388 Dividend Record and Key Points You Need to Know

Image Source: pexels

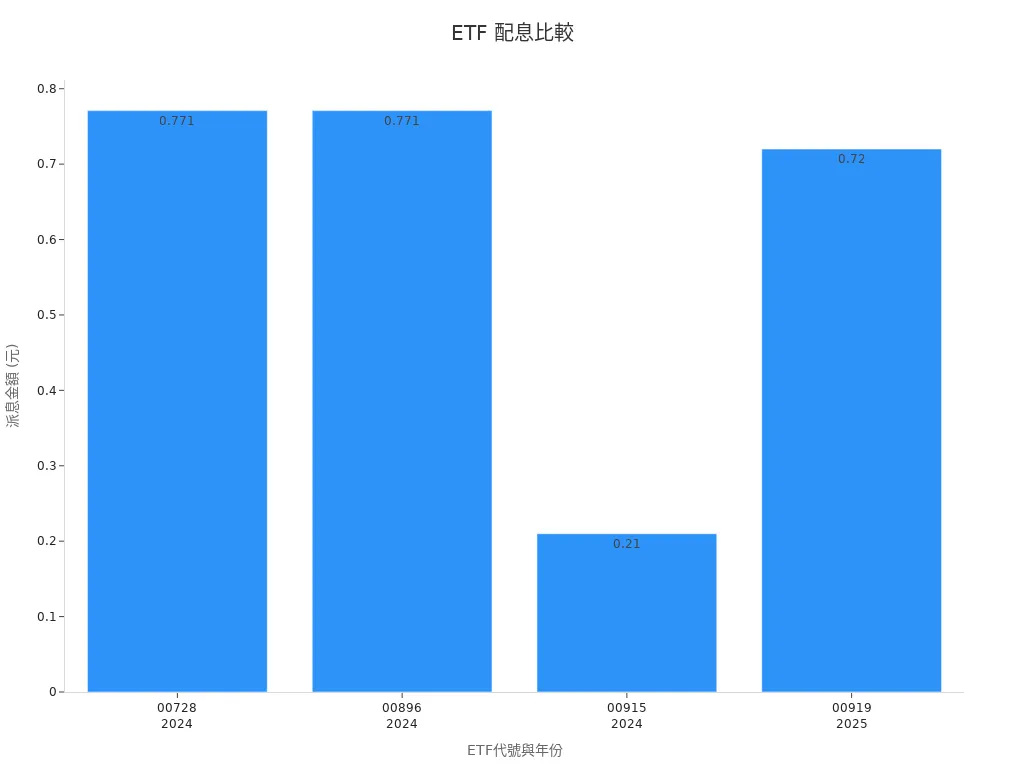

In 2024, 388 dividend amounts significantly increased, with continuous growth in annual payouts. The 2025 interim dividend has not yet been distributed, attracting high market attention. The table below summarizes the dividend data of major ETFs, enabling investors to quickly grasp the latest developments:

| ETF Code | Year | Dividend Amount (USD) | Annualized Dividend Yield (%) | Remarks |

|---|---|---|---|---|

| 00919 | 2024 | 0.54 ~ 0.72 | Approx. 13.16 | Announced 9th dividend of 0.72 on June 2, 2025, a new high |

| 00918 | 2024 | Approx. 0.7 | Approx. 12.73 | Stable dividends, yield above 10% |

| 00915 | 2024 | 0.21 | N/A | Lower dividends |

| 00728 | 2024 | 0.771 | N/A | Changed from annual to quarterly dividends |

| 00896 | 2024 | 0.771 | N/A | Clear dividend policy |

Key Points

- In 2024, 388 dividend amounts significantly increased, with multiple ETFs reaching historical highs, indicating strong market demand for high-yield assets.

- Investors must pay attention to the announcement date and ex-dividend date, as only those holding ETFs before the ex-dividend date can receive dividends.

- 388 dividend yields are higher than the Hong Kong stock market average, but high yields come with higher risks, requiring careful assessment of personal risk tolerance.

- Dividend sources may include principal, and dividends do not equate to actual returns; investors should fully understand the fund’s dividend structure.

