Hang Seng ebanking Tax Offer 2025: Comprehensive Analysis of Cashback and Installment Plans

Image Source: pexels

You can use Hang Seng ebanking to pay taxes and enjoy multiple benefits. No retail spending is required, and each credit card can independently earn cashback, making it suitable for accumulating cashback with multiple cards. Installment payment fees are as low as 0.18% per month, approximately $0.02 USD per $10. For the 2025 Bank of China Hong Kong tax payment offer, you can receive up to USD320 (approximately HKD2500) in cashback, with an additional USD256 (approximately HKD2000) cashback for installments. You can easily register via online or mobile banking, and the offer applies to both personal and third-party tax payments.

| Offer Item | Details |

|---|---|

| Cashback Amount | Up to USD320 cashback |

| Installment Fee | As low as 0.18% per month (approx. USD0.02 per $10) |

| Additional Installment Cashback | Up to USD256 |

| Registration Method | Online/mobile banking |

| Applicable Taxes | Personal and third-party taxes |

Key Points

- Hang Seng ebanking tax payment offers up to USD320 in cashback, and you can use multiple credit cards to accumulate cashback, flexibly earning more benefits.

- Installment payment fees are as low as 0.18% per month, and choosing a 12-month installment plan also qualifies you for additional cashback, easing tax payment pressure.

- The registration and tax payment process is simple and fast, completable via online banking or the mobile App, applicable to both personal and third-party taxes.

- The offer has a limited quota, requiring tax payment completion between December 1, 2024, and February 28, 2025, using an eligible credit card.

- Cashback can be issued as +FUN Dollars or yuu points, automatically credited to your credit card or yuu account for convenient use.

Offer Period and Eligible Cards

Promotion Period

You need to pay attention to the start and end dates of the promotion period. The 2025 tax payment offer promotion will begin on December 1, 2024, and end on February 28, 2025. You can enjoy the relevant cashback only if you pay your taxes during this period. Different tax payment amounts come with different cashback. For example, if your tax payment is between USD3,840 (approximately HKD30,000) and USD12,800 (approximately HKD100,000), you can receive USD19 (approximately HKD150) in cashback. If your tax payment exceeds USD12,800 (approximately HKD100,001), you can receive USD38 (approximately HKD300) in cashback.

| Item | Details |

|---|---|

| Promotion Period End Date | February 28, 2025 |

| Tax Payment Amount USD3,840 to USD12,800 | Cashback USD19 |

| Tax Payment Amount USD12,801 or Above | Cashback USD38 |

Tip: You should complete your tax payment within the promotion period to receive the maximum cashback.

