Duan Yongping 2.90 billion bottom fishing god operation, the next day the US stock market soared! Decoding the options attack and defense behind Duan's bottom fishing, how can ordinary people copy?

Duan Yongping is a god again! 2.90 billion bottom fishing US stocks!

The Nasdaq surged 12% the next day! Can ordinary people learn?

There were quite a few good news this weekend. The US announced the extension of tariff exemptions for some goods, which means there is still more room for negotiation in the future.

In fact, high tariffs, low inflation, and the stability of US stocks and bonds constitute an “impossible triangle”.

As early as a year before Trump first took office, Charlie Munger admitted in an interview that Trump was the last presidential candidate he wanted to see.

When the host asked for the reason, he commented, “This person is extremely arrogant and enthusiastic about showing off.”

Similarly, when it comes to trade policy, Yellen, who served as the chairperson of the Federal Reserve and later became the finance secretary of the previous administration, also publicly criticized the current policy as seriously flawed, calling it tantamount to economic self-harm.

Since many parties are against it, why does Trump still insist on going his own way? Do most US people believe that they can really make the US great again?

With three years and nine months left until the end of his term, all policies may face interruption. Moreover, he has had multiple bankruptcies in the business field, which makes his decision-making ability more questionable.

However, recently, Duan Yongping expressed his opinion on social media that Trump will continue to create turmoil in the next three years and nine months.

Although this “negotiation strategy” is not effective in corporate management, it can be played at will under the power of the president, essentially an extension of personal performance desire. However, he also expressed his gratitude to Trump because the turmoil has created opportunities to buy high-quality companies at low prices.

Last week, Duan Yongping 2.90 billion yuan bottom fishing technology stocks operation, may be due to the pressure of public opinion, he immediately announced the temporary departure from social media.

However, from the perspective of investment logic: measured by a ten-year cycle, the survival time of these tech giants will inevitably far exceed Trump’s political life, so holding them for a long time at a reasonable price is still a wise choice.

However, on the other hand, in the current era of “rising in the east and falling in the west” and “decoupling theory”, large-scale purchases of US stocks are inevitably controversial, especially for public figures.

2.90 billion gambling details

On April 8th, Duan Yongping shocked Capital Markets with a textbook-level options battle.

395 million US dollars (about 2.90 billion RMB) sold tech giant put options (Sell Put), the next day the US stock market rebounded collectively , Apple, NVIDIA single-day surge of more than 7%, perfect verification of its “panic premium” logic.

Now let’s take a look at Duan Yongping’s core bottom fishing list and tactical breakdown.

