- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stop Wasting Money: Using Stablecoins for Remittance is the Smart Choice

Image Source: pexels

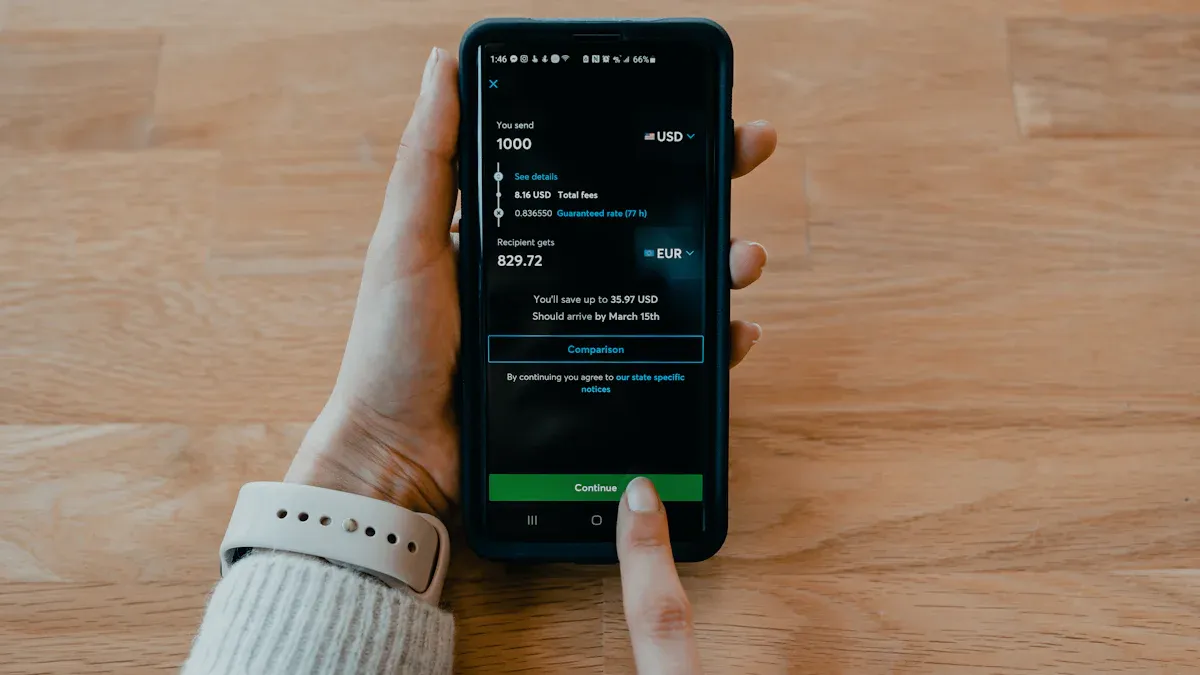

When remitting to Nigeria, are you still troubled by high fees? The answer is yes, using stablecoin remittance is usually a smarter choice. Traditional banks add a significant markup of 3% to 6% on exchange rates, while Western Union’s exchange rates often include hidden costs, all of which increase your actual expenses.

Imagine this: remitting 1000 USD, traditional methods might cause you to lose 50 USD or even more. Using USDT, the total cost might be less than 5 USD.

This “swallowed” money should belong to your recipient.

Key Points

- Using stablecoins (such as USDT) to remit to Nigeria is more cost-effective than traditional banks or Western Union.

- USDT remittance has low fees, recipients get better exchange rates, and funds arrive faster.

- When purchasing USDT, choose a reputable exchange and complete identity verification.

- When transferring USDT, be sure to confirm the recipient address and blockchain network are correct to avoid loss of funds.

- When converting USDT to Naira in Nigeria, use the P2P market and ensure you receive the money before releasing USDT.

Core Cost Advantages of USDT Remittance

Image Source: unsplash

You might wonder how exactly USDT helps you save money. The answer lies in three key areas: fees, exchange rates, and time.

Say Goodbye to High Traditional Fees

One of the biggest pain points of traditional remittance methods is the layered fees. Banks and remittance institutions not only charge fixed fees but may also charge a percentage.