Eligible Credit Cards

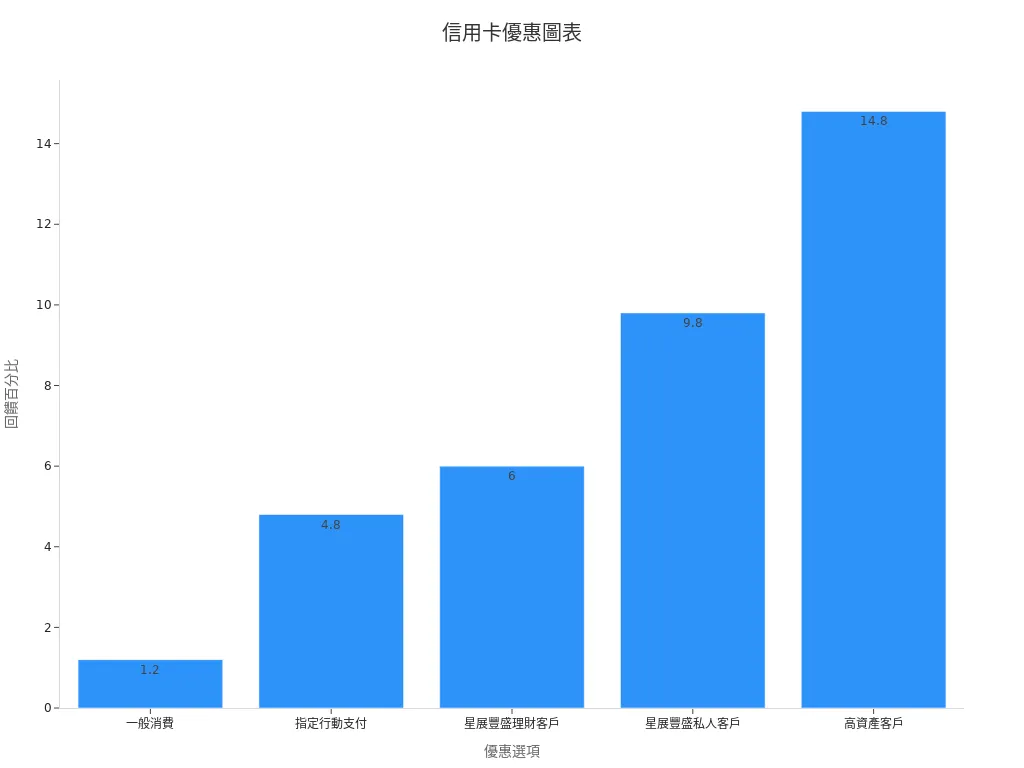

You can use various Hong Kong bank credit cards to participate in the tax payment offer. Different credit cards come with different reward ratios and conditions. You can refer to the table below for details on the rewards offered by various credit cards:

| Offer Item | Reward Ratio and Conditions | Reward Cap and Notes |

|---|---|---|

| General Spending | 1.2% cash points with no cap | No cap |

| Designated Mobile Payment Binding | Additional 4.8% cashback | Maximum monthly reward USD77 (approx. HKD600) |

| DBS Total Assets Threshold | Total assets reach USD6,400 (approx. NTD500,000) | Must meet this during the billing month |

| DBS Wealth Management Clients | 1.2% cash points + additional 4.8% cashback = 6% reward | Maximum monthly reward USD77 |

| DBS Private Wealth Clients | 5% cash points + additional 4.8% cashback = 9.8% reward | Maximum monthly reward USD77 |

| High-Net-Worth Clients | 10% cash points + additional 4.8% cashback = 14.8% reward | Maximum monthly reward USD77 |

| Promotion Period | 2025/01/01 ~ 2025/06/30 | - |

| Annual Fee Waiver Conditions | First year free for primary card, subsequent years waive fee with 12 transactions or USD3840 spending | Primary card annual fee USD384, supplementary card free |

You can see a comparison of the reward percentages for different credit cards in the chart below:

Applicable Taxes

You can use eligible credit cards to pay both personal and third-party taxes. This offer is not limited to your own tax bill; you can also pay taxes for family or friends and still enjoy cashback. This allows you to flexibly use multiple credit cards to accumulate more cashback.

Hang Seng ebanking Cashback Details

Image Source: pexels

Cashback Amount

During the promotion period from December 1, 2024, to February 28, 2025, if you use Hang Seng ebanking to pay taxes and accumulate a tax amount of USD1,280 (approximately HKD10,000), you can receive USD64 (approximately HKD500) in +FUN Dollars or 100,000 yuu points. No retail spending is required; you only need to use an eligible credit card to pay taxes. Each credit card can independently earn cashback. If you have multiple credit cards, you can use the “multi-card strategy” to accumulate more cashback.

Tip: You can pay taxes for family or friends, allowing you to flexibly use multiple credit cards to earn more cashback.

Points Options

You can choose between USD64 +FUN Dollars or 100,000 yuu points as your cashback. Different points schemes have varying redemption values and usage methods. You can refer to the table below to compare the features of different points options:

| Scheme | Redemption Value (Approx.) | Usage Scope | Flexibility | Recommended Choice |

|---|---|---|---|---|

| +FUN Dollars | USD64 | Hang Seng credit card spending | High | Frequent Hang Seng credit card users |

| yuu Points | 100,000 points = USD64 | yuu partner merchants | Medium | Frequent shoppers at yuu merchants |

When choosing a points scheme, you can decide based on your spending habits and redemption flexibility. According to the multi-attribute decision-making method, the ZFM method can effectively compare different points options with varying values. The ZFM method is simple to calculate, requires less data, and has high ranking accuracy, making it suitable for making the best choice among multiple cashback options.

Cashback Cap

Each credit card can receive a maximum of one USD64 +FUN Dollars or 100,000 yuu points cashback during the promotion period. If you have multiple credit cards, each card can independently qualify for a reward. You can use multiple cards to accumulate cashback and increase your total cashback amount.

Note: Each credit card can only receive one cashback; please utilize a multi-card strategy effectively.

