- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

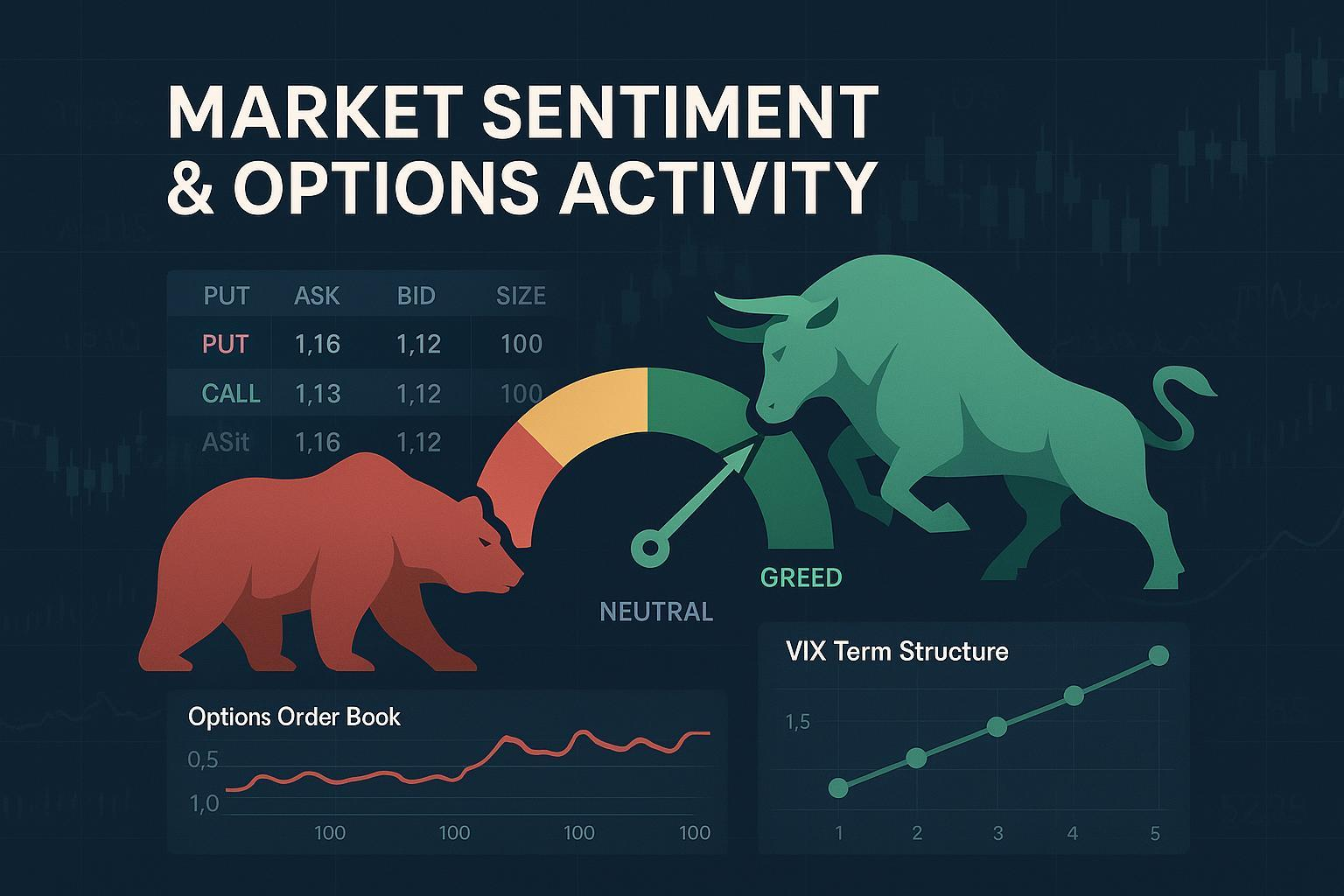

Can the Put/Call Ratio Really Predict Market Reversals? A Deep Analysis of the Value and Traps of Sentiment Indicators

Let’s be clear: The Put/Call Ratio (hereafter PCR) is a great tool for identifying “sentiment extremes,” but it’s not a crystal ball for predicting reversals. In practice, I treat it more as a “weighting factor,” only stepping in or scaling down when it resonates with volatility structure, capital flow/breadth, and price action.

This article breaks down from a practical perspective: differences in PCR metrics, boundaries for setting thresholds, case studies from 2024–2025, common failures and how to avoid them, and a replicable multi-indicator resonance and risk control process.

