- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Do You Transfer Money from Wise to Wise in 2025

Image Source: unsplash

You want to send money to someone using Wise in 2025? It’s simple. Open the Wise app or website, pick your currency, enter the recipient’s email or phone, and confirm the transfer. Wise to Wise transfers in the same currency are free and usually instant. If the person doesn’t have a Wise account, they get a message to set one up and claim their money. Wise stands out because you see all fees upfront, use the real exchange rate, and can transfer money quickly without hidden costs. You only need a few details to get started, making Wise easy for anyone to use.

Key Takeaways

- You can send money from Wise to Wise quickly using the app or website with just the recipient’s email or phone number.

- Wise to Wise transfers in the same currency are free and usually arrive instantly, saving you money and time.

- Wise shows all fees and exchange rates upfront, so you always know the exact cost before sending money.

- If the recipient does not have a Wise account, Wise will guide them to create one and claim the money easily.

- Wise keeps your money safe with strong security measures and offers 24/7 support if you need help.

Wise to Wise Transfer Steps

Image Source: pexels

Sending money from Wise to Wise in 2025 is quick and easy. You can use either the Wise app or the website. Here’s how to use Wise for a smooth transfer.

App or Website

You can start your Wise to Wise transfer on your phone or computer. The Wise app and website both work well, so you can pick whichever feels more comfortable. Here’s a simple guide to get you started:

- Open the Wise app or go to the Wise website.

- Log in to your account. If you don’t have one, you can create it in a few minutes.

- Make sure you have a balance in the currency you want to send. Wise lets you hold over 40 currencies, including USD, EUR, GBP, AUD, and more.

- Tap on the ‘Recipients’ section in the app or find the ‘Send Money’ button on the website.

- Choose ‘Find friends on Wise’ to sync your contacts. This helps you find people who already use Wise.

- Select the contact you want to send money to, or add a new recipient using their email or phone number.

Tip: Wise supports sending and receiving money in many currencies, such as USD, EUR, GBP, JPY, and SGD. Some currencies have special rules, so check Wise’s list if you’re unsure.

Select Currency

Wise gives you a lot of flexibility with currencies. You can send money in USD, EUR, GBP, and many others. Before you transfer money, make sure both you and the recipient have a balance in the currency you want to use. If the recipient doesn’t have a balance in that currency, Wise will create one for them automatically.

- Wise supports a wide range of currencies, including:

- USD, EUR, GBP, AUD, CAD, JPY, SGD, HKD, and more.

- Some currencies have restrictions. For example, you can only receive AUD if your address is outside Australia.

- Wise lets you hold and convert money at the real exchange rate, so you always know how much you’re sending.

Enter Recipient Info

You don’t need a lot of details to send money with Wise. Here’s what you need:

- The recipient’s email address or phone number linked to their Wise account.

- If you’re sending to someone new, just enter their email or phone. Wise will send them a message to claim the money if they don’t have an account yet.

- You can also select a recipient from your synced contacts in the Wise app.

If you ever need to send money directly to a bank account, Wise may ask for more details, like the recipient’s full name, bank name, account number, and sometimes a SWIFT/BIC code. But for Wise to Wise transfers, email or phone is usually enough.