Issuance Time

After completing your tax payment during the promotion period, Hang Seng ebanking will automatically credit the cashback to your credit card account by the end of April 2025. No additional application or registration is required. You can check the cashback records on your credit card statement.

Warm Reminder: If you choose yuu points, the points will be automatically added to your yuu account, allowing you to spend them immediately.

Hang Seng ebanking Installment Plans

Image Source: unsplash

Installment Options

You can choose different installment payment terms through Hang Seng ebanking to flexibly manage your finances. Hang Seng ebanking offers 6-month or 12-month installment options, allowing you to select based on your repayment ability. As long as your single installment amount reaches USD1,025 (approximately HKD8,000) and you choose a 12-month or longer installment, you can enjoy additional cashback. This additional cashback is calculated separately from the tax payment cashback, giving you more benefits.

| Installment Term | Minimum Installment Amount (USD) | Corresponding HKD (Approx.) | Additional Cashback Eligibility |

|---|---|---|---|

| 6 Months | 1,025 | 8,000 | None |

| 12 Months | 1,025 | 8,000 | Yes |

Tip: By choosing a 12-month installment and meeting the specified amount, you can receive both installment cashback and tax payment cashback, maximizing your total return.

Fees

The handling fees for installment payments through Hang Seng ebanking are very low. For 6-month or 12-month installments, the fee is as low as USD13 (approximately HKD100). This fee is significantly lower than the standard for most credit card installments. You can use this low-cost method to spread out your tax payment pressure and reduce short-term financial burden.

| Installment Term | Fee (USD) | Corresponding HKD (Approx.) | Monthly Actual Fee (USD) |

|---|---|---|---|

| 6 Months | 13 | 100 | 2.17 |

| 12 Months | 13 | 100 | 1.08 |

Note: The handling fee will be charged in full with the first installment; please ensure your credit card has sufficient credit limit.

Application Method

You can easily apply for installments through Hang Seng ebanking online banking or the mobile App, with a simple application process requiring no complicated procedures. The general application process is as follows:

- Log in to Hang Seng ebanking online banking or the mobile App.

- Select the “Credit Card” function and click on “Installment Payment.”

- Enter the tax amount you want to pay in installments and choose between 6-month or 12-month terms.

- Confirm the installment fee and monthly repayment amount.

- Submit the application; the system will process it instantly.

- Upon success, you will receive a confirmation notification, and the installment amount will be automatically spread across your monthly bills.

Warm Reminder: You must ensure your credit card account is in good standing and has sufficient credit limit. If you have questions, you can call the Hang Seng Bank customer service hotline for assistance.

You can refer to installment services from other Hong Kong banks and find that the application methods are generally similar. Most banks provide an installment portal and detailed instructions on their official websites. You can also choose different payment methods, such as credit card installments, ATM transfers, or online transfers. Some banks have specific refund and reimbursement policies, so it’s recommended to read the relevant terms carefully before applying.

Registration and Tax Payment Process

Registration Method

You can complete registration via online banking or the mobile App. First, log in to your online banking account. Then, select the “Credit Card” or “Payment” function. You need to enter the details from your tax bill, including the tax bill number and payment amount. The system will display available credit card options. You can choose the credit card you want to use for cashback or installments. After confirming the details are correct, submit the registration application. The system will instantly display the registration result. You can also check your registration records within the App to ensure the data has been successfully submitted.

Tax Payment Steps

You need to follow the official guidelines to complete each step. The standard tax payment process is as follows:

- Prepare all necessary documents, such as the tax bill, identification proof, and payment details.

- Log in to online banking or the mobile App and select the “Tax Payment” service.

- Enter the tax bill number and the amount due; the system will automatically populate the tax category.

- Choose your payment method and credit card, ensuring all details are correct.

- Submit the tax payment application; the system will process it instantly and display the payment result.

- After completing the payment, you will receive a confirmation notification. You can download or screenshot the payment record for future reference.

Official documents recommend checking all details before tax payment to avoid issues due to data errors. If you encounter system problems, you can refer to the electronic customs declaration system guide or call the bank for assistance.

Precautions

You should pay attention to several points when registering and paying taxes. First, ensure all details are correct, especially the tax bill number and amount. If there are errors, it may be considered a misdeclaration, which, according to official regulations, could incur penalties. Second, it’s recommended to retain all payment records and confirmation notifications for future verification. Finally, if you choose installment payments, please note the handling fees and monthly repayment amounts, ensuring your credit card has sufficient credit limit. If you have questions, contact the bank early or refer to the official FAQ.

