- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

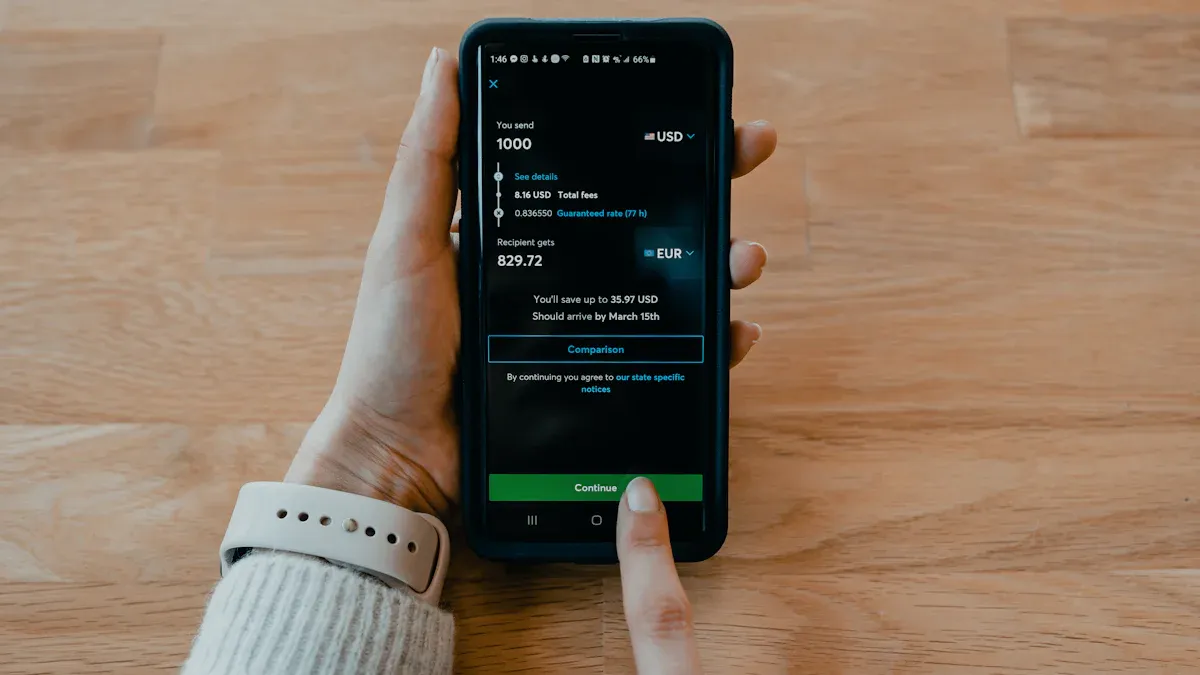

Can Stablecoin Remittances Really Save Money? Real Test Comparison of Popular Apps and Platform Fees

Image Source: pexels

For medium to large cross-border transfers, the conclusion is clear: using the stablecoin USDT for remittances can indeed help you save expenses and shorten waiting times. You may be like many international students, contributing significantly to education and living in the U.S. each year, but the process of paying tuition often comes with high fees.

Traditional Remittance vs. Cryptocurrency Remittance

Service Type Average Cost Transaction Time Traditional Remittance Services About 6.2% 1 to 5 business days Cryptocurrency Remittance As low as 1% Within minutes

The high costs of traditional methods make stablecoin USDT remittances an extremely attractive option, effectively reducing your capital in-transit costs.

Key Takeaways

- Using USDT for remittances is cheaper and faster than traditional bank transfers.

- Traditional remittances have many hidden fees, such as exchange rate spreads and intermediary charges.

- USDT remittance fees are low, mainly including the cost of buying/selling USDT and network transfer fees.

- Choosing the TRC-20 network for USDT transfers is the most cost-effective, with low fees and fast speed.

- For withdrawal, C2C markets offer better rates but carry risks; BiyaPay is safer and more compliant.

Fee Structure Analysis: Why USDT Remittances Save Money

Image Source: pexels

To understand why stablecoin remittances save money, you first need to clearly see the fee structures of traditional remittances and stablecoin remittances. The fees you see on the surface are often just the tip of the iceberg.

