- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is an ABA number and where can I find it?

Image Source: pexels

You may be wondering what an ABA number is. It is a nine-digit code that identifies U.S. banks, also known as a Routing Number. In the U.S., many of your financial activities rely on this number. For example, over 95% of U.S. employees receive their salaries through direct deposit, a process that requires an ABA number.

Did You Know? In 2021 alone, the total value of ACH transfers, checks, and wire transactions relying on ABA numbers exceeded $1,500 trillion. This highlights its central role in the U.S. financial system.

Key Points

- An ABA number is a nine-digit code that identifies U.S. banks, ensuring your money reaches the correct destination.

- You can find your ABA number on checks, online banking, or bank statements.

- ABA numbers are used for direct deposits, electronic transfers, and domestic wire transfers, among other financial transactions.

- Different types of transactions, such as wire transfers, may require different ABA numbers, so always verify carefully.

- Protect your ABA number and bank account number to prevent fraud.

What Is an ABA Number

Image Source: pexels

Now, let’s dive deeper into what an ABA number is. Simply put, it is a unique nine-digit code specifically used to identify banks and other financial institutions in the U.S.

Definition and Uses of an ABA Number

According to the American Bankers Association (ABA), an ABA number is a unique identifier assigned to a bank. Only financial institutions authorized to hold accounts with the Federal Reserve can receive an ABA number.

Its core purpose is to ensure your funds flow accurately and efficiently. You need it for the following operations:

- Check Processing: Banks use it to identify the paying bank for a check.

- Bill Payments: Whether paying online or setting up automatic payments over the phone, you need to provide it.

- International Remittances: When someone sends money to your U.S. account from another country, this number is needed to locate your bank.

Tip: An ABA number ensures your salary, tax refunds, or other payments are accurately deposited into your account, not someone else’s.

Composition and History of ABA Numbers

You might be curious about how this important number came to be. The American Bankers Association created the routing number system in 1910, and it was officially launched in 1911 to standardize the growing check processing procedures at the time. Today, the Federal Reserve maintains this system, but it is still commonly referred to as the “ABA number.”

This nine-digit code is not a random combination; each part has a specific meaning. Understanding the composition of an ABA number can help you better appreciate it.

- First Four Digits: This part represents the Federal Reserve routing symbol. It indicates the Federal Reserve Bank region, specific check processing center, and state your bank is associated with.

- Fifth to Eighth Digits: These four digits are a unique identifier assigned to your bank.

- Ninth Digit: This is a “check digit.” It is generated through a special algorithm to verify the accuracy of the first eight digits, acting as a built-in error-prevention tool to avoid transaction failures due to input errors.

4 Ways to Find an ABA Number

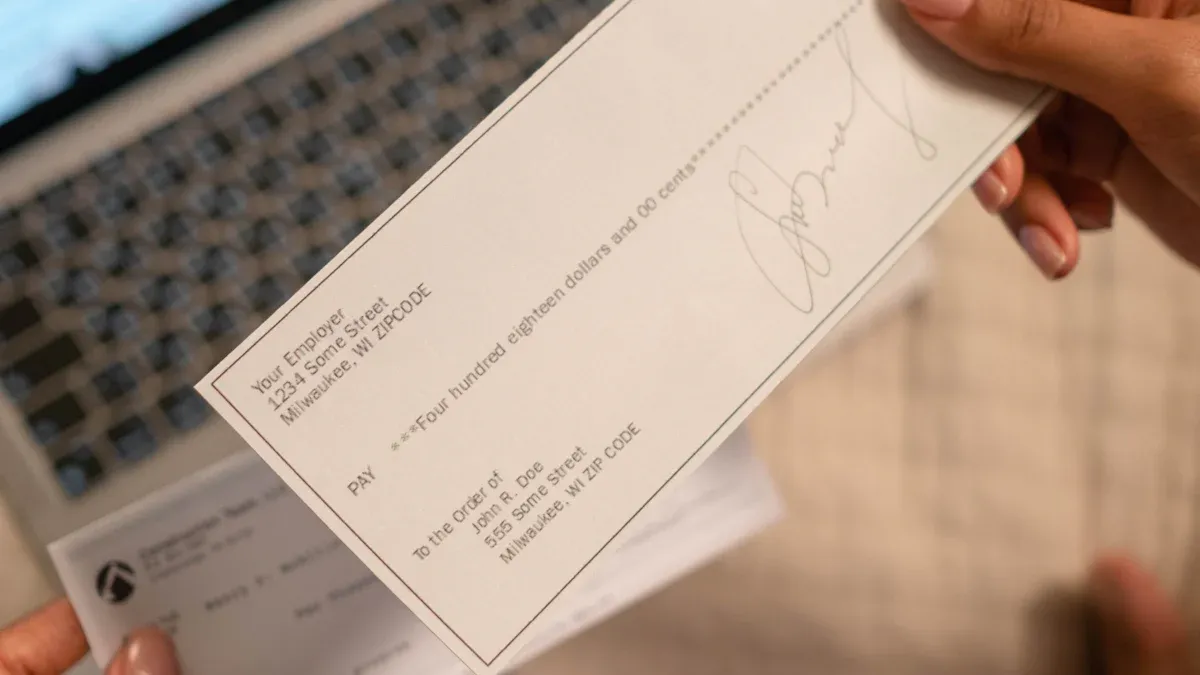

Image Source: unsplash

Now that you understand what an ABA number is, the next question is: where can I find it? Fortunately, there are several simple and quick ways to locate this critical nine-digit code. Here are the four most common methods.

