How to Transfer Money to a Bank Account Securely and Conveniently Using a Capital One Credit Card

Image Source: unsplash

You cannot directly transfer money from your Capital One credit card to a bank account as you would with a debit card. However, you have three main methods to access funds: requesting a cash advance, using a convenience check, or utilizing specific third-party online services.

Please note that these methods are not free solutions. They are typically treated as “cash advances,” which means they incur immediate fees and high interest rates, with no grace period like regular purchases.

Key Points

- Credit cards cannot directly transfer money to a bank account; any cash withdrawal is treated as a “cash advance.”

- Cash advances are costly, incurring immediate fees and high interest with no grace period.

- Using convenience checks or third-party online services also counts as a cash advance, carrying similar high fees and risks.

- Cash advances increase your debt, raise your credit utilization rate, and may harm your credit score.

- Personal loans and balance transfers are better alternatives, offering lower costs and risks.

Core Concept: Credit Card Transfers Are “Cash Advances”

To understand how to access funds from a credit card, you first need to grasp the fundamental difference from a bank account. A credit card is not a deposit account but a credit tool. Therefore, you cannot directly transfer the “money” out as you would with a debit card.

Why Credit Cards Cannot Directly Transfer

Your bank account holds your own funds, which you can freely transfer or withdraw. However, your Capital One credit card limit represents a pre-approved loan amount from the bank. Every purchase you make is essentially borrowing money from the bank. Thus, converting your credit limit into cash deposited into a bank account is not considered a “transfer” by the bank but a cash loan.

Understanding Cash Advances

A cash advance is a feature that allows you to borrow cash directly from your credit limit. You can complete a cash advance via an ATM, bank counter, or convenience check.

Simply put, a cash advance is essentially a high-interest, short-term cash loan. This amount is deducted directly from your available credit limit.

Since it is treated as a loan rather than a purchase, its fee structure and interest calculation differ significantly from regular purchases, typically costing much more.

Key Differences Between Cash Advances and Purchases

Cash advances and regular purchases differ significantly in fee calculations, which is something you need to be particularly cautious about. The table below clearly illustrates the key differences:

| Feature | Cash Advance | Standard Purchase |

|---|---|---|

| Interest Start | Interest typically accrues immediately | Typically has a grace period (if paid in full on time) |

| Interest Rate Type | Uses “Cash Advance APR” | Uses “Purchase APR” |

| Interest Rate Level | Usually higher rates | Rates may be relatively lower |

| Promotional Eligibility | May not qualify for promotional rates (e.g., 0% APR) | May qualify for promotional rates (e.g., 0% APR) |

In summary, cash advances have no grace period and carry higher interest rates, which is the price you pay for accessing immediate cash.

Method 1: ATM or Counter Cash Advance

Image Source: pexels

This is the most direct way to convert your credit limit into cash but is typically the most expensive option. It’s suitable for emergencies when you urgently need physical cash.

Specific Steps

You can withdraw cash at any ATM that supports your credit card network (e.g., Visa or Mastercard). The process is straightforward:

- Insert your Capital One credit card into the ATM.

- Enter your Personal Identification Number (PIN).

- Select “Cash Advance” or a similar option on the screen.

- Enter the amount you wish to withdraw and confirm the transaction.

- Collect your cash and receipt.

Forgot your PIN? You can log into the Capital One website or mobile app to request a temporary PIN. The bank will send it to you via a secure channel (e.g., SMS or email), allowing you to complete the withdrawal smoothly.

Cash Advance Fees and Interest Rates

This is the part you need to focus on, as the costs are significant. Cash advances incur two main fees:

- Cash Advance Fee: Typically 3% of the withdrawal amount, with a minimum fee of $5. This means even a $100 withdrawal incurs a $5 fee.

- Cash Advance APR: This rate is much higher than your purchase APR and has no grace period. Interest starts accruing from the day of withdrawal. Currently, Capital One’s cash advance APR can be as high as 29.49%.

Cash Advance Limit Restrictions

Your cash advance limit is typically only a portion of your total credit limit, not the entire amount. For example, you may have an $8,000 total credit limit, but your cash advance limit might be only $2,500. Moreover, this cash advance limit may not increase with your total credit limit. You can check your specific cash advance limit on your monthly statement or by logging into online banking.

