- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring the Best Ways to Send Money to Brazil:Which remittance method is the fastest and most cost - effective?

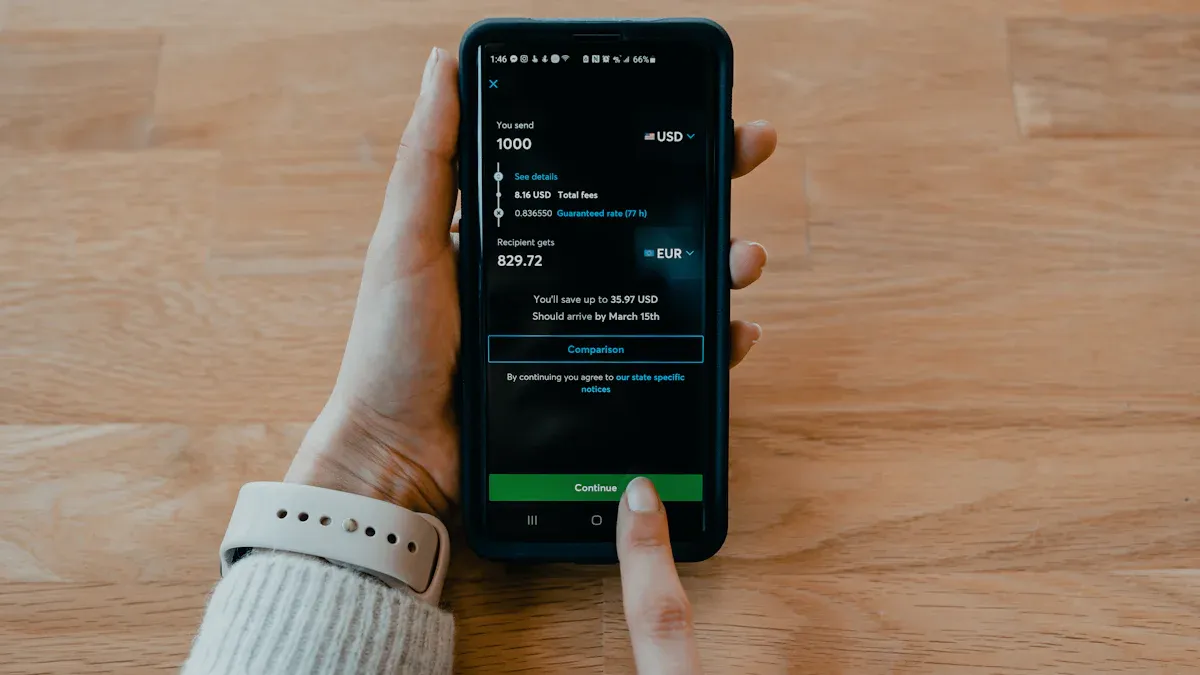

Image Source: unsplash

Are you looking for the fastest and cheapest way to send money to Brazil? Wise and Pix are currently the best remittance methods. Wise offers low fees and competitive exchange rates, with most remittances arriving within one to two business days. Pix has become Brazil’s mainstream payment tool, used by approximately 76.4% of the population, offering instant transfers and simple operations. In July 2025, Brazil’s overseas remittance inflows reached 362.80 million USD, showing sustained demand growth. As digital payments become more widespread, choosing efficient and secure methods is increasingly important. You can continue to explore detailed comparisons and practical recommendations for different remittance methods.

Key Points

- Wise and Pix are the best choices for sending money to Brazil, offering low fees and fast transfer services.

- Wise supports multi-currency accounts, ideal for large cross-border remittances, with transparent fees and excellent exchange rates.

- Pix enables instant transfers, suitable for small domestic transactions in Brazil, with almost no transaction fees.

- When choosing a remittance method, focus on transfer speed, fees, and operational convenience to meet personal needs.

- Before sending money, verify recipient information and associated fees to ensure security, compliance, and avoid fraud risks.

Recommended Remittance Methods

Image Source: unsplash

Recommended Methods

When choosing the best remittance method, you should focus on transfer speed, fee transparency, and operational convenience. Wise and Pix are currently the top choices for sending money to Brazil. Wise is known for its low costs and real mid-market exchange rates, with a clear fee structure and support for multi-currency account management. Pix has rapidly gained popularity in Brazil’s financial sector, processing over 17 trillion USD in transactions, offering near-instant transfers, ideal for users needing quick transactions.

