Identify Oversold Traps and False Rallies with the Psychological Line (PSY) to Avoid Being "Shaved"!

Image Source: unsplash

Learn to use the Psychological Line, stay away from the fate of being cut like a leek! When investing, you often encounter sudden market drops or rebounds, easily influenced by emotions into making wrong decisions. The Psychological Line identification helps you master true market sentiment through data analysis, reducing the risk of blind trading. As long as you master the correct methods, you can better protect your capital safety.

Key Points

- The Psychological Line (PSY) is a tool for measuring market sentiment, helping you determine whether the market is oversold or overheated.

- When the Psychological Line falls below 25%, the market may be oversold, but you need to combine other indicators to confirm signals, avoiding blind buying.

- False rebounds are usually accompanied by insufficient trading volume and low market sentiment, requiring cautious judgment to avoid chasing highs.

- Combining the Psychological Line with other technical indicators, such as MACD and trading volume, can improve the accuracy of trading decisions.

- Continuous learning and reflection on trading strategies, cultivating mental resilience, can effectively reduce the risk of being swayed by market emotions.

Psychological Line Basics

Image Source: pexels

Definition and Principle

When investing, you are often influenced by the market’s ups and downs. The Psychological Line (PSY) is a technical indicator for measuring market sentiment. It calculates the proportion of up days within a certain period, helping you judge the current optimism or pessimism of the market. You can use the Psychological Line to identify whether the market is in an extreme sentiment range, thus making more rational buy or sell decisions. The Psychological Line identification is not only suitable for short-term trading but can also provide sentiment reference for medium- to long-term investments.

