides low-cost cross-border remittance services, with fees as low as $1, helping users save money.

- The platform supports multiple currencies, allowing users to easily perform seamless currency conversions, avoiding losses due to exchange rate fluctuations.

- Boxypay’s transfer speed is extremely fast, with funds arriving in minutes in most cases, enhancing fund utilization efficiency.

- All fees are transparent, and users can clearly see all related costs before transferring, avoiding hidden charges.

- Boxypay employs multiple security measures to ensure the safety of users’ funds and information, providing a worry-free remittance experience.

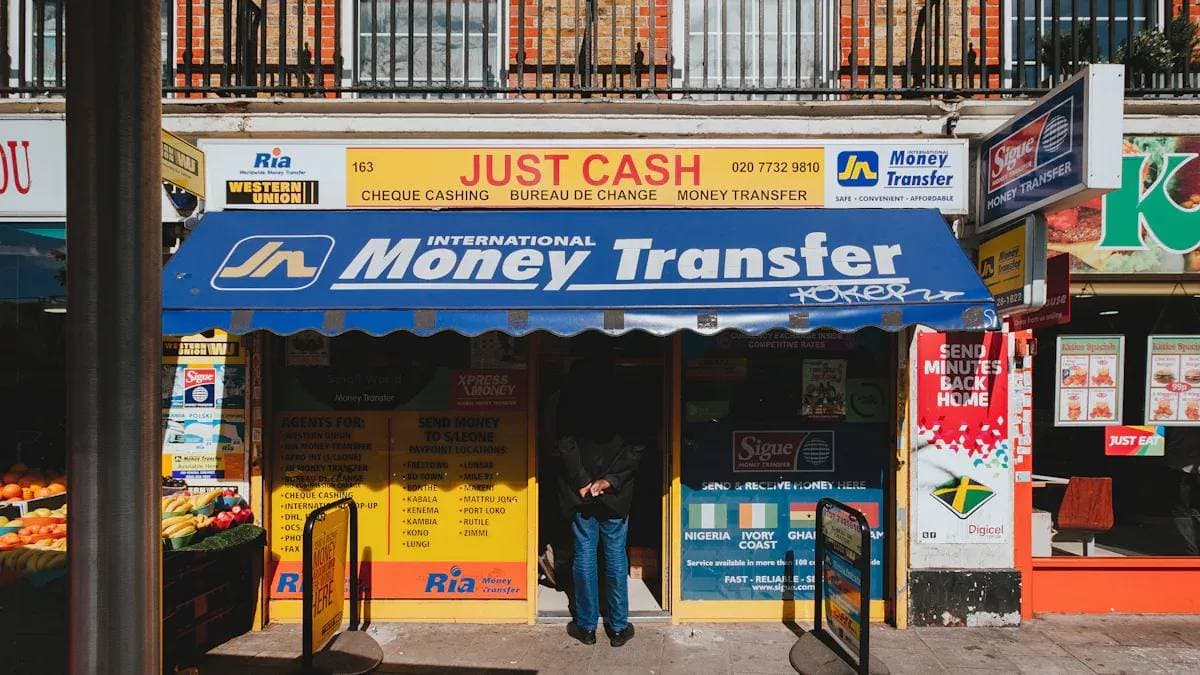

Global Remittance Needs

Image Source: unsplash

Supported Countries

When choosing a remittance service, you are likely most concerned about destination coverage. Boxypay supports multiple countries and regions worldwide, meeting your global remittance needs. Whether you need to send funds to Europe, the Americas, Asia, or Oceania, Boxypay provides a convenient channel. Below are the most popular destination cities chosen by Boxypay users:

| Rank | Destination | Feature |

|---|---|---|

| 1 | Stockholm, Sweden | Most open place |

| 2 | Toronto, Canada | Most open place |

| 3 | Amsterdam, Netherlands | Most open place |

| 4 | Auckland, New Zealand | Best quality of life |

| 5 | Vienna, Austria | Most attractive place |

| 6 | Madrid, Spain | Most attractive place |

| 7 | Athens, Greece | Most attractive place |

| 8 | Miami, USA | Most attractive place |

| 9 | Las Vegas, USA | Most attractive place |

| 10 | Lisbon, Portugal | Lowest cost of living |

You can see that Boxypay covers multiple popular cities, helping you easily meet global remittance needs. Whether you are in mainland China or need to send money to the US, Canada, Europe, or elsewhere, Boxypay provides stable and reliable services.