1. First, Clarify: What Exactly Does PCR Measure (and How It Shouldn’t Be Used)?

- Core Definition: The ratio of put option trading volume (or open interest) to call option trading volume (or open interest) over a specific period. Based on sample scope and metrics, there are three common types: Total, Equity-only, Index; and two common metrics: Volume PCR and Open Interest (OI) PCR. For data sources and metric classifications, refer to Cboe’s options market statistics and historical data portal (official issuer channel, convenient for calculating sequences) at Cboe Options Market Statistics – Historical Data (Cboe, Long-Term Maintenance).

- The “Sentiment” We Focus On:

- Equity-only PCR is more aligned with the sentiment of participants in individual stocks and ETF options, typically more sensitive to retail and speculative activity.

- Index PCR is often used by institutions for hedging, easily “contaminated” by non-directional demands, and thus should not be directly treated as a mirror of public sentiment. This practical viewpoint is often emphasized in A-share market timing studies, see BigQuant’s Practical Interpretation of Options/Futures Indicators (2023–2024 Collection).

- How It Shouldn’t Be Used:

- Treating a single-day extreme value as a “reversal is imminent” hard trigger.

- Blindly applying thresholds across markets (e.g., using US stock thresholds directly for A-shares/Hong Kong stocks).

- Confusing Equity vs. Index or Volume PCR vs. OI PCR, leading to contradictory conclusions.

Tip: OI PCR leans toward structure and medium-term sentiment; Volume PCR is more sensitive to short-term sentiment shocks. The two should not be mixed for the same judgment.

2. Thresholds Are Not “Golden Rules”: Use Historical Percentiles and Rolling Benchmarks Instead of Static Lines

Many textbooks suggest “>1.0 indicates panic, <0.6 indicates optimism” as a rule of thumb, but this is only a starting point. A more robust approach is:

- Benchmarking and Percentile Bands: Calculate the historical distribution of PCR for your market and target (at least 3–5 years), using rolling mean/standard deviation and percentile bands (e.g., 70th/90th/95th percentiles) to define “extremes.”

- Smoothing Period: For markets with high daily noise (especially the US market with heavy 0DTE/short-term options trading), observe 4–20 trading day averages or z-scores.

- Market Differences: Liquidity and participant structures differ for A-share ETF options, Hong Kong index options, and US stock options, so thresholds should be calibrated separately.

A real-world example is that in 2025, MacroMicro’s “Equity-only PCR 4-week average” chart hovered around a low of 0.56, signaling rising market optimism but not necessarily an immediate price drop; a more reasonable approach is to treat it as a sign of “increasing overheating risk” and look for other resonances, see MacroMicro’s US CBOE Equity Put/Call Ratios 4 Week Average Chart (2025 Page).

3. Insights from 2024–2025: Treat PCR as “Supporting Evidence,” Not a Lone Prophet

- US Market: In 2024–2025, Equity-only PCR typically fluctuated around 0.8–1.0; when it significantly deviated (e.g., nearing 0.5–0.6 lows or >1.0 highs), the probability of short-term pullbacks or rebounds increased. However, whether a trend reversal occurred still depended on volatility and capital structure resonance, with the aforementioned MacroMicro 2025 chart providing a sample of an overheated sentiment phase (specific daily extremes should be verified with official data and self-calculated sequences).

- A-shares and ETF Options: Extreme pessimism often saw simultaneous spikes in Volume PCR and OI PCR, alongside rising implied volatility (IV); however, policy, northbound capital flows, and breadth indicators influenced “panic persistence,” making PCR more of a “supporting evidence in bottom-building” that requires confirmation from price action and capital flows.

- Hong Kong Stocks: PCR can be self-calculated using HKEX product and historical data services, but due to liquidity stratification, institutional hedging, and frequent structural events, relying solely on PCR to judge reversal risks is high-risk. Data access is available at HKEX Data Marketplace (Official Historical Data Service, Continuously Updated).

4. Common Failures and Pitfalls (and Actionable Mitigation Strategies)

- Event-Driven “Extreme Lingering”

- Issue: Earnings, macroeconomic, or regulatory events may cause PCR to linger in extreme zones while price trends extend.

- Mitigation: Set a “time stop-loss” and require multidimensional confirmation (VIX term structure, price breadth, capital flows) as a necessary condition.

- Index PCR “Contaminated” by Hedging

- Issue: Institutional hedging with index options distorts the “sentiment meaning” of Index PCR.

