What’s Behind the Recent Changes in SAIC Stock

Image Source: unsplash

Science Applications International Corporation has seen notable changes in its stock price due to several major events. The release of first-quarter results for fiscal year 2026 triggered a sharp 9% drop in saic stock after earnings fell short of analyst expectations. Earlier in March 2025, strong operational performance, a strategic share buyback, and new partnerships led to a surge in stock value. The table below highlights these impactful events:

| Date | Event Description | Stock Price Impact |

|---|---|---|

| Early Mar 2025 | Partnerships, strategic initiatives | Stock surged ~9.8% |

| Early Mar 2025 | Share buyback program | Reinforced stock value |

| Mar 2025 | Operational performance, financial stability | Supported positive trend |

| Jun 2025 | Q1 FY2026 earnings miss, negative free cash flow | Stock dropped 9% |

Recent technical indicators show bullish momentum for saic stock in the short term, with a 5.87% price increase since August 2025. Over the past five years, science applications international corporation has experienced slow revenue growth and stable margins. Analyst sentiment remains mixed, with valuation and company news continuing to influence investor confidence.

Key Takeaways

- SAIC stock recently dropped due to earnings missing expectations and negative cash flow but showed short-term gains from strong contracts and buybacks.

- The company’s revenue grows steadily but slower than peers, supported by large government contracts and a $22 billion backlog.

- Analysts mostly rate SAIC stock as Hold, seeing moderate upside but caution due to margin pressures and budget uncertainties.

- SAIC invests heavily in technology and partnerships, boosting its position in defense and government markets.

- Risks include government spending changes and contract delays, but SAIC’s diversification and strong contract wins support future growth.

SAIC Stock Movement

Image Source: unsplash

Recent Price Trends

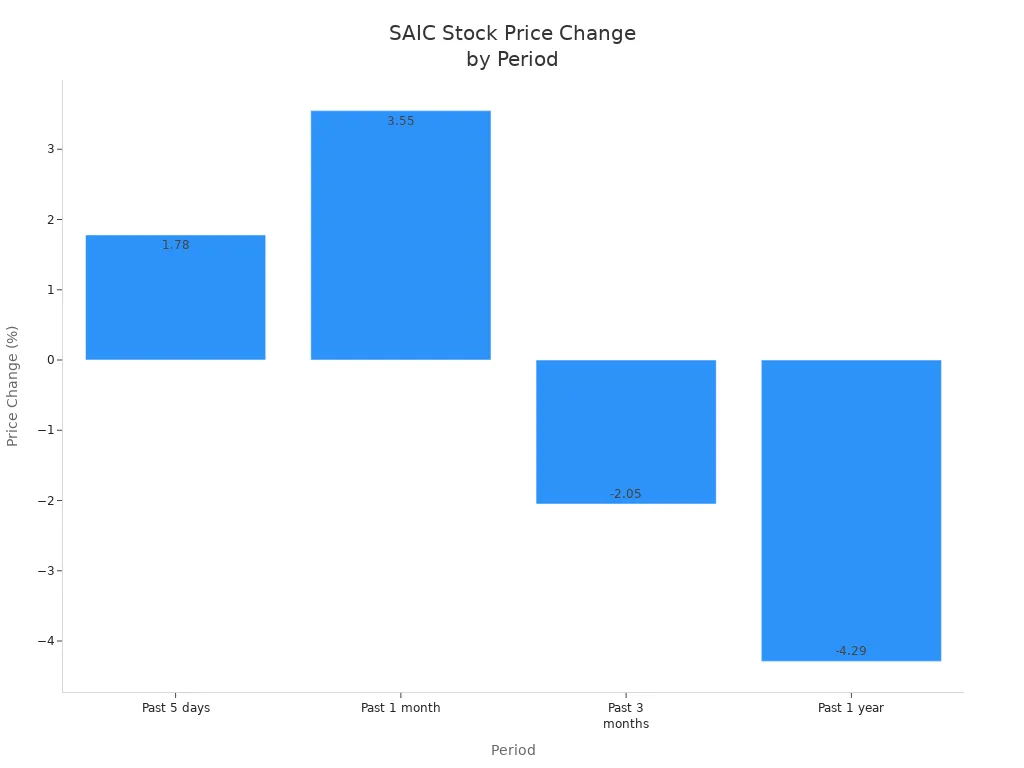

SAIC stock has experienced notable price changes over the past year. Investors have observed a modest recovery in the short term, while longer periods show a different trend. The table below summarizes the percentage change in stock price across several key timeframes:

| Period | Price Change (%) |

|---|---|

| Past 5 days | +1.78% |

| Past 1 month | +3.55% |

| Past 3 months | -2.05% |

| Past 1 year | -4.29% |

This data highlights a positive shift in the most recent weeks. SAIC stock gained 1.78% in the last five days and 3.55% over the past month. However, the stock declined by 2.05% over three months and 4.29% over the past year. These price changes reflect both short-term optimism and longer-term challenges.

Short-Term vs Long-Term Performance

In the short term, SAIC has outperformed expectations. Several factors have contributed to this recent market movement:

- Market concerns about government spending have eased, positioning SAIC as a value opportunity.

- Strong cash flow and capital return strategies, such as a 1.4% dividend yield and aggressive share buybacks, have supported the stock. The company reduced its share count by 8.25% in the first quarter of fiscal 2026 and plans $375 million in buybacks for the year.

- Revenue increased by 1.6% year-over-year in the first quarter of 2025, driven by new contract wins and a favorable book-to-bill ratio of 1.3.

- Adjusted earnings exceeded expectations, despite some margin contraction from contract turnover and payment timing.

- Company guidance forecasts 2.5% organic growth and revenue between $7.6 and $7.75 billion, which analysts consider cautious given the strong contract pipeline.

- The impact from government spending changes and the Defense Operations Guidance Effect (DOGE) remains minimal, offset by new business wins.

- Analyst sentiment has improved, with price targets suggesting about 20% upside and ratings moving from Reduce to Hold.

Over longer periods, SAIC stock has underperformed. Several challenges have weighed on performance:

- Government-related issues, especially from the Department of Government Efficiency (DOGE), have caused procurement delays and pushed award timelines later.

- Net income declined by 12% year-over-year, and operating margins shrank to 6.4%.

- CEO Toni Townes-Whitley noted higher turnover rates among government customers, increasing uncertainty and delays.

- Ongoing Congressional budget battles have created a fluid environment, delaying clarity on future government spending.

- These factors have pressured financial results and investor sentiment, leading to weaker stock performance over the past year.

Note: The contrast between recent gains and longer-term declines shows how quickly market movement can shift based on new information, contract wins, and changes in government policy.

Financials

Image Source: pexels

Earnings Results

Science Applications International Corporation reported mixed results in its fourth quarter fiscal year 2025 results. The company’s first-quarter profit came in below analyst expectations, which contributed to a sharp decline in stock price. First-quarter profit also reflected margin pressure from contract transitions and delayed government awards. Despite these challenges, science applications international corporation maintained positive operating income and continued to invest in its core business.

Analysts noted that the company’s financial performance showed resilience, even as net income dropped by 12% year-over-year. The company’s management attributed the shortfall to higher turnover among government customers and ongoing budget uncertainty. Investors reacted negatively to the earnings miss, but some analysts believe the company’s strong contract pipeline could support future growth.