Terms and Conditions

Quota Limitation

You need to be aware that the Hang Seng ebanking tax payment offer has a total quota limitation. Once the quota is exhausted, the bank will immediately announce it on the official website or App. You should complete registration and tax payment as early as possible to avoid missing out on cashback opportunities. The following are key points regarding the quota:

- Each promotion period has a fixed quota, available on a first-come, first-served basis.

- If the quota is filled, the bank reserves the right to end the offer early.

- You can check the latest quota status on the Hang Seng Bank website.

Tip: You should act as soon as the promotion period starts to increase your chances of receiving cashback.

Ineligible Situations

When participating in the offer, you must meet all conditions. The following situations will disqualify you from receiving cashback:

- You use an ineligible credit card to pay taxes.

- You fail to complete tax payment within the promotion period.

- The tax bill information you provide is incorrect or incomplete.

- Your credit card account is in an abnormal state, such as overdue payments or being frozen.

- You register the same tax bill or credit card multiple times.

Note: In case of disputes, Hang Seng Bank reserves the final decision rights.

Other Fine Prints

You should carefully read all terms and conditions to fully understand the offer details. The following are common fine prints:

- Cashback cannot be transferred or redeemed for cash.

- If you cancel a transaction or request a refund, the bank reserves the right to reclaim any issued cashback.

- All amounts are calculated in USD, with the exchange rate based on the transaction date.

- Hang Seng Bank reserves the right to change or terminate the offer at any time, with the latest arrangements published on the website.

| Term Category | Summary |

|---|---|

| Cashback Issuance | Limited to eligible transactions and issued within the specified time |

| Transaction Anomalies | Refunds or cancellations will result in cashback reclamation |

| Exchange Rate Calculation | Based on the transaction date exchange rate |

| Terms Changes | Bank reserves the right to revise at any time, with updates published on the website |

Suggestion: You should regularly check the Hang Seng Bank official website for the latest terms and offer information.

You can utilize the Hang Seng ebanking tax payment offer to flexibly choose between cashback or installment plans. You should make your decision based on your spending habits and financial needs. Remember to register early, read the terms carefully, and ensure all details are correct. By seizing the promotion period, you can earn more cashback and ease your tax payment burden.

FAQ

Is Registration Required for the Hang Seng ebanking Tax Offer?

You need to complete registration via online banking or the mobile App. Simply follow the instructions to enter your tax bill details, and the system will instantly confirm the registration result.

Can You Use Multiple Credit Cards to Earn Cashback Simultaneously?

Yes, you can. Each eligible credit card can independently receive one cashback. You can use a multi-card strategy to accumulate more cashback.

In What Form Will the Cashback Be Issued?

You can choose between USD64 +FUN Dollars or 100,000 yuu points. The cashback will be automatically credited to your credit card account or yuu account.

Is There a Minimum Amount Requirement for Installment Payments?

Yes. You need a single installment amount of at least USD1,025 (approximately HKD8,000) to apply for installments and qualify for additional cashback.

Can You Still Receive Cashback If the Quota Is Filled?

No. The offer has a limited quota. Once the quota is exhausted, the bank will announce it on the website or App; please register and pay taxes as early as possible.

Hang Seng e-Banking’s tax payment offers up to HKD500 (approx. USD64) cashback and low HKD100 installment fees, but high cross-border remittance costs and complex exchanges can hinder wealth management. BiyaPay provides an all-in-one platform for global financial success! Our remittance fees are as low as 0.5%, covering 190+ countries with instant transfers, surpassing traditional banks. The flexible savings product yields a 5.48% annualized return, with daily interest credited automatically. It supports real-time conversion of 30+ fiat currencies and 200+ cryptocurrencies, secured by KYC verification.

Register in minutes to manage funds effortlessly. Try BiyaPay now to start your global financial journey! Pair it with e-Banking and join BiyaPay today at BiyaPay for efficient wealth management and steady returns.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

How to Wire Transfer USD from Industrial and Commercial Bank of China to OCBC Singapore? This Guide is All You Need

Want to Predict China A-Share Market Moves? Understanding These 5 Macro Signals Is Enough

Like a Snowball: Let Shanghai Stock Market Index Make Your Money Work for You

China A-Share Crash Turning Point: Will 2026 Deliver a Legendary Bull Market?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.