How to Convert US Dollars to Philippine Pesos and Achieve Quick Remittance via Remitly

Image Source: unsplash

Do you want to send USD to your family in the Philippines quickly and securely? With Remitly, the entire process is much simpler than you might imagine. Remittance to the Philippines can be completed in as little as a few minutes. This guide acts like a checklist, breaking down every step from start to successful transfer. Simply follow these easy steps to complete the process effortlessly.

Key Takeaways

- Before remitting, prepare your identification and the recipient’s full details to ensure a smoother process.

- Remitly offers multiple receiving options, including cash pickup, mobile wallets, and bank deposits—choose the one that best suits the recipient.

- You can optar for “Economy” or “Express” services, which differ in fees and arrival times—select based on your needs.

- Remitly’s fees are transparent with no hidden charges; you’ll see all costs and exchange rates before sending.

- You can track the remittance status anytime to ensure funds arrive safely, and Remitly will notify you via email and SMS.

Preparations Before Remittance

Taking a few minutes to gather the necessary information before starting will make the entire process smoother. It’s like packing luggage before a trip—the better prepared you are, the easier the journey.

Documents Required for the Sender

As the sender, you’ll need to prepare basic personal documents to verify your identity. This is not only for regulatory compliance but also to protect your funds.

You’ll need to provide a valid government-issued photo ID. Common options include:

Tip: Understand your remittance limits When you first start using the service, your account will have an initial remittance limit. Knowing these limits helps you plan your transfers better.

If you need to send more than these amounts, you can apply to increase your limit. Typically, you’ll need to provide your full Social Security Number (SSN) and additional identity documents to complete the upgrade.

Information Required for the Recipient

Accurate recipient information is key to ensuring funds arrive safely. Before remitting, confirm the following details with the recipient in the Philippines:

- Recipient’s full legal name: Must match exactly what’s on their ID.

- Recipient’s address: Complete home address.

- Recipient’s phone number: For receiving remittance notifications.

- Bank account details: If choosing bank deposit, you’ll need the recipient’s bank name and account number.

Communicating and verifying this information in advance can prevent delays due to errors.

Remitly Remittance: Step-by-Step Guide

Image Source: unsplash

Once preparations are complete, you can officially start the remittance. Each subsequent step is straightforward—just follow the on-screen instructions.

Creating an Account and Logging In

For first-time users, you’ll need to create an account. This process is very quick.

- You’ll need to provide some personal information and set a password.

- Then, complete email verification to activate your account.

What to do if you encounter login issues? Occasionally, you might face minor issues, such as the system requesting additional information. This is usually for security reasons, like when logging in from a new device. If you forget your login email, you can seek help on the login page by providing personal details to recover it. If your account is temporarily suspended due to multiple failed login attempts, don’t worry—this is to protect your funds. Check your email, prepare your ID documents, and contact customer support to resolve it.

