Hang Seng Personal e-Banking vs Other Banks: A Surprising Comparison of Online Banking

Image Source: pexels

Have you ever wondered what differences there are between Hang Seng Personal e-Banking and other Hong Kong banks’ online banking services? In fact, Hong Kong users have increasingly high expectations for online banking, with over 44% of people using it at least once a week, and 92% saying they will continue to use it. However, different banks perform differently in terms of features, user experience, security, fees, promotions, and support. Some people prefer checking balances, while others want more investment reports. So how do you choose the one that best suits you?

Key Points

- Hang Seng Personal e-Banking offers comprehensive features, supporting balance inquiries, transfers, investments, and foreign currency remittances, with simple operations and a customizable homepage for convenient financial management.

- Robust security measures, including two-factor authentication, mobile security tokens, and real-time transaction alerts, ensure user fund safety and provide 24-hour customer support.

- Most basic services are free, international remittance fees are reasonable, and frequent cashback and reward points enhance financial returns.

- The Hang Seng Bank app is designed to be simple and smooth, with fast login and support for fingerprint and facial recognition, improving user experience and operational efficiency.

- When choosing an online banking platform, compare features, fees, promotions, and support services based on personal needs, and flexibly use multiple banks to leverage their respective strengths.

Comparison Highlights

Features

What do you care about most when it comes to online banking?

- You can check accounts, transfer money, pay bills, invest, send foreign currency remittances, and even apply for credit cards.

- Some banks offer automated financial tools to help you manage assets.

- Platforms like Kraken provide multiple security settings such as “Global Settings Lock,” with increasingly diverse features.

User Experience

Do you find some app operations complicated?

- Some bank apps are designed simply, with fast login and easy balance inquiries.

- Some banks push personalized information based on your usage habits.

- You can manage your finances anytime, anywhere, without queuing at a branch.

Security

Are you worried about the safety of online banking?

- Most banks use two-factor authentication and mobile security tokens to protect your account.

- Kraken experienced a white-hat hacker theft of USD 3 million, but all funds were fully recovered, demonstrating strong handling capabilities.

- Some banks regularly send risk alerts to remind you of suspicious activities.

Fees

Are you concerned about high handling fees?

- Spot trading fees are approximately 0.16% to 0.26%, and futures trading fees are about 0.02% to 0.05%.

- Some banks’ online banking services are free, while others charge small fees.

- You can compare different banks’ fee schedules to choose the most cost-effective option.

Promotions

Do you want to know about exclusive offers?

- Some banks offer reward points, cashback, or promotional campaigns.

- Sometimes new customers receive welcome bonuses for opening accounts.

- You can check the latest promotions pushed within the bank app.

Support

When you encounter issues, do you want someone to help?

- Most banks offer 24-hour online customer service or hotlines.

- Some bank apps have real-time chat functions to address your questions.

- You can also visit a branch for in-person assistance, with diverse support channels.

Hang Seng Personal e-Banking

Main Features

With Hang Seng Personal e-Banking, you can check account balances and transaction records anytime. If you want to transfer money, pay bills, set up fixed deposits, or apply for a credit card, it’s all handled in one app. You can also use it for foreign currency remittances, supporting multiple countries. For investments, you can trade funds, stocks, and even apply for insurance products. All features are centralized in one platform, making financial management convenient for you.

Security Measures

Are you most concerned about security? Hang Seng Personal e-Banking has multiple safeguards. You can log in using a mobile security token, two-factor authentication, and it also supports Touch ID and Face ID. For every transaction, the system sends real-time alerts to keep you informed. If you receive notifications of suspicious activities, you can contact the bank immediately. These measures help protect your funds.

Fees and Promotions

Are you worried about high fees when using online banking? Most basic services of Hang Seng Personal e-Banking are free, such as checking balances, transfers, and bill payments. International remittances incur a small handling fee, approximately USD 10-20, with actual amounts adjusted based on exchange rates. When you open an account or participate in promotional campaigns, you often get cashback or reward points. You can check the latest promotions in the app to earn more rewards.

