Why SDOW Stock Can Be Both a Boon and a Bust

Image Source: unsplash

You can experience both rapid gains and steep losses when you trade SDOW stock. This investment tool acts as a 3x leveraged inverse ETF, moving in the opposite direction of the Dow Jones Industrial Average. SDOW ETF trades with high volatility—a daily standard deviation of 50.95% and a 3-year price swing from $39.09 to $176.20 show big risks and rewards.

You need to understand how SDOW ETF works before investing. Think carefully about your risk tolerance and your goals in the stock market.

Key Takeaways

- SDOW ETF offers triple inverse exposure to the Dow Jones, aiming for big gains when the market falls but also carrying high risk.

- This ETF resets daily, making it suitable only for short-term trading and hedging, not for long-term holding.

- High volatility and compounding effects can cause rapid losses and value decay, especially in choppy markets.

- Active traders with strong market knowledge and risk management skills benefit most from SDOW ETF.

- Investors should avoid SDOW if they prefer low risk, long-term investing, or cannot monitor their trades closely.

SDOW Stock Overview

Image Source: unsplash

What Is SDOW ETF?

You may wonder what the SDOW ETF is and how it works. The SDOW ETF, also known as the ProShares UltraPro Short Dow30, is an inverse fund. It aims to deliver triple leverage to the inverse daily performance of the Dow Jones Industrial Average. When the Dow falls, the SDOW ETF rises by about three times that amount. If the Dow climbs, the SDOW ETF drops at triple the rate. The fund uses swap agreements and futures contracts to achieve this inverse exposure. The SDOW ETF rebalances every day to keep its target leverage. This makes it different from regular ETFs and even other inverse ETFs.

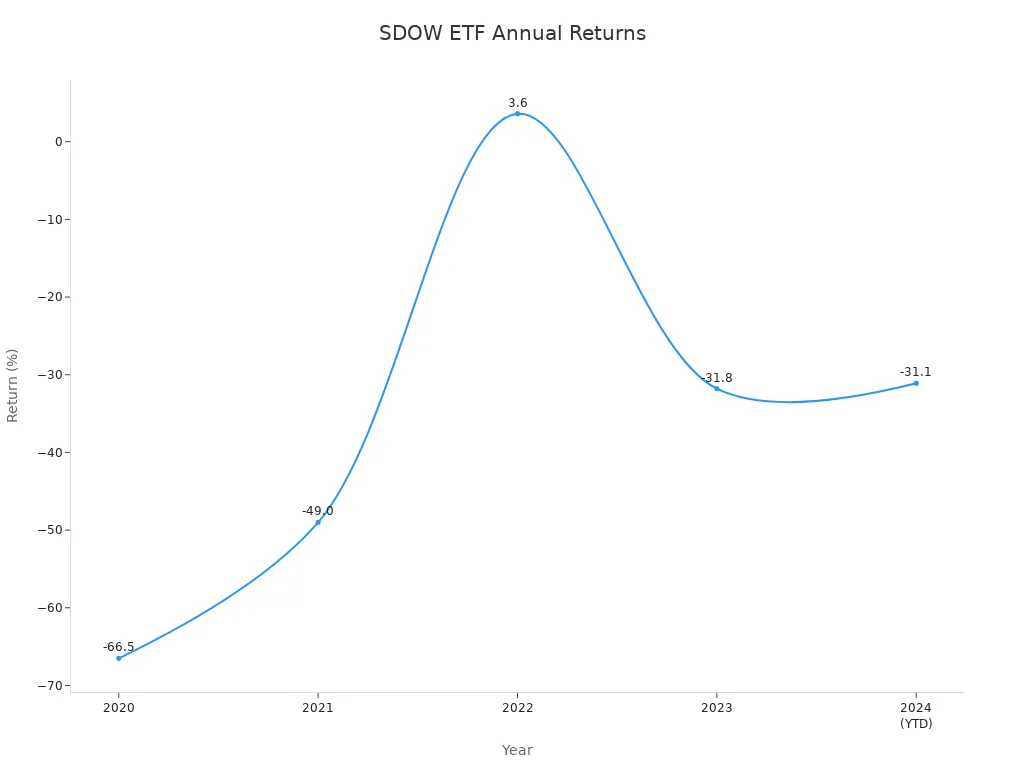

The SDOW ETF launched on February 11, 2010. It is designed for short-term trading and hedging. You should not use it for long-term investing. The compounding effect and daily resets can cause the SDOW ETF to lose value over time, even if the Dow stays flat. The table below shows the annualized returns for SDOW ETF over several periods. You can see that long-term returns are mostly negative.

