- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

My USDT Remittance Money-Saving Guide: Saving Thousands of Dollars for Family Each Year

Image Source: unsplash

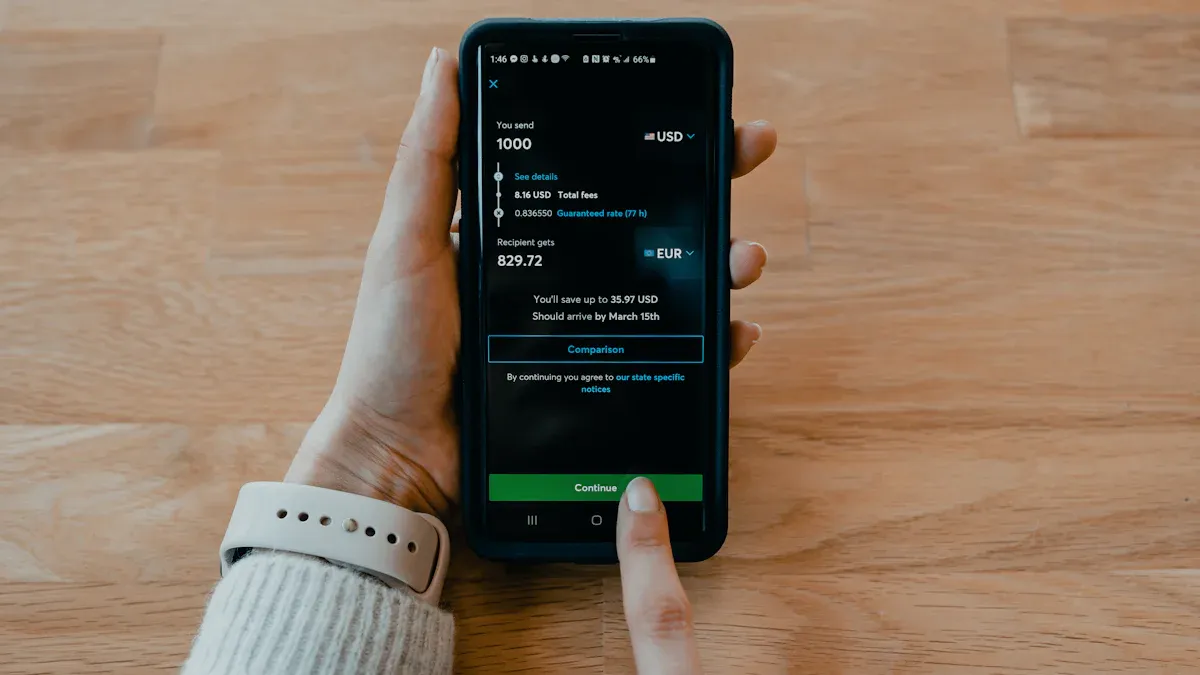

For the same remittance of $1000 USD, traditional methods leave family with about $850, while with USDT, family can nearly receive the full $1000 equivalent in shillings.

This is not an isolated case. Many young Africans now actively request family to use USDT for remittances. According to the Chainalysis report, stablecoins already account for 43% of the region’s total cryptocurrency transactions, effectively reducing remittance costs. The United States as Kenya’s main remittance source, mastering this simple money-saving guide allows you to send more hard-earned money to your family.

Key Points

- USDT remittance saves more money than traditional methods, allowing family to receive more.

- USDT remittance is fast, usually arriving in just a few minutes.

- USDT remittance requires purchasing through an exchange and selecting the TRC20 network for transfer.

- During P2P trading, always confirm receipt of money before releasing USDT to avoid scams.

- Protecting account security is important; use strong passwords and enable two-factor authentication.

USDT Remittance vs Traditional Remittance: Cost Breakdown

Image Source: unsplash

Every cent of your hard-earned money should reach your family as completely as possible. Traditional remittance methods seem straightforward, but the hidden fees act like a bottomless pit, constantly devouring your funds. Let’s carefully break it down to see exactly where the money goes.

Hidden Costs of Traditional Remittances

When using bank wire transfers or services like Western Union, you pay far more than just the fee stated at the counter. The real costs hide in unseen links.

- High wire transfer fees: Banks typically charge a fixed fee for initiating an international wire. For example, from the US, this fee can be around $38 USD.

- Layered intermediary bank fees: Your remittance does not arrive directly in Kenya; it passes through one or more intermediary banks. Each acts like a toll station, deducting a processing fee from your remittance.

- Opaque exchange rate losses: This is the largest hidden cost. The USD to Kenyan Shilling exchange rate provided by banks and remittance institutions is usually far worse than the market real-time rate. They earn silently through this spread.

- Recipient fees: Sometimes, the receiving bank in Kenya charges another incoming fee for international remittances.

Overall, these visible and invisible fees combined can cause you to lose up to 15% of the total remittance. This means sending $1000 USD, your family may ultimately receive only $850 USD equivalent in shillings.

Fee Structure of USDT Remittance

In contrast, USDT remittance has a very simple and transparent fee structure, mainly consisting of three parts, all extremely low.

