Exploring the MoneyGram App: Instant Remittances, Exchange Rate Queries, and Reward Features

Image Source: unsplash

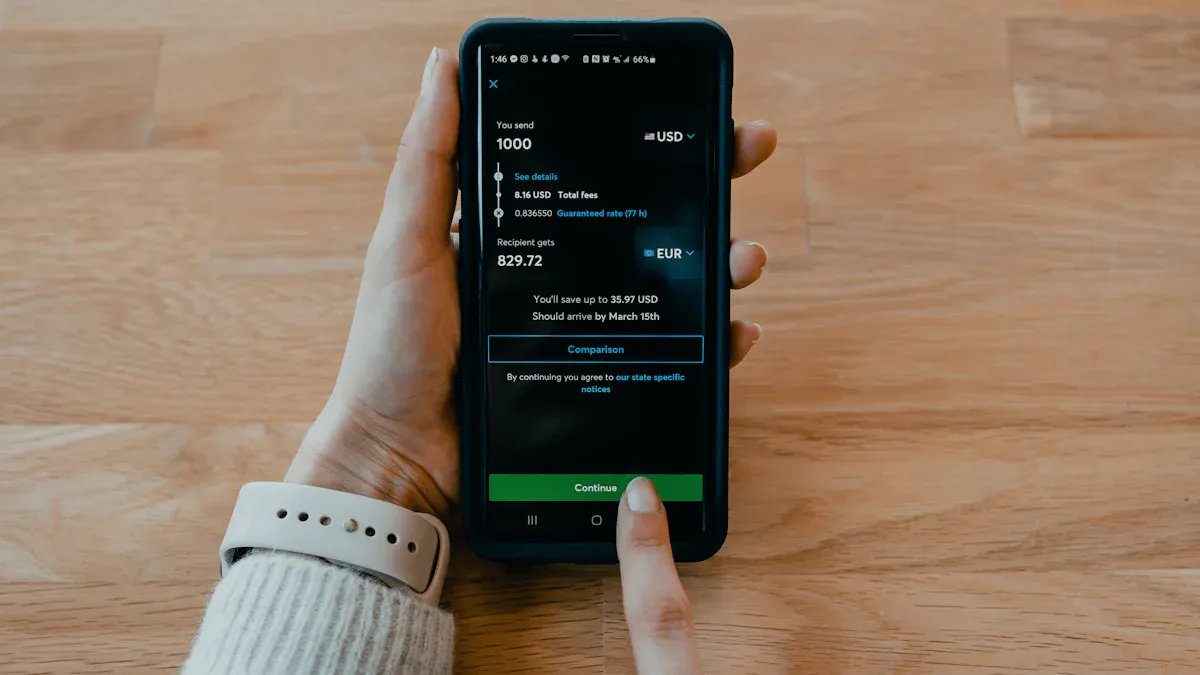

You can easily complete cross-border fund transfers through the MoneyGram app. No matter where you are, the app can help you achieve instant remittance, meeting family support or personal needs.

- MoneyGram supports remittances to over 200 countries and regions.

You can also check real-time exchange rates at any time to ensure every transaction is open and transparent. The reward features allow you to gain more benefits during the remittance process, enhancing the overall experience. The app focuses on speed, security, and convenience, making your global transfers simple and reliable.

Key Highlights

- The MoneyGram app supports instant remittances to over 200 countries and regions, facilitating cross-border fund transfers for users.

- Users can check real-time exchange rates at any time, ensuring transparency and accuracy in every transaction, avoiding losses due to exchange rate fluctuations.

- After registering for the MoneyGram Plus Rewards program, users can earn points and discounts through remittances, enhancing the overall experience.

- The app interface is simple and intuitive, allowing users to easily navigate, quickly complete remittances, check exchange rates, and manage transactions.

- MoneyGram prioritizes transaction security, implementing multiple safety measures to protect users’ funds and personal information.

