- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stop Using Traditional Remittances: Stablecoin USDT Transfers Are Cheaper

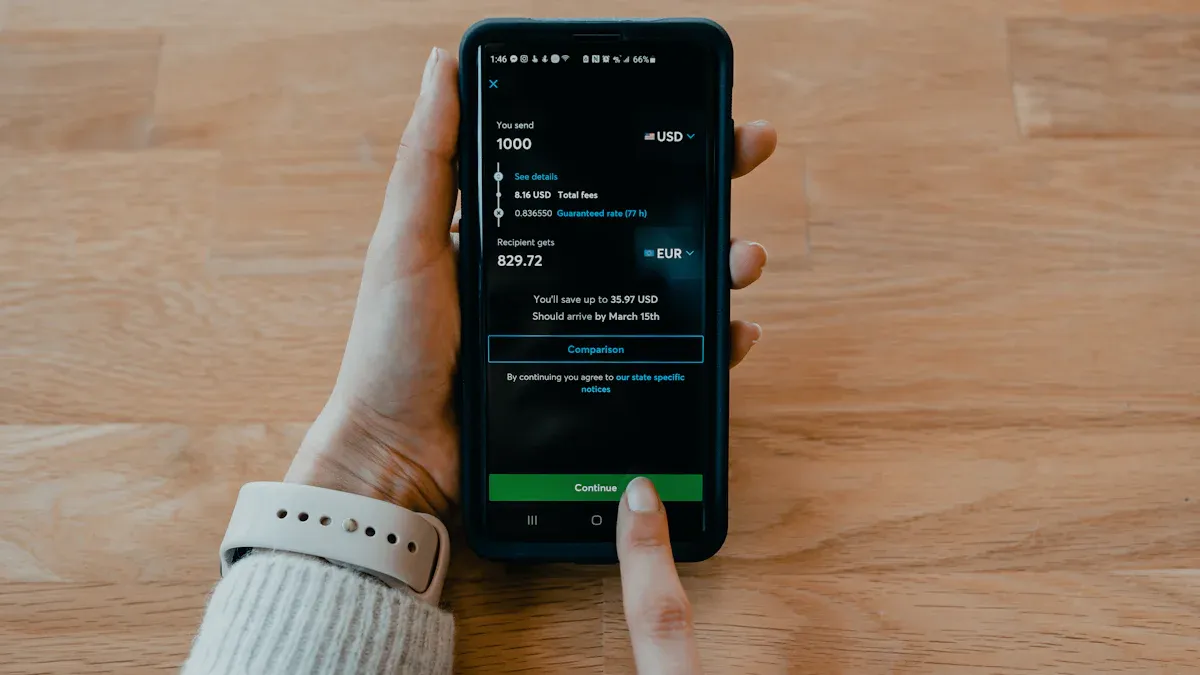

Image Source: unsplash

Are you still enduring traditional cross-border remittances? It not only takes 24 to 72 hours for arrival, but the global average handling fee is as high as 6.49%. The answer is yes. By using stablecoin USDT, you can achieve secure and fast global fund transfers. Choose the right network, and the per-transaction fee can even be less than $1.

This 2025 latest guide will teach you step by step how to operate, allowing you to easily bid farewell to high fees and experience efficient and convenient fund transfers.

Core Points

- USDT transfers are much cheaper than traditional remittances, with fees possibly under $1.

- Choosing Solana or TRC-20 networks for USDT transfers is the most cost-effective and fast.

- When buying and selling USDT in the C2C market, select reputable merchants and use platform escrow services.

- When transferring USDT, always carefully verify the recipient address and network type; choosing wrong can lead to permanent loss of funds.

- Release USDT only after receiving the money—this is the key to protecting yourself from scams in C2C transactions.

Choose Low-Fee Cryptocurrency Exchanges

Image Source: unsplash

Choosing a secure and low-cost cryptocurrency exchange is your first step in starting the USDT remittance journey. A good platform not only secures your funds but also helps you save costs from the source.

Platform Fee Comparison

When purchasing USDT, you mainly encounter two types of fees: C2C/P2P trading fees and withdrawal fees.

