- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Top 10 Digital Wallets: The Best Apps for Secure and Convenient Payments

What is a Digital Wallet?

Still fumbling for cash or a card? Say goodbye to these hassles and stay tuned with the current trend of using a digital wallet app. A mobile wallet or digital card wallet, as the name suggests, is a virtual mobile-based wallet that you can link to your bank accounts for cashless interactions. These digital wallets are further divided into multiple types, such as open, semi-open, semi-closed, and closed, depending on the type of usage and payments that can be made.

From storing payment information to initiating transactions, these digital wallets allow you to manage your daily payment needs in a jiffy. In order to fully utilize the app, just download it on your smartphone, link it with your bank account or card, and start making effortless transactions right away.

Best Digital Wallet Apps: Top Picks for 2025

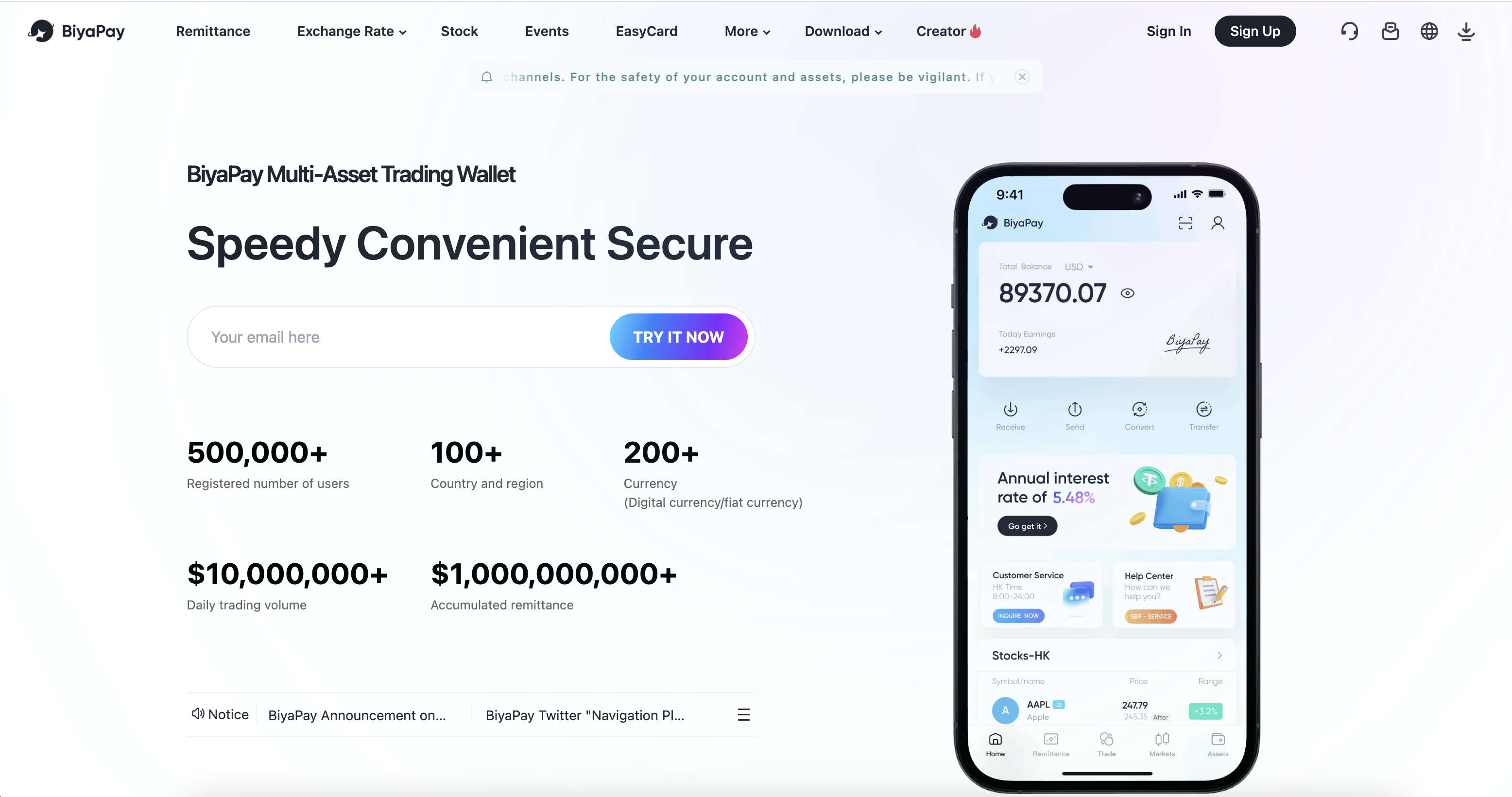

BiyaPay

BiyaPay is a popular digital wallet app, known for its low transaction fees and support for over 200 digital currencies. Moreover, this digital payment platform provides a straightforward and transparent fee structure, ensuring that users know exactly what they will pay for each transaction. It also enables users to invest in US and Hong Kong stocks, manage assets, and make instant cross-border transfers.

Features:

- Supports over 200 digital currencies and multiple fiat currencies

- Transparent fees as low as 0.5% on certain transactions

- Real-time exchange rates and instant cross-border transfers

- Enables investing in US and Hong Kong stocks

- Asset management tools within the app

User Reviews:

- “BiyaPay’s low fees and fast transfers saved me both money and time.” – Jessica, Freelancer

- “The stock investment feature is a bonus on top of easy transfers.” – Mark, Investor

- “Real-time tracking gives peace of mind for every transaction.” – Anil, Business Owner

Security Highlights:

- End-to-end encryption and multi-factor authentication

- Regulatory compliance ensures strong user protection

- Secure custody of assets with insurance coverage

Statistical Data:

- Over 5 million active users worldwide as of 2024

- Handles over $2 billion in transactions monthly

- Achieves a 99.9% transaction success rate, minimizing failures and delays

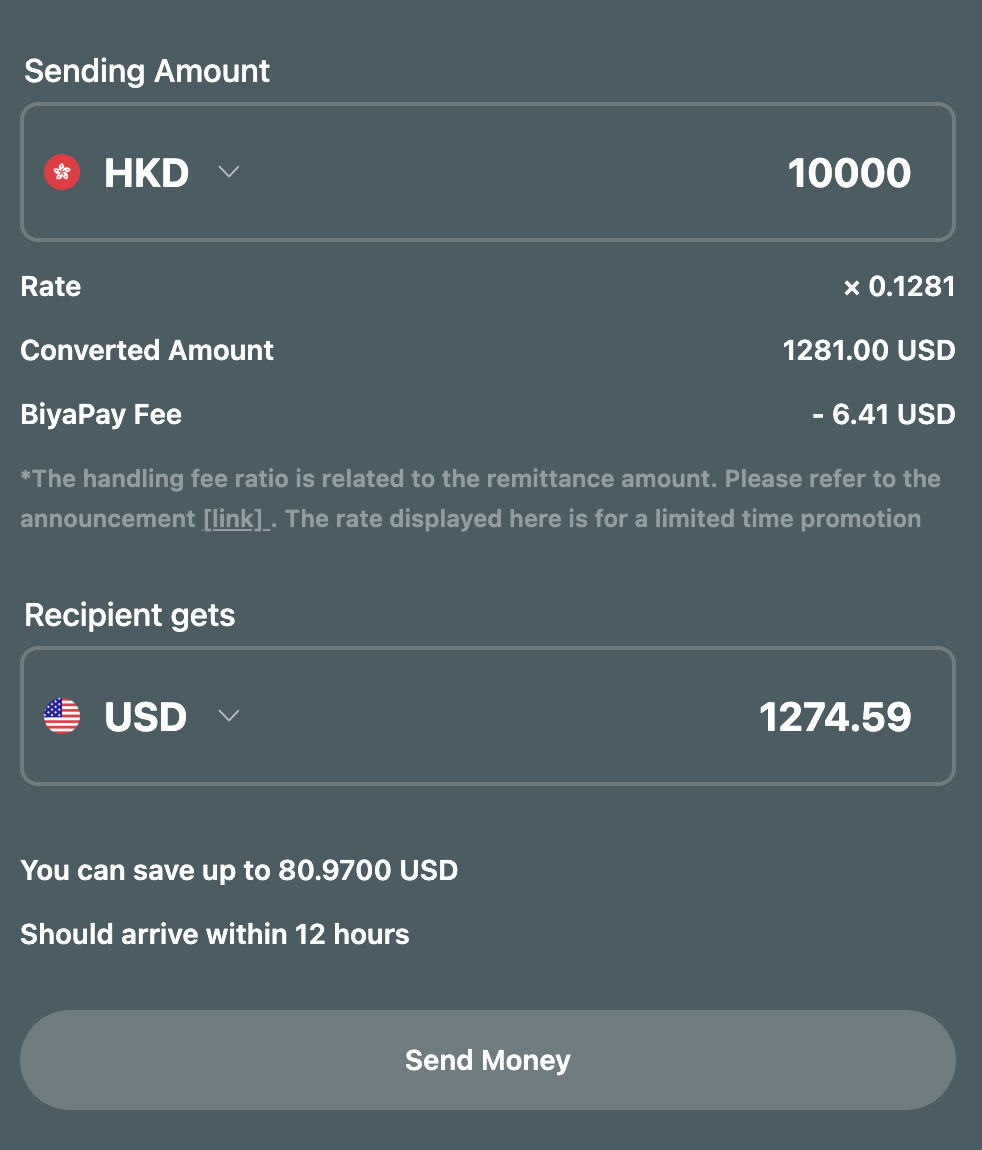

Step To Using Biyapay Digital Wallet App

Step 1: Install the BiyaPay App

Visit the BiyaPay money transfer app page and download it to your device.

Step 2: Register and Complete Identity Verification

Launch the app, sign up with your email, and follow the steps to verify your identity. Add your bank card and provide the required personal information to complete the registration.

Step 3: Fund Your Account with USDT

On the homepage, tap the Deposit button, select the on-chain deposit method, and transfer USDT into your BiyaPay account.

Step 4: Make a Fiat Currency Transfer

Go to the Transfer section, select USDT for remittance (the amount will be converted into USD for the transfer), pick the recipient’s account, and input the email or Biya Authenticator code to confirm the transaction.

Apple Pay

Apple Pay is the leading iPhone digital wallet, offering seamless integration with Apple devices and strong security through Face ID, Touch ID, and device-specific tokenization. It uses Near Field Communication (NFC) technology to securely transmit payment information. This digital wallet on iPhone is a quick and easy way to split bills or pay someone back for a loan.

Features:

- Seamless integration with Apple devices (iPhone, Apple Watch)

- Strong biometric security using Face ID and Touch ID

- Uses NFC for secure contactless payments

- Supports peer-to-peer payments and bill splitting

- Wide acceptance in retail and online stores

User Reviews:

- “Apple Pay makes paying in stores so easy and secure.” – Emily, iPhone User

- “The privacy features are reassuring when using my phone for payments.” – Raj, Entrepreneur

- “I love how it’s integrated into all my Apple devices.” – Sarah, Student

Security Highlights:

- Device-specific tokenization protects card information

- Payment data never shared with merchants

- Requires biometric or passcode authentication for each transaction

Statistical Data:

- Used by over 500 million active users globally (Statista, 2024)

- Accepted at more than 85% of U.S. retail locations

- Processes over 2 billion transactions per quarter

Google Pay

Google Pay is one of the top digital wallets, enabling users to make cashless transactions on both Android and iPhone. The app uses Near Field Communication (NFC) technology to securely transmit payment information. Moreover, Google Pay lets users add offers and loyalty cards to their accounts, thus keeping track of rewards and savings from various stores.