Multi-Currency Support

When making cross-border remittances, you often encounter currency conversion issues. Boxypay supports multi-currency operations, helping you achieve seamless currency conversion. You can directly select the target currency without complex calculations, and the system will automatically complete the conversion based on real-time exchange rates. This allows you to better manage your funds, avoiding losses due to exchange rate fluctuations. Boxypay enables a more efficient fund transfer experience under global remittance needs.

Tip: Boxypay supports major international currencies, including USD, EUR, GBP, and more. Simply select the target country and currency, and the system will automatically match the best exchange rate and conversion method.

Remittance Methods

When transferring money, you may be concerned about whether the process is simple. Boxypay offers multiple remittance methods, including bank account transfers, digital wallets, and mobile payments. You can choose the most suitable method based on your needs, and the system will guide you through each step. Whether you are an individual or a business user, Boxypay provides tailored remittance solutions.

- Bank account transfers: Ideal for large transfers, with high security.

- Digital wallets: Suitable for small, fast transfers with quick delivery.

- Mobile payments: Convenient for on-the-go operations, offering flexibility.

When meeting global remittance needs, Boxypay provides diverse options, making your fund transfers more efficient and secure.

Fees and Exchange Rates

Low Fees

When choosing a cross-border remittance service, fees are a top concern. Boxypay offers highly competitive low-fee solutions. You only need to pay minimal service fees, starting as low as USD 1. Whether you are an individual or a business user, you can enjoy the same low-cost advantage. Boxypay optimizes processes to reduce intermediaries, helping you save on every fee. You can easily meet global remittance needs without worrying about high handling fees.

Real-Time Exchange Rates

When transferring money, exchange rate fluctuations directly impact the received amount. Boxypay provides real-time exchange rates, with the system automatically converting based on the latest market data. You can clearly see the current exchange rate before placing an order, avoiding losses due to delays. Boxypay uses exchange rate data synchronized with licensed Hong Kong banks, ensuring you get the best conversion experience. You don’t need to manually calculate during operations, as the system handles all conversions, letting you focus on the fund transfer itself.

Tip: You can check the latest exchange rates on the Boxypay platform anytime, and the system will automatically lock in the rate at the time of order, protecting your interests.

Transparent Fees

When using Boxypay, all fees are clearly visible. The platform displays all related costs, including service fees and exchange rate margins, before you transfer. You don’t need to worry about hidden charges or discrepancies between the expected and actual received amounts. Boxypay adheres to a transparent fee policy, making every fund movement clear. You can review all expenses through the fee breakdown, improving fund management efficiency.

| Service Item | Fee (USD) | Notes |

|---|---|---|

| Service Fee | Starting at 1 | Tiered based on amount |

| Exchange Rate Margin | Real-time fluctuation | Transparently displayed |

| Other Hidden Fees | None |

When meeting global remittance needs, Boxypay makes fee management simple, transparent, and controllable.

Fast Delivery

Transfer Speed

When making cross-border remittances, delivery speed directly affects fund usability. Boxypay offers industry-leading transfer speeds, with funds arriving in minutes in most cases. You don’t need to wait long, making fund transfers more efficient. The table below compares Boxypay’s transfer times with industry standards:

| Remittance Method | Boxypay Average Delivery Time | Industry Standard Delivery Time |

|---|---|---|

| Bank Account Transfer | Minutes | 1-3 business days |

| Cash Pickup | Minutes | 1-2 business days |

| Mobile Payment | Minutes | 1-2 business days |

| Mobile Top-Up | Minutes | 1-2 business days |

You can see that, regardless of the method, Boxypay significantly shortens delivery times. You can quickly complete fund transfers even in urgent situations, meeting daily or business needs.

Tip: Through bank deposits, cash pickups, mobile payments, or mobile top-ups, Boxypay can achieve delivery in minutes, greatly enhancing your fund liquidity.

Automated Transfers

When transferring frequently, manual operations can lead to errors and waste time. Boxypay offers an automated transfer function, helping you schedule and process bulk fund transfers. You simply set up the recipient details and transfer plan in advance, and the system will execute automatically on time, eliminating repetitive operations. This allows you to focus on work and life, reducing operational stress.

