How to Easily Make International Remittances via Money Express and Enjoy High-Quality Services

Image Source: unsplash

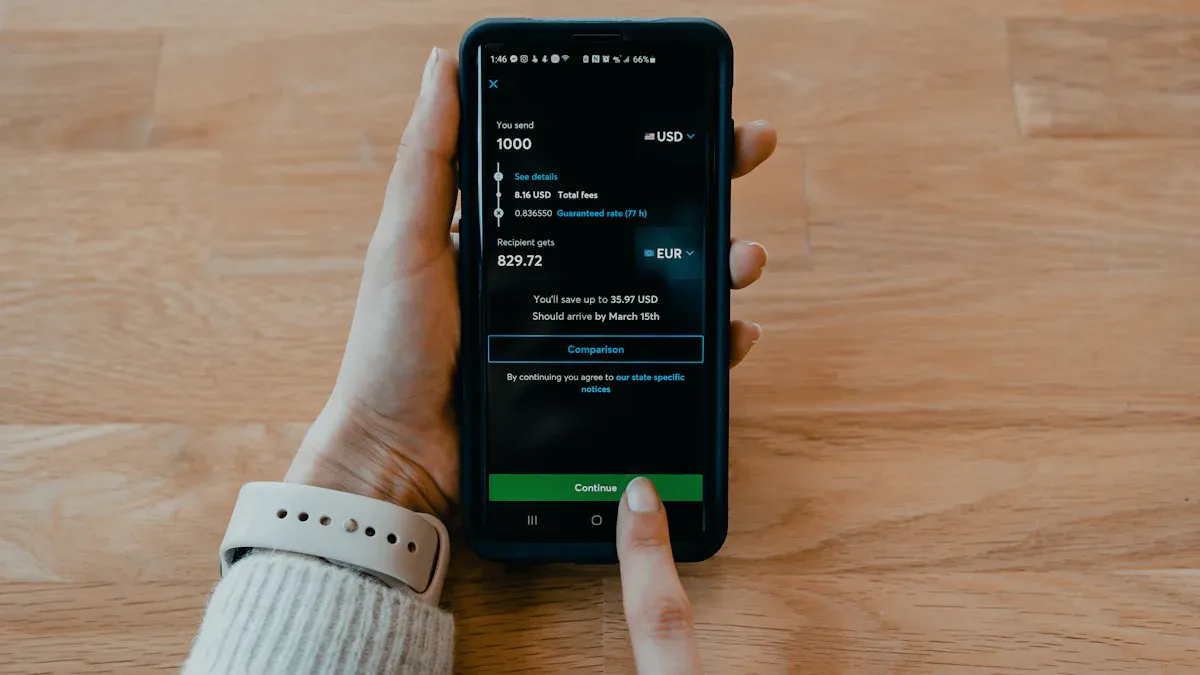

Do you find the international transfer process complicated? With Money Express, you can operate within the mobile app of a partner institution, making transfers as simple as local ones. You can lock in exchange rates in advance to avoid market fluctuation risks. At the same time, the fee structure is clear, and the transfer speed is fast.

With the global digital remittance market expected to grow at approximately 16.7% annually, convenient services like Money Express are becoming the new standard.

This modern approach allows you to say goodbye to complexity and send funds securely with ease.

Key Points

- Money Express allows you to lock in exchange rates, ensuring the recipient receives the exact amount.

- The recipient receives RMB directly, without needing to convert foreign currency themselves.

- Transfers typically arrive quickly, with a maximum of $10,000 per transaction.

- You need to operate via a mobile app and carefully enter the recipient’s pinyin name and UnionPay card number.

- The recipient must use a UnionPay debit card issued in mainland China to receive the transfer.

Core Advantages of Money Express

When you choose Money Express for international transfers, you’re not just completing a transaction—you’re opting for a smarter, more efficient way to manage funds. This service is designed around your core needs, offering three significant advantages.

Locked Exchange Rates and Transparent Fees

The exchange rate market is always fluctuating. A major pain point of traditional transfer methods is that the exchange rate may change unfavorably between the time you send the funds and when the recipient receives them, resulting in a lower actual received amount.

Money Express completely addresses this issue. It allows you to lock in the transaction exchange rate at the moment you initiate the transfer. This means the amount you see on the mobile app is the exact amount the recipient will receive, fully mitigating the risk of exchange rate fluctuations.

Before deciding whether to lock the rate, use BiyaPay’s free Fiat Rate Comparator to check live prices and total conversion costs, reducing surprises from hidden spreads.

If UnionPay cards aren’t convenient for the recipient, or you need broader corridors and currencies, BiyaPay’s Remittance lets you create an order by destination and currency, with fees and ETA shown for side-by-side comparison with Money Express.