App Overview

Main Uses

You can perform various cross-border financial operations through the MoneyGram app. The app supports over 200 countries and regions globally, with extensive coverage. You can easily complete fund transfers in the U.S. market, whether for personal remittances or family support. The table below shows MoneyGram’s global service coverage:

| Number of Countries and Regions | Description |

|---|---|

| 200+ | MoneyGram operates in over 200 countries and regions, providing cross-border payment services. |

You can use MoneyGram for the following operations:

- Conduct cash and cryptocurrency transactions through wallets supporting MoneyGram Ramps.

- Convert cash to USDC (USD stablecoin) at participating MoneyGram locations.

- Convert USDC back to cash, flexibly managing personal funds.

The app also provides real-time exchange rate inquiries and reward-earning features to help you make informed remittance decisions. You can stay updated with the latest exchange rates, ensuring every transaction is open and transparent. The reward system allows you to earn points or coupons during remittances, enhancing the overall experience.

Target Audience

The MoneyGram app is suitable for various user groups. If you are an expatriate living abroad and need to send money to mainland China or other regions, you can choose MoneyGram. Members of immigrant communities often use the app to support family members conveniently and quickly. Travelers can also manage expenses during international travel through MoneyGram, enabling flexible fund movement.

- Expatriates: Living abroad and sending money to their home country.

- Immigrant communities: Supporting family members after migration.

- Travelers: Managing personal expenses during international travel.

You can choose the MoneyGram app based on your needs, whether for daily remittances or special scenarios, enjoying a secure and convenient service experience. The app’s diverse features meet the cross-border financial needs of different users, helping you easily tackle global fund movement challenges.

Instant Remittance

Image Source: unsplash

Remittance Process

You can easily complete instant remittances through the MoneyGram app. The entire process is highly intuitive, requiring no complex operations. You only need to follow these steps:

- Download the MoneyGram online remittance app from Google Play or the App Store.

- Create a profile or log into your account. If you are a new user, you need to fill in detailed information and complete identity verification.

- Enter the recipient’s details and the amount you want to send.

- Choose the payment and receipt methods.

- Carefully review all information and send the remittance after confirming accuracy.

This process allows you to quickly complete cross-border fund transfers in the U.S. market or other countries. You can initiate instant remittances anytime, anywhere, meeting family support or personal needs.

Coverage

The MoneyGram app supports instant remittance services to over 200 countries and regions worldwide. You can choose different currencies based on the recipient’s location. The app automatically displays available currencies based on the country, making it easy for you to choose. Common receipt methods include:

- Direct remittance to bank accounts (e.g., licensed bank accounts in Hong Kong)

- Sending to mobile wallets

- Cash pickup (available at MoneyGram agent locations)

You can choose the most suitable method based on the recipient’s situation. Whether you need to send money to mainland China, the U.S. market, or other regions, MoneyGram offers diverse options.

Speed and Security

When you use the MoneyGram app for instant remittances, the funds arrive very quickly. In most cases, if you pay with a debit or credit card, the funds typically arrive within minutes. If you choose a bank account transfer, it may take 3-5 business days. The cash pickup method is also highly efficient, with recipients usually able to collect funds within minutes at any MoneyGram agent location.

MoneyGram places a high priority on transaction security. The app employs multiple safety measures to protect your funds and personal information. Key measures include:

| Security Measures | Description |

|---|---|

| Data Encryption | Every transaction is encrypted to ensure the security of customer data. |

| Identity Verification | Customers must provide valid identification and answer security questions before completing a transfer. |

| Compliance | Adheres to international regulatory standards, including Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols. |

Additionally, MoneyGram does not store your credit or debit card information. Every instant remittance requires valid identification to prevent fraud and identity theft. You can confidently use the MoneyGram app for cross-border fund transfers, enjoying an efficient and secure service experience.

Exchange Rate Inquiry

Image Source: unsplash

Real-Time Inquiry

You can check the latest exchange rates anytime within the MoneyGram app. The app automatically displays the current available exchange rates based on the remittance country and currency you select. You simply enter the amount on the remittance page, and the system instantly calculates the corresponding exchange value. This way, you can clearly see the actual cost and received amount for each transfer.

When using MoneyGram, the system uses real-time exchange rates and updates them regularly. Although the specific update frequency is not explicitly stated, this mechanism ensures you receive fair and accurate exchanges during international remittances. You don’t need to worry about outdated rates or inaccurate information, as the app automatically displays the latest data.

