- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

USDT Remittance Costs Revealed: Real Experiences and Feedback from Global Users in 2025

Image Source: pexels

Traditional banks use the SWIFT network for cross-border remittances, with average costs as high as 6%. This system relies on multiple banks to relay information, creating delays and multi-layered fees. In contrast, stablecoin USDT remittance costs can be controlled between 0.5% and 3%. Besides costs, speed advantages are also significant.

| Remittance Method | Estimated Arrival Time |

|---|---|

| Bank Wire Transfer | 1-5 business days |

| USDT Transfer | Seconds to minutes |

Tip: This article will thoroughly reveal every USDT remittance fee through real user cases and provide the latest low-cost remittance paths and ultimate money-saving strategies for 2025.

Key Takeaways

- USDT remittances are much cheaper and faster than traditional bank remittances.

- The total cost of USDT remittances includes four parts: cost of buying USDT, transfer fee, withdrawal fee, and cost of selling USDT.

- Choosing the TRC20 network for USDT transfers saves the most money because it has low fees and fast speeds.

- Users should carefully verify the recipient address because USDT transfers cannot be revoked once sent.

- In the future, USDT remittances will become cheaper due to new technologies and more banks joining.

Full Breakdown of Stablecoin USDT Remittance Costs

Image Source: pexels

To fully understand stablecoin USDT remittance costs, users need to break it down into four core stages. The entire process starts with converting local fiat into USDT and ends with the recipient receiving local fiat. Each stage may generate fees, and clearly understanding these is key to controlling total costs.

On-Ramp Cost: Exchange Loss Between Fiat and USDT

On-ramp refers to the first step where users buy USDT with local fiat (e.g., USD, EUR). The most mainstream method is through centralized exchange (CEX) C2C (Customer-to-Customer) trading markets.

In C2C markets, users trade directly with others. Platforms like Biyapay, Binance, or OKX usually do not charge fees. For example, KuCoin’s P2P platform supports multiple payment methods without platform fees. However, costs are hidden in two places:

- Price Spread: C2C merchants’ USDT sell quotes are usually slightly higher than the real-time exchange rate. This difference is the merchant’s profit and the user’s main on-ramp cost. For example, if the real-time rate is 1 USD to 7.30 CNY, a merchant may sell USDT at 7.32.

- Payment Channel Fees: Some payment methods may incur extra fees. For example, using Alipay for large or frequent bank transfers may trigger a 0.1% fee. In contrast, choosing local transfer services from Hong Kong licensed banks may cost less.

Core Tip: On-ramp cost is not a fixed exchange fee but a floating cost determined by C2C market supply-demand and merchant quotes. Users should compare different merchants’ quotes to find the best price.