Features:

- Compatible with both Android and iOS devices

- Supports NFC payments and online transactions

- Integrates offers, loyalty cards, and rewards

- Simple peer-to-peer money transfers

- Works with numerous banks and financial services

User Reviews:

- “Google Pay makes it simple to store and use loyalty cards.” – Alex, Shopper

- “Cross-platform compatibility is a big plus for me.” – Mia, Freelancer

- “Good for quick payments, though some features depend on the region.” – Omar, Teacher

Security Highlights:

- Encryption of payment data during transmission

- Fraud protection and Google’s security infrastructure

- Biometric login supported on compatible devices

Statistical Data:

- More than 150 million active users worldwide (Google, 2024)

- Supports payments in over 100 countries

- Average transaction time under 3 seconds

PayPal

PayPal is a well-known digital wallet that allows you to send and receive money online. The platform offers a simple way to create an account, make payments, and send money to friends and family. Moreover, PayPal is widely used for accepting international payments at low transaction fees and with a high level of security.

Features:

- Globally accepted for online and in-app payments

- Supports multiple fiat currencies and some cryptocurrencies

- Buyer protection and dispute resolution services

- Easy account creation and widespread merchant acceptance

- Peer-to-peer transfers and business payment solutions

User Reviews:

- “PayPal is reliable for sending money internationally.” – Nina, Consultant

- “The buyer protection gave me confidence in online shopping.” – Carlos, Customer

- “Fees can add up, but the convenience is worth it.” – Julia, Entrepreneur

Security Highlights:

- Advanced fraud detection and encryption

- Secure login with two-factor authentication

- Monitored accounts for suspicious activity

Statistical Data:

- Over 435 million active accounts globally (PayPal, Q1 2024)

- Processes more than $400 billion in annual payment volume

- Handles transactions in more than 100 currencies

Venmo

Venmo is part of the larger PayPal family of brands and is owned by PayPal. You can send and receive money instantly with this mobile payment app. It is intended to be a fast and free method for completing these transactions, whether you need to pay a friend’s restaurant bill or split the rent with your roommate.

Features:

- Instant peer-to-peer payments within the U.S.

- Social media-like feed to share transactions

- Cost-effective with no fees for standard transfers

- Allows linking bank accounts, debit, and credit cards

- Owned by PayPal, benefiting from strong security infrastructure

User Reviews:

- “Venmo is my go-to for splitting bills with friends.” – Tom, College Student

- “Love the social aspect—it’s fun and functional.” – Leah, Freelancer

- “Limited to the U.S., which is a drawback for international use.” – Ethan, Traveler

Security Highlights:

- Data encrypted in transit and at rest

- Optional PIN code and multi-factor authentication

- User controls over privacy settings for transactions

Statistical Data:

- More than 80 million active users in the U.S. alone (2024)

- Processes over $230 billion in annual transaction volume

- Over 60% of users utilize Venmo for everyday transactions

Samsung Pay

Still looking for a digital currency wallet? Samsung Pay can help you out!! As the name implies, this payment option is applicable for Samsung users only and supports both NFC and MST technology for broad in-store compatibility.

Features:

- Supports both NFC and MST technology for widespread acceptance

- Exclusive to Samsung devices

- Integrates loyalty and gift cards

- Allows payments in stores and online

- Supports multiple card types including credit and debit cards

User Reviews:

- “Works seamlessly with my Samsung phone and most payment terminals.” – Linda, Retail Worker

- “The MST feature is a lifesaver when NFC isn’t accepted.” – David, Developer

- “Limited to Samsung users, so I can’t recommend it to everyone.” – Maria, Student

Security Highlights:

- Uses Samsung Knox security platform

- Biometric authentication required for transactions

- Secure tokenization protects card data

Statistical Data:

- Available on over 400 million Samsung devices worldwide

- Compatible with over 90% of payment terminals globally

- Processes over 1 billion transactions annually

Zelle

Zelle is one of the leading American digital payment networks integrated with many major banks, enabling instant transfers between bank accounts. This peer-to-peer payment service is the fastest and the easiest way to send or receive money online. It supports more than 2200 banks and credit card unions across the world, making it ideal for all kinds of users.

