BITU Stock Analysis for Investors in 2025

Image Source: unsplash

BITU stands out as a compelling option for investors seeking high returns in 2025. The bitu stock delivered a 1-year return of 160.01% with a monthly dividend yield of 6.10%, outperforming many leveraged ETFs. Investors must consider bitu’s leveraged structure, which amplifies both gains and risks. Expense ratio sits at 0.95%, lower than several peers. Technical trends show strong momentum and liquidity.

BITU’s investment objective and structure provide opportunities for those comfortable with volatility and seeking enhanced yield.

Key Takeaways

- BITU is a leveraged ETF that aims to deliver twice the daily return of the Bloomberg Bitcoin Index, making it suitable for short-term traders who want amplified exposure to Bitcoin.

- The fund has shown strong past performance with a 1-year return of about 160%, but it carries high volatility and risk due to its leverage and daily reset feature.

- BITU pays monthly dividends with yields around 5% to 6%, offering regular income, but dividend amounts can vary each month.

- Investors should use BITU cautiously, applying risk management tools like stop-loss orders, and avoid holding it long term because daily compounding can cause unexpected returns.

- BITU fits experienced investors with high risk tolerance seeking tactical Bitcoin exposure, but it is not recommended for conservative or long-term investors.

BITU Overview

Structure

BITU operates as a leveraged exchange-traded fund (ETF) that aims to deliver twice the daily performance of the Bloomberg Bitcoin Index. The fund does not hold Bitcoin directly. Instead, it uses financial instruments to achieve its investment goals.

- BITU is structured as an open-ended fund.

- The fund provides 2x daily leveraged exposure to the Bloomberg Bitcoin Index.

- BITU gains exposure mainly through swap agreements with financial institutions.

- When necessary, the fund invests in cash-settled CME Bitcoin futures contracts.

- BITU holds money market instruments as collateral to support its positions.

- The leveraged exposure is managed through a wholly owned subsidiary based in the Cayman Islands.

- The fund resets its leverage daily, which means it is designed for short-term trading. Holding BITU for longer than one day can lead to returns that differ from the expected 2x performance due to the effects of daily compounding.

This structure allows BITU to offer amplified returns, but it also increases the risk of significant losses. Investors should understand how the fund operates before adding it to their portfolios.

Objective

BITU’s main objective is to provide investors with double the daily return of the Bloomberg Bitcoin Index. The fund seeks to capture the price movements of Bitcoin without requiring investors to own the cryptocurrency directly. By using swaps and futures, BITU tracks the index’s performance and magnifies both gains and losses. The daily reset feature ensures that the fund maintains its 2x leverage each trading day. This makes BITU suitable for investors who want to capitalize on short-term price swings in Bitcoin. However, the fund’s design means that it may not perform as expected over longer periods, especially in volatile markets. Investors should use BITU as a tactical tool rather than a long-term holding.

BITU Stock Performance

Image Source: pexels

Returns

BITU stock has delivered remarkable performance over the past year. Investors who held BITU saw a 1-year return of 169.5%. This figure stands out when compared to the S&P 500, which posted a 21.9% return during the same period. The table below highlights BITU’s performance against the S&P 500 across different time frames:

| Period | BITU Return | SPY (S&P 500) Return |

|---|---|---|

| 1 Year | +169.5% | +21.9% |

| Last 3 Months | +29.8% | +10.5% |

| Last 2 Weeks | +2.8% | +1.2% |

BITU’s year-to-date return in 2024 reached 37.90%. This result demonstrates the fund’s ability to capture strong price movements in the underlying Bitcoin index. Since its inception, BITU has achieved an average annual return of 59.69%. These returns reflect the fund’s leveraged structure, which amplifies both gains and losses. Investors should note that while BITU’s performance can be impressive during bullish periods, the fund may experience sharp declines during market corrections.

Note: BITU’s returns are not guaranteed and can fluctuate widely due to its leveraged exposure. Investors should monitor performance regularly and adjust their positions as needed.

Volatility

BITU’s performance comes with significant volatility. Over the past 52 weeks, the price of BITU stock ranged from a low of $18.56 to a high of $68.43. This wide range represents a price increase of about 158.83%, underscoring the fund’s sensitivity to market swings. BITU’s implied volatility stands at 75.47%, while historical volatility measures 60.70%. These figures indicate that BITU experiences larger price movements than most traditional ETFs.

