U.S. Stock Investment Guide for Beginners: Must-Know Tips

Image Source: pexels

Why Choose to Invest in U.S. Stocks?

The U.S. stock market is one of the core components of the global capital market, attracting the attention of many investors. It offers a wide range of investment options, including globally renowned large companies such as Apple, Microsoft, and Amazon. The U.S. stock market has high transparency, with comprehensive information disclosure, allowing investors to easily access company financial reports and market dynamics. Additionally, the U.S. market has strong liquidity, with active trading, making it more convenient to buy and sell stocks.

How to Buy U.S. Stocks: The First Step for Beginners

For beginners, understanding how to buy U.S. stocks is the first step in investing. You need to first choose a suitable broker and complete the account opening process. Then, through the trading platform provided by the broker, you can purchase U.S. stocks. The entire process is simple and clear, enabling even beginners to get started quickly.

U.S. Stock Market Overview

Image Source: unsplash

Three Major Stock Exchanges and Their Characteristics

The U.S. stock market consists of three major exchanges: the New York Stock Exchange (NYSE), the Nasdaq Stock Exchange (NASDAQ), and the American Stock Exchange (AMEX). Each exchange has unique characteristics, and you can choose a suitable platform based on your investment needs.

- New York Stock Exchange (NYSE)

The NYSE is the world’s largest stock exchange, primarily focused on blue-chip stocks and large enterprises. Its trading system is stable, suitable for those pursuing long-term investments. - Nasdaq Stock Exchange (NASDAQ)

The NASDAQ is known for technology stocks and high-growth companies. If you are interested in innovative businesses, this is an ideal choice. - American Stock Exchange (AMEX)

The AMEX primarily serves small and medium-sized enterprises and ETF trading. Its flexibility is high, suitable for diversified investment strategies.

These three major exchanges collectively form the core of the U.S. stock market, providing you with abundant investment opportunities.

Role and Significance of the Three Major Indices

The three major indices of the U.S. stock market—the Dow Jones Industrial Average (DJIA), the S&P 500 Index, and the Nasdaq Composite Index—are important tools for measuring market performance. Their respective characteristics and significance are as follows:

| Index Name | Main Characteristics | Calculation Method | Example Companies | Significance |

|---|---|---|---|---|

| Dow Jones Industrial Average (DJIA) | Represents the largest blue-chip companies in the U.S. | Price-weighted | Apple (AAPL), Microsoft (MSFT) | Reflects the overall state of the U.S. economy, with strong stability. |

| S&P 500 Index | The most representative index of the U.S. stock market | Market cap-weighted | Apple (AAPL), Amazon (AMZN) | Covers over 80% of the total U.S. stock market value, providing a more accurate economic picture. |

| Nasdaq Composite Index | Focuses on technology and high-growth companies | Market cap-weighted | Apple (AAPL), Tesla (TSLA) | Strongly influenced by innovation and growth stocks, suitable for evaluating tech industry performance. |

Through these indices, you can quickly understand the overall market trends and performance across different sectors.

Unique Advantages of the U.S. Stock Market

The U.S. stock market has many unique advantages, making it a top choice for global investors. The following are some key points:

- Strong Liquidity: The U.S. stock market has active trading, making it more convenient to buy and sell stocks.

- High Transparency: Company information disclosure is comprehensive, allowing you to easily access financial reports and market dynamics.

- Rich Investment Options: From blue-chip stocks to tech stocks, the U.S. market offers diverse choices.

- Optimistic Market Sentiment: Recent data shows that the S&P 500 Index has returned to 6000 points, with institutional investor confidence strengthening. The market is focused on expectations of Federal Reserve rate cuts, which may bring more investment opportunities.

These advantages make the U.S. stock market a highly promising investment field. If you are looking for a stable and diversified investment environment, the U.S. stock market is a worthy consideration.

Basic Rules of U.S. Stock Investment

U.S. Stock Trading Hours and Time Difference

U.S. stock trading hours are divided into regular trading sessions and pre-market and after-hours trading periods. The regular trading session runs from 9:30 AM to 4:00 PM Eastern Time. For Chinese investors, due to the time difference, trading hours are typically from 9:30 PM to 4:00 AM the next day Beijing time. Pre-market trading starts at 8:00 PM Beijing time, and after-hours trading extends until 8:00 AM the next day.