Pros and Cons Analysis

| Pros 👍 | Cons 👎 |

|---|---|

| Fast and convenient: The quickest way to access cash in emergencies. | Extremely costly: High fees and interest make this cash very expensive. |

| Globally accessible: You can withdraw cash worldwide at supported ATMs. | Immediate interest: Interest accrues from the transaction day with no grace period. |

| Potential credit impact: Frequent withdrawals may signal financial instability. | |

| Limited limit: Cash advance limits are low and may not meet large funding needs. |

Method 2: Using Capital One Convenience Checks

Convenience checks look similar to regular personal checks but are directly linked to your Capital One credit card account. You can use them to pay yourself or others, thereby converting your credit limit into cash.

Obtaining and Using Convenience Checks

Capital One sometimes mails convenience checks to you, especially if you have a good credit history. If you haven’t received them, you can request them by calling the customer service number on the back of your credit card. Additionally, you can order them online by following these steps:

- Log into your Capital One website account or mobile app.

- Select the credit card account for which you want to order checks.

- Find and select “Order Checkbook” in the “Account Services” menu.

- Confirm your personal information and mailing address, then submit the order.

Once you receive the checks, you can fill them out and cash them like regular checks, with the funds deducted from your credit card’s cash advance limit.

Fees and Interest Structure

The costs of using convenience checks are identical to ATM cash advances, as they are also treated as cash advances. You’ll incur two fees:

- Cash Advance Fee: Typically 5% of the check amount, with a minimum fee of $5.

- Cash Advance APR: The interest rate is typically as high as 28.99% or more, with interest accruing immediately from the day the check is processed by the bank, with no grace period.

Potential Risks and Precautions

Convenience checks carry far greater risks than regular credit card purchases. Lost or stolen blank checks are a goldmine for criminals, who can easily access your account information and forge transactions. Unlike credit cards, fraudulent transactions via convenience checks are harder to dispute, and you cannot earn cashback or rewards through this method.

- Destroy Immediately: If you don’t plan to use them, shred received convenience checks thoroughly.

- Store Securely: If you keep them, lock them in a safe place as you would cash.

- Stop Receiving: Contact the bank to stop mailing you convenience checks to eliminate the risk at the source.

Pros and Cons Analysis

| Pros 👍 | Cons 👎 |

|---|---|

| Flexible payments: Can be used to pay individuals or merchants who don’t accept credit cards. | High costs: Fees and interest are as expensive as ATM cash advances. |

| Simple operation: As easy as writing a regular check, no PIN required. | High risk: Lost or stolen checks expose your account information, posing significant fraud risks. |

| No grace period: Interest accrues from the day the check is cashed. | |

| No purchase protections: Typically lacks fraud protection and purchase benefits offered by credit cards. |