| Period | SDOW Annualized Return | Category Return Low | Category Return High | Rank in Category (%) |

|---|---|---|---|---|

| 3 Year | -24.2% | -72.0% | 10.2% | 71.65% |

| 5 Year | -30.3% | -72.0% | 6.1% | 75.59% |

| 10 Year | -37.0% | -72.4% | -3.6% | 85.47% |

How the UltraPro Short Dow30 Works

The UltraPro Short Dow30 uses financial tools called swap agreements and futures contracts. These tools help the SDOW ETF get triple leverage to the inverse daily movement of the Dow Jones. If the Dow drops by 1% in a day, the SDOW ETF should go up by about 3%. If the Dow rises by 1%, the SDOW ETF should fall by 3%. This triple leverage makes the SDOW ETF very sensitive to daily changes. You get strong inverse exposure, but you also face big risks.

The SDOW ETF resets its leverage every day. This means it does not track the Dow’s inverse performance over weeks or months. The daily reset can cause the SDOW ETF to lose value in choppy markets. Even if the Dow ends up flat, the SDOW ETF may still lose money because of compounding and volatility decay.

3x Leveraged Inverse ETF Structure

The SDOW ETF is a 3x leveraged inverse ETF. It uses derivatives to give you three times the inverse exposure to the Dow Jones each day. The fund rebalances daily to keep its triple leverage. This structure can lead to large gains if you time the market right, but it can also cause big losses if the market moves against you.

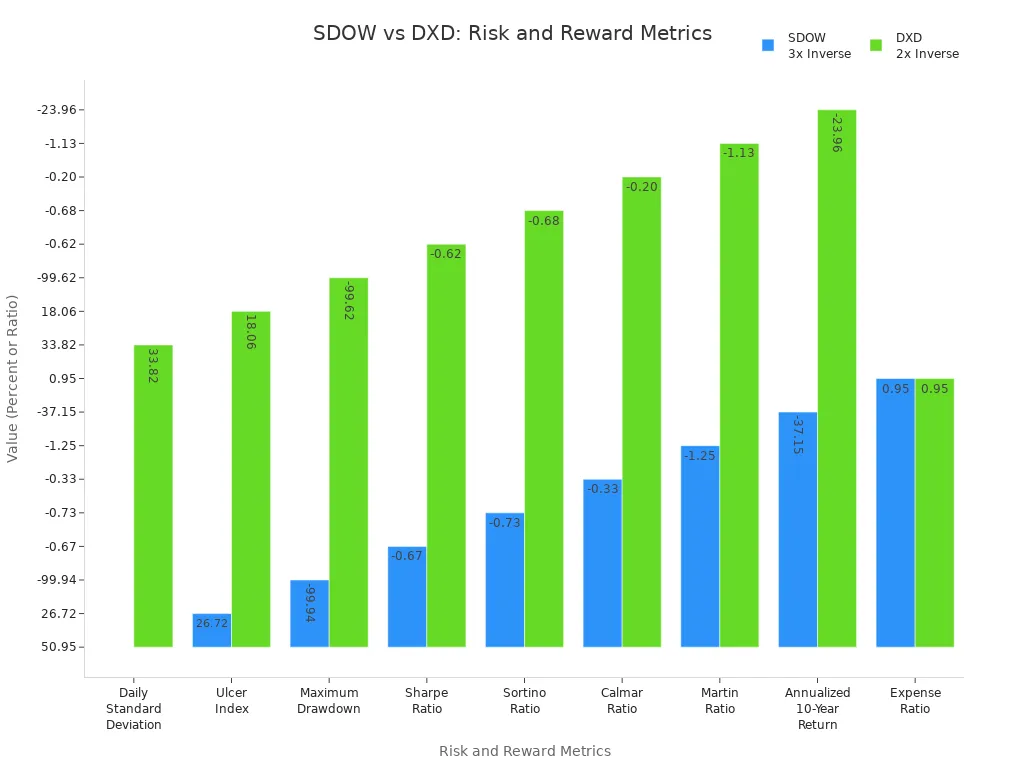

You should know that the SDOW ETF is not for long-term holding. The compounding effect and daily resets can erode your returns. The table below compares SDOW ETF to DXD, a 2x inverse ETF. You can see that SDOW ETF has higher volatility and risk.

| Metric | SDOW (3x Inverse) | DXD (2x Inverse) |

|---|---|---|

| Daily Standard Deviation | 50.95% | 33.82% |

| Ulcer Index | 26.72% | 18.06% |

| Maximum Drawdown | -99.94% | -99.62% |

| Sharpe Ratio | -0.67 | -0.62 |

| Sortino Ratio | -0.73 | -0.68 |

| Calmar Ratio | -0.33 | -0.20 |

| Martin Ratio | -1.25 | -1.13 |

| Annualized 10-Year Return | -37.15% | -23.96% |

| Expense Ratio | 0.95% | 0.95% |

Financial authorities warn that leveraged and inverse ETFs like SDOW ETF are complex products. They are designed for daily performance, not for long-term investing. You should read all disclosures and understand the risks before investing in SDOW stock.

