- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

5 Key Questions About the AUD to CNY Exchange Rate

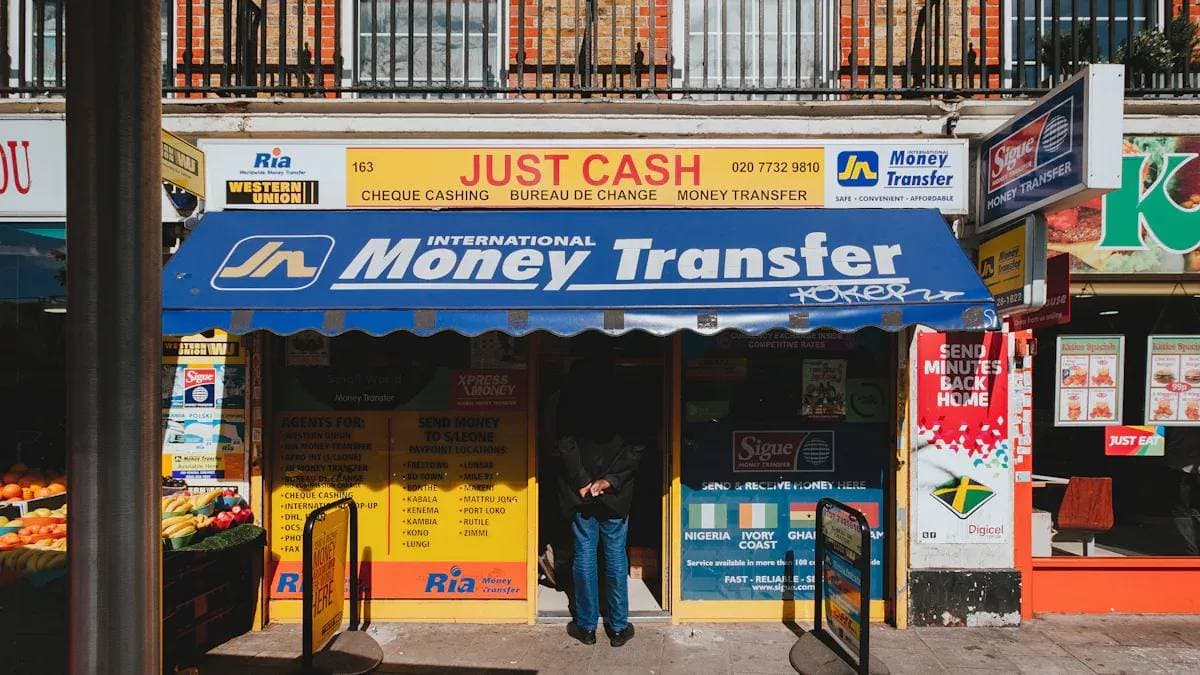

Image Source: unsplash

You can feel the changes in the AUD to RMB exchange rate every day. According to the data released by the Bank of China on July 25, 2025, 1 AUD is currently equal to about 4.7158 RMB.

| Exchange Rate Type | RMB per 1 AUD |

|---|---|

| Spot Buying Price | 4.6971 |

| Cash Buying Price | 4.6971 |

| Spot Selling Price | 4.7345 |

| Cash Selling Price | 4.7345 |

| BOC Conversion Rate | 4.7158 |

If you are an investor, fluctuations in the AUD to RMB exchange rate will directly affect your forex investment returns. If you are a student or a cross-border trade enterprise, exchange rate changes will also affect tuition, living expenses, and import/export costs. You need to pay attention to exchange rates to better manage funds and avoid risks.

Key Points

- The AUD to RMB exchange rate changes daily, influenced by economic data, interest rate policies, and international events.

- Exchange rate fluctuations directly affect tuition costs, living expenses, and corporate import/export costs, requiring attention to make proper financial arrangements.

- The economic performance of Australia and China, interest rate differences, and political situations are the main factors affecting the exchange rate.

- When investing or exchanging, pay attention to exchange rate risks. It is recommended to buy foreign exchange in batches and use financial tools to reduce losses.

