Mobile Banking Wire Transfer to Hong Kong Account Guide: Recipient Information Filling Examples

Image Source: unsplash

You can now easily transfer money from mainland China to Hong Kong directly through your mobile banking app. Before starting, having a clear recipient information example is crucial.

Recipient Information Filling Example

| Field (Field) | Example (Example) |

|---|---|

| Recipient Name | Zhang San |

| Recipient Address | Flat A, 16/F, Lucky Building, 123 Nathan Road, Kowloon |

| Receiving Bank Name | Standard Chartered Bank (Hong Kong) Limited |

| SWIFT Code | SCBLHKHHXXX |

| Recipient Account Number | 12345678901 |

Many people are confused about questions like “How should the recipient address be filled when wiring to a Hong Kong account?”. The following sections will explain each field’s filling rules one by one.

Key Takeaways

- Before remittance, you need to prepare your Hong Kong bank card and recipient information.

- You have an annual foreign exchange purchase limit of USD 50,000, and the remittance amount will count toward this quota.

- When filling recipient information, the name, address, bank name, SWIFT Code, and account number must be accurate.

- Transfers usually arrive within 1–3 business days, but incorrect information will cause delays.

- Always double-check all details to avoid failed transfers or extra charges.

Pre-Transfer Preparation: Account and Quota

Before you begin, thorough preparation makes the entire process smoother. You need to confirm the following key points to ensure everything is ready.

Mainland Banks That Support Transfers

First, confirm whether your banking app supports cross-border transfers. Currently, many major mainland Chinese banks have enabled this service. You can complete the operation through their mobile banking apps.

- Industrial and Commercial Bank of China (ICBC)

- Agricultural Bank of China

- Bank of China

- China Construction Bank

- Bank of Communications

- China Merchants Bank

Prepare a Hong Kong Bank Card

You must have a local Hong Kong bank account. This account will receive the funds you send from mainland China. Make sure you have the correct bank name, account holder name, and account number.

Annual Personal Foreign Exchange Purchase Quota

Cross-border transfers involve currency conversion. According to regulations, you need to know your personal annual foreign exchange purchase quota.

According to the State Administration of Foreign Exchange (SAFE), mainland Chinese residents have an annual convenience foreign exchange purchase quota equivalent to USD 50,000.

All your cross-border transfer amounts count toward this annual total. If your transfer needs exceed this limit, you must submit additional documents to the foreign exchange authority for approval. For most personal purposes, this quota is sufficient.

Ensure Your App Is Updated

Finally, take a moment to check your mobile banking app. It is recommended to update it to the latest version. Newer versions usually offer improved features and smoother experience, helping you avoid unnecessary technical issues during the transfer.

