- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Impact of 2025 Foreign Exchange Fee Adjustments on Businesses

Image Source: unsplash

The 2025 foreign exchange fee adjustments will have a profound impact on businesses’ foreign exchange transactions. The increase or decrease in fees directly alters business transaction costs, especially for those frequently engaging with international markets. You need to pay special attention to these changes, as they may affect your business’s profit margins and capital turnover efficiency.

Take Chinese businesses as an example: if a company conducts U.S. dollar settlements with multiple countries, fee adjustments may lead to increased costs per transaction. You can imagine that such changes may force businesses to reassess their foreign exchange transaction strategies or even alter their banking partnerships.

Understanding the details and potential risks of these policy adjustments will help you better prepare for the future.

Key Points

- The 2025 foreign exchange fee adjustments will directly impact business transaction costs, requiring businesses to reassess their foreign exchange transaction strategies.

- Changes in fees may affect business liquidity, increasing cash flow pressure, particularly for businesses reliant on foreign currency financing.

- Businesses should optimize foreign exchange management processes and simplify transaction steps to reduce costs and improve efficiency.

- Choosing appropriate banks and financial services can help businesses control fees and secure more favorable transaction terms.

- Fee adjustments may impact businesses’ internationalization strategies, requiring attention to market selection and capital allocation changes.

Specific Details of the 2025 Foreign Exchange Fee Adjustments

Major Policy Changes

The 2025 foreign exchange fee adjustments have garnered widespread attention. According to the authoritative interpretation by the People’s Bank of China and the State Administration of Foreign Exchange, the core objective of these adjustments is to optimize the management mechanism of the foreign exchange market while strengthening oversight of illegal activities such as money laundering and terrorist financing. Below are several key points of the policy changes:

- Personal Foreign Exchange Purchase Quota Remains Unchanged: The central bank has explicitly stated that the new regulations will not affect the annual personal foreign exchange purchase convenience quota.

- Enhanced Transaction Transparency: Through the issuance of the “Management Measures,” foreign exchange transaction processes are further standardized, ensuring the traceability of transaction records.

- Optimized Fee Structure: The adjusted fee standards are more detailed, with differentiated rates set for different transaction types.

These changes not only reflect policy flexibility but also provide businesses with a more transparent transaction environment.

Applicable Scope and Affected Parties

The scope of these foreign exchange fee adjustments covers multiple areas, including foreign exchange transaction activities of businesses and individuals. Below is a classification of the main affected parties:

- Businesses: Particularly those engaged in international trade, involving significant foreign exchange settlements and payments.

- Financial Institutions: Such as Hong Kong banks, which must adjust fee collection methods in accordance with the new regulations.

- Individuals: Although the personal foreign exchange purchase quota remains unchanged, fee adjustments may affect the cost of individual cross-border payments.

For businesses, changes in foreign exchange fees may directly impact their transaction costs and profit margins. Especially for businesses reliant on foreign currency financing, they need to reassess their capital management strategies.

Implementation Timeline and Transition Period Arrangements

According to the official announcement, the new policy will take effect on January 1, 2025. To help businesses and individuals adapt to the policy changes, relevant authorities have established a six-month transition period. During this period, businesses can:

- Familiarize with New Regulations: Attend policy interpretation sessions or consult professional institutions to understand the specific details of the adjustments.

- Adjust Internal Processes: Optimize foreign exchange management processes to ensure compliance with the new regulations.

- Communicate with Banks: Negotiate with partner banks (e.g., Hong Kong banks) regarding specific implementation details post-fee adjustments.

