Understanding the Safety and Stability of SGOV for Cash Investors

Image Source: unsplash

You want your cash holdings to stay safe and easy to access. SGOV has earned its reputation as a safe haven because it invests only in ultra-short-term U.S. Treasury securities. Take a look at how SGOV stacks up against other options:

| Metric | SGOV Value | Comparison / Interpretation |

|---|---|---|

| Expense Ratio | 0.09% | Lower than most competitors |

| Liquidity Rating | A- | High liquidity, easy trading |

| Credit Quality | 104.33% U.S. Treasury | Minimal credit risk |

| Maturity Focus | 0-3 months | Reduces interest rate risk |

With SGOV, you get an ETF that puts safety, stability, and liquidity first for your cash management needs.

Key Takeaways

- SGOV invests only in ultra-short-term U.S. Treasury bonds, offering strong government backing and very low risk for your cash.

- The fund provides high liquidity, allowing you to buy or sell shares easily without big price changes or delays.

- SGOV offers competitive yields that often beat money market funds and high-yield savings accounts, helping your cash grow steadily.

- Its short duration protects your investment from big losses when interest rates change, keeping your money stable.

- While SGOV is not FDIC insured, it remains a reliable choice for cash management and portfolio stability with tax advantages in many states.

SGOV Safety

Image Source: pexels

Government Backing

When you look for a safe place for your cash, you want strong protection. SGOV gives you that by holding only U.S. Treasury securities. These are government-backed bonds, which means the U.S. government promises to pay back both the principal and interest on time. This guarantee makes Treasury bonds the highest credit quality you can find.

- SGOV invests in Treasury bonds backed by the full faith and credit of the U.S. government.

- The U.S. government’s backing makes these bonds a top choice during uncertain times or market swings.

- You get peace of mind because the government stands behind every payment.

- Treasury bonds are also very liquid, so you can buy or sell SGOV easily whenever you need cash.

Note: Even though the government backs these bonds, their prices can still change before they mature. You should know that market values can go up or down, but the risk of not getting paid is extremely low.

Credit Risk and Stability

You want to avoid surprises with your cash. SGOV helps you do that by focusing on ultra-short-term Treasury bonds. These bonds mature in three months or less, so they carry very little credit risk. The credit ratings for these Treasury securities are among the highest, as agencies like S&P, Moody’s, and Fitch regularly review them. BlackRock, which manages SGOV, uses a careful process to check these ratings and make sure the fund stays stable.

SGOV stands out compared to other short-term bond ETFs. For example, funds like VGSH hold Treasury bonds with longer maturities, which means they have slightly more risk and can react more to changes in interest rates. SGOV’s focus on very short-term Treasury bills keeps its risk low and its stability high.

Here’s how SGOV compares to other options:

| Fund | Maturity Range | Credit Risk | Volatility | Max Drawdown |

|---|---|---|---|---|

| SGOV | 0-3 months | Minimal | Very Low | Near Zero |

| VGSH | 1-3 years | Low | Low | Slightly Higher |

| SWSBX | 1-5 years | Low-Med | Higher | Higher |

SGOV ranks at the top for risk-adjusted performance. It has a 0.00% Ulcer Index, which means almost no drawdowns or losses. You get a fund that keeps your cash safe and steady, even when markets get rough.

SGOV as a Safe Haven

Cash Preservation

When you want a safe haven for your cash, you look for something that keeps your money steady, even when markets get shaky. SGOV stands out because it focuses on ultra-short-term U.S. Treasury bonds. These are some of the safest investments in the world. You get strong capital preservation because these bonds mature in just a few months, so there is little chance for big price swings.

Let’s break down why SGOV is trusted for capital preservation, especially during times of market volatility:

- SGOV invests only in ultra-short-term U.S. Treasury bonds, which are known for their safety and reliability.

- The fund has a very short duration—about 0.09 years—so it reacts very little to changes in interest rates.

- SGOV is highly liquid, with over $27 billion in assets under management. You can buy or sell shares quickly without moving the price much.

- Even when markets are uncertain, SGOV offers a competitive yield. For example, its 30-Day SEC Yield has reached 5.18%, giving you a way to earn income while keeping your cash safe.

You can see how investors have turned to SGOV for capital preservation:

- SGOV is a favorite during market swings because it gives you liquidity and keeps interest rate risk low.

- In April 2025, SGOV saw $19.9 billion in new investments. This shows that many people trust it for capital preservation.

- SGOV made up 32.8% of all new money going into similar funds this year, showing a clear move toward safety.