In contrast, the cost of USDT transfers mainly comes from blockchain network fees. You can think of it as a “tip” to miners. Choosing different networks results in huge fee differences. For example, using the TRON network (TRC20) for transfers, the cost is usually very low.

| Feature | ERC20 (Ethereum) | TRC20 (TRON) |

|---|---|---|

| Average Fee | $5 - $50 | $0.10 - $1 |

Operation Tip: Choose the TRC20 network for USDT transfers, and your fees usually won’t exceed 1 USD. This means that whether you remit 100 USD or 10,000 USD, the fees are almost negligible.

Lock in Better Local Exchange Rates

Do you think the exchange rate provided by banks is the market rate? That’s not the case. Banks profit through the “spread” between buying and selling prices. This means that when your recipient exchanges to Naira, the rate they get is not favorable.

The chart above clearly shows the USD buying and selling spread of major Nigerian banks. This gap is the money you lose invisibly. When your recipient sells USDT on a cryptocurrency exchange’s P2P (peer-to-peer) market, they face prices determined by real market supply and demand, which are usually more favorable than the official bank rate, allowing them to exchange for more Naira.

Avoid Hidden Losses from Exchange Rate Fluctuations

Traditional wire transfers take several business days to arrive. During these days, if the Naira exchange rate fluctuates unfavorably, the amount your recipient ultimately receives will shrink. This is a hidden loss you cannot control.

Using stablecoin remittance is almost instant. Your USDT can reach the recipient’s wallet within minutes. They can immediately sell on the P2P market at the current best rate, firmly locking in the fund value and perfectly avoiding exchange rate risks during the waiting period.

How to Safely Remit with Stablecoins: Three-Step Guide

Image Source: unsplash

Now that you understand the cost advantages of USDT, let’s move to the practical part. This three-step guide will teach you step-by-step how to complete a stablecoin remittance safely and efficiently. The whole process is much simpler than you imagine.

Step 1: Purchase USDT

Your first step is to exchange your fiat currency (such as USD) for USDT. You need to complete this on a cryptocurrency exchange.

Choosing a reliable platform is crucial. You can consider the following two types:

- International mainstream exchanges: Platforms like OKX and Binance are popular choices for global users. They are known for low fees and good reputation. For example, OKX regularly publishes proof of reserves verified by independent parties, allowing users to confirm that their assets are always fully backed, greatly enhancing security.

- Africa-localized platforms: Platforms like Yellow Card focus on the African market with simple and intuitive interface design, very suitable for beginners.

To help you choose, here is a simple comparison:

| Feature | Binance (International Platform) | Yellow Card (Localized Platform) |

|---|---|---|

| User-Friendliness | Comprehensive features, suitable for all types of users | Simple and intuitive, extremely friendly to beginners |

| Available Cryptocurrencies | Over 500 | A few mainstream cryptocurrencies |

| Advanced Features | Offers futures, staking, and other advanced trading tools | Focuses on basic functions like buying/selling and bill payments |

| Best For | Users at all levels who want to explore more features | African users seeking simple operations and strong local support |

No matter which platform you choose, you need to complete the identity verification (KYC) process. This usually requires providing identification documents and is a standard step to ensure account security and comply with regulations.

Step 2: Transfer USDT to the Recipient

After purchasing USDT, you reach the core part of transferring to the Nigerian recipient. This process is like online bank transfer, but there are a few key points you need to pay extra attention to.

Here are the general transfer steps:

- Select currency: In your exchange wallet, choose the “send” or “withdraw” function, then find USDT.

- Enter address: Enter the USDT wallet address provided by the recipient. It’s best to copy and paste directly to avoid manual input errors.

- Select network: This is the most critical step! You must choose the correct blockchain network.

- Enter amount: Fill in the USDT amount you wish to transfer.

- Verify information: Carefully check if the recipient address, network, and amount are completely correct.

- Confirm send: Enter the transaction password or perform biometric verification to complete the transfer.

Security Alert: Wrong network selection = permanent loss of funds

- You must ensure that the network you choose is exactly the same as the one supported by the recipient’s wallet. For example, if you choose the TRC20 network, the recipient must also provide a TRC20 address.

