- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Latest Rankings of Hong Kong Banks' Fixed Deposit Rates

Image Source: unsplash

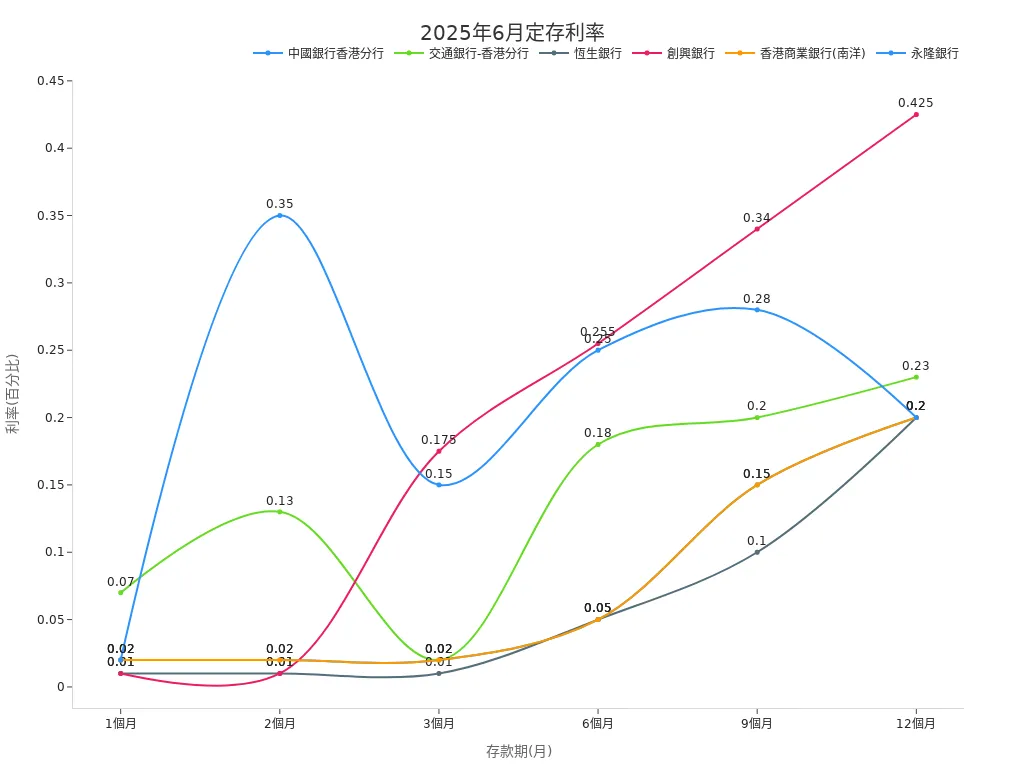

Do you want to know the fixed deposit rates of major Hong Kong banks in June 2025? The table below shows the latest rates for different deposit terms at major banks, making it easy for you to compare at a glance:

| Bank Name | 3-Month Rate (%) | 6-Month Rate (%) | 12-Month Rate (%) |

|---|---|---|---|

| Bank of China (Hong Kong) | 0.02 | 0.05 | 0.20 |

| Bank of Communications (Hong Kong Branch) | 0.02 | 0.18 | 0.23 |

| Hang Seng Bank | 0.01 | 0.05 | 0.20 |

| Chong Hing Bank | 0.175 | 0.255 | 0.425 |

| Nanyang Commercial Bank | 0.02 | 0.05 | 0.20 |

| Wing Lung Bank | 0.15 | 0.25 | 0.20 |

You can choose based on Hong Kong bank rankings and personal needs, noting that rates may vary depending on deposit amounts, new fund promotions, or application thresholds.

Key Points

- Fixed deposit rates at major Hong Kong banks vary by term and bank, with different promotions for short- and long-term rates; it’s recommended to choose a term based on your funds and financial goals.

- Virtual banks offer higher rates and lower thresholds, suitable for small deposits and younger users, with convenient applications manageable via mobile apps.