Revenue Growth

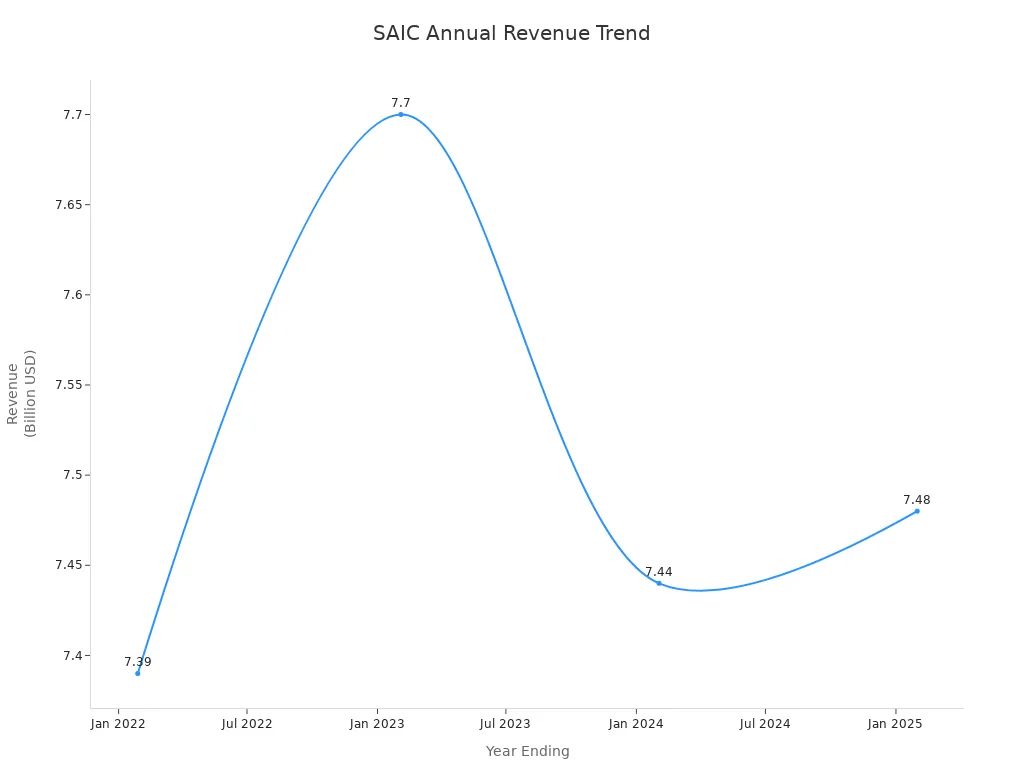

Science applications international corporation has experienced modest but steady revenue growth over the past several years. The table below summarizes annual revenue and year-over-year changes:

| Year Ending | Annual Revenue (Billion USD) | Year-over-Year Change | Growth Trend |

|---|---|---|---|

| 2025-01-31 | 7.48 | +0.47% | Slight increase |

| 2024-02-02 | 7.44 | -3.37% | Decline |

| 2023-02-03 | 7.70 | +4.19% | Increase |

| 2022-01-28 | 7.39 | +4.57% (approximate) | Increase |

Quarterly data also shows improvement. In the second quarter of 2025, revenue reached $1.9 billion, up 2.1% from the previous quarter and 1.62% year-over-year. For the trailing twelve months ending April 30, 2025, revenue totaled $7.51 billion, representing a 3.39% increase compared to the prior year. This growth rate is higher than the company’s five-year compound annual growth rate of 2.86%, but still trails the industry average of 4.83%.

Looking ahead, analyst consensus forecasts revenue growth between 2.37% and 4.21% for the next fiscal year. The company’s guidance for fiscal year 2026 projects revenue between $7.6 billion and $7.75 billion, which implies organic growth of about 3% at the midpoint. The table below summarizes these forecasts:

| Fiscal Year | Revenue Forecast | Previous Year Revenue | Growth Rate Approximation |

|---|---|---|---|

| FY25 | $7.48 billion | N/A | N/A |

| FY26 | $7.6 billion to $7.75 billion | $7.48 billion | ~1.6% to 3.6% |

Note: Science applications international corporation’s revenue growth remains positive, but the pace is slower than many industry peers. Management continues to focus on winning new contracts and expanding its technology offerings to drive future gains.

Cash Flow Changes

Science applications international corporation has faced challenges in cash flow management in recent quarters. In the fourth quarter of fiscal year 2024, operating cash flow dropped to $63 million, a decrease of $82 million compared to the same period the previous year. For the full fiscal year 2024, operating cash flow totaled $396 million, down $136 million from the prior year. The decline resulted from lower cash inflows from the MARPA Facility, changes in working capital, and higher tax payments.

