Where to Buy a Travelex Card in the United States in 2025

Image Source: pexels

You cannot purchase travelex card in the US in 2025. If you look for travelex options, you will not find them for u.s. travelers. Instead, you can pick a Mastercard multi-currency Cash Passport or other prepaid Mastercard cards. These let you manage different currencies and help you avoid high fees. Always check the fees before you choose a card. You get better control and clear limits on your spending.

Key Takeaways

- You cannot buy or reload a Travelex card in the US in 2025 because Travelex stopped offering these cards here.

- Mastercard multi-currency Cash Passport and similar prepaid cards are good alternatives that let you hold and spend multiple currencies.

- Always check fees like ATM withdrawals, currency conversion, and inactivity charges before choosing a travel card to avoid surprises.

- Most prepaid travel cards let you manage money easily through apps, reload funds online, and offer strong security features like chip and PIN.

- Compare supported currencies and reload options to pick a card that fits your travel needs and helps you save on extra costs.

Purchase Travelex Card in the US

Image Source: pexels

Travelex Card Availability

You might want to purchase travelex card for your next trip, but you will not find these cards in the United States in 2025. If you visit travelex locations or check their website, you will see that the option to purchase travelex card is not available for US customers. Travelex has stopped offering these cards in the US, so you cannot get one at airports, stores, or online.

Note: If you search for travelex cards in the US, you will only find information about other products or services. You will not see any way to purchase travelex card for your travel needs.

Why Travelex Card Is Unavailable

You may wonder why you cannot purchase travelex card in the US. Travelex made a decision to stop selling these cards in the American market. This means you cannot buy, reload, or manage these cards if you live in the US. The company now focuses on other services, so the cards are not part of their US offerings.

If you need a prepaid travel card, you should look at other options. The Mastercard multi-currency Cash Passport is a strong choice. Many travelers use these cards because they work in many countries and let you load several currencies. You can purchase these cards online or at select banks, including some Hong Kong banks that serve international customers.

Here is a quick list of what you can do instead:

- Choose a Mastercard multi-currency Cash Passport for your travel money.

- Visit the official website to see where you can purchase these cards.

- Ask your local bank if they offer prepaid travel cards.

- Compare fees and supported currencies before you decide.

You will not find travelex cards at travelex locations in the US. Instead, focus on the best alternatives to make your travel easy and safe.

Travelex Prepaid Mastercard Alternatives

Leading Alternatives

You have several good choices if you want a prepaid debit card for travel. Many travelers look for cards that are easy to use and help manage spending in different countries. The travelex prepaid mastercard is not available in the US, but you can find other cards that work well for your needs.

Here is a table that shows some top alternatives recommended by financial experts:

| Card Name | Key Features | Pros | Cons |

|---|---|---|---|

| Mastercard Multi-currency Cash Passport | Spend in up to 10 currencies, Chip and PIN security, manage online | Easy to use, accepted worldwide, manage online | Not offered by major US banks or retailers |

| Bluebird American Express | Free purchase online, no foreign transaction fees, manage online/app | No interest, no foreign fees, easy account management | Limited acceptance outside the US, some top-up fees |

| Discover it Secured | Secured card, cashback rewards, no foreign fees | Build credit, earn cashback, no annual fee | Not always accepted abroad, cash advance fees |

Note: Always check if your card works in the country you plan to visit. Some cards may not be accepted everywhere.

Where to Buy Alternatives

You can purchase online or in-store, but options are limited in the US. The Mastercard multi-currency Cash Passport is not sold by major US banks or retailers. Travelex offers this card, but only at select locations like airports or through their website. Wise also has a multi-currency card, but you need to order it online.

If you want to buy a prepaid debit card, follow these steps:

- Visit the official website of the card provider.

- Choose the card you want and start the purchase online.

- Fill in your details and upload any needed documents.

- Pay for the card and wait for it to arrive by mail.

- Some airports or in-store locations may offer cards, but always check availability first.

You cannot get the Tesco Travel Money card in the US. It is only for UK residents. Always compare fees, supported currencies, and where you can use the card before you decide.

Card Features

Image Source: pexels

Supported Currencies

You want a travel card that works almost anywhere. Most leading prepaid travel cards in the United States let you hold and spend between 14 and 20 different currencies. This wide range matches what you see in other developed markets. You can use these cards in many countries without worrying about extra conversion fees. Some cards even detect the local currency and use it for your purchase, so you avoid surprise fees.

Here are some of the most common currencies you can load and spend with Mastercard multi-currency Cash Passport and other top alternatives:

- US Dollar (USD)

- Euro (EUR)

- British Pound (GBP)

- Australian Dollar (AUD)

- Canadian Dollar (CAD)

- Japanese Yen (JPY)

- Singapore Dollar (SGD)

- Chinese Yuan (CNY)

- Swiss Franc (CHF)

- Indian Rupee (INR)

- UAE Dirham (AED)

- Hong Kong Dollar (HKD)

You can also find cards like Wise and Revolut that support even more currencies, sometimes over 30. These cards help you avoid high fees when you travel or shop online. Always check which currencies your card supports before you load money. Some cards charge extra fees if you spend in a currency not on your card.