- Mitigation: Prioritize Equity-only PCR to observe public/speculative sentiment; use Index PCR only as a supplement and assess expiration cycles and hedging needs. This practical consensus appears in multiple domestic quant and educational materials, see BigQuant’s Practical Views and Case Studies (Recent Compilation).

- Data Metric Confusion

- Issue: Mixing Volume PCR with OI PCR or Equity with Index.

- Mitigation: Build a data pipeline with clearly labeled fields and layered backtesting; ensure all charts specify “metric + sample.”

- Market Maker Gamma/Market Microstructure Noise

- Issue: Short-term 0DTE/weekly expiration options trading amplifies Volume PCR fluctuations, creating noise.

- Mitigation: Use 4–20 day smoothing or event window layering; filter with VIX term structure and price action.

5. Multi-Indicator Resonance Framework: Turning “Sentiment Extremes” into “Higher-Probability Trading Opportunities”

Suggested Four Pillars:

- PCR (Equity-only as Primary): Identify extreme or significantly deviated phases.

- VIX and Its Term Structure: Contango is the norm, while Backwardation often appears during panic periods. VIX calculation methodology is available at Cboe VIX Methodology (Official Technical Document, Long-Term Maintenance).

- Sentiment Surveys and Composite Indicators: AAII’s weekly investor sentiment survey is useful for identifying potential bottoms during extreme pessimism, see AAII’s The Put-Call Ratio: Viewing Market Sentiment… (2025 Article). CNN’s Fear & Greed Index, incorporating PCR among seven dimensions, serves as a supplementary threshold reference, see CNN Fear & Greed Index Methodology Page (Long-Term Page).

- Price and Capital Structure: Market breadth (new highs/lows, advance/decline ratio), volume, and key structural levels (previous lows/highs/gaps).

Practical Judgment Example:

- Increased Bottom Probability: Equity-only PCR in high historical percentiles, rising VIX with a flattening or inverted term structure, positive breadth divergence (waning downward momentum), and extreme AAII bearish sentiment—gradually build positions with spatial and time stop-losses.

- Increased Top Probability: Equity-only PCR in low historical percentiles, low VIX with steep Contango term structure, and overly concentrated gains—scale out or hedge.

6. Cross-Market Practical Notes (US Stocks / A-shares / Hong Kong Stocks)

- US Stocks: Use Equity-only PCR as a proxy for retail/speculative sentiment, calculated from Cboe’s historical volume and OI data to ensure consistent metrics; see Cboe Options Historical Data Portal (Official).

- A-shares: Combine ETF options (e.g., SSE 50 ETF, CSI 300 ETF) and index options. Use Volume PCR for short-term shocks and OI PCR for structure; integrate with implied volatility surfaces, northbound capital flows, and index breadth.

- Hong Kong Stocks: Calculate PCR for HSI/HKCEI options via HKEX data services, noting structural biases from expiration cycles and institutional hedging; see HKEX Data Marketplace (Official Historical Data).

7. Data Acquisition, Monitoring, and Backtesting: A Replicable Implementation Path

- Data Acquisition:

- Cboe historical data or commercial data products to calculate Total/Equity/Index Volume PCR and OI PCR; see Cboe Market Statistics – Historical Data (Official Portal).

- Broker APIs to pull market and options volume/OI data for daily aggregation, e.g., IBKR’s TWS API (multi-language support), official documentation at IBKR TWS API Documentation (Long-Term Maintenance).

- HKEX historical data subscription and processing, see HKEX Historical Data Service (Official).

- Calculation and Standardization:

- Separate Equity-only and Index threads.

- Calculate daily PCR and generate 4/10/20-day rolling averages and z-scores.

- Use a 3–5 year window to calculate percentile bands (70th/90th/95th).

- Feature Synergy:

- Incorporate VIX and VIX futures term structure (near-month vs. next-month spread).

- Add AAII weekly sentiment and CNN Fear & Greed ranges.

- Include price breadth and volume.

- Strategy and Risk Control:

- Use PCR as a weighting signal with “multi-condition confirmation” thresholds.

- Gradual position scaling (e.g., 3–4 tiers).

- Spatial stop-loss (e.g., previous lows/ATR multiples) + time stop-loss (e.g., exit if signal doesn’t materialize within X days).

