- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Use JMMB Online Money Transfer? Effortlessly Complete International Transfers

Image Source: unsplash

You can easily complete international transfers through online remittance. Simply register an account, log in to the platform, fill in the recipient’s information and amount, and finally confirm the submission. The operation steps are simple, and even beginners can quickly get started. Please continue reading for detailed operation guidance and practical advice.

Key Points

- After registering a JMMB account, ensure you upload valid identification documents to smoothly conduct online remittances.

- When adding recipient information, carefully verify the name, account number, and bank code to avoid delays due to errors.

- Before submitting the remittance, check all information and upload a scan of your identification document to ensure fund security and smooth transactions.

Online Remittance Process

Image Source: pexels

Registration and Login

You need to first have a valid JMMB account and complete registration on its online banking platform. During registration, the system will require you to upload relevant identification documents. The common types of identification documents are listed in the table below:

| Identification Document Type |

|---|

| Valid Passport |

| Valid National ID |

| Birth Certificate or Similar Document |

| For individuals under 17, a birth certificate and guardian’s identification are required |

| If the driver’s license does not indicate nationality, additional identification such as a national ID or passport is required |

| If utility bills are not in your name, a signed authorization letter and the bill owner’s identification are required |

You can complete registration and login via the web or mobile app. After registration, log in to the platform to access the online remittance interface.

Adding a Recipient

After logging in, you need to add new recipient information. The system will require you to fill in detailed recipient details. The table below lists the main information you need to prepare and fill in:

| Beneficiary Name | <Fill in Beneficiary Name> |

|---|---|

| Beneficiary Account Number | <Fill in Beneficiary Account Number> |

| Beneficiary Address | <Fill in Beneficiary Address> |

| Beneficiary Bank Name | JMMB Bank (Jamaica) Limited |

| Beneficiary Bank Branch | <Fill in Beneficiary Bank Branch> |

| Beneficiary Bank SWIFT/BIC | JMJAJMKN |

| Intermediary Bank | Citibank N.A. London |

| Intermediary Bank Address | Citigroup Centre, Canada Square, Canary Wharf London, E145LB |

| Intermediary Bank SWIFT/BIC | CITIGB2L |

| Intermediary Bank Sort Code | 18-50-08 |

| Payment Details | Additional payment details, such as invoice number, financial beneficiary, etc. |

Please ensure all information is accurate. Incorrect information may lead to delays or failures in online remittances.

