- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Ultimate Beginner's Guide to GCash Remittance and Payments

Image Source: unsplash

GCash allows you to easily make payments and transfers without complicated procedures. Through simple steps, you can quickly complete payments or remittances for both daily expenses and international transfers. It supports multiple payment methods, including QR code scanning and online payments, meeting your various needs. Your first step is to complete GCash registration, after which you can enjoy convenient digital payment experiences. Always verify information during payments to ensure transaction security. Start using GCash now to experience efficiency and convenience!

Key Points

- Download the GCash app, register an account, and enjoy convenient payment and transfer services.

- Ensure sufficient account balance, bind a bank card, or recharge through other channels to complete payments smoothly.

- Use QR code payments and online shopping payments to complete transactions quickly and securely, avoiding cash-related hassles.

- Easily transfer money to friends or make international remittances via GCash, enjoying low fees and fast fund delivery.

- Set strong passwords and enable two-factor authentication to protect account security and avoid fraud risks.

GCash Registration and Verification

Download the GCash App

The first step to using GCash is to download its app. You can search for “GCash” in major app stores (such as Google Play or the App Store) and click to download. GCash’s user base has grown rapidly in recent years, with currently over 55 million registered users and 4.5 million partner merchants. Below is trend data on GCash user growth:

| Year | Registered Users | Partner Merchants |

|---|---|---|

| 2017 | 26 million | N/A |

| Now | 55 million | 4.5 million |

By downloading the GCash app, you join a large user community to enjoy convenient payment and transfer services.

Account Registration Process

After downloading the app, you need to register for GCash. Open the app, click the “Register” button, and enter your mobile phone number. The system will send a verification code to your phone; enter it to proceed. Next, fill in your personal information, including name, date of birth, and email address. Ensure the information is accurate for smooth subsequent verification. After completing these steps, your GCash account is successfully created.

Complete Account Verification

To ensure account security and unlock more features, you need to complete account verification. Click the “Account Verification” option in the app, upload a valid ID document (such as a passport or driver’s license), and take a clear selfie. The system will review your documents shortly. Once verified, you can enjoy higher transfer limits and more payment functions. Account verification not only enhances security but also allows you to fully utilize GCash’s services.

By completing the above steps, your GCash registration is complete. Now you can start experiencing GCash’s efficient payment and transfer services.

Steps to Use GCash for Payments

Image Source: pexels

Bind a Bank Card or Recharge Balance

Before using GCash for payments, ensure your account has sufficient balance. Here are two common methods:

- Bind a Bank Card

- Open the GCash app and click “My Account.”

- Select “Bind Bank Card” and enter your bank card information.

- The system will send a verification code to your phone; enter it to complete the binding.

Tip: After binding a bank card, you can directly recharge your GCash account from the card for convenience.

- Recharge via Offline or Online Channels

- If you don’t have a bank card, you can recharge at GCash-partnered convenience stores or bank counters.

- Online recharge is also simple: select “Recharge Balance” and choose your preferred payment method to complete the operation.

Whichever method you choose, ensuring sufficient account balance is the first step to completing payments smoothly.

QR Code Payment

QR code payment is one of GCash’s most popular features, suitable for offline scenarios like restaurants, malls, and more. Here’s how:

- Open the GCash app and click “Scan QR Code.”

- Point your phone at the merchant’s QR code, and the system will automatically recognize it.

- Enter the payment amount and confirm the transaction.

Note: Before confirming payment, carefully check the amount and merchant name for accuracy.

QR code payment is not only fast but also avoids the hassle of carrying cash, making your shopping experience more effortless.

Online Shopping Payment

GCash also supports online shopping payments, allowing you to complete purchases from home. Here are the steps:

- Select items on an e-commerce platform that supports GCash and proceed to checkout.

- Choose “GCash” as the payment method, and the system will redirect to the GCash payment page.

- Log in to your GCash account, confirm the payment amount, and complete the transaction.

Tip: When paying with GCash, some platforms offer extra discounts or coupons—be sure to watch for these benefits!

With GCash online payments, you can enjoy secure and convenient shopping without worrying about credit card information leaks.

Payment Scope

Alipay +

As a partner of Alipay+, GCash supports user payments at over 80 million merchants in 45+ countries/regions, covering diverse scenarios such as retail, dining, tourism, and transportation. For example, it can be used at KFC in Shanghai, 7-11 convenience stores in Japan, and Ocean Park in Hong Kong.