The time difference has some impact on trading volume. Data shows that the average daily trading volume of U.S. stocks in 2021 was 700 million shares, expected to reach 1.7 billion shares by 2025. This indicates that with increasing participation from global investors, the activity level of the U.S. stock market continues to rise.

| Year | Average Daily Trading Volume (Billion Shares) |

|---|---|

| 2021 | 0.7 |

| 2025 | 1.7 |

Understanding trading hours and time differences helps you better plan your trading strategies and avoid missing important market opportunities.

Trading Units and Settlement Mechanism

The minimum trading unit for U.S. stocks is one share, which differs from the “lot” unit used in A-shares. You can flexibly purchase stocks based on your financial situation. Additionally, U.S. stocks use a T+2 settlement mechanism, meaning funds and stocks are settled two business days after the transaction. This mechanism requires you to ensure sufficient funds in your account during trading to avoid transaction failures due to insufficient funds.

For beginners, understanding the settlement mechanism is crucial. You need to plan fund flows in advance to avoid impacting subsequent investment operations due to settlement cycles.

Price Fluctuation Limits and Circuit Breaker Mechanism

The U.S. stock market does not have daily price fluctuation limits like A-shares, but it has a circuit breaker mechanism to address extreme market volatility. The circuit breaker mechanism has three levels:

- Level 1 Circuit Breaker: S&P 500 Index falls 7%, trading pauses for 15 minutes.

- Level 2 Circuit Breaker: S&P 500 Index falls 13%, trading pauses again for 15 minutes.

- Level 3 Circuit Breaker: S&P 500 Index falls 20%, trading stops for the day.

This mechanism aims to protect investor interests and prevent further escalation of market panic. As an investor, you need to monitor market dynamics, assess risks rationally, and avoid blind operations during circuit breaker periods.

Tip: Cybersecurity reviews and data compliance are important parts of U.S. stock investment rules. Companies listing in the U.S. must detail compliance status and potential risks in their prospectuses. Different companies vary in data compliance disclosures, so it’s advisable to pay attention to this information to avoid investment decisions impacted by compliance issues.

Fees and Tax Information

Understanding fees and tax-related matters is crucial when investing in U.S. stocks. These costs directly affect your investment expenses and returns. The following are key aspects to focus on:

1. Fees

U.S. stock trading fees vary by broker. When choosing a broker, you need to carefully compare the following common fees:

- Trading Commission

Many brokers offer zero-commission trading, but some still charge approximately $0.01-$0.02 per share per trade. - Platform Usage Fee

Some brokers charge monthly or annual fees, typically between $10 and $50. - Transfer Fees

Transferring funds from a Chinese bank account to a U.S. stock broker account may incur international transfer fees, usually between $15 and $50. - Foreign Exchange Fees

U.S. stock trading is settled in USD, requiring you to convert RMB to USD. Exchange rate differences and conversion fees increase costs, typically 0.5%-1% of the converted amount.

Tip: When choosing a broker, prioritize zero-commission platforms like Robinhood or Webull. Also, check for hidden fees, such as account management fees or inactivity fees.

2. Tax Information

Taxes involved in U.S. stock investments mainly include dividend tax and capital gains tax. You need to understand the basic rules of these two tax types:

- Dividend Tax

The U.S. imposes a 30% withholding tax on dividend income for foreign investors. For example, if you hold Apple (AAPL) stock and receive a $1 per share dividend, you actually receive $0.70. Some countries have tax treaties with the U.S., allowing you to apply for a reduced tax rate of 10%-15%. - Capital Gains Tax

When selling stocks for a profit, the U.S. does not levy capital gains tax on foreign investors. However, you need to declare and pay relevant taxes according to Chinese tax laws.

| Tax Type | Tax Rate | Applicable Scope | Notes |

|---|---|---|---|

| Dividend Tax | 30% | Dividend income from U.S. stocks | Tax rate can be reduced through tax treaties. |

| Capital Gains Tax | None | Profits from stock trading | Must be declared under Chinese tax law to avoid tax risks. |

Note: Ensure your broker provides tax reporting features to facilitate recording and declaring tax-related information.