- Continuously paying attention to market dynamics and exchange rate information helps individuals and enterprises make wiser financial decisions.

Current Status of AUD to RMB Exchange Rate

Image Source: unsplash

Real-time Exchange Rate

You can see the AUD to RMB exchange rate changing every day. This rate is affected by many short-term factors. For example, Australia’s monthly inflation report will affect the monetary policy of the Reserve Bank of Australia. If Australia’s inflation rises, the Reserve Bank may raise interest rates, which strengthens the AUD, and the AUD to RMB exchange rate will also rise. The U.S. economic policy and the trend of the U.S. dollar indirectly affect the AUD. If the USD strengthens, the AUD may weaken, and the AUD to RMB rate will fall. Technically, if the AUD to USD exchange rate breaks through a key resistance level, it may also trigger short-term volatility. Global trade tensions and changes in market risk sentiment, such as Middle East unrest or Japanese earthquakes, can also cause sharp fluctuations in exchange rates. By following such news, you can better understand the changes in the exchange rate.

Tip: The balance of payments also affects exchange rates. If China exports more than it imports, the demand for exchanging RMB increases, leading to RMB appreciation and a potential drop in the AUD to RMB exchange rate. Conversely, if imports exceed exports, the RMB may depreciate, and the AUD to RMB rate will rise.

Daily Significance

The fluctuations in the AUD to RMB exchange rate affect your and companies’ daily expenses. If you are a business owner, exchange rate changes may bring exchange losses and increase financial expenses. In the first half of 2017, 1,870 listed companies increased financial expenses due to exchange losses, with the manufacturing industry being most affected. Exchange rate fluctuations also affect import costs and sales revenue for enterprises. If companies have foreign currency debts, exchange rate changes will affect repayment costs. If you are an individual investor, participating in RMB futures trading, exchange rate fluctuations will also affect your trading costs and risk management expenses. Enterprises often use forwards, swaps, and options to manage exchange rate risks, which also bring additional costs.

In daily life, you may notice changes in tuition fees, living expenses, or overseas shopping costs due to fluctuations in the AUD to RMB rate. Understanding the real-time movements of exchange rates and their causes helps you make better financial decisions.

Historical Trends

Image Source: unsplash

Five-Year Trend

If you follow the AUD to RMB exchange rate, you will see an overall decline in the past five years. In 2019, 1 AUD could be exchanged for about 4.9 RMB. By 2024, the rate had fallen below the psychological threshold of 4.7 RMB multiple times. Whenever the rate breaks such integer levels, market sentiment changes significantly. You will notice that Australia’s slowing economic growth and volatile commodity prices directly affect the AUD’s value. Meanwhile, China’s sustained economic growth and low inflation levels support RMB stability. These factors together pushed the AUD to RMB exchange rate downward.

Tip: You can use Hong Kong banks’ exchange rate quotes to track real-time changes, which helps adjust investment and consumption plans in time.

Key Events

When observing exchange rates, you’ll find that major international and economic events significantly impact the AUD to RMB exchange rate. For example, on October 15, 2024, the central parity rate of RMB to AUD was raised, reflecting changes in the international economic environment and market dynamics. As a commodity currency, the AUD is heavily influenced by global commodity prices. Australia’s export capacity and economic data directly affect the AUD. Chinese government policies and the process of RMB internationalization also enhance RMB’s confidence and competitiveness, pushing up the RMB against the AUD.

You should also pay attention to the following long-term structural factors that determine long-term trends:

- Inflation levels: Low inflation helps currency stability.

- Economic growth and restructuring: Rapid Chinese growth and successful restructuring strengthen RMB.

- Money supply: Changes in supply affect exchange rate trends.

- Trade surplus: A strong surplus supports currency appreciation.

- Internationalization of local currency: Greater international use stabilizes exchange rates.

- Capital flow regulation: Effective regulation reduces short-term volatility.

- Market sentiment: Large short-term influence, but fundamentals dominate long-term.

If you understand these events and structural factors, you can better predict the direction of future exchange rates.