- C2C/P2P trading fees: These are fees incurred when trading with other users on the platform. The good news is that many mainstream platforms offer zero-fee C2C trading to attract users.

For example, P2P trading on mainstream exchanges like OKX is completely free, so you don’t pay any platform fees for buying or selling USDT.

- Withdrawal fees: These are fees for transferring USDT from the exchange to another wallet or platform and are key to cost control. This fee depends on the transfer network you choose, not the platform itself.

To help you understand intuitively, here is a comparison of USDT withdrawal fees on mainstream platforms based on different networks:

| Network Type | Withdrawal Fee (Approx.) | Speed | Recommendation |

|---|---|---|---|

| TRC-20 (Tron) | ~$1 USD | Fast | ⭐⭐⭐⭐⭐ |

| Solana (SOL) | ~$0.03 USD | Extremely Fast | ⭐⭐⭐⭐⭐ |

| BEP-20 (BSC) | ~$0.3 USD | Fast | ⭐⭐⭐⭐ |

| ERC-20 (Ethereum) | ~$2 - $8 USD | Slower | ⭐ |

Cost-saving tip: Many platforms offer invitation links for registration. Through these links, you may get a lifetime 20% trading fee rebate, saving a considerable amount in the long run.

Identity Verification (KYC) Guide

To ensure fund security and comply with global financial regulations, all legitimate exchanges require you to complete identity verification (KYC). Though it may seem troublesome, it is an important defense against account theft.

To pass verification quickly, prepare the following materials in advance:

- Identity proof: Usually your ID card, passport, or driver’s license.

- Address proof: Utility bills, bank statements, or government-issued documents from the past 3 months with your name and address.

- Selfie: Take a clear selfie as required by the platform for facial recognition comparison.

How to avoid verification delays? Platforms hate mismatched information or poor document quality during KYC. Ensure submitted materials are authentic and valid, photos are clear without glare, and documents are within validity. Any forgery or tampering will cause verification failure.

How to Buy Stablecoin USDT at the Best Price

You’ve chosen the platform; next is buying USDT at the most cost-effective price. The C2C (Customer-to-Customer) trading market is your best choice, as it gathers many sellers, allowing you to compare like shopping on Taobao.

Cost-Saving Tips for C2C Trading

In the C2C market, prices are set by sellers. To find the best price, learn to screen reliable merchants. A good merchant offers fair prices and fast transactions. Focus on these two metrics:

- Total orders: Represents the merchant’s trading experience.

- Completion rate: 99% or above usually means good reputation.

You may worry: what if you pay but the other party doesn’t release the coins? This is where platform escrow services come in.

Platform escrow service acts like a neutral referee, ensuring fair trading. Its workflow is:

- Lock assets: After you place an order, the platform immediately locks the seller’s USDT.

- Buyer pays: You pay to the seller’s provided account.

- Seller confirms: Seller confirms receipt of your payment.

- Release assets: Platform releases the locked USDT to your account.

In this process, the seller’s coins are locked in advance, so they can’t run away with the money. This mechanism greatly reduces fraud risk, letting you trade with peace of mind.

Payment Method Selection

Choosing the right payment method concerns not only convenience but directly your fund security. C2C platforms usually support bank cards, Alipay, WeChat Pay, and more.

Risk warning: Be vigilant of payment risks in trading. Some criminals exploit payment vulnerabilities for fraud:

- Dirty money risk: You may receive illegally sourced funds, causing your bank account to be frozen.

- Fake proof: Scammers send forged payment screenshots or SMS to trick you into releasing assets early.

- Chargeback fraud: After receiving your assets, the other party maliciously reverses the transfer using certain payment platform features.

To avoid these risks, strongly recommend using your real-name bank card for transactions. Bank transfer records are clear and hard to reverse, making it one of the safest methods. Avoid trading with merchants accepting only anonymous or easily reversible payment methods.

Choose the Right Remittance Network (Core Technique)

Image Source: unsplash

You’ve successfully bought USDT; now comes the most critical step: choosing the right transfer network. This step directly determines your remittance cost and speed. Choose right, fees may be just cents; choose wrong, not only high costs but possible permanent fund loss.