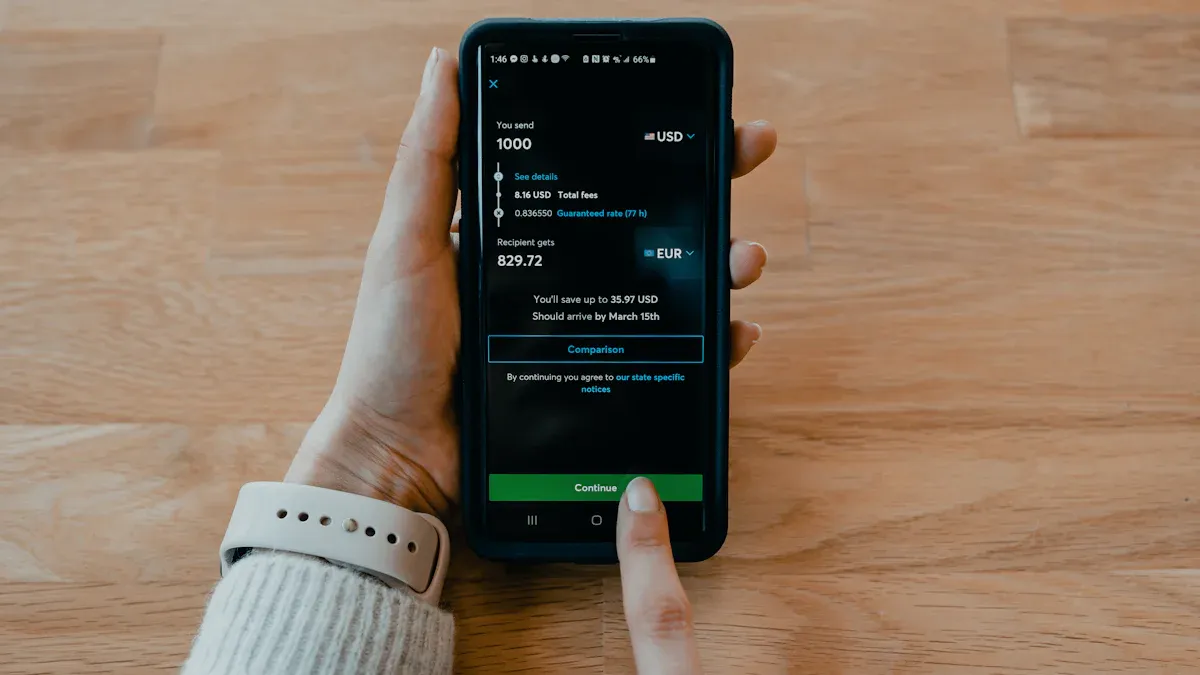

Entering the Amount

After adding the recipient, you can select the remittance currency and enter the specific amount. The system will display the current exchange rate and the estimated amount to be received. You can also choose the delivery speed, which may affect the arrival time and fees. All amounts are priced in USD, making it convenient for you to budget for international transfers.

Tip: It’s recommended to check the current exchange rate and fee standards before entering the amount to avoid unnecessary losses due to exchange rate fluctuations.

Confirm Submission

Before submitting the online remittance, you need to review all information again. Ensure the recipient’s name, account number, amount, and other details are correct. The system will require you to upload a scan of a valid identification document, such as a government-issued photo ID, passport, or national ID. You need to follow these steps:

- Upload a scan of a valid identification document.

- Check all remittance information to ensure accuracy.

- Agree to the relevant terms and submit the remittance application.

The JMMB platform employs multiple security measures to protect your funds. The system monitors all accounts in real-time to ensure every online remittance is processed safely and promptly. You can access the platform on any device, and the system will automatically protect your financial information.

Track Progress

After submitting the remittance, you can check the remittance progress anytime via online banking or the mobile app. Most online remittance transactions are processed within 2 to 5 business days. In some cases, funds may arrive on the same day after authorization and payment confirmation, depending on the recipient bank’s processing speed.

Friendly Reminder: If you notice abnormal remittance progress or delays, contact platform customer service promptly for detailed assistance.

Through the above steps, you can efficiently and securely complete international online remittances, which are highly convenient for both personal and business purposes.

Online Remittance Notes

Document Preparation

Before conducting online remittances, you need to prepare the relevant documents in advance. This ensures a smoother process. You should prepare the following documents and information:

- Valid government-issued photo identification, such as a passport, national ID, or driver’s license.

- Proof of residential address, such as utility bills.

- Tax identification number (e.g., TRN or SSN).

- Source of funds documentation.

These documents help the bank verify your identity and the legitimacy of the transaction. You can organize all documents in advance to avoid delays due to incomplete information.

Common Mistakes

When conducting online remittances, some common mistakes may occur. Below are issues to pay special attention to:

- Incorrect recipient information: You should carefully verify the recipient’s name, account number, and bank code. It’s recommended to use verification tools and confirm details directly with the recipient.

- Non-compliance with local regulations: You need to understand the regulatory requirements of the sending and receiving countries to ensure compliance.

- Ignoring payment speed and processing time: Choose the appropriate payment method based on transaction urgency and understand the expected arrival time in advance.

- Ignoring security risks: Adopt strict security protocols, choose reputable payment platforms, and regularly learn to identify fraud.

The table below shows the consequences of entering incorrect information:

| Error Type | Example | Result |

|---|---|---|

| Incorrect Beneficiary Name | Spelling mistake or different name | The bank may delay or stop the transfer, triggering security checks. |

| Incorrect Account Number | Extra digit or invalid number | Funds may be transferred to the wrong account, with a complex recovery process, or returned after several days. |

| Incorrect SWIFT/IBAN Code | Omitted or entered incorrectly | Transaction delayed, and the bank will request additional information. |

| Missing Special Instructions | Tuition payment without student ID | The recipient cannot identify the payment, causing delays. |

| Legal Consequences | Non-compliance | May lead to restrictions on future remittances or fines. |

Security Measures

When using online remittances, the bank employs multiple security measures to protect your funds and information. Key security protocols include:

- Using advanced encryption technology to protect data transmission between your device and the server.