- Short-term Treasury ETFs like SGOV help you keep your cash safe and easy to access, even when the economy feels uncertain.

- The rush into SGOV and similar funds often happens when there is worry about the economy or world events. This proves their role as safe havens for capital preservation.

How does SGOV compare to other places you might keep your cash? Here’s a quick look:

| Feature / Fund Type | SGOV (iShares 0-3 Month Treasury Bond ETF) | Money Market Funds | High-Yield Savings Accounts |

|---|---|---|---|

| Investment Type | U.S. Treasury bonds with maturities ≤ 3 months | Various short-term instruments aiming to keep $1 NAV | Bank deposit accounts |

| FDIC Insurance | No | No | Yes, up to FDIC limits |

| Net Asset Value Stability | Does not seek to maintain stable $1.00 NAV | Typically aims to maintain $1.00 NAV (not guaranteed) | N/A (account balance stable) |

| Principal Protection | Less principal protection; subject to interest rate and credit risk | Prioritizes cash preservation but no FDIC guarantee | Principal insured by FDIC |

| Yield Behavior | Potentially higher yields and capital appreciation | Yields can fall rapidly when Fed cuts rates | Yields generally stable but tied to bank rates |

| Risk Factors | Interest rate risk, credit risk, valuation risk | Some risk of NAV fluctuation, no FDIC insurance | Minimal risk due to FDIC insurance |

| Liquidity | Tradable ETF, market price may fluctuate | Highly liquid, but NAV can fluctuate | Highly liquid, withdrawals usually allowed anytime |

SGOV gives you a chance for higher income and capital appreciation, but it does not have the same principal protection as a high-yield savings account. Money market funds also try to keep your cash safe, but they do not have FDIC insurance. If you want the highest level of principal protection, a high-yield savings account at a Hong Kong bank with FDIC insurance in the United States might be best. If you want a safe haven with higher yield and easy access, SGOV is a strong choice.

Interest Rate Risk

Interest rate risk is something you always need to think about when you invest in bonds. When rates go up, bond prices usually go down. SGOV helps you avoid most of this risk because it holds short-duration treasury bills. These bills mature in three months or less, so their prices do not change much when rates move.

SGOV’s yield and price have very low sensitivity to changes in short-term interest rates. The fund’s average maturity is about 0.10 years. This short duration acts like a shield, keeping your investment steady even when the Federal Reserve changes rates. You do not have to worry about big losses if rates rise quickly.

Let’s look at how SGOV compares to a long-term bond fund when rates change:

| Metric | SGOV (Ultra-Short-Term Treasury ETF) | TLT (Long-Duration Treasury ETF) |

|---|---|---|

| Launch Date | May 2020 | N/A |

| Assets Under Management (AUM) | $50+ billion (as of July 2025) | $64.5 billion (peak in 2023/early 2024) |

| Year-to-Date Inflows | $20.5 billion | $2.9 billion outflows |

| Performance Since Launch | 14.97% return | 14.19% return |

| Interest Rate Sensitivity | Low (ultra-short duration) | High (long duration) |

| Impact of Fed Rate Hikes | More stable, less vulnerable to losses | Significant losses during rising rates |

You can see that SGOV’s focus on ultra-short-term U.S. Treasury bonds keeps it stable, even when the Federal Reserve raises rates. Long-term bond funds like TLT can lose value quickly in those times. SGOV’s low interest rate risk makes it a reliable safe haven for your cash and a smart choice for capital preservation.

SGOV Liquidity and Yield

Image Source: unsplash

High Liquidity

You want to move your cash in and out of an investment without hassle. SGOV gives you high liquidity, making it easy to buy or sell shares whenever you need. This ETF trades over 13 million shares each day, with an average daily dollar volume above $261 million. That means you can enter or exit positions quickly, even with large amounts.

| Metric | Value |

|---|---|

| Average Daily Volume | 13,082,890 shares |

| Dollar Volume | $261,627,341 |

| Expense Ratio | 0.07% |

| Assets Under Management | $15,076,460,937 |

SGOV’s bid-ask spread sits at just 0.01%. You pay less to trade, and you do not have to worry about big price swings when you buy or sell. The low expense ratio also keeps your costs down. Many investors choose SGOV because it is one of the least expensive and most liquid options among short-term government bond ETFs.

Tip: High liquidity means you can react fast if you need to move your cash for an emergency or a new opportunity.