Context note: BiyaPay is a multi-asset wallet enabling fiat/digital conversions and operates under licenses such as U.S. MSB and NZ FSP. These details are provided for tooling context and do not alter this article’s neutral guidance on process and risk.

Additionally, the fee structure is a key concern. Compared to traditional bank wire transfers, which often charge tens of dollars in handling fees, Money Express offers very low and fully transparent fees. You can clearly see all fee details before making the payment.

To give you a clearer understanding of the fee differences, here’s a comparison:

| Service Type | Fee Characteristics | Example Fee (Sending $500) |

|---|---|---|

| Remittance Service (e.g., Money Express) | Lower fees, typically known in advance, better exchange rates. | $3–$5 |

| Traditional Bank Wire Transfer | Higher fees, including sender and receiver bank fees, less favorable exchange rates. | $25–$45 |

RMB Receipt and Automatic Conversion

Another major highlight of Money Express is the utmost convenience it provides for recipients. Your recipient doesn’t need to deal with complex foreign exchange matters, as the funds will be deposited directly in RMB into their UnionPay card account.

This means for the recipient:

- Avoiding exchange rate risks: The recipient doesn’t need to worry about when to convert foreign currency to RMB for the best rate.

- Saving conversion costs: The recipient avoids additional fees or unfavorable rates that may arise when converting at a bank.

- Improved fund efficiency: Funds are immediately usable, speeding up the transaction process, especially for payments to suppliers in mainland China.

Important Note: According to China’s State Administration of Foreign Exchange (SAFE) regulations, the annual convenient foreign exchange settlement quota for mainland China residents is equivalent to $50,000. Money Express’s transfer service automatically completes the settlement declaration within this quota for your recipient, eliminating the hassle of visiting a bank branch.

Fast Arrival and Secure Limits

In the digital age, speed is critical. Money Express understands your need for efficiency, and its processed international transfers can arrive quickly, often within a few minutes.

At the same time, the service strikes a perfect balance between security and practicality. Money Express allows a maximum transfer limit of $10,000 per transaction. This amount is sufficient to meet most of your transfer needs, whether for paying tuition fees, supporting family expenses, or settling payments with business partners. The high limit, combined with robust security measures, ensures that every transfer reaches its destination safely and reliably.

How to Complete an International Transfer

Image Source: unsplash

Having understood the advantages of Money Express, you’ll find the actual operation process surprisingly simple. The entire transfer process is designed to be highly intuitive, and you can complete an international transfer with just a few steps via a mobile app.

Log In to the App and Select the Service

First, you need to open the mobile app of your financial institution or remittance provider. Money Express, as a value-added service, has been integrated into the platforms of numerous partners. For example, in the Middle East, Al Ansari Exchange has integrated this service into its app; you can also find it in UnionPay International’s official UnionPay App.

The steps are typically as follows:

- Open the App: Log in to the mobile app of your partner bank or remittance provider.

- Locate the Transfer Entry: In the main menu or function list, look for options like “Transfer,” “Remittance,” or “International Transfer.”

- Select the Service Type: In the service list, choose “UnionPay MoneyExpress” or a similar name to access the dedicated transfer interface.

Enter Recipient and Transfer Information

This is the most critical step in the process. To ensure funds reach the recipient accurately and quickly, you need to prepare the following information in advance and enter it carefully:

- Recipient’s Name: Must be entered in Pinyin and must match the name registered with the recipient’s bank card exactly.

- Recipient’s UnionPay Card Number: A valid 16-19 digit UnionPay card number issued by a mainland China bank.

- Remittance Amount: Enter the amount you wish to send. The system will automatically calculate the RMB amount the recipient will receive based on the locked exchange rate.

- Purpose of Remittance: Per regulatory requirements, you need to select or enter the purpose of the transfer, such as “family living expenses,” “education fees,” or “business payments.” Providing an accurate purpose helps ensure the transaction passes review smoothly.

Key Tip: How to Avoid Common Mistakes Accuracy is the core of ensuring a successful transfer. When entering information, double-check carefully to avoid delays or failures due to minor errors.

Common Mistakes How to Prevent Incorrect recipient name spelling Before transferring, confirm the exact pinyin spelling of the recipient’s name in writing to ensure it matches bank records. Incorrect UnionPay card number Double-check every digit. Preferably, copy and paste the card number from the recipient to reduce the chance of errors. Incomplete information Ensure all required fields (name, card number, amount, purpose) are fully completed without omissions.