- When comparing fixed deposit rates, pay attention to minimum deposit amounts, new fund promotions, and early withdrawal penalties to avoid losing interest due to unclear terms.

- Bank rates adjust with market changes, so regularly check official information and use comparison tools to stay updated on the latest promotions and make informed choices.

- Diversifying funds across different banks and deposit terms enhances flexibility and security, while choosing banks supporting sustainable development adds long-term value.

Hong Kong Bank Rankings and Fixed Deposit Rate Table

Image Source: pexels

Do you want to know the latest Hong Kong bank rankings and fixed deposit rates for June 2025? This section provides a detailed analysis of fixed deposit rates, promotions, and conditions for major banks and virtual banks across different terms. You can select the most suitable bank and term based on your needs.

3-Month Rates

3-month fixed deposit rates vary significantly across banks. Some banks offer high short-term rates to attract new funds.

You can refer to the following data:

- Citibank International’s 3-month USD fixed deposit annual rate is 4.05%, with 1.3% for HKD, and minimum deposits of USD 200,000 and USD 100,000 for new funds, respectively.

- Nanyang Commercial Bank’s 1-month USD fixed deposit offers up to 5% annual interest, with a minimum deposit of just USD 1,000, showing banks adjust rates to attract customers.

- KGI Bank launched a limited-time high-yield USD fixed deposit plan in early June 2025, with a 3-month rate of up to 5.3%, reflecting banks’ active promotion of short-term high rates.

- China Construction Bank lowered its 3-month fixed deposit rate to 0.65% in mid-June 2025, with several major banks following suit, indicating a downward trend in rates.

- Virtual banks like WeLab Bank GoSave 2.0 offer a 3-month HKD fixed deposit rate of 1.80%, with a minimum deposit of just USD 10, suitable for small depositors.

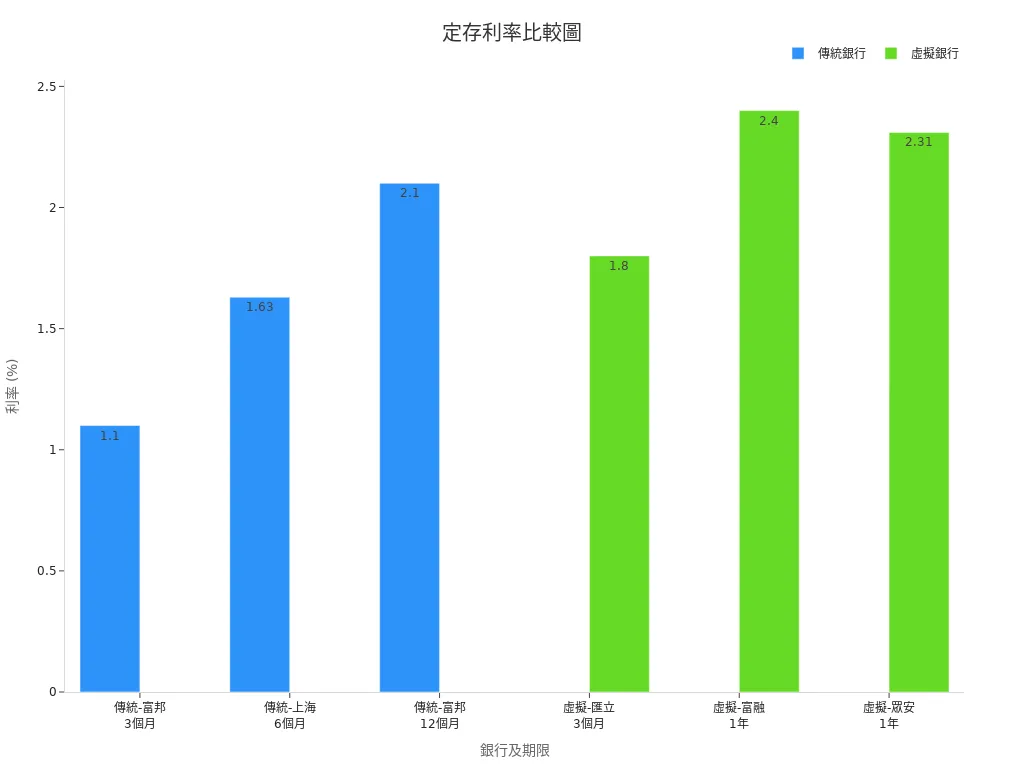

You can refer to the table below to quickly compare 3-month fixed deposit rates for major and virtual banks:

| Bank Type | Bank Name | Term | Rate (%) | Minimum Deposit | Notes |

|---|---|---|---|---|---|

| Traditional Bank | Fubon Bank | 3 Months | 1.10 | USD 500,000 | New Funds Promotion |

| Virtual Bank | WeLab Bank GoSave 2.0 | 3 Months | 1.80 | USD 10 | New Funds Promotion |

| Traditional Bank | Citibank International | 3 Months | 4.05 (USD)/1.3 (HKD) | USD 200,000/USD 100,000 | New Funds Promotion |

| Traditional Bank | KGI Bank | 3 Months | 5.3 (USD) | USD 10,000 | Limited-Time Offer |

| Traditional Bank | China Construction Bank | 3 Months | 0.65 | USD 1,000 | Adjusted Rate |

Tip: 3-month fixed deposit rates fluctuate significantly, and some banks periodically offer high-yield short-term promotions. You should closely monitor Hong Kong bank rankings and the latest updates on bank websites.

6-Month Rates

6-month fixed deposit rates are also influenced by market changes. Some banks offer higher rates for new funds or large deposits. You can choose a bank based on your fund size and liquidity needs.

- Public-sector banks’ 6-month USD fixed deposit rates are around 2.50%, similar to 1-month and 3-month rates.

- China Construction Bank adjusted its 6-month fixed deposit rate to 0.85% in June 2025.

- Shanghai Commercial Bank’s 6-month fixed deposit rate is 1.63%, with a minimum deposit of USD 1,000, part of a new funds promotion.

- KGI Bank’s 6-month USD fixed deposit rate is around 4.8%, but it’s a limited-time, limited-quantity offer.

- Virtual banks’ 6-month fixed deposit rates are generally higher than those of traditional banks, with some having no minimum threshold.

| Bank Type | Bank Name | Term | Rate (%) | Minimum Deposit | Notes |

|---|---|---|---|---|---|

| Traditional Bank | Shanghai Commercial Bank | 6 Months | 1.63 | USD 1,000 | New Funds Promotion |

| Traditional Bank | China Construction Bank | 6 Months | 0.85 | USD 1,000 | Adjusted Rate |

| Traditional Bank | KGI Bank | 6 Months | 4.8 (USD) | USD 10,000 | Limited-Time Offer |

| Public-Sector Bank | Multiple Banks | 6 Months | 2.50 (USD) | USD 1,000 | Standard Rate |

| Virtual Bank | WeLab Bank GoSave 2.0 | 6 Months | 1.90 | USD 10 | New Funds Promotion |

Note: 6-month fixed deposits are suitable for those seeking higher rates without locking funds for too long. You should compare Hong Kong bank rankings and promotion terms across banks.

12-Month Rates

12-month fixed deposit rates have been trending upward recently, with some banks offering higher rates to lock in funds. If you have ample funds and are willing to deposit long-term, you can consider 12-month fixed deposits.

- Public-sector banks’ 12-month USD fixed deposit rates are around 2.55%, slightly higher than shorter terms.

- KGI Bank’s 12-month USD fixed deposit rate is 4.2%, part of a limited-time high-yield plan.

- Fuon Bank’s 12-month fixed deposit rate is 2.10%, with a minimum deposit of USD 1,000,000, limited to new funds.

- Virtual banks like Fusion Bank offer up to 2.40% for 12-month fixed deposits, with no minimum deposit, suitable for small depositors.