- Supported Countries/Regions: Including mainland China, Hong Kong, Macau, Japan, South Korea, Singapore, Malaysia, Thailand, the UAE, Qatar, the US, UK, France, Germany, Italy, Switzerland, Australia, etc. (as of November 2024).

- Operation Method:

- Open the GCash app and select “Pay Abroad with Alipay+”;

- Scan the merchant’s Alipay+ QR code or generate a GCash QR code for the merchant to scan;

- Confirm the payment amount, and the system will provide real-time exchange rates (no service fees; foreign exchange conversion costs are borne by the merchant).

- Features: Zero service fees, real-time exchange rate settlement, wide coverage (e.g., all 3 million PayPay-partnered merchants in Japan support it).

GCash Visa Card

Launched in October 2023, the GCash Visa Card is accepted at over 100 million Visa merchants in 200+ countries/regions, covering major global offline stores, restaurants, and online platforms.

- Key Features:

- Users can apply for virtual or physical cards via the GCash app, paying with wallet balances or GCredit (credit limits);

- Single-payment limits of up to $500, supporting online and offline payments with competitive exchange rates, usable without traditional credit cards.

GCash Overseas Services and Cross-Border Remittances

- GCash Overseas Function:

Verified users can use GCash in 16 countries/regions, including the US, Canada, UK, Australia, Japan, Italy, Hong Kong, South Korea, Singapore, Taiwan, UAE, Saudi Arabia, Kuwait, Qatar, Spain, and Germany (10 new countries added in February 2024).- Overseas Registration: Filipino users in the above countries can register for GCash using international SIM cards to enjoy services like transfers, bill payments, and data purchases.

- Cross-Border Remittance Services:

GCash partners with international remittance platforms like Remitly, Western Union, and MoneyGram to support overseas users (e.g., overseas Filipinos, OFWs) in sending money to GCash accounts in the Philippines, facilitating cross-border fund flows.

Steps to Use GCash for Transfers

Image Source: unsplash

GCash can not only be used for payments but also allows you to easily complete transfers. Whether sending money to friends, family, or making international remittances, GCash meets your needs. Here are the specific steps.

Transfer to a GCash Account

Transferring funds to another GCash account is straightforward. Just follow these steps:

- Open the GCash app and click the “Transfer” option.

- Enter the recipient’s GCash phone number or scan their QR code.

- Enter the transfer amount and confirm the transaction.

Tip: Ensure the recipient’s phone number is correct to avoid misdirected transfers.

Transfers between GCash accounts are typically instant, suitable for small daily payments or urgent transfers.

Transfer to a Bank Account

If you need to transfer funds to a bank account, GCash also offers a convenient solution. Here’s how:

- Select “Transfer to Bank” in the GCash app.

- Choose the target bank from the list or manually enter the bank name and account information.

- Enter the transfer amount and confirm the transaction.

Note: Transferring to a bank account may incur fees, depending on the target bank and transfer amount.

Compared to traditional bank transfers, GCash is simpler and faster. You can complete transfers anytime, anywhere, without queuing or filling out complex forms.

International Remittance Operations

GCash also supports international remittances, allowing you to easily transfer funds to overseas accounts. Here’s how:

- Open the GCash app and select the “International Remittance” function.

- Enter the recipient’s detailed information, including name, country, and bank account details.

- Enter the remittance amount; the system will automatically display exchange rates and fees.

- Confirm the transaction, and funds will arrive shortly.

Tip: When using GCash for international remittances, check exchange rates and fees in advance to choose the most cost-effective time for the transaction.