Hidden Fee List for Traditional Remittances

When you use a bank for international wire transfers, what you pay is far more than just a fixed handling fee. The cost of traditional remittances is a complex list that includes many “hidden fees” you cannot see.

A $1,000 wire transfer, the real cost may far exceed your imagination Assuming a remittance handling fee of $20, plus $15 charged by intermediary and receiving banks, and a 2% exchange rate spread loss ($20), your total cost reaches $55.

These fees are mainly hidden in the following areas:

- Exchange Rate Markup (Exchange Rate Markup): This is the main hidden cost. The exchange rate provided by the bank is not the real-time market rate; the difference is the bank’s profit.

- Intermediary Bank Fees: If your remittance needs to pass through one or more intermediary banks, each may deduct a pass-through fee of $10 to $50.

- Wire Transfer Fee: This is the most explicit fee, but it varies greatly among banks. For example, international outgoing fees at some major U.S. banks are between $25 and $50.

Full Process Cost Analysis for USDT Remittances

In contrast, the cost structure of stablecoin USDT remittances is much simpler and more transparent. Its fees mainly consist of three parts, and the total cost is extremely low.

The entire process cost can be broken down into:

- Deposit Cost: When converting fiat currency (such as USD) to USDT, the trading platform charges a very low handling fee or spread.

- Transfer Cost: This is the fee for transferring USDT on the blockchain network, also called “miner fee” or “Gas Fee”. Choosing an efficient network is crucial. For example, using the TRC-20 network, the fee per transfer is usually only $1-$2.

- Withdrawal Cost: When converting USDT back to the target country’s fiat currency, C2C merchants or platforms charge a small spread.

Let’s take a $1,000 remittance as an example and directly compare the total costs of the two methods:

| Fee Type | Traditional Bank Wire (U.S. Example) | USDT Remittance (Using TRC-20 Network) |

|---|---|---|

| Handling/Network Fee | $25 - $50 | $1 - $2 |

| Exchange Rate & Spread Loss | About $20 (2% markup) | About $5 - $10 (buy/sell spread) |

| Intermediary/Other Fees | $10 - $20 | $0 |

| Total Cost | $55 - $90 | $6 - $12 |

| Estimated Receipt | $910 - $945 | $988 - $994 |

Through this comparison, you can clearly see that by choosing the right path, a $1,000 remittance can easily save over $50 in fees.

Stablecoin USDT Remittance: Full Process Tools and Platform Comparison

Image Source: unsplash

After understanding the fee differences, the next step is to choose the right tools to complete your remittance. A successful stablecoin USDT remittance includes three key steps: deposit (buying USDT), transfer (moving on the blockchain), and withdrawal (converting back to fiat). Each step has optimal choices to minimize your costs.

Deposit Section: Where to Buy USDT Most Cost-Effectively

Your first step is to convert your fiat currency (such as USD) into USDT. Currently, the mainstream choice is centralized exchanges (CEX), such as Binance or OKX. They are like a “supermarket” for digital currencies, offering the best liquidity and most convenient purchasing experience.

Although you may have heard of decentralized exchanges (DEX) that do not require identity verification, for remittance beginners, CEX is a safer and more direct choice.

Beginner Guide: Why Choose Centralized Exchanges (CEX)?

- Simple Operation: CEX interfaces are designed for ordinary users, with clear and intuitive purchasing processes, just like using online banking.

- Fiat Channels: You can directly use credit cards or bank transfers to buy USDT, seamlessly connecting traditional finance and the crypto world.

- High Liquidity: As large trading platforms, CEX have huge trading volumes, ensuring you can quickly buy USDT at stable prices without affecting the price due to large purchases.

- Customer Support: If you encounter problems, you can contact customer service for help.

In contrast, although DEX allows you to fully control your private keys, the operation is complex, requiring you to manage your wallet yourself and understand technical concepts like Gas fees, and it does not provide direct fiat purchase channels. For first-time users, its steep learning curve and potential smart contract vulnerabilities make it a less ideal starting point.

Therefore, to smoothly start your remittance journey, it is recommended to choose a reputable CEX that requires identity verification (KYC) to complete the deposit.

Transfer Section: Mainstream Blockchain Network Fee and Speed Comparison

After purchasing USDT, you need to withdraw it from the exchange and transfer it to the recipient’s wallet address. During withdrawal, the platform will let you choose a “transfer network”, and this choice directly determines your transfer fee and speed.

