Hang Seng Bank Latest Fixed Deposit Rates and Wealth Management Tips

Image Source: pexels

You are currently most concerned about Hang Seng Bank fixed deposit rates. Below is the latest reference (calculated in USD, 1 USD ≈ 7.8 HKD):

| Currency | 1 Week | 1 Month | 3 Months | 6 Months | Preferential Annual Rate (New Funds/Online) |

|---|---|---|---|---|---|

| HKD | 0.80% | 1.60% | 2.00% | 2.10% | Up to 2.80% |

| USD | 1.00% | 2.30% | 2.60% | 2.70% | Up to 3.00% |

You will notice that CNY fixed deposit rates fluctuate significantly, with some periods exceeding 4%, and the minimum deposit amount is as low as approximately 1,282 USD, as banks actively attract funds. Rates are updated daily, influenced by deposit amounts, whether they are new funds, and online renewals. You should closely monitor the official latest announcements.

Key Points

- Hang Seng Bank fixed deposit rates are updated daily, with different rates for HKD, USD, and CNY, and CNY rates showing greater fluctuations, exceeding 4% in some periods.

- Choosing new funds or online renewals can enjoy higher preferential annual rates, up to 2.80% for HKD and 3.00% for USD.

- Fixed deposits are suitable for conservative wealth management when funds are not needed in the short term, and depositing in batches with different tenors can enhance fund flexibility.

- Comparing rates and minimum deposit amounts across banks helps find the most suitable product, with Hang Seng Bank offering low minimum deposits, stable rates, and flexible promotions.

- When managing wealth, you should balance risk and return, pay attention to interest rate and exchange rate risks, regularly review your investment portfolio, and maintain flexible strategy adjustments.

Hang Seng Bank Fixed Deposit Rates

Image Source: unsplash

HKD Fixed Deposits

When you choose HKD fixed deposits, you will find significant differences in rates across different tenors. Hang Seng Bank fixed deposit rates are adjusted based on tenors such as 1 week, 1 month, 3 months, and 6 months. You can refer to the following points to understand market trends:

- Many Hong Kong banks have introduced tiered interest and flexible withdrawal HKD fixed deposit products. For example, some banks’ “Flexible Deposit” services allow you to withdraw principal within a year, with interest maximized based on actual deposit days.

- Some banks offer “Smart Fixed and Current” plans, supporting 3-month, 6-month, and 1-year fixed deposits. When you withdraw early, interest is calculated based on the actual deposit period, enhancing your interest income.

- Featured savings products set rates based on the People’s Bank of China’s 1-year fixed rate plus a premium, offering higher rates for a full year, with early withdrawals calculated at maximized rolled-over rates.

- The market has seen large-scale negotiable certificates of deposit (NCDS), with rates determined by the market, breaking through central bank rate controls, providing you with higher return options.

- The overall trend shows that HKD fixed deposit rates are moving toward marketization and flexibility.

When you open an HKD fixed deposit at Hang Seng Bank, the minimum deposit amount is generally 1,282 USD (approximately 10,000 HKD), with rates updated daily. You can choose new funds promotions or online renewal promotions, with preferential annual rates up to 2.80%. You should closely monitor Hang Seng Bank’s latest fixed deposit rate announcements and choose the most suitable tenor and plan.

Tip: Choosing online renewals or new fund deposits usually enjoys higher preferential annual rates. You can use online banking to check the latest rates and promotions.