3. How to Reduce Costs

- Choose Low-Fee Brokers

Prioritize zero-commission brokers with no account management fees. - Optimize Transfer Methods

Use Hong Kong bank accounts for international transfers, as fees are typically lower. - Plan Transactions Rationally

Reduce frequent trading to lower cumulative fees.

By understanding fee and tax rules, you can better control investment costs and improve overall returns.

How to Buy U.S. Stocks: From Account Opening to Trading

Image Source: unsplash

Key Factors in Choosing a Broker

Choosing the right broker is the first step in investing in U.S. stocks. The broker’s service quality, fee structure, and platform features directly impact your investment experience. The following are key factors to evaluate based on your needs:

- Trading Fees

Zero-commission brokers are increasingly popular, but you still need to check for other fees, such as platform usage or transfer fees. Choosing a transparent, low-cost broker can help reduce investment costs. - Platform Features

A high-quality trading platform should offer real-time quotes, user-friendly operations, and various analytical tools. Choose brokers that support both mobile and desktop platforms for trading anytime, anywhere. - Customer Service

The speed and professionalism of customer service are crucial. Quick resolutions to issues can prevent trading losses. - User Reviews

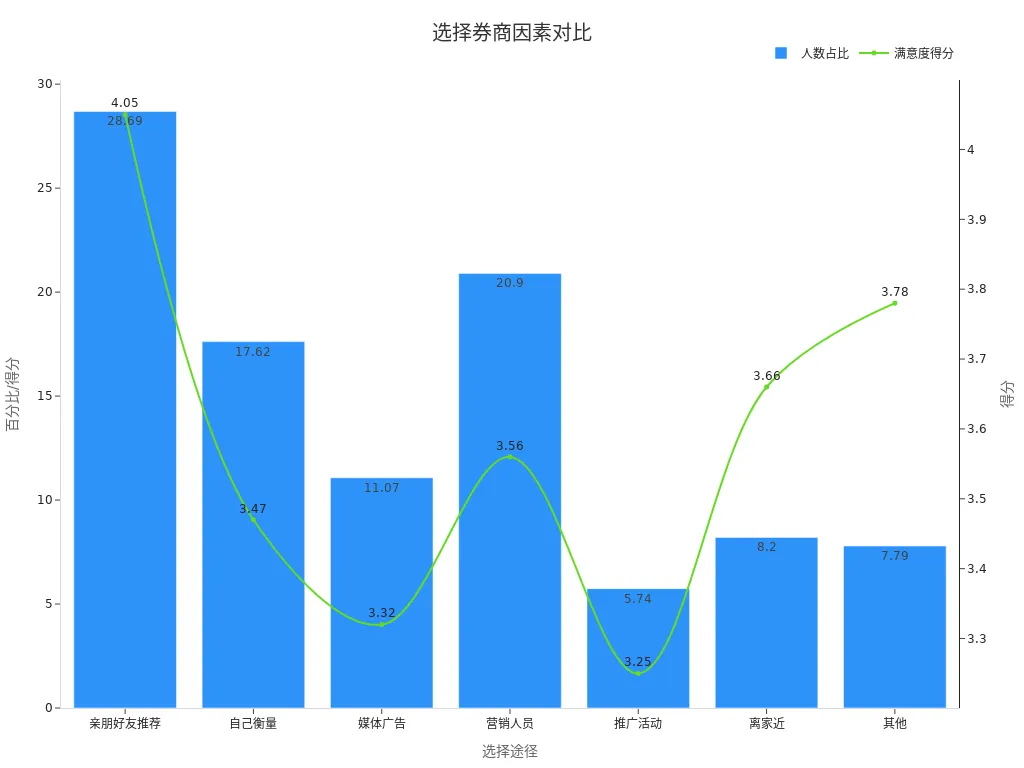

Survey data shows that user satisfaction is closely related to the selection method. The following are some statistics:Selection Method Percentage of Users Average Satisfaction Score Friend/Family Recommendation 28.69% 4.05 Self-Evaluation 17.62% 3.47 Media Advertising 11.07% 3.32 Sales Personnel 20.90% 3.56 Promotional Events 5.74% 3.25 Proximity to Home 8.20% 3.66 Other 7.79% 3.78

Through these data, you can better understand the pros and cons of different selection methods and find a broker that suits you.

