Key Details You Must Know Before Making an Online Remittance via Western Union

Image Source: unsplash

Are you preparing to use Western Union for online remittances? You are not alone. The global digital remittance market is developing rapidly, and data from multiple research institutions show that its scale reached approximately $25 billion in 2024. This huge figure means countless transactions are conducted daily across global networks.

Before you hurriedly click the “send” button, taking a few minutes to understand some key details is crucial. This can help you avoid common troubles and ensure your funds reach the receiver safely and smoothly.

This guide will serve as a clear operation handbook, providing all the information you need.

Key Takeaways

- Before remitting, carefully check service fees and exchange rate margins to understand the total cost.

- Pay attention to Western Union and China’s foreign exchange remittance limits to ensure the receiver can get the money.

- The receiver’s name must exactly match the spelling on their ID, which is key to successful remittance.

- After remitting, tell the receiver the MTCN number to facilitate tracking and pickup of the remittance.

- If information is incorrect or the remittance does not arrive, immediately contact Western Union customer service for help.

Fees and Exchange Rates: Total Cost Structure

Image Source: unsplash

The total cost of remittance is not just the “service fee” displayed on the page. It consists of two parts: explicit service fees and the margin hidden in the exchange rate. Understanding these two allows you to accurately calculate how much your money will ultimately “shrink.”

Service Fee Breakdown

The service fee you pay varies depending on the payment and receipt methods.

Payment method is key

- Paying with a credit card: Service fees are usually the highest. Your credit card company may also charge additional fees, such as “cash advance fees,” which can be 3% to 5% of the advance amount.

- Paying with a bank account or debit card: Fees are usually lower and may provide you with better exchange rates.

Additionally, whether the receiver chooses cash pickup or bank account deposit may also affect the final fees. Before remitting, you can try different combinations on Western Union’s fee calculator to find the most economical option.

Exchange Rate Margin Explanation

The exchange rate provided by Western Union remittances is not the real-time “mid-market exchange rate.” The mid-market exchange rate is the benchmark rate used in transactions between banks and large financial institutions. Remittance providers add a margin to this rate to make a profit.

This margin is a hidden cost. You can use independent tools like Wise or Xe to check real-time mid-market exchange rates, then compare them with the rate provided by Western Union to understand how much this part costs.

Cost Calculation Method

Let’s calculate the total cost with a specific example. Suppose you want to remit 300 USD from the United States to mainland China.

- Remittance Amount: 300 USD

- Service Fee (Example): 14 USD

- Your Total Payment: 314 USD

Now, let’s look at the exchange rate:

- Exchange Rate Provided by Western Union: 1 USD = 7.10 CNY

- Receiver Ultimately Receives: 300 USD × 7.10 = 2130 CNY

If the mid-market exchange rate at that time was 1 USD = 7.25 CNY, then the hidden cost due to the exchange rate margin is 300 × (7.25 - 7.10) = 45 CNY. This means, in addition to the 14 USD service fee, you paid an extra approximately 6.2 USD (converted at 7.25 rate) due to the exchange rate margin.

When calculating the total cost above, start with BiyaPay’s free FX rate comparison to benchmark provider quotes against the mid-market and estimate the net receive amount; once confirmed, initiate the transfer via BiyaPay Remittance. To reduce returns caused by incomplete beneficiary details, verify them before submission with SWIFT lookup or IBAN check (bank code, account format, legal name).

BiyaPay is a multi-asset wallet supporting multi-currency balances and cross-border payments; it operates under US MSB and New Zealand FSP registrations. Keeping pricing, checks and execution in one place helps minimize tool-switching errors and makes fees, FX and receive paths easier to reason about.

Remittance Limits: How Much Can I Send?

Before remitting, you need to understand two key limits: one is Western Union’s sending limit as a remittance platform, and the other is the foreign exchange management limit for individual receipts in mainland China. Both will affect your remittance plan.

Western Union’s Online Remittance Limits

Western Union sets initial limits for online remittances. If you are a new user or your identity is unverified, you can usually only send smaller amounts per transaction, such as around 1,000 USD. This restriction is for security reasons.

The good news is that you can increase this limit through identity verification. After verification, your per-transaction remittance limit can significantly increase, for example, to 5,000 USD.

- How to Increase the Limit? You need to submit identity proof documents online.