- ZA Bank’s 12-month fixed deposit rate is 2.31%, with a minimum deposit of just USD 1.

| Bank Type | Bank Name | Term | Rate (%) | Minimum Deposit | Notes |

|---|---|---|---|---|---|

| Traditional Bank | Fubon Bank | 12 Months | 2.10 | USD 1,000,000 | New Funds Promotion |

| Traditional Bank | KGI Bank | 12 Months | 4.2 (USD) | USD 10,000 | Limited-Time Offer |

| Public-Sector Bank | Multiple Banks | 12 Months | 2.55 (USD) | USD 1,000 | Standard Rate |

| Virtual Bank | Fusion Bank | 12 Months | 2.40 | None | New Funds Promotion |

| Virtual Bank | ZA Bank | 12 Months | 2.31 | USD 1 | New Funds Promotion |

Tip: 12-month fixed deposits offer higher rates but lower liquidity. You should choose the most suitable bank and term based on your financial goals and Hong Kong bank rankings.

You will notice that Hong Kong bank rankings may shift monthly due to market rate changes. Banks adjust rates for different terms flexibly based on policies, funding needs, and market competition. You should regularly check bank websites or reliable information platforms to stay updated on the latest fixed deposit rates and promotions, making the most informed choices.

Comparison Methods and Notes

Deposit Amount and Customer Type

When comparing fixed deposit rates, you should first note each bank’s minimum deposit requirements. Some banks require deposits of USD 10,000 or more, while some virtual banks need only USD 10. If you have limited funds, you can choose banks with lower thresholds.

Additionally, different banks offer special promotions for new funds or new customers. If you’re opening an account for the first time or transferring new funds, you can usually enjoy higher rates. Existing customers typically receive standard rates. You should choose the most suitable fixed deposit plan based on your status and fund source.

Application Methods

You can apply for fixed deposits through various channels. Most Hong Kong banks support online banking, mobile apps, phone customer service, and in-branch applications. For example, KGI Bank allows you to apply online, via app, phone, or in person at a branch. New customers can also open digital deposit accounts online or visit branches in person.

Tip: You should compare the application processes and convenience of different banks. Some banks offer extra rate promotions for online applications or launch limited-time foreign currency fixed deposit campaigns. You can check bank websites or call customer service for the latest promotion details.

Rate Conditions

When choosing a fixed deposit product, you must carefully review the conditions for applicable rates. Some banks’ high-yield promotions apply only to new funds or specific deposit amounts. Early withdrawals incur penalties or reduced interest. For example, KGI Bank stipulates no interest for early termination within one month, and 80% interest for withdrawals after one month. Each bank’s penalties and promotion validity periods vary. You should understand these details before depositing to avoid losing interest due to early withdrawals.

Remember: Promotional rates usually have a time limit, reverting to standard rates after expiration. You should regularly check bank announcements to ensure you enjoy the best rates.

Major Bank Rate Comparisons

HSBC

If you’re interested in large banks’ fixed deposit rates, HSBC is one of your options.

- HSBC’s fixed deposit rates in June 2025 are around 2.0% to 2.2%, mainly for Premier Banking customers.

- You need to deposit at least USD 1 million, with a maximum of USD 15 million.

- Although HSBC’s rates aren’t the highest in the market, you can enjoy stable services and comprehensive wealth management support.

- Multiple financial platforms and user comments confirm the accuracy of HSBC’s rate data, sourced from official and professional comparison websites.

Tip: If you have ample funds and prioritize safety and brand reputation, HSBC’s fixed deposit plans are worth considering.

Hang Seng

Hang Seng Bank’s fixed deposit rates are similar to HSBC’s. You can choose 3-month, 6-month, or 12-month terms, with rates ranging from 0.01% to 0.20%.

- New funds promotions are frequently offered, suitable for those transferring large funds for the first time.

- Hang Seng’s online application process is simple, making it easy to check the latest rates.