Currently, mainstream exchanges generally support multiple USDT networks, the most common including:

- Tron (TRC-20)

- Ethereum (ERC-20)

- Binance Smart Chain (BEP-20)

- Solana (SOL)

Among them, ERC-20 is based on the Ethereum network. Although widely used, it has high fees and slower speeds, especially during network congestion, where a single transfer may cost tens of dollars.

Note: Before transferring, be sure to confirm with the recipient which network they support. Address formats vary by network; transferring to the wrong network will result in permanent loss of funds.

To help you make the best choice, here is a comparison of the two most commonly used networks:

| Network Type | Average Fee (USD) | Estimated Arrival Time | Advantages and Scenarios |

|---|---|---|---|

| TRC-20 (Tron) | $1 - $2 | Within 1 minute | Fast speed, extremely low fees, the preferred network for cross-border remittances. |

| ERC-20 (Ethereum) | $5 - $25+ | 5-10 minutes (longer during congestion) | High security, but high cost, not suitable for regular remittances. |

Thanks to the Tron network’s high performance of processing up to 2000 transactions per second, TRC-20 transfers are usually confirmed within seconds. Therefore, when remitting, prioritizing the TRC-20 network is key to maximizing cost and time savings.

Withdrawal Section: How to Choose Between C2C Markets and Emerging Platforms

The final step in remittance is to safely convert the received USDT into the target country’s fiat currency, such as USD or HKD. At this step, you have two mainstream choices: the exchange’s C2C market and emerging compliant withdrawal platforms.

1. C2C (Customer-to-Customer) Market

Exchanges like Binance and OKX have built-in C2C markets that allow you to trade directly with individual buyers.

- Advantages: Rates may be more favorable since you trade directly with individuals in the market.

- Disadvantages: Huge risks exist. You cannot guarantee the legality of the counterparty’s fund sources. Once you receive “dirty money,” your bank account may face judicial freezing. Additionally, beware of fake payment proofs, refund fraud, and other scams.

C2C Trading Safety Tips

- Screen Merchants: Only trade with “verified merchants” and check their completion rate (>95%) and positive reviews.

- UsePlatform Escrow: Ensure the transaction is under the platform’s escrow service; the platform will lock the counterparty’s USDT until you confirm receipt.

- Verify Receipt: Before releasing your USDT, log in to your banking app or online banking to confirm funds have arrived with your own eyes; do not trust any screenshots or SMS notifications.

- Emerging Compliant Platforms: BiyaPay

For users prioritizing safety and compliance, platforms like BiyaPay provide a perfect solution. It acts as a regulated “fund bridge,” safely converting your USDT to fiat and depositing it directly into your bank account.

The process of using BiyaPay is very clear:

- Complete identity verification (KYC) on BiyaPay.

- Recharge USDT from your exchange or wallet to your BiyaPay account.

- Convert USDT to USD within the app.

- Withdraw USD to your bound licensed Hong Kong bank account or Wise account.

Since BiyaPay is a financially regulated platform, it ensures the legality of all transactions and the cleanliness of fund sources, fundamentally eliminating the risk of receiving “dirty money” in C2C transactions.

| Comparison Dimension | C2C Market (e.g., Binance) | Compliant Platform (e.g., BiyaPay) |

|---|---|---|

| Core Advantage | Potentially optimal rates | Safe and compliant, no dirty money risk |

| Main Risk | Account freezing, fraud | Platform operational risk |

| Operation Process | Communicate with individual buyers, verify | Direct conversion and withdrawal in app |

| Suitable For | Users seeking ultimate rates with high risk tolerance | Students and family remitters prioritizing fund safety and ease of operation |

In summary, if you prioritize fund safety and operational convenience, especially if you do not want to risk your bank account being frozen, withdrawing through a compliant platform like BiyaPay is a more reliable and worry-free choice.

Two Mainstream Path Practical Guides

You have mastered the theoretical knowledge; now you need clear practical steps. Below, we break down two mainstream remittance paths for you; you can choose based on your preferences for cost, safety, and convenience.