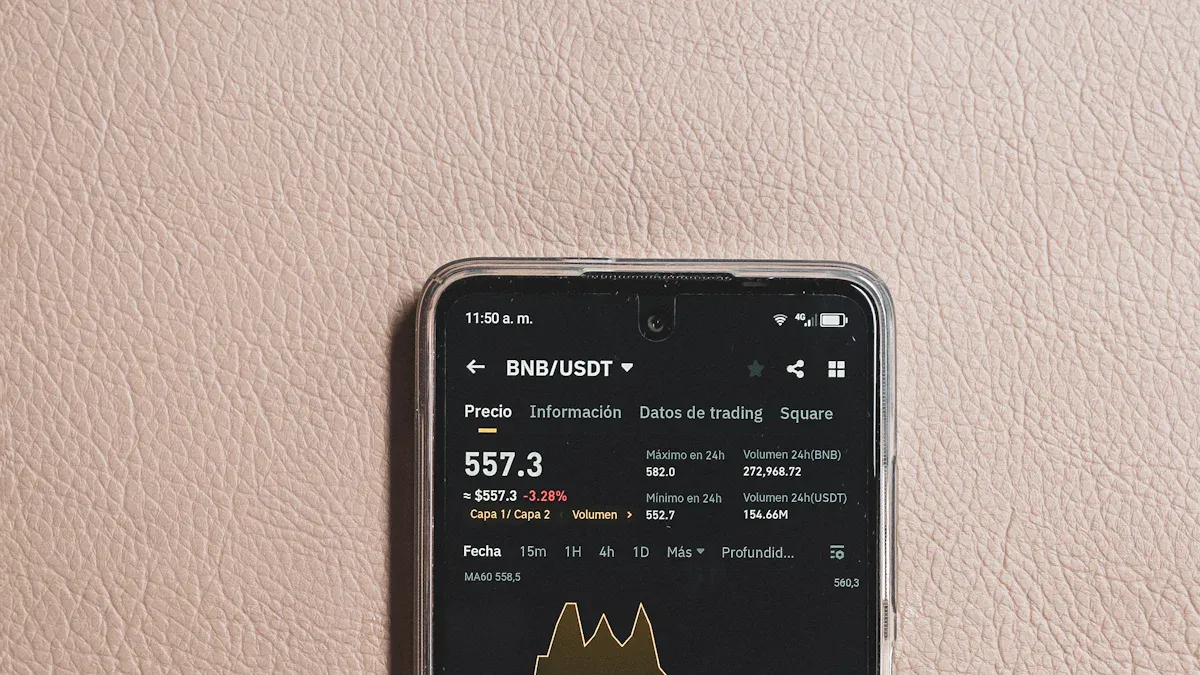

Transfer Cost: Mainstream Public Chain Gas Fee Comparison

After buying USDT, the next step is transferring it from the exchange or personal wallet to the recipient’s wallet address. This step’s cost is the “Gas fee” paid to the blockchain network for processing and verifying transactions. Gas fees vary greatly across public chains, directly affecting small remittance efficiency.

TRC20 (Tron network) is the most cost-effective choice for small stablecoin USDT remittances due to consistently low fees and high speeds. ERC20 (Ethereum network) is widely used but fees surge during congestion, unsuitable for small transfers. Solana network fees are extremely low, but supporting exchanges and wallets are relatively fewer.

For intuitive differences, the table below compares USDT transfer fees on three mainstream public chains under different network conditions:

| Network (Protocol) | Normal Period Fee (USD) | Congestion Period Fee (USD) | Remittance Advantages |

|---|---|---|---|

| TRON (TRC20) | About 1.3 - 2.0 USD | About 2.0 - 4.0 USD | Stable fees, fast speed, preferred for small amounts |

| Ethereum (ERC20) | About 1.0 - 5.0 USD | Up to 10 - 30 USD | Most mature ecosystem, but high cost volatility |

| Solana (SPL) | About 0.001 - 0.02 USD | About 0.01 - 0.05 USD | Extremely low fees, but slightly lower adoption |

Money-Saving Technique: During transfers, users can operate during lower network activity periods (e.g., late night or weekends) to pay lower Gas fees. For most personal remittance scenarios, TRC20 is the best balance of cost and convenience.

Withdrawal Cost: Exchange Fixed Fees

When users need to transfer USDT from exchange accounts to external wallets (e.g., recipient’s wallet or own cold wallet), exchanges charge a fixed withdrawal fee. This fee is unrelated to blockchain Gas fees and is the platform’s service charge.

This fee is usually per coin and network, independent of withdrawal amount. Thus, single large withdrawals are more cost-effective than multiple small ones.

Below are reference USDT withdrawal fees for different chains on major exchanges (early 2025 data):

| Exchange | USDT (TRC20) Withdrawal Fee | USDT (ERC20) Withdrawal Fee | USDT (Solana) Withdrawal Fee |

|---|---|---|---|

| Binance | 1 USD | About 3.2 - 5 USD | 1 USD |

| Bybit | About 1.6 USD | About 1 - 10 USD | About 0.8 USD |

| KuCoin | 1 USD | 5 USD | 1 USD |

| Biyapay | 1 USD | 5 USD | 1 USD |

Note: Withdrawal fees adjust dynamically with market conditions; refer to real-time withdrawal page info.