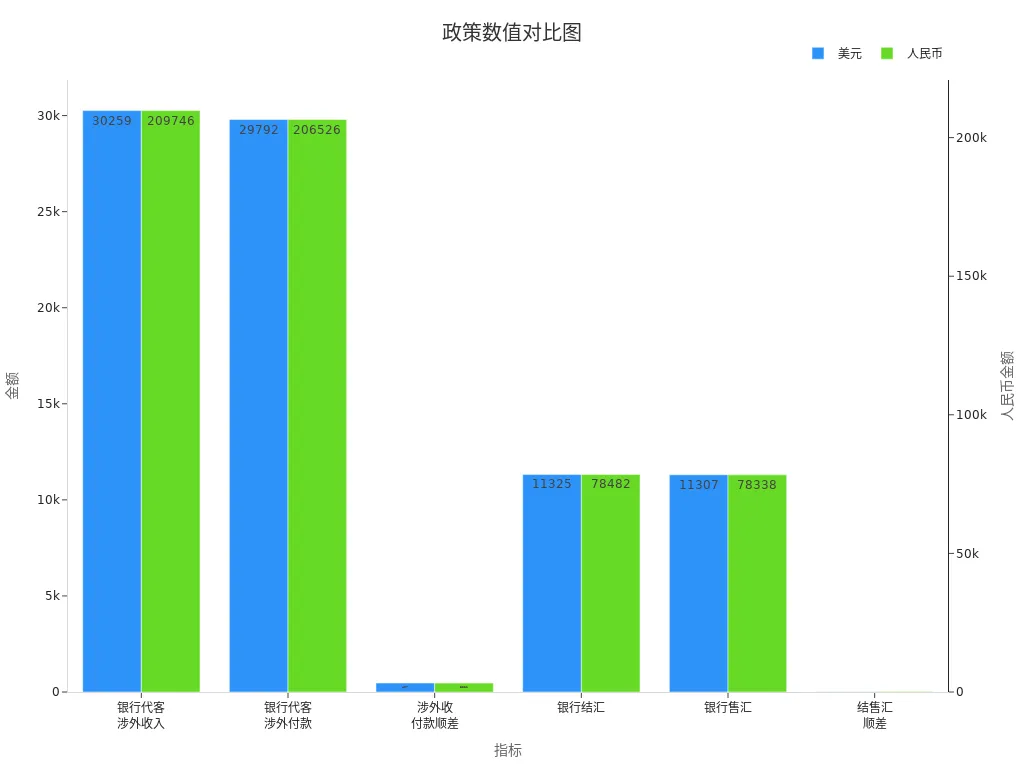

Below is a data comparison illustrating the overall state of the foreign exchange market:

| Indicator | Value (USD) | Value (CNY) |

|---|---|---|

| Bank Agency International Receipts | 3,025.9 billion | 20,974.6 billion |

| Bank Agency International Payments | 2,979.2 billion | 20,652.6 billion |

| International Receipts and Payments Surplus | 46.7 billion | 322.1 billion |

| Bank Foreign Exchange Purchases | 1,132.5 billion | 7,848.2 billion |

| Bank Foreign Exchange Sales | 1,130.7 billion | 7,833.8 billion |

| Foreign Exchange Purchase and Sale Surplus | 1.8 billion | 14.3 billion |

| Corporate Foreign Currency Financing Balance | 274.9 billion | N/A |

| Foreign Exchange Sale Rate | 69.2% | N/A |

Additionally, the following chart visually displays the comparison of U.S. dollar and CNY data:

Through this data, you can gain a clearer understanding of the current state of the foreign exchange market and the potential impacts of policy adjustments.

Potential Impacts of Foreign Exchange Fee Adjustments on Businesses

Image Source: unsplash

Impact on Foreign Exchange Transaction Costs

Foreign exchange fee adjustments directly affect business transaction costs. Changes in fees may lead to an increase or decrease in the cost of each foreign exchange transaction. For businesses reliant on foreign exchange settlements, these changes may significantly impact their profit margins.

Suppose you operate an export business that needs to complete dozens of foreign exchange transactions monthly. If fees increase, the cost of each transaction will rise, potentially putting pressure on the business’s overall operating costs over time. Conversely, if fees decrease, your transaction costs will be reduced, potentially freeing up more funds for other business development activities.

Moreover, fee adjustments may prompt businesses to reassess their banking relationships. For instance, Hong Kong banks may adjust their fee standards based on the new regulations. You need to closely monitor these changes and select the financial service provider best suited to your business needs.

Impact on Business Liquidity

Foreign exchange fee adjustments also affect business liquidity. An increase in fees may lead to greater cash flow pressure in the short term, particularly for businesses where cash inflows are insufficient to cover outflows.