User Experience

When you use the app, you’ll find its interface clean and operations smooth. You can customize the homepage to prioritize frequently used features. Multiple login methods are supported, including fingerprint and facial recognition, allowing you to access the system in seconds. Checking balances, transferring money, and investing are all convenient, eliminating the need to queue at a branch.

Customer Support

If you encounter issues, you can always find someone to help. Hang Seng Personal e-Banking offers 24-hour online customer service with real-time chat. You can also call the hotline or book an appointment with a branch specialist. The bank regularly updates the app to address user-reported issues. You can use it with peace of mind, knowing the support team is always there.

Other Major Banks

HSBC

With HSBC online banking, you can check accounts, transfer money, pay bills, and access investment features anytime. HSBC’s app has a modern design, supporting fingerprint and facial recognition login. You can use “PayMe” for instant transfers, which is convenient and fast. HSBC offers various foreign currency remittance options, with handling fees around USD 10-25, depending on exchange rates and regions. For security, HSBC has two-factor authentication and real-time transaction alerts. If you encounter issues, you can use the in-app real-time chat or call the 24-hour hotline. HSBC frequently launches welcome bonuses and reward points, suitable for those like you who prefer diverse services.

Bank of China (BOC)

If you choose Bank of China (Hong Kong), you can enjoy comprehensive online banking services. You can check balances, transfer money, pay bills, trade foreign currencies, and access funds and insurance products. The BOC app supports multiple languages, accommodating different users. You can log in using fingerprint or facial recognition, ensuring high security. BOC’s international remittance fees are around USD 12-20, adjusted based on exchange rates. You can check the latest promotions in the app, often including cashback or reward points. BOC offers 24-hour online customer service and hotlines, with comprehensive support services.

Standard Chartered

With Standard Chartered online banking, you can manage accounts, investments, credit cards, and foreign currencies in one place. The Standard Chartered app has a clean interface and smooth operations. You can customize frequently used features to improve efficiency. Standard Chartered offers “SC Pay” for instant transfers, supporting multiple banks. For security, it has two-factor authentication and mobile security tokens. International remittance fees are around USD 15-22, adjusted based on exchange rates and regions. If you encounter issues, you can use in-app real-time chat or call the hotline. Standard Chartered frequently offers promotional campaigns and reward points, ideal for those like you seeking promotions.

Tip: You can use the table below to quickly compare the key features of the three banks.

| Bank | App Login Methods | International Remittance Fees (USD) | 24-Hour Customer Support | Reward Points/Cashback Offers |

|---|---|---|---|---|

| HSBC | Fingerprint/Facial Recognition | 10-25 | Yes | Yes |

| BOC | Fingerprint/Facial Recognition | 12-20 | Yes | Yes |

| Standard Chartered | Fingerprint/Facial Recognition | 15-22 | Yes | Yes |

Feature Comparison

Image Source: unsplash

Transfers and Bill Payments

The features you use most often are likely transfers and bill payments. Hang Seng Personal e-Banking allows you to make instant transfers in one app, whether local or interbank, with near-instant processing. You can set up frequent payees for faster transfers next time. HSBC, BOC, and Standard Chartered also support FPS transfers, with comprehensive bill payment features. However, some banks’ transfer times may be slightly longer, with some digital accounts averaging 20-30 seconds. Hang Seng emphasizes simple operations and fast speeds, with clear balance inquiries and transaction details.

Investments

Want to invest in funds, ETFs, or stocks? Hang Seng Personal e-Banking offers diverse investment options, supporting one-time or regular investments. You can compare different funds’ standard deviation and Beta values to understand risks and returns. For example, a higher standard deviation indicates greater volatility, and a Beta value greater than 1 means it’s more sensitive than the broader market. Other banks like HSBC and BOC also offer smart investment services, with some platforms having ETF minimum entry fees of about USD 5,000 and funds starting at USD 1,000. Fee-wise, different banks offer zero-fee promotions or management fee waivers, so you can choose based on your needs.