Off-Ramp Cost: Spread Between USDT and Target Fiat

Off-ramp is the final remittance step where the recipient sells received USDT for local fiat. This process is similar to on-ramp, usually in C2C markets.

Off-ramp cost is also in the price spread. Recipients seek buyers in C2C markets willing to purchase USDT. Buyers’ bids are usually slightly below real-time rates. For example, if the real-time rate is 1 USD to 150 ARS, a buyer may bid only 149 ARS. This difference is the off-ramp cost.

Choosing a high-liquidity, reputable C2C platform is crucial to ensure quick, safe off-ramp at fair prices. Overall, complete stablecoin USDT remittance cost is the sum of these four stages.

Real Experiences and Feedback from Global Users

Image Source: unsplash

Theoretical analysis reveals cost structure, but real user cases vividly show USDT remittance effects, challenges, and advantages in the real world. Below, we dive into 2025 remittance experiences of different global users through three typical scenarios.

Case One: Southeast Asian Migrant Worker Family Remittance

Scenario: Maria is a Filipino domestic worker in Singapore who needs to send 500 USD monthly salary to her family in the Philippines.

Previously, Maria relied on Western Union. Though reliable, fees and poor rates pained her. Now, she uses USDT remittances.

USDT (TRC20) Remittance Process and Cost Calculation:

- On-Ramp: Maria buys about 502 USD equivalent USDT with SGD via C2C in Singapore. Cost is mainly C2C merchant’s ~0.4% spread, about 2 USD.

- Transfer: She chooses TRC20 to transfer USDT from her exchange to family wallet. Exchange charges 1 USD fixed withdrawal fee, network Gas ~ 1.5 USD.

- Off-Ramp: Her family sells USDT for PHP on local compliant platform (e.g., Coins.ph) via C2C. Off-ramp spread cost ~0.5%, or 2.5 USD.

With USDT, Maria’s total cost is 2 + 1 + 1.5 + 2.5 = 7 USD, funds arrive in family hands in 10 minutes.

Cost Comparison

| Remittance Method | Amount | Estimated Total Cost | Arrival Speed | Family Receives (Approx.) |

|---|---|---|---|---|

| USDT (TRC20) | 500 USD | 7 USD (1.4%) | About 10 minutes | 493 USD |

| Western Union | 500 USD | 25-35 USD (5-7%) | Hours to 1 day | 465-475 USD |

Safety Operation Guide For users like Maria, safety is priority. These tips effectively avoid risks:

- Choose Compliant Platforms: Use locally registered, reputable licensed virtual asset service providers (VASPs), e.g., recipient can use Coins.ph partnered with Western Union.

- Verify Address: Crypto transfers are irrevocable. Before sending, repeatedly confirm recipient wallet address accuracy.

- Small Test Transfer: For first transfers to new addresses, send tiny amount (e.g., 10 USDT) to test smooth process.

Case Two: International Trade Payment

Scenario: A mainland China trade company needs to pay 10,000 USD to an Argentine supplier.

Traditional bank T/T takes 3-5 business days, involves multiple intermediaries, total fees possibly 100-300 USD. Fund path is opaque, hard to track. The company adopts USDT payment.

Large Payment Advantages and Compliance Challenges:

Using USDT, total cost (including all spreads/fees) controls under 0.8%, about 80 USD, payment confirms in half hour. Saves enterprise capital and time costs.

However, enterprises face stricter compliance for large cross-border stablecoin payments than individuals.

- Tax Characterization: IRS and other tax authorities treat stablecoins as “property” not “currency”. Each transaction may generate capital gains/losses; enterprises need detailed records and reporting. For example, U.S. enterprises report all digital asset activities on Form 1040.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): Enterprises must operate through compliant exchanges with bank-level AML/KYC. Regulators require large transaction monitoring and suspicious activity reports.

- Sanctions and Blacklists: USDT issuer cooperates with global sanctions lists, freezing assets related to sanctioned addresses. Enterprises must ensure counterparts not on sanctions lists to avoid fund freeze risks.

