2025 Latest Cross-Border Transfer Platform Comparison: Wise, PayPal, and Payoneer

Image Source: unsplash

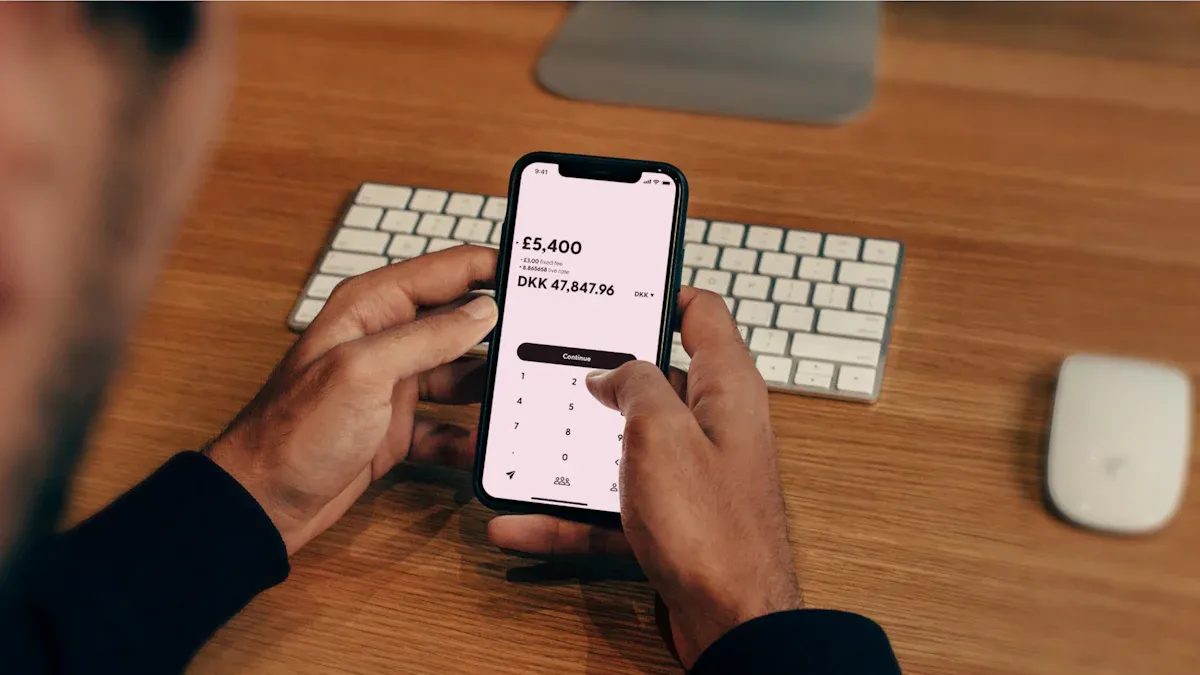

In today’s globalized world, cross-border money transfers have become a daily necessity for many individuals and businesses. Choosing the right platform can help you save on fees, increase efficiency, and ensure fund security.

UK-based Wise is favored for its transparent fee structure and fast delivery, especially for users needing frequent small transfers. US-based PayPal, with its extensive payment network and versatility, is a go-to tool for e-commerce sellers and freelancers. Payoneer excels in cross-border e-commerce and large business payments, supporting multi-currency account management.

According to feedback from a European freelancer, selecting the right transfer platform not only impacts costs but also optimizes business processes. Understanding each platform’s features will help you make an informed choice, no matter your transfer needs.

Key Takeaways

- Wise is ideal for frequent small transfers, with transparent fees and fast delivery to save costs.

- PayPal’s global payment network suits e-commerce sellers and users needing versatile payment solutions.

- Payoneer supports multi-currency account management, perfect for cross-border e-commerce and large payments.

- Choosing the right platform optimizes processes, reduces costs, and ensures fund security.

- Understanding platform features and use cases helps you make informed decisions based on your needs.

Service Quality Comparison

Wise’s Service Quality

Wise is renowned for its transparent services and user-friendly interface. You can complete cross-border transfers quickly, often within hours. According to UK fintech media Finextra, Wise’s transfer speed ranks among the industry’s best, particularly in Europe and North America.

Wise’s customer support is highly praised. Users can access help via live chat or email in multiple languages, including English, French, and Spanish, making it convenient for international users. A French freelancer noted that Wise’s support team responds quickly and resolves issues efficiently.