The fund’s beta is 1.39, which means BITU reacts more strongly to changes in the broader market. Investors who seek higher returns must accept the risk of greater losses during downturns. Volatility analysis shows that BITU is suitable for those who can tolerate rapid price changes and are comfortable with short-term trading strategies.

- BITU’s volatility exceeds that of the S&P 500 and other major indices.

- The fund’s leveraged structure magnifies both upward and downward price movements.

- Investors should use stop-loss orders and risk management tools when trading BITU.

BITU’s performance and volatility make it a unique choice for investors who want exposure to Bitcoin price movements without owning the cryptocurrency directly. The fund’s returns can be attractive, but the risks require careful consideration.

Technical Trends

Image Source: pexels

Momentum

BITU shows strong momentum based on several technical indicators. The 5-day simple moving average (SMA) has crossed above the 10-day, 15-day, and 30-day SMAs. This pattern signals short-term bullish momentum. No bearish indicators appear in the current analysis. The overall technical rating for BITU stands at neutral, with a score of 3 out of 5. This suggests that while recent trends favor buyers, the market remains cautious.

| Indicator Type | Details | Implication |

|---|---|---|

| Bullish Indicators | 5-day SMA crossing above 10-, 15-, 30-day SMAs | Indicates short-term bullish momentum |

| Bearish Indicators | None | No bearish momentum detected |

| Neutral Indicators | Overall BITU rating: Neutral (3/5 score) | Suggests balanced or uncertain momentum |

Investors often use these signals to gauge entry and exit points. When short-term averages move above longer-term averages, traders see this as a sign of upward price movement. The absence of bearish signals adds confidence to the current trend. However, the neutral overall rating means that the market could shift quickly. Investors should monitor these indicators daily to track changes in performance.

Trading Volume

BITU maintains high trading volume, which supports strong liquidity. Average daily volume remains above 1.2 million shares. This level of activity allows investors to enter and exit positions with minimal price impact. High volume often reflects increased interest and confidence in the fund’s performance.

Note: High liquidity reduces the risk of slippage during large trades. Investors benefit from tighter bid-ask spreads and more efficient execution.

Trading volume also acts as a confirmation tool for momentum. When price increases align with rising volume, the trend gains credibility. BITU’s consistent volume supports its reputation as a reliable vehicle for tracking Bitcoin’s performance.