Foreign Currency Fixed Deposits

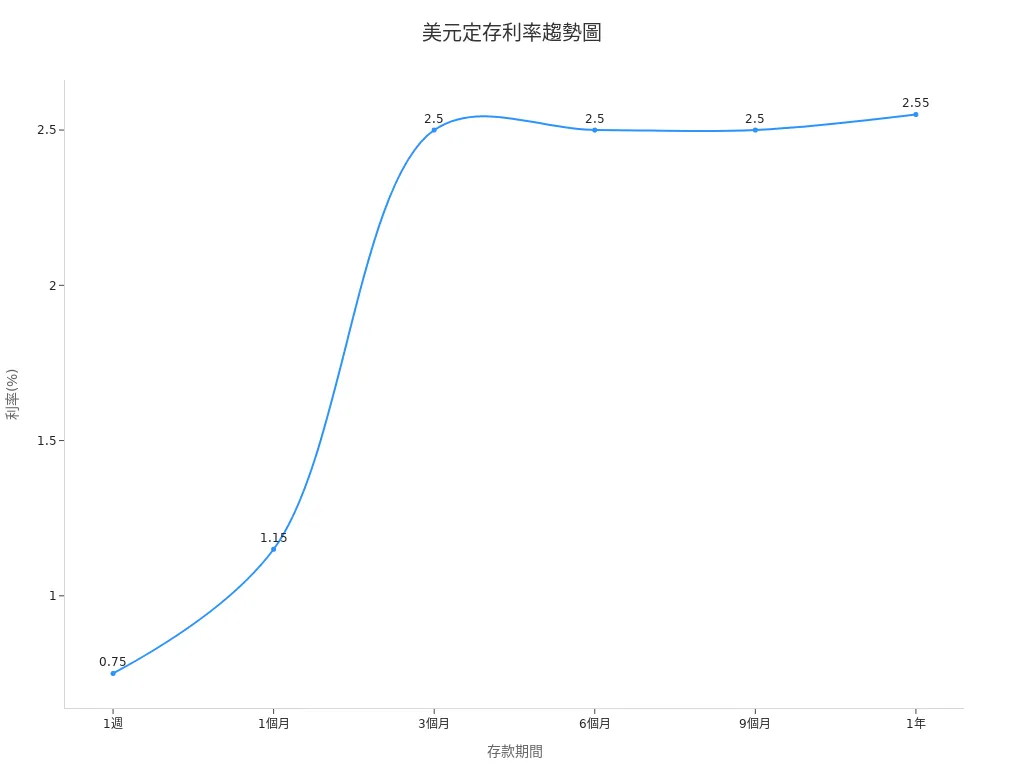

If you consider foreign currency fixed deposits, USD and CNY are the most common choices. USD fixed deposit rates vary with tenors, generally increasing with longer tenors. You can refer to the table below to understand the USD fixed deposit rate distribution:

| Deposit Period | Rate (%) |

|---|---|

| 1 Week | 0.75 |

| 1 Month | 1.15 |

| 3 Months | 2.50 |

| 6 Months | 2.50 |

| 9 Months | 2.50 |

| 1 Year | 2.55 |

You will find that USD fixed deposit rates gradually rise from 0.75% (1 week) to 2.55% (1 year). This design allows you to flexibly choose tenors based on your cash flow needs. CNY fixed deposit rates fluctuate significantly, reaching over 4% in some periods. When choosing foreign currency fixed deposits, you should note the minimum deposit amount (generally 1,282 USD) and whether there are additional promotions for new funds or online renewals.

When opening a foreign currency fixed deposit at Hang Seng Bank, it is recommended to regularly check the latest fixed deposit rate information. Rates adjust due to market changes, deposit amounts, and promotional activities. You can use online banking or visit a branch to inquire, ensuring you get the most suitable rate.

Market Rate Comparison

Image Source: unsplash

Major Banks Comparison

When choosing fixed deposits, you should compare rates and minimum deposit amounts across different Hong Kong banks. This helps you find the product best suited to your needs. The table below summarizes the minimum deposit amounts and promotional rates of several major banks:

| Bank Name | HKD Fixed Deposit Minimum Deposit (USD) | Promotional Rate Example | USD Fixed Deposit Minimum Deposit (USD) | USD Fixed Deposit Highest Rate |

|---|---|---|---|---|

| Hang Seng Bank | Approx. 1,282 | 2.80% (6 months) | Approx. 1,282 | 3.00% (6 months) |

| HSBC | Approx. 128,205 | 2.20% (3 months) | 38,462 | 6.00% (3 months) |

| O-Bank | 2,564 | 2.00% (6 months) | 300 | Approx. 3.00% |

| Yang Hsin Bank | No limit | 1.80% (12 months) | N/A | N/A |

You can see that minimum deposit amounts and rate differences across banks are significant. Hang Seng Bank’s fixed deposit rates rank above average among local banks, especially for new funds or online renewals, where promotional rates are more attractive. HSBC’s USD fixed deposit rates are high but require a higher minimum deposit. O-Bank and Yang Hsin Bank are suitable for depositors with smaller funds.

Tip: You should choose the appropriate bank and deposit product based on your fund size and wealth management goals.

Advantages and Disadvantages

When choosing Hang Seng Bank fixed deposits, you can enjoy the following advantages:

- Low minimum deposit amount, suitable for most depositors.

- Hang Seng Bank fixed deposit rates are stable, with flexible promotions for online renewals and new funds.

- Diverse product options, supporting multiple currencies, facilitating risk diversification.

However, you should also note the following disadvantages:

- Some competing banks offer higher short-term promotional rates during specific periods.

- USD fixed deposit highest rates are decent but lag behind larger banks like HSBC.

- Promotional rates mostly target new funds or online operations, and existing depositors may receive lower rates if conditions are not met.

You should regularly compare rates and promotions across banks and flexibly adjust your wealth management strategy to achieve the best returns.

Wealth Management Tips

Suitable Timing

When choosing fixed deposits, you should consider your cash flow needs. If you don’t need to use the funds in the short term, fixed deposits are a conservative choice. When market rates are high, or banks launch promotions for new funds or online renewals, these are particularly good times to lock in higher rates. You can also choose different tenors based on your wealth management goals to flexibly allocate funds.

Tip: You can deposit in batches with different tenors, so even if sudden needs arise, you can flexibly withdraw some funds.