Competitive Yield

You want your cash to work for you. SGOV offers an attractive yield that often beats money market funds and high-yield savings accounts. Right now, SGOV’s yield sits between 4% and 5%. That is higher than the best money market funds, which offer about 4.03%, and much higher than many savings accounts at Hong Kong banks.

| Investment Type | Yield (%) | Notes |

|---|---|---|

| SGOV (iShares 0-3 Month Treasury Bond ETF) | 4 - 5 | Monthly income; tax advantages (exempt from state and local taxes) |

| Best Money Market Funds (Aug 2025) | 4.03 | Top market rates |

| Vanguard Municipal Money Market Fund (VMSXX) | 2.75 | Lower yield, tax-exempt |

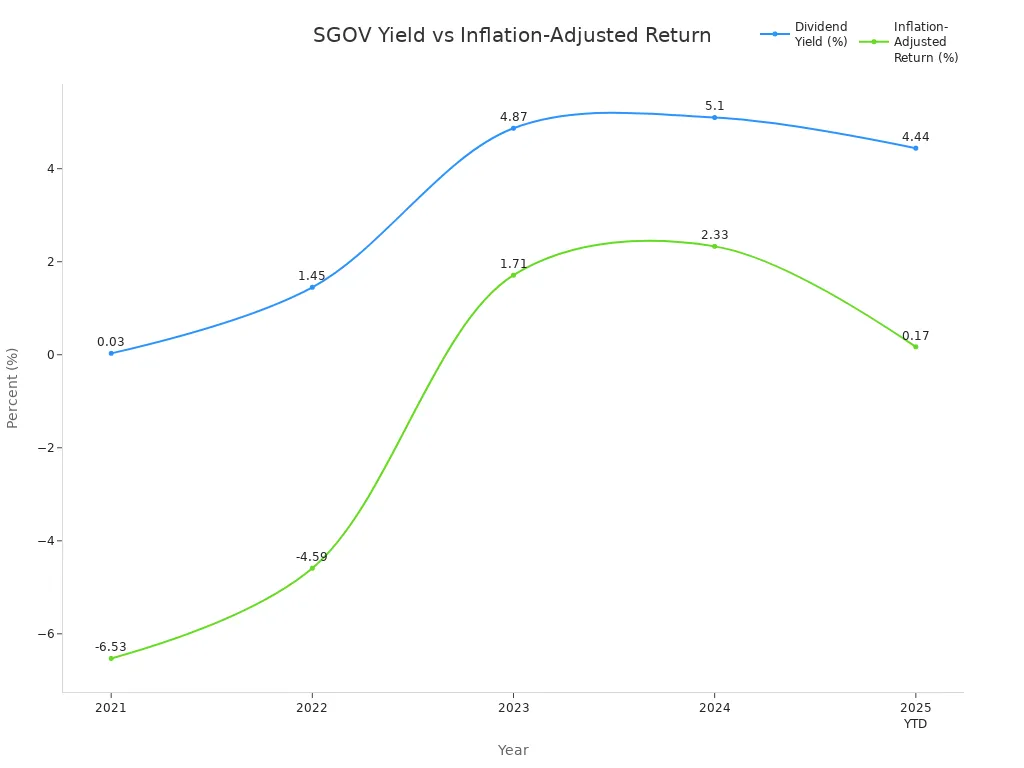

SGOV pays income monthly, so you see regular returns. The attractive yield helps your cash keep up with inflation. Over the past year, SGOV’s dividend yield reached about 4.44%, with positive real returns in 2024 and 2025.

You get a combination of high liquidity, attractive yield, and steady income. This makes SGOV a strong choice for anyone who wants to earn more from their cash without giving up flexibility.

Risks and Considerations

Tax Implications

You want to know how SGOV affects your taxes. SGOV pays interest income from U.S. Treasury bills. You report this income as ordinary dividends on Form 1099-DIV. The good news? This interest is exempt from state and local taxes in most places, including states like California, Connecticut, and New York. You still need to pay federal income tax on these distributions.

Here’s what you should keep in mind:

- You pay federal income tax on SGOV’s interest income.

- Most of this income is exempt from state and local taxes. In 2024, 97.53% of SGOV’s income qualified for this exemption.

- If you sell SGOV shares for a profit, you may owe capital gains tax. Short-term gains are taxed at ordinary rates, while long-term gains get lower rates.

- You need to check your tax software to make sure it applies these exemptions correctly.

- Bank savings accounts, including those at Hong Kong banks, do not offer state tax exemptions. You pay tax at both federal and state levels.

- Money market funds can be tricky. They often mix different types of income, so you might pay more state tax than you expect.