- Regularly reviewing dividend records and official announcements helps investors seize dividend opportunities and optimize portfolio allocation.

Latest 388 Dividends

Dividend Amounts

In 2024, 388 dividend amounts significantly increased. Multiple related ETFs, such as 00919, 00918, and 00728, recorded historical highs. Investors can refer to the table below for the latest dividend amounts of each ETF in 2024 and 2025:

| ETF Code | Year | Per Unit Dividend Amount (USD) | Remarks |

|---|---|---|---|

| 00919 | 2024 | 0.72 | New high in 2024 |

| 00918 | 2024 | 0.70 | Stable dividends |

| 00728 | 2024 | 0.771 | Changed from annual to quarterly dividends |

| 00896 | 2024 | 0.771 | Clear dividend policy |

| 00919 | 2025 | Not yet announced | Interim dividend expected to be announced in the second half of the year |

Experts note that 388 dividend amounts continued to grow in 2024, reflecting strong market demand for high-yield assets. Some ETFs in 2025 have not yet announced interim dividends, and investors need to closely monitor official announcements.

Dividend Dates

The ex-dividend date, payment date, and announcement date for 388 dividends are crucial for investors. Below are the relevant dates for major ETFs in 2024 and 2025:

- 00919 (2024 9th Dividend)

- Announcement Date: June 2, 2024

- Ex-Dividend Date: June 10, 2024

- Payment Date: June 21, 2024

- 00918 (2024)

- Announcement Date: May 28, 2024

- Ex-Dividend Date: June 6, 2024

- Payment Date: June 17, 2024

- 00728 (2024)

- Announcement Date: May 30, 2024

- Ex-Dividend Date: June 7, 2024

- Payment Date: June 18, 2024

- 00919 (2025)

- Announcement Date, Ex-Dividend Date, Payment Date: Not yet announced

Investors should hold the relevant ETFs before the ex-dividend date to receive the respective 388 dividends.

Special Notes

- In 2024, 388 dividend amounts reached a new high, with significant growth in annual dividends.

- Some ETFs in 2025, such as 00919, have not yet announced interim dividends, and the market expects new developments.

- 00728 changed from annual to quarterly dividends, and investors need to note the change in dividend frequency.

- 388 dividends are influenced by market conditions, fund performance, and management policies, and future amounts may fluctuate.

- Investors should closely monitor announcement dates and ex-dividend dates to avoid missing dividend opportunities.

Experts recommend that investors regularly review 388 dividend records and adjust their portfolios based on their risk tolerance.

Dividend Records

Historical Records

Over the past decade, global corporate dividends have continued to expand. According to public data, global dividend totals reached 1.37 trillion USD in 2018, rising to 1.43 trillion USD in 2019, a new high. Dividend growth rates have remained above 5% long-term, indicating stable corporate dividend performance. Below are the key statistical trends:

- Global corporate dividends have grown by approximately 97%, with an average annual growth of about 7%.

- Emerging markets, North America, and Japan have shown the most significant dividend growth, while Europe has limited growth due to higher dividend yields.

- The banking and mining sectors have shown notable dividend growth, while the telecommunications sector has been relatively weak.

- Most companies choose to maintain or expand dividends, reflecting healthy corporate earnings and cash flows.

- Future dividend growth is expected to slow slightly, but total dividend amounts are still likely to continue rising.

According to the BlackRock Global Enhanced Equity Yield Fund description, dividend sources include capital gains, dividend income, and royalty income from stocks or securities. Fund managers periodically review and adjust dividend amounts, which may come from principal, with no guaranteed returns. Investors can check specific dividend records on the fund’s official website, but the company has not disclosed complete dividend data for the past decade.

Investors should note that past dividend performance does not guarantee future results, and 388 dividend amounts may vary due to market fluctuations.

Announcement and Ex-Dividend Dates

For each 388 dividend, the fund company will announce the announcement date, ex-dividend date, and payment date in advance. These dates are crucial for investors, as only those holding the relevant ETF before the ex-dividend date can receive the dividend. Below is the typical process:

- The fund company releases dividend information on the announcement date.