The company’s capital deployment remained strong, with $116 million spent in the quarter on share repurchases, dividends, and capital expenditures. For the full year, science applications international corporation deployed $463 million for these purposes. However, free cash flow turned negative in the first quarter of fiscal year 2026, reaching $(44) million. This negative free cash flow signals emerging challenges in managing cash, driven by the timing of payroll, customer collections, and ongoing investments.

Despite these pressures, science applications international corporation continues to generate positive operating cash flow overall. Management remains focused on improving cash conversion and maintaining flexibility for future investments.

Analyst and Market Reaction

Analyst Ratings for SAIC Stock

Analysts currently hold a cautious view of saic stock. The consensus rating stands at “Hold,” with ten analysts covering the company. Most recent actions from firms like Truist Securities and UBS maintain Hold or Neutral ratings. The table below summarizes the latest analyst ratings and targets:

| Metric | Value |

|---|---|

| Consensus Analyst Rating | HOLD |

| Number of Analysts | 10 |

| Last Close Price (USD) | 117.23 |

| Average Target Price (USD) | 118.67 |

| High Price Target (USD) | 140.00 |

| Low Price Target (USD) | 102.00 |

SAIC’s analyst ratings over the past three months show a mix of bullish and neutral opinions, with no bearish ratings. The average 12-month price target is about $117.57, ranging from $100.00 to $137.00. Compared to industry peers, SAIC’s financial performance is slightly below average, which explains the moderate analyst sentiment. Analysts see some upside but do not expect the stock to outperform its competitors.

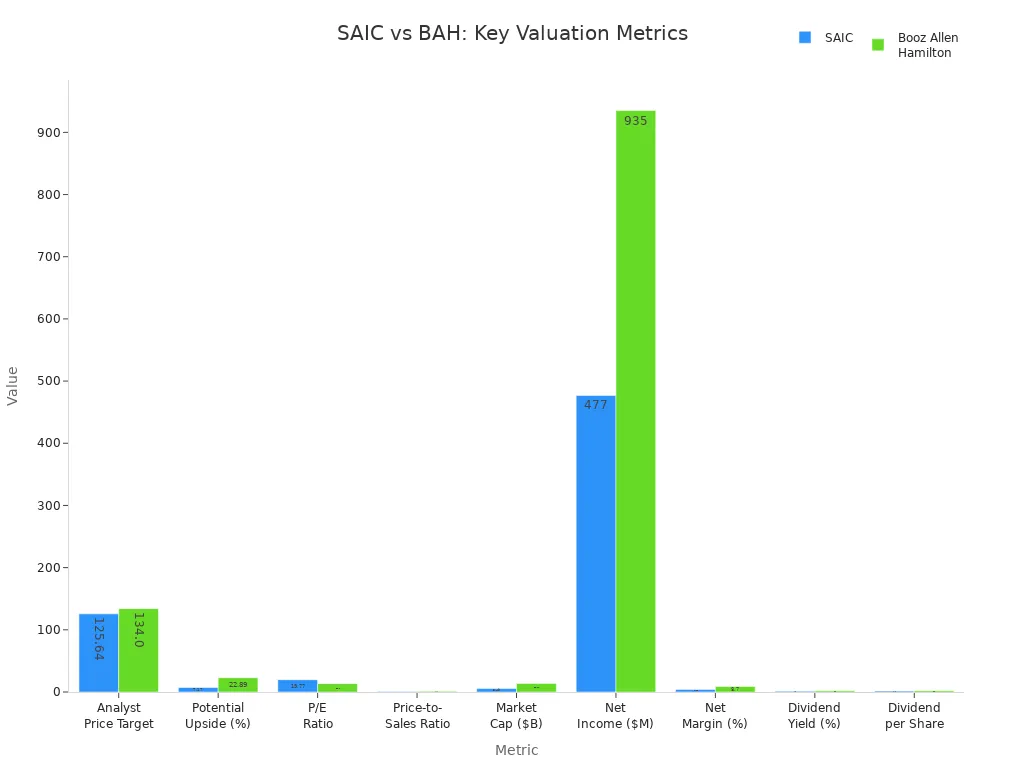

Price Targets

Analyst price targets for saic stock suggest modest potential gains. The consensus average price target is $125.64, representing a 7.17% upside from the current price of $117.23. The highest target is $176.00, while the lowest is $103.00. Eleven analysts provide coverage, with one recommending sell, six hold, and four buy. Recent actions include Stifel Nicolaus initiating coverage with a Buy rating and a $130 target, and Truist Financial raising its target from $100 to $110.