SGOV stands out for investors in high-tax states. You get better after-tax returns compared to bank savings accounts and most money market funds.

Tip: Always check with a tax advisor about your state’s rules. Each state treats Treasury income a little differently.

Opportunity Cost

When you choose SGOV, you trade off some features found in other cash options. SGOV gives you liquidity, convenience, and automatic reinvestment. You can buy or sell shares easily on the stock exchange. You also get professional management and diversification.

Let’s compare SGOV to other choices:

| Option | Yield Potential | Liquidity | Penalties/Restrictions | Tax Advantages |

|---|---|---|---|---|

| SGOV | Competitive | High | None | State/local tax exempt |

| Individual T-Bills | Slightly higher | Moderate | Must hold to maturity | State/local tax exempt |

| CDs | Lower | Low | Early withdrawal penalties | None |

| Bank Savings Accounts | Lowest | High | None | None |

Individual Treasury bills may offer a bit more yield, but you need to manage them yourself. CDs can lock up your money and charge penalties if you withdraw early. SGOV lets you move your cash quickly and reinvest dividends automatically. You might give up a small amount of yield, but you gain flexibility and ease of use.

One more thing to consider: SGOV is not FDIC insured. Unlike bank accounts at Hong Kong banks, you do not get federal deposit insurance. You face market fluctuations and interest rate changes. Treasury securities are backed by the U.S. government, but you still carry some risk.

Using SGOV for Cash Management

Portfolio Integration

You want your portfolio to stay steady, even when markets get bumpy. SGOV works well as a portfolio stabilizer because it focuses on ultra-short-term U.S. Treasury bonds. Many investors use SGOV as the core holding for cash management. You can blend it with other funds to get more yield or tax benefits.

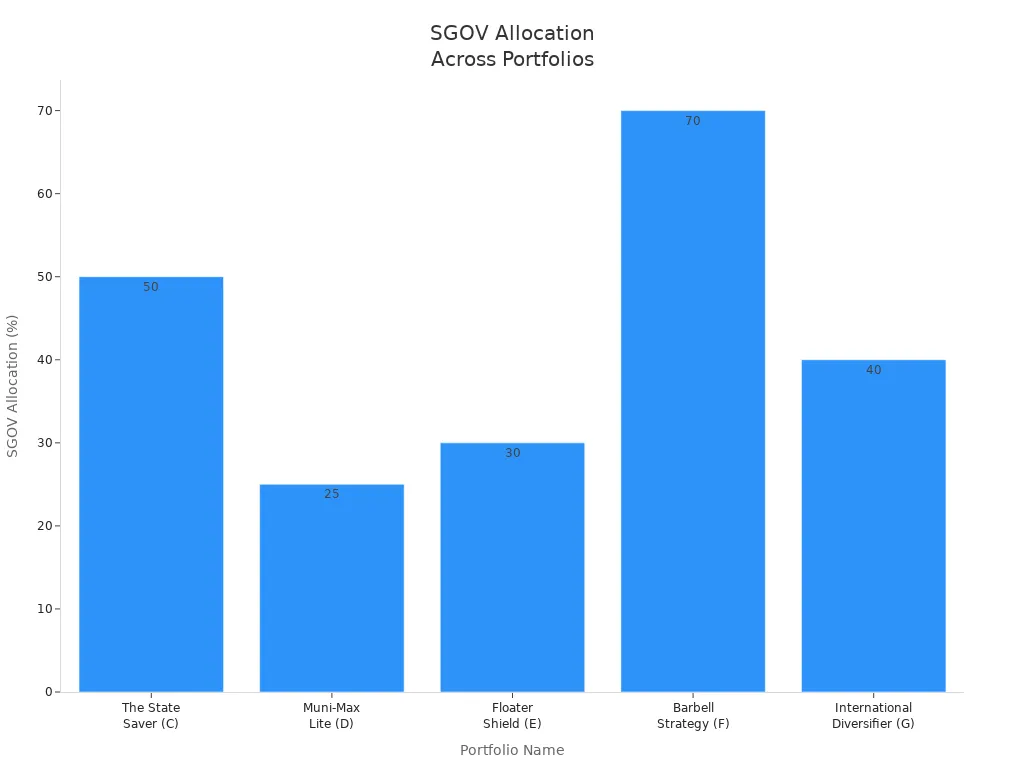

Here’s a look at how different portfolios use SGOV:

| Portfolio Name | Target Investor Profile | SGOV Allocation | Other Key Holdings | Strategy Highlights |