- What Documents Are Needed? Usually government-issued valid IDs, such as your passport or driver’s license.

- What Is the Verification Process? Log in to your Western Union account and follow the website instructions to complete the online verification steps.

This process helps Western Union confirm your identity, thereby providing you with a higher remittance quota.

China’s Individual Annual Foreign Exchange Settlement Limit

In addition to Western Union’s sending limit, you must consider the regulations in the receiver’s location. According to regulations from China’s State Administration of Foreign Exchange (SAFE), the annual limit for mainland Chinese residents to convert foreign currency to RMB is 50,000 USD.

This means that even if Western Union allows you to send over 50,000 USD, the total amount your receiver can convert to RMB in a year cannot exceed this figure. If the receiver’s annual quota is used up or nearly exhausted, they will not be able to successfully receive your remittance.

Therefore, before initiating a large remittance, be sure to communicate with the receiver to confirm whether their annual individual settlement quota is sufficient. This can effectively avoid troubles caused by exceeding the limit leading to remittance returns.

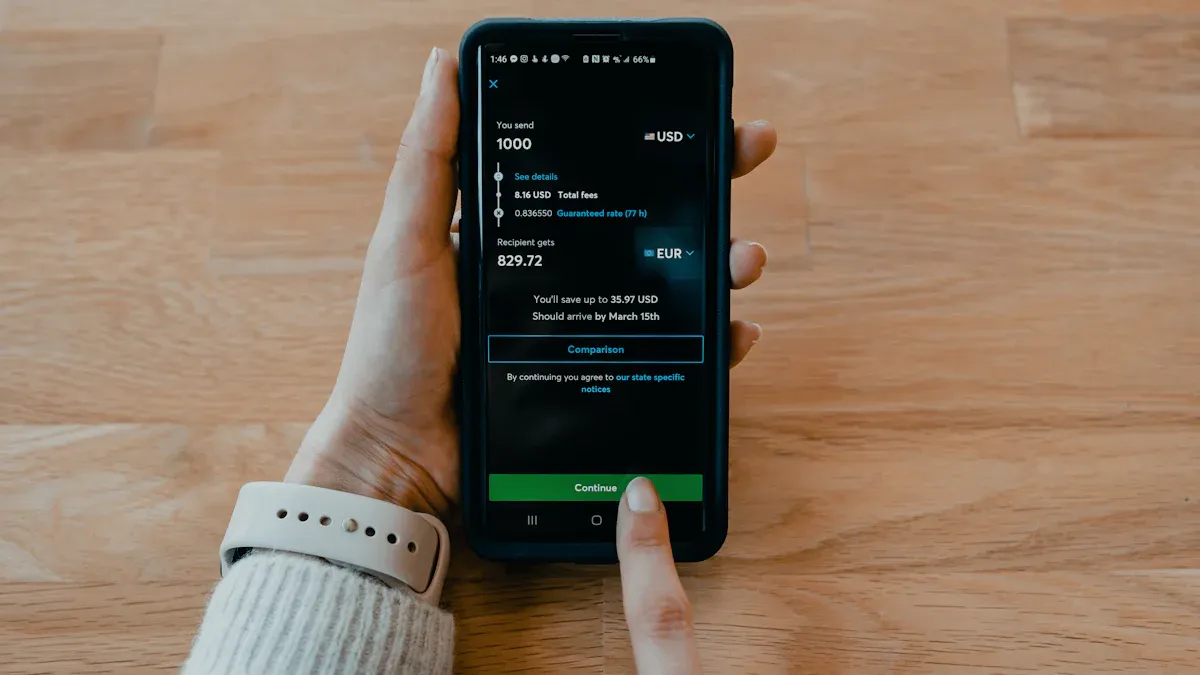

Online Remittance: Complete Operation Process

Image Source: unsplash

After understanding fees and limits, you can start the actual operation. The online remittance process itself is very intuitive, but mastering a few key details can make the entire process smoother. This section will guide you through every step from preparation to tracking.

Preparations Before Remittance

Before logging into the Western Union website or App, taking a few minutes to prepare all necessary information and documents can save you a lot of time.