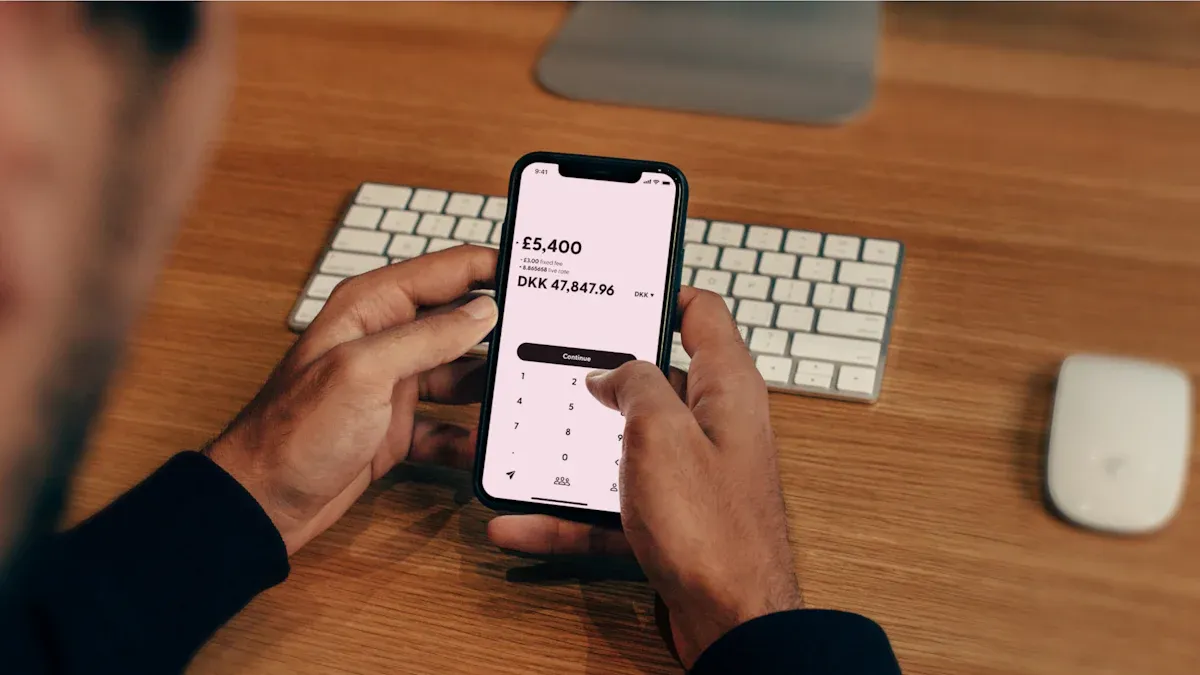

Method 3: Online Transfers via Third-Party Services

Image Source: unsplash

In addition to traditional methods, you can use online platforms to transfer funds from your credit card to a bank account. This method seems convenient, but you must understand the costs and risks before proceeding.

Linking External Bank Accounts

Most third-party services, such as international remittance platforms or online payment apps, allow you to link multiple funding sources. You need to add both your Capital One credit card and the receiving bank account to the platform. This process is usually simple, requiring only the card and account information for verification.

Choosing the Right Online Platform

Several platforms facilitate fund transfers, mainly falling into two categories:

- International Remittance Services: Platforms like Wise or Remitly, primarily for cross-border transfers, but can also be used for transfers to your own account.

- Online Payment Apps: PayPal is a typical example, allowing transfers between users.

When choosing a platform, carefully read its terms of service, especially regarding credit card payments.

Online Transfer Process

Although platform interfaces vary, the basic process is similar:

- Log into your third-party platform account.

- Select the “Send Money” or “Transfer” function.

- Choose your Capital One credit card as the payment method.

- Enter the recipient’s information (your own bank account details) and the transfer amount.

- Confirm the transaction details, including the platform’s fees, and complete the payment.

Fee Comparison and Risk Assessment

This is a critical step. While the operation is convenient, the costs can be significant. You need to consider two types of fees: the platform’s service fees and the bank’s fees.

Important Warning: Transactions may be treated as “cash advances” Many users report that Capital One treats PayPal transactions as cash advances. This means that even if the platform interface shows it as a regular payment, the bank may process it as a cash advance. This incurs immediate high cash advance fees and interest with no grace period.

Before proceeding, assume the transaction will be treated as a cash advance to calculate costs. This means you’ll face both the platform’s service fees and the credit card’s cash advance fees, making this method far more expensive than expected.

Safety Guidelines and Better Alternatives

Converting credit card limits to cash always carries risks. Before acting, you must understand how to protect your information and credit score. More importantly, prioritize lower-cost, lower-risk alternatives.

If your real goal is “getting funds safely and traceably into a recipient’s account” rather than short-term cashing out, consider evaluating BiyaPay alongside banks and third-party apps.

Positioned as a multi-asset wallet, BiyaPay provides international remittances, currency conversion, and account management in one place; for cross-border needs, this routes the flow as a payment/settlement rather than a “cash advance,” changing both fee composition and risk exposure. Before sending, use the free exchange-rate comparison tool to check live USD mid-market rates and estimated costs; if the beneficiary bank requires routing details, SWIFT lookup and IBAN lookup help validate fields and reduce return risk.

From a trust and safety standpoint, BiyaPay operates under multiple regulatory registrations (including U.S. MSB and New Zealand FSP) and applies KYC, transaction monitoring, and encrypted transmission—useful when you need compliant delivery and auditable tracking. Practically, model the all-in cost of a credit-card cash advance against BiyaPay’s “explicit fee + FX spread,” then weigh against delivery time and receipt method. In many everyday transfer scenarios, this “payment instead of cash-advance” route can materially lower costs and protect your credit profile.