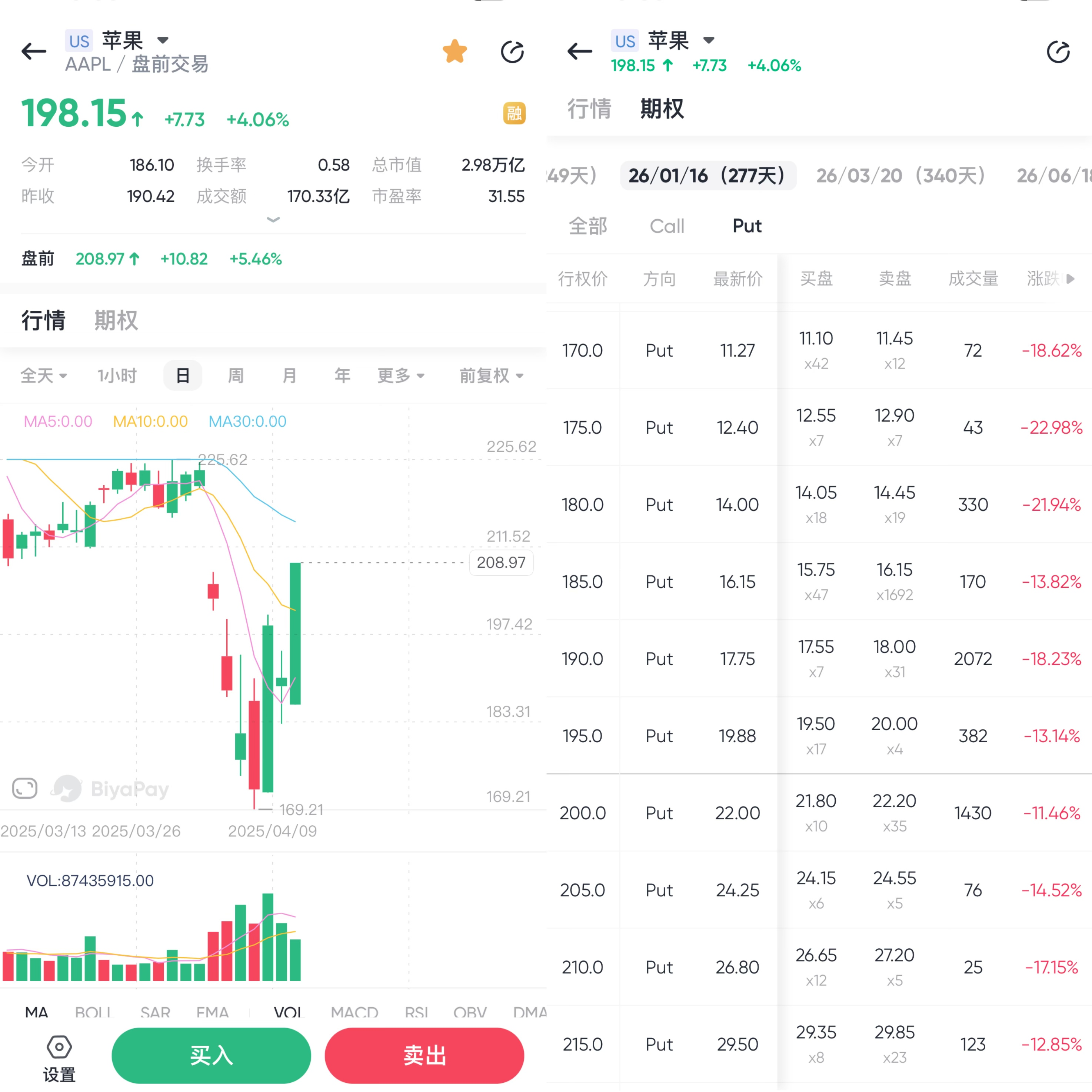

1. Apple (AAPL): The King of Safety Mats

Sell Put stocks due in January 2026 with an exercise price of $175-180, with a premium of up to $20 per share.

Logic: As long as Apple does not fall below $155 within 2 years, it will earn $20 per share; if it falls below, it will be bought at a discounted price, which is equivalent to locking in a “discount coupon” in advance.