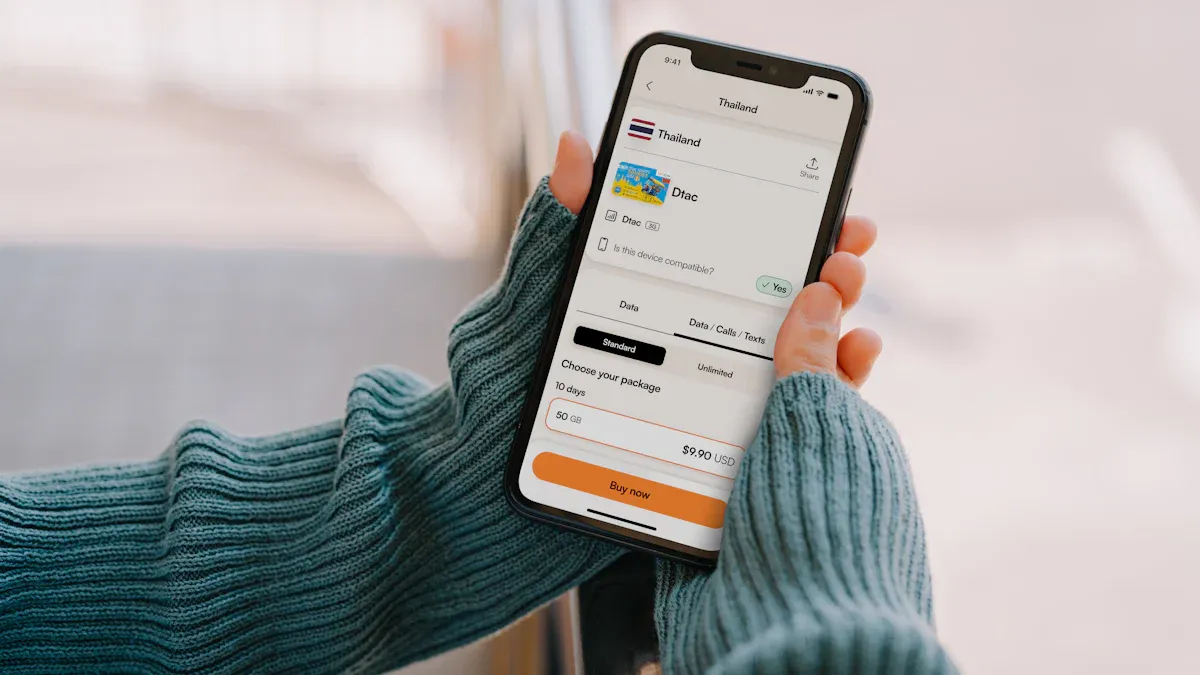

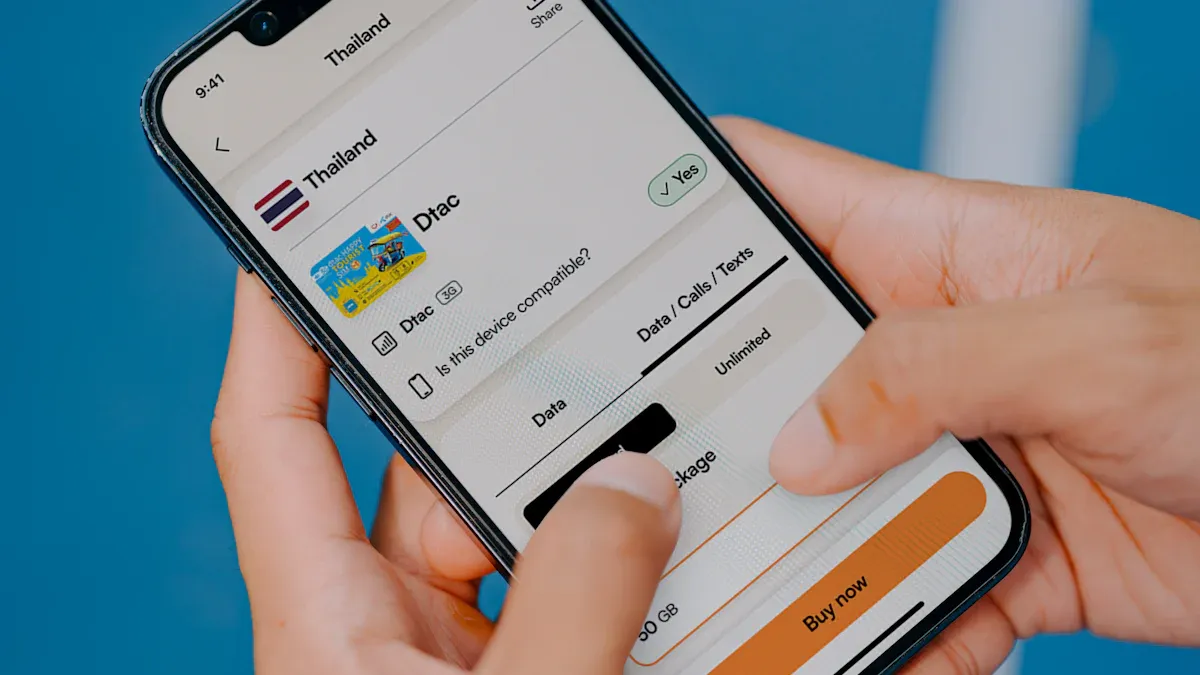

Operation Process: Step-by-Step Illustrated Guide

Image Source: unsplash

Once preparation is complete, you can start the actual operation. Although each bank’s app interface differs slightly, the core process is basically the same. This section uses mainstream banks as examples to show you the complete path from login to successful transfer.

Step 1: Find the Cross-Border Transfer Entrance

First, log into your mobile banking app. Usually, the cross-border transfer function is prominently placed.

Navigation Tips

The common entrance is on the home page or under the “Transfer” section. Look for menus labeled “Cross-border”, “Remittance”, or “Foreign Exchange”. For example, the path might be: Home → Transfer → Cross-Border Remittance.

Many apps use a globe icon to mark this function for quick access.

Step 2: Fill in Sender Information

After entering the transfer flow, the system will ask you to fill in or confirm sender information. This part is usually auto-filled from your bank account data — you just need to verify it.

Information to confirm includes:

- Name (in Pinyin)

- Last name

- First name

- Middle name (if any)

- Contact phone number

Make sure these details exactly match what you provided when opening the account.

Step 3: Fill in Recipient and Transfer Details

This is the most critical step in the entire process. You must accurately enter the recipient and current transfer details. You need to fill in the recipient name, address, receiving bank name, SWIFT Code, and account number.

You also need to fill in transfer details, including selecting the transfer currency (e.g., HKD), entering the transfer amount, and choosing a transfer purpose. Common personal purposes include “Private Travel” or “Family Support”.

Step 4: Confirm Information and Complete Payment

Before submission, the app will display a confirmation page with all entered information.