- Networks like TRC20 and ERC20 are completely independent systems. Sending USDT to the wrong network type usually results in permanent loss of funds, almost unrecoverable.

- Action Suggestion: Before transferring, confirm with the recipient multiple times which network they are using.

Fund Security Tip: Must verify before transferring

- Copy and paste address: Always copy and paste the wallet address, never manually enter it; a single character error can lead to loss of funds.

- Conduct a small test transfer: If you are making a large transfer, it is strongly recommended to first send a small amount (such as 1-5 USD) of USDT for testing. After confirming the recipient successfully receives it, send the remaining large amount. This simple step can save you from huge losses.

Step 3: Convert to Naira in Nigeria

When your recipient receives the USDT, the final step is to convert it to the local currency—Naira (NGN). This process is usually completed on the exchange’s P2P (peer-to-peer) market.

On the P2P market, the recipient can directly trade with local buyers who want to purchase USDT with Naira. Here is the simplified process for selling USDT on Binance P2P:

- Enter P2P market: Find the “P2P trading” area in the exchange App.

- Select sell: Click the “sell” button and choose USDT. You will see a list of buyers with their offers, acceptable payment methods, and trading limits.

- Choose buyer: Select a buyer with good reputation, high completion rate, and trading limits that meet your needs.

- Initiate trade: Enter the amount of USDT you want to sell and choose your receiving method (such as your Nigerian bank account).

- Wait for payment: The buyer will transfer the agreed amount of Naira to your bank account. In Nigeria, common payment methods include bank transfers and mobile wallets.

- Confirm receipt and release: After logging into your bank App and confirming the money has arrived, return to the exchange platform and click the “confirm receipt and release USDT” button.

The entire P2P trading process is usually fast, but the specific time depends on the buyer’s payment speed. Although the blockchain transfer part of stablecoin remittance only takes a few minutes, the P2P trading part may take from a few minutes to an hour.

- Prioritize verified merchants: Try to trade with merchants on the platform that have “verified” or “Pro” labels; they have higher credibility.

- Verify payer information: Ensure that the bank account name making the payment matches the buyer’s real name on the P2P platform.

- Never release coins until money arrives: No matter how the other party urges, you must confirm in person that your bank account has received the full amount before releasing your USDT on the platform.

Risk Identification and Safety Pitfall Avoidance Techniques

Although USDT remittance has huge advantages, it is not without risks. Understanding these potential pitfalls and learning how to avoid them is key to ensuring your fund security. This is just as important as learning to check the rearview mirror and step on the brakes before driving.

Risk 1: Counterparty Fraud

When you or your recipient sell USDT on a P2P platform, you are dealing with real people. Unfortunately, not everyone is honest and trustworthy. Scammers use various tricks to try to steal your cryptocurrency.

Here are some common P2P scam methods:

- Fake payment proof: Scammers send a forged bank transfer screenshot, urging you to release USDT quickly. They bet that you won’t verify the bank account.

- Overpayment trap: The buyer deliberately pays more than the agreed amount, then claims they transferred wrongly and asks you to refund the difference. Once you refund the difference, they contact the bank to reverse the initial payment, leaving you empty-handed.

- Payment reversal (chargeback) fraud: The buyer uses a payment method that supports reversal. After you release USDT, they report to the bank that the transaction was “unauthorized,” and the bank may refund them, while you lose your USDT.

- SMS/email scam: Scammers impersonate the bank and send you a fake receipt SMS or email, making you think the money has arrived.

Core Security Rule: Confirm first, then release

No matter how the other party urges, you must personally log into your bank App or online banking to confirm that the full amount has “completely arrived,” not “processing.” Before confirming, absolutely do not click the “I have received and release” button.

Fortunately, you can significantly reduce risks by reviewing the counterparty’s profile. When choosing a buyer, be sure to check the following:

- Review trading history and completion rate: A reliable merchant usually has a large number of trading records and a high completion rate. If a user’s completion rate is below 80%, you need to be extra vigilant.

- Read user feedback and reviews: Other users’ evaluations are an important reference for judging their credibility. A large number of positive reviews usually means reliability, while negative reviews or almost no reviews are a danger signal.