Check Your Personal Check or Deposit Slip

One of the fastest ways to find an ABA number is to look at your personal checkbook. Banks include all necessary information when printing checks.

Pick up a check, and you’ll see a line of numbers printed in special magnetic ink at the bottom. This line is called the MICR (Magnetic Ink Character Recognition) line.

- Bottom Left: The nine-digit number on the far left is your ABA number.

- Middle: The string of numbers following it is your personal bank account number (Account Number).

- Bottom Right: The final number is typically the check number (Check Number).

Thus, you can immediately find it by looking at the bottom left of the check. Some banks also print the ABA number in the same position on deposit slips.

Log Into Your Online Banking Account

In the digital age, logging into your online banking or mobile banking app is the most convenient way to find your ABA number. Almost all banks clearly display this number on your account information page.

The steps are usually very straightforward:

- Log into your online banking account or mobile banking app.

- Select the checking account (Checking Account) or savings account (Savings Account) you want to query.

- Look for options like “Account Details,” “Show Details,” or “Account & Routing Numbers” and click.

Your ABA number and bank account number are typically displayed side by side, making it easy to copy or note down.

Check Your Bank Statement

If you have a paper or electronic bank statement, that’s another great place to find your ABA number.

Banks usually print the ABA number in a prominent position on the statement. You can find it in the upper half of the statement, often near your personal information and bank account number. Carefully check the corners of the statement, and you’re likely to find this nine-digit code.

Visit the Bank’s Website or Inquire Directly

If you don’t have a check or statement on hand, you can also find the ABA number through your bank’s official channels.

Most banks provide their ABA numbers on their website’s “FAQ” or “Help Center” pages. You can also search for “Routing Number” or “ABA Number” directly on the website. Additionally, the American Bankers Association’s official website routingnumber.aba.com offers a public lookup tool where you can confirm a bank’s ABA number by entering its name and address.

Important Note: Verify the Correct Number Before using an ABA number, you must confirm it’s the correct one for your specific transaction.

- Multiple ABA Numbers: Large banks may have multiple ABA numbers due to operations in different states. For example, an account opened in California may have a different ABA number than one opened in New York.

- Different Transaction Types: Banks may assign different ABA numbers for different transaction types. The number used for electronic transfers (ACH) may differ from the one used for domestic wire transfers.

If you’re unsure, the most reliable method is to contact your bank’s customer service directly. Tell them the type of transaction you’re conducting (e.g., setting up direct deposit or receiving a wire transfer), and they’ll provide the most accurate ABA number to ensure your funds arrive safely and on time.

Main Use Cases for ABA Numbers

Now that you understand what an ABA number is and how to find it, let’s look at the everyday financial activities where you’ll need it. This nine-digit code is key to handling many U.S. domestic transactions.

Setting Up Direct Deposit

Setting up direct deposit is one of the most common uses of an ABA number, allowing your salary or government benefits to be automatically deposited into your bank account. When starting a new job, you’ll need to provide your employer with an authorization form containing the following information:

- Your name and address

- Your Social Security Number (SSN)

- The bank name and ABA number

- Your bank account number (Account Number)

Once the employer receives this information, they’ll set it up through the ACH network. Typically, your direct deposit takes one to three business days to activate and complete the first deposit.

Processing Electronic Funds Transfers (ACH)

When you transfer money to a friend through a banking app or pay a bill online, you’re likely using the ACH (Automated Clearing House) network. To complete an ACH transfer, the payer needs the recipient’s ABA number and bank account number.

ACH transfers are known for their efficiency and low cost. Banks process these transactions in batches. Depending on your needs, you can choose different speed options:

| Transfer Type | Processing Time | Approximate Cost |

|---|---|---|

| Standard ACH | 1-3 business days | Usually free or low-cost |

| Same-Day ACH | Same business day | Approximately $1 - $10 per transaction |

Initiating Domestic Wire Transfers

For large, urgent, and secure fund transfers, domestic wire transfers are a common option. Like ACH transfers, initiating a domestic wire transfer requires an ABA number to locate the recipient’s bank.

Special Note: Verify the Wire Transfer Number Many banks provide different ABA numbers for different transaction types. The number used for wire transfers may differ from the one on your check or used for ACH transfers. Using the wrong number could delay or fail the transfer. Before initiating a wire transfer, always log into your online banking or contact your bank to confirm the correct ABA number for “domestic wire transfers.”

Setting Up Automatic Payments

To avoid missing bill payments, you can use your ABA number and bank account number to set up automatic payments. This allows you to authorize merchants to deduct funds from your account regularly. You can set up automatic payments for the following types of bills:

- Utility and internet bills

- Insurance premiums

- Mortgage or rent payments

- Gym memberships or streaming service subscriptions

Setting up automatic payments is not only convenient, some lenders even offer slight interest rate discounts for customers who choose autopay.

ABA Numbers vs. Other Codes

To process financial transactions accurately, you need to understand the difference between an ABA number and other bank codes. Confusing it with a bank account number or SWIFT code could lead to failed or delayed transfers.

Comparison with Bank Account Number

You might confuse an ABA number with a bank account number, but their roles are entirely different. Think of them as an address:

- ABA Number: Like the bank’s “street address,” it tells other financial institutions which bank to send funds to.

- Bank Account Number: Like your “apartment number,” it specifies which account within that bank the funds should go to.

These two numbers are typically used together to complete transactions.

Security Tip: Protect Your Account Information Sharing your bank account number alone poses relatively low risk, but if scammers obtain both your bank account number and ABA number, they could:

- Initiate unauthorized ACH transfers, stealing funds from your account.

- Forge checks or make fraudulent online purchases.

- Use your bank information for identity theft or money laundering.