| Metric | Value / Details |

|---|---|

| Consensus Average Price Target | $125.64 (7.17% upside from $117.23 current price) |

| Highest Price Target | $176.00 |

| Lowest Price Target | $103.00 |

| Number of Analysts | 11 (1 sell, 6 hold, 4 buy) |

| Recent Analyst Actions | Stifel Nicolaus: Buy, $130 target (June 24, 2025) |

| Truist Financial: Raised to $110 (July 24, 2025) | |

| Consensus Rating | Hold |

When compared to Booz Allen Hamilton, a key peer, SAIC trades at a higher price-to-earnings ratio but a lower price-to-sales ratio. Booz Allen Hamilton receives more favorable analyst recommendations and has a higher potential upside.

Investor Sentiment

Investor sentiment toward saic stock has shifted in response to recent events. The Q1 FY2026 earnings report on June 2, 2025, missed expectations, causing a negative sentiment impact of -13.26%. However, positive news followed. On June 25, 2025, the company announced major contract awards, which improved sentiment by +2.52%. By August 12, 2025, the stock closed at $117.23, up 1.17% from the previous period.

- SAIC reaffirmed its FY2026 guidance despite the earnings miss.

- The company secured large contracts, including $928 million from the U.S. Air Force and $1.8 billion from the U.S. Army.

- Management declared a quarterly dividend of $0.37 per share and completed $125 million in share repurchases.

- Sentiment scores showed volatility, with negative reactions to earnings and positive responses to contract news.

- Overall, investors remain cautiously optimistic, balancing short-term disappointments with long-term growth prospects.

SAIC’s ability to win and manage large contracts supports its revenue outlook. However, operational challenges and budget uncertainties can temper enthusiasm. Investors watch for both contract wins and execution risks when evaluating the stock.

Science Applications International Corporation Developments

New Contracts

Science applications international corporation has secured several significant contracts in the past year, strengthening its position in the government services sector. The table below highlights two of the most notable awards:

| Contract Name | Contracting Activity | Contract Type | Value | Contract Date | Description |

|---|---|---|---|---|---|

| Defense Health Agency (DHA) Military Medical Research and Development Services | Defense Health Agency Professional Services Contracting Division | Multiple awards, IDIQ | $10 billion | May 16, 2022 | Science applications international corporation is one of 55 companies awarded a $10B ceiling IDIQ contract for military medical R&D services, with a 5-year base period ending 2027 and option to 2032. |

| Air Force Life Cycle Management Contract (AFLCMC) for Multi-Domain Systems Innovation | Air Force Life Cycle Management | Indefinite-delivery/indefinite-quantity | $900 million | December 9, 2022 | Science applications international corporation is among 92 companies awarded a $900M ceiling contract to develop innovative multi-domain systems capabilities, with work expected through 2032. |

These new contracts have driven increased contract volume for science applications international corporation. The company reported an 11% revenue increase in its civilian segment, supported by ramped-up activity on existing agreements. The total backlog now stands at approximately $22.4 billion, providing strong visibility for future revenue. This backlog growth has supported a positive outlook for both financial performance and investor sentiment.

Partnerships

Science applications international corporation has formed strategic partnerships to enhance its technology offerings and expand its market reach. The company secured a $202 million multi-year contract with the U.S. Navy to deliver modernized training solutions. This agreement improves near-term revenue visibility and demonstrates the company’s ability to win competitive bids.