Mainstream Network Cost and Speed Comparison

Different blockchain networks are like different courier companies—some fast and cheap, others slow and expensive. For USDT transfers, the most common networks are TRC-20, Solana, BEP-20, and ERC-20.

For clarity, here is their core data comparison:

| Network | Per-Transfer Fee (Approx.) | Arrival Speed | Recommendation Reason |

|---|---|---|---|

| Solana (SOL) | ~$0.0005 | ~10 seconds | Extremely low cost, lightning speed, ideal for small frequent transfers. |

| TRC-20 (Tron) | ~$1 - $2 | Seconds | Low fee, fast speed, mature ecosystem, widely supported. |

| BEP-20 (BSC) | ~$0.1 - $0.3 | Seconds | Competitive fee and speed, another excellent choice. |

| ERC-20 (Ethereum) | ~$0.4 - $8+ | 5 minutes to hours | Highest cost, slowest speed; avoid unless specified by recipient. |

From the table, you can clearly see Solana and TRC-20 networks show huge cost advantages. According to FXC Intelligence, in 2025, Ethereum (ERC-20) average Gas fees fluctuate between $0.4 and $8, with higher fees during network congestion (e.g., during hot NFT or token events). In contrast, Solana transfer costs are almost negligible.

Thus, your cost-saving formula is simple: Prioritize Solana or TRC-20 networks for transfers.

USDT Transfer Step-by-Step Operation

Theory mastered, now enter practice. We’ll use Biyapay as an example to show you how to complete a secure, low-cost USDT transfer.

- Obtain recipient address and network type First, ask your recipient for two things:

- USDT recipient address (a long string of letters and numbers).

- Corresponding network type (e.g., TRC-20 or Solana).

- Initiate transfer in Biyapay Open the Biyapay app, go to your wallet, find USDT assets. Click “Send” or “Withdraw”.

- Fill transfer information (most critical step) On the transfer page, fill in:

- Address: Copy and paste the recipient’s address completely.

- Network: This is the most error-prone and fatal part. You must choose the network exactly matching the recipient address.

⚠️ Serious warning: Wrong network, assets permanently lost!** Blockchain transactions are irreversible. If you send TRC-20 USDT to an ERC-20 address, the funds enter an unreachable “black hole” forever unrecoverable, completely different from traditional bank wrong transfers that can be recovered. So, before clicking send, confirm the network choice multiple times.

- Verify information and confirm After entering the amount, the system lets you final-confirm all info. Carefully check:

- Network type matches recipient’s requirement.

- Recipient address starting and ending characters match what you copied, preventing paste errors or malware tampering.

- Complete transfer After confirmation, enter your payment password or biometric verification to send. On efficient networks like Solana or TRC-20, your recipient usually sees funds within 1 minute.

Through these steps, you complete a global fund transfer much faster and cheaper than traditional methods.

Secure Receipt and Fiat Conversion

You’ve successfully transferred funds to the recipient’s wallet; now safely convert these digital assets to local currency. This process is often called “cashing out,” and the C2C market is again the best place.

Selling USDT in the C2C Market

The process of selling USDT is very similar to buying, just roles reversed. Now, you are the seller. To ensure smooth and optimal pricing, screen reliable buyers.

When choosing counterparties, refer to platform-provided buyer reputation info. These data build trust for confident trading. Focus on:

- Transaction volume: An experienced buyer usually handles many orders.

- Completion rate: Look for high completion rate buyers, indicating good reputation and few cancellations.

- User feedback: Check other sellers’ reviews of the buyer to understand their habits.

Taiwan cash-out tip: If your receipt location is Taiwan, consider using local compliant exchanges supporting TWD cash-out. Such platforms usually offer better rates and lower bank fees, smoothing your conversion.

Ensure Funds Safely Arrive

Security is paramount in cash-out. In C2C trading, your core principle is: Confirm receipt of money before releasing your digital assets.

Core safety principle: Never click “I have received payment” and release USDT before confirming full payment in your bank account. This is your most important defense against fraud.

To ensure safe fund arrival, follow these steps:

- Verify account info: When posting sell ads or choosing buyers, ensure your provided bank account info is accurate. Account name must match your real-name (KYC) info exactly.