SDOW Stock Rewards

Rapid Gains in Bear Markets

You can see the power of the SDOW ETF during sharp market declines. When the Dow Jones Industrial Average drops, the SDOW ETF aims to deliver three times the opposite movement each day. For example, if the Dow falls by 2% in one day, the SDOW ETF should rise by about 6%. This triple leverage gives you a tool to capture large gains quickly when markets turn negative. The SDOW ETF is structured to deliver these daily returns, making it a strong choice for traders who expect sudden declines. You can use this ETF to benefit from short-term drops in the market, but you must act quickly. The SDOW ETF does not match the Dow’s long-term performance, so you should not hold it for extended periods.

Tip: The SDOW ETF works best when you anticipate a sharp decline in the Dow Jones. You can use it to take advantage of market corrections or sudden downturns.

Portfolio Hedging with SDOW ETF

You can use the SDOW ETF as a hedge against declines in your portfolio. If you hold stocks that track the Dow Jones, adding the SDOW ETF can help offset losses during market downturns. The inverse structure of the SDOW ETF means it moves in the opposite direction of the Dow. When your other investments lose value, the SDOW ETF can gain, helping to balance your overall returns. Many investors use this ETF to protect their portfolios during uncertain times. The SDOW ETF acts as insurance when you expect short-term volatility or negative news that could impact the market.

Here is a simple example of how you might use the SDOW ETF for hedging:

| Scenario | Dow Jones Movement | SDOW ETF Movement | Portfolio Impact |

|---|---|---|---|

| Market Correction | -3% | +9% | Losses offset by gains |

| Market Rally | +2% | -6% | Hedge reduces returns |

You should remember that the SDOW ETF is not a perfect hedge for long periods. The daily reset and compounding can cause the ETF to drift from its target over time. Use it for short-term protection rather than as a permanent part of your portfolio.

Short-Term Trading Opportunities

You can find many short-term trading opportunities with the SDOW ETF. Traders often use this ETF to profit from quick market moves. The SDOW ETF responds rapidly to changes in the Dow Jones, making it attractive for those who want to capitalize on volatility. Short-term trading strategies, such as the Inverse ETF Trader approach, have shown positive returns of about +3.95%. This strategy involves taking positions in the SDOW ETF when you expect the market to decline. While the returns are positive, they are lower than some other short-term strategies, such as the Choppy Market Trader strategy on NET, which produced higher gains.

You should focus on timing your trades carefully. The SDOW ETF is designed for daily movements, so holding it for longer periods can reduce your returns. Many traders use technical analysis or market news to decide when to enter and exit positions. You can also use the SDOW ETF to take advantage of sudden news events or economic reports that may cause the Dow Jones to drop.

Note: The SDOW ETF offers strong potential for short-term gains, but you must monitor your positions closely. Quick action is key to maximizing returns and minimizing losses.

SDOW Stock Risks

Image Source: pexels

High Volatility and Loss Potential

You face significant risks when you trade the SDOW ETF because of its high volatility. The price of this ETF can swing sharply in a single day. These swings can lead to rapid losses, especially if the Dow Jones rises instead of falls. You may see your investment drop much faster than with a regular ETF. The SDOW ETF can lose value quickly in rising markets, which can cause substantial capital erosion.

- High volatility in SDOW ETF trading leads to significant price fluctuations, increasing the risk of losses.

- Wider bid-ask spreads occur during volatile periods, raising transaction costs for investors.

- Reduced liquidity, especially in market stress, can make it difficult to buy or sell ETF shares at desired prices.

- ETFs may trade at significant discounts during periods of market stress.

- Volatility management techniques can cause periods of loss and underperformance, limiting the fund’s ability to benefit from rising markets and increasing transaction costs.

- Frequent trading in volatile markets increases commissions and other costs, potentially offsetting savings from low fees.

- Market makers widen spreads to hedge risks during volatile periods, and these costs are passed on to investors.

You must understand that the SDOW ETF carries high risks involved. If you are not careful, you can lose a large part of your investment in a short time. The potential risks are greater for those who do not have experience with leveraged or inverse products.