A partnership with Google Public Sector allows science applications international corporation to deploy artificial intelligence at the edge, integrating advanced technologies into defense and civilian projects. These collaborations reinforce the company’s reputation as a key technology integrator in mission-critical government operations. Investors have responded positively to these developments, as they support expectations for margin improvement and future contract opportunities. However, some caution remains due to risks from changes in government procurement priorities and potential delays in defense spending cycles.

Corporate Governance

Science applications international corporation has made several changes to its corporate governance structure. The Board of Directors expanded to 11 members, with 10 classified as independent. Donna Morea, a non-executive female director, now serves as chair. Board diversity has increased, with 45.5% women and multiple members from underrepresented groups. The Board enforces strong governance practices, including annual self-evaluations, education programs, and a focus on transparency.

The company established an Artificial Intelligence Council to oversee responsible AI use, reflecting its commitment to ethical standards and adaptation to new technologies. In December 2024, John K. Tien, Jr. joined the Board, increasing its size to twelve members. Insider buying by the CEO and senior executives in March 2025 signaled strong internal confidence, even as the stock experienced volatility. These governance actions have improved science applications international corporation’s reputation and contributed to a rebound in stock price, supporting positive market sentiment.

Industry and Market Context

Sector Performance

Science applications international corporation operates in a competitive sector that includes defense, intelligence, and technology services. The company’s stock price growth over the past twelve months has remained steady and outperformed many S&P 500 constituents. The table below compares science applications international corporation to sector and market benchmarks:

| Metric/Aspect | Science Applications International Corporation | Sector/Industry Benchmark | Market Benchmark (S&P 500) |

|---|---|---|---|

| Price Growth (12 months) | Steady, higher than S&P 500 constituents | Industry average declines (-2%, -4%, -7%) | Baseline for comparison |

| Profit vs. Risk Rating | Slightly better than industry average (82) | Industry average | N/A |

| Valuation Metrics (P/B, P/E, PEG, Dividend Yield, P/S) | Around industry averages (P/B 3.651 vs. 17.922) | Industry averages | N/A |

| Market Capitalization | $5.49B | $10.03B | N/A |

| Technical Signals | Bullish: Above 50-day MA, positive momentum | N/A | N/A |

| Dividend | $0.37 per share (July 25, 2025) | N/A | N/A |

Science applications international corporation maintains a diversified portfolio across defense, intelligence, and civilian markets. The company ranks #21 in the Technology – Services industry and shows steady compound annual growth rates in revenue and profitability. Strategic acquisitions and product innovations support ongoing growth.