Dividends and Expenses

Dividend Yield

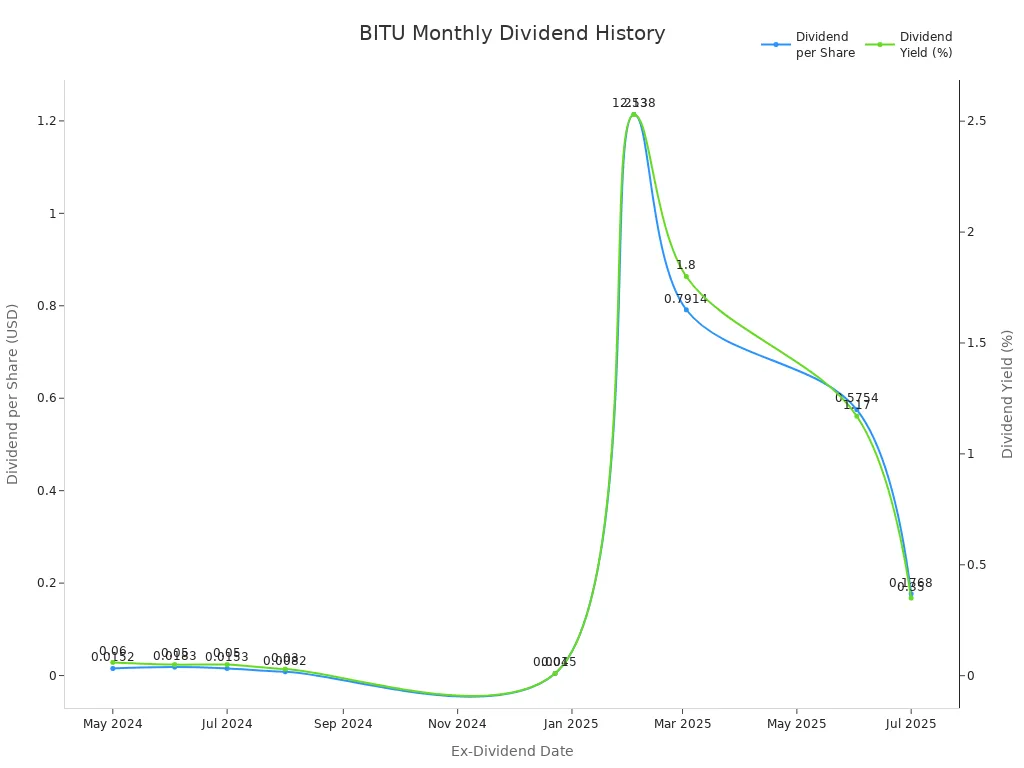

BITU pays dividends every month. The fund’s monthly dividend payments show both consistency and variability. Investors receive regular income, but the amount changes from month to month. The table below displays BITU’s monthly dividend history over the past year:

| Month/Ex-Dividend Date | Payment Date | Dividend per Share (USD) | Dividend Growth Rate QoQ | Dividend Yield (%) |

|---|---|---|---|---|

| 2025-07-01 | 2025-07-08 | 0.1768 | -69.3% | 0.35 |

| 2025-06-02 | 2025-06-06 | 0.5754 | -27.3% | 1.17 |

| 2025-03-03 | 2025-03-07 | 0.7914 | -34.8% | 1.8 |

| 2025-02-03 | 2025-02-07 | 1.2138 | 26695.6% | 2.53 |

| 2024-12-23 | 2024-12-31 | 0.0045 | -45% | 0.01 |

| 2024-08-01 | 2024-08-08 | 0.0082 | -46% | 0.03 |

| 2024-07-01 | 2024-07-09 | 0.0153 | -16.6% | 0.05 |

| 2024-06-03 | 2024-06-10 | 0.0183 | 20.3% | 0.05 |

| 2024-05-01 | 2024-05-08 | 0.0152 | 0% | 0.06 |

BITU’s trailing 12-month dividend yield ranges from 5.16% to 6.10%. The fund’s monthly payout schedule appeals to investors who want frequent income. The dividend growth rate fluctuates, which means investors should monitor changes in yield and payment amounts. The chart below illustrates the monthly dividend per share and yield over the past year:

Note: BITU’s dividend payments can change quickly. Investors should review the fund’s payout history before making decisions.

Expense Ratio

BITU has an expense ratio of 0.95%. This figure represents the fund’s annual operating costs as a percentage of its average net assets. The expense ratio is deducted from the fund’s assets each year, which reduces the net returns for investors. Even though BITU has posted strong gross returns, the expense ratio lowers the actual gains that investors receive. Over time, this annual deduction compounds and can have a significant impact on long-term returns. Investors should consider the expense ratio when evaluating BITU’s overall performance and suitability for their portfolios.

Risks

Leverage

Leveraged ETFs like bitu use financial tools to multiply returns. This approach increases both potential gains and losses. When the market rises, bitu can outperform the underlying index. However, during downturns, losses can become much larger. The use of leverage means that even small market moves can have a big impact on the fund’s value. Daily rebalancing adds another layer of risk. The fund resets its leverage every day, so returns over longer periods may not match the expected multiple of the index. This effect, known as compounding, can cause returns to drift away from what investors expect, especially in volatile markets. Most investors find these risks challenging. Leveraged ETFs are generally not suitable for those who want to hold them for long periods.

Investors should understand that leverage can quickly turn small losses into large ones. This risk makes bitu a complex product that requires careful monitoring.

Market Risk

Market volatility affects leveraged ETFs like bitu more than traditional funds. On days when the market swings, both gains and losses are amplified. The daily compounding effect can make returns unpredictable if held for more than one day. High volatility can also increase the fund’s expenses, which reduces overall returns. The structure of leveraged ETFs means they must buy when prices rise and sell when prices fall. This process can make losses worse during sharp market moves. Investors who do not have experience with leveraged or volatile products may find these risks too great.

The following types of investors may find bitu suitable:

- Those with a high risk tolerance

- Investors who understand leveraged and volatile products

- Individuals seeking amplified exposure to Bitcoin’s daily price movements

Conservative or risk-averse investors should avoid bitu. The fund’s structure and risk profile make it unsuitable for most long-term strategies.

