Beginner’s Guide to Sending Money from DasherDirect to Your Bank

Image Source: pexels

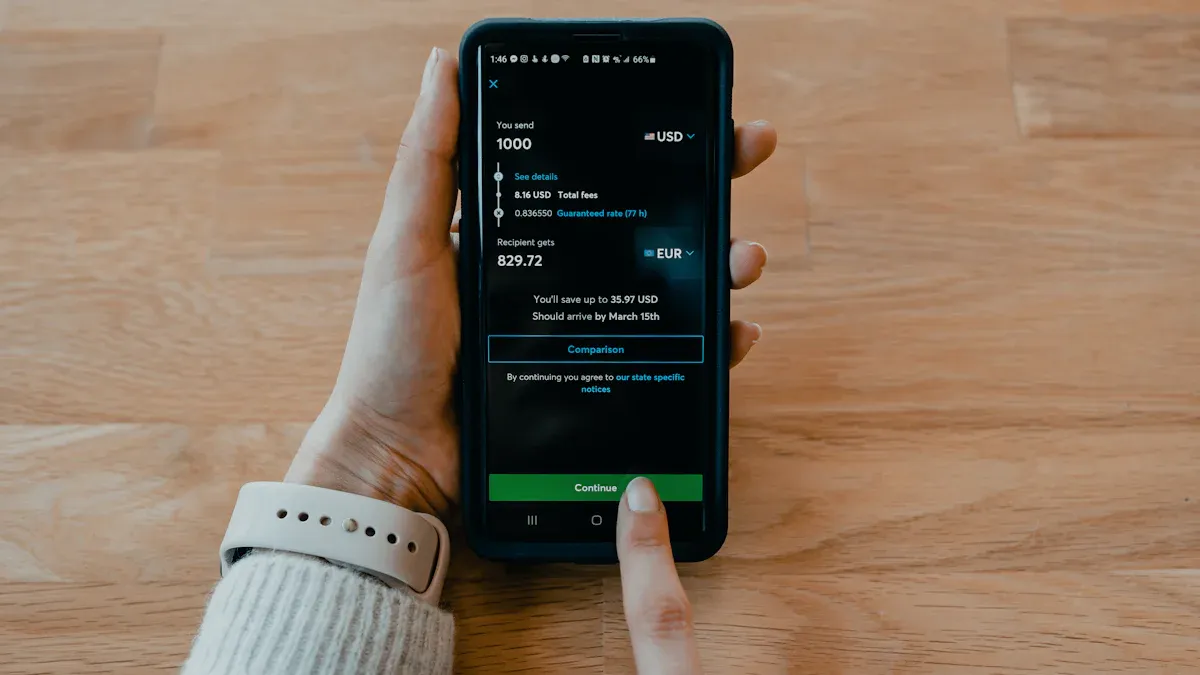

You want to transfer money from your DasherDirect account to your bank account? Open the DasherDirect app and use it to send money straight from your DasherDirect account. You can transfer your DoorDash earnings with just a few taps. Make sure your bank account details match your DasherDirect account. When you transfer money, always check your bank account information before you send money. The DasherDirect app helps you transfer money to a bank account quickly. If you have any issues with your DasherDirect account, support can help.

Key Takeaways

- Log in to the DasherDirect app, link your bank account carefully, and follow simple steps to transfer money quickly and safely.

- Always double-check your bank details before sending money to avoid delays or errors in your transfer.

- Set up direct deposit to get your DoorDash earnings instantly without fees and enjoy extra benefits like cash back and no monthly charges.

Transfer Money from DasherDirect

Image Source: pexels

Log In to DasherDirect App

You need to start by logging into your DasherDirect app. Open the app on your phone and enter your login details. If you have not set up your DasherDirect account yet, follow the prompts to create one. Make sure you use the same information you used for your DoorDash account. This helps keep your payment and transfer process smooth.

Add Bank Account

Before you transfer money, you must link your bank account to your DasherDirect account. Here’s how you can do it:

- Tap “More” at the bottom right corner of the DasherDirect app.

- Select “Move Money.”

- Tap “Send Money To Someone.”

- Click “Add Recipient.”

- Enter your bank account number and routing number. Double-check these details to avoid any issues.

- Save your bank account information.

Tip: Always make sure your bank account details match your DasherDirect account information. If you need to update your bank account, just repeat these steps and enter the new details.

Transfer Money Steps

Now you are ready to transfer money from DasherDirect to your bank account. Follow these steps:

- Open the DasherDirect app and sign in.

- Tap “More” at the bottom right of the home screen.

- Select “Move Money.”

- Tap “Send Money.”

- Choose “To yourself.” You can select your linked bank account or add a new one if needed.

- Enter the amount you want to transfer. You can transfer up to $2,000 every 24 hours and up to $5,000 every 30 days.

- Tap “Confirm Transfer” to finish.