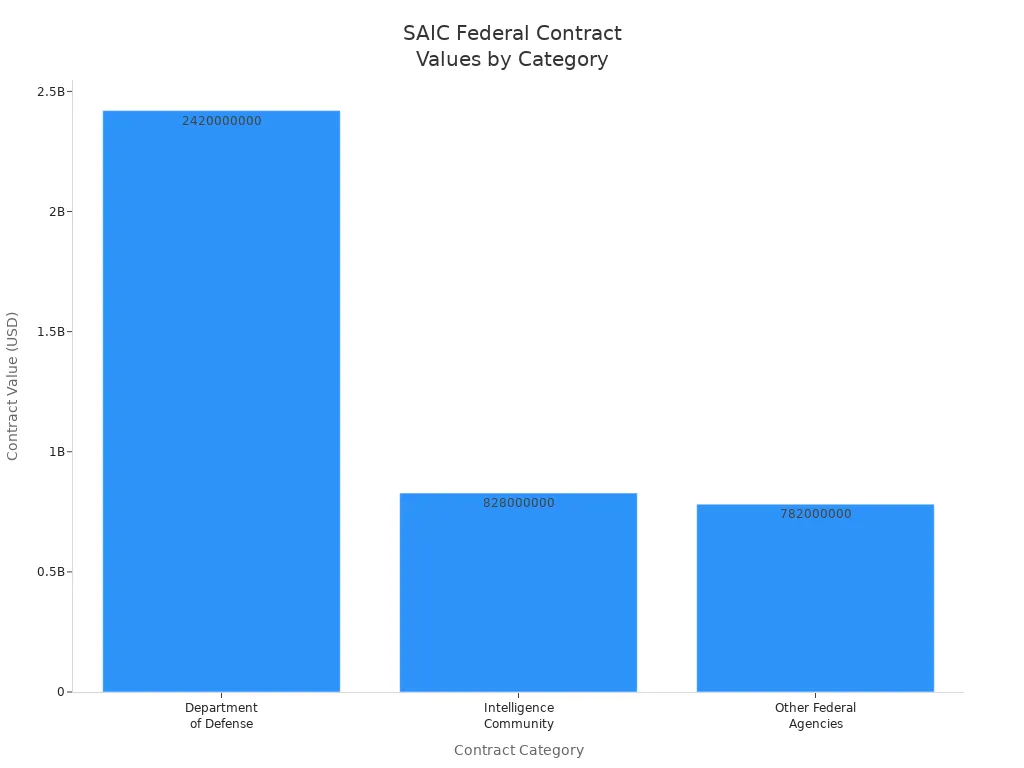

Government Spending

Government spending drives the majority of revenue for science applications international corporation. The company relies on U.S. government contracts for 87% of its revenue, with 52% from the Department of Defense and 18% from the Intelligence Community. The table below highlights contract categories and values:

| Contract Category | Revenue Share | Contract Value (approx.) |

|---|---|---|

| U.S. Government Contracts | 87% | N/A |

| Department of Defense | 52% | $2.42 billion |

| Intelligence Community | 18% | $828 million |

| Other Federal Agencies | 17% | $782 million |

Science applications international corporation holds a contract backlog of $22.3 billion and actively pursues large bids, with $7 billion tendered in the first quarter of 2025. Federal technology modernization budgets remain strong, with $97.3 billion allocated in 2024, including $11.2 billion for Department of Defense digital modernization. The company’s financial guidance reflects expectations for continued growth, supported by mission-centric solutions and technology integration.

Note: Science applications international corporation faces risks from competitive bidding, regulatory changes, and potential budget cuts. Diversification and operational efficiency help mitigate these challenges.