Wise has high user satisfaction. You can refer to the following rating data:

Platform Rating Apple AppStore 4.7 / 5 Google Play Store 4.8 / 5 Trustpilot 4.4 / 5 Users generally praise Wise for its fast service, smooth transaction process, competitive fees, and professional, accessible customer support.

Financial experts recommend Wise and Pix for the following reasons:

- Wise offers transparent and low-cost currency exchange rates.

- Uses real mid-market exchange rates, charging only a small upfront fee.

- Supports multi-currency accounts, making it convenient to manage different currencies.

- Pix’s share in Brazil’s commercial payments has grown rapidly, with P2B payments increasing from 5% to 38%, reflecting its widespread acceptance.

- Pix is considered Brazil’s most disruptive financial technology, enabling small and informal businesses to accept payments from personal accounts.

When using these top remittance methods, you need to be aware of eligibility and restrictions. Wise supports both personal and business accounts, with a maximum transfer limit of 250,000 BRL (approximately USD) per transaction, requiring recipient information. Pix has no minimum limit, with a nightly cap of 1,000 BRL, and is restricted to transactions between accounts within Brazil. Specific requirements are as follows:

| Sending Method | Account Type | Transfer Amount Limit | Other Requirements |

|---|---|---|---|

| Wise Personal Account | Personal Account | Up to 250,000 BRL per transaction | Requires recipient’s name, account number, etc. |

| Wise Personal Account | Business Account | Up to 10,000 USD per transaction | May require additional documents |

| Wise Business Account | Personal Account | Up to 3,000 USD per transaction | Requires identity verification |

| Wise Business Account | Business Account | Up to 10,000 USD per transaction | Requires identity verification |

| Pix | N/A | No minimum limit (nightly limit 1,000 BRL) | Restricted to transactions between accounts in Brazil |

You can choose the most suitable method based on your needs and transfer amount. Wise is ideal for large and cross-border remittances, while Pix is better for small, instant domestic transfers in Brazil.

Target Audience

Different user groups have varying needs when selecting the best remittance method. If you are an expatriate or traveler, Wise and Pix’s convenience and cost advantages will benefit you the most. Wise’s multi-currency accounts are ideal for users needing frequent cross-border remittances. Pix offers 24-hour instant transfer services for Brazilian residents and businesses, with almost no fees.

- Expatriates and travelers can easily use Wise for remittances, with low fees and fast delivery.

- Pix is suitable for Brazilian residents and businesses, supporting instant transfers between personal and business accounts.

- For Brazilians needing to quickly support family, Pix is nearly free and easy to use.

- Over one million Brazilians live in Europe, many relying on remittances to stay connected with family. If you are overseas, choosing the best remittance method not only saves costs but also helps maintain close family ties.

When sending money, you may face challenges like time zone differences and identity verification. Expatriates often deal with emotional stress from family separation while adapting to life in a new country. Choosing an efficient remittance method can help you better support your family, reducing wait times and unnecessary fees.

You can flexibly choose the best remittance method based on your identity, transfer amount, and recipient needs. Both Wise and Pix offer secure, efficient remittance experiences.

Comparison of Remittance Methods

Traditional Banks

If you choose to send money to Brazil through a licensed Hong Kong bank, you will typically face higher fees and slower transfer times. Banks charge transfer fees, exchange rate margins, receiving fees, and intermediary fees. The Brazilian government also levies a Financial Operations Tax (IOF). The table below outlines the main fee types:

| Fee Type | Description |

|---|---|

| Transfer Fee | Fixed fee charged by the bank, typically $20-$50 |

| Exchange Rate Margin | Unfavorable rates with profit margins |

| Receiving Fee | Brazilian banks may charge additional fees |

| Intermediary Fees | Charged by intermediary banks involved in the transfer |

| Financial Operations Tax (IOF) | Levied by the Brazilian government, varying by transfer type |

You will find that traditional banks have higher overall costs due to administrative expenses, unfavorable exchange rates, and multiple intermediary steps, with transfer times reaching up to 5 business days.

Wire Transfers

Wire transfers are a familiar international remittance method for many users. When initiating a wire transfer through a bank, fees typically range from $20-$50, with transfer times up to 5 business days. The process is cumbersome, requiring detailed information. Compared to online remittance services, wire transfers are slower and more expensive.