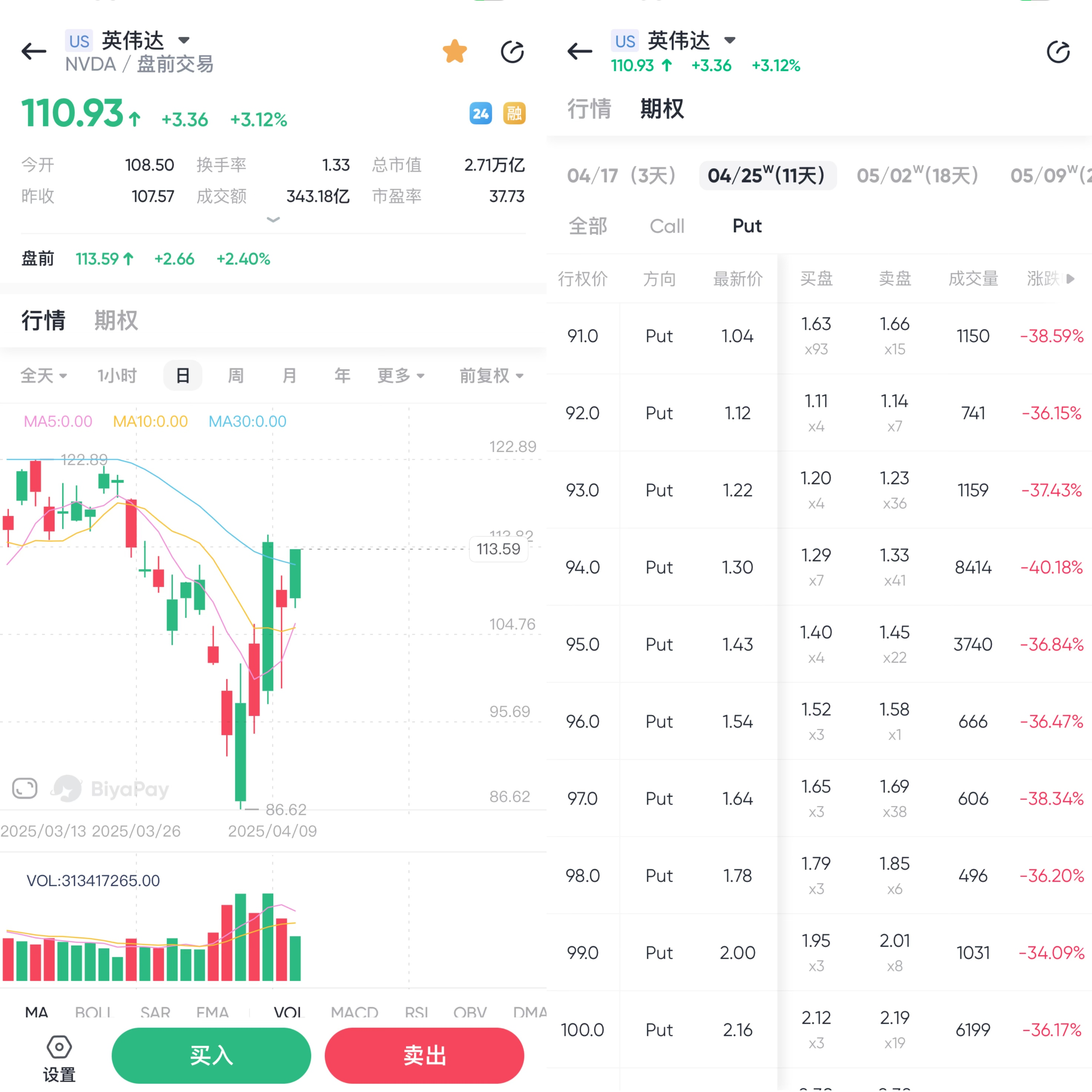

2. NVIDIA (NVDA): Double insurance for AI computing power

• Operation: Sell short-term Put (due in April) to harvest the panic premium, and buy 10,000 shares at $94 per share.

Logic: Short-term profit from volatility, long-term bet on GPU dominance, forming a combination of “option rental + bottom position holding”.