Code Framework (Pseudo-code for easy adaptation on any platform):

# Data Preparation

df = load_option_data() # Volume and OI, split by Equity/Index, from Cboe/HKEX/Broker API

df['pcr_vol_equity'] = df['put_vol_equity'] / df['call_vol_equity']

df['pcr_vol_index'] = df['put_vol_index'] / df['call_vol_index']

# Smoothing and Percentiles

for col in ['pcr_vol_equity']:

df[col+'_ma4'] = df[col].rolling(4).mean()

df[col+'_z'] = (df[col]-df[col].rolling(252).mean())/df[col].rolling(252).std()

df[col+'_q90'] = rolling_percentile(df[col], window=756, p=0.9)

df[col+'_q10'] = rolling_percentile(df[col], window=756, p=0.1)

# Synergistic Factors

vix = load_vix()

vix_term = calc_vix_term_structure() # Near-month vs. next-month or term structure slope

aaii = load_aaii_weekly()

fg = load_fear_greed()

# Trading Logic (Example)

long_signal = (

(df['pcr_vol_equity'] > df['pcr_vol_equity_q90']) &

(vix.level_rising & vix_term.flattening_or_inversion) &

(breadth_positive_divergence)

)

short_signal = (

(df['pcr_vol_equity'] < df['pcr_vol_equity_q10']) &

(vix.low_and_contango_steep) &

(breadth_narrow_leadership)

)

# Position Scaling and Exit

position = scale_in(long_signal, steps=3, risk_per_trade=0.5/100)

exit = time_stop(days=10) | price_stop(atr=2.0) | signal_mean_revert()

8. Execution Checklist

- Metrics and Samples: Specify Equity-only vs. Index; Volume PCR vs. OI PCR; label covered markets and targets.

- Dynamic Thresholds: Use at least rolling mean ± standard deviation or historical percentile bands; avoid static line transplants.

- Noise Filtering: Observe 4–20 day smoothing and event windows; identify 0DTE and expiration cycle disturbances.

- Multidimensional Confirmation: PCR extremes + VIX and term structure + price breadth + sentiment surveys/composite indicators.

- Trade Execution: Gradual entry/exit, spatial and time stop-losses, conditional withdrawal (when PCR and VIX normalize without price confirmation).

- Review Mechanism: Monthly review of threshold percentiles, win rates, and drawdowns; recalibrate parameters as needed.

9. Scope of Application and Final Advice

- PCR is better suited for identifying “probabilistic zones of sentiment extremes” rather than serving as a “precise reversal trigger” in time.

- Index PCR’s hedging contamination, noise from 0DTE/short-cycle trading, and “extreme lingering” due to event shocks can all render a single indicator ineffective.

- Treat PCR as a weighting factor, not a switch; it offers higher win rates and more controlled drawdowns only when resonating with volatility term structure, price breadth, and sentiment surveys.

Further Reading and Official Resources:

- Cboe Options Market Statistics and Historical Data (Long-term official portal for self-calculating PCR sequences): Cboe Options Market Statistics – Historical Data

- VIX Methodology (Official technical document explaining index construction and meaning): Cboe VIX Methodology

- AAII Investor Sentiment Survey (2025 article interpreting PCR and sentiment): AAII The Put-Call Ratio: Viewing Market Sentiment…

- CNN Fear & Greed Index (Methodology page): CNN Fear & Greed Index

- HKEX Historical Data Service (For self-calculating HSI/HKCEI PCR): HKEX Data Marketplace

- MacroMicro 2025 Chart Page (Equity-only PCR 4-week average): US CBOE Equity Put/Call Ratios 4 Week Average

- Broker API for Data Access and Backtesting Automation: IBKR TWS API Official Documentation

Conclusion: If you treat PCR as a “predictor,” you’re likely to be disappointed; but if you use it as a “confirmation and calibration tool” combined with multidimensional resonance and strict risk control, it becomes a highly cost-effective, stable component in your market timing and position management.

Sentiment indicators like PCR provide critical signals for identifying “extremes,” which serve as important weighting factors in your timing strategy. However, multi-factor strategies often require incremental, small, and high-frequency entries and exits. In this process, excessive commissions and slippage can significantly dilute your strategy’s edge. A platform that ensures low-friction execution and highly efficient capital movement is essential for realizing multi-factor success.

BiyaPay is committed to providing an efficient execution environment for your global trading strategies. You can trade US and Hong Kong stocks on one platform without the need for complex foreign accounts. The advantage of zero commission on contract order placement helps you maximize profit retention when executing incremental entries or rapid exits.

For capital flow, BiyaPay offers real-time exchange rate checks and conversion services, supporting seamless exchange between 30+ fiat currencies and 200+ cryptocurrencies, with remittance fees as low as 0.5%, ensuring same-day transfer and arrival of funds.

Register quickly with BiyaPay today, allowing your rigorous multi-factor analysis to be complemented by convenient, low-cost global trading practices.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.