Foreign Currency Remittances

Need to send money overseas? Hang Seng Personal e-Banking supports multi-country foreign currency remittances with a simple process and fees around USD 10-20, adjusted based on exchange rates. HSBC, BOC, and Standard Chartered offer similar services with comparable fee ranges. You can check exchange rates and fees instantly in the app, making it easy to compare costs and speeds across banks.

Other Features

Beyond basic banking, Hang Seng Personal e-Banking offers insurance applications, credit card management, and financial analysis reports. You can customize the homepage to prioritize frequently used features. Other banks like HSBC and BOC offer lifestyle bill payments, cardless withdrawals, and smart budgeting tools. You can choose the platform that best fits your lifestyle needs.

User Experience Comparison

App Design

When you open a bank app, the design is the first thing you notice. Hang Seng Personal e-Banking’s interface is clean, with clear color coding and easily accessible features. You don’t need to spend time searching for buttons, as all operations are intuitive. HSBC, BOC, and Standard Chartered continuously optimize their app designs for modernity and ease of use. According to market data, after some banks revamped their apps, user numbers grew by 90%, with monthly login frequency increasing from 3-4 to over 10 times. Google Play and App Store ratings average 4.5, indicating high user satisfaction with the design. You’ll find that more banks are integrating credit cards, investments, and insurance into a single app, making financial management seamless.

| Metric | Description |

|---|---|

| User Growth | Grew by 90% post-revamp, with over 4 million users in Hong Kong |

| Monthly Login Frequency | Increased from 3-4 times pre-revamp to over 10 times, with over 70% logging in monthly |

| App Rating | Approximately 4.5, among the highest in the industry |

| Transfer Transaction Volume | Averages 9 million transactions, accounting for 85% of bank transfer transactions |

| Feature Integration | Integrates credit cards, investments, and other functions into one app |

Operation Flow

When using an app, you hate complicated steps. Hang Seng Personal e-Banking prioritizes a smooth experience, with login supporting fingerprint or facial recognition, accessing the system in seconds. Checking balances, transferring money, and investing are all straightforward. HSBC, BOC, and Standard Chartered also focus on operational flow, with some apps offering quick-access buttons for frequent functions. You no longer need to memorize complex paths, and the operation process is smooth, reducing errors. According to user surveys, over 70% of users agree that current bank apps are more convenient than before, especially for busy users like you.

Personalization

Want a tailored experience? Hang Seng Personal e-Banking allows you to customize the homepage, placing frequently used features upfront. You can adjust the layout based on your habits, making balance inquiries, transfers, and investments clear at a glance. HSBC, BOC, and Standard Chartered also offer personalized notifications, recommending financial products or promotions based on your past activities. Some apps even provide tailored information based on your age and financial goals. The more you use the app, the better it understands you, making your banking experience more personalized.

Tip: Regularly update the app to enjoy the latest designs and features, improving banking efficiency.

Security Comparison

Image Source: pexels

Authentication Methods

When using online banking, the first step is logging in. Hang Seng Personal e-Banking supports multiple authentication methods. You can choose a mobile security token, two-factor authentication, or Touch ID/Face ID. These methods make login faster and more secure. HSBC, BOC, and Standard Chartered also support fingerprint and facial recognition. However, Hang Seng’s mobile security token is particularly user-friendly. The system requires additional authentication for every login or large transaction, reducing the risk of unauthorized access.

Transaction Protection

Your biggest worry is probably whether your money could disappear unexpectedly. Hang Seng Personal e-Banking sends real-time alerts for every transaction. If there’s any unusual activity, the bank notifies you immediately. HSBC, BOC, and Standard Chartered have similar real-time notification features. Some banks also allow you to set transaction limits, letting you adjust the maximum daily transfer amount. This reduces the risk of loss. If you spot suspicious transactions, Hang Seng Personal e-Banking offers a 24-hour hotline for immediate reporting or account freezing.