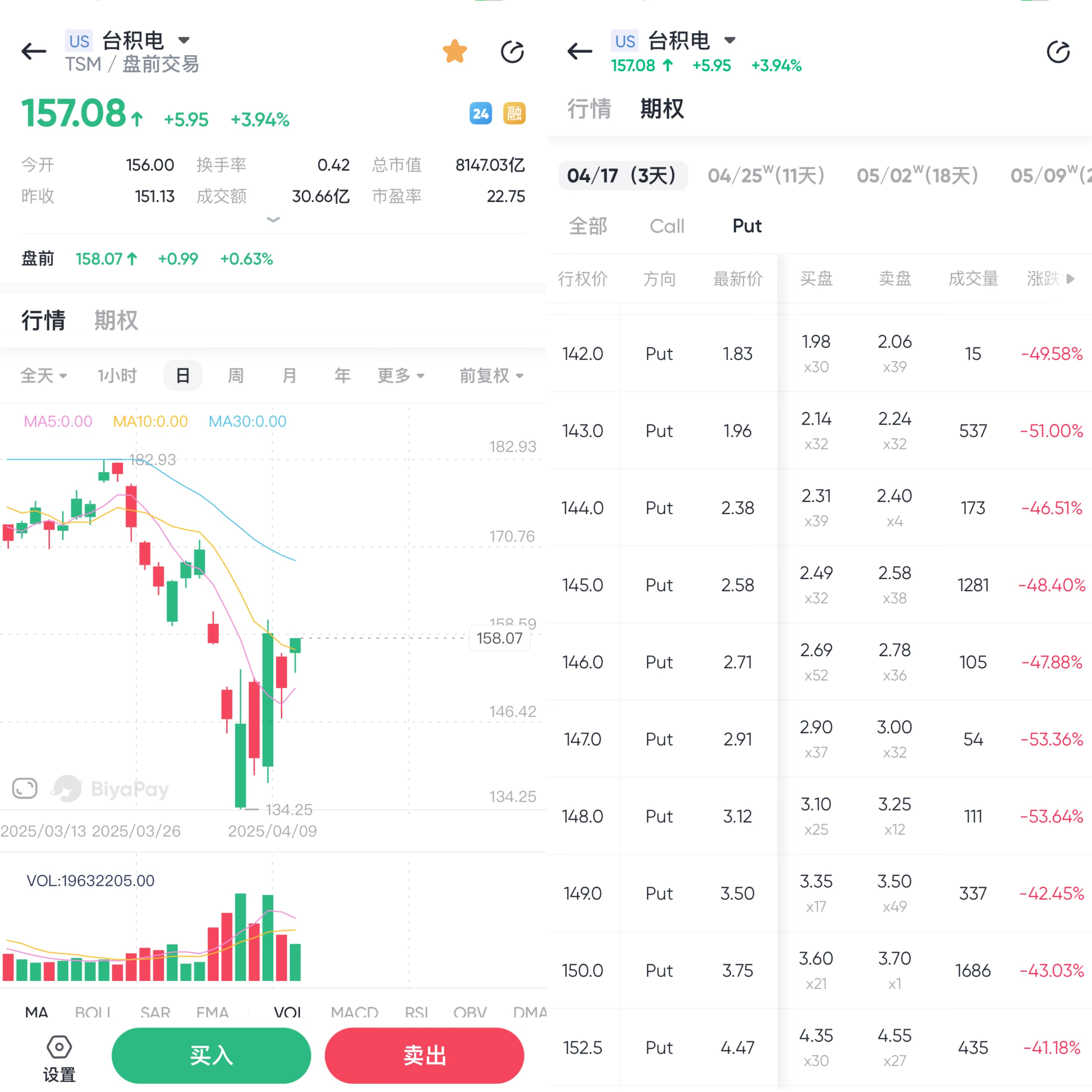

3. TSMC (TSM), Google (GOOG): precise sniper oversold rebound

TSMC: Bet on the $144 Put due on April 11-25, betting on a technical rebound after the chip panic.

Google: Taking advantage of market concerns about advertising business, sell $145 Put, with a premium of $4-7 per share.

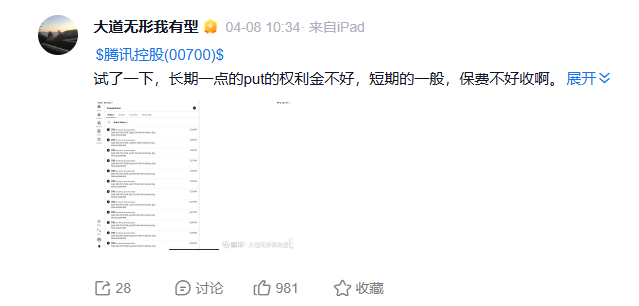

4. Tencent ( 0700.HK ): Hong Kong stock test water temperature

Operation: Sell a small amount of HKD 440 Put, but admitted that “the premium is not cost-effective”, highlighting caution about the liquidity of Hong Kong stocks.

Underlying Logic: Casting a Margin of Safety with “Market Panic”

This operation by Duan Yongping is by no means a simple bottom fishing, but a structured layout based on three core Value Investment principles.

