- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Real-Time Transfers: A Fast and Secure Way to Send Money Instantly

What is real-time transfer?

Real-time transfers represent a significant leap forward from traditional payment methods, addressing the long-standing issue of payment delays. These systems enable the near-instantaneous sending and receiving of funds, offering immediate transaction processing both domestically and internationally. This speed drastically improves the efficiency and convenience of financial interactions for individuals and businesses alike.

The technology underpinning real-time transfers relies on sophisticated payment networks and digital infrastructures that operate outside the conventional banking clearinghouse cycles. Networks like SWIFT gpi (Global Payments Innovation) (Zycus, 2025) and Visa Direct have been instrumental in making near-instantaneous cross-border transactions a reality, starkly contrasting with traditional bank transfers that could take 1-5 business days or even longer for international transfers.

The core differentiator lies in speed. While traditional bank transfers often involve batch processing and multiple intermediaries, leading to delays, real-time transfers aim for completion within seconds. For example, SWIFT gpi has significantly accelerated cross-border payments, with nearly 50% of payments credited to end beneficiaries within 30 minutes and almost 100% within 24 hours (Forbes, 2025). Similarly, Visa Direct facilitates near real-time push payments to eligible cards, often within minutes (Encorp, 2025). This immediacy has had a profound impact on various aspects of finance.

In India, for instance, the Unified Payments Interface (UPI), launched in 2016, processed a staggering $5.2 trillion in transactions in 2023 (PIB, 2024), showcasing the widespread adoption and impact of real-time payments. This technology has particularly revolutionized global remittances, allowing families to receive crucial funds almost instantly, and has streamlined everyday financial transactions, making commerce faster and more efficient.

Finally, the global real-time payments market was valued at $25.92 billion in 2024 and is projected to reach $116.23 billion by 2029 (Thunes, 2024), demonstrating its rapid growth and increasing importance in the global financial landscape.

How instant money transfer works

The process behind instant cash transfer is relatively simple, yet it involves sophisticated technology to ensure the transaction is completed in a secure and timely manner. Here’s how it works:

- Initiating the transfer: Users start by selecting the recipient and entering their payment details on the app or platform. Most mobile money transfer services allow users to select from multiple payment methods, including bank accounts, debit/credit cards, and digital wallets.

- Processing the transaction: Once the transfer is initiated, the money is immediately processed through a secure, real-time network. This network ensures that funds are transferred without delay, even across borders.

- Completing the transaction: The recipient receives the funds in their designated account or mobile wallet within seconds, depending on the service and transfer method selected.

Payment processors such as SWIFT GPI, Visa Direct, and others play a vital role in enabling instant fund transfers. These services ensure that the funds are transferred securely while offering competitive exchange rates and low transaction fees.

Mobile apps like BiyaPay are playing a crucial role in this process, enabling users to send money to different currencies worldwide. By using these apps, both the sender and recipient can enjoy real-time tracking and faster delivery times compared to traditional bank transfers.

Benefits of real-time transfer

Real-time money transfers have rapidly gained traction over traditional methods, offering a suite of compelling benefits that cater to the fast-paced demands of both personal and business financial interactions.

- Unparalleled speed: The most striking advantage is the near-instantaneous nature of these transactions. Whether it’s an urgent payment to a family member or a critical settlement with a business partner, funds typically reach the recipient within seconds. This immediacy is a game-changer; for instance, in a recent survey, over 60% of users cited speed as the primary reason for choosing real-time payment methods (Orum IO, 2022). This makes immediate money transfer apps invaluable for time-sensitive situations where delays can have significant consequences.

- Unmatched convenience: Unlike traditional banking hours, real-time transfer services operate around the clock, 24 hours a day, 7 days a week. This always-on availability provides unparalleled flexibility. According to a study on digital payment adoption, transactions outside of traditional banking hours account for over 40% of all real-time payments (Economic Times, 2024), demonstrating the high demand for this convenience, especially on weekends and holidays, when traditional banking services are often limited.