Calculation Method

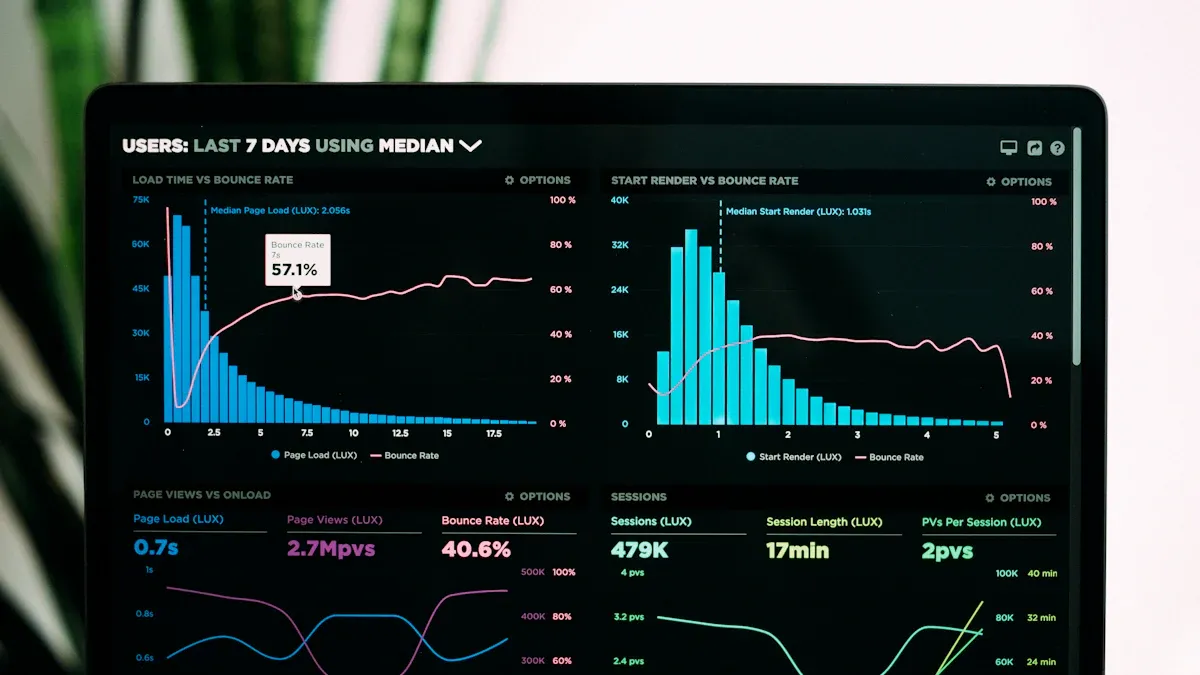

You can calculate the Psychological Line through a simple formula. Taking the common 14-day period as an example, if the stock price rises on 8 days within 14 days, then the Psychological Line is 8/14×100%=57.1%. You can also calculate the moving average of the Psychological Line (PSYMA) to smooth data fluctuations. The table below shows common calculation methods:

| Indicator | Calculation Formula |

|---|---|

| PSY | Number of up days in N days / N × 100% |

| PSYMA | M-day average of PSY |

In the U.S. market, investors commonly use 14-day or 20-day periods as the calculation cycle for the Psychological Line. You can choose appropriate parameters based on your trading style.

Application Scenarios

You can use the Psychological Line to identify market sentiment in various investment scenarios. For example, when the Psychological Line value falls below 25%, the market may be in an oversold state, likely to show rebound signals. When the Psychological Line exceeds 75%, the market may be overheated, with a risk of a short-term pullback. You can combine it with other technical indicators, such as RSI or MACD, to further improve judgment accuracy. The Psychological Line is not only suitable for short-term traders but also for medium- to long-term investors to grasp overall market sentiment changes.

Identifying Oversold Traps

Image Source: pexels

Definition of Oversold Traps

When investing, you may see a stock or index continuously declining, psychologically feeling that the price is already very low, thinking it will rebound soon. In this case, if you buy rashly and the price continues to fall, you will fall into an oversold trap. An oversold trap refers to a market that appears to show oversold signals on the surface but actually lacks real reversal momentum, and the price may continue to decline. You need to be cautious of this trap to avoid blindly bottom-fishing due to emotional influences.

Using PSY to Identify Oversold Traps

You can use the Psychological Line to identify oversold traps. The Psychological Line calculates the proportion of up days within a certain period, helping you judge market sentiment. When the Psychological Line value falls below 25%, the market is usually in an oversold range. You may think this is a buying opportunity, but the reality is not always so. You need to combine other technical indicators, such as RSI or stochastic indicators, to further confirm signals.

Tip: You can observe the coordination between the Psychological Line and price behavior. If the Psychological Line remains low but the price shows no obvious rebound, it indicates that market sentiment is still pessimistic, and the rebound signal is not strong enough. You can also combine indicators like RSI to confirm whether the price is truly turning. In the U.S. market, many investors refer to both the Psychological Line and MACD to avoid misjudgments caused by a single indicator.

Pitfalls and Risks

When using the Psychological Line to identify oversold conditions, you are prone to encounter some common pitfalls and risks:

- An oversold market does not guarantee a rebound. Frequently suppressed stocks may continue to decline or remain flat before rebounding.

- In volatile markets, the RSI indicator may produce false signals, and its lagging nature may lead to decision delays.

- Technical indicators usually lag behind current prices, so you should not rely solely on indicators to make buy or sell signals.

- Combining technical indicators with price action analysis can improve the accuracy of trading signals, especially when identifying oversold traps. Tools like RSI and stochastic indicators can confirm price movements and provide additional context for price behavior.

When trading, you should analyze the market from multiple perspectives, avoiding looking only at the Psychological Line or a single indicator. You can improve judgment accuracy and reduce the risk of being trapped by oversold conditions through cross-verification with multiple tools.

Identifying False Rebounds

Characteristics of False Rebounds

When investing, you often encounter a sudden price rebound that looks like the market is about to reverse upward. In fact, such rebounds are sometimes just temporary corrections, followed by continued declines. False rebounds usually have the following characteristics:

- The rebound amplitude is small, the duration is short, and the price quickly returns to the downtrend.