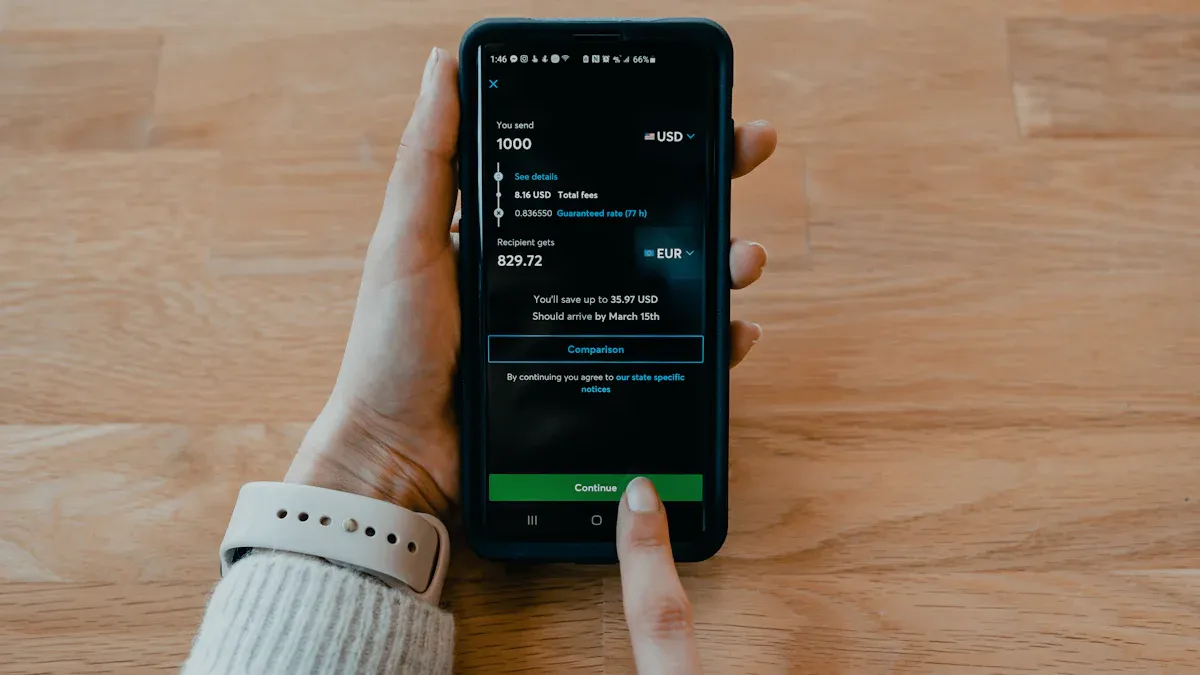

Review and Send

Before you finish, Wise will show you all the details of your transfer. This is your chance to double-check everything:

- Review the recipient’s info and the amount you want to send.

- Check the currency and see if there are any fees. Wise to Wise transfers in the same currency are free.

- Confirm the transfer details. Wise will show you the exchange rate if you’re converting money.

- Click ‘Confirm and continue’ to send the money.

Note: Most Wise to Wise transfers arrive instantly. In 2024, about 63% of transfers completed in under 20 seconds. If you’re sending in the same currency, your transfer is usually free and instant. If you need to convert currencies, Wise charges a low, transparent fee, and the transfer might take a bit longer.

Wise takes security seriously. Every transfer uses bank-level encryption, two-factor authentication, and real-time notifications. Wise follows strict rules from regulators like the UK FCA and US FinCEN, so your money stays safe.

If you’re sending a large amount, Wise may ask for extra documents, like a passport or proof of address, to keep your account secure and follow the law.

How does Wise work? Wise lets you transfer money quickly, safely, and at low cost. You always see the real exchange rate and any fees before you send money.

Recipient Details for Send Money

When you send money with Wise, you need to know how to enter the right details for your recipient. Wise makes it easy for you to send money to friends, family, or anyone else who uses a Wise account. You can use their email address, phone number, or even their Wise account info. Let’s break down each option so you know exactly what to do.

Email Address

You can send money to someone using their email address. This is one of the most common ways to receive money on Wise. If your friend already has a Wise account linked to that email, the money will show up in their balance right away. If they don’t have a Wise account yet, Wise will send them an email with instructions on how to receive money. They just need to follow the steps to set up their Wise account and claim the money.

Tip: Always double-check the email address before you send money. A small typo can send your money to the wrong person.

Phone Number

Wise also lets you send money using a phone number. This works well if you don’t know the recipient’s email but have their phone number. Enter the number, including the country code, and Wise will check if it matches a Wise account. If your friend uses that number for their Wise account, they will receive money instantly. If not, Wise will send them a text message with instructions on how to receive money and set up their Wise account.

- Make sure you enter the full phone number with the country code.

- If your contact list is synced with Wise, you can pick the phone number directly from your contacts.

Wise Account Info

Sometimes, you might want to send money to someone using their Wise account info, like their Wisetag. This is a unique ID for Wise users. You can search for a recipient by Wisetag, email, or phone number in the Wise app. Here’s how you can add or select a new recipient:

- Open the Wise app and tap ‘Send’ from the home screen.