Risk Alerts

When using online banking, banks regularly send risk alerts. Hang Seng Personal e-Banking reminds you to watch out for phishing websites, fraudulent calls, and suspicious emails. These alerts help you stay vigilant. HSBC, BOC, and Standard Chartered also issue security notices within their apps. By staying alert and regularly updating the app, you can significantly reduce the risk of fraud.

Tip: Enable all security alert functions and regularly check account activity to protect your funds.

Fees and Promotions

Handling Fees

When using online banking, you’re most concerned about high handling fees. Most basic services of Hang Seng Personal e-Banking are free, such as checking balances, transfers, and bill payments. International remittances incur fees of around USD 10-20, adjusted based on exchange rates. HSBC, BOC, and Standard Chartered have similar international remittance fees, ranging from USD 10-25. If you frequently need cross-border transfers, compare each bank’s fee schedules to choose the most cost-effective option.

Tip: Use the fee comparison tables in online banking platforms to clearly understand the actual costs of each service.

Promotions

Want to earn more rewards? Hang Seng Personal e-Banking frequently offers new customer welcome bonuses, such as cashback, fee waivers, or extra reward points. By opening an account or completing designated transactions during promotional periods, you can receive rewards. HSBC, BOC, and Standard Chartered also periodically launch promotional campaigns, such as transfer gift vouchers or investment cash rewards. Check the latest promotional information in the app to seize reward opportunities.

Reward Points and Cashback

When using online banking, you can earn reward points or cashback. Hang Seng Personal e-Banking lets you earn points for credit card payments, transfers, and investments, which can be redeemed for gifts, cash, or travel miles. HSBC, BOC, and Standard Chartered have similar reward programs, with some offering extra cashback for specific transactions. Compare each bank’s reward redemption rates to choose the platform best suited for you.

Tip: Regularly check your reward points balance and use them to redeem desired gifts or cash to enhance financial returns.

Support Services

Online Customer Service

When you encounter issues, do you first think of online customer service? In fact, Hong Kong banks’ online customer service is becoming increasingly convenient. You can ask questions directly in the app or on the official website, with most banks offering real-time chat functions. Hang Seng Personal e-Banking provides 24-hour online customer service, allowing you to reach a real person anytime, day or night.