- Log in to online banking to confirm: When buyer marks “paid,” don’t rely on their screenshots or SMS. Personally log into online or mobile banking to check balance and confirm actual arrival.

- Beware suspicious behavior: If buyer urges quick release or uses account name mismatched with platform real-name, stay alert. You can cancel and report to platform support.

- Release after confirmation: Only after 100% confirming funds in your bank account, return to platform, click “confirm receipt and release assets”.

By strictly following these steps, you greatly reduce trading risks, ensuring every cash-out is safe and reliable.

Risks to Watch and Avoidance Methods

Though USDT transfers are efficient and cheap, understand this convenience comes with new risks. Unlike traditional banks, blockchain operations are irreversible once confirmed. Thus, understanding and avoiding risks is prerequisite for safe USDT use.

Operational Error Risks

Operational errors are the most common mistakes for beginners and the leading cause of fund loss. Due to blockchain irreversibility, a small oversight can cost dearly.

The three most common fatal errors:

- Sent to wrong address: USDT addresses are long character strings. If you miscopy one character or malware tampers clipboard, funds go to an unreachable address, permanently lost.

- Chose wrong network: This is the most critical and error-prone step. For example, sending TRC-20 USDT to an ERC-20 address drops money into network “cracks,” almost unrecoverable.

- Insufficient Gas fee: On some networks (like Ethereum), transfers need Gas fees. If set too low, transaction may stall, take long to process, or fail.

If transferred wrong, any rescue?

Though recovery hope is slim, in specific cases, you can try these steps to possibly salvage:

- Check wallet compatibility: If assets transferred to another wallet under your name (e.g., BEP-20 tokens to MetaMask’s Ethereum address supporting multi-chain), try switching to corresponding network (like BSC) in wallet to see if assets appear.

- Contact exchange support: If coins sent to a centralized exchange wallet address, immediately contact their support. Provide detailed TxID and explanation; they may manually recover, but usually charge a service fee and take time.

- Seek professional help: If above fail, consider professional crypto recovery services. Note these charge high fees and cannot guarantee 100% success.

Counterparty Risks

In C2C/P2P markets, you deal with strangers. Though platforms have escrow, beware fraudsters trying to bypass rules.

- Request off-platform communication: Counterparty tries to move to Telegram, WhatsApp, etc., promising better prices. This is usually scam start to escape platform oversight.

- Urge asset release: Before you confirm bank receipt, counterparty pressures with various reasons to release USDT.

- Use third-party payment: Buyer’s payment bank account name mismatches platform real-name. Funds may be “dirty money,” risking your bank freeze.

- Provide fake payment proof: Counterparty sends forged bank transfer screenshot to trick you into thinking payment received. You must personally check online banking.

- Impersonate platform support: Scammers pose as support via SMS or email, claiming account issues and requiring operations. Remember, platform support never contacts off-site or asks for passwords/transfers.

To protect from phishing and fraud, develop good security habits. Stick to reputable platforms for all operations, enable two-factor authentication (2FA). Ignore any strange calls or messages claiming account issues and requiring crypto purchase to “resolve.”

Now you’ve mastered the cost-saving formula: choose low-fee platforms paired with right transfer networks (like Solana or TRC-20). Using USDT for remittances, costs can be cents, while traditional averages 6.49%.

After fully understanding risks, start with a small transfer. For example, send $5, confirm address and network correct, then do larger amounts. Experience USDT’s efficiency and convenience firsthand!

FAQ

Is USDT transfer legal?

You need to understand your region’s laws. Different countries and regions have varying cryptocurrency regulations. Before use, confirm local financial rules to ensure compliance.

Will USDT price fluctuate like Bitcoin?

No. USDT is a stablecoin pegged 1:1 to USD. Thus, its price is very stable, not fluctuating wildly like Bitcoin. You can think of it as digitized USD, perfect for transfers.

What if the recipient doesn’t know how to use cryptocurrency?

The recipient needs a cryptocurrency wallet address to receive USDT. You can guide them to register on a compliant exchange. The process is simple, like registering a new electronic payment tool.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.