- Enter the recipient’s details directly, such as their Wisetag, email, or phone number.

- You can also go to the ‘Recipients’ tab and tap ‘Add a recipient’.

- If you and your friend both have discoverability turned on, syncing your contacts will help Wise find people you know who already use Wise.

- You can manage who can find you in the app’s Privacy settings.

Note: If you want to receive money, make sure your Wise account info is up to date and discoverability is enabled. This helps others find you easily.

With Wise, you can send money to anyone, even if they don’t have a Wise account yet. Wise will guide them through how to receive money, so you don’t have to worry about a thing.

Wise to Wise Fees and Times

Image Source: pexels

Free Transfers

You can transfer money from Wise to another Wise user for free if you send it in the same currency. Wise makes this easy. You do not need to worry about hidden costs or surprise charges. If you send USD to a friend’s USD balance, Wise does not charge any fee. This rule applies to all supported currencies, like EUR, GBP, or AUD. Wise’s official pricing page confirms that same-currency transfers between Wise users are always free in 2025. You do not need to meet any special conditions. These free transfers do not count toward earning fee-free transfer rewards because they are already free by default.

Tip: Always check that you and your recipient both have a balance in the same currency. This helps you avoid any unexpected fees.

Currency Conversion Fees

If you want to transfer money in one currency and your recipient wants to receive it in another, Wise will convert the currency for you. Wise uses the real mid-market exchange rate, so you get a fair deal. Before you confirm your transfer, Wise shows you all the fees and the exact exchange rate. The fee usually includes a small fixed amount (about $7 USD per transfer) and a percentage of the amount you send (often between 0.33% and 2%). Wise also tells you if your bank might charge extra for the payment. You can see a clear breakdown of all costs before you send your money. This helps you make smart choices and compare Wise with other services.

| Fee Type | Amount (USD) | When It Applies |

|---|---|---|

| Same-currency | $0 | Wise to Wise only |

| Currency convert | $7 + 0.33%-2% | Cross-currency transfers |

Transfer Speed

Wise works fast. Most Wise to Wise transfers in the same currency arrive instantly. In 2024, about 50% of all transfers were instant, and most others arrived within an hour. If you transfer money across currencies, the speed depends on the destination and the amount. Smaller transfers usually move faster. Sometimes, local bank processing can slow things down, and a few transfers may take up to five days. Wise keeps improving its speed every year. You always see the estimated arrival time before you confirm your payment.

Note: Wise always shows you all fees, exchange rates, and estimated delivery times before you send your money. You stay in control and know exactly what to expect.

Wise to Wise Troubleshooting

Recipient Without Wise Account

Sometimes you want to send money, but your friend does not have a wise account yet. No worries! Wise lets you send money using just an email address. Wise will email your recipient a secure link. They can follow the steps to set up their wise account and receive money. If you do not know their bank details, Wise will ask them to enter this information each time they want to receive money. This makes it easy for anyone to get started, even if they have never used Wise before. Wise guides your recipient through every step, so you do not have to explain how to receive money.

Tip: Remind your friend to check their email inbox and spam folder for Wise’s message. They need to finish the setup to receive money.

Failed Transfers

Transfers do not always go as planned. If your wise transfer fails, you can fix it by following these steps:

- Check if you entered the correct reference number and transfer amount.

- Make sure your wise account and bank account names match.

- Look for any red banners or alerts in your Wise dashboard.

- Cancel any duplicate transfers you did not pay for.

- Watch out for delays during public holidays or outside banking hours.

- If you see a refund, Wise will return extra money if you sent too much.

- If you still cannot receive money, upload proof of payment and contact Wise support.

Common reasons for failed transfers include not enough funds, wrong account details, or your bank stopping the payment. Sometimes, Wise may block a transfer if they see something suspicious or need more verification. Wise always tries to keep your money safe.