Setting Remittance Details

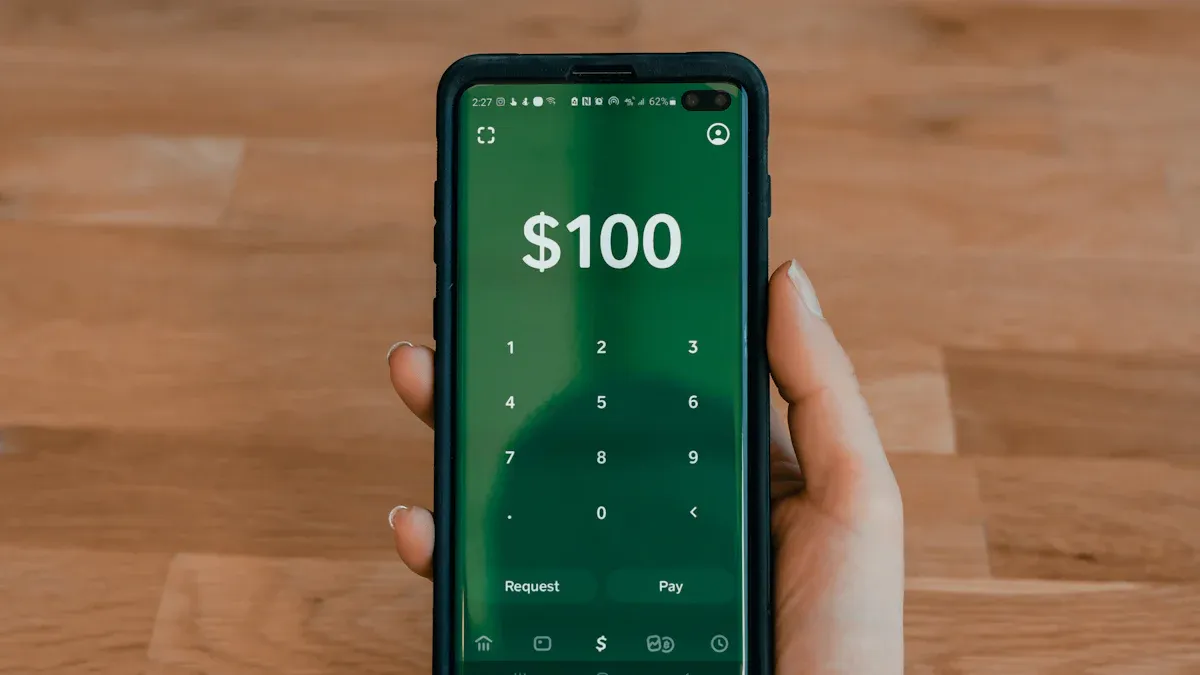

After logging in, you’ll enter the main remittance interface. Here, you’ll set the specific details for this transfer.

- First, select the remittance destination as “Philippines”.

- Next, enter the USD amount you wish to send. The system will automatically display the Philippine Pesos (PHP) amount the recipient will receive. You can also directly enter the PHP amount the recipient needs, and the system will reverse-calculate the USD you need to pay.

- Then, choose a delivery speed. Remitly offers two main options:

| Feature | Economy | Express |

|---|---|---|

| Fees | Lower fees, better exchange rate | Slightly higher fees |

| Arrival Time | Usually 3-5 business days | As fast as a few minutes |

| Payment Method | Typically bank account payment | Typically debit or credit card payment |

| Best For | Non-urgent regular remittances | Urgent situations needing fast arrival |

Choosing the Receiving Method

The next critical step is selecting how your family wants to receive the money. Remitly offers multiple flexible options to suit different needs.

Important Tip: Before choosing, communicate with your recipient to ask which method is most convenient. This ensures a flawless remittance process.

Here are the main receiving methods:

- Cash Pickup: The recipient can collect cash directly at thousands of partner locations in the Philippines (such as BDO Unibank, M Lhuillier, Cebuana Lhuillier, etc.) with a valid ID and transaction reference number.

- Mobile Money: If your recipient uses GCash or Maya mobile wallets, you can send money directly to their phone account. This method is usually very fast, with funds arriving in minutes or days depending on whether you choose “Express” or “Economy.”

- Home Delivery: Ideal for recipients in remote areas or with mobility issues. Funds are delivered directly to the recipient’s doorstep by a partner courier, typically within 1 to 7 business days.

- Bank Deposit: You can deposit money directly into the recipient’s Philippine bank account. This is a very secure and common method.

Filling in Recipient Information

After selecting the receiving method, accurately enter the recipient’s information. Use the details you verified during the preparation phase.

- Enter the recipient’s full legal name (must match their ID).

- Fill in their address and phone number.

- If choosing “Bank Deposit,” enter the recipient’s bank name and account number.

Double-check all information for accuracy to avoid unnecessary delays.

Selecting Payment Method

Now it’s your turn to choose how to pay for the remittance. In the U.S., you can use the following methods:

- Bank Account

- Debit Card

- Credit Card

Different payment methods affect fees and speed. Bank account transfers are usually the cheapest option for “Economy” remittances. Using a debit card enables “Express” remittances, while credit card payments are convenient but typically incur higher fees.

Tracking Remittance Status

After submitting the remittance, your main concern is where the funds are. You can track the status anytime.

Log into your account, enter the transaction reference number on the “Track Transfer” page, and see real-time progress. Additionally, the system will automatically send updates via email and SMS, keeping you informed of each stage so you can be completely at ease.

If you encounter any issues or have questions during this process, Remitly’s customer support team is always ready to help.