Considerations

When choosing fixed deposits or other wealth management products, you should pay attention to balancing risk and return. Risk statistics for wealth management products mainly cover the following indicators:

- Sharpe Ratio: Calculates the return per unit of risk, with higher values indicating better efficiency.

- Standard Deviation: Measures the volatility of returns, with higher volatility indicating greater uncertainty.

- Beta: Reflects the product’s volatility relative to the market, with Beta=1 indicating alignment with the market, Beta>1 indicating higher volatility, and Beta<1 indicating stability.

- You should also pay attention to interest rate and exchange rate risks, especially for foreign currency assets.

You should not focus solely on a single indicator or past performance but consider return rates, expense ratios, and risk indicators comprehensively. Past performance does not guarantee future results, and it’s recommended to regularly review your investment portfolio and maintain flexible adjustments.

Other Wealth Management Options

If you aim for higher returns, you can consider other wealth management products. The table below compares the return rate ranges of different wealth management products:

| Investment Product Type | Return Rate Range |

|---|---|

| Current Deposit | Approx. 0.2% |

| Fixed Deposit | Approx. 1.0% |

| Foreign Currency Fixed Deposit (USD) | Approx. 2.0% - 2.5% |

| Taiwan 10-Year Government Bond Yield | Approx. 0.85% |

| U.S. 10-Year Treasury Yield | Approx. 2.9% - 3.1% |

| U.S. Investment-Grade Bond ETF | Approx. 3.6% |

| Stocks and Real Estate | Higher annualized returns but high volatility |

You can see that fixed deposits have lower returns but also lower risks. Bonds and ETFs offer higher returns but fluctuate with market prices. Stocks and real estate have the highest potential returns but also the greatest risks. You should choose the most suitable wealth management tool based on your risk tolerance and investment horizon. If you seek stable income, Hang Seng Bank fixed deposit rates remain a good choice for conservative wealth management.

You now understand that digital banks and emerging banks are more competitive in USD fixed deposit rates. Traditional large banks like Hang Seng Bank, while offering new funds and online renewal promotions, do not stand out in major rate rankings. When choosing wealth management products, you should evaluate the market environment and your needs based on the following indicators:

- U.S. ISM Manufacturing Index, Consumer Price Index (CPI), Employment Data

- Corporate financial statement indicators, such as R&D expense ratio, management expense ratio, shareholder equity ratio

- Stock price and trading volume conditions to ensure asset liquidity

You should flexibly choose suitable deposit or investment products based on your financial goals and risk tolerance. It is recommended to regularly monitor the latest bank rate information and adjust your wealth management strategy promptly.

FAQ

What is the minimum deposit amount for Hang Seng Bank fixed deposits?

When you open a fixed deposit at Hang Seng Bank, the minimum deposit amount is generally 1,282 USD (approximately 10,000 HKD, 1 USD ≈ 7.8 HKD).

Can fixed deposits be automatically renewed upon maturity?

You can choose automatic renewal. When setting automatic renewal via online banking, you usually enjoy preferential annual rates. It’s recommended to check the latest rates before maturity.

Do foreign currency fixed deposits have exchange rate risks?

When you deposit USD or CNY fixed deposits, you face exchange rate fluctuations. Exchange rate changes at withdrawal may affect actual returns.

How can I check Hang Seng Bank’s latest fixed deposit rates?

You can log into Hang Seng Bank’s online banking or mobile app to check. You can also call the customer service hotline or visit a branch to inquire about the latest rates.

Is there a penalty for early withdrawal of fixed deposits?

When you withdraw early, the bank adjusts interest based on the actual deposit period. You may not receive the original rate and might only earn current account interest.

In 2025, Hang Seng Bank’s fixed deposit rates (HKD up to 2.80%, USD up to 3.00%) offer stability but limited returns, with businesses facing high opening fees (USD 100) and remittance costs (USD 2–3). BiyaPay optimizes finances with online account opening in minutes, skipping lengthy reviews. Enjoy low or zero fees and flexible balance requirements. International transfers cost just 0.5%, with HKD-to-USD conversions at live rates to minimize exchange risks.

BiyaPay’s 5.48% annualized return product outperforms bank deposits, with single-account access to US and Hong Kong stocks.Compliance-registered as FSP (New Zealand) and MSB (the US), regulated by regulatory authorities of both regions, it ensures compliance. Join BiyaPay now to boost fund efficiency! Sign up today to grow your wealth in 2025!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2025 China Stock Market App Review: Tonghuashun, East Money, Sina Finance - Who is the Best Value King

Beginner's Guide to the Hang Seng Index: Essential Introduction and Its Connection to the Hong Kong Economy

Industry Observation: Sina Finance's Differentiated Competition Path Benchmarking East Money and Tonghuashun

2025 Tested Effective: Complete Steps for Converting Cash Foreign Currency to Remittance Currency via Bank of China Mobile Banking

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.