How Did Dow Close Today After Market Moves

Image Source: pexels

The Dow Jones Industrial Average closed at 42,171.66 today, falling 44.14 points or 0.10%. How did dow close today? The answer: the dow edged down but stayed near record highs. Stock markets showed mixed results, with the S&P 500 and Nasdaq posting small gains in this market update. How did dow close today? Investors watched these moves closely.

Key Takeaways

- The Dow closed slightly lower at 42,171.66, staying near record highs despite a small drop of 44 points.

- Geopolitical tensions and Federal Reserve policies strongly influenced market moves, causing mixed results across major indexes.

- Investors should stay informed about global events and economic data to make smart decisions and adjust strategies carefully.

How Did Dow Close Today

Image Source: pexels

Closing Value and Change

The Dow Jones Industrial Average closed at 42,171.66 today. The index dropped by 44.14 points, which equals a 0.10% decrease. This small decline did not push the Dow far from its recent record highs. Many investors continue to watch how did dow close today because it signals the overall health of the market.

| Index Name | Closing Value | Point Change | Percentage Change |

|---|---|---|---|

| Dow Jones Industrial Average | 42,171.66 | -44.14 | -0.10% |

This table shows the latest market update for the Dow. The numbers reflect a minor pullback after a strong run in recent weeks. The Dow remains a key focus for those tracking stocks and market trends.

Market Context

Stock markets showed mixed results today. The S&P 500 and Nasdaq both posted small gains, while the Dow edged lower. This pattern highlights how did dow close today compared to other major indexes. Investors saw the S&P 500 rise by 0.2% and the Nasdaq gain 0.3%. These moves suggest that technology and growth stocks outperformed traditional blue-chip companies.

Note: The Dow’s performance stands out because it remains near all-time highs, even as some sectors face pressure.

To understand how did dow close today, it helps to look at long-term trends. The Dow has experienced both bull and bear markets over the past century. During secular bear markets, returns often stay flat or negative for years. The table below summarizes some of these periods:

| Period Start | Period End | Duration (Years) | Annualized Return | Cumulative Return | Annualized Volatility (Std. Dev.) |

|---|---|---|---|---|---|

| Early 1906 | Mid 1924 | 18 | Negative | Negative | High |

| Late 1929 | Late 1954 | 25 | Near Zero | Slightly Positive | Very High |

| Early 1966 | Late 1982 | 17 | Near Zero | Slightly Positive | Moderate |

| Early 2000 | End 2010 | 11 | Near Zero | Slightly Positive | Moderate |

Investors use this historical data to compare today’s market update with past cycles. Standard deviation, a measure of volatility, helps them understand risk during different periods. When the Dow stays near record highs, it often signals strong investor confidence. However, history shows that markets can shift quickly.

Market Drivers and Investor Takeaways

Image Source: unsplash

Key Influences

Recent geopolitical tensions have played a major role in shaping market sentiment.

- The ongoing conflict between Israel and Iran has led to daily missile exchanges, raising fears of a broader war.

- Oil prices surged, with West Texas Intermediate crude climbing 5.2% to $75.50 per barrel, as investors worried about supply disruptions.

- President Trump’s early departure from the G7 summit to address Middle East developments added to market uncertainty.

- Economic data on retail sales, industrial production, and homebuilder confidence came in weaker than expected, increasing volatility ahead of the Federal Reserve’s interest rate announcement.

The Federal Reserve continues to influence the market through its monetary policy. The Fed uses flexible average inflation targeting, allowing inflation to exceed 2% after periods of undershooting. Its decisions on interest rates affect borrowing costs, inflation, and employment. Recently, the Fed held rates steady, reflecting caution due to persistent inflation and supply shocks. This approach keeps market participants alert to any changes in policy or projections.

Sector and Stock Highlights

Sector performance showed clear differences today. The energy sector stood out as the only group to close positively, driven by a 4% rise in oil prices. Manufacturing data for May showed industrial production at -0.2%, below expectations, and capacity utilization fell to 77.4%. These numbers reflect concerns about economic growth and supply disruptions.