How to Ensure a Safe Transfer Process

When using third-party platforms for transfers, protecting your financial information is critical. Follow these best safety practices:

- Enable Multi-Factor Authentication (MFA): Add an extra layer of security to your account. Even if your password is compromised, attackers cannot easily log in.

- Use Strong Passwords: Set unique, complex passwords for different platforms to avoid a single breach affecting all accounts.

- Monitor Accounts Regularly: Make it a habit to check your credit card and bank statements regularly to detect suspicious activity promptly.

- Beware of Phishing Scams: Avoid clicking links in unsolicited emails or texts. Capital One or any legitimate financial institution will not request sensitive information this way.

Impact on Credit Score

Cash advances are not marked as “cash advances” on your credit report, but they can indirectly harm your credit score in two ways:

- Increased Credit Utilization: Credit utilization (your total debt as a percentage of your credit limit) is a key factor affecting your credit score, accounting for 30%. A cash advance immediately increases your debt, raising your credit utilization, which lenders see as a sign of financial strain.

- Increased Risk of Delinquency: The high interest rates and fees of cash advances make repayment more difficult. Missing a payment harms your payment history, the most significant factor in your credit score (35%).

Even a single missed payment can cause severe and lasting damage to your credit score.

Alternative: Personal Loans

In most cases, applying for a personal loan is a smarter choice than a cash advance. While approval may take a day or two, the cost benefits are significant.

| Feature | Personal Loan | Cash Advance |

|---|---|---|

| Interest Rate | Typically much lower than cash advance rates (around 14.98% for those with good credit) | Extremely high rates (often over 28%) with no grace period |

| Fees | May have low or no origination fees | Typically incurs 3%-5% cash advance fees |

| Repayment | Fixed monthly payments with a clear schedule | Unfixed repayment amounts, risking a debt spiral |

For non-urgent large funding needs, personal loans can save you significant interest expenses.

Alternative: Balance Transfer

If you need funds to pay off another high-interest credit card, consider a balance transfer. Some credit cards offer a 0% introductory APR period.

This method allows you to transfer debt from one card to another and enjoy interest-free repayments for a few months. However, note:

- Eligibility Requirements: You typically need a good or excellent credit score to qualify for a 0% APR offer.

- Transfer Fees: Most cards charge a 3% to 5% fee on the transferred amount.

This option is suitable for consolidating debt, not for accessing cash.

Whether through ATM withdrawals, convenience checks, or third-party platforms, you are essentially engaging in a costly cash advance.

Any action to convert your credit limit to cash should be reserved for emergencies only and never used as a regular financial tool. Relying on this “quick cash” can trap you in a debt spiral of accumulating interest and fees.

Before acting, calculate all costs carefully. To protect your financial health and credit history, prioritize lower-risk, more cost-effective financing options like personal loans.

FAQ

Will a cash advance affect my credit score?

Yes, it will. It can indirectly affect your credit score in two ways:

- Increased Credit Utilization: A cash advance immediately increases your debt, raising your credit utilization, a key factor in your credit score.

- Increased Delinquency Risk: High interest and fees make repayment harder, and missing payments severely harms your credit history.

Can I prioritize repaying the higher-interest cash advance debt?

Typically, no. Banks usually apply your payments to lower-interest debts (e.g., regular purchases) first, repaying the highest-interest cash advance portion last. This results in paying more interest.

Can I earn cashback or reward points on cash advances?

No. Cash advances are treated as cash loans, not eligible purchases. Therefore, you cannot earn cashback, miles, or reward points on cash advance transactions.

Can I cancel cash advance fees and interest if I repay immediately?

No. Cash advance fees are incurred at the time of the transaction. Interest also starts accruing from the day of the advance. Even if you repay the same day, these fees are typically unavoidable.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

BiyaPay Secures Sumsub's Highest Security Certification: Building a Rock-Solid Foundation for a Global Integrated Financial Platform with Zero-Tolerance Risk Controls

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

2025 Advanced Guide to US Stock Trading: What is Level 2 Data and Software Choices

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.