- Automated transfers are ideal for salary payments, regular family remittances, tuition payments, and similar scenarios.

- You can modify or cancel automated transfer plans at any time, maintaining flexible control over fund arrangements.

Boxypay’s automated services make cross-border remittances smarter and more efficient. You can enjoy fast delivery while experiencing convenient fund management.

Transaction Limits and Compliance

Limits

When using Boxypay for cross-border remittances, the platform sets transfer limits based on the regulations of different countries and regions. This helps you comply with local laws and ensures fund security. The table below shows single transaction limits for common destinations:

| Destination Country/Region | Single Transaction Limit (USD) | Notes |

|---|---|---|

| United States | 10,000 | Requires identity verification |

| Canada | 8,000 | Requires identity verification |

| Europe | 7,000 | Requires identity verification |

| Australia | 6,000 | Requires identity verification |

You can check platform prompts before transferring to plan fund movements appropriately. For large transfer needs, you can split transactions or contact Boxypay’s customer service for professional advice.

Regulatory Compliance

When choosing a remittance service, compliance is a key consideration. Boxypay is a licensed and regulated remittance company, strictly adhering to financial regulatory requirements in various countries. The platform collaborates with licensed Hong Kong banks to ensure every transaction meets international standards. During the remittance process, the system automatically verifies identity information to prevent illegal fund flows. Boxypay undergoes regular regulatory reviews, continuously optimizing compliance processes to give you peace of mind.

Tip: When submitting a remittance request, you need to complete identity verification and document reviews. The platform protects your funds and personal information in accordance with regulatory requirements.

Fraud Prevention

When making cross-border remittances, security is critical. Boxypay employs multiple anti-fraud measures to protect your funds and information:

- Uses advanced encryption technology to secure all data transmission, preventing information leaks.

- Implements strict privacy policies to ensure customer data is not shared with third parties.

- Regularly updates security systems, monitors suspicious activities in real-time, and takes additional security measures promptly.

- Continuously complies with regulatory standards and undergoes oversight by regulatory authorities to enhance overall security.

During the remittance process, the platform automatically identifies abnormal transactions and promptly notifies you for resolution. Boxypay’s multi-layered protections ensure you can complete every cross-border transfer with confidence.

Security Measures

Image Source: pexels

Data Encryption

When using Boxypay for cross-border remittances, data security is a top priority. Boxypay employs advanced data encryption technology to protect every piece of your information. The platform uses 256-bit SSL encryption for data transmission. This encryption method effectively prevents hackers from stealing your account details and transaction data. When you input personal and remittance information, the system automatically encrypts all content.

Tip: You can see the “https” indicator in the browser address bar, confirming your data is encrypted. Boxypay collaborates with licensed Hong Kong banks to ensure all fund transfer processes meet international security standards. Every operation on the platform is protected by multiple encryption layers, reducing the risk of data breaches.

Identity Verification

When registering and transferring, the platform requires you to complete identity verification. Boxypay uses multi-factor authentication to ensure only you can operate your account. You need to upload valid identification documents and complete secondary verification via facial recognition or SMS codes. The system automatically verifies your identity information to prevent unauthorized account use.

- Identity verification process includes:

- Uploading identification document photos

- Facial recognition or SMS verification code

- Automatic system review

After completing identity verification, the platform assigns a dedicated security level to your account. Each login or transfer triggers additional identity checks, ensuring your funds’ safety. Boxypay strictly adheres to mainland China and international compliance requirements, protecting your legal rights.

Privacy Protection

When using Boxypay, the platform strictly safeguards your personal privacy. Boxypay has a comprehensive privacy policy, promising not to disclose your information to any third parties. All customer data is stored on encrypted servers, accessible only to authorized personnel.

Note: You can view and manage your privacy settings on the platform at any time. Boxypay undergoes regular regulatory reviews to ensure privacy measures remain effective. All operation records on the platform are legally protected and not used for commercial promotions or advertising. During cross-border remittances, Boxypay provides comprehensive privacy protection, keeping you safe from data leaks and privacy risks through robust technical and institutional safeguards.

Customer Support and Partnerships

Customer Support

When using Boxypay, you may encounter various issues. Boxypay offers 24/7 customer support, ensuring help is available regardless of your time zone. You can contact the support team via online chat, phone, or email. The support staff will patiently address your questions and assist with the remittance process.