BITU vs Alternatives

ETFs

Investors often compare bitu to major index ETFs such as SPY and QQQ. These funds track large-cap U.S. equities and offer steady returns with lower risk. In contrast, bitu provides 2x leveraged exposure to Bitcoin, resulting in much higher volatility and return potential. The table below highlights key differences:

| Metric | BITU Value | Comparison to SPY/QQQ |

|---|---|---|

| 5-Day Volatility | 123.48% | Much higher |

| 20-Day Volatility | 51.91% | Significantly higher |

| 50-Day Volatility | 61.04% | Elevated |

| 200-Day Volatility | 76.09% | Substantially higher |

| 1-Year Return | 160.01% | Far exceeds |

| Expense Ratio | 0.95% | Higher |

BITU’s risk/reward profile stands out. Investors seeking high growth may find bitu attractive, but they must accept the possibility of large losses. SPY and QQQ suit those who prefer stability and long-term growth.

When comparing bitu to other Bitcoin-related ETFs, such as QBTC.TO, ARKB, and BITB, bitu delivers higher absolute returns in 2024. However, it also carries greater risk, as shown by its higher standard deviation and Ulcer Index. Risk-adjusted metrics favor non-leveraged funds, making bitu more suitable for investors with a high risk tolerance.

Stocks

Some investors consider individual stocks for Bitcoin exposure. Companies like Coinbase or MicroStrategy hold significant Bitcoin assets. These stocks can move with Bitcoin prices, but they also face company-specific risks, such as management decisions or regulatory changes. BITU offers pure exposure to Bitcoin’s price movements without the added risks of company performance. Investors who want direct, amplified exposure to Bitcoin may prefer bitu over individual stocks. Those who seek diversification or lower risk may choose broad market ETFs or non-leveraged Bitcoin funds.

Outlook for 2025

Trends

Market analysts expect Bitcoin to continue its bullish trajectory in 2025. Leveraged Bitcoin ETFs, including bitu, have posted weekly gains of about 12%, placing them among the top-performing crypto funds. This strong investor interest in leveraged exposure reflects confidence in Bitcoin’s ongoing rally. Institutional demand remains robust, with significant inflows into Bitcoin ETFs. In just five trading sessions, $7.1 billion flowed into these funds, and total inflows since launch reached $50.1 billion. Regulatory clarity is improving, supported by new legislation such as the GENIUS Act and the establishment of strategic Bitcoin reserves. These factors increase investor confidence and support the growth of leveraged products.

Macroeconomic conditions also favor Bitcoin. Inflation and geopolitical uncertainty have positioned Bitcoin as a hedge asset. Renewed institutional participation and optimism about global crypto adoption further strengthen the outlook. Leveraged ETFs like bitu benefit from these trends, offering amplified exposure to Bitcoin’s price movements. The fund’s structure allows investors to capitalize on short-term price swings, making it a preferred choice during periods of high volatility.

BITU’s recent performance highlights its ability to capture these market trends. The fund’s amplified returns and consistent trading volume indicate strong momentum. As regulatory progress continues and institutional interest grows, bitu is likely to remain a favored instrument for investors seeking enhanced exposure to Bitcoin.

BITU stock offers amplified returns and a 5.00% dividend yield, but investors face significant risks. The table below outlines key risk factors:

| Risk Type | Explanation |

|---|---|

| Concentration Risk | Exposure to a few sectors and countries increases vulnerability. |