Online Remittance Services

You can choose online remittance services like Wise, Remitly, or Paysend. These platforms offer lower fees and faster transfers, typically completed within 1-2 business days. The table below compares their main advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Fast speed | Risk of fraud |

| Low fees | Potential network issues |

| Convenient | |

| 24/7 service | |

| Transparent exchange rates |

You will find that online remittance services, with their transparent fees and convenient operations, are the preferred choice for many users.

Digital Wallets

Digital wallets like PayPal support international remittances. You can operate via mobile, which is convenient and fast. Some digital wallets have higher fees and less favorable exchange rates compared to online remittance services. Transfer times are generally 1-3 business days. You need to ensure account security and complete identity verification.

Pix

Pix is Brazil’s Central Bank’s real-time payment system. You can enjoy the following benefits:

- Instant transfers, available 24/7

- Low processing fees, reducing intermediary steps

- All transactions occur in a secure environment with two-factor authentication

- Operates directly from any Brazilian bank account, with rate previews to eliminate currency risks

- Supports higher spending limits, improving liquidity

If you prioritize efficiency and low costs, Pix is one of Brazil’s most popular payment methods. When choosing the best remittance method, consider the amount, speed, and convenience comprehensively.

Fees and Transfer Times

Image Source: pexels

Fee Comparison

When choosing a remittance method, fees are a critical consideration. Different providers have distinct fee structures. The table below shows the main fee details for Wise, Remitly, Paysend, and Pix, with all amounts in USD:

| Service Provider | Fee Type | Fee Description |

|---|---|---|

| Wise | Service Fee | Typically about 0.35% of the transfer amount |

| Wise | Exchange Rate | Uses real mid-market rates, no hidden fees |

| Remitly | Express Transfer | Higher fees, usually funded by debit or credit card |

| Remitly | Economy Transfer | Lower fees, longer delivery time, funded by bank transfer |

| Paysend | Fixed Service Fee | Generally $2-$3 per transaction, slight rate markup |

| Pix | Transaction Fee | Nearly free for interbank transfers within Brazil |

You can see that Wise and Pix have clear advantages in fees. Wise uses real exchange rates with transparent fees. Pix charges almost no fees, ideal for small domestic transfers in Brazil. Remitly and Paysend charge varying fees based on transfer speed and method.

Exchange rates play a critical role in international remittances, affecting the amount received and transfer costs. Understanding how rates work and taking steps to mitigate their impact ensures more funds reach the destination.

- Exchange rate fluctuations affect the amount recipients receive.

- Transfer fees vary by service due to exchange rates.

- Choosing a reliable remittance provider can reduce the impact of rate fluctuations.

When selecting the best remittance method, prioritize fee structures and exchange rate transparency to save more costs.

Transfer Speed

Transfer speed directly impacts your and the recipient’s experience. You can refer to the typical transfer times for common methods:

- Wise: Typically 1-2 business days, with some cases arriving same-day.

- Remitly: Express transfers arrive in minutes, economy transfers take 1-3 business days.

- Paysend: Generally 1-2 business days.

- Pix: Instant transfers within Brazil, available 24/7.

If you need urgent remittances, Pix and Remitly’s express transfers are excellent choices. Wise and Paysend are suitable for users prioritizing low fees and transparent rates. Choose flexibly based on the transfer amount and urgency.

Convenience and Security

Operational Process

When sending money to Brazil, the operational process directly affects the remittance experience. Platforms like Wise, Pix, and Paysend offer clear, user-friendly steps. For example, sending money via Paysend using Pix involves the following steps:

- Register a Paysend account and complete identity verification.

- Select Pix as the payment method and enter the USD amount to send.

- Provide the recipient’s Pix key and related information.

- Review transaction details and submit after confirmation.

- Pay fees using a debit card, credit card, or bank transfer.

- After completion, funds instantly reach the recipient’s Brazilian bank account.

Wise and Remitly follow similar processes, supporting mobile apps and web operations. You can track transfer progress anytime and get help via online customer support or chatbots. The table below shows the convenience and user experience ratings for each platform:

| Platform Name | User Rating | Convenience and User Experience Description |

|---|---|---|

| Wise | 4.7/5 | Transparent fees, excellent rates, multi-currency support, easy operation |

| OrbitRemit | 4.8/5 | User-friendly mobile app, real-time chat support, robust transfer tracking |

| Remitly | 4.8/5 | Fast transfers, flexible payment options, excellent mobile experience |

You can choose the most suitable platform based on your needs for an efficient and convenient remittance service.