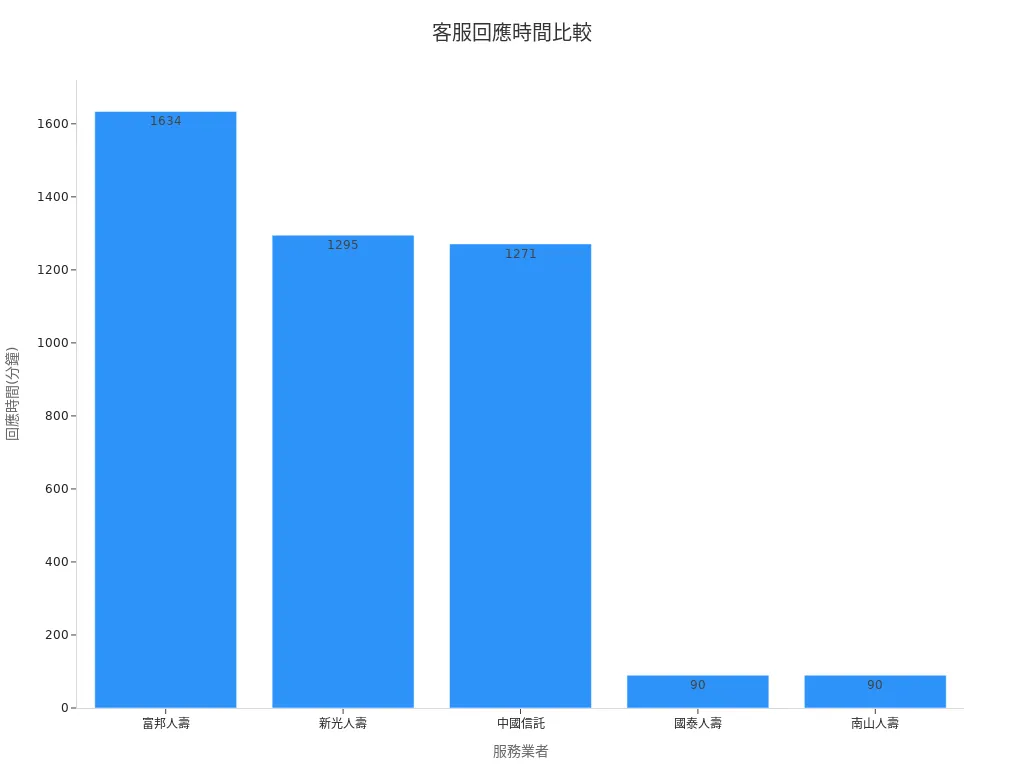

Some banks respond faster, while others may take longer. You can refer to the chart below to understand the average response times of different banks and insurance companies’ online customer service:

You’ll find that some institutions respond in just 1.5 hours, while others take over 50 hours. Choosing a bank with fast response times gives you more peace of mind in emergencies.

Hotline

Sometimes, calling a hotline is the most convenient option. Hang Seng Personal e-Banking offers a 24-hour hotline, allowing you to speak with a specialist anytime. HSBC, BOC, and Standard Chartered also provide round-the-clock hotline services. For urgent issues, such as account theft, calling the hotline is the fastest solution. You can save the bank’s hotline number in your phone for immediate contact when needed.

Branch Support

If you prefer face-to-face solutions, branch support is ideal. Hang Seng has multiple branches across Hong Kong, where you can book appointments with specialists to handle complex matters in person. HSBC, BOC, and Standard Chartered also have extensive branch networks throughout Hong Kong. You can use the app to book appointments in advance to reduce waiting time.

Tip: For online banking issues, try online customer service or the hotline first to save time instead of visiting a branch.

Surprising Discoveries

Hang Seng Advantages

When using Hang Seng Personal e-Banking, you’ll find several particularly convenient aspects. First, its app design is clean, with a smooth operation flow. You can customize the homepage to place frequently used features upfront, making balance inquiries, transfers, and investments clear at a glance. Multiple login methods, including fingerprint and facial recognition, allow you to access the system in seconds. You don’t need to remember complex passwords, making it both secure and fast.

Security-wise, Hang Seng Personal e-Banking offers mobile security tokens and two-factor authentication. The system requires additional authentication for large transactions. You receive real-time transaction alerts, and if there’s any unusual activity, the bank notifies you immediately. These measures help safeguard your funds.

If you frequently use online banking, you’ll find Hang Seng’s fees transparent. Most basic services are free, and international remittance fees are at reasonable market levels. By participating in promotional campaigns, you often get cashback or reward points. You can use points to redeem gifts, cash, or travel miles, earning rewards while banking.

For support services, Hang Seng offers 24-hour online customer service and a hotline. If you encounter issues, you can always reach a real person. You don’t need to queue at a branch, saving time and effort.

Tip: Regularly check the latest promotions in the app and use reward points and cashback to enhance financial returns.

Hang Seng Shortcomings

Although Hang Seng Personal e-Banking has many advantages, you may find some areas for improvement. For example, the selection of some investment products is not the most comprehensive, particularly for emerging market funds or innovative ETFs, where choices may be limited. If you want to engage in more advanced investments, you may need to consider other platforms.

Some users report that app updates occasionally cause slow logins or temporary unavailability of certain functions. If you encounter these issues, you may need to wait for the bank’s technical team to fix them. Some promotional campaigns are exclusive to new customers, so existing customers may find the offers less appealing.

Additionally, while Hang Seng’s foreign currency remittances are convenient, the handling fees and exchange rates may not be the lowest in the market. If you frequently need large cross-border transfers, compare fees and exchange rates across multiple banks.

Other Highlights

When using other Hong Kong banks’ online banking, you’ll discover several innovative services. For example, HSBC’s “PayMe” allows instant transfers to friends, making daily spending more convenient. The BOC app supports multiple languages, suitable for users from different backgrounds. Standard Chartered’s “SC Pay” supports instant transfers across multiple banks, improving transfer efficiency.

