Shocking! The App That Transfers USD to CNY in as Fast as One Minute Is Actually This One

Image Source: unsplash

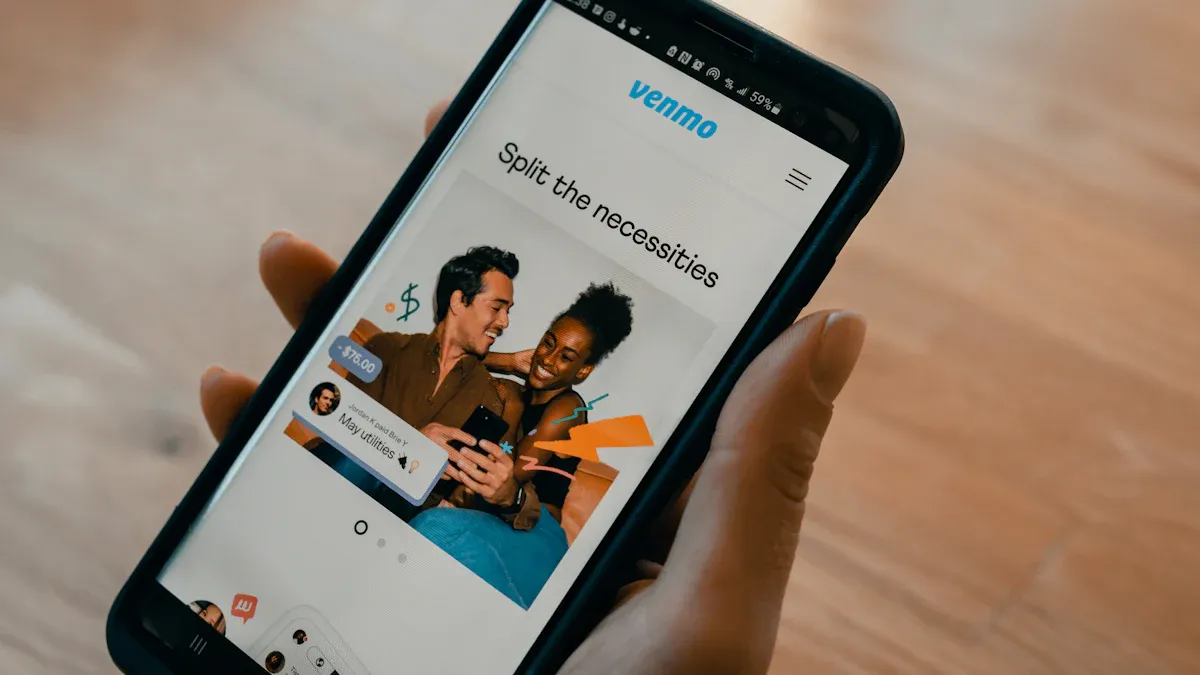

If you want to experience USD to CNY transfers that arrive in as fast as one minute, the answer is Xoom. As PayPal’s dedicated remittance service, its speed performance is truly outstanding. However, does lightning-fast arrival mean it’s your only choice? Understanding its differences with popular apps like Remitly and Wise can help you make a smarter decision.

Key Points

- Xoom is PayPal’s remittance service and can transfer USD to a CNY account in as little as one minute.

- Xoom partners with Tencent to send money directly to WeChat Pay wallets or linked bank cards, making it extremely fast.

- Remitly and Wise are also excellent options: Remitly offers both Express and Economy modes, while Wise is renowned for transparent exchange rates.

- When choosing a remittance app, consider not only speed but also fees, exchange rates, security, and receiving methods.

- Prepare accurate recipient information and select the correct remittance purpose in advance to avoid delays.

Speed Showdown: Who Is the True Minute-Level Champion?

Image Source: unsplash

When your family or business partner urgently needs funds, transfer speed is everything. You may wonder which of these apps claiming “fast arrival” can truly deliver “minute-level” performance. Let’s dive deep and uncover the truth behind the speed.

Speed King: How Xoom Achieves One-Minute Arrival

Xoom didn’t become the speed champion by accident. Its core advantage lies in powerful technical integration and strategic partnerships.

Xoom collaborates with Tencent’s cross-border payment platform, creating a highly efficient fund channel. This partnership allows money to be sent directly to the recipient’s WeChat Pay wallet or linked bank card. By bypassing the complex clearing process of traditional banks, fund processing speed is dramatically improved. Under ideal conditions, once the transfer instruction is sent, funds can arrive in just a few minutes.