For efficiency-seeking enterprises, assessing full stablecoin USDT remittance costs includes not only transaction fees but also hidden compliance operation costs.

Case Three: Overseas Student Living Expense Transfer

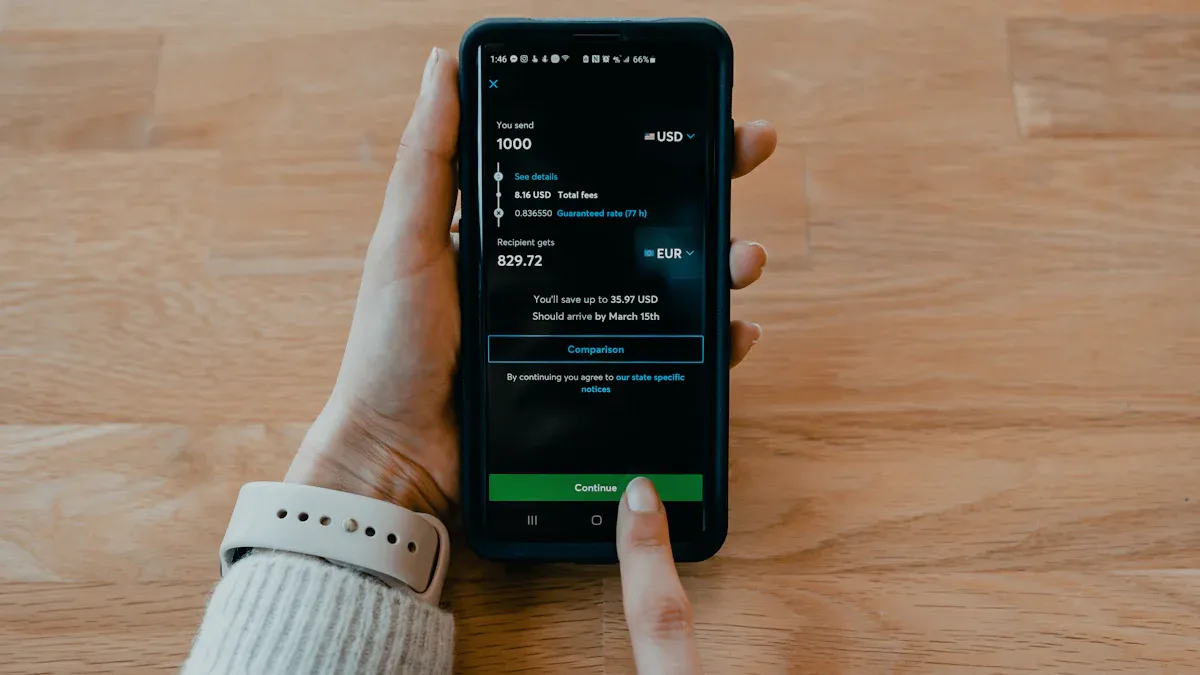

Scenario: A European couple plans to transfer 2,000 USD living expenses to their child studying in the U.S. They want a fast and economical solution.

For medium amounts with timing needs, USDT shows excellent balance.

Lowest Cost Path Sharing:

- Choose On-Ramp Platform: Parents in Europe choose mainstream, high-liquidity exchange (e.g., Kraken, Binance), transfer EUR via SEPA, then convert to USDT. SEPA fees extremely low, USDT conversion ~0.1%. Cost about 2 USD.

- Choose Transfer Network: Explicitly select TRC20. Exchange withdrawal + network fee total 2-3 USD.

- Choose Off-Ramp Platform: Child in U.S. receives USDT on strictly regulated exchange (e.g., Coinbase, Kraken U.S.). These provide transparent USDT to USD conversion, rates ~0.5%, then low-cost USD withdrawal to U.S. bank. Off-ramp cost about 10 USD.

Total cost 2 + 3 + 10 = 15 USD, only 0.75% of amount. In contrast, European bank international wire fees possibly 40-60 USD, taking days.