Bank of China

Bank of China (Hong Kong) consistently ranks high in Hong Kong bank rankings.

- You can choose different deposit terms, with rates ranging from 0.02% to 0.20%.

- Bank of China often launches short-term high-yield promotions for new funds to attract deposits.

- If you have substantial funds, you can watch for Bank of China’s limited-time fixed deposit campaigns.

Standard Chartered

Standard Chartered Bank is highly competitive in the USD fixed deposit market.

- USD fixed deposit rates for 6-month to 1-year terms in 2025 range from 4.4% to 4.6%, but are limited to Priority Banking new customers with a minimum deposit of about USD 20,000.

- General customers receive around 2% for USD fixed deposits.

- Standard Chartered offers innovative services, such as allowing you to convert fixed deposit interest into China Airlines miles, increasing financial flexibility.

- For CNY fixed deposits, Standard Chartered once offered up to 4% annualized rate for 6 months, along with exchange rate discounts and fee waivers.

Note: If you’re a new customer or have foreign currency needs, Standard Chartered’s fixed deposit promotions are worth considering.

Bank of East Asia

Bank of East Asia’s fixed deposit rates are at a medium level. You can choose different currencies and terms, with rates ranging from 0.02% to 0.20%.

- Bank of East Asia periodically offers new funds promotions, suitable for flexible fund allocation.

- You can apply through online banking or branches, which is convenient and fast.

Bank of Communications

Bank of Communications offers diverse fixed deposit products, especially high-yield plans for large deposits.

- If you deposit large new funds, you can enjoy higher rates, with 6-month fixed deposit rates up to 0.18% and 12-month rates at 0.23%.

- Bank of Communications frequently adjusts rates based on market conditions, so you should regularly check official information.

Suggestion: When choosing a bank, you should compare fixed deposit plans based on Hong Kong bank rankings, personal fund size, and promotion conditions.

Virtual Bank Rates

Image Source: unsplash

If you want flexible fund management, virtual banks are a great choice. These banks typically offer higher fixed deposit rates, with some products having no minimum deposit requirements. You can open accounts easily via mobile, enjoying the convenience of real-time queries and operations. Virtual banks are especially suitable for young people and small investors, as they value cashback and small-scale investments.

Fusion Bank

Fusion Bank’s fixed deposit rates are among the higher ones in the market. You only need USD 10 to enjoy a 12-month fixed deposit rate of up to 2.40%. Fusion Bank often offers exclusive promotions for new users, such as account opening gifts or cash rebates. You can manage deposits anytime via the mobile app without visiting a branch. Fusion Bank uses big data analytics to optimize the user interface, making operations simpler.

Mox Bank

Mox Bank targets young users and digital wealth management. You need just USD 1 to open a fixed deposit, with a 3-month rate of up to 1.80%. Mox frequently collaborates with merchants to offer cashback and spending discounts. You can enjoy multiple fee-free interbank transfers, facilitating flexible fund allocation. Mox’s users are mostly 20- to 39-year-olds, and the bank promotes exclusive offers via social media to attract account openings.

livi Bank

livi Bank’s fixed deposit products are designed simply, suitable for those new to wealth management. You can choose 3-month, 6-month, or 12-month terms, with rates ranging from 1.50% to 2.10%. livi has no high thresholds, requiring just USD 1 to open an account. You can also enjoy account opening gifts and cashback with linked credit cards. livi emphasizes smart wealth management services, making it easy to track fund flows.

WeLab Bank

WeLab Bank offers multiple promotions for new users. You need only USD 10 to join a fixed deposit plan, with a 3-month rate of around 1.70%. WeLab frequently launches limited-time high-yield campaigns to attract new funds. You can use the app to check rates and manage deposits instantly, experiencing the convenience of digital banking.

Other Platforms

Besides the above banks, the market includes other virtual banks and digital account platforms. For example, New New Bank offers 2% high-yield savings accounts and multiple fee-free interbank transactions. These platforms target young, mobile-savvy users, combining cross-industry partnerships and exclusive promotions to enhance user experience. You can choose the most suitable virtual bank based on your needs.