Volatility Arbitrage: The Art of “Rent Collection” in Crisis

Under the extreme situation that NASDAQ plunged 5% in a single day and the VIX panic index soared to 45, the implied volatility (IV) of options skyrocketed. Take Apple’s $175 Put in January 2026 as an example. Duan Yongping sold at $20.15 per share. As long as Apple does not fall below $154.85 (175-20.15) within two years, he can net the premium. This is equivalent to letting the market “prepay insurance premiums” for possible declines, while Duan Yongping waits for tenants (market sentiment) to make mistakes as a “landlord”.

(2) Term mismatch: the attack and defense matrix of long and short-term contracts

Short-term game (expires in April): Some contracts of TSMC and Google have only a few days left to expire, betting on a technical rebound after excessive release of panic.

Long-term layout (expiring in 2026): Apple and Nvidia’s far-month contracts lock in long-term valuation safety cushions to avoid being forced to take over due to short-term fluctuations.

Target screening: Double bets on AI revolution and cash flow dominance

AI computing power core: NVIDIA (GPU leader) and TSMC (3nm process monopoly) directly target AI infrastructure. Duan Yongping admitted that “although I didn’t fully understand it, the Competitive Edge is deep enough”.

Cash flow kings: Apple (free cash flow over $100 billion) and Google (advertising business cash cow) provide downside protection, in line with their principle of “don’t invest if you don’t understand, only bet heavily”.

Strategic Depth: Cycle Crossing from Bearing Position to Heavy Position

This operation forms a perfect closed loop with its “bear position escape” in March.

Escape logic: Warned of overvaluation of US stocks in early March, cleared positions to avoid the 26% plunge of Nasdaq, practicing “risk management is the core of investment”.

Bottom fishing philosophy: When the market falls to a technical support level (such as NVIDIA’s high point retracement of 25%), decisively replace direct buying with options to reduce holding costs while retaining cash initiative.

Should ordinary people copy homework?

Duan Yongping’s operation has sparked two poles of discussion. One is the supporters, who believe that his “sell put + underlying stock” combination is a model of “asymmetric returns”, and the premium income can offset some of the losses from the decline.

The other is a warning school, reminding retail investors of the lack of Duan Yongping’s unlimited cash flow support. If the target plummets below the exercise price, there may be a huge risk of buying.

For investors who support Duan Yongping and want to invest in options, it is very important to choose a suitable platform. A user-friendly platform is not only smooth to use and has accurate values, but also has high security. For example, you can choose a more trustworthy securities firm for investment, such as Jiaxin Wealth Management and Interactive Brokers, which are globally renowned investment securities firms. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities or Interactive Brokers for investment in US stocks and US stock options. Of course, you can also directly invest in options on BiyaPay, choose suitable US stock targets, click on options, and you can see the option chain.

Global Capital Dark War: China Concepts Stock and the Ice and Fire of US Stocks

Duan Yongping’s move coincides with the differentiation of Chinese and American Capital Markets.

- US stocks:

The impact of US tariffs has caused severe fluctuations, but the fundamentals of tech giants have not changed, and funds have borrowed panic to fill the positioning.

- Hong Kong Stock/Class A Shares:

China’s synchronous support, the rebound of technology stocks resonates with Duan Yongping, highlighting the “East-West value consensus in crisis”.

Duan Yongping’s 2.90 billion gamble is essentially a contemporary interpretation of Buffett’s “others fear me, I am greedy”. The inspiration behind his settlement is not in the specific target or amount, but in the revolutionary thinking of “carving a safety margin with options” - when the market is trembling under the shadow of tariffs, true Value Investors are already calculating the pricing error of fear. As Duan Yongping said: “The mountain is still the same mountain, and the beam is still the same beam”, what transcends the cycle is always the intrinsic value of assets and the calm calculation of investors.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Weekly US Stock Index Futures Review and Outlook: What Investors Should Focus On

2025 US Stock Market Opening Hours Guide: What Time in Beijing Time? Daylight Saving and Standard Time Notes

Profit Expansion is the Core Driver: Analyzing the Growth Engines of the US Stock Market in 2026

US Penny Stock Gold Rush: The Most Promising Potential Stocks to Watch in 2026

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.