Important Reminder

Please carefully double-check every detail on the page, especially the recipient name, account number, and SWIFT Code. Even a tiny mistake can cause the transfer to fail or be delayed.

Once you confirm everything is correct, enter your payment password or SMS verification code to complete the final payment step. After successful submission, you will receive a notification from the bank.

Transfer Costs: Fees and Arrival Time

After submitting the transfer request, the most concerning issues are fees and arrival time. Understanding these details helps you choose the most cost-effective method and plan your funds properly.

Handling Fee and Telegraph Fee Structure

Cross-border transfer costs usually consist of two parts: handling fee and telegraph fee. The handling fee is the service charge for processing your request, while the telegraph fee covers the cost of sending messages through the SWIFT international network.

Fees vary widely depending on the bank and channel. Generally, online channels like mobile banking are much cheaper than visiting a branch counter.

Fee Comparison Example (Bank of China channels)

Channel Fee per Transaction (Personal) Mobile Banking/Electronic HKD 65 Branch Counter HKD 260

Additionally, if the transfer route involves intermediary banks, extra correspondent bank fees may apply.

Fee Reduction Strategies (BOC Hong Kong)

Some banks offer fee discounts for specific transfer paths. You can proactively check and take advantage of them.

Money-Saving Tip

If you are transferring from a mainland Bank of China account to a Hong Kong Bank of China account, consider using the “BOC Remittance Express” service. Through mobile banking and other electronic channels, personal customers can usually enjoy fee waiver, saving you a considerable amount.

Before transferring, check the bank’s latest fee schedule or consult customer service to find the most economical option.

Expected Arrival Time

Under normal circumstances, funds transferred to Hong Kong are expected to arrive within 1–3 business days. However, actual timing may vary due to several factors. Pay attention to situations that may cause delays:

- Bank Processing Time: Transfers submitted after the bank’s daily cut-off time or on holidays will be processed on the next business day.

- Compliance Review: Banks conduct anti-money laundering (AML) and other compliance checks, which may extend processing time.

- Incorrect Information: Errors in recipient name, address, or account number will directly cause failure or delay.

Understanding “Cross-Border Wealth Management Connect”

You may have heard of “Cross-Border Wealth Management Connect,” but note that it is fundamentally different from ordinary personal transfers.

“Cross-Border Wealth Management Connect” is a cross-border investment channel designed specifically for Greater Bay Area residents. It operates under a closed-loop system — funds can only be used to purchase designated wealth management products, and investment returns must be repatriated through the same channel. It has its own individual investment quota (e.g., RMB 3 million), and investors must meet specific requirements, such as having more than two years of investment experience.

In short, if you simply want to send living expenses or travel money to Hong Kong, use the ordinary cross-border transfer function described above, not “Cross-Border Wealth Management Connect”.

Recipient Information Filling: Detailed Explanation Examples

Image Source: pexels

Filling recipient information is the step most prone to errors in the entire transfer process. A tiny mistake can cause the transfer to fail or be delayed for a long time. This section breaks down the filling rules for each field in detail and provides clear examples to ensure you succeed on your first attempt.

Recipient Name (Pinyin Format)

You must use the Pinyin or English name registered with the Hong Kong bank when the account was opened. Do not use Chinese characters.

- Format Requirement: Use uppercase Pinyin for both surname and given name, surname first, followed by given name, separated by one space.

- Single-Character Name: For example, if the recipient is “张三”, fill in

ZHANG SAN. - Two-Character Name: For example, if the recipient is “李小明”, fill in

LI XIAOMING.

Important Reminder

The name must exactly match the record in the receiving bank account. Before transferring, it is best to confirm the exact registered name with the recipient again.

How to Fill the Recipient Address? (English Standard)

Many users are confused about “How to fill the recipient address when wiring to a Hong Kong account?”. According to bank regulations, providing a detailed recipient address is necessary to assist with compliance checks. You need to translate the Chinese address into the standard English format.

Hong Kong English addresses follow the order from small to large: Flat/Room → Floor → Building → Street Number → District.

Address Filling Example

- Chinese Address: 九龙,弥敦道123号,幸运大厦,16楼,A室

- English Filling:

Flat A, 16/F, Lucky Building, 123 Nathan Road, Kowloon

To solve the puzzle of “How to fill the recipient address when wiring to a Hong Kong account?”, you can directly use the address registered when opening the account or any mailing address that can receive letters. As long as you master the English address writing order above, the question of how to fill the recipient address when wiring to a Hong Kong account will be easily resolved. Remember, a clear address effectively avoids unnecessary trouble, so don’t worry anymore about how to fill the recipient address when wiring to a Hong Kong account. Accuracy is key — it allows the bank to process your transfer quickly. Once you understand this, you’ll know exactly how to fill the recipient address when wiring to a Hong Kong account.