Risk 2: Operational Errors and Fund Loss

In the crypto world, one of the biggest risks often comes from yourself. A tiny operational error can lead to permanent loss of funds, and it is almost impossible to recover.

The most common errors include:

- Sending to the wrong address: Cryptocurrency wallet addresses are long strings of complex characters. Manual input is highly error-prone; just one wrong character sends your funds to an uncontrolled address, disappearing forever.

- Choosing the wrong network: As emphasized earlier, TRC20 and ERC20 are two completely different “highways.” If you transfer from the TRC20 network to an ERC20 address, the money falls into a “dimensional rift” and cannot be recovered.

To avoid these catastrophic errors, you can take the following key security measures:

Security Tip: Conduct a small test transfer

If you are transferring to an address for the first time or need to transfer a large amount, it is strongly recommended to conduct a small test transfer first. You can send 5 USD of USDT first. After confirming with the recipient that they successfully received this small amount, send the remaining large funds. This simple step can help you avoid huge losses.

At the same time, you should enable all available security features in your exchange account:

- Two-factor authentication (2FA): This feature adds an extra security door to your account. Even if someone steals your login password, without the dynamic verification code on your phone, they cannot perform sensitive operations like withdrawals.

- Withdrawal address whitelist: You can set a “whitelist” to allow your account to withdraw only to a few pre-approved specific addresses. This way, even if your account is hacked, hackers cannot transfer your funds to their own addresses.

Risk 3: Avoiding Price Fluctuation of the Coin

USDT is called a stablecoin because it maintains a 1:1 peg with the USD through a reserve mechanism. In theory, every circulating USDT is backed by an equivalent USD asset.

However, “stable” does not mean “absolutely unchanging.” Under extreme market conditions or trust crises, stablecoins may experience brief “depegging,” where their price deviates from 1 USD.

- Historical case: In March 2023, due to part of its reserves being deposited in the collapsed Silicon Valley Bank, another mainstream stablecoin USDC’s price briefly fell to 0.87 USD. The earlier TerraUSD (UST) completely went to zero due to the collapse of its algorithmic mechanism.

Although USDT’s historical performance is relatively stable, you still need to be aware of this risk. The core of using stablecoin remittance is to utilize it as an efficient payment tool, not a long-term investment holding.

You can avoid this risk in the following ways:

- Shorten holding time: The entire remittance process—from purchasing USDT to the recipient selling it for Naira—should be completed as quickly as possible. Do not keep large amounts of USDT in your wallet for a long time.

- Stay informed: Pay attention to market news and regulatory developments related to stablecoins. For example, the Central Bank of Nigeria is evaluating the regulatory framework for stablecoins, indicating official attention to the field, but future policy directions remain uncertain.

- Diversify holdings: If you need to hold a certain amount of stablecoins, consider diversifying them across several different reputable stablecoins to spread the risk of a single project.

Remitting to Nigeria by choosing stablecoin remittance is not only to save money but also a smart move to embrace financial technology and improve efficiency.

You will gain three core advantages:

- Extremely low cost: Fees usually less than 1 USD.

- Superior exchange rate: Recipients can exchange for more Naira.

- Near-instant: Funds arrive within minutes, not several business days.

After fully understanding the risks and following the safety guide, you can try this efficient method to make every penny worth it. This even opens the door to new application scenarios such as small e-commerce payments and B2B transactions.

FAQ

Is using USDT legal in Nigeria?

The Central Bank of Nigeria restricts banks from processing cryptocurrency transactions. However, peer-to-peer transactions between individuals are common. Using the P2P market to exchange USDT for Naira is currently not prohibited and is a commonly used method locally.

How long does the entire remittance process take?

The entire process is divided into two steps:

- USDT transfer: The blockchain transfer itself usually takes only a few minutes.

- P2P transaction: The subsequent Naira exchange depends on the buyer’s payment speed, generally taking 15 minutes to 1 hour to complete.

Can I remit small amounts like 10 USD?

Of course. This is one of the major advantages of USDT remittance. You can easily send small amounts, and network fees (such as TRC20) remain very low, usually below 1 USD. This provides great convenience for small payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.