- USDT purchase fee: When buying USDT with fiat (like USD) on the exchange, the platform charges a very low fee or includes a tiny spread in the price. This part is usually less than 0.1%.

- Transfer network fee (Gas Fee): This is the fee paid to the blockchain network when transferring USDT from your wallet to your family’s wallet. Using the TRC20 network is currently the most economical choice.

- Extremely low fee: A single transfer fee is usually between $1 to $3 USD, regardless of whether you remit $100 or $10000; the fee is basically fixed.

- Controllable cost: As shown below, with advanced operations (like renting energy), you can even reduce single transfer costs to under $1 USD.

- USDT selling fee: Your family in Kenya sells the received USDT via P2P (peer-to-peer) to exchange for Kenyan Shillings.

Good news: Mainstream cryptocurrency exchanges like OKX conduct transactions on their P2P market completely free. You do not pay any fees.

Overall, the total cost of USDT remittance is mainly that fixed, low transfer network fee.

Cost Comparison Summary: Which is More Cost-Effective

Now, let’s use a clear table to compare the huge differences when remitting $1000 USD to Kenya via different methods. This will give you a more intuitive understanding of the power of this money-saving guide.

| Remittance Method | Various Fees (Estimate) | Final Arrival (Estimate) | Expected Time |

|---|---|---|---|

| Bank Wire | $50 - $80 (fixed fee + rate loss, etc.) | ~$920 - $950 | 3-7 business days |

| Western Union | $80 - $150 (high rate + rate loss) | ~$850 - $920 | Hours to 1 day |

| USDT Remittance | $2 - $5 (mainly network fee) | ~$995 - $998 | 15-30 minutes |

The table results are clear at a glance. USDT remittance not only allows your family to receive nearly the full amount but also shortens the original days-long wait to minutes.

This is not just talk. In the Reddit community, users share using this method to remit from the US to Kenya for 5 years, proving it a long-term stable and reliable tool. Mastering this method means you can realistically increase your family’s income by thousands of USD annually.

USDT Remittance to Kenya Money-Saving Guide: Four-Step Operation Guide

Image Source: unsplash

Theory is done; now enter the practical phase. Don’t worry, this process is much simpler than you imagine. Just follow the four steps below to easily master this powerful money-saving guide. We will use the OKX exchange as an example to guide you step by step.

Step One: Purchase USDT on the Exchange

First, you need a place to buy USDT with fiat (like USD). This place is a cryptocurrency exchange. Think of it as a “digital currency bank” where you can buy, sell, and store various currencies.

- Choose and register an exchange: We recommend global leading platforms like OKX or Binance. Their apps have user-friendly interfaces and high security. Download their app from your phone’s app store and complete registration.

- Complete identity verification (KYC): Per regulatory requirements, you need identity verification to trade digital currencies. This process secures your account.

Materials you typically need to prepare:

- Government-issued ID: Such as your passport or driver’s license.

- Live selfie: The app guides you through simple facial recognition to confirm it’s you operating.

- Proof of address: In some cases, the platform may require proof like a recent utility bill or bank statement.

- Purchase USDT: After verification, you can buy USDT. On the OKX homepage, find the “Buy Crypto” quick entry. Click to enter, select buying USDT with USD, then follow prompts to bind your bank card or choose another payment method to complete payment.

Step Two: Transfer USDT to Recipient Wallet (Select TRC20 Network)

After buying USDT, the next step is to send it to your family in Kenya. This process is called “withdrawal” or “transfer.”

- Obtain recipient address: First, ask your family for their USDT receiving address. This is a long string of letters and numbers, similar to a bank account number.

- Select the correct network: This is the most critical step in the money-saving guide. During transfer, you must choose the TRC20 (TRON) network. This network has extremely low transfer fees (usually $1-$2) and very fast speed.

- Execute transfer operation:

- In the OKX App, go to the “Assets” page and click “Withdraw.”

- Select currency as USDT.

- Paste your family’s wallet address into the “Address” field.

- In the “Withdrawal Network” field, be sure to select TRC20.

- Enter the remittance amount and submit.

Security Tip: After submission, the platform requires security verification, such as entering email code, phone code, or Google Authenticator (2FA) code. Before confirming transfer, double-check the wallet address and network type. Wrong address or network may cause permanent fund loss. For first operations, test with a small amount (like $10).

Step Three: Family in Kenya Receives USDT

Now, it’s your family in Kenya’s turn to operate. They need their own crypto wallet to receive the USDT you send.

- Download and create wallet: We recommend non-custodial wallets like Trust Wallet or MetaMask. This means your family fully controls their assets, not held by a platform. They can easily download from the phone’s App Store or Google Play.

- Create wallet and back up seed phrase:

- After opening the app, select “Create new wallet.”

- The app generates a 12- or 24-word “seed phrase” (Recovery Phrase).

Extremely important: This seed phrase is the only way to recover the wallet! Write it down on paper and store in an absolutely safe, non-losing place. Never screenshot or tell anyone.

- The app requires verifying the seed phrase to ensure correct backup.