Review Information and Confirm Payment

After entering all the information, the system will generate a transaction confirmation page. This is your final opportunity to review before the funds are sent.

- Carefully Review: Double-check the recipient’s pinyin name, UnionPay card number, transfer amount, and the estimated RMB amount to be received. Any errors could lead to delays or returns.

- Select Payment Method: Choose your payment method based on the options provided in the app. Common payment methods include:

- Visa or MasterCard debit/credit card

- Direct deduction from your bank account

- Confirm Payment and Track: After confirming the information is correct, authorize the payment. Upon completion, you will receive a Reference Number or order number. You can use this number to track the status of your transfer within the app or on the provider’s website. Many services also send status updates via email or SMS, keeping you informed of the funds’ progress.

Key Information Before and After Transferring

Image Source: pexels

To ensure every international transfer is completed smoothly, it’s crucial to understand some key information in advance. Following these guidelines can help you effectively avoid common issues.

Preparations Before Transferring

Before opening the app and starting the process, take a few minutes to prepare the following information. This will make the entire transfer process faster and smoother.

- Accurate Recipient Information: Reconfirm the recipient’s pinyin name and 16-19 digit UnionPay card number.

- Clear Transfer Amount: Determine the USD amount you wish to send.

- Select Transfer Purpose: Be ready to choose a purpose that matches the actual situation, such as “family expenses.”

- Prepare Payment Method: Ensure your payment card (e.g., Visa/MasterCard) or bank account has sufficient funds.

Handling Common Issues

Even though the process is simple, occasional unexpected issues may arise. Understanding the most common reasons can help you resolve problems quickly.

The most common reasons for transfer delays or failures are incorrect recipient information. Even a minor error in the pinyin name or card number can lead to the transaction being rejected by the bank. Additionally, to prevent fraud, banks may conduct extra security checks, which could require you to provide additional information.

If your transfer information is incorrect or you wish to cancel the transaction, contact the customer service team of the remittance provider you’re using immediately. Be sure to provide your transaction reference number to help them quickly locate your order and assist you. Note that a transaction can only be canceled if the recipient has not yet received the funds.

Specific Requirements for Recipient Cards

To ensure funds are successfully deposited, the recipient’s bank card must meet specific conditions.

- Supported Card Types: Money Express currently supports transfers primarily to UnionPay debit cards issued by mainland China banks. Most bank credit cards do not support receiving such transfers.

- Account Status Requirements: The recipient’s bank account must be in “active” status and in good standing, not frozen or canceled.

- Supported Banks: The service covers most banks in China, including all major state-owned banks and many regional banks. Examples include:

- Industrial and Commercial Bank of China (ICBC)

- Bank of China (BOC)

- China Construction Bank (CCB)

- Agricultural Bank of China (ABC)

- Bank of Communications (BoCom)

- Postal Savings Bank of China (PSBC)

As long as the recipient’s card meets these requirements, your funds can be delivered safely and quickly.

Money Express offers a modern international transfer solution. It combines locked exchange rates, fast delivery, and RMB receipt into one. You can complete the entire process via a mobile app, making it exceptionally easy.

Open your partner bank’s app now and experience this hassle-free transfer service yourself!

FAQ

We’ve compiled some questions you may encounter during the transfer process. We hope these answers help you complete your operations more smoothly.

What happens if the recipient’s annual foreign exchange quota is full?

The transaction will fail. According to China’s foreign exchange regulations, the annual settlement quota per person is equivalent to $50,000. You should confirm the recipient’s remaining quota before transferring to ensure the funds can be successfully deposited.

How long does it typically take for a transfer to arrive?

Most transfers can reach the recipient’s UnionPay card account within a few minutes. If it’s your first transfer or the bank requires additional security checks, there may be slight delays. You can track the transfer status at any time via the app’s tracking feature.

Which types of UnionPay cards can I send money to?

This service primarily supports transfers to personal UnionPay debit cards issued by mainland China banks. Most UnionPay credit cards, quasi-credit cards, or corporate accounts cannot receive such transfers. Be sure to confirm the recipient’s card type in advance.

Is there a minimum transfer amount?

Most partner institutions do not set a minimum transfer amount. However, specific rules may vary depending on the app you use. Check the relevant prompts in the transfer interface or contact customer service for the most accurate information.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

In-Depth Analysis of US GDP: Comprehensive Insights from Consumption to Investment

US Stock Index Futures Trading Secrets: Master the Four Major Indices to Unlock Wealth Opportunities

2025 Advanced Guide to US Stock Trading: What is Level 2 Data and Software Choices

US Stock Broker Opening Guide: Fees, Security, and App Experience Comparison (Futu vs Tiger vs Firstrade)

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.