You can use MoneyGram’s online estimation tool to understand transfer fees and exchange rates in advance. This allows you to flexibly choose the remittance time and amount based on your needs, avoiding losses due to exchange rate fluctuations.

- MoneyGram uses real-time exchange rates, updated regularly.

- You can directly check the exchange rate for each transaction within the app.

- The online estimation tool helps you make informed decisions.

Transparency Advantage

MoneyGram places great emphasis on the transparency of exchange rate information. Before initiating a remittance, you can clearly see all fees and exchange rate details. The app displays transfer fees and exchange rates separately, making them easy to understand. You can compare the costs of different remittance methods based on this information and choose the most suitable option.

| Platform | Exchange Rate Transparency | Fee Structure | User Experience |

|---|---|---|---|

| MoneyGram | High | Variable | Detailed Display |

| Remitly | Very High | Clear | Simple Structure |

When using MoneyGram, the system encourages you to carefully review the fees and exchange rates for each transaction. Although fees and rates vary based on the country, currency, and amount, the app always maintains transparent information. In comparison, Remitly is noted for its clear and transparent fee structure, which may be more advantageous in some scenarios.

Through the MoneyGram app, you can stay informed about exchange rates and fee changes, ensuring every remittance is open and transparent. This allows you to confidently make decisions when sending money to the U.S. market or mainland China, avoiding unnecessary costs.

Reward Features

Reward Types

When using the MoneyGram app, you can earn various rewards by registering for the MoneyGram Plus Rewards® program. Reward types mainly include points and coupons. Points can be accumulated with each remittance, while coupons offer discounts on transfer fees. You can also enjoy personalized rewards and exclusive offers. These rewards make cross-border remittances more cost-effective, enhancing the overall experience.

- After registering for the MoneyGram Plus Rewards® program, you can earn points.

- You can receive discount coupons for transfer fees.

- You have the opportunity to enjoy personalized rewards and exclusive offers.

How to Earn

You simply need to register for the MoneyGram Plus Rewards program to start earning rewards. Each remittance through the app earns you points. After your first registration, you receive a 20% discount on your next transfer fee. You continue to accumulate points with eligible transactions, which can be used for future transfer discounts. If you complete 5 transfers within 12 months, you upgrade to premium membership, enjoying a 40% discount on every 5th transfer. You also receive a welcome gift and exclusive offers.

- Register for the MoneyGram Plus Rewards program to start your reward journey.

- Earn points with every remittance.

- Receive a 20% transfer fee discount after first registration.

- Complete 5 transfers within 12 months to upgrade to premium membership for higher discounts.

- Receive personalized rewards and exclusive offers.

After joining MoneyGram Plus Rewards, you earn rewards with every fund transfer, and you receive a welcome gift upon registration.

Redemption Process

When redeeming rewards, no promotional code is required. The system automatically applies your rewards to the next eligible transaction. If you have other promotional codes, you can use them simultaneously, and the reward discounts will automatically stack on your next transaction. You can check your reward balance and available offers within the app, making the redemption process simple and efficient.

| Question | Answer |

|---|---|

| Do I need a promotional code to receive reward discounts? | No, rewards are automatically applied to the next eligible transaction. |

| What happens to my reward discounts if I use other MoneyGram promotional codes? | You can use promotional codes, and reward discounts will be applied to the next transaction. |

You can check reward details in the app at any time, ensuring every remittance enjoys the deserved benefits. This way, when sending money to the U.S. market or mainland China, you can easily earn rewards and reduce transfer costs.

User Experience

Operational Convenience

When using the MoneyGram app, you can experience its clean and intuitive design. The app interface is clearly laid out, with all features easily accessible. You can quickly find main functions like remittance, exchange rate inquiries, and rewards without complex operations.

- The app adopts a clean and simple design, ensuring easy navigation.

- The intuitive layout guides you through each step, reducing the chance of errors.

- All options are clearly labeled, with a simplified process, making it suitable for quick and secure fund transfers.

- The app supports a multilingual interface, improving accessibility for different users.

- You can track transfer progress in real-time, staying updated on fund status.