- Enhanced security: Security is a non-negotiable aspect of online financial transactions, and real-time transfer services prioritize it. These platforms commonly employ end-to-end encryption, a security measure that scrambles data from sender to receiver, making it virtually unreadable to unauthorized parties. Furthermore, the integration of multi-factor authentication (MFA), can block over 99.9% of account compromise attacks (Drive Strike), adds a critical layer of protection. Coupled with sophisticated fraud detection systems that analyze transaction patterns in real-time, users can have a high degree of confidence in the safety of their funds during every transfer.

- Significant cost-effectiveness: Traditional bank transfers, particularly for international transactions, can be riddled with hefty fees and unfavorable exchange rates. In contrast, many instant money transfer services, such as BiyaPay, often offer significantly lower transaction fees and more competitive exchange rates. Studies have indicated that users can save an average of 3-5% on international transfers by opting for dedicated digital transfer services over traditional banks. This cost-effectiveness makes mobile fund transfer an increasingly attractive option for individuals and businesses looking to maximize the value of their cross-border transactions.

Best instant money transfer apps

When it comes to choosing the best app for instant transfer, it’s essential to consider factors like ease of use, security, fees, and transfer speed. Here are some of the top instant money transfer apps currently available:

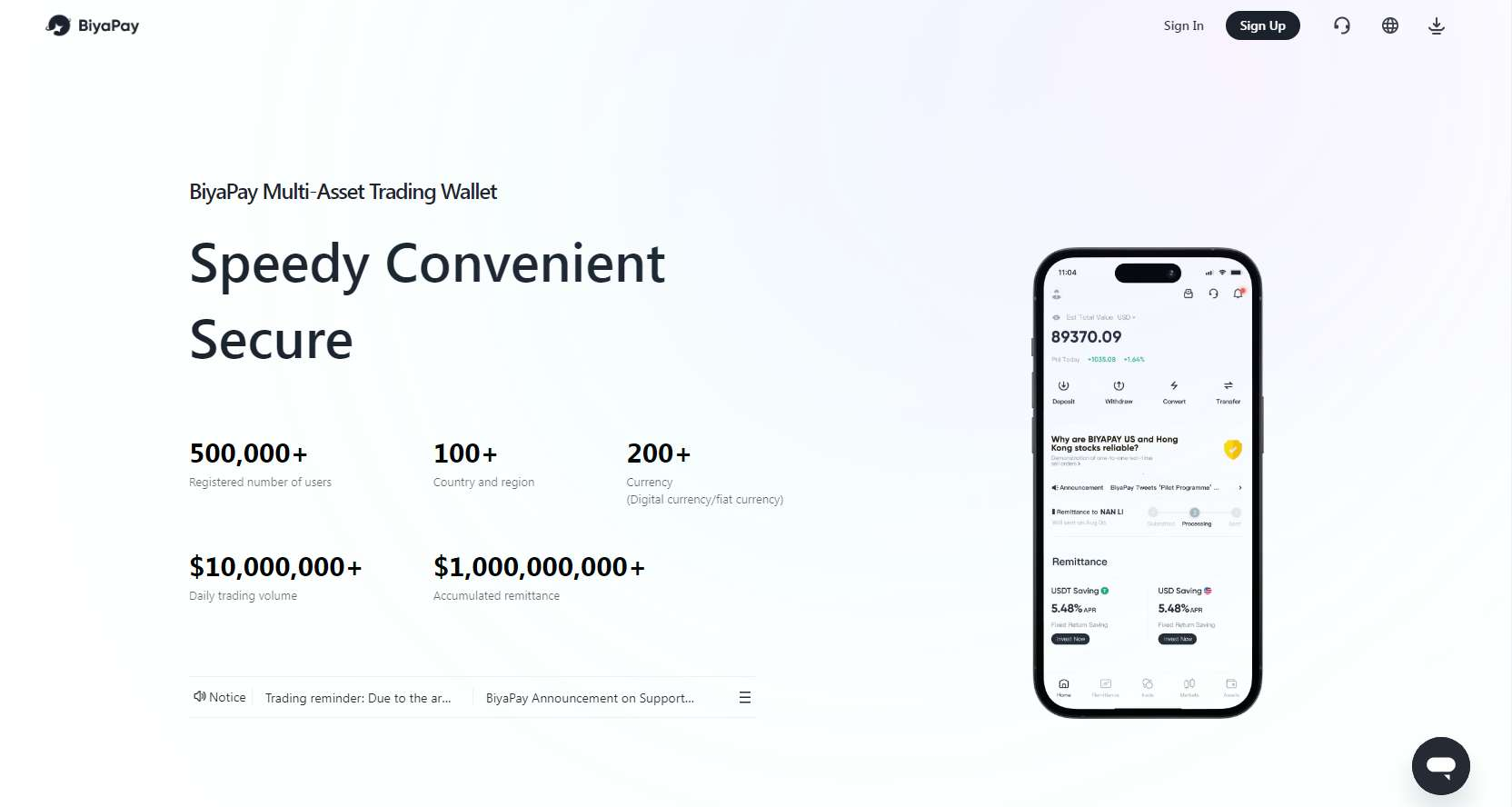

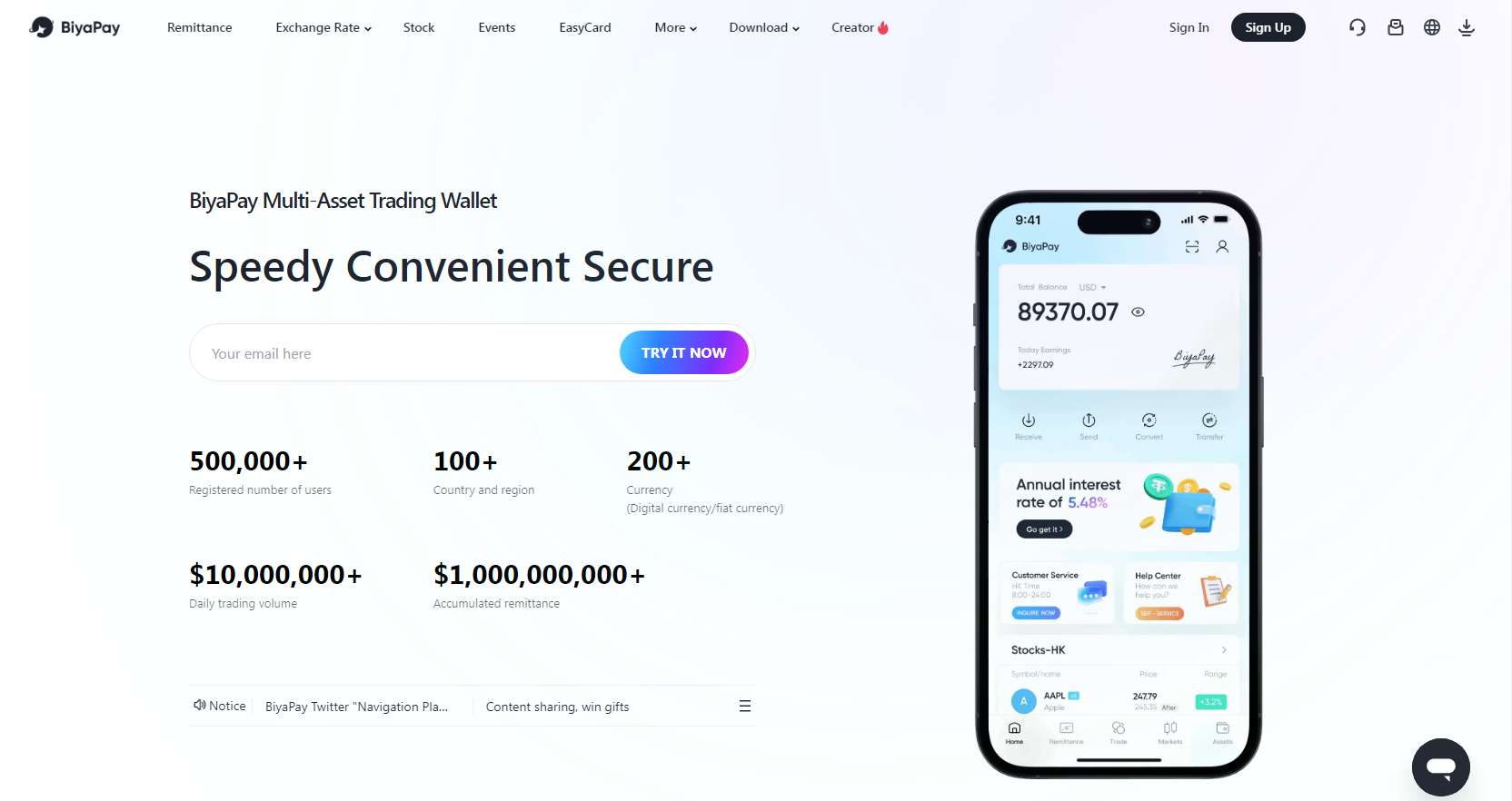

1. BiyaPay

BiyaPay is a robust mobile money transfer app offering instant global money transfers. The app supports multiple currencies and provides a secure, efficient way to send money across borders. With real-time tracking and low transaction fees, BiyaPay is an ideal solution for both personal and business transfers. It is designed to provide users with a seamless and hassle-free experience when transferring funds globally.