Note: The SDOW ETF is generally not recommended for inexperienced investors due to its complexity and risk profile.

Compounding and Value Decay

You need to know how compounding and value decay affect your returns with the SDOW ETF. This ETF aims to deliver three times the inverse of the Dow Jones’s daily return, not its long-term performance. The fund resets its leverage every day. This daily reset locks in gains or losses, but it does not account for compounding over time.

- In volatile or sideways markets, compounding of daily returns causes the ETF’s value to erode relative to the underlying index’s cumulative performance.

- For example, if the Dow drops 10% one day and gains 11.11% the next, it returns to its original level. A 3x leveraged inverse ETF like SDOW would lose 30% on the first day, then gain 33.33% the next day, ending below its starting value.

- This path dependency means that even if the Dow ends unchanged, the SDOW ETF can lose value due to daily compounding.

- The decay effect is more pronounced over longer holding periods and in choppy markets.

- Management fees add to decay but are less important than compounding and rebalancing.

You should remember that the SDOW ETF often underperforms expectations based on simple leverage multiples over longer time frames. This is why you see significant risks when you hold the SDOW ETF for more than a few days.

Not for Long-Term Holding

You should avoid holding the SDOW ETF for long periods. Leveraged ETFs like SDOW reset daily, which causes their long-term returns to diverge from the performance of the Dow Jones. This structural feature makes the SDOW ETF unsuitable for long-term investment horizons. Financial regulators, such as FINRA, warn that leveraged ETFs carry significant risks and are not designed for buy-and-hold strategies. If you keep the SDOW ETF in your portfolio for weeks or months, you may see your investment shrink, even if the Dow does not move much.

Market Timing Challenges

You must time the market well to succeed with the SDOW ETF. Market timing is difficult, even for experienced investors. You need to predict short-term declines in the Dow Jones to profit from this ETF. If you enter at the wrong time, you can face rapid losses. The SDOW ETF does not forgive mistakes in timing. You may see your investment drop quickly if the market moves against you.

- Market timing requires you to act fast and make decisions based on short-term trends.

- You must monitor the market closely and react to news or events that could cause declines.

- If you miss the right moment, you may not recover your losses, especially with the high risks involved in leveraged and inverse ETFs.

You should consider whether you have the skills and experience to manage these risks. Many investors struggle with market timing and end up with losses instead of gains. The SDOW ETF is best for those who understand the risks and can act quickly.

Who Should Use SDOW ETF?

Suitable Investor Profiles

You may find the SDOW ETF useful if you have a strong bearish outlook on the Dow Jones Industrial Average. Investors who benefit from SDOW ETF often predict short-term declines and act quickly. You need to understand how inverse ETFs work and have experience with market timing. If you want to avoid the complexity of traditional short selling, investing in SDOW gives you a simpler way to profit from falling markets. You do not need a specialized brokerage account to use this ETF.

Investors who succeed with SDOW ETF usually have these traits:

- You can manage trades daily and react to market changes.

- You have a disciplined approach and know how to handle risk.

- You focus on short-term investing and do not hold positions for long periods.

- You understand the risks of leveraged ETFs and inverse ETFs.

- You use SDOW ETF for hedging or tactical trading, not for long-term investing.

SDOW ETF magnifies both gains and losses. You must stay alert and monitor your investments closely. Considerations before investing include your ability to predict market downturns and your comfort with high risk.

Who Should Avoid SDOW Stock

You should avoid investing in SDOW if you prefer a conservative approach or need easy access to your money. Investors who lack sophistication or experience with complex products may find SDOW ETF unsuitable. If you cannot manage trades daily or have a low risk tolerance, investing in SDOW may lead to losses.

Unsuitable investor characteristics include:

- You have a long investment time horizon.

- You need liquidity and cannot tie up funds.

- You do not want to take on high risk.

- You lack experience with leveraged or inverse ETFs.

- You do not actively monitor your investments.

Financial advisors look at your age, financial situation, investment objectives, experience, time horizon, liquidity needs, and risk tolerance before recommending SDOW ETF. Considerations before investing should include your ability to handle volatility and your understanding of the product’s risks. If you do not meet these criteria, investing in SDOW may not fit your goals.

SDOW ETF Trading Tips

Entry and Exit Strategies

You need a clear plan before you start trading SDOW ETF. Many traders use swing trading and trend-following strategies. Swing trading means you look for breakout points using technical indicators. You might watch for triangle chart patterns. When you see a breakout, you enter the trade in that direction. Trend following uses moving averages to spot when the market starts a new trend. You can use tools like RSI and Bollinger Bands to help decide when to buy or sell. Setting a target price based on the chart pattern helps you know when to exit. Trailing stops can also help you lock in profits as the price moves in your favor. These methods work well for trading inverse and leveraged investment products like SDOW, especially if you want to capture short-term price swings.