|---|---|---|---|---|

| The State Saver © | Moderate risk tolerance, max yield w/in 1% risk | 50% | USFR (35%), VTES (15%) | Heavy Treasury focus for tax efficiency; municipal bonds add federal tax-free income |

| Muni-Max Lite (D) | High earners seeking tax optimization | 25% | USFR (35%), VTES (40%) | Maximizes federally tax-free muni bond income while maintaining Treasury stability |

| Floater Shield (E) | Comfortable with minimal corporate credit risk | 30% | USFR (40%), FLOT (30%) | Adds yield premium via floating rate corporate bonds; ultra-low duration minimizes interest rate risk |

| Barbell Strategy (F) | Risk-balanced, seeking higher yields | 70% | VTEB (30%) | Combines ultra-short Treasury anchor with tax-exempt bonds for yield enhancement |

| International Diversifier (G) | Concerned about USD risk, currency hedge | 40% | IAGG (30%), FLOT (30%) | Diversifies sovereign risk internationally with currency-hedged bonds; hedging costs reduce returns |

You can see that SGOV often makes up a big part of these portfolios. It helps keep your cash safe and ready to use. Some investors add municipal bonds for tax savings or floating-rate notes for extra yield. This mix gives you both stability and income.

Tip: Many people use platforms like M1 Finance to set up automatic rebalancing and keep their target SGOV allocation on track.

Short-Term Needs

SGOV fits well when you need to manage cash for short-term goals. You might want to set aside money for an emergency fund, a big purchase, or upcoming expenses. SGOV lets you keep your cash liquid and easy to access, while still earning a solid yield.

Financial advisors suggest a few ways to balance SGOV with other assets for the best results:

- Focus on income over duration by using short-term Treasury bonds like SGOV.

- Pair SGOV with short-term TIPS to help protect against inflation.

- Add municipal bonds for tax advantages and steady returns.

- Use active income funds to reach higher-yield sectors and spread out risk.

- Blend these choices to get both liquidity and stability in your cash management plan.

SGOV’s high liquidity means you can move your cash quickly if you need it. You can use it for your emergency fund or to park money before making a big investment. Many investors like to keep SGOV as their first stop for cash management, then add other funds for extra growth or protection.

SGOV stands out as a reliable safe haven because it invests in ultra-short-term U.S. Treasury bills, offering strong government backing, high liquidity, and steady preservation of value. When you decide if SGOV fits your needs, consider these points:

- SGOV’s short duration means low risk and easy access to your money.

- It works well for income, stability, and flexible portfolio management.

- You should match your investment with your own goals and comfort with risk.

Remember, while SGOV is among the safest choices, always review other options and talk with a financial advisor to make the best decision for your situation.

FAQ

What makes SGOV safer than other cash investments?

You get safety from SGOV because it holds only U.S. Treasury bills. The U.S. government backs these bills. This backing means you face very little risk of losing your money.

Can you lose money with SGOV?

SGOV is very stable, but its price can move a little. If you sell during a rare dip, you might lose a small amount. Most people hold SGOV for short periods and see almost no loss.

Is SGOV insured like a bank account at a Hong Kong bank?

No, SGOV is not FDIC insured. If you want FDIC insurance, you need a savings account at a Hong Kong bank in the United States. SGOV relies on U.S. government backing, not deposit insurance.

How quickly can you access your cash in SGOV?

You can sell SGOV shares any trading day and get your cash in a few days. This process is fast and easy, much like selling a stock. You do not face withdrawal limits.

Are SGOV’s yields better than high-yield savings accounts?

SGOV often pays a higher yield than many high-yield savings accounts at Hong Kong banks. Yields change with market rates. Always check the latest numbers and compare before you decide.

SGOV is a compelling option for anyone seeking a safe, stable, and liquid place for their cash. Its government backing and focus on ultra-short-term bonds make it an effective tool for cash management, providing a competitive yield without the risks of long-term investments. For international investors, however, accessing US-listed ETFs like SGOV can present a logistical hurdle. This is where a modern financial platform becomes essential. BiyaPay provides a seamless way to fund your brokerage account and trade US-listed stocks and ETFs. Our low, transparent fees and a built-in real-time exchange rate converter ensure that you can get more for your money when converting and investing. By simplifying the process of moving funds and trading internationally, BiyaPay empowers you to execute your cash management strategy with confidence and efficiency. Take control of your finances and start trading. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

How to Choose US Major Indices: Pros and Cons Analysis of S&P 500, Dow Jones, and Nasdaq

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.