Key Features

- Instant global money transfers

- Real-time tracking of transactions

- Low transaction fees

- Multi-currency support

- Secure payments with encryption and authentication

Pros

- Lightning-fast transfers: Funds zip across borders like they’re late for a flight—no lag, no stress.

- FX rates that don’t rob you blind: BiyaPay dishes out near-market exchange rates without the sneaky markup tax.

- Robust security: Multi-factor authentication, encryption, and zero shady business - your money sleeps in a vault.

- Cross-border, low-cost love: International transfers with fees so low, they feel like a steal (but legally).

Cons

- Not everywhere: If you’re trying to send money to a remote outpost, BiyaPay might not have boots on that ground (yet).

- App interface could have been better: While the BiyaPay app’s UI is user-friendly, it still needs some work to be compared to its rivals.

2. PayPal

PayPal is one of the most widely recognized platforms for online payments, offering a secure and efficient way to send money globally. It allows for instant payments to other PayPal users, making it a top choice for quick transactions. While PayPal provides excellent service for both individuals and businesses, its fees can be relatively high for international transfers. Despite this, it remains a reliable and trusted option for those needing to send money instantly.

Key Features

- Instant payments to PayPal users

- Global availability in over 200 countries

- Supports credit/debit cards and bank accounts

- Buyer and seller protection

- Multiple currencies supported

Pros

- Bulletproof trust & buyer shields: PayPal wraps every transaction in a security blanket, giving users peace of mind with built-in dispute resolution.

- No-brainer interface: Even your tech-averse uncle could send money with PayPal—it’s that intuitive.

- Accepted almost everywhere: From indie Etsy shops to global giants, PayPal is practically the internet’s wallet of choice.