Using Stop-Loss Orders

Stop-loss orders help you manage risk when trading SDOW ETF. You should plan your stop-loss and take-profit points before you enter a trade. Many traders use the one-percent rule, which means you do not risk more than 1% of your trading capital on a single trade. Technical analysis tools, such as moving averages, can help you set your stop-loss level. Professional traders often use stop-limit orders instead of stop-loss market orders, especially during volatile periods. A stop-limit order lets you set a price gap between the stop trigger and the limit price. This helps you avoid selling at a bad price if the market moves quickly. You should avoid panic selling and always stick to your plan.

Limiting Position Size

You should keep your position size small when trading SDOW ETF. Leveraged ETFs can move quickly, so small positions help you control risk. Many traders hold these positions for only a few days or even just one day. You should only trade when you feel confident about the market trend. Use stops to limit your losses and avoid large drawdowns. Focus on quick exits once the momentum fades. Always understand the underlying index and check the ETF’s liquidity and expense ratio before investing. This careful approach helps you avoid big losses and keeps your investing plan on track.

Monitoring Market Conditions

You need to watch the market closely when trading SDOW ETF. Moving averages help you see the market’s momentum and spot trends. Oscillators, like RSI, show if the ETF is overbought or oversold. Pivots mark important price levels where the price might change direction. Technical ratings combine several indicators, such as the Ichimoku Cloud and MACD, to give you a fuller picture. You should also follow related news and broader market data. Using these tools together helps you make better decisions and react quickly to changes. Careful monitoring is key to successful investing with SDOW ETF.

You face both high rewards and high risks when you invest in SDOW stock. This ETF moves quickly and can help you profit from market drops, but you may lose money just as fast. You need to understand how SDOW works, including its daily resets and leverage.

Always check your risk tolerance before you trade. If you feel unsure, talk to a financial professional.

- Research SDOW and similar ETFs using resources like ETF Database and Vanguard.

- Keep learning about leveraged and inverse ETFs to make better decisions.

Expert Tip:SDOW suits active traders with strong financial knowledge. Long-term investors should avoid it.

FAQ

What does SDOW ETF track?

You track the inverse daily performance of the Dow Jones Industrial Average with SDOW ETF. When the Dow drops, SDOW rises by about three times that amount. When the Dow rises, SDOW falls at triple the rate.

Can you hold SDOW ETF for the long term?

You should not hold SDOW ETF for the long term. The fund resets daily, which causes value decay over time. You may lose money even if the Dow does not move much.

How do you buy SDOW ETF?

You can buy SDOW ETF through most online brokers. You place a trade just like you would for any stock or ETF. If you use a Hong Kong bank brokerage, check for access to U.S. markets and review fees in USD. See current USD exchange rates.

What are the main risks of SDOW ETF?

You face high volatility and risk of rapid losses. The triple leverage means small moves in the Dow can cause large swings in SDOW. You must monitor your investment closely and use risk controls.

Who should consider trading SDOW ETF?

You should consider SDOW ETF if you have experience with leveraged products and can manage trades daily. This ETF suits active traders who want to profit from short-term declines in the Dow. Long-term investors should avoid it.

SDOW stock is a powerful tool for short-term traders who can manage its significant risks. Its 3x inverse leverage offers the potential for strong gains in a falling market, but it also exposes investors to volatility decay and rapid losses. Navigating these risks requires constant vigilance and a robust financial platform. For investors outside the United States, accessing and trading US-listed ETFs like SDOW requires a reliable and efficient financial platform. BiyaPay provides a seamless solution. Our platform enables you to easily fund your account and trade US-listed stocks, including high-volatility ETFs, with minimal friction. With our low fees for cross-border transactions and a transparent real-time exchange rate converter, you can execute your trades efficiently and keep your costs low. By simplifying the complexities of international finance, BiyaPay empowers you to focus on your trading strategy and risk management. Take control of your portfolio and begin your investment journey. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US Stock Market Holiday Countdown: How Investors Should Position for Next Week's Trading

Micro Dow, Micro Nasdaq, Micro S&P Futures Comprehensive Comparison – Helping You Find the Best Trading Choice

Annual Review: Best Performing US Stock ETFs in 2026 and the Logic Behind Them

How to Choose US Major Indices: Pros and Cons Analysis of S&P 500, Dow Jones, and Nasdaq

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.