Wise uses mid-market exchange rates with no hidden fees, ensuring transparency in every transaction. For users needing frequent small transfers, Wise offers an efficient, cost-effective solution.

PayPal’s Service Quality

As a globally recognized payment platform, PayPal offers extensive coverage, enabling payments and receipts in over 200 countries. Its primary strength is its robust payment network, ideal for e-commerce sellers and online shoppers.

However, PayPal’s service quality varies by region. In North America, customer support is generally prompt, but users in emerging markets may experience slower responses. An Indian user reported that PayPal’s support needs improvement, particularly for dispute resolution.

Despite this, PayPal’s user experience is commendable. Its mobile app is intuitive, suitable for users of all ages. For those needing versatile payment solutions, PayPal remains a reliable choice.

Payoneer’s Service Quality

Payoneer focuses on serving cross-border e-commerce and business users, offering seamless multi-currency account management. It performs exceptionally well in the Asia-Pacific region. A Singapore-based e-commerce business praised Payoneer’s localized support for quick responses.

Payoneer’s customer support is available 24/7, ensuring assistance anytime. It also offers flexible withdrawal options, allowing funds to be transferred to local bank accounts or spent via a Payoneer prepaid card. This flexibility makes Payoneer a preferred choice for many businesses.

Fee Comparison

Image Source: unsplash

Wise’s Fee Advantages

Wise is known for its transparent fee structure and low costs. It offers mid-market exchange rates, eliminating hidden rate margins. Fees typically range from 0.35%-1%, depending on the transfer amount and destination.

For example, transferring £1,000 from the UK to Europe might incur a fee of about £5. This low-cost advantage makes Wise a top choice for individuals and small businesses. European fintech reviews highlight Wise’s competitive fees, especially for frequent small transfers.

Wise’s fee calculation is transparent. You can view detailed fees on its website or app before transferring, avoiding unexpected costs. For cost-conscious users, Wise provides an efficient, reliable solution.

PayPal’s Fee Structure

PayPal’s fee structure is more complex but versatile, making it a popular choice for e-commerce sellers and freelancers. Key fees include:

| Fee Type | PayPal Fees |

|---|---|

| Monthly Fee | None |

| Sending Payments | 2.99% (goods and services) |

| Receiving Payments | 2.99% (goods and services) |

| 3.49% + fixed fee (most standard business payments) | |

| 2.99% + fixed fee (debit/credit cards) | |

| International Payments | Domestic fees + 1.5% + currency conversion fee |

| Currency Conversion | 3-4% (depending on transaction type) |

For e-commerce sellers, PayPal’s receiving fees can impact profit margins, especially for international transactions with 3%-4% conversion fees. A North American seller noted that despite higher fees, PayPal’s extensive network and trust make it indispensable.

PayPal suits users needing versatile payment solutions, but you should evaluate its fees’ impact on your costs.

Payoneer’s Fee Characteristics

Payoneer attracts cross-border e-commerce and business users with its flexible fee structure and diverse services:

- Receiving Fees: 1%-3% (varies by method and amount)

- Withdrawal Fees: 1.5%

- Currency Conversion Fees: 0.5%-1%

Payoneer offers promotional rates, such as 3.9% + $0.30 for eBay sellers, compared to a standard 4.4% + $0.30 for transactions up to $3,000.

| Fee Type | Payoneer Fees | Comparison to Other Platforms |

|---|---|---|

| Receiving Fees | 1%-3% | Varies by platform |

| Withdrawal Fees | 1.5% | Varies by platform |

| Currency Conversion | 0.5%-1% | Varies by platform |

An Asia-Pacific e-commerce business noted that Payoneer’s low conversion fees saved significant costs, especially for large international payments. For businesses managing multiple currencies, Payoneer offers an efficient, cost-effective solution.

Use Case Comparison

Wise’s Ideal Users

Wise is ideal for frequent small cross-border transfers. Its transparent fees (0.5%-1%) and mid-market rates make it cost-effective. A German freelancer reported saving nearly 30% on fees using Wise for international client payments, per UK fintech analysis.