You will get a confirmation number and a push notification once you complete the transfer. Most transfers arrive in your bank account within 1-2 business days. If you start the transfer before midnight Eastern Time, your funds usually arrive faster. Transfers made on weekends or holidays may take longer.

Note: Transfers are free. You can only send money to US bank accounts. If you need to cancel a transfer, go to the “Move Money” menu before the same-day cutoff.

Set Up Direct Deposit

If you want to avoid manual transfers, you can set up direct deposit. With direct deposit, your DoorDash earnings go straight to your DasherDirect account after every dash. You do not pay any fees, and you get instant access to your money. This is different from manual transfers, which may require you to wait for weekly payments or pay extra fees for instant cash out.

Here are some benefits of using direct deposit with DasherDirect:

- You get instant direct deposit of your DoorDash earnings after every dash, with no fees.

- You avoid Fast Pay fees, so you keep more of your money.

- You earn 2% cash back on gas purchases at eligible gas stations.

- There are no monthly fees or minimum balance requirements.

- You can switch between your DasherDirect account and your regular bank account for payouts.

- Your funds are held in an FDIC-insured bank, so your money stays safe.

Tip: Setting up direct deposit helps you get your payment faster and removes the need to transfer money manually. If you rely on your DasherDirect account for daily expenses, direct deposit is the best choice.

If you want to switch your payment method, go to your DoorDash app and update your payout preferences. Choose DasherDirect as your main payment option to enjoy instant, fee-free transfers.

Transfer Limits & Issues

Image Source: unsplash

Transfer Limits and Fees

You need to know the limits before you transfer money from dasher direct to your bank account. Here’s a quick look at the current limits:

| Transfer Type | Daily Limit | Daily Transfer Count Limit | Monthly Limit | Monthly Transfer Count Limit |

|---|---|---|---|---|

| Transfers from DasherDirect to personal bank account | $2,000 per day | Up to 3 transfers daily | $5,000 per month | Up to 30 transfers monthly |

You do not pay any fees when you transfer money from dasher direct to your bank account within these limits. Here are some key points:

- Transfers to any US bank account are free.

- You can make up to 3 transfers each day.

- You can transfer up to $2,000 daily and $5,000 monthly.

- If you go over these limits, extra fees may apply.

- Other fees may exist for ATM use or card replacement, but not for bank transfers.

Processing Times

When you transfer money from dasher direct, your funds usually reach your bank account in 1-2 business days. If you start the transfer before midnight Eastern Time, you may get your money faster. Transfers made on weekends or holidays might take longer. You can check your dasherdirect account balance after the payout time to see if the transfer is complete.

Troubleshooting Transfer Money from Dasher Direct

Sometimes, you might have trouble with a transfer. Here’s what you can do:

- Make sure your dasherdirect account has enough money.

- Check that your card is active and linked to the app.

- Look for any holds or alerts by contacting dasherdirect support.

- Confirm you are not over your daily or monthly transfer limits.

- Reconnect your dasherdirect card in the app if needed.

- Contact your bank if you see errors with your bank account.

- Keep your app updated and clear the cache.

Tips for Smooth Transfers

You can avoid problems if you double-check your bank account details before you transfer money. Always start your transfer early in the day to avoid delays. Watch your dasherdirect account for notifications about your transfer. If you ever have questions, dasherdirect support can help you right away.

You can move your earnings from dasherdirect to your bank by logging in, linking your account, and following the transfer steps. Always double-check your details. If you have trouble, dasherdirect support offers help through the app, phone, or live chat. Setting up direct deposit with dasherdirect gives you faster, fee-free access.

Remember, dasherdirect makes managing your money easy. Use the app to check your balance, transfer funds, and get support. Direct deposit with dasherdirect means you get paid right after each dash, so you never wait for your money.

FAQ

How long does it take for my transfer to reach my bank account?

Most transfers arrive in 1-2 business days. If you transfer before midnight Eastern Time, your money may show up faster.

Can I transfer money to a bank outside the United States?

You can only send money to banks in the United States. Transfers to banks in Hong Kong or other countries are not supported.

What should I do if my transfer fails?

| Step | What to Do |

|---|---|

| Check your balance | Make sure you have enough. |

| Review details | Double-check your info. |

| Contact support | Get help in the app. |

Frustrated by waiting 1-2 business days for DasherDirect transfers or limited to US banks? BiyaPay offers a smarter way to manage your earnings. With transfer fees as low as 0.5%, you can send money to most countries worldwide, including same-day transfers for instant access. BiyaPay supports seamless conversions between fiat and digital currencies, with real-time exchange rates to ensure transparency. Avoid the hassle of transfer limits and unreliable bank details—BiyaPay’s secure platform makes global payments effortless. Sign up with BiyaPay today to unlock fast, affordable, and reliable transfers for your DoorDash earnings!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

The Relationship Between Fed Rate Cuts and New York Stock Market Fluctuations Is No Longer a Simple Cause-and-Effect

What Does Price-to-Earnings Ratio (PE) Mean? Master It to Navigate the Chinese Stock Market

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.