Below are key points for analyzing changes in business liquidity:

| Analysis Point | Description |

|---|---|

| Cash Flow Statement | Reflects the direction and volume of funds between institutional sectors, a key tool for macroeconomic analysis. |

| Income Distribution Relationships | In-depth study of income distribution relationships among institutional sectors. |

| Fund Surplus or Deficit | Assesses the extent of surplus or shortfall in funds. |

| Financing Scale | Analyzes the overall scale of financing. |

| Financing Structure | Examines the specific structure of financing. |

If your business has a negative net cash flow from operating activities, this indicates that cash inflows are insufficient to cover outflows. Cash flow from investment activities may be relatively active, but expenditures on fixed and intangible assets are low, suggesting no change in the resource base. Financing activities show no significant net cash inflows, possibly because the company does not require additional funds. These factors need to be considered when adjusting your foreign exchange management strategy.

Impact on International Business Expansion

Changes in foreign exchange fees may also affect businesses’ international expansion. An increase in fees could raise the cost of cross-border transactions, reducing competitiveness in international markets.

For example, if you plan to expand into the Southeast Asian market, higher fees may increase the costs of cross-border payments and settlements. This could force you to reassess market entry strategies or even delay expansion plans.

On the other hand, a reduction in fees may provide businesses with more financial support, facilitating faster entry into new markets. You can use the saved funds to invest in marketing, supply chain optimization, or other critical areas, thereby enhancing your international competitiveness.

Strategies for Businesses to Address Foreign Exchange Fee Adjustments

Image Source: unsplash

Optimizing Foreign Exchange Management Processes

Optimizing foreign exchange management processes can help you reduce transaction costs and improve capital efficiency. You can start with the following aspects:

- Simplify Transaction Processes: Reduce unnecessary approval steps to shorten transaction times.

- Use Automation Tools: Adopt foreign exchange management software to monitor exchange rate changes in real-time and complete transactions quickly.

- Regular Policy Reviews: Periodically review changes in foreign exchange policies to ensure your processes comply with the latest regulations.

For example, if your business frequently conducts foreign exchange settlements, optimizing processes can reduce additional costs due to cumbersome procedures. By improving efficiency, you can better address foreign exchange fee adjustments.

Choosing Appropriate Banks and Financial Services

Selecting suitable banks and financial services is a key strategy for addressing foreign exchange fee adjustments. Different banks may have varying fee standards and service quality. You can consider the following points:

- Compare Fee Standards: Choose banks with lower fees and high service quality, such as Hong Kong banks.

- Focus on Value-Added Services: Some banks offer foreign exchange risk management consulting or cross-border payment solutions, which can help reduce risks.

- Build Long-Term Partnerships: Establishing stable relationships with banks may lead to more favorable fee rates.

Suppose your business engages in trade with multiple countries; selecting an experienced bank can reduce uncertainties in foreign exchange transactions. By choosing financial services wisely, you can better control costs.

Enhancing Foreign Exchange Risk Management Capabilities

Improving foreign exchange risk management capabilities can help you address uncertainties caused by exchange rate fluctuations. Below are some effective measures:

- Heilongjiang Province has launched a new “Enterprise Exchange Rate Risk Management Service” scenario to help businesses better manage exchange rate risks.

- The cross-border financial service platform has implemented seven application scenarios, offering businesses more options.

- Banking institutions have completed nearly $1.7 billion in online financing credit for small and micro enterprises, alleviating funding pressure.

You can leverage these services, combined with your business’s needs, to develop more scientific foreign exchange risk management strategies. For example, using exchange rate hedging tools can reduce the impact of exchange rate fluctuations on your profits.

By optimizing management processes, selecting appropriate banks, and enhancing risk management capabilities, you can better address foreign exchange fee adjustments, ensuring stable development of your international business.

Long-Term Impacts and Trends of Policy Adjustments

Impact on Industry Competitive Landscape

Foreign exchange fee adjustments will have a profound impact on the competitive landscape of industries. Changes in fees may give some businesses a cost control advantage, while others may face greater pressure. You need to focus on the following aspects:

- Challenges for Small and Medium Enterprises: Higher fees may impose a greater burden on SMEs, which often lack bargaining power to secure favorable rates from banks.

- Advantages for Large Enterprises: Large enterprises may benefit from economies of scale and long-term partnerships, securing lower fee rates from banks (e.g., Hong Kong banks), further consolidating their market position.

- Opportunities for Fintech Companies: As fees adjust, more businesses may turn to fintech platforms, which typically offer lower transaction costs and higher efficiency.