Wise excels in Europe and North America, with transfers often completed in hours. Its simple interface is beginner-friendly, and it supports over 40 currencies, making it perfect for freelancers and small businesses.

| Platform | Service Features | Fee Structure |

|---|---|---|

| Wise | High transparency, low cost, wide coverage | Fixed fees 0.5%-1%, no extra conversion fees |

PayPal’s Ideal Users

PayPal suits e-commerce sellers and users needing versatile payment solutions. Its network spans 200+ countries, supporting credit and debit card payments. A North American e-commerce business credited PayPal’s payment features for quick international market expansion.

PayPal’s brand trust and user base make it a preferred choice for online shoppers, benefiting sellers. However, its complex fees, especially high international conversion costs, require careful cost evaluation.

Payoneer’s Ideal Users

Payoneer is perfect for cross-border e-commerce and businesses handling large international payments. It supports 120+ currencies and local bank transfers. An Asia-Pacific e-commerce firm highlighted Payoneer’s low conversion fees (0.5%-1%) for significant savings.

Payoneer’s flexibility suits frequent withdrawals, with options to transfer to local accounts or use a prepaid card. Its 24/7 support ensures timely assistance.

| Platform | Service Features | Fee Structure |

|---|---|---|

| Payoneer | Global network, local transfers, easy withdrawals | Receiving: 1%-3%, withdrawals: 1.5%, conversion: 0.5%-1% |

Advantages and Disadvantages Summary

Wise’s Advantages and Disadvantages

Wise earns global trust with transparent fees and fast service. It supports 40+ currencies with no monthly fees, ideal for individuals and small businesses. UK fintech reviews rank Wise’s fee transparency among the best.

Advantages:

- Mid-market rates, no hidden fees.

- Fast transfers, often within hours.

- User-friendly interface, beginner-friendly.

- Supports multiple currency accounts for international transactions.

Disadvantages:

- Limited for large business payments.

Tip: Wise is ideal for freelancers or frequent small transfers.

PayPal’s Advantages and Disadvantages

PayPal’s global recognition and extensive network support 200+ countries, ideal for e-commerce and versatile payment needs. However, its complex fees, especially for international transactions, can be high.

Advantages:

- Extensive payment network, multiple payment methods.

- Instant transfer capabilities for efficient fund flow.

- Robust customer support for disputes and refunds.

- Offers debit Mastercard for spending.

Disadvantages:

- Supports only 25 currencies, limiting flexibility.

- Complex fee structure, high international fees.

- Limited to 15,000 payments per batch.

- Debit card daily spending limit of $3,000.

| Platform | Advantages | Disadvantages |

|---|---|---|

| PayPal | Payment gateway, instant transfers, robust support | Complex fees, high international costs, limited currencies |

Case Study: A North American seller noted PayPal’s high fees but valued its network and trust for market expansion.

Payoneer’s Advantages and Disadvantages

Payoneer caters to e-commerce and business users, supporting 120+ currencies with simple fees and robust support.

Advantages:

- Supports 120 currencies, ideal for multi-country needs.

- Simple fee structure, low conversion fees (0.5%-1%).

- Debit Mastercard with $200,000 daily limit, no monthly cap.

- 24/7 customer support, fast responses.

Disadvantages:

- Limited to 200 payments per batch.

- Longer average transfer times, not ideal for instant needs.

- Lacks payment gateway functionality for e-commerce.

Chart:

| Platform | Advantages | Disadvantages |

|---|---|---|

| Payoneer | 120 currencies, simple fees, robust support | Longer transfers, limited batch payments, no gateway |

Suggestion: Payoneer is reliable for e-commerce businesses handling large payments.

Usage Recommendations

Recommendations for Cross-Border E-Commerce Users

E-commerce users need platforms for quick international payments with transparent fees and currency support. Payoneer is highly recommended. It supports multi-currency accounts, ideal for receiving payments from Western platforms. A New York e-commerce firm noted Payoneer’s low conversion fees saved significant costs.

Here’s a comparison of platforms by transparency, speed, and currency support:

| Platform | Fee Transparency | Transfer Speed | Currency Support | Coverage |

|---|---|---|---|---|

| Wise | High | Fast | Multiple | Global |

| PayPal | Medium | Medium | Few | Global |

| Payoneer | High | Medium | Multiple | Global |

Payoneer’s flexibility and quality support large payments, while Wise suits fast-delivery orders.