Account Opening Process and Precautions

Opening an account is the second step in investing in U.S. stocks. The following is the basic account opening process and key precautions:

- Prepare Documents

You need to provide identity proof (e.g., passport or ID card), address proof (e.g., utility bill), and bank account information. Ensure the documents are authentic and valid to avoid review failures. - Choose Account Type

U.S. stock brokers typically offer cash accounts and margin accounts. Cash accounts are suitable for beginners with lower risk; margin accounts allow borrowing for investments but carry higher risk. - Fill Out Application Form

When filling out the online application form, carefully verify information to avoid delays due to errors. - Deposit Funds

After opening the account, you need to transfer funds to the broker’s account. Choosing a low-cost transfer method can reduce fees.

Tip: During account opening, check whether the broker offers Chinese-language support. If you’re not fluent in English, choosing a broker with Chinese support can reduce communication barriers.

Investment Methods: Direct Stock Purchase vs. Contracts for Difference (CFDs)

When investing in U.S. stocks, you can choose to directly purchase stocks or trade through Contracts for Difference (CFDs). Each method has its characteristics, and you can choose based on your investment goals and risk tolerance.

Direct Stock Purchase

Direct stock purchase is the most traditional investment method. You can hold stocks and enjoy dividend payouts. Its advantages include:

- Long-Term Returns: Suitable for long-term investors, with stock price appreciation and dividends providing stable returns.

- Ownership: You have actual ownership of the stocks, including participation in company decisions (e.g., voting rights).

However, direct stock purchases require higher capital investment, and trading costs can be significant.

Contracts for Difference (CFDs)

CFDs are a derivative trading method where you don’t need to own the actual stocks to trade. Its features include:

- Leveraged Trading: You can trade larger positions with less capital, but the risk is higher.

- Flexibility: Supports short-selling, allowing profits even in a declining market.

CFDs are suitable for short-term investors but require higher risk tolerance.

Note: When choosing an investment method, assess your risk tolerance and financial situation. Beginners are advised to start with direct stock purchases and gradually gain experience before trying CFDs.

Stock Selection and Investment Techniques

How to Select Stocks: Long-Term vs. Short-Term Strategies

When selecting stocks, you need to choose a strategy that aligns with your investment goals. Long-term investing suits investors seeking stable returns. You can focus on companies with strong competitiveness and stable growth, such as blue-chip stocks or industry leaders. These companies typically have high risk resistance, suitable for long-term holding.

Short-term investing is better for those seeking quick returns. You can choose stocks with higher volatility, such as tech stocks or companies in emerging industries. Short-term investing requires close monitoring of market dynamics to capture buying and selling opportunities promptly. Regardless of the strategy, having a clear investment plan and stop-loss points is crucial.

Referencing Financial Reports and Market Data

Financial reports and market data are essential for stock selection. You can improve the scientific rigor of stock selection through the following steps:

- Collect and clean stock data to ensure accuracy and consistency.

- Use statistical analysis and machine learning techniques to build screening models for stock evaluation.

- Backtest the screening model on historical data to verify its effectiveness and stability.

- Monitor market dynamics and company announcements in real-time, adjusting the screening model and conditions as needed.

- Ensure the data used is accurate, complete, and updated promptly to avoid decisions based on incorrect data.

Through these methods, you can better analyze a company’s financial health and market performance, making more informed investment decisions.

Recommended Tools for U.S. Stock Investing

When investing in U.S. stocks, using the right tools can help you manage investments more efficiently. The following are some commonly used tools:

- Stock Screeners

Stock screeners allow you to filter stocks based on your investment preferences. For example, Yahoo Finance and Finviz offer powerful screening features to help you quickly identify target stocks. - Financial Analysis Tools

Bloomberg Terminal and Morningstar are professional financial analysis tools. They provide detailed company financial data and market analysis, suitable for in-depth research. - Trading Platforms

Choosing a feature-rich trading platform is crucial. Robinhood and Webull not only support real-time trading but also offer extensive market data and analytical tools. - News and Market Updates

CNBC and Seeking Alpha are two popular financial news platforms. They help you stay informed about market dynamics and company news.