First-Time Remittance? Identity Verification Is the First Step

If this is your first time using Western Union online remittance, you need to complete identity verification first. This step is to comply with anti-money laundering regulations and protect your account security. Required documents vary by country. For example, if verifying in Japan:

Resident Type Required Documents Japanese Resident Japanese Passport and My Number Card Foreign Resident Residence Card and My Number Card (or Resident Certificate with My Number)

After preparing personal identity verification, you also need to organize the following remittance information:

- Receiver Information: Ensure you have the receiver’s full name exactly matching their official ID, their bank account number, and bank name and code.

- Your Payment Method: Prepare your bank account information, credit card, or debit card.

- Remittance Purpose: As required, you may need to state the purpose of the remittance, such as “family living expenses” or “education expenses.”

Name Spelling and Information Accuracy

This is the step in the entire process most prone to errors and also the most fatal. If information is incorrect, the remittance will be delayed or even returned.

This key detail must not be overlooked. Banks or receipt agent points will strictly verify the ID presented by the receiver when paying out funds. If the name on the remittance information does not match the ID, they will not be able to pay out the funds.

- Correct Example: If the name on the receiver’s ID is “张三”, then when filling in the name, you should enter

San Zhang(first name San, last name Zhang), notZhang Sanor the Chinese characters “张三”. - Verification: Before clicking send, it is best to confirm the name spelling on their ID with the receiver again.

Step-by-Step Operation Guide

Once you have all information ready, the actual online remittance process is very simple.

- Register or Log In: Visit the Western Union official website or open its mobile app, create a new account or log in to your existing account.

- Enter Remittance Information: Select the receiving country (for example: China) and enter the amount you wish to send (for example: 500 USD). The system will automatically calculate the service fee and estimated RMB amount to be received.

- Fill in Receiver Information: Accurately enter the receiver’s name (using English letters), address, and bank account information.

- Select Payment Method: Choose to pay with a credit card, debit card, or bank account.

- Confirm and Send: Carefully check all information, including amount, exchange rate, and receiver name. After confirming everything is correct, complete the payment.

- Obtain MTCN: After a successful transaction, you will receive a Money Transfer Control Number (MTCN). This number is the credential for tracking and picking up the remittance. You can find it in the transaction receipt, confirmation email, or account transaction history.

Remittance Status Tracking

After sending the remittance, you can check the latest fund status at any time. Tracking remittances with MTCN is very convenient.

- Find Your MTCN: Locate this 10-digit number in the confirmation email or transaction history record received after completing the transaction.

- Visit the Tracking Page: Go to the Western Union official website and find the “Track Transfer” function.

- Enter Information: Input your MTCN; sometimes you may also need to provide the sender’s name and other information for verification.

- View Status: After clicking “Continue” or “Track,” the system will display your remittance status, such as “In Process,” “Available for Pickup,” or “Paid.” This way, both you and the receiver can have a clear understanding of the fund’s whereabouts.

Arrival and Receipt: Key Details You Must Master

You have successfully clicked “send,” but this is only half of the remittance journey. Now, the focus shifts to the receiver. How and when can they receive the money? Understanding the receipt process and key details ensures your intentions are smoothly delivered and avoids unnecessary troubles.

Estimated Arrival Time

The question you care about most is probably: “How long until the money arrives?” The answer depends on multiple factors.

Under ideal conditions, remittances can be very fast. Western Union partners with multiple banks in mainland China; if you choose direct deposit to an eligible bank account and operate during bank working hours, funds can arrive in as little as a few minutes.

However, please note that this is not an absolute guarantee. International remittance arrival times may be delayed due to the following reasons:

- Remittance amount size

- Destination country’s regulations or foreign exchange controls

- Additional operations the receiver needs to complete

- Bank branch operating hours or time zone differences

In some cases, an international remittance may take one to five business days to complete. Therefore, communicate with the receiver in advance to give them a reasonable expectation of possible arrival times.

Receipt Methods Explained in Detail

Western Union provides multiple flexible receipt methods for receivers in mainland China. You can choose the most suitable option during remittance based on the receiver’s convenience.

This is a very convenient digital receipt method. As the sender, you only need to select remittance via mobile number on the Western Union platform. The receiver will receive the funds through the following steps:

- Receive Notification: The receiver will get an SMS and a notification within the Alipay app.

- Enter the App: Search and open the “Cross-Border Remittance” or similar mini-program in the Alipay App.

- Complete Authentication: First-time receipt requires real-name authentication.

- Choose Receipt Path: Can choose to deposit funds into a bound bank card or Alipay wallet balance.