Remittance Costs and Arrival Speeds

Image Source: unsplash

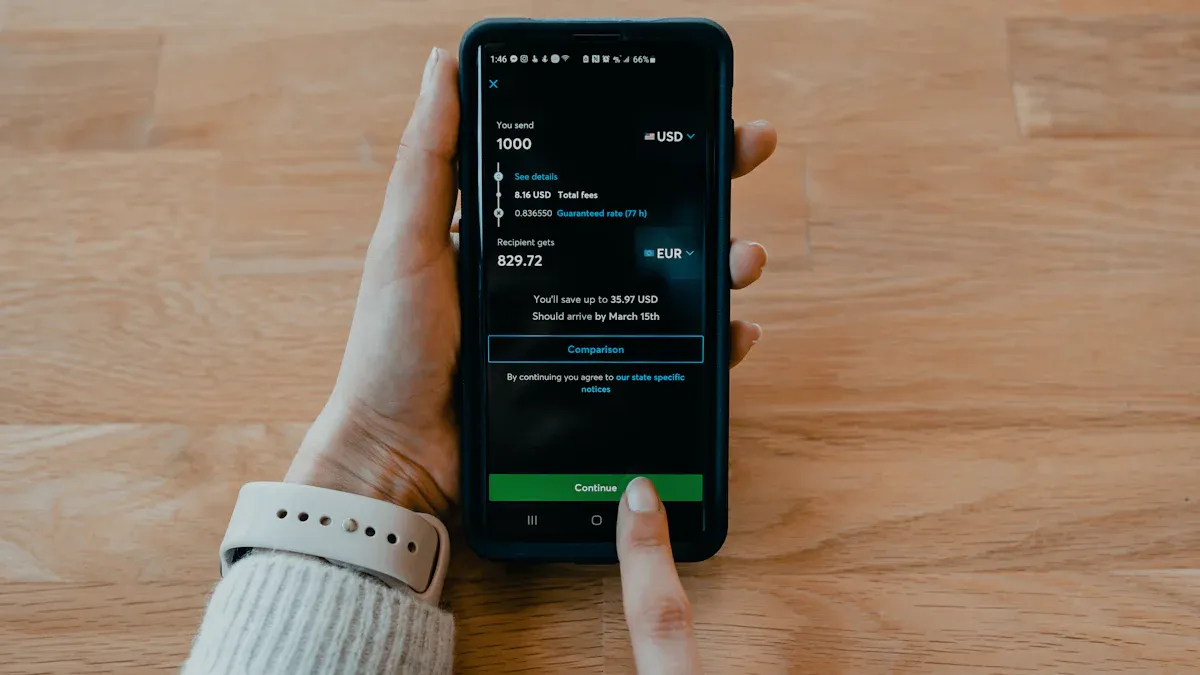

Understanding remittance costs and how quickly funds arrive helps you make the best choice. You need to balance fees, exchange rates, and timing to meet both your and the recipient’s needs.

Remitly’s Fee Structure

The total cost of a remittance mainly consists of two parts: the transfer fee and the exchange rate margin. You need to clearly understand both to accurately calculate expenses.

- Transfer Fee: This fee varies based on the chosen “delivery speed” (Economy vs. Express). Generally, Express services have higher fees, while Economy is cheaper.

- Payment Method: Your chosen payment method also affects fees. For example, using a credit card may incur up to 3% additional fees, while bank account payments are usually the lowest cost.

- Remittance Amount: In some cases, the size of the remittance affects the fee. Sometimes, when your remittance exceeds a certain amount (e.g., $1,000), the provider may waive the fee.

Fee Transparency Promise One of Remitly’s major advantages is fee transparency. Before confirming the remittance, you’ll clearly see all fees and the final amount received, with no hidden charges.

How to Get the Best Exchange Rate

The exchange rate determines how many Philippine Pesos your USD can convert into, so securing a good rate is crucial.

First, understand that exchange rates fluctuate constantly. The rate offered by providers typically adds a small markup to the mid-market rate, usually between 1% and 3.7%.

To help you get the most value, consider the following:

- Take Advantage of New Customer Promotions: If you’re a first-time user, you can often enjoy highly attractive promotional rates. For example, new customers might get 1 USD for about 58.19 PHP. This is a great money-saving opportunity.