Tip: Virtual banks’ high rates and low thresholds are especially suitable for small deposits and new users. You should regularly check each platform’s latest promotions and use mobile apps to manage funds for higher returns.

Selection Tips

Terms and Penalties

When choosing a fixed deposit, you must carefully review each bank’s terms. Different banks have varying penalties for early withdrawals. For example, some Hong Kong banks stipulate that early termination results in no interest or only savings account rates. You should clarify these details before depositing to avoid losing interest due to urgent cash needs.

Tip: You can diversify funds across different terms to ensure that, even if you need to withdraw early, only part of the interest is affected.

Promotions and Limited-Time Rates

Banks frequently launch limited-time high-yield promotions to attract new funds. These offers typically have clear validity periods, reverting to standard rates after expiration. You should regularly check bank websites or use apps like “Deposit Rate Comparison” to stay updated on the latest rate information.

- You can set reminders to track major banks’ promotional campaigns.

- Some banks offer extra rewards for new customers or large deposits, such as cash rebates or gifts.

Risk Management

When choosing fixed deposit products, you should also consider risk management. In recent years, many financial institutions have incorporated ESG (Environmental, Social, and Governance) into credit assessments to ensure funds don’t flow to high-risk or unsustainable businesses.

- Responsible Lending: Banks track fund usage to avoid supporting high-carbon industries.

- Responsible Investment: Banks follow international standards to exclude investments in controversial industries.

- Green Fixed Deposit Projects: Some banks launch fixed deposit products specifically supporting renewable energy or sustainable water resources.

- Specific Case: Some banks invest in renewable energy and use digital tools to enhance fund management transparency.

You can choose banks with deposit protection and diversify funds across different banks and products to reduce single-point risks. This safeguards your principal while supporting sustainable development.

When choosing a fixed deposit, you should make decisions based on Hong Kong bank rankings and your needs. Currently, banks with higher USD fixed deposit rates, like Cathay United Bank, offer 6-month 3.7% and 12-month 3.95%, but often with new funds and term restrictions. Short-term deposits suit flexible fund allocation, while long-term ones offer higher rates. Virtual banks are ideal for small depositors, while traditional banks prioritize stability and service. You should regularly check the latest promotions, balancing rates, terms, and liquidity.

FAQ

What is a Fixed Deposit?

A fixed deposit is when you deposit funds in a bank for a specified period, and the bank pays you a fixed interest rate based on the term. Upon maturity, you can withdraw your principal and interest.

How to Choose a Suitable Fixed Deposit Bank?

You should compare rates, minimum deposit amounts, promotion conditions, and services across Hong Kong banks. Choose based on your funds and financial goals.

What Happens with Early Withdrawal?

If you withdraw early, banks typically reduce interest or pay only savings account rates. You should understand the penalties to avoid losses.

What Are the Advantages of Virtual Bank Fixed Deposits?

Virtual banks usually offer higher rates and lower thresholds. You can manage deposits easily via mobile apps, suitable for small funds and young users.

How is Fixed Deposit Interest Calculated?

You can use this formula:

Interest = Principal × Annual Rate × Deposit Days ÷ 365

The bank calculates interest based on your deposited USD amount and rate.

Hong Kong’s fixed deposit rates vary, but are liquidity constraints and high cross-border fees limiting your options? BiyaPay offers a dynamic solution! Trade US and Hong Kong stocks directly without offshore accounts, capitalizing on global opportunities effortlessly. Benefit from a 5.48% annualized yield savings product with flexible withdrawals for optimal liquidity.

Real-time exchange rate tracking supports conversions between USD, HKD, and over 30 fiat currencies with USDT, while remittances to 190+ countries start at just 0.5% in fees, ensuring swift transfers. Sign up with BiyaPay today to streamline your global financial strategy!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.