- Confirm Receipt: After verifying the information is correct, confirm to complete.

Tip: Once the receiver successfully sets it up the first time, subsequent remittances can be deposited directly into their chosen account more quickly without repeated authentication.

Similar to Alipay, WeChat also provides convenient receipt services. The receiver can complete operations through the “WeRemit” mini-program.

- Create Receipt Profile: First-time users need to search for the “WeRemit” mini-program in WeChat, follow instructions to create their receipt profile, and complete real-name authentication.

- Click Link to Receive: You will receive an SMS containing a URL link; you need to send this link to the receiver. The receiver must click the link within 48 hours to enter the mini-program and complete receipt.

- Choose Receipt Path: They can choose to deposit funds into WeChat wallet balance or bound bank card.

- Sign Documents: As prompted, may need to sign a service agreement. If the remittance purpose is family support, also need to sign a family relationship commitment letter.

3. Receive via Partner Banks

If the receiver prefers traditional methods, they can go to Western Union’s partner bank branches in China to pick up cash. Western Union has over 27,000 agent locations in China, with wide coverage, including China Postal Savings Bank, China Everbright Bank, etc.

The receipt process is as follows:

| Step | Operation Instructions |

|---|---|

| Step 1 | Go to any Western Union partner bank branch. |

| Step 2 | Fill out the receipt form, provide sender name, remittance amount, and MTCN. |

| Step 3 | Show government-issued valid ID (such as ID card) to the bank staff. |

| Step 4 | After the bank staff verifies the information is correct, pay out the cash. |

Materials Required by the Receiver

No matter which receipt method is chosen, the receiver needs to prepare some basic materials. This is the final key detail to ensure safe fund delivery.

Remember: MTCN and valid ID are the keys to withdrawal.

The Money Transfer Control Number (MTCN) is the unique identifier for this transaction. At the same time, the receiver’s name must exactly match the spelling on their ID. Any single information error will lead to receipt failure.

Core materials that must be provided during receipt include:

- MTCN (Money Transfer Control Number): The 10-digit number you receive after completing the remittance.

- Government-Issued Valid ID: For example, the receiver’s ID card or passport.

- Sender Information: Including the sender’s name and approximate remittance amount.

After remitting, be sure to inform the receiver of the accurate MTCN and your name information, and remind them to bring valid ID to ensure a flawless receipt process.

Before clicking send, please take one minute to complete this final checklist to ensure everything is perfect.

Final Checklist

- Verify Total Fees: Confirm you understand the full cost consisting of service fees and exchange rate margins.

- Check Dual Limits: Ensure the remittance amount does not exceed Western Union and the receiver’s location limits.

- Confirm Receiver Information: Double-check the receiver’s name spelling (must be in English letters) for accuracy.

- Communicate Receipt Method: Agree with the receiver on the most convenient receipt option.

Doing these preparations can maximize the guarantee that your remittance arrives safely and smoothly. If you encounter any issues, you can contact Western Union customer service at any time for help, for example, by calling (800) 325-6000.

FAQ

What if I filled in the receiver information incorrectly?

You need to immediately contact Western Union customer service. If the funds have not yet been picked up or deposited into the bank, they can help you modify the information. Once the funds have been paid, recovering them will be very difficult. Therefore, be sure to double-check before remitting.

Can I cancel a remittance that has already been sent?

Yes, but only if the receiver has not yet picked up the cash or the funds have not been deposited into their bank account. You can log in to your Western Union account to find the transaction and choose to cancel, or directly contact customer service. Please note that cancellation may incur a fee.

What should I do if the receiver did not receive the money?

- First, track the remittance using MTCN. Enter the MTCN on the Western Union official website to check if the transaction status is “Available for Pickup”.

- Contact the Receiver. If the status shows available for pickup, ask the receiver to confirm again with the bank or receipt agent point.

- Contact Western Union Customer Service. If the issue remains unresolved, prepare the MTCN and contact Western Union customer service for help.

Is there a difference between remitting via the App and on the website?

There is no difference in core functions. You can complete remittances, track transactions, and manage accounts online in both ways. The App’s advantage is convenience, allowing you to operate anytime, anywhere via mobile phone. Both methods use the same security standards and fee structure.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

2026 China Stock Market Investment Guide: Spotlight on 5 Must-Watch Leading Tech Stocks

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.