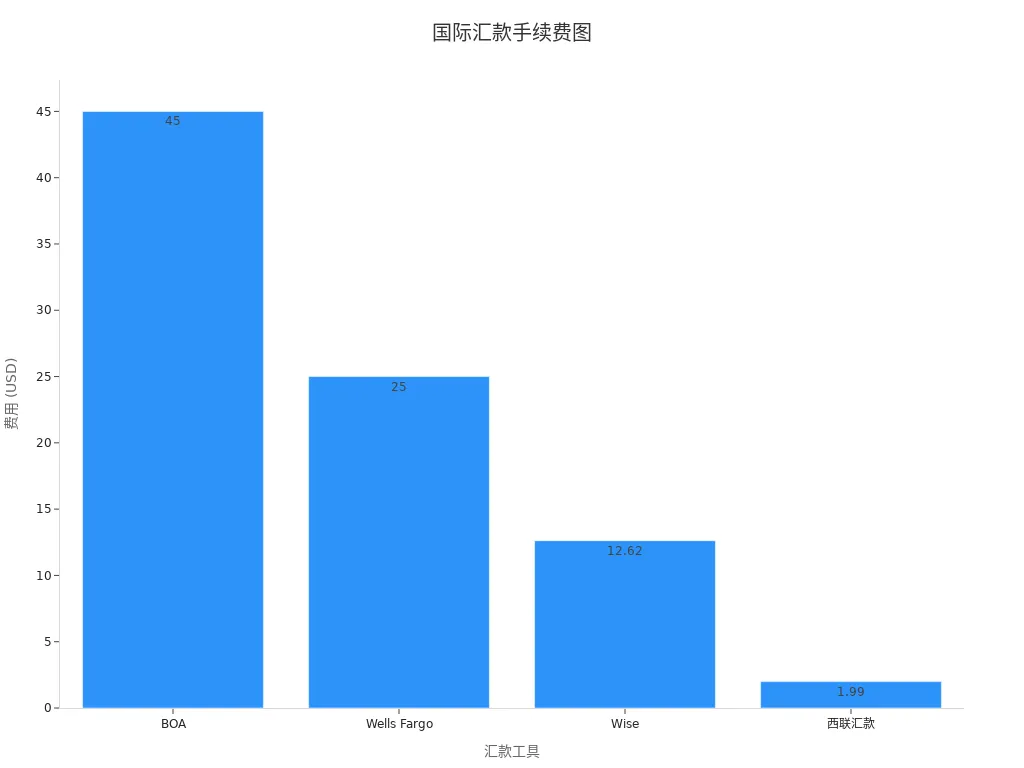

Compared to traditional banks, GCash’s international remittances offer significant fee and exchange rate advantages. Below is a comparison of fees and delivery times for different remittance tools:

| Remittance Tool | Fee for Sending $1,000 USD | Received Amount for $1,000 USD | Delivery Time |

|---|---|---|---|

| BOA | $45 USD | $955 USD remaining | 1-2 business days |

| Wells Fargo | $25 USD | $975 USD remaining | 1-5 business days |

| Wise | $12.62 USD | 7,131.53 CNY | Within hours |

| Western Union | $1.99 USD | 7063.42 | 0-4 business days |

As shown in the table, GCash’s international remittance service is not only low-cost but also fast, significantly enhancing the user experience.

Additionally, the following chart shows exchange rate differences for different remittance amounts:

With GCash’s international remittances, you can save costs and enjoy more efficient services. Whether supporting family or paying overseas bills, GCash is your trusted assistant.

GCash Account Security Guide

Account security is paramount when using GCash. By following these methods, you can effectively protect your account and avoid unnecessary risks.

Set a Strong Password

A strong password is the first line of defense for your account. Choose a password with a mix of uppercase/lowercase letters, numbers, and special characters, at least 8 characters long. For example, Gca$h2025! is a good choice. Avoid using easily guessable information like birthdays or phone numbers. Regularly changing your password is also important—we recommend updating it every three months.

Tip: Do not store passwords in mobile phone memos or share them with others. Using a password manager can help you securely store complex passwords.

Fraud Prevention Tips

Fraud methods are constantly evolving, but you can effectively avoid them by staying vigilant. Here are some practical tips:

- Beware of Suspicious Links: Do not click links sent by strangers, especially messages claiming “winning a prize” or “account anomalies.”

- Verify Identities: When receiving calls from someone claiming to be GCash customer service, verify their identity through official channels first.

- Enable Two-Factor Authentication: Turn on two-factor authentication in your GCash account for an extra layer of security.

According to statistics, GCash has significantly reduced security incidents through technical optimizations, legal regulations, and user education. Below are specific improvement measures:

| Optimization Aspect | Specific Measures |

|---|---|

| Software Technology | Adopt more efficient encryption methods and add identity verification to prevent account information theft. |

| Legal Regulation | Comply with PCI DSS standards, formulate relevant regulations to protect payment card data security, and strengthen supervision of e-payment platforms. |

| User Education | Disseminate security knowledge through multiple channels, enhance user awareness, and create targeted safety education materials for different user groups. |

These improvements have significantly enhanced GCash’s security. By staying alert, you can effectively prevent fraud.