The table below summarizes common usability features of the MoneyGram app, helping you better understand its advantages:

| Feature | Description |

|---|---|

| Control | Funds are held in stable USD, protecting recipients from local currency depreciation. |

| Flexibility | Recipients can freely manage funds and withdraw cash at MoneyGram retail locations. |

| Security | Built on years of compliance and global trust, ensuring fund safety. |

| Instant | Funds arrive in seconds, leveraging blockchain and global networks. |

| Transparency | Transactions are fully trackable, with recipients receiving real-time notifications. |

| Personalization | You can add personalized messages via the app, SMS, or other methods. |

| Inclusivity | Only a smartphone is needed, no bank account required. |

Transaction Management

You can easily manage all transactions in the MoneyGram app. After completing a transfer, the system generates a unique reference number. You can use this number to check the transfer status in real-time on the app or website, ensuring funds arrive safely.

- MoneyGram provides an easy-to-use tracking system to monitor every transfer in real-time.

- You only need to enter the reference number, sender’s last name and birth date, and recipient’s name to check the status.

- If you have a MoneyGram account, you can view all transaction history in the dashboard or “Recent Activity” after logging in.

When managing transactions, you may encounter common issues, such as technical glitches, rejected transactions, or failed recurring transfers. Common questions include:

- Why did my recurring transfer fail?

- Why was my bank card rejected?

If you encounter these issues, you can first check if the account information was entered correctly or contact MoneyGram customer service for assistance. The app’s help center also provides detailed operational guides and FAQs. This way, you can efficiently and securely manage every cross-border remittance, enjoying a smooth experience in the U.S. market or mainland China.

You can quickly complete cross-border remittances through the MoneyGram app, enjoying an efficient and secure service experience. The table below highlights MoneyGram’s key advantages in speed, security, and user experience:

| Advantage | Description |

|---|---|

| Speed | A vast agent network enables faster cash pickups. |

| Security | Online and in-person verification ensures compliance with legal requirements. |

| User Experience | Multiple withdrawal methods and a user-friendly mobile app. |

You can send funds to up to five recipients at once, track transfer status anytime, and set up recurring payment plans. First-time users can also enjoy a USD fee discount, easily experiencing the reward features. The MoneyGram app meets your remittance and reward needs in the U.S. market and mainland China.

FAQ

How do I register for a MoneyGram app account?

You can download the app from Google Play or the App Store. After opening it, follow the prompts to fill in personal information and complete identity verification. The registration process is simple and takes just a few minutes.

What receipt methods can I choose for remittances?

You can choose to send to licensed bank accounts in Hong Kong, mobile wallets, or cash pickups. The system automatically displays available options based on the recipient’s country.

How much is the service fee for remittances?

Service fees vary based on the remittance amount, country, and receipt method. You can view the USD fees for each transaction in real-time within the app, with clear and transparent fee details.

How do I ensure my funds are secure?

MoneyGram uses data encryption and identity verification measures. Each remittance requires identity verification, and the system adheres to international compliance standards to ensure the safety of funds and information.

How do I contact customer service if I encounter issues?

You can access the help center within the app to find FAQs. For human assistance, you can use the in-app online customer service or contact the customer service phone line for support.

MoneyGram app enables instant transfers (minutes) to 200+ countries, real-time rates, and Plus Rewards points (20% off signup, 40% on 5th transfer) for better experience, but variable fees ($1.99+) and markups inflate costs, especially in 2025’s $80+ trillion remittance market, where USDC conversions and regional limits create hurdles. For a lower-cost, seamless alternative, explore BiyaPay. With transfer fees as low as 0.5%, BiyaPay outperforms MoneyGram, maximizing recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex verifications needed. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current USD rates , optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Like a Snowball: Let Shanghai Stock Market Index Make Your Money Work for You

Stop Relying Only on the Shanghai Composite: How the Shenzhen Component and ChiNext Indices Reveal New A-Share Opportunities

Volume-Price Rising Together or Diverging? Complete A-Share Practical Trading Strategy Guide

How to Wire Transfer USD from Industrial and Commercial Bank of China to OCBC Singapore? This Guide is All You Need

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.