Technology Trends

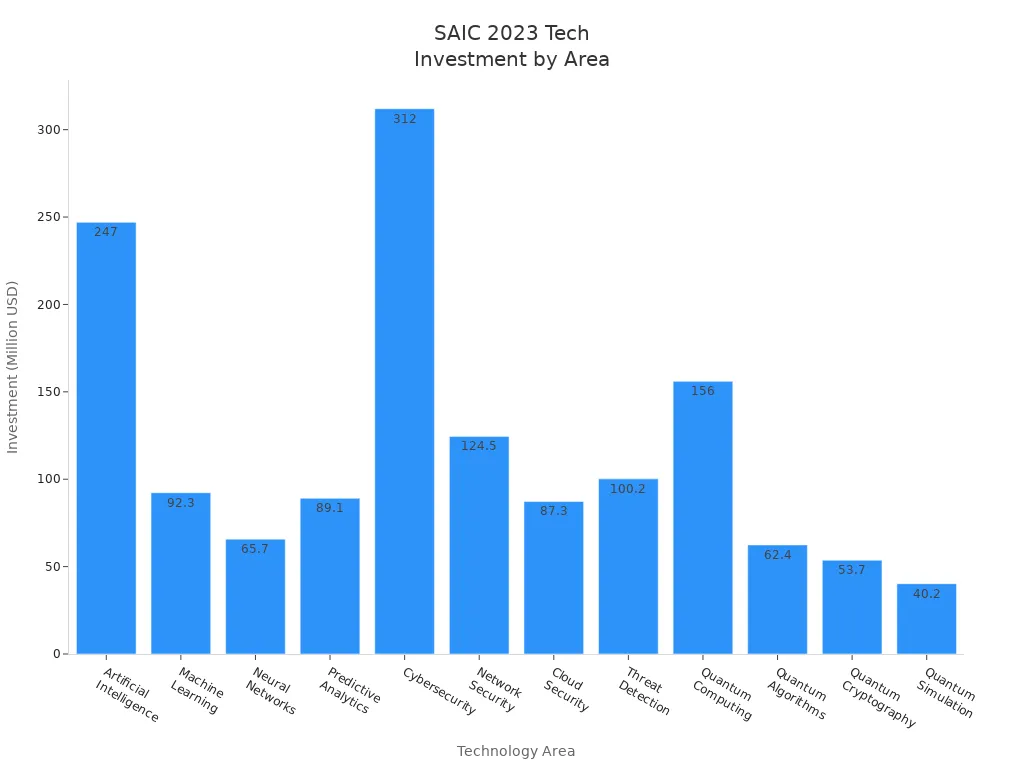

Science applications international corporation invests heavily in emerging technologies to maintain its competitive edge. In 2023, the company allocated $245 million to research and development, focusing on artificial intelligence, quantum computing, and cybersecurity. The chart below illustrates investments in key technology areas:

The Innovation Factory at science applications international corporation enables rapid identification and delivery of new solutions for government agencies. This approach supports continuous exploration and application of technologies such as AI-enabled biometrics, cloud computing, and digital engineering. The company uses sprint cycles and commercial marketplaces to accelerate deployment, aligning with government investment priorities. Strategic partnerships and acquisitions further strengthen science applications international corporation’s position in defense, space, and intelligence markets.

Science applications international corporation adapts to technology trends by bridging the gap between commercial advances and government needs. The company’s focus on mission-critical IT, secure cloud platforms, and operational artificial intelligence positions it to benefit from increased federal investment in technology modernization.

Science applications international corporation has seen its stock move due to earnings results, analyst opinions, and new contracts. Financial performance, company news, and industry trends all play a role. Science applications international corporation continues to win large government contracts and invest in technology. Analysts watch for new earnings and contract updates. Investors should follow science applications international corporation for future announcements. Ongoing changes in the sector may affect science applications international corporation and its stock.

FAQ

What caused the recent drop in SAIC stock price?

SAIC stock dropped after the company reported first-quarter earnings that missed analyst expectations. Investors reacted to lower profit and negative free cash flow. Contract delays and government budget uncertainty also contributed to the decline.

How do new government contracts affect SAIC’s financial outlook?

New government contracts increase SAIC’s revenue and backlog. Large awards, such as those from the U.S. Air Force and Army, provide stable income and improve future financial forecasts. Investors often view contract wins as positive signals.

Why do analysts rate SAIC stock as “Hold”?

Analysts rate SAIC as “Hold” because the company shows steady revenue but faces challenges like margin pressure and budget delays. The stock trades near its fair value, with limited upside compared to industry peers.

What risks does SAIC face in the current market?

SAIC faces risks from government spending changes, contract competition, and regulatory shifts. Delays in contract awards and budget decisions can impact revenue. The company manages these risks through diversification and operational efficiency.

How does SAIC’s dividend compare to industry standards?

SAIC pays a quarterly dividend of $0.37 per share. This yield aligns with industry averages. Investors seeking income may find the dividend attractive, but should review current rates and USD exchange rates for comparison.

SAIC stock presents a compelling case for patient, long-term investors seeking a stable company with a strong government-backed business model. While recent financial fluctuations have created short-term volatility, the company’s massive contract backlog and strategic investments in technology provide a solid foundation for future growth. For investors outside the United States, accessing and trading US-listed stocks like SAIC requires a reliable and efficient financial platform. BiyaPay provides a seamless solution. Our platform enables you to easily fund your account and trade US-listed stocks, with minimal friction. With our low fees for cross-border transactions and a transparent real-time exchange rate converter, you can preserve more of your capital and potential dividend income. By simplifying the complexities of international finance, BiyaPay empowers you to focus on your long-term investment goals and build a robust portfolio. Take control of your financial future and begin your investment journey. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Micro Dow, Micro Nasdaq, Micro S&P Futures Comprehensive Comparison – Helping You Find the Best Trading Choice

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

Annual Review: Best Performing US Stock ETFs in 2026 and the Logic Behind Them

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.