- Lightning-fast internal transfers: Sending money within the PayPal ecosystem? Blink and it’s done.

Cons

- Fee frenzy for cross-border moves: International payments? Prepare to watch chunks of your funds vanish into PayPal’s fee machine.

- Exchange rate ambush: Currency conversions often come with a stealth markup—more than banks, less than fair.

3. Venmo

Venmo, popular in the U.S., is a peer-to-peer payment app designed to make transferring money easy and fast between friends and family. Its user-friendly interface makes it a go-to app for personal transfers. Venmo allows users to send money instantly with no fees for standard transfers, but it does charge for instant transfers. While it’s convenient for domestic payments, its international transfer options are limited.

Key Features

- Instant transfers to Venmo balance

- Peer-to-peer payment system

- Simple interface for quick payments

- Allows payments with debit/credit cards

- Social features for tracking and sharing payments

Pros

- Free-for-all (almost): Standard transfers won’t cost you a dime—send money to friends without burning your balance.

- Bill-splitting bliss: Dinner with friends? Group trip chaos? Venmo turns IOUs into tap-and-go peace.

- Available instantly: Instant transfer option shoots funds to your bank faster than your caffeine fix kicks in.

- Money meets social: Track who paid who—and for what—with a TikTok-meets-bank-feed vibe (yes, emojis included).

Cons

- International who?: Cross-border payments? Not here—Venmo stays strictly stateside.

- Fees if you’re in a hurry: That instant transfer magic? It’ll cost you a slice—expect a small (but annoying) percentage cut.

4. Revolut

Revolut is a digital banking app that allows users to make international transfers in seconds. It offers a built-in exchange rate system, making it easy to convert and send money between currencies. Revolut also includes budgeting tools and financial management features, making it a versatile option for those seeking a comprehensive financial app. However, its free version comes with limitations on transfer amounts.