Security and Compliance

When sending money, security and compliance are critical. The Pix system uses end-to-end encryption to ensure secure data transmission. Multi-factor authentication (MFA) requires multiple layers of verification to authorize payments, and Brazil’s Central Bank monitors all transactions in real-time, automatically identifying and blocking suspicious activities. Platforms like Wise also have alert systems to prevent unusual transactions and require verification for new device transactions.

Common risks include romance scams, investment fraud, fake online stores, and impersonation scams. You can take the following steps to reduce risks:

- Verify the recipient’s identity to ensure information is reliable.

- Choose secure and compliant platforms for remittances.

- Independently confirm emergencies to avoid impulsive transfers.

In 2024, Brazil’s financial sector reported 10.1 billion BRL in fraud losses. Stay vigilant before sending money to protect your funds. Choosing compliant platforms and standardized processes effectively reduces risks, ensuring smooth remittances.

Practical Recommendations

Selection Tips

When choosing a remittance method to Brazil, base your decision on your specific needs. Different users have different priorities. You can refer to the following key criteria:

- Choose a transfer method: Select Wise, Pix, or other online services based on the transfer amount and recipient’s location.

- Cost: Compare service fees and exchange rates, prioritizing providers with transparent fees and no hidden costs.

- Convenience: Choose platforms with mobile operations and simple processes to save time and effort.

- Required Documents: Prepare recipient name, account information, identity proof, and other materials in advance to ensure smooth remittances.

If you need large cross-border remittances, prioritize Wise. For small domestic transfers in Brazil, Pix is more suitable. Combine transfer speed and fees to flexibly adjust your plan.

Precautions

Before sending money, pay attention to the following common issues to avoid unnecessary losses:

- Ignoring hidden fees and exchange rate markups

- Providing incorrect recipient information

- Failing to comply with local regulations

- Not considering payment speed and processing times

- Ignoring fraud and security risks

You can adopt the following best practices to reduce risks:

When making international remittances, carefully verify recipient information to ensure all details are accurate. Understand all related fees, including service fees and exchange rate margins. Ensure compliance with Brazilian and mainland Chinese regulations. Choose reputable payment providers and confirm all details before transferring to effectively protect your funds.

When preparing remittance materials, organize recipient account information, identity proof, and transfer purpose statements in advance. If you encounter suspicious links or requests for transfers from strangers, stay vigilant to avoid scams.

When sending money to Brazil, Wise and Pix offer the fastest and cheapest experiences. You will find that while traditional banks dominated transaction volumes in 2017, they have high fees and slow speeds. Digital payment platforms are growing due to the popularity of the internet and smartphones. The table below shows future trends:

| Development Direction | Details |

|---|---|

| Growth of Digital Payment Platforms | More users choose online services and mobile apps |

| Emphasis on Compliance and Security | Providers strengthen KYC and AML measures |

| Increased Remittance Inflows | Brazilian overseas workers support family expenses |

Pay attention to security and compliance, choosing the best method based on your needs.

FAQ

What basic documents are needed to send money to Brazil?

You need to prepare the recipient’s name, bank account information, identity proof, and transfer purpose statement. When using Wise or Pix, the system will guide you to provide required information.

How long does it take for a remittance to arrive in Brazil?

With Wise, transfers typically take 1-2 business days. Pix offers near-instant transfers within Brazil. Times vary by service.

How to ensure fund security during remittances?

Choose compliant platforms like Wise or licensed Hong Kong banks. Verify recipient information and enable multi-factor authentication. Avoid clicking suspicious links to prevent fraud.

Are there limits on remittance amounts?

Wise allows up to 250,000 BRL per transaction (approximately USD). Pix has a nightly limit of 1,000 BRL. Limits vary by platform and account type.

What fees are incurred during remittances?

You pay service fees and exchange rate margins. Wise charges about 0.35%, and Pix is nearly free. Some banks and platforms may charge additional fees.

Remitting to Brazil via Wise offers 0.35% low fees and 1-2 business day delivery, while Pix enables near-instant, near-zero-fee transfers, but traditional banks’ $20-50 wire fees and 5-day waits inflate costs, especially with Brazil’s projected $3.6+ billion remittances in 2025, where markups and limits (e.g., Wise’s 250,000 BRL per transfer) erode received amounts. For a cheaper, faster alternative, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay beats Wise, maximizing recipient value with full transparency.

BiyaPay serves most countries and regions, including Brazil, with registration in minutes and same-day processing, no lengthy verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current USD/BRL rates (e.g., USD/BRL around 5.42), optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.