- Find and copy receiving address:

- After wallet creation, find USDT on the wallet homepage. If not found, add manually and ensure selecting TRC20 network USDT.

- Click USDT, then “Receive.”

- The screen shows a QR code and long address. This is the receiving address your family needs to send you. They just click “Copy.”

Step Four: Exchange USDT for Shillings in Kenya (via P2P)

After family successfully receives USDT, the final step is exchanging it for usable Kenyan Shillings (KES). The most convenient and fast way is through the exchange’s P2P (peer-to-peer) platform.

- Deposit USDT into exchange: Family needs to register on OKX or Binance and complete identity verification. Then, “deposit” USDT from Trust Wallet into the exchange’s funding account.

- Enter P2P trading market: In the exchange app, find the “P2P Trading” or “C2C Trading” entry.

- Screen suitable buyers:

- Select “Sell” USDT.

- Select payment method as M-Pesa (Kenya’s most mainstream mobile payment).

- You will see a list of many buyers willing to purchase USDT.

- Choose reliable buyer: Do not just look at price. When selecting a trading partner, check their profile.

Prioritize:

- High completion rate: Look for buyers with over 98% completion rate.

- High transaction count: More transactions (like thousands) usually mean more experience and reliability.

- Positive reviews: Check evaluations from other users.

- Complete transaction:

- Place order with selected buyer, enter USDT quantity to sell.

- Wait for the other party to pay your family’s account via M-Pesa.

- Key step: After your family confirms full amount received in M-Pesa account, return to the exchange app and click “Confirm Receipt and Release Currency.”

At this point, the entire remittance process is complete. Your sent USD has efficiently and low-loss transformed into Kenyan Shillings in your family’s phone.

USDT Remittance Security Notes and Risk Prevention

Mastering the remittance method, securing funds is paramount. The digital currency world offers great convenience but comes with risks. Follow simple guidelines to effectively protect your assets.

Core Guidelines for Securing Funds

Your exchange account and wallet are like your digital vault. Protecting them requires good security habits.

Enable two-factor authentication (2FA): This is the most effective defense for your account. Even if someone steals your password, without the dynamic code on your phone, they cannot log in or transfer your assets.

Here are core security guidelines to follow:

- Use strong passwords: Set a unique and complex password for your account and consider using a password manager to store them securely.

- Enable withdrawal whitelist: In exchange settings, create a “whitelist” allowing withdrawals only to pre-set trusted addresses. This prevents hackers from transferring funds to unknown addresses.

- Diversify asset storage: Do not put all eggs in one basket. Store large, unused assets in offline cold wallets, keeping only small amounts for trading in the exchange’s hot wallet.

Identifying Common Scams in P2P Trading

P2P trading is convenient, but beware of common scams. Scammers’ most used trick is forging payment proofs.

- Forged payment screenshots: Scammers send a realistic-looking payment screenshot, urging you to release USDT quickly.

- “Middleman” scam: Scammers communicate with you and another buyer simultaneously. They have the other buyer pay you, then you send USDT to them. Ultimately, the paying buyer does not receive coins and reports, potentially freezing your account.

Only verification standard:Do not trust any screenshots. Be sure to log into your M-Pesa or bank app and personally confirm full amount arrival. Never click “Confirm Release Currency” before confirming receipt.

Wallet Address Operations: Error Prevention Guide

The most error-prone part of transfer operations is the wallet address and network. Once wrong, funds may be permanently lost.

First, understand different network concepts. Our recommended TRC20 is just one; common others include ERC20. They are like different banking systems, incompatible.

Transfer Error Prevention Checklist:

- Verify network: Ensure the withdrawal network you choose (TRC20) exactly matches the receiving address network provided by family.

- Verify address: Double-check the wallet address. After copying, carefully check if the beginning and ending characters are correct.

- Small-amount test: When transferring to a new address for the first time, test with a small amount (like $10). Proceed with large transfers only after confirmation.

- Beware of “dust attacks”: If you find unexplained tiny token amounts in your wallet, do not touch them. This may be attackers tracking your transaction activity.

USDT remittance is a direct and reliable tool; its core advantages are money-saving, efficiency, and transparency. Mastering this money-saving guide genuinely increases your family’s income and improves their lives. Many people use this method to ensure more hard-earned money reaches family.

Start small, try your first $50 remittance. We encourage sharing your experience or questions in the comments to help more people.

FAQ

Is this remittance method legal?

In most countries, individuals holding and transferring USDT is legal. It is considered a digital asset. But regulations vary by country; you need to understand and comply with rules in your location and the recipient’s. This method aims to optimize remittance costs, not evade regulation.

Will USDT’s price fluctuate wildly like Bitcoin?

No. USDT is a stablecoin with value pegged 1:1 to the USD. This means 1 USDT equals about 1 dollar. It is designed as a stable-value digital currency for transactions and storage, avoiding price volatility risks of cryptocurrencies like Bitcoin.

What if my family in Kenya does not understand technology?

This is a common issue. You can help them through:

- Remote guidance: Teach step-by-step via video call.

- Seek help: Have them find a tech-savvy young friend or relative to assist setup. After first success, subsequent operations become very simple.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.