- Requiring multi-factor authentication to ensure secure account access and transaction verification.

- Continuous system monitoring to promptly identify and respond to suspicious activities.

- Offering customizable security settings, such as transaction limits and alerts.

- Using anti-fraud tools to reduce fraud risks.

You can set security options based on your needs to enhance account security.

Fees and Exchange Rates

When conducting international online remittances, you need to pay attention to related fees and exchange rates. The bank charges certain fees, as shown in the table below (priced in USD):

| Transaction Type | Fee Type | Fee |

|---|---|---|

| International POS Transaction | Per Transaction | 2.5% of transaction amount or minimum $4.00 |

| International Credit Card | Per Transaction | 2.5% of transaction amount or minimum $4.00 |

| Outgoing Wire Transfer | Per Transaction | $65.00 |

| Incoming Wire Transfer (Foreign Currency Account) | Per Transaction | $15.00 |

| Incoming Wire Transfer (Local Account) | Per Transaction | Free |

You should also note that intermediary banks may charge additional fees. Exchange rate fees will also affect the actual amount received by the recipient. You can check all fees and exchange rates in advance to plan the remittance amount reasonably and avoid unnecessary losses.

Advantages and Services

Image Source: unsplash

Convenient and Efficient

When using JMMB online remittance, you can experience many significant advantages.

- You can complete remittances with just a few clicks on a laptop, tablet, or phone, anytime, anywhere.

- The recipient does not need to fill out complex forms or provide additional identification documents.

- Most online remittances are completed within the same day, suitable for urgent situations.

- Service fees are generally lower than traditional bank transfers, unless you choose debit or credit card payments.

- You and the recipient will receive remittance status updates via email or SMS, making it easy to track progress.

- The platform uses security features like data encryption and two-factor authentication to ensure fund safety.

You can enjoy a more efficient service experience through JMMB Group’s digital initiatives. The platform collaborates with partners like Paysend and MoneyGram, allowing family and friends in the U.S. market to receive funds safely and conveniently on the same day.

| Evidence Source | Description |

|---|---|

| JMMB Group Pursues Digital Acceleration | JMMB Group implements digital initiatives to enhance customer experience and service efficiency. |

| Paysend partners with JMMB | You can remit funds in the U.S. market, and recipients can receive funds on the same day. |

| JMMB Money Transfer Partners with MoneyGram | Platform partnerships provide you with more choices and convenience. |

Customer Support

During the JMMB online remittance process, you can receive timely assistance for any issues. The platform offers multiple customer service channels to ensure you can always reach professional staff.

| Type | Details |

|---|---|

| Phone | (876) 998-JMMB (5662) |

| Toll Free | US and Canada: 1-877-533-5662 |

| England: 0 800 404 9616 | |

| info@jmmb.com | |

| Customer Service Hours | Monday to Saturday: 8:00 a.m. - 9:00 p.m. |

| Sunday: 8:00 a.m. - 5:00 p.m. |

You can contact platform customer service via phone or email. Service hours cover most of the week, providing professional support whether you’re in mainland China or the U.S. market.

When using JMMB online remittance, keep the following points in mind:

- Verify recipient information and comply with KYC and AML regulations to ensure compliance.

- If you encounter issues, promptly contact customer service with transaction details and relevant documents.

- First-time transfers may be free, and the platform supports discounts for large remittances.

- Monitor the arrival progress and request investigations or refunds for disputes.

You can experience efficient remittances through a secure and reliable platform, enjoying continuously optimized services and exclusive offers.

FAQ

How do I check my remittance progress?

You can log in to online banking or the mobile app, go to the “Transaction History” page, and check the remittance status and processing progress at any time.

What should I do if I enter incorrect information?

You should immediately contact customer service and provide the correct information. The bank will assist you in making corrections to avoid delays or returns of funds.

How long does it take for a remittance to arrive?

Most international remittances take 2 to 5 business days to arrive. The specific time depends on the recipient bank’s processing speed and intermediary bank procedures.

JMMB online remittances enable same-day delivery and multi-channel support, but fees ($65 per international wire) and intermediary charges can raise costs, especially in 2025’s $80+ trillion remittance market, where traditional banks’ reviews cause delays. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.