Some banks offer personalized investment recommendations based on your financial goals. You can receive exclusive promotions or financial tips to better manage your wealth. Some bank apps feature smart budgeting tools that automatically analyze your spending habits to help you plan your budget.

Tip: Mix and match different banks’ online banking services based on your needs to leverage their respective strengths for more comprehensive banking.

Practical Advice

User Choices

To choose the online banking service that best suits you, ask yourself a few questions:

- What are the features you use most? (Balance inquiries, transfers, investments, foreign currency remittances)

- Do you prioritize fees, promotions, or app user experience?

- Do you frequently need cross-border transfers or overseas product investments?

- Do you need 24-hour support?

If you value simplicity and comprehensive features, Hang Seng Personal e-Banking is a great choice. You can manage accounts, investments, and credit cards in one app, with multiple login methods that are convenient and secure. If you frequently use PayMe or need multi-language support, consider HSBC or BOC. If you want instant transfers and abundant promotions, Standard Chartered is worth a try.

Tip: You can open accounts with multiple banks and use them flexibly based on your needs to leverage their strengths.

Banking Tips

When using online banking, keep these points in mind:

- Regularly check account activity and contact the bank immediately if you spot anything unusual.

- Enable all security alert functions to protect your funds.

- Take advantage of in-app promotional information to participate in cashback or reward point campaigns.

- Compare handling fees and exchange rates across banks to choose the most cost-effective services.

- Regularly update the app to enjoy the latest features and enhanced security.

Remember: You don’t need to stick to one bank. Choose the online banking platform that best fits your lifestyle and financial needs for greater flexibility.

To choose the most suitable online banking platform, carefully review each bank’s features, fees, and promotions. According to user surveys, people value financial advice and fund research reports the most. Hang Seng Personal e-Banking is simple to use, ideal for those like you who prioritize convenience and security. If you want more investment analysis or higher savings interest rates, compare other Hong Kong bank apps. Remember, choosing based on your needs makes banking easier.

FAQ

How long does it take to open a Hang Seng Personal e-Banking account?

You can apply through the mobile app, with the process taking as little as 10 minutes. Prepare your ID and proof of address, then follow the instructions to upload photos.

Are there fees for online banking transfers?

Local transfers are generally free. For international remittances, fees are around USD 10-20, with actual amounts adjusted based on exchange rates.

What should I do if I forget my login password?

You can use the “Forgot Password” function in the app to reset it. Follow the steps, enter your information, and it’s done in minutes.

What security measures does online banking have?

You need two-factor authentication, a mobile security token, and can use fingerprint or facial recognition for login. Real-time alerts for every transaction protect your funds.

What customer support options are available?

You can use 24-hour online customer service, call the hotline, or book a branch specialist. Help is always available for any issues.

Hang Seng Bank’s Personal eBanking offers intuitive operations, robust security, and free local transfers for seamless daily financial management, but how can you cut cross-border transfer costs and unlock global investment potential? BiyaPay provides an all-in-one financial platform, enabling trading of US and Hong Kong stocks without offshore accounts, complementing eBanking’s local strengths with global opportunities. Supporting USD, HKD, and 30+ fiat and digital currencies, real-time exchange rate tracking ensures cost transparency, while global remittances to 190+ countries feature transfer fees as low as 0.5% with swift delivery, ideal for FPS and international transactions.

A 5.48% annualized yield savings product, with no lock-in period, keeps idle funds growing. Sign up for BiyaPay today to merge Hang Seng’s reliable eBanking with BiyaPay’s cost-effective, global financial solutions for a superior wealth management experience!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

Getting Started with US Stock Analysis: How to Seize Next Year's Tech Stock Opportunities

How Beginners Can Invest in the Three Major US Stock Index ETFs: Understanding How to Choose SPY, DIA, and QQQ

Do You Need to Stay Up Late to Trade US Stocks? One Chart to Understand the Correspondence Between US Stock Trading Hours and Beijing Time

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.