Features:

- Instant money transfers directly between bank accounts

- Integrated with over 2200 U.S. banks and credit unions

- No fees for sending or receiving money

- Ideal for peer-to-peer and bill payments

- Supports mobile and desktop banking apps

User Reviews:

- “Zelle’s instant transfers make paying friends hassle-free.” – Rachel, Nurse

- “No fees is a huge advantage over other services.” – Mike, Accountant

- “Only available in the U.S., which limits my ability to send money abroad.” – Sophie, Expat

Security Highlights:

- Transactions protected by participating banks’ security protocols

- Uses multi-factor authentication

- Real-time fraud monitoring by banks

Statistical Data:

- Used by over 100 million U.S. consumers

- Supports transactions totaling more than $300 billion annually

- Transfers usually complete within minutes

Alipay

Another best digital wallet you can opt for is Alipay. The application boasts a super-friendly interface and offers payments, financial services, and lifestyle features, with growing international acceptance. Moreover, Alipay is widely applauded for its strong security features that keep your digital transactions safe.

Features:

- Extremely popular in China with expanding global acceptance

- Provides payment, financial, and lifestyle services

- Supports online and in-store payments

- Strong fraud prevention and user verification

- Integrates with numerous third-party apps

User Reviews:

- “Alipay is essential when traveling in China.” – Zhang Wei, Tourist

- “Offers many financial services beyond payments.” – Li Na, Entrepreneur

- “Not very intuitive for non-Chinese speakers.” – Mark, Expat

Security Highlights:

- Multi-layered encryption and risk controls

- Real-time fraud detection

- User identity verified through government databases

Statistical Data:

- Over 1.3 billion active users worldwide (2024)

- Processes over $17 trillion in annual transactions

- Accepted in more than 50 countries

Cash App

Cash App, developed by Block, is a peer-to-peer payment service, supporting investing in stocks and Bitcoin. It’s designed for simplicity and speed in transferring money. Initially introduced in 2013 as Square Cash, the service has changed little since its inception.

Features:

- Peer-to-peer transfers with Bitcoin and stock investments

- Intuitive interface for quick transactions

- Instant deposits available

- Strong encryption and offline Bitcoin storage

- Developed by Block (formerly Square)

User Reviews:

- “Great for Bitcoin purchases and quick payments.” – Jordan, Investor

- “Simple to use but limited to US users.” – Emily, Freelancer

- “Needs more transparency on fees.” – Sean, Consultant

Security Highlights:

- End-to-end encryption

- Two-factor authentication

- Regular security audits

Statistical Data:

- Over 36 million active users (2024)

- Processes more than $30 billion annually

- Bitcoin transactions growing at 25% year-over-year

Skrill

Let’s wrap up the list of the top digital wallets with the Skrill app. It attracts users due to low transaction fees, simple automation, and a high level of security. Moreover, this is one of the most versatile payment solutions for newbies who have recently stepped into digital payments.

Features:

- Low fees and supports multiple currencies

- Buy and sell cryptocurrencies

- Earn reward points on transactions

- Supports email or mobile number transfers

- Provides prepaid cards linked to wallets

User Reviews:

- “Affordable fees and easy crypto buying.” – Priya, Seller

- “Good rewards program.” – Alex, Trader

- “Verification process takes longer than expected.” – Fatima, New User

Security Highlights:

- PCI DSS compliance

- Two-step verification

- Fraud detection systems

Statistical Data:

- More than 30 million users globally

- Handles billions in transaction volume annually

- Active in over 200 countries

Safety Tips and Best Practices for Using Digital Wallets

- Always enable multi-factor authentication (MFA) for extra security Multi-factor authentication adds an additional layer of security by requiring users to verify their identity using two or more methods (e.g., password + SMS code or biometric scan). According to a Microsoft report, enabling MFA blocks over 99.9% of automated cyberattacks. Given that 60% of data breaches involve compromised credentials, MFA is one of the most effective defenses against unauthorized wallet access.