With these tools, you can more easily analyze markets, screen stocks, and develop investment strategies. If you’re still learning how to buy U.S. stocks, these tools will be great helpers for getting started.

Advantages and Disadvantages of U.S. Stock Investment

Main Advantages of Investing in U.S. Stocks

Investing in U.S. stocks offers significant economic benefits and market advantages. The long-term performance of the U.S. stock market surpasses many other regional capital markets. The following are the main advantages of U.S. stock investment:

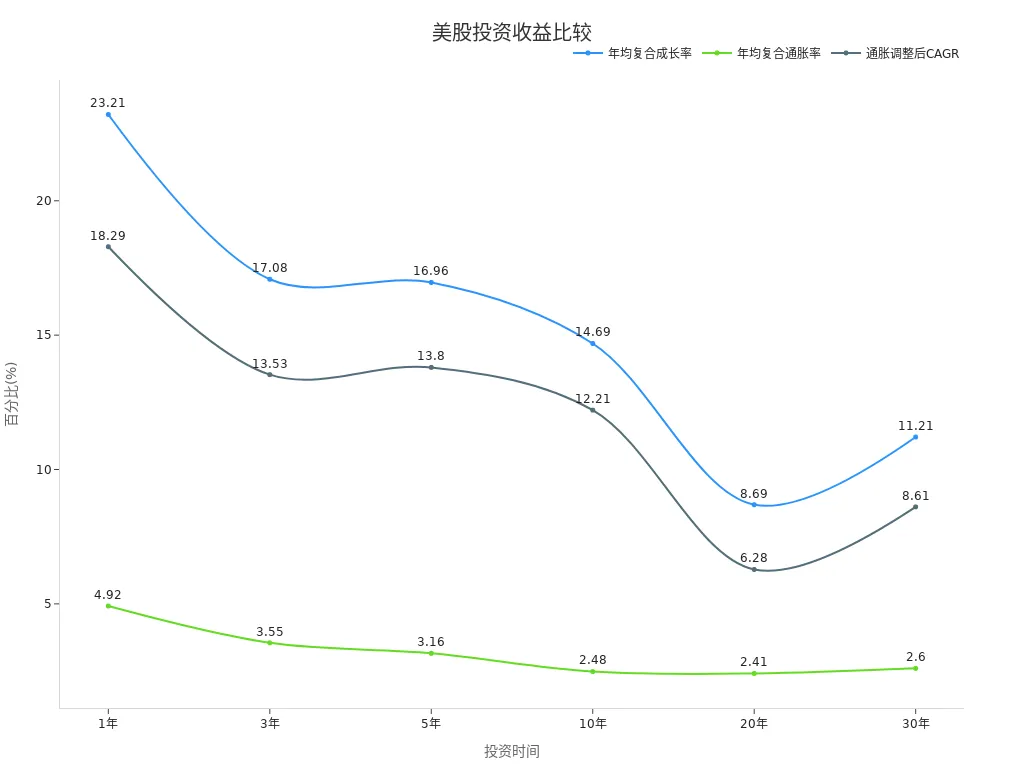

- High Returns

The U.S. stock market’s annualized compound growth rate (CAGR) performs strongly across different investment periods. The following are specific data:Investment Period (as of 12/31/2021) Annualized CAGR Annualized Inflation Rate Inflation-Adjusted CAGR 1 Year 23.21% 4.92% 18.29% 3 Years 17.08% 3.55% 13.53% 5 Years 16.96% 3.16% 13.80% 10 Years 14.69% 2.48% 12.21% 20 Years 8.69% 2.41% 6.28% 30 Years 11.21% 2.60% 8.61%

- Economic Growth Support

The United States maintains a high GDP growth rate over the long term, providing a solid foundation for the U.S. stock market. The following is a comparison of GDP growth rates between the U.S. and Europe:Region GDP Growth Rate United States 3% Europe 0.5% - U.S. GDP growth has remained around 3% over the past two years.

- European GDP growth is only 0.5%.

- Future U.S. GDP growth is expected to continue outperforming Europe, providing a strong investment foundation.