Usage and Management

Using a prepaid travel card is simple. You load money onto your card, pick the currencies you want, and start spending. Most cards let you manage everything through a mobile app or website. You can reload your card, check your balance, and move money between currencies. If you need to send money to another cardholder, you can do that right from the app. You can also withdraw cash at ATMs, but watch out for ATM fees.

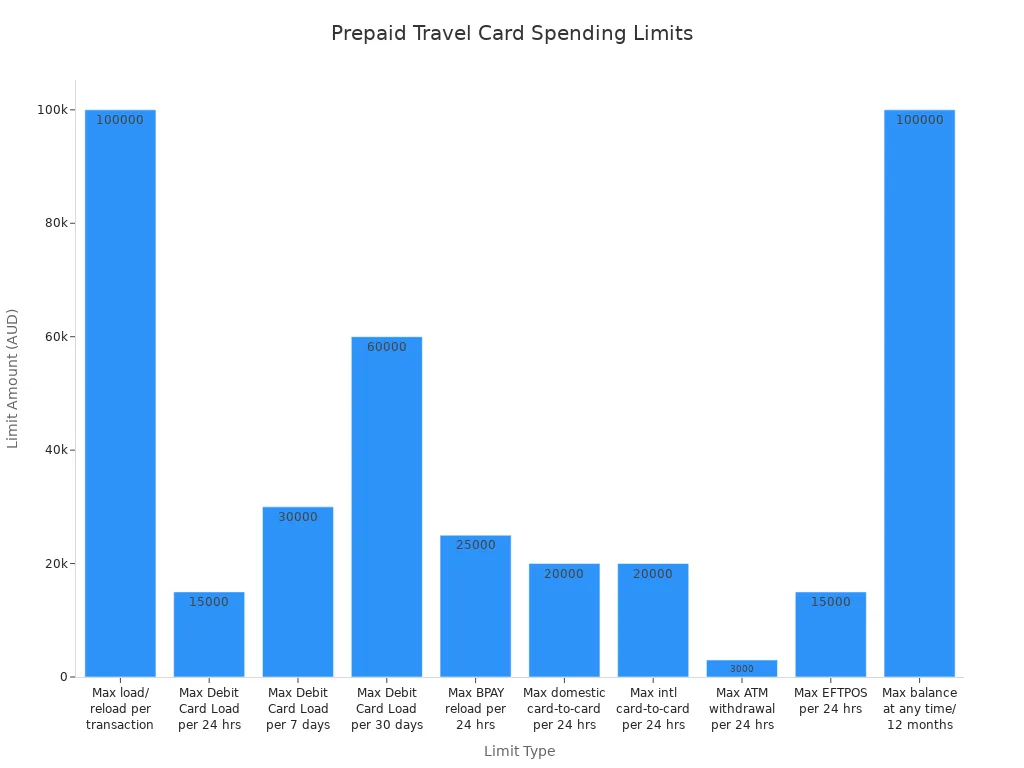

Here’s a quick look at some typical spending and loading limits for these cards:

| Limit Type | Limit Amount (USD equivalent) |

|---|---|

| Maximum load/reload per transaction | $67,000 |

| Maximum load per 24 hours | $10,000 |

| Maximum load per 7 days | $20,000 |

| Maximum load per 30 days | $40,000 |

| Maximum ATM withdrawal per 24 hours | $2,000 |

| Maximum balance allowed at any time | $67,000 |

You get a lot of control with the mobile app. Here are some features you can use:

| Feature Category | Description |

|---|---|

| Reload Money | Add funds to your card using the app or online banking. |

| Check and Transfer Balances | See your balances and move money between currencies. |

| Send Money | Transfer funds to other cardholders. |

| Move Money to Bank Account | Withdraw money from your card to your bank account. |

| View Transactions | Check your spending history anytime. |

| Manage Account | Handle all your card settings, reloads, and currency choices. |

| Contactless Payments | Tap to pay where accepted. |

| 24/7 Global Assistance | Get help if your card is lost or stolen, including emergency cash. |

| Locked-in Exchange Rates | Lock in rates when you load up to 11 currencies. |

Security is a big deal. Your card uses chip and PIN protection, and it is not linked to your main bank account. You get Mastercard Zero Liability protection, so you are not responsible for unauthorized transactions. If you lose your card, you can get a free replacement or emergency cash. You can also suspend your card online if you notice anything strange. The app uses biometric login for extra safety.