- Choose “Economy” Service: Though slower, “Economy” remittances usually offer better exchange rates than “Express”. If your remittance isn’t urgent, this is a cost-effective choice.

- Time Your Remittance: The forex market is most active during weekdays (especially early mornings), when you’re more likely to get better rates. Weekend and holiday rates are usually less favorable. You can use the platform’s rate alert feature to get notified when the rate hits your target.

Arrival Times for Different Methods

Arrival time is one of your top concerns. This mainly depends on the chosen “delivery speed” and “receiving method.”

| Receiving Method | Express | Economy |

|---|---|---|

| Mobile Wallet (GCash/Maya) | Usually within minutes, nearly instant. | 3-5 business days |

| Cash Pickup | Funds usually available for pickup within hours or 24 hours. | 3-5 business days |

| Bank Deposit | As fast as minutes, depending on the receiving bank’s processing. | 3-5 business days |

| Home Delivery | Not supported for Express | 1-7 business days, depending on the address. |

Tip: Choosing “Express” service and sending to GCash or similar mobile wallets is one of the fastest arrival methods, ideal for emergencies. For cash pickup, while funds arrive quickly, the recipient still needs to account for travel time to the pickup location.

Now you’ve seen that sending USD to the Philippines is actually very straightforward. You have multiple receiving options, from cash pickup to GCash, with clear fee structures and fast arrival speeds. High user ratings also prove its convenience.

Platform Rating (out of 5 stars) Apple App Store 4.8 Google Play 4.6

This guide has provided all the necessary steps. Now that you’ve mastered all the key information, go ahead and send some love to your loved ones far away!

FAQ

How can I increase my remittance limit?

You can apply to increase your remittance limit. Remitly will request additional information based on your needs, such as your full Social Security Number (SSN). Once verified, your limit will be raised.

Can I cancel a remittance if I entered wrong information?

Yes. As long as the recipient hasn’t collected the funds, you can cancel the remittance. Simply log into your account, find the transaction, and select cancel. The amount and fees will be refunded to your payment account.

What documents does the recipient need to pick up cash?

Your recipient needs to present a valid government-issued photo ID. Ensure the name on the ID exactly matches the recipient name you entered to ensure smooth pickup.

Does Remitly have hidden fees?

No. Remitly promises fee transparency. Before confirming the remittance, you’ll see all details, including fees and exchange rates. What you pay is the final cost, with no hidden charges.

Through this Remitly guide’s thorough breakdown, we’ve grasped the flexibility of its Economy/Express services and transparent fees, effectively countering traditional remittance woes like 1%-3.7% rate markups, info verification delays, and 3-5 day waits—tailored for urgent family aid or routine deposits to the Philippines. However, for USD-to-PHP conversions broadening to global multi-currency swaps, digital asset links, or higher-volume sends, a more versatile, low-rate platform amplifies ease, evading Remitly’s initial caps and 3% card extras. BiyaPay, the cross-border payment trailblazer, delivers real-time exchange rate queries and conversions for over 30 fiat currencies and 200+ cryptocurrencies, securing optimal mid-market rates like the current USD/PHP around 58.20, devoid of any hidden surcharges.

Simply register instantly to harness remittance fees as low as 0.5%, spanning most countries worldwide with same-day arrivals. This outpaces Remitly’s cash pickup needs and weekend rate dips, empowered by end-to-end encryption, multi-factor authentication, and live tracking for secure delivery to GCash or bank accounts. Whether navigating Philippine CPF requirements or sudden market shifts, BiyaPay’s worldwide web maximizes your PHP yield and streamlines multi-tool juggling.

Ignite action right away! Visit the real-time exchange rate query to monitor live USD/PHP trends and initiate your free account. Embrace BiyaPay and enter a streamlined, clear-cut era of international remittances where every dollar-to-peso shift is spot-on and streamlined.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Top 10 U.S. Tech Stocks Most Worth Owning in 2025 Recommended by UBS and Citi

Weekly US Stock Index Futures Review and Outlook: What Investors Should Focus On

Overcoming Human Weaknesses: Detailed Guide to Beginner-Friendly Automated US Stock Trading Strategies

Best Free Real-Time US Stock Quote Websites Besides Yahoo Finance

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.