Influencing Factors

Economic Performance

When paying attention to the AUD to RMB exchange rate, you should first consider the economic performance of Australia and China. Growth data directly affects exchange rates. For example, when Australia’s GDP and unemployment data is released, markets immediately react. China’s Producer Price Index (PPI) also influences market expectations. Research shows these macroeconomic releases cause significant volatility, which lasts for some time. If economic data is poor, market sentiment becomes pessimistic, and volatility increases. You can monitor such changes via Hong Kong bank exchange rate quotes.

Tip: Negative economic news usually has a bigger impact on exchange rates than positive news, known as the “leverage effect.”

Interest Rates and Inflation

You also need to focus on interest rate policies and inflation levels in both countries. Australia’s Q4 2024 inflation rate dropped to 2.4%, but the central bank still worried about inflationary pressure. The Reserve Bank of Australia adjusts rates based on unemployment and growth. Higher rates attract capital inflows, boosting the AUD; lower rates may weaken it. You should know that on July 8, 2025, the RBA kept its cash rate at 3.85%, causing the AUD to rise briefly against the USD—showing how directly rate decisions impact exchange rates. China’s rate and inflation changes also affect the RMB’s strength and thus the AUD to RMB rate.

- Interest rate differences affect capital flows and exchange rates

- Inflation changes influence central bank policies and rates

- Economic fundamentals and market expectations shape exchange rate trends

- Government policy and foreign exchange market intervention also play roles

Politics and Market

You should also follow political stability and international situations. Political changes in Australia and China influence market confidence. For example, when the U.S. labeled China a “currency manipulator”, uncertainty rose, causing greater volatility. Australia relies on both the U.S. and China, so when U.S.-China relations are tense, Australia’s economic risks increase, and the AUD to RMB rate becomes more volatile. International commodity price changes are also critical. In 2013, the AUD to RMB depreciated by over 16%, while the CRB commodity futures index fell 8.39%. As a commodity currency, the AUD weakens when copper and commodity prices fall. Paying attention to these factors helps predict exchange rate movements.

Future Outlook

Market Expectations

If you focus on the AUD to RMB exchange rate outlook, you’ll find mainstream institutions and experts agree the AUD is unlikely to appreciate significantly in the short term. The Reserve Bank of Australia expects a small chance of further rate hikes, with possible cuts by mid-2024 and the cash rate dropping to 3.25% by end-2025. Australia’s economy may achieve a soft landing, with growth recovering to 2.3% by end-2025, unemployment between 3.6% and 4.5%, and inflation down to 2.8%. Most experts agree, but some believe inflation risks could still push a 0.15% rate hike.

You also need to monitor the main factors affecting the AUD to RMB rate:

- U.S. policy uncertainty, such as tariffs, affecting trade and commodity prices.

- Weak Australian economic growth and trade performance.

- Rate differentials between Australia and the U.S.

- Iron ore and coal price volatility.

- Geopolitical risks and possible trade wars.

- Chinese economic growth and RMB exchange rate trends.

Experts believe although the AUD faces challenges, China’s positive growth may provide some support. By tracking these factors, you can judge exchange rate movements.

Risks and Advice

When investing or exchanging, you must note exchange rate volatility risks. Global financial market risk appetite and RMB index fluctuations directly affect exchange rates. When negative global news emerges, capital flows to USD, the AUD weakens, and volatility rises. Other risks include:

- Gains or losses caused by exchange rate volatility.

- Bank quotes may differ from actual trading rates.

- Once transactions are done, they cannot be reversed, creating risks.

- Sudden market disruptions may halt trading.

- Major events widen spreads, raising trading costs.

You can reduce risks by:

- Buying foreign exchange in batches to spread risk.

- Holding some USD assets to hedge against exchange risks.

- Monitoring global economies and policies to adjust asset allocation.

- Students can buy FX in batches at lower rates.

- Families with large needs can pre-exchange for foreign currency wealth management.

Reminder: Always set stop-loss points when investing in forex to prevent further losses. Diversify assets to avoid single-currency risk.