- On the ex-dividend date, the list of holders is finalized, and buyers after this date will not receive the dividend.

- On the payment date, investors receive cash dividends or reinvested units.

Investors should closely monitor announcement and ex-dividend dates and adjust their holdings based on their investment strategies. Some funds may adjust dividend frequency due to market conditions or policies, so it is recommended to regularly review official announcements to ensure no 388 dividend opportunities are missed.

388 Dividend Trends

Image Source: pexels

Regular Dividends

Regular dividends reflect the stable cash flow of a fund or ETF. Over the past few years, 388 regular dividends have shown a gradual upward trend. Most funds saw steady growth in per-unit dividend amounts between 2022 and 2024. For example, 00919’s per-unit dividend was approximately 0.60 USD in 2022, rising to 0.68 USD in 2023, and reaching a new high of 0.72 USD in 2024. This growth is mainly driven by increased fund net income and rising market demand for high-yield assets.

- Dividend fluctuations are influenced by multiple factors:

- Dividend sources may come from net income or estimated income; if estimates are insufficient, some dividends may use principal.

- Changes in dividend frequency (e.g., from annual to quarterly) may cause short-term fluctuations in single dividend amounts.

- Different fund types (e.g., equity or infrastructure) have varying impacts on dividend stability.

- Market conditions and fund expenses (e.g., distribution fees) affect fund net value, which is reflected in dividend amounts.

Investors can refer to the chart below to observe the annual trend of 388 regular dividends and understand long-term growth potential.

Special Dividends

Special dividends are non-recurring and typically distributed due to additional fund income or capital gains. 388 special dividends occur less frequently but have larger fluctuations in amounts. For example, in 2023, some funds distributed a single special dividend as high as 0.15 USD due to asset revaluation or one-time income. In 2024, no significant special dividends were distributed, indicating that fund managers preferred to retain income or use it for reinvestment.

- Characteristics of special dividend fluctuations:

- Sources are mostly capital gains or one-time income, unlike regular dividends.

- If fund income falls short of expectations, special dividends may decrease or be suspended.

- Market volatility, fund asset restructuring, and other factors directly affect special dividend distributions.

Investors should closely monitor fund announcements, as special dividends significantly impact total returns but cannot be relied upon as a stable income source.

Yield Comparison

Image Source: pexels

Yield Calculation

TTM yield (Trailing Twelve Months Yield) measures the ratio of a fund or ETF’s actual dividends over the past 12 months to its current price. This metric helps investors assess the expected cash return from entering the market now. The calculation method is as follows:

TTM Yield = Total Dividends Over Past 12 Months ÷ Current Fund Price × 100%

For example, if an ETF paid a total of 0.72 USD in dividends over the past year and its current price is 5.5 USD, the TTM yield is approximately 13.09%. This figure reflects the annual cash return investors can expect if they buy at the current price.

When calculating yields, investors should note the following:

- Fund dividends may come from principal, not entirely from investment income. Dividends do not equal actual returns.

- Dividends may not account for all related expenses, potentially reducing the original investment amount.

- Dividends affect fund net value, which fluctuates with market conditions.

- Dividend sources are disclosed on the fund’s official website, where investors can find detailed information.

- Yield calculations reflect dividend performance, but statistical values should be interpreted cautiously.

- Investors are advised to refer to the fund’s prospectus to fully understand the impact of dividends on yields.

Experts recommend that investors should not base investment decisions solely on yield figures but also consider fund net value, dividend sources, and market conditions.

Peer Comparison

388 dividend yields stand out among similar products. According to the latest 2024 data, the TTM yields of major high-yield ETFs are as follows:

| ETF Code | TTM Yield (%) | Remarks |

|---|---|---|

| 00919 | 13.16 | New high in 2024 |

| 00918 | 12.73 | Stable dividends |

| 00728 | 11.80 | Changed from annual to quarterly dividends |

| 00896 | 11.50 | Clear dividend policy |

| Hong Kong Stock Average | Approx. 4.0-4.5 | 2024 data |

| China A-Share High Dividend ETFs | Approx. 3.5-4.0 | 2024 data |

The table shows that 388 dividend-related ETFs have yields significantly higher than the Hong Kong stock market average and China A-share high-dividend ETFs. For example, 00919’s 2024 TTM yield reached 13.16%, far exceeding the market average. This reflects the strong appeal of 388 dividend products for investors seeking cash flow.