| Technological Risk | Rapid innovation and competition may impact holdings. |

| Regulatory Risk | Policy changes can affect performance. |

| Volatility Risk | 2x leverage amplifies gains and losses. |

| Expense Ratio Risk | Higher fees reduce net returns. |

| Bitcoin Volatility | Price swings can cause large losses. |

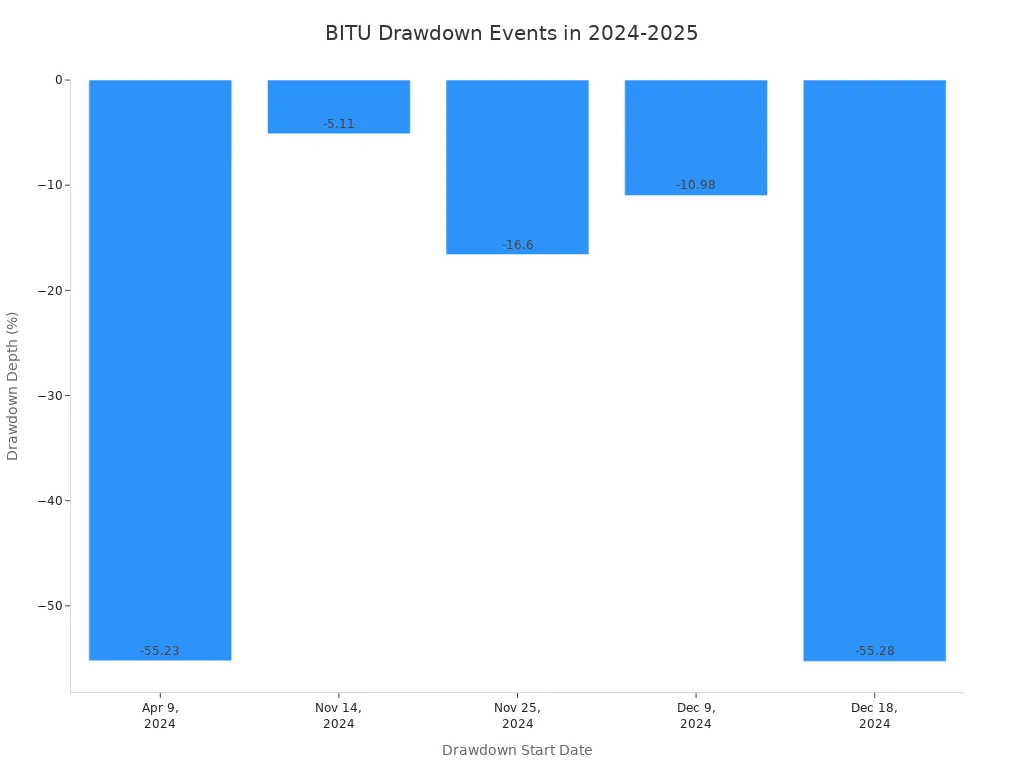

Investors should monitor monthly swings, drawdowns, and risk-adjusted ratios. The chart below shows recent drawdown depths:

BITU stock suits experienced investors seeking tactical exposure to Bitcoin. It fits best as a speculative tool within a diversified portfolio, not as a core holding.

FAQ

What is the main risk of investing in BITU?

BITU uses leverage to amplify returns. This leverage increases both gains and losses. Investors can lose money quickly if Bitcoin prices fall. BITU suits those who understand and accept high risk.

How does BITU pay dividends?

BITU pays dividends monthly. The amount changes each month. Investors receive payments in USD. The fund’s yield ranges from 5.16% to 6.10%. Dividend history helps investors track changes.

Can investors hold BITU for the long term?

BITU is designed for short-term trading. Daily leverage resets can cause returns to differ from the expected 2x performance over time. Long-term holding increases risk due to compounding effects.

How does BITU compare to other Bitcoin ETFs?

BITU offers 2x leveraged exposure to Bitcoin. Other Bitcoin ETFs, such as ARKB or BITB, do not use leverage. BITU provides higher potential returns but also higher risk and volatility.

What is the expense ratio for BITU?

BITU has an expense ratio of 0.95%. This fee reduces net returns for investors. The expense ratio is higher than many traditional ETFs but lower than some leveraged peers. Investors should consider this cost when evaluating BITU.

The analysis of BITU highlights the dual nature of high-yield investments: amplified returns come with amplified risks. For investors navigating this complex landscape, success depends on having the right tools to act with precision and efficiency. If you’re looking for a way to streamline your high-growth investment strategy, a single, powerful platform is essential.

BiyaPay offers a seamless solution. You can fund your account with ease thanks to our low remittance fees, and you’ll always have access to real-time exchange rates for the best value. But that’s not all. With BiyaPay, you can participate in US and Hong Kong stock trading and manage your digital assets, all from one platform without needing a separate overseas bank account. This empowers you to manage your entire portfolio from a single dashboard. Take control of your investments. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

Is the W-8BEN Form Required for Opening a US Stock Account? Understand How to Save on Taxes in One Article

Micro Dow, Micro Nasdaq, Micro S&P Futures Comprehensive Comparison – Helping You Find the Best Trading Choice

How to Choose US Major Indices: Pros and Cons Analysis of S&P 500, Dow Jones, and Nasdaq

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.