Practical Impact

Personal Impact

If you plan to study in Australia, AUD to RMB fluctuations will directly affect tuition and living costs. For example, from 2014 to 2015, the rate dropped from 5.8 to 4.97. Assuming annual expenses of AUD 40,000, originally requiring 23,240 USD, after the drop you’d only need 19,800 USD, saving about 3,440 USD. Currently, the rate is around 4.7, making tuition and living expenses cheaper in RMB. For instance, a Master’s in Business at Melbourne University costs about AUD 30,000–70,000, equivalent to USD 14,000–33,000. Accommodation costs 250–500 AUD weekly, about USD 1,200–2,400. You can offset costs with part-time work, but fluctuations affect your RMB-converted income. You can exchange in advance at lower rates to lock costs and plan your budget, avoiding sudden rate hikes.

If you are a real estate investor, AUD to RMB fluctuations affect your housing costs and future returns. You need to watch exchange rates both when exchanging funds for purchases and when realizing assets. Experts advise diversifying assets, putting some into stable RMB assets like property, and holding strong currencies to reduce depreciation risks. You can also use forward FX contracts to lock rates in advance. Recent Australian policies raised capital gains withholding taxes and restricted foreign buyers to new homes, affecting investment decisions. You must combine rate trends and policy changes to plan purchases and exchanges.

Enterprise Impact

If you run cross-border e-commerce or an import/export business, fluctuations in AUD to RMB affect your profits and cost structure. When AUD falls, Australian tourism and retail costs rise, reducing your products’ competitiveness. RMB appreciation reduces export profits and orders, raising cost pressure. You must closely track exchange rates and adjust pricing and procurement strategies promptly.

You can adopt various risk management tools, such as forwards, swaps, and options, to lock future exchange rates. You may also use balance sheet restructuring, global production layouts, and supply chain finance coordination for natural hedging. Hong Kong banks provide many risk management products to optimize funding structures. You can also leverage cross-border RMB remittance services with forward contracts and trade financing to improve efficiency. Properly using differences between onshore CNY and offshore CNH rates also offers arbitrage opportunities to reduce costs.

Tip: In practice, adopt a “neutral risk” mindset, using derivatives to lock costs and profits instead of speculation. Diversify assets, follow policies and markets, and you’ll manage risks effectively.

When tracking exchange rates, focus on these five key points:

- Rate changes directly affect currency strength, with higher rates attracting foreign capital.

- Economically strong countries’ currencies appreciate more easily.

- Geopolitics and trade disputes bring risks and reduce confidence.

- Currency supply and demand drive trends, with tourism and investment demand raising value.

- Exchange rate volatility affects transfer costs and funding efficiency.

If you continuously follow market dynamics, you can better time exchanges and arrange funds. Enterprises can manage risks via multi-currency portfolios and financial tools, while individuals can optimize decisions with exchange rate info. This knowledge helps you boost returns and reduce risks in the global economy.

FAQ

Does the AUD to RMB exchange rate change daily?

Yes, you can see daily changes. Market supply and demand, economic data, and international news all affect it. You can check Hong Kong bank websites for real-time rates.

How do you calculate AUD to RMB amounts?

Just multiply the AUD by the current rate. For example, if 1 AUD = 4.7 RMB, exchanging 1,000 AUD requires 4,700 RMB.

Does exchange rate fluctuation affect tuition?

Yes. If the AUD to RMB rate falls, you need fewer RMB to pay tuition and living expenses. If it rises, you’ll need more.

How can enterprises reduce exchange rate risk?

You can use forwards, options, and other tools to lock rates. Hong Kong banks provide many risk management products to stabilize costs.

Can you predict exchange rates in advance?

You can judge trends by watching economic data, interest rate policies, and news, but no one can predict rates 100%. You should analyze rationally and diversify risks.

Whether you’re a student paying tuition, a business settling cross-border trade, or an investor managing currency risk, exchange rate fluctuations and hidden fees can eat into your money. Traditional channels are often costly and slow.

BiyaPay is the smarter way:

- Transfer fees from just 0.5%

- Real-time, transparent exchange rates

- Same-day arrival with fiat and crypto support

- No hidden charges—ideal for remittances, tuition payments, and currency exchanges

Move your money faster, cheaper, and safer.

Start today with BiyaPay

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.