Receiving Bank Name and SWIFT Code

The receiving bank name must be the full official English name. More importantly is the SWIFT Code (Bank Identifier Code) — it is the bank’s unique “ID” in the international network.

A correct SWIFT Code ensures your funds are accurately routed to the destination bank. If filled incorrectly, the transfer cannot be completed.

| Field (Field) | Example (HSBC as example) |

|---|---|

| Receiving Bank Name | The Hongkong and Shanghai Banking Corporation Limited |

| SWIFT Code | HSBCHKHHXXX |

Knowledge Extension:SWIFT Code vs. Hong Kong Local Bank Code

You may have also heard of “bank code”, e.g., HSBC is

004. This is the code used by Hong Kong’s local clearing system and only applies to local HK transfers. For cross-border transfers from mainland China to Hong Kong, you must use the internationally recognized SWIFT Code.

Recipient Account Number or FPS ID

You need to fill in the complete receiving bank account number. Hong Kong bank accounts usually consist of several parts.

- Account Structure: Generally includes a 3-digit bank code, 3-digit branch code, and 6–9-digit personal account number.

- Filling Method: In mobile banking apps, you usually just enter one long string of digits without separators. For example, HSBC account

004-123-456789-001may need to be entered as004123456789001or123456789001(follow the app prompts).

Modern Receiving Method:FPS (Faster Payment System ID)

If the recipient has activated Hong Kong’s “FPS” (Faster Payment System), you can also use their FPS ID (a 7- or 9-digit number), mobile number, or email address for the transfer. This method is usually faster, with near-instant arrival. However, not all mainland bank apps support FPS ID transfers — confirm before use.

Examples for Different Banks (HSBC vs Standard Chartered)

To help you understand more intuitively, here are complete recipient information templates for the two most common Hong Kong banks — HSBC and Standard Chartered.

Example 1: Transfer to Hong Kong HSBC

| Field | Content |

|---|---|

| Recipient Name | Zhang San |

| Recipient Address | Flat A, 1/F, HSBC Main Building, 1 Queen’s Road Central, Central |

| Receiving Bank Name | The Hongkong and Shanghai Banking Corporation Limited |

| SWIFT Code | HSBCHKHHXXX |

| Recipient Account Number | 123456789001 (please enter your full 12-digit account) |

Example 2: Transfer to Hong KongStandard Chartered

| Field | Content |

|---|---|

| Recipient Name | Li Si |

| Recipient Address | Room B, 2/F, Standard Chartered Bank Building, 4 Des Voeux Road Central, Central |

| Receiving Bank Name | Standard Chartered Bank (Hong Kong) Limited |

| SWIFT Code | SCBLHKHHXXX |

| Recipient Account Number | 12345678901 (please enter your full account) |

Tip

In addition to traditional bank channels, some digital payment platforms on the market may simplify the information filling process through integrated systems. But regardless of the channel, verifying information accuracy is always the top priority.

You have now mastered the complete process of mobile banking transfers to Hong Kong. The entire operation can be summarized in three core steps: prepare and verify information, accurately fill the form, and finally confirm payment.

Always double-check the recipient name, account number, and SWIFT Code. Wrong name or account number is the most common reason for failed transfers. Once funds are sent, the recall process is complicated and not guaranteed to succeed, so pre-check is essential.

We hope this guide gives you confidence. Bookmark this article — next time you need it, just follow the steps and you can easily complete your first transfer to Hong Kong.

FAQ

What if I accidentally filled in the wrong recipient information?

You should immediately contact your sending bank. The customer service team will guide you through the next steps.

Emergency Handling

If the funds have not yet been sent, the bank may be able to intercept the transaction. If already sent, the recall process is very complicated and may incur additional fees. Always double-check before sending.

Why was my transfer application rejected by the bank?

Transfers are rejected usually for a few reasons. Check if any of the following apply:

- Recipient name or account does not match bank records.

- Your annual foreign exchange purchase quota is already used up.

- The stated transfer purpose is unclear or not accepted by the bank.

Can I make a transfer on weekends or holidays?

You can submit a transfer application anytime via mobile banking. However, banks only process and execute cross-border transfers on business days. Applications submitted on non-business days will be deferred to the next business day.

Is there a limit on single transfer amount?

In addition to the annual USD 50,000 quota, some banks may also set a maximum limit per transaction. This limit varies by bank. Pay attention to the app prompts during transfer or consult customer service.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US Stock Investing 101: How to Evaluate Company Value and Pick Your First Great Stock

US Index ETF Investing 2025: From Beginner to Pro – Strategies and Top Recommendations

Beginner’s Guide: Easily Understand the Shanghai Composite Index and Its Investment Value

From the Frenzy at 6124 Points to the Darkness Before Dawn: Memory Fragments of China's Shanghai A-Shares

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.