Key Features

- Instant international transfers

- Built-in exchange rate system

- Multi-currency support

- Mobile banking and financial management features

- Cryptocurrency support

Pros

- Global transfers at warp speed: Zip money across borders with FX rates so tight they feel like interbank magic.

- No sneaky fees (on basics): What you see is what you pay—no smoke, no mirrors on standard transfers.

- Sleek app, sharp tools: Budget, save, trade, and track—all from an interface smoother than your morning espresso.

- Currency exchange like a boss: Trade currencies at interbank rates with just a swipe—no middlemen, no nonsense.

Cons

- Free tier not recommended: Daily limits and feature caps might cramp your global style unless you upgrade.

- Premium perks, premium price: Want metal cards, travel insurance, or crypto perks? Be ready to cough up extra.

Real-time transfer vs. Traditional bank transfers

While traditional bank transfers have been around for centuries, they are becoming less popular due to their delays, high fees, and reliance on outdated systems. The following is a deeper comparison of real-time transfers and traditional bank transfers.

- Speed: Real-time transfers happen in seconds, while traditional bank transfers can take several days, especially for international transactions. This makes real-time transfers ideal for emergencies or urgent payments.

- Accessibility: Real-time transfers are available 24/7, meaning you can send money anytime, even on weekends or holidays. In contrast, traditional bank transfers are restricted to banking hours, which can be inconvenient if you need to send money outside of these hours.

- Cost: Traditional bank transfers often come with high fees, especially for international transfers, due to the involvement of multiple intermediary banks. On the other hand, real-time transfer services typically offer lower fees, with some even providing fee-free transfers for certain amounts or services.

- Currency conversion: Traditional banks tend to charge higher currency conversion fees and offer less favorable exchange rates compared to real-time transfer services. With real-time transfers, services like BiyaPay provide competitive exchange rates, which helps save money on international transfers.

- Security: While traditional bank transfers are generally secure, real-time transfer services often come with enhanced security measures, such as encryption and two-factor authentication, to provide even greater protection for your funds and personal data.

- Ease of use: Traditional bank transfers usually require multiple steps and paperwork, especially for international transfers. Real-time transfer services, on the other hand, provide a simple, user-friendly interface on mobile apps, making it easier to send money on the go with just a few taps.

- Global reach: Traditional bank transfers often require a network of intermediaries, which can result in delays and higher costs. Real-time transfer services like BiyaPay offer direct connections to global payment networks, allowing for faster, more efficient transfers to a wide range of countries.

- Customer support: While banks offer support through branches or call centers, real-time transfer services typically provide 24/7 customer support through apps or online chat, ensuring that users can get help whenever needed.

BiyaPay: the ultimate real-time transfer solution

BiyaPay has emerged as a leading solution for real-time money transfers, offering a fast, secure, and cost-effective way to send funds globally. With competitive fees and rapid processing, BiyaPay is designed for both personal and business use. Whether you’re sending money to a loved one across the globe or managing payments for your international clients, BiyaPay ensures your money reaches its destination in seconds. For example, you can send 10,000 HKD from Hong Kong to the USA instantly via BiyaPay’s real-time transfer service.

Key Features

- Real-Time transfers with competitive fees: BiyaPay makes it easy to send money instantly, with competitive fees that make it an affordable choice compared to traditional bank transfers. The app’s low transaction costs allow users to save money on every transfer, making it a practical option for individuals and businesses alike.

- Low transaction fees: BiyaPay offers highly competitive transaction fees, making it one of the most cost-effective mobile money transfer services available today.

- Instant fund delivery: Money is delivered almost instantly, ensuring that recipients can access their funds without delay.

- Seamless cross-border transactions: One of BiyaPay’s standout features is its ability to send money across borders instantly. The app supports a wide range of currencies, making international transactions as simple as domestic transfers. Whether you’re sending money from the U.S. to Europe or Asia, BiyaPay ensures that recipients receive their funds in the currency of their choice with ease.

- Security features: BiyaPay takes security seriously, using encryption and multi-factor authentication to ensure every transaction is protected against fraud and unauthorized access.