Path One: Ultimate Cost-Effectiveness C2C Operation Process

This path helps you achieve the lowest transaction costs, but you need to stay highly vigilant and strictly follow safety rules. The entire process is completed within a large exchange (such as Binance).

- Deposit: Buy USDT You can purchase USDT in two ways within the exchange:

- Credit/Debit Card: This is the fastest method. Simply enter the amount on the “Buy Crypto” page, select USDT, and input your Visa or Mastercard card information to complete the purchase.

- Bank Transfer: This method has lower fees. You need to bind your bank account first, then initiate a transfer; once funds arrive, you can buy USDT on the spot market.

- Transfer: Internal Transfer Purchased USDT is usually in your “funding account” or “spot account”. You need to transfer it to the “C2C account” or “fiat account” to proceed. This step is internal to the platform with no fees.

- Withdrawal: Sell USDT on C2C Market Enter the C2C trading area, post an ad to sell USDT, or directly select a buyer with a suitable offer. The counterparty will pay you via bank transfer.

C2C Trading Safety Lifeline

- Screen Buyers: Be sure to choose buyers with “verified” badges, high completion rates (>95%), and many positive reviews.

- Confirm Receipt: Before releasing your USDT, log in to your online banking or mobile banking app to confirm the money has arrived with your own eyes. Never trust any screenshots.

- Use Platform Escrow: The entire transaction is under platform escrow. As long as you do not click “Confirm Receipt and Release,” your USDT is safe.

Path Two: Compliance and Convenience with BiyaPay + Wise

If you do not want to bear any risks of C2C transactions and want the entire process to be simple, transparent, and with absolutely clean fund sources, this path is your best choice. It uses BiyaPay as a regulated bridge to safely transfer your stablecoin USDT remittance to your bank account.

The operation process is very straightforward:

- Register and Verify: First, register and complete BiyaPay’s identity verification, then bind your receiving bank account, such as your licensed Hong Kong bank account or Wise account.

- Recharge USDT: From your exchange (such as Binance) or personal wallet, recharge USDT to your BiyaPay account via on-chain transfer (recommend TRC-20 network).

- Convert to Fiat: In the BiyaPay App, use the “Instant Conversion” function to one-click convert received USDT to USD.

- Withdraw to Bank: Finally, go to the “Remittance” page, select your bound Wise or bank account, enter the amount, complete security verification, and withdraw USD. The entire process is as simple as operating a regular banking app.

Although this path incurs some platform service fees, it provides fund safety guarantees and operational convenience that C2C cannot match.

Choosing the right tools and paths, stablecoin USDT remittance is indeed a current efficient and economical cross-border fund solution.

Here are the key points to save money:

- Deposit: Find platforms with low spreads to buy USDT.

- Transfer: Prioritize low-fee networks like TRC-20.

- Withdrawal: Choose based on your needs; C2C markets have better rates, while BiyaPay ensures compliance and safety.

Safety First 🔔

Remember, all operations should be on reputable platforms. You need to be wary of C2C transaction and phishing website risks. Always carefully verify the address before transferring, as mistakes may result in permanent loss of funds.

FAQ

Are There Legal Risks in Using USDT for Remittances?

You need to comply with the laws and regulations of your location and the recipient’s location. Choosing compliant platforms like BiyaPay that require identity verification (KYC) can ensure the legality of the fund chain and reduce risks. These platforms help you avoid potential compliance issues through strict review processes.

USDT is a Stablecoin, Will Its Price Fluctuate?

USDT is pegged 1:1 to the USD, with a design goal to maintain price stability. Although the market may have very slight fluctuations (usually less than 0.1%), it does not fluctuate dramatically like Bitcoin, making it very suitable as a value storage tool for remittances.

What If I Send USDT to the Wrong Address?

Blockchain transfers are irreversible. Once you send funds to the wrong address, they are almost impossible to recover. Therefore, before confirming the transfer, you must repeatedly verify that the receiving address and transfer network (such as TRC-20) are completely correct.

Should I Choose C2C or BiyaPay for Withdrawal?

It depends on your risk preference:

- Pursuing Ultimate Rates: You can choose C2C markets, but you bear the risks of screening merchants and fund sources yourself.

- Prioritizing Safety and Compliance: We recommend using BiyaPay, which fundamentally avoids the risk of your bank account being frozen due to receiving funds of unknown origin.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.