Recommendations for Freelancers

Freelancers prioritize low fees and simplicity. Wise’s transparent fees and fast delivery make it a top choice. A German freelancer saved 30% on fees using Wise, per UK fintech reports.

PayPal’s network and trust suit freelancers with North American or European clients, supporting multiple payment methods. Payoneer’s multi-currency accounts and withdrawal flexibility help freelancers manage diverse incomes.

Recommendations for Individual Transfer Users

For personal transfers, low fees and ease of use are key. Wise’s transparent fees and mid-market rates are ideal, with transfers often completed in hours.

PayPal suits users needing versatile solutions. Its intuitive app and instant transfers helped a North American user with family remittances. Payoneer is great for large transfers, with low conversion fees (0.5%-1%), as noted by a New York e-commerce firm for optimized fund management.

Considerations for individuals:

- For fast delivery: Choose Wise.

- For versatile solutions: Choose PayPal.

- For large transfers: Choose Payoneer.

Multi-Asset Management Wallet: BiyaPay

Image Source: unsplash

BiyaPay’s Service Features

BiyaPay is a powerful multi-asset wallet designed for diverse global financial needs. It supports real-time conversion of 30+ fiat and 200+ digital currencies with transparent mid-market rates and no hidden fees. You pay only a small handling fee for low-cost transfers and asset management.

BiyaPay’s transfer speed is impressive, with same-day delivery via local transfers and no amount limits. Singapore fintech media ranks BiyaPay’s speed and transparency among industry leaders.

BiyaPay also supports investment services, including US stocks, Hong Kong stocks, and digital currency trading. Manage multiple assets in one account without needing an offshore account. Registration is fully online and takes 1 minute, making it widely popular.

Tip: BiyaPay is ideal for users seeking integrated transfer, trading, and investment solutions.

BiyaPay’s Use Cases

BiyaPay suits various scenarios for individuals and businesses. For e-commerce sellers, it offers low-cost transfers and multi-currency management, enabling quick receipt of international payments and withdrawals to local accounts. An Asia-Pacific seller reported 20% savings on conversion costs using BiyaPay.

Freelancers benefit from converting digital currencies (e.g., USDT) to USD or HKD for local withdrawals, enhancing income management. A European freelancer praised BiyaPay’s fast delivery for better financial planning.

For individuals, BiyaPay is secure and convenient for family transfers, investments, or currency conversions, handling both small and large transfers efficiently.

Case Study: A North American investor used BiyaPay for fast transfers and seamless US stock and crypto trading, saving time and costs.

Choosing the right platform involves weighing fees, service quality, and use cases. Here’s a summary of Wise, PayPal, and Payoneer:

| Platform | Fee Structure | Currency Support | Transfer Speed | Customer Support |

|---|---|---|---|---|

| Wise | Transparent, low | 40+ currencies | Fast | Multilingual online |

| PayPal | Complex, higher fees | 25 currencies | 1-3 days | Live chat, phone |

| Payoneer | Relatively low | 120 currencies | 2-5 days | Online support, forums |

Choose based on your needs: Wise for transparent fees and speed, PayPal for e-commerce networks, or Payoneer for multi-currency business accounts.

Tip: Evaluate platform features and your needs for the best choice.

FAQ

Does Wise Support Large Transfers?

Wise excels in small, frequent transfers. Finextra notes its transparency and speed, but Payoneer is more flexible for large payments.

Are PayPal’s Currency Conversion Fees Transparent?

PayPal’s conversion fees (3%-4%) are less transparent. A North American seller valued its network but noted high fees. Wise or BiyaPay offer better transparency.

Is Payoneer Suitable for Freelancers?

Payoneer suits freelancers managing multiple currencies. An Asia-Pacific freelancer praised its low conversion fees and withdrawal flexibility. For speed, Wise is better.

How Fast Are BiyaPay Transfers?

BiyaPay’s local transfers deliver same-day, per Singapore fintech media. It handles both small and large transfers efficiently.

Which Platform Suits E-Commerce Sellers?

Payoneer and BiyaPay are ideal for e-commerce. Payoneer supports multi-currency accounts, while BiyaPay’s low fees saved an Asia-Pacific seller 20%. Wise is great for fast orders.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

The Relationship Between Fed Rate Cuts and New York Stock Market Fluctuations Is No Longer a Simple Cause-and-Effect

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.