However, “one-minute arrival” is not unconditional.

Note: Lightning-fast arrival is usually affected by the following factors:

- Account Verification & Limits: Xoom sets different transfer limits based on your verification level (Level 1, 2, or 3). For example, Level 1 accounts typically have a 24-hour limit of $2,999](https://wise.com/us/blog/xoom-transfer-limit). First-time or large-amount transfers may trigger additional compliance reviews, extending arrival time.

- Recipient Information: Ensure all recipient details are 100% accurate; any error can cause delays or failure.

- Service Hours: Although the system runs 24/7, transfers may still be affected by partner bank working hours or mainland China holidays.

Strong Contenders: Remitly and Wise Speed Performance

Although Xoom leads in speed, Remitly and Wise are powerful competitors that offer different balances between speed and cost.

- Remitly: Flexible Speed Options Remitly provides two modes: Express and Economy. For maximum speed, using a debit card with Express mode can deliver funds to the recipient’s Alipay or WeChat account in minutes to a few hours. While slightly slower than Xoom’s ideal “one minute,” it’s still fast enough for most urgent cases. Choosing Economy reduces fees but extends arrival to 3–5 business days.

- Wise: The Model of Stable Transparency Wise’s core selling point is not extreme speed but transparent and stable exchange rates. Wise transfers typically take a few hours to 1–2 business days. It doesn’t promise “minute-level” arrival, but its estimated time is highly accurate—you’ll know exactly when funds will arrive before sending. For users who plan ahead and are cost-sensitive, Wise is very reliable.

Real-World Test: Side-by-Side Speed Comparison

To give you a clear view, we’ve compiled a real speed comparison table based on user feedback and official information.

| App | Best Case (Ideal Speed) | Average Speed (Business Days) | Weekend/Holiday Performance | Key Influencing Factors |

|---|---|---|---|---|

| Xoom | Within minutes | 5–30 minutes | Possible delays | Account verification level, amount, compliance review |

| Remitly (Express) | Within minutes | 30 min – 3 hours | Possible delays | Payment method (debit card fastest), receiving method |

| Wise | ~2–4 hours | 4 hours – 1 business day | Processed on next business day | Bank processing speed, first-time recipient |

Many users are amazed by Xoom’s speed. As one user shared on social media:

“First time using Xoom, just wanted to try it. The moment I clicked ‘Confirm’, took a sip of water, and my mom said on WeChat the money had arrived! The whole process was under two minutes—unbelievably fast.”

In summary, if speed is your top priority, Xoom is currently the market leader. But if you need a balance between speed, cost, and ease of use, Remitly and Wise are equally deserve serious consideration.