- During the rebound, trading volume does not significantly increase, and the market lacks real buying support.

- During the rebound process, market sentiment does not clearly turn optimistic, and investor confidence is insufficient.

- After the price rebounds, it fails to break through previous key resistance levels and falls again.

You need to be wary of these signals to avoid blindly buying during false rebounds.

Using PSY to Identify False Rebounds

You can use the Psychological Line to identify false rebounds. The Psychological Line identification calculates the proportion of up days within a certain period, helping you judge whether market sentiment has truly changed. When the market rebounds but the Psychological Line value does not rise significantly or remains low, it indicates that market sentiment is still weak, and the rebound may only be a temporary correction.

You can combine price and Psychological Line changes to judge the authenticity of a rebound. For example, in the U.S. market, if the price briefly rebounds but the Psychological Line remains below 50%, it indicates that most trading days are still bearish, and the rebound lacks sustained momentum. If the Psychological Line and price rise synchronously with increased trading volume, the rebound is more reliable.

Tip: You can combine the Psychological Line with other indicators like trading volume and MACD. If the Psychological Line does not rise with the price rebound or trading volume does not increase, the probability of a false rebound is higher. You can observe for a few more days, waiting for clearer signals before making decisions.

Avoiding Chasing Highs

When facing false rebounds, the most important thing is to avoid chasing highs. Many investors see a price rebound, get emotionally excited, and buy blindly, only to be trapped at high levels. You can adopt the following practical strategies to reduce the risk of chasing highs:

- Adjust position sizing. You can flexibly adjust your holding proportion based on market conditions, avoiding heavy buying all at once.

- Use trailing stops. In volatile markets, you can set trailing stops to protect existing profits and prevent losses from sudden price drops.

- Monitor trading volume in real-time. You can pay attention to volume changes during rebounds. If the price rises but the trading volume does not increase synchronously, it indicates insufficient rebound momentum.

- Dynamically adjust stop-loss levels. You can modify stop-loss positions based on the latest price movements to reduce loss risks.

- Regularly review trades. You can periodically review your trades, analyzing which decisions were effective and which were easily influenced by emotions, helping you continuously optimize your investment strategy.

In actual trading, you should analyze the market from multiple perspectives, combining Psychological Line identification with other technical indicators, and patiently wait for true reversal signals to appear. This can effectively reduce the risk of chasing highs and being trapped in false rebounds, protecting your capital safety.

Case Studies

Oversold Trap Case Study

You can imagine this scenario: A tech stock in the U.S. market continuously declines, with the Psychological Line (PSY) value falling below 20%. Many investors see this low level, think the price is already cheap, and choose to buy. If you only look at the Psychological Line, you are likely to mistakenly think the market is about to rebound. But in reality, the stock price continues to fall in the following days, and the Psychological Line remains low for a long time. You will find that relying solely on the Psychological Line to judge oversold conditions easily leads to a “bottom-fishing” trap. Only when the Psychological Line starts to rise, accompanied by increased trading volume, does the market have a chance for a true reversal.

False Rebound Case Study

In the U.S. stock market, you may encounter a consumer stock suddenly rebounding. The Psychological Line briefly rises to 55%, but the trading volume does not significantly increase. If you chase the high and buy at this point, you may find the price quickly falls back to its original low. False rebounds often occur when overall market sentiment has not significantly improved. You need to combine the Psychological Line with trading volume, price trends, and other indicators to more accurately judge the authenticity of a rebound. Only when the Psychological Line and trading volume rise synchronously does the rebound have more sustainability.

Lessons Learned

In actual trading, you can learn many practical lessons from these cases.

- Loss aversion: You may be unwilling to admit losses, holding declining stocks for a long time, resulting in greater losses.

- FOMO (Fear of Missing Out): When you see others profiting, you are prone to blindly follow and buy without sufficient analysis, ultimately suffering losses.