How BiyaPay helps businesses

For businesses, BiyaPay offers an ideal solution for managing international payments. Its real-time transfer capabilities enable businesses to process payments instantly, improving cash flow and operational efficiency. Figuratively speaking, if you are running a business and are planning to send 10,000 US Dollars to a vendor in Japan (to be converted into Japanese Yen or JPY), then using BiyaPay should be the way to go. By eliminating the delays associated with traditional bank transfers, BiyaPay helps businesses stay agile and responsive in a fast-paced global economy.

Steps to use BiyaPay for real-time transfers

Step 1: Download the BiyaPay app Start off your journey by first downloading the BiyaPay app on your smartphone. It’s currently available for both Android and iOS devices

Step 2: Register and verify your identity After installing BiyaPay, launch the app and then proceed to sign up using your email address. Once the sign up process is complete, you need to complete the identity verification process. Additionally, don’t forget to fill out your profile details.

Step 3: Select the send or transfer option

In the subsequent step, you need to select the “Send” or “Transfer” option from the homescreen and then proceed to fill out the details of the recipient, such as the person’s name, address, bank account, bank branch ID, SWIFT/BIC codes, etc.

Step 4: Enter the requisite amount

Next, you will need to enter the specific amount you are planning to send and the currency in which you will be sending it as well. Once done, you will be asked to add your bank account or bank card (debit or credit card), which will act as the main source of funds. Alternatively, if you have sufficient funds in your BiyaPay Wallet, you can use that too instead.

Step 5: Confirm, verify, and complete the payment

After entering all the necessary details, confirm the same and then perform the verification process to complete the transaction. As soon as the verification process is completed, the transfer will be initiated and your funds will be sent to the receiver in real-time.

User Reviews

“I’ve been using BiyaPay for a few months now, and I’m consistently impressed with how incredibly easy it is to navigate. From setting up my account to making my first transaction, the entire process was seamless. The interface is clean, intuitive, and doesn’t overwhelm you with unnecessary features. It’s truly a breath of fresh air compared to other payment platforms I’ve tried. Highly recommend it for anyone looking for a hassle-free way to manage their payments!”

“BiyaPay has become my go-to for quick and reliable transactions. Whether I’m sending money to family or paying for online services, the transfers are almost instantaneous. I’ve never experienced any delays or issues, which gives me immense peace of mind. The reliability is top-notch, and I can always count on my payments going through without a hitch. It’s a fantastic service that delivers on its promise of efficiency.”

“What stands out most about BiyaPay for me is their commitment to security and their excellent customer support. I feel completely confident that my financial information is protected by their robust security measures. On the rare occasion, I had a question, their support team was incredibly responsive and helpful, resolving my query quickly and professionally. It’s reassuring to know there’s a competent team behind the scenes. BiyaPay truly prioritizes its users’ safety and satisfaction.”

Conclusion

Real-time money transfers have revolutionized the way we send and receive funds globally. With the ability to transfer money instantly, securely, and with low fees, most reputable payment apps offer a fast and efficient solution for personal and business transactions. Real-time transfers allow for 24/7 availability, competitive exchange rates, and enhanced security, making them a superior alternative to traditional bank transfers.

BiyaPay stands out by offering instant, cross-border transactions with real-time tracking, making it an excellent choice for users looking for convenience and affordability. Explore BiyaPay today for secure, low-cost, and fast transfer solutions for all your payment needs.

FAQs

- How do I send money instantly using an app?

To send money instantly, simply select the recipient, choose your payment method, and confirm the transfer. Apps like BiyaPay ensure funds are delivered within seconds.

- What is the fastest way to send money internationally?

The fastest way to send money internationally is through real-time transfer services like BiyaPay, which offer instant processing times.

- Is real-time money transfer safe?

Yes, real-time money transfer services use encryption and multi-factor authentication to ensure secure transactions, as seen with BiyaPay.

- How can I track my instant transfer?

Most apps, including BiyaPay, offer real-time tracking so you can monitor the status of your transfer and receive updates throughout the process.

- What makes BiyaPay a reliable choice for real-time transfers?

BiyaPay offers low transaction fees, fast processing times, secure payment methods, and real-time tracking, making it a trusted solution for instant money transfer needs.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.