- Keep your app and device software updated to patch vulnerabilities Regular updates fix security flaws and protect against new cyber threats. The Verizon 2023 Data Breach Investigations Report found that 30% of breaches exploit known vulnerabilities for which patches were available but not applied. By keeping wallet apps and operating systems updated, users minimize the risk of malware, ransomware, and hacking attempts targeting outdated software.

- Avoid using public Wi-Fi when making transactions Public Wi-Fi networks are often unsecured, making it easier for hackers to intercept sensitive data, including wallet credentials. A study by Kaspersky revealed that 62% of public Wi-Fi users are vulnerable to cyberattacks such as man-in-the-middle attacks. When conducting digital wallet transactions, use trusted networks or a VPN to encrypt your connection and protect your financial information.

- Regularly monitor your transaction history for unauthorized activity Frequent review of your wallet’s transaction logs can help detect fraudulent activity early. According to Javelin Strategy & Research, nearly 40% of consumers only notice fraud after it causes significant damage. Many digital wallets offer real-time alerts and monthly statements to facilitate monitoring, which is crucial for prompt dispute resolution and preventing loss.

- Use strong, unique passwords for your wallet accounts Passwords are the first line of defense. The 2023 SplashData report listed “123456” and “password” among the most common passwords, which are easily cracked. Using strong, unique passwords—preferably generated and stored by password managers—reduces the chance of account takeover. In fact, 81% of hacking-related breaches involve stolen or weak passwords (Verizon, 2023).

Conclusion

In conclusion, the guide has explored ten digital wallets to make your transactions easy and effortless. Digital wallet apps have now become the talk of the town for their ease of use and cashless transactions. Moreover, they have streamlined the way people make payments and eliminated the need for carrying cash or physical cards. For those seeking secure, seamless, and global payment solutions, BiyaPay is the best bet. It stands out as a comprehensive platform that integrates traditional fiat and over 200 digital currencies, offering instant transfers, low transaction fees, and a user-friendly interface. So, why wait? Get started with BiyaPay now and enjoy cashless transactions with confidence and convenience.

FAQs

What is the best digital wallet app for 2025?

While the internet is packed with plenty of digital wallet apps, the best option that you must give a try is BiyaPay. With its simple interface, seamless payment solution, and integration with traditional fiat, this app makes transactions easier for users.

How can I set up a digital wallet on my iPhone?

To set up the digital wallet on your iPhone, simply download the app, add your credit or debit card details as asked, and set a strong PIN or password to ensure privacy. If you are looking for the best payment solution for iPhone, simply opt for BiyaPay and install it on your smartphone easily to get started.

Are digital wallets safe for online payments?

Yes, of course. Digital wallets are paired with high-end encryption and safety protocols that make your online transactions easier than ever. However, you must take certain precautions, like setting up strong passwords or using trusted wallet providers, to avoid any cyberattack. Looking for the safest solution? Opt for BiyaPay and make your transactions smoother and safer.

Can I use a digital wallet for cryptocurrency transactions?

Yes, definitely. Most digital wallets support cryptocurrency transactions, allowing you to store, send, and receive digital assets. BiyaPay stands out by supporting over 200 digital currencies, making it easy to manage both crypto and fiat assets in one place.

How do I transfer money with a digital wallet?

To transfer money, open your wallet app, select the transfer or send money option, enter the recipient’s details (such as mobile number or wallet ID), specify the amount, and confirm the transaction. Transfers are often instant, but always check for any applicable fees or limits. With BiyaPay, you can transfer funds globally with low fees, whether you’re sending fiat or digital currency, and enjoy fast, secure transactions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.