Tip: If your business is a small or medium-sized enterprise, consider partnering with fintech companies to reduce foreign exchange transaction costs.

Fee adjustments may also prompt businesses within the industry to reassess their foreign exchange management strategies. Some may enhance competitiveness by optimizing processes or adopting new technologies. You can use these approaches to maintain an advantage in industry competition.

Implications for Business Internationalization Strategies

Changes in foreign exchange fees also provide new insights for businesses’ internationalization strategies. Fee adjustments may affect your layout and expansion pace in international markets. Below are key points:

- Market Selection: If fees increase, you may need to prioritize markets with lower transaction costs, such as countries with lower fee structures for trade cooperation.

- Capital Allocation: Fee changes may prompt you to replan fund flows, such as allocating more funds to business areas with lower fees.

- Risk Management: Fee adjustments may exacerbate the impact of exchange rate fluctuations, requiring stronger foreign exchange risk management to ensure stable international operations.

Suppose your business plans to enter the Southeast Asian market; fee changes may influence your market entry strategy. If fees decrease, you can use the saved funds to increase marketing investments, boosting brand influence. Conversely, if fees increase, you may need to adjust your budget, prioritizing high-return projects.

By focusing on the long-term trends of fee adjustments, you can better formulate internationalization strategies, ensuring competitiveness in global markets.

The 2025 foreign exchange fee adjustments will significantly impact businesses’ foreign exchange transactions and capital management. You need to focus on the direct effects of policy changes on transaction costs and international business expansion. By optimizing foreign exchange management processes and selecting appropriate financial services, you can reduce costs and improve liquidity.

Policy adjustments present not only challenges but also potential opportunities. Fee changes may prompt you to reassess internationalization strategies, identifying more promising markets. Actively adapting to new policies and enhancing foreign exchange risk management capabilities will help you maintain competitiveness in global markets.

FAQ

1. Will Foreign Exchange Fee Adjustments Affect All Businesses?

No. Foreign exchange fee adjustments primarily affect businesses involved in foreign exchange transactions, especially international trading companies. If your business operates only locally, the policy adjustments may have minimal impact. However, if you engage in cross-border transactions, fee changes may directly affect costs.

2. How Can Businesses Calculate the Impact of Fee Changes on Costs?

You can calculate based on the amount of each transaction and the adjusted fee rate. For example, if the fee increases from 0.5% to 0.7% per transaction, for a $100,000 transaction, your fee will rise from $500 to $700.

3. Can Businesses Negotiate Lower Fee Rates After the Adjustments?

Yes. You can negotiate with banks (e.g., Hong Kong banks), especially if your transaction volume is significant. Banks may offer preferential rates or value-added services to help reduce costs. Building long-term partnerships may also yield more benefits.

4. Will the Policy Adjustments Affect Individual Foreign Exchange Purchases?

No. According to official statements, the annual personal foreign exchange purchase quota remains unchanged. However, fee adjustments may increase the cost of individual cross-border payments. If you frequently make international payments, monitor fee changes and choose appropriate payment methods.

5. How Can Businesses Reduce Foreign Exchange Transaction Risks Amid Policy Adjustments?

You can reduce risks by optimizing foreign exchange management processes, using exchange rate hedging tools, or selecting professional financial service providers. For example, Hong Kong banks’ foreign exchange risk management services can help you better address exchange rate fluctuations and fee changes.

The 2025 forex fee adjustments increase transaction costs (0.2% on average), straining cash flow and impacting competitiveness in international trade. BiyaPay offers efficient, low-cost cross-border payment solutions, supporting conversions across 30+ fiat currencies and 200+ cryptocurrencies with remittance fees as low as 0.5%, covering 190+ countries with same-day delivery. Whether for trade settlements or cash flow management, BiyaPay ensures efficiency and transparency. You can also invest in U.S. and Hong Kong stocks directly on the BiyaPay platform without needing an additional overseas account, optimizing capital allocation. Join BiyaPay now to reduce transaction costs! Licensed by U.S. MSB and SEC, BiyaPay uses advanced encryption, with real-time exchange rate tracking to minimize losses and a 5.48% APY through current investment products. Sign up with BiyaPay to empower your global business!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.