Fraud protection is strong. Visa and Mastercard branded cards give you fraud protection and dispute options. The card provider monitors for suspicious activity, like odd spending patterns or multiple fundings. You will see limits on how much you can load or spend, which helps stop fraud. You also get alerts and can register your card for better monitoring. The app uses real-time fraud detection to keep your money safe. You should always watch for scams and never share your card details.

You will see fees for some services, like ATM withdrawals, currency conversion, or reloading your card. Some cards charge monthly fees or inactivity fees if you do not use your card for a while. Always read the fee schedule before you choose a card. Compare the fees for each card, because they can add up fast. Some cards have lower fees for certain currencies or transactions. If you travel often, look for a card with low foreign transaction fees. You can avoid some fees by using the app to manage your money and by spending in supported currencies. If you lose your card, replacement fees may apply, but many providers offer one free replacement. Watch out for hidden fees, especially when you withdraw cash or reload your card. Some cards offer fee-free spending in select countries, but others do not. Always check the terms so you do not get surprised by extra fees.

Fees and Top-Up Methods

Card Fees

When you pick a prepaid travel card, you want to know about all the fees. Every card comes with its own set of fees. You might see fees for buying the card, loading money, or using it at an ATM. Some cards charge monthly fees if you do not use the card for a while. You may also pay fees when you spend in a currency that is not loaded on your card. These fees can add up fast, so you need to check the fee schedule before you choose.

Here is a table to help you compare common fees:

| Fee Type | Typical Amount (USD) |

|---|---|

| Card purchase fee | $5 – $10 |

| ATM withdrawal fee | $2 – $3 per withdrawal |

| Currency conversion fee | 3% of transaction amount |

| Inactivity fee | $3 per month |

| Reload fee | $0 – $5 per reload |

Tip: Always read the card’s terms. Some cards have hidden fees that you might miss if you do not look closely.

You can avoid some fees by spending in supported currencies and using the card’s app to manage your money. If you lose your card, you may pay a replacement fee, but many providers offer one free replacement.

Reload Options

You want to keep your card loaded with enough money for your trip. Most prepaid travel cards let you reload funds in a few easy ways. You can use online banking, a mobile app, or even visit select Hong Kong banks that support international cards. Some cards let you reload at airport kiosks or partner stores, but you should always check if extra fees apply.

Here are some popular reload options:

- Online banking transfer

- Debit card payment through the app

- Cash reload at select bank branches

- Reload at airport kiosks (check for fees)

You should always check if your reload method has extra fees. Some cards offer free reloads, but others charge each time you add money. If you reload in a different currency, you may pay extra conversion fees. Always plan your reloads to avoid paying more than you need.

You cannot get a Travelex card in the US, but you have good options. The Mastercard multi-currency Cash Passport and similar cards let you spend in many currencies and manage your money easily. Keep in mind some common issues with prepaid cards:

- Limited consumer protection if you lose money to fraud

- No credit-building or rewards

- ATM and inactivity fees

Check the latest details on Wise.com, Mastercard, Visa, or the Federal Reserve’s website. Prepaid travel cards keep growing, so you will see more choices and better features soon. Choose the card that fits your travel style and always read the terms before you buy.

FAQ

Can you buy a Travelex card at US airports in 2025?

You cannot buy a Travelex card at any US airport in 2025. Travelex no longer sells these cards in the United States. You can look for other prepaid travel cards at airport kiosks or online.

What is the best alternative to a Travelex card for US travelers?

You can try the Mastercard multi-currency Cash Passport. This card lets you load several currencies and manage your spending. You can also check out Wise or Revolut cards for more options.

Where can you reload a prepaid travel card?

You can reload your prepaid travel card online, through a mobile app, or at select Hong Kong banks. Some cards let you reload at airport kiosks. Always check if your reload method charges extra fees.

Do prepaid travel cards work as a currency exchange service?

Yes, prepaid travel cards can act as a currency exchange service. You load money in different currencies and spend without worrying about high conversion fees. Always check the exchange rates before you load your card.

Are there any hidden fees with prepaid travel cards?

Some prepaid travel cards have hidden fees, like inactivity fees or ATM withdrawal charges. You should read the fee schedule before you buy. Using the card’s app can help you avoid some extra costs.

For U.S. travelers in 2025, the end of Travelex cards means searching for reliable, low-cost alternatives. Prepaid cards can be useful, but many come with hidden fees, ATM surcharges, or limited reload options that eat into your travel budget. BiyaPay offers a smarter solution: real-time exchange rate checks, instant conversions between multiple fiat and digital currencies, and remittance fees as low as 0.5%. With support for most countries worldwide, BiyaPay helps you manage money abroad with more flexibility and transparency than prepaid travel cards ever could.

Travel should be about experiences, not worrying about fees. Register with BiyaPay today and enjoy faster, safer, and more cost-effective global transfers.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

US Stock Broker Opening Guide: Fees, Security, and App Experience Comparison (Futu vs Tiger vs Firstrade)

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.