Wise Support

If you need help, Wise support is ready to assist. You can call their 24/7 phone line at (888) 501-4041. You can also email reply@support.wise.com or use the Wise Help Centre online. Wise has mailing addresses in both the United States and the United Kingdom if you need to send documents. Wise support answers most questions about how to receive money, transfer issues, or wise account problems.

| Contact Method | Details |

|---|---|

| Phone Support | (888) 501-4041 (24/7) |

| Email Support | reply@support.wise.com |

| Online Contact Form | Wise Help Centre: https://wise.com/login?redirectUrl=%2Fhelp%2Fcontact |

| U.S. Mailing Address | 30 W 26th St, 6th Floor, New York, NY 10010 |

| UK Mailing Address | 6th Floor, Tea Building, 56 Shoreditch High Street, London, E1 6JJ United Kingdom |

International Money Transfer Tips

Sending Abroad

When you want to transfer money internationally, you want it to be fast, easy, and affordable. Wise helps you send money to over 160 countries. You can open an account online or in the Wise app. You can hold and send money in more than 40 currencies. This makes it simple if you travel or work with people in different countries.

Here are some tips to make your international money transfer smooth:

- Double-check the recipient’s details. Make sure you have the right name, bank account number, and any country-specific codes.

- Pick the best payment method for your needs. Wise lets you use ACH, wire transfer, debit card, or credit card. Each method has different speeds and fees.

- Use Wise’s tracking tools. You can see where your money is at every step.

- If you run a business, you can use Wise Business features like BatchTransfer. This lets you pay up to 1,000 invoices at once, saving you time.

Tip: Wise uses local bank accounts to move your money faster and keep costs low. Over 60% of transfers arrive instantly, and most others show up within 24 hours.

Exchange Rates

Exchange rates can make a big difference when you transfer money internationally. Wise always uses the mid-market rate, which is the fairest rate you can get. You never pay hidden fees or markups. Wise shows you all costs upfront, so you know exactly what you will pay.

You can use Wise’s transfer calculator to check live exchange rates and see the rate history. This helps you decide the best time to send your money. You can even set up auto-conversions. Wise will send your money when the rate hits your target.

Choosing the right currency also matters. If you pay in the local currency, you avoid extra fees from Dynamic Currency Conversion. Wise lets you hold balances in over 40 currencies, so you can save money and avoid extra conversions.

Note: If you want to know how does wise work, just remember—Wise gives you clear prices, real exchange rates, and tools to help you make smart choices for every international money transfer.

You can send and receive money with just a few taps. Always check the recipient’s details and review any fees before you send. Wise gives you fast transfers, low costs, and clear rates. Many people receive money in seconds, not days. If you have questions, the Wise Help Centre has answers about how to receive money, transfer times, and more.

FAQ

How do you cancel a Wise to Wise transfer?

You can cancel a Wise to Wise transfer if it has not been completed. Go to your Wise app or website, find the transfer in your activity, and select “Cancel.” Wise will refund your money if the transfer has not reached the recipient.

What happens if I send money to the wrong email or phone number?

If you send money to the wrong email or phone, the recipient cannot claim it unless they create a Wise account with that info. You can cancel the transfer if it remains unclaimed. Always double-check details before sending.

Are there limits on how much I can send with Wise?

Yes, Wise sets limits based on your country, payment method, and verification status. For example, you might send up to $50,000 USD per transfer. Check your Wise account for your specific limits.

Tip: If you need to send more, Wise may ask for extra documents to verify your identity.

Can I track my Wise transfer?

Yes, you can track every Wise transfer in real time. Open your Wise app or website, go to your transfer, and see the status. Wise will also send you notifications when your money arrives.

Wise-to-Wise transfers in 2025 offer instant, free same-currency payments with transparent mid-market rates, outshining traditional bank fees of $20-$50. For an even more versatile solution, try BiyaPay. BiyaPay provides transfer fees as low as 0.5%, compared to Wise’s 0.33%-2% for cross-currency transfers, with real-time exchange rate transparency across 30+ fiat currencies and 200+ cryptocurrencies in 100+ countries. Its Biya EasyCard, a virtual card with no annual fee, supports Amazon, eBay, and PayPal, simplifying global business payments or personal transactions in 190+ countries. Whether sending funds to suppliers or managing international expenses, BiyaPay ensures same-day transfers and easy setup with ID verification. Licensed in the U.S. and New Zealand, BiyaPay guarantees secure, compliant transactions. Elevate your global payments with BiyaPay’s cost-effective, flexible platform. Sign up at BiyaPay today to optimize your transfers in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.