If you encounter issues with transfer limits, identity verification, or delivery times, you can directly consult customer support. Boxypay’s support team is professionally trained to respond quickly to your needs. When facing technical or process-related obstacles on the platform, you’ll receive timely guidance. Below are Boxypay’s main customer support channels:

- Online chat: Ideal for instant communication and quick issue resolution.

- Phone support: Suitable for complex issues requiring detailed explanations.

- Email service: Appropriate for document submissions and follow-ups.

When using Boxypay, you don’t need to worry about being unsupported. The customer support team is always there to ensure a smooth and secure remittance experience.

Partnerships

When choosing a remittance platform, service reliability is crucial. Boxypay has established partnerships with multiple global financial institutions, particularly maintaining close collaboration with licensed Hong Kong banks. This ensures secure and compliant fund transfers. Boxypay also works with international payment networks and technology providers to enhance system stability and delivery speed.

When sending money to the US, Canada, Europe, or elsewhere, Boxypay selects the optimal partner channels based on the destination. The platform optimizes fund routes through its global network, reducing remittance costs. During cross-border transfers, you can enjoy efficient and stable services. The table below outlines Boxypay’s main partner types and their roles:

| Partner Type | Primary Role |

|---|---|

| Licensed Hong Kong Banks | Fund security and compliance |

| International Payment Networks | Enhanced delivery speed |

| Technology Providers | System stability and security |

When using Boxypay, its global partnership network supports every transfer. The platform continuously expands its partnerships to improve service quality, ensuring confident international fund transfers.

When making global remittances, Boxypay offers low fees, real-time exchange rates, and fast delivery. You can easily perform seamless currency conversions and enjoy 24/7 customer support. Boxypay strictly adheres to regulatory compliance, employing multiple security measures to protect your funds and information. By choosing Boxypay, you gain an efficient and secure international remittance solution.

If you want to send money to the US market safely and conveniently, Boxypay is always there to support you.

FAQ

What currencies does Boxypay support for remittances?

You can use Boxypay to transfer major international currencies like USD, EUR, GBP, and more. The system automatically handles currency conversions, enabling easy transfers to multiple countries and regions worldwide.

How long does it take for a transfer to arrive?

With Boxypay, funds typically arrive in minutes. Some specific countries or regions may take longer. You can track progress on the platform at any time.

How does Boxypay ensure my funds’ safety?

Boxypay uses 256-bit SSL encryption and collaborates with licensed Hong Kong banks. Every transaction undergoes multi-factor authentication, and the platform monitors for anomalies in real-time to ensure the safety of your funds and information.

What fees does Boxypay charge?

You can see all fees clearly before transferring. Boxypay’s service fees start at USD 1, with real-time transparent exchange rates and no hidden charges. You can check fee details anytime.

How can I contact customer support if I have issues?

You can reach Boxypay’s customer support via online chat, phone, or email. The support team is available 24/7 to assist with remittance, identity verification, and other issues.

After delving into how Boxypay meets global remittance needs while ensuring security, you might recognize that while it delivers low fees (starting at USD 1), real-time rates, and minutes-fast arrivals to key destinations like the US, Canada, and Europe, the average remittance cost lingers at 6.35%, with some corridors charging excessively. Limits (e.g., USD 10,000 per transaction to the US) and compliance verifications can hinder large or repeated transfers. Moreover, limited flexibility in multi-currency to digital asset conversions and absence of investment features make fund management feel restrictive amid exchange volatility or worldwide liquidity requirements.

BiyaPay, as an advanced cross-border finance platform, addresses these challenges head-on. Our real-time exchange rate query provides instant access to mid-market rates, cutting conversion losses. Remittance fees drop to just 0.5%, enabling conversions across 30+ fiat currencies and 200+ digital assets, spanning 100+ countries with same-day delivery and no amount caps. Standout is the single-wallet access to stocks trading in US and Hong Kong markets—without an overseas account—and zero fees on contract orders, empowering remittance funds for smart growth. Backed by US MSB, Canada MSB, and New Zealand FSP licenses, plus 256-bit encryption and real-time fraud detection, security is paramount.

Sign up today at BiyaPay to unlock low-cost, worldwide remittances with seamless fund flow and investment ease, making your international finance smarter and more dependable!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.