The high yields of 388 dividend products stem from the fund management team’s proactive approach to seeking high-yield assets and flexibly adjusting portfolios. Investors looking to boost cash returns may consider allocating some funds to these high-yield ETFs. However, high yields come with higher risks, and investors should carefully select based on their risk tolerance.

Notices

Dividend Definition

Dividends refer to a company or fund distributing part of its profits to shareholders or fundholders in cash or shares. This distribution typically comes from corporate earnings, capital gains, or other investment income. In the Hong Kong market, many listed companies and ETFs pay dividends periodically. Investors can choose to receive dividends in cash or reinvest them in the relevant products. Dividend amounts vary based on company performance, policies, and market conditions. Some funds specify dividend sources, including investment income and principal. Investors should carefully read the fund’s prospectus to understand the dividend structure and risks.

Record Description

Dividend records reflect the fund’s or company’s dividend history. These records include each dividend amount, announcement date, ex-dividend date, and payment date. Investors can access this information on the fund company’s website or the Hong Kong Stock Exchange website. Some fund websites periodically update dividend data to facilitate investor tracking of income performance. If there are changes in dividend frequency or amount, the fund company will explain the reasons in announcements. Investors should regularly review dividend records to check and adjust their holdings based on their investment objectives.

Company Background

The Hong Kong market has several fund management companies focused on high-yield products. These companies typically have extensive asset management experience and professional teams responsible for investment decisions. Some companies collaborate with Hong Kong banks to offer diversified wealth management products. Fund companies adjust their portfolios based on market changes to achieve stable dividends and capital appreciation while striving for. Investors can check the company’s background, management team, and past performance on the official website. Choosing a company with a strong reputation and transparency helps reduce investment risks.

388 dividends recorded significant growth in 2024, with new developments expected in 2025. Investors should closely monitor dividend frequency, amount changes, and yield trends. Dividend information is for reference only, and investment decisions require multi-faceted analysis.

This article is for informational purposes only and does not constitute investment advice. All rights are reserved. Unauthorized reproduction is prohibited.

FAQ

What are 388 dividends?

388 dividends refer to several high-yield ETFs in the Hong Kong market that periodically distributing regular cash dividends. Investors holding these ETFs can receive cash dividends proportional to their holdings, calculated in USD, influenced by market and fund performance.

What are the risks of investing in 388 dividend ETFs?

Investors face risks from market fluctuations, exchange rate changes, and fund management risks. Dividend amounts may fluctuate due to economic conditions, fund income, and policy adjustments, with no guaranteed returns.

How can investors check the latest 388 dividend announcements and dates?

Investors can check the announcement date, ex-dividend date, and payment date on the fund company’s official website or the Hong Kong Stock Exchange website. It is recommended to regularly review official information to avoid missing dividend opportunities.

How are 388 dividend amounts calculated?

The fund calculates TTM yield by dividing the total dividend amount over the past 12 months by the current fund price, divided by. All amounts are displayed in USD and reflect the current exchange rate.

Who are suitable investors for 388 dividends?

388 dividends are more suitable for investors seeking stable cash flow and medium- to long-term returns. They typically have those seeking a certain level of risk tolerance and prioritize asset allocation and diversified investment.

Tracking 388 dividend records and ETF payouts sharpens your investment strategy, but how do you streamline global fund management? BiyaPay offers a seamless platform for trading US and Hong Kong stocks, including high-yield ETFs like 00919, without offshore accounts. Benefit from a 5.48% annualized yield savings product for flexible dividend reinvestment.

Real-time exchange rate tracking and conversions support USD, HKD, and 30+ fiat and digital currencies, with global remittances to 190+ countries at fees as low as 0.5%. Sign up for BiyaPay today to optimize funds and maximize dividend returns!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.