Core Pitfall Avoidance Guide:

- Never Choose Wrong Network: During exchange withdrawal, ensure both send/receive select TRC20. Wrong choice (e.g., ERC20) increases fees drastically, funds may be permanently lost.

- Estimate Full Cost: Don’t just look at transfer fee. On-ramp and off-ramp spreads or fees are major total cost parts; understand in advance.

- Beware OTC Scams: Avoid “discount exchanges” with strangers on social media; often scam traps. Always operate through reputable centralized platforms.

Cost Optimization Strategies and Future Trends

Understanding current cost structure is the first step; mastering future tech trends and optimization strategies is key to minimizing remittance costs. Emerging technologies and traditional finance entry are shaping a more efficient, lower-cost global payment future.

Emerging Technologies: Layer2 and Solana Potential

Ethereum’s high Gas fees were once a major USDT transfer pain point. Layer 2 solutions like Arbitrum process transactions outside Ethereum mainnet to solve this. They batch multiple transactions into one, significantly reducing per-transfer cost, while still enjoying Ethereum mainnet security.

Solana stands out with extreme speed and near-negligible fees. Stablecoin remittances on Solana usually cost under 0.01 USD.

This potential is noticed by traditional remittance giants. Western Union announced plans to launch its stablecoin on Solana blockchain in first half of 2026. This signals mainstream remittance channels will massively adopt blockchain, further lowering global average costs.

Ultimate Money-Saving Strategy: Cost Minimization Path

Combining theory and practice, users can control each step cost optimally via this checklist:

- Choose Best On-Ramp Channel: In C2C, compare merchant quotes. Platforms like Biyapay help screen reputable, low-spread merchants.

- Time Transfers: For non-TRC20, Gas fees fluctuate real-time. Transfer during low activity (e.g., late night) for lower fees.

- Prefer Withdrawal Platform and Network: Always prioritize TRC20 or Solana for withdrawals. Compare exchange fixed withdrawal fees pre-withdrawal, choose lowest.

- Find Efficient Off-Ramp Merchants: Recipients choose high-liquidity, large-user C2C platforms to quickly convert USDT to local fiat at near-market rates.

Industry Change: Traditional Finance Entry

Besides Western Union, more traditional institutions embrace stablecoins. Major banks like JPMorgan (JPM Coin) and Citibank (Citi Token Services) develop own digital currencies or tokenization services.

As regulatory frameworks clarify, more institutions expected to issue own digital currencies. This trend intensifies competition, drives innovation, ultimately benefiting ordinary users. Future USDT remittance costs expected to drop further on current basis, becoming more inclusive global payment option.

USDT remittance core advantage is significant cost and speed. It reduces intermediaries via direct on-chain settlement. However, success key is users’ clear awareness and active management of on-ramp, transfer, off-ramp fees.

Summary money-saving strategy: Prefer TRC20 network, use low-fee platforms, time transactions, key to achieving total cost within 1%.

Looking ahead, with Layer2 maturity and more traditional institution participation, USDT remittance costs expected to decrease further. This encourages users to embrace this efficient, transparent new global payment paradigm.

FAQ

Is using USDT for remittances legal?

USDT remittance legality depends on user’s country/region laws. Each has different digital asset regulations. Users must understand and comply with local financial laws before remitting for compliant operations.

What if USDT transfer address is wrong?

Blockchain transfers are irreversible. If sent to wrong address, funds cannot be recovered. Users must repeatedly verify recipient address accuracy before confirming. First transfers can test with small amounts.

Does USDT price fluctuate like Bitcoin?

USDT is a stablecoin pegged 1:1 to USD. Its design goal is price stability, avoiding Bitcoin-like drastic fluctuations. This makes USDT a reliable value transfer medium suitable for remittances.

Why not use banks directly for large remittances?

Bank wire for large transactions usually takes days, involves high fees and rate losses. USDT completes in half hour, total cost usually lower, providing efficient economical alternative for international trade payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.