Goldman Sachs’ report notes that while current economic data remains robust, the coming months may show signs of weakness. Over the long term, economic growth and stock market performance are positively correlated, further supporting the superiority of U.S. stock investments.

Potential Risks and Mitigation Strategies

Despite its many advantages, investors must remain aware of potential risks in the U.S. stock market and adopt effective mitigation strategies. The following are the main risks and corresponding strategies in the recent U.S. stock market:

- Delisting Risk for Chinese Concept Stocks

Recent risk events in the U.S. stock market have primarily focused on delisting risks for Chinese concept stocks. Some Chinese concept stocks have chosen to delist from the U.S. or relist in Hong Kong to mitigate potential losses. Short-term risks are manageable, with successful cases showing that dual-listed Chinese concept stocks tend to outperform during negative events. - Market Volatility

The U.S. stock market has high volatility, requiring investors to closely monitor market dynamics. Establishing a clear investment plan and stop-loss points can effectively reduce risks. - Economic Environment Changes

Economic data may show signs of weakness, affecting market sentiment. Investors should monitor macroeconomic indicators and adjust strategies promptly.

Tip: Diversified investment is an effective way to mitigate risk. By investing in different types of stocks and industries, you can reduce the impact of single-market or company risks on your portfolio.

By understanding the potential risks of U.S. stocks and adopting reasonable mitigation strategies, you can better protect your investments and achieve long-term returns.

When investing in U.S. stocks, keep the following core points in mind:

- Choose a broker that suits you, focusing on fees and service quality.

- Familiarize yourself with trading rules, including hours, settlement mechanisms, and tax requirements.

- Develop a clear investment plan and diversify risks rationally.

Tip: Start with small investments to gain experience. Stay informed about market dynamics and learn to analyze financial reports and data. Gradually improving your investment skills will lead to long-term returns in the U.S. stock market.

Through continuous learning and practice, you’ll master U.S. stock investment techniques and achieve wealth growth goals.

FAQ

1. How Long Does It Take to Open a U.S. Stock Account?

Typically, opening a U.S. stock account takes 1 to 3 business days. You need to submit identity proof and address proof documents. Some brokers offer expedited review services, allowing account opening within the same day.

2. Is There a Minimum Funding Requirement for U.S. Stock Trading?

Most brokers have no strict minimum funding requirements. You can start investing with a small amount. However, some margin accounts may require a minimum deposit, such as $2,000.

3. What Risks Should Be Noted When Trading U.S. Stocks?

The U.S. stock market has high volatility, which can lead to significant risks. You need to monitor market dynamics, set stop-loss strategies, and avoid excessive leverage.

Tip: Diversified investment can effectively reduce risks.

4. How Are Dividends from U.S. Stocks Handled?

The U.S. imposes a 30% withholding tax on dividend income for foreign investors. The dividends you receive will be net of taxes. If your country has a tax treaty with the U.S., you can apply for a reduced tax rate.

5. Can U.S. Stock Trading Be Done on a Mobile Phone?

Yes, most brokers offer mobile trading apps. You can use these apps to view real-time quotes, place trades, and manage your account, making it very convenient.

Recommendation: Try trading platforms like Robinhood or Webull that support mobile devices.

Investing in U.S. stocks offers beginners diverse opportunities and high return potential, but navigating account setup, trading fees, and cross-border fund management is key. BiyaPay provides a seamless financial platform, enabling trading in U.S. and Hong Kong stocks without offshore accounts, allowing you to leverage USD, HKD, and other assets for quick market entry.

Supporting 30+ fiat and digital currencies with real-time exchange rate transparency, plus global remittances to 190+ countries with remittance fees as low as 0.5%, it helps new investors maintain liquidity and manage costs and risks effectively in volatile markets. A 5.48% annualized yield savings product with no lock-in period enhances flexibility. Sign up for BiyaPay today to combine U.S. stock investing advantages with BiyaPay’s cost-effective tools for efficient, secure investments!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

US-China Trade War Enters New Phase: How the Tech Industry Can Respond to Supply Chain Impacts

How to Choose US Major Indices: Pros and Cons Analysis of S&P 500, Dow Jones, and Nasdaq

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

Is the W-8BEN Form Required for Opening a US Stock Account? Understand How to Save on Taxes in One Article

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.