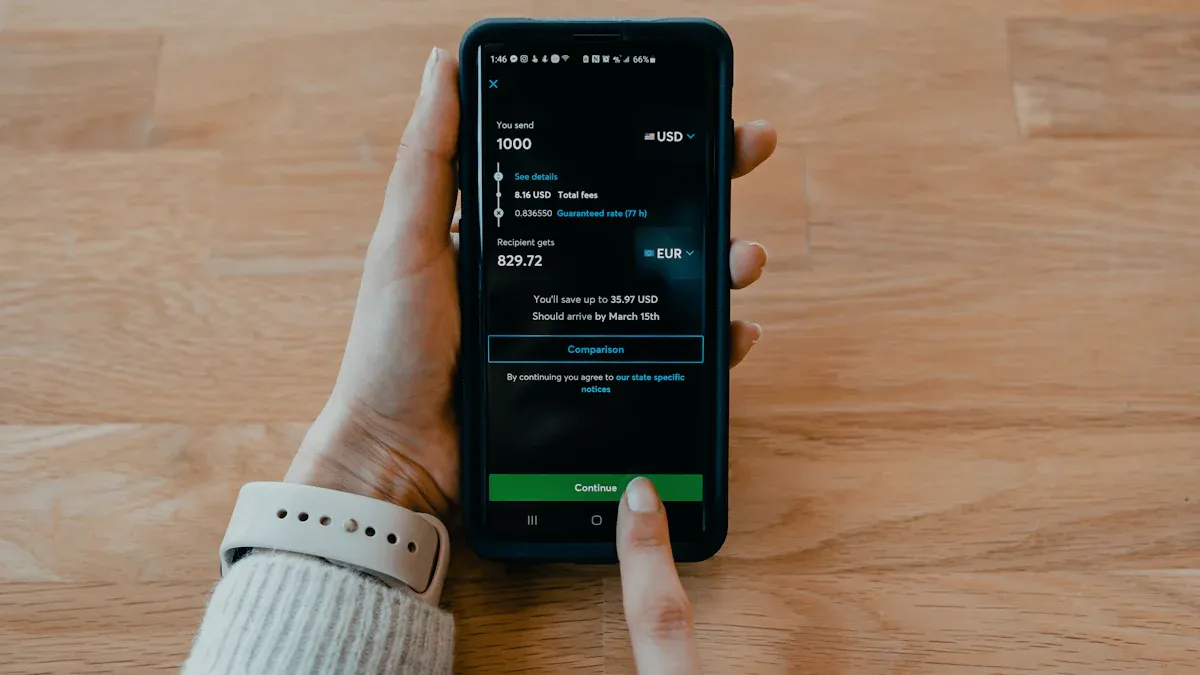

Comprehensive Comparison: How to Choose the Best USD to CNY App?

Image Source: unsplash

Speed matters, but a successful transfer also involves fees, security, and convenience. Whether an app truly suits you requires evaluating all these aspects. Below, we deeply analyze the major mainstream apps to help you find the “best choice.”

Fees & Exchange Rates: Who Saves the Most and Is Most Transparent?

When sending USD to CNY, your actual cost consists of two parts: handling fees and exchange rate spread. Some apps advertise “zero fees” but hide profits in the rate. Transparency is key to saving money.

- Wise excels here. It openly uses the mid-market exchange rate—the real rate you see on Google. Wise does not add profit to the rate and instead charges a small, transparent service fee starting from 0.57%, with possible discounts for larger amounts](https://wise.com/gb/pricing/send-money). This model is fair and clear.

- Xoom and some others differ. They may offer seemingly low fixed fees, but their rates are usually below the mid-market rate, meaning they profit from the spread—a “hidden cost” you might not notice.

Tip: When comparing apps, don’t just look at fees. Focus on “how much CNY the recipient actually receives”—this figure already includes all fees and exchange conversion and is the true cost.

Here’s a clear comparison table:

| App | Fee Structure | Rate Characteristics | Advantages | Disadvantages |

|---|---|---|---|---|

| Wise | Transparent % fee + small fixed fee | Mid-market rate | Fair, transparent, no hidden fees | Fee varies with amount, less competitive for very small transfers |

| Xoom | Fixed fee (depends on amount & payment) | Contains markup | Simple fee structure, good for small transfers | Non-transparent rate, hidden costs |

| Remitly | Express (higher) vs Economy (lower) | Contains markup | Flexible options, balance speed & cost | Rate has markup |

| Panda Remit | Usually fixed fee, frequent promotions | Contains markup | Chinese-friendly interface, often fee-free promotions | Average rate transparency |

| Western Union | Variable fee, different online vs offline | Usually high markup | Long-established brand, many offline locations | Usually least cost-effective |

Security & Compliance: How Is Your Money Protected?

Entrusting hard-earned money to an app means security is non-negotiable. Fortunately, all mainstream remittance apps are strictly regulated and use multiple layers of technology to protect funds.

- Xoom benefits directly from PayPal’s robust security and compliance framework. In the US, its money transmission is provided by PayPal, Inc. under nationwide multistate licensing (#910457)](https://www.xoom.com/legal) and holds money transmitter licenses in nearly every state, including Arizona, Maryland, and Pennsylvania](https://www.paypal.com/us/webapps/mpp/licenses). Every operation is under strict financial oversight.

- Remitly invests heavily in security with:

- Bank-grade encryption: 256-bit SSL encryption protects personal and financial data.

- Smart fraud detection: 24/7 monitoring using automation and machine learning.

- Strict identity verification: Multi-factor authentication and rigorous KYC processes.

- Wise uses a unique safeguarding model. It is not a bank, so funds are not FDIC-insured (unless you use its interest feature). Instead, it protects money through Safeguarding:

- Fund segregation: Your money is completely separated from Wise’s operational funds.

- Low-risk holdings: Funds held in reputable banks or invested in highly liquid government bonds.

- Global regulation: Supervised by FCA (UK), FinCEN (US), and other authorities worldwide.

In short, all these platforms are very safe. You can confidently use them for USD to CNY transfers.

Convenience Comparison: Which Receiving Methods Are Supported?

The last mile—how the recipient gets the money—is crucial. A good app should support mainstream mainland China receiving methods so your family and friends can receive funds easily.