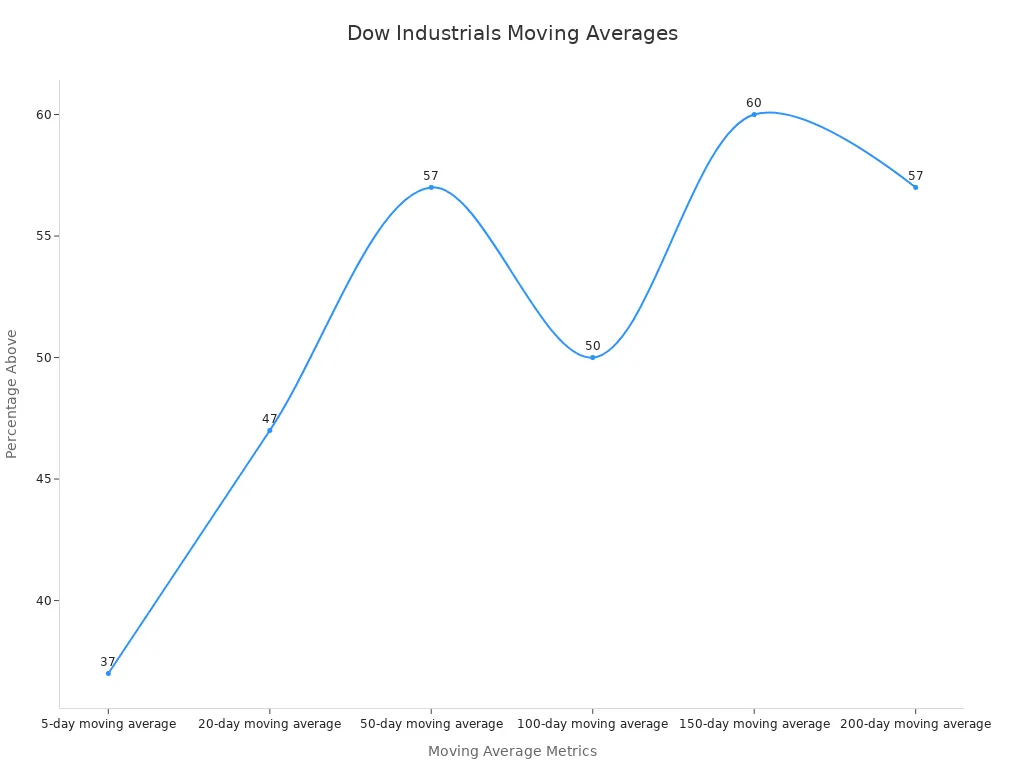

| Metric (Moving Average) | Percentage of Dow Industrials Stocks Above |

|---|---|

| 5-day moving average | 37% |

| 20-day moving average | 47% |

| 50-day moving average | 57% |

| 100-day moving average | 50% |

| 150-day moving average | 60% |

| 200-day moving average | 57% |

Large companies within the dow, especially those in energy and consumer goods, had the strongest impact on today’s movement. Stocks in sectors like restaurants, hotels, and transportation faced more pressure, while medical and communication stocks showed resilience.

Analyst Insights

Analysts point to several factors driving today’s market moves. BlackRock’s commentary highlights the influence of central bank meetings, inflation pressures, and geopolitical risks. They maintain a positive outlook on U.S. equities, supported by themes like artificial intelligence and corporate reforms. Investor’s Business Daily tracks daily price changes and notes that analyst recommendations often lead to strong market reactions, especially when ratings or target prices change significantly. Studies show that positive analyst reports can boost stock prices, while negative reports can trigger declines.

What It Means for Investors

Investors should remain aware of both global events and economic indicators.

- Surveys and real-time feedback help investors understand market sentiment and adjust strategies quickly.

- Investor sentiment acts as a contrarian indicator, signaling possible market reversals. Tools like the Volatility Index and Put/Call Ratio provide useful signals.

- Psychological factors, such as fear and optimism, influence decisions about stocks and asset allocation.

- Contrarian strategies may help when sentiment reaches extreme levels.

Staying informed about geopolitical risks, Federal Reserve policy, and sector trends can help investors make better decisions in a changing market.

The Dow closed at 42,171.66, showing a slight drop after recent highs. Geopolitical tensions and Federal Reserve policy shaped today’s market. Research methods, including surveys and industry reports, support these findings. Predictive models help forecast future trends. Investors should stay alert as new data and global events may shift market direction.

FAQ

What caused the Dow to drop today?

Geopolitical tensions and weaker economic data led to investor caution. The Federal Reserve’s decision to hold rates steady also influenced the Dow’s slight decline.

How did other major indexes perform?

The S&P 500 gained 0.2%. The Nasdaq rose 0.3%. Technology and growth stocks outperformed traditional blue-chip companies in today’s trading session.

Should investors change their strategy after today’s close?

Analysts recommend staying informed about global events and economic indicators. Investors should review their portfolios but avoid making sudden changes based on one day’s movement.

The Dow Jones Industrial Average’s slight decline to 42,171.66 on June 27, 2025, amid geopolitical tensions and Federal Reserve policy shifts, highlights the need for investors to navigate volatile markets with agility. High cross-border fees and the complexity of establishing overseas accounts often hinder diversification into stable markets like Hong Kong. BiyaPay addresses these challenges by enabling you to invest in both U.S. and Hong Kong stock markets directly on its platform without needing an overseas account. Offering real-time, fee-free conversion of over 200 digital currencies, including USDT, into 30+ fiat currencies like USD and HKD, and cross-border remittance fees as low as 0.5%, BiyaPay surpasses traditional platforms in cost efficiency. With a 1-minute BiyaPay account registration, you gain swift, secure access to global markets, allowing you to diversify and manage risks effectively in an uncertain economic landscape.

Seize global investment opportunities now! Join BiyaPay.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

What Does Price-to-Earnings Ratio (PE) Mean? Master It to Navigate the Chinese Stock Market

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.