Contact Customer Service for Issue Resolution

If you encounter account problems or security concerns, contacting GCash customer service is the most effective solution. You can get help through the following channels:

- Online Chat: Open the GCash app, go to “Help Center,” and select “Online Customer Service” to communicate with staff.

- Hotline: Call GCash’s official customer service number and provide your account information and problem description.

- Email Support: Send an email to GCash’s official mailbox, detailing the issue and attaching relevant screenshots.

Note: When contacting customer service, avoid disclosing passwords or other sensitive information. Official customer service will never request such details.

Through these methods, you can quickly resolve issues and ensure account security. Keep these security guidelines in mind, and GCash will be your trusted payment tool.

Common Questions and Answers

Reasons for Account Verification Failure

Account verification failure can be confusing, but understanding the causes can help you resolve issues quickly. Below are common reasons for verification failure and their impact:

| Main Reasons | Impact Scope |

|---|---|

| High-risk device detected | Limits on failed authentication attempts and cooling-off periods |

| Frequent repeated authentication attempts | Limits on failed authentication attempts and cooling-off periods |

| Use of test demo package name | Limits on failed authentication attempts and cooling-off periods |

If you experience verification failure, check your device settings, avoid frequent repeated operations, and ensure you use the official app. These steps can improve verification success rates and help you unlock more features.

Solutions for Payment Failure

Payment failure may affect your shopping experience, but most issues can be easily resolved. Here are common causes and solutions:

- Complex payment processes or strict risk control may lead to transaction rejections.

- From 2019 to 2022, consumer losses due to payment false declines reached $35 billion.

- Overall transaction losses reached $507 billion.

To avoid payment failures, try the following:

- Ensure sufficient account balance.

- Check if your bound bank card is valid.

- Avoid making payments in unstable internet environments.

If the problem persists, contact GCash customer service for professional support.

Transfer Limits and How to Increase Them

GCash has transfer limits, but you can increase them through simple steps. Completing account verification is the first step, which not only improves security but also unlocks higher transfer limits. Additionally, regularly updating account information helps increase limits.

Tip: If you need higher transfer limits, contact GCash customer service to apply for special permissions. They will evaluate based on your account usage.

With these methods, you can easily exceed transfer limits and enjoy more efficient payment and transfer services.

GCash provides efficient and convenient solutions for your payment and transfer needs. Through this guide, you have mastered the full process from registration to payment and transfers. Now it’s time to take action! Try GCash immediately to experience the convenience and security of digital payments.

If you need more comprehensive global remittance and investment services, consider learning about the BiyaPay multi-asset trading wallet. It supports real-time conversion of over 30 fiat currencies and 200+ digital currencies, with transparent and low handling fees. Whether in North America, Europe, or the Asia-Pacific region, BiyaPay helps you achieve same-day remittance and fund arrival. Choose BiyaPay to make your global financial operations easier!

FAQ

What should I do if account verification fails?

Account verification may fail due to blurry ID documents or inconsistent information. Re-upload clear ID photos and ensure the filled information matches the documents.

Tip: Take ID photos in natural light to avoid glare or blurriness and improve verification success rates.

How can I avoid payment failures?

Payment failures often result from insufficient balance or unstable internet. Ensure adequate account balance and operate in a well-connected environment.

- Check the binding status of your bank card.

- Ensure the payment amount is within the limit.

Note: Contact GCash customer service if the issue persists.

What are the transfer limits?

GCash transfer limits vary by account verification level:

| Account Type | Daily Limit |

|---|---|

| Unverified Account | 5,000 PHP |

| Fully Verified Account | 100,000 PHP |

Tip: Complete account verification to unlock higher limits for large transfers.

How long does international remittance take?

International remittances typically arrive within hours, depending on the target country and bank processing speed.

Tip: Use GCash’s international remittance feature for low fees and fast delivery.

How to protect account security?

The key to account security is setting strong passwords and enabling two-factor authentication. Avoid clicking unknown links or disclosing account information.

- Change passwords regularly.

- Use the official app.

Tip: Freeze your account and contact GCash customer service immediately if unusual activity is detected.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.