The most popular methods are Alipay, WeChat Pay, and bank cards.

- Xoom: Supports direct transfer to recipient’s Alipay wallet, WeChat wallet, and most major mainland China bank cards.

- Remitly: Also supports Alipay, WeChat Pay, and bank cards with very wide coverage](https://www.remitly.com/us/en/providers-china).

- Wise: Mainly supports Alipay accounts and UnionPay bank cards.

Important Reminder: In recent years, the single-transaction limit for direct Alipay receipt has been adjusted, usually capped at 50,000 CNY. For larger amounts, choose bank card receipt—it has higher limits and equally efficient processing.

Overall, all three apps handle receiving methods very well and fully meet daily needs. Choose based on the recipient’s preferred method.

Hands-On Guide: Complete a Lightning-Fast Transfer in Three Minutes

You’ve learned the theory—now let’s go practical. Using Xoom as an example, completing a USD to CNY lightning transfer is extremely simple. Just follow these three steps.

Pre-Transfer Preparation: Required Documents Checklist

Preparing everything in advance makes the process smooth. You need:

- Your information (sender)

- Bank account, debit card, or credit card for payment.

- ID document (passport or driver’s license) for first-time registration or large transfers.

- Recipient’s information

- Recipient’s name in exact Pinyin as on ID.

- Recipient’s phone number and address.

- Account details for chosen receiving method (e.g., bank card number and bank name).

Important Tip: When sending to mainland China, you must select a remittance purpose code. China’s SAFE requires a purpose for all inbound transfers](https://www.opendue.com/blog/how-to-send-money-from-the-u-s-to-china—best-way-2025-comparison). Choosing the wrong code can cause delays or rejection—select the most accurate one, e.g., “family living expenses.”

Registration & Verification: Account Setup Process

If you don’t have an account yet, registration and verification take just minutes.

- Download & Register: Search and download the Xoom App from your app store. You can log in directly with your PayPal account to skip filling basic info.

- Fill Basic Info: Enter name, address, etc., as prompted.

- Complete Identity Verification: For security and compliance, the system may ask credit-report-related questions. If automatic verification fails, you’ll need to upload a photo of your state-issued ID or passport.

Transfer Operation: From Order Creation to Funds Arrival

Once your account is ready, the exciting part begins. The process is intuitive and fast.

- Select Destination & Amount: Log in, choose “China” as destination, enter USD amount. The app instantly shows the current rate and estimated CNY received.

- Choose Receiving Method: Select Alipay, WeChat Pay, or bank card.

- Enter Recipient Details: Accurately input the recipient info you prepared.

- Select Payment Method: Choose your funding source (bank account or card).

- Review & Confirm: Double-check all details, fees, rate, and final amount. Slide or click to confirm.

After submission, you can track status in the app—from “Processing” to “Funds Sent” in real time.

Now you clearly understand how to choose the best USD to CNY remittance app. For ultimate speed → Xoom. For transparent fees → Wise. For flexible options → Remitly.

Decision Guide:

- Speed First → Choose Xoom

- Transparent Fees → Choose Wise

- Flexible Options → Choose Remitly

Take action now—download and try the one that fits your needs:

- Xoom: Xoom Official Website

- Remitly: Remitly Official Website

- Wise: Wise Official Website

FAQ

Do I need to provide special information when sending to mainland China?

Yes, you must provide the recipient’s name in Pinyin and select a remittance purpose (e.g., “family living expenses”). This is required by China’s foreign exchange regulations to pass review smoothly.

What happens if my transfer amount is very large?

Large transfers (e.g., several thousand USD+) may trigger extra security reviews, extending arrival time. Your personal limit also depends on your account verification level in the app.

Why was my “minute-level” transfer delayed?

Common reasons:

- Incorrect recipient information

- Additional security review required

- Non-business hours or public holidays in mainland China

Is paying by credit card faster?

Not necessarily. Credit card speed is similar to debit card, but fees are usually higher and your card issuer may add cash advance fees. The most cost-effective method is usually bank account payment, though slightly slower.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US Stock Investing 101: How to Evaluate Company Value and Pick Your First Great Stock

Data-Driven Analysis: Shanghai Stock Index 2026 Earnings Growth Forecast

2025 Year-End Outlook: Can the Nasdaq Continue Its Growth Legend Amid Volatility?

Say Goodbye to Currency Exchange Hassles: In-Depth Review of the Best Channels for Converting RMB to USD

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.