- Single indicator risk: If you rely only on the Psychological Line, you are easily misled by market illusions.

- Multi-indicator combination: Combining the Psychological Line, trading volume, and price behavior can greatly improve judgment accuracy.

- Patiently wait for signals: You need to wait for the Psychological Line and other indicators to jointly issue clear signals before making decisions, avoiding emotional trading.

Through continuous review and summary, you can gradually improve your market judgment, reducing the risk of being cut like a leek.

Common Questions

Handling Indicator Failures

In actual trading, you may find that the Psychological Line (PSY) sometimes cannot accurately reflect market sentiment. At this time, you can try the following methods to improve judgment:

- Combine other technical indicators, such as MACD, SAR, VW MACD, and Dual MACD, which can provide more comprehensive signals.

- Use time series forecasting models, such as ARIMA, Prophet, and ETS, to analyze price trends, helping you capture market trends.

- Incorporate market sentiment analysis, combining data and emotions to enhance the scientific nature of trading decisions.

These methods can help you maintain rational judgment when PSY signals fail.

Preventing Emotional Trading

When trading, emotions often affect decisions. Common psychological factors include fear, greed, overconfidence, and FOMO (Fear of Missing Out). These emotions easily lead you to close positions early, chase highs and sell lows, or trade impulsively. You can take the following measures:

- Develop a clear trading plan, setting goals and risk management rules.

- Practice mindfulness and stress management, such as meditation and deep breathing, to help you stay calm.

- Set stop-loss and take-profit points to avoid frequent trading due to emotional fluctuations.

- Backtest with historical data to optimize your trading strategy.

These methods can effectively reduce the risks brought by emotional trading.

Beginner Questions

As a beginner, you often worry about how to correctly use the PSY indicator. You may ask: Can you profit by relying only on technical indicators? How to avoid psychological pitfalls? Experts suggest:

- Improve your knowledge and mental resilience before investing, and don’t rely on automated systems.

- Learn to manage fear and greed, which requires continuous learning and practice.

- Identify overconfidence, loss aversion, and herd mentality, enhancing self-awareness.

- Effective stress management helps you maintain clear thinking and make rational decisions.

Through continuous learning and self-reflection, you can gradually improve trading performance, reducing the risk of being swayed by market emotions.

Through Psychological Line identification, you can effectively judge oversold traps and false rebounds, protecting your capital safety.

- You can combine the PSY indicator with tools like trendlines, support, and resistance to improve the accuracy of trading decisions.

- Continuous learning and reflection on practice help you continuously optimize trading strategies.

- Stick to believing in your strategy, cultivate mental resilience, and face market fluctuations with more confidence. As long as you persist in learning and practicing, the market will eventually reward your efforts.

FAQ

Which investors is the Psychological Line (PSY) suitable for?

You can use the Psychological Line to analyze short-term and medium- to long-term market trends. If you like data analysis and sentiment judgment, this indicator is very suitable for you.

What is the difference between the PSY indicator and RSI?

You use PSY to look at the proportion of up days in the market. You use RSI to judge overbought or oversold conditions. Both can reflect sentiment, but their calculation methods are different.

Is the PSY indicator effective in the U.S. stock market?

You can use PSY in the U.S. stock market. Many U.S. investors combine PSY with indicators like MACD to improve judgment accuracy.

How to avoid relying on a single indicator?

You can combine PSY, MACD, trading volume, and other tools. Analyzing the market from multiple perspectives can reduce judgment errors.

How can beginners quickly master the use of PSY?

You can first learn the basic principles of PSY. By conducting more simulated trading and reviewing historical U.S. stock market cases, you can understand and apply it more quickly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Ultimate Guide to Applying for a Schengen Visa in the USA in 2025: Understand the Process, Documents, and Timeline in One Article

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

2026 China Stock Market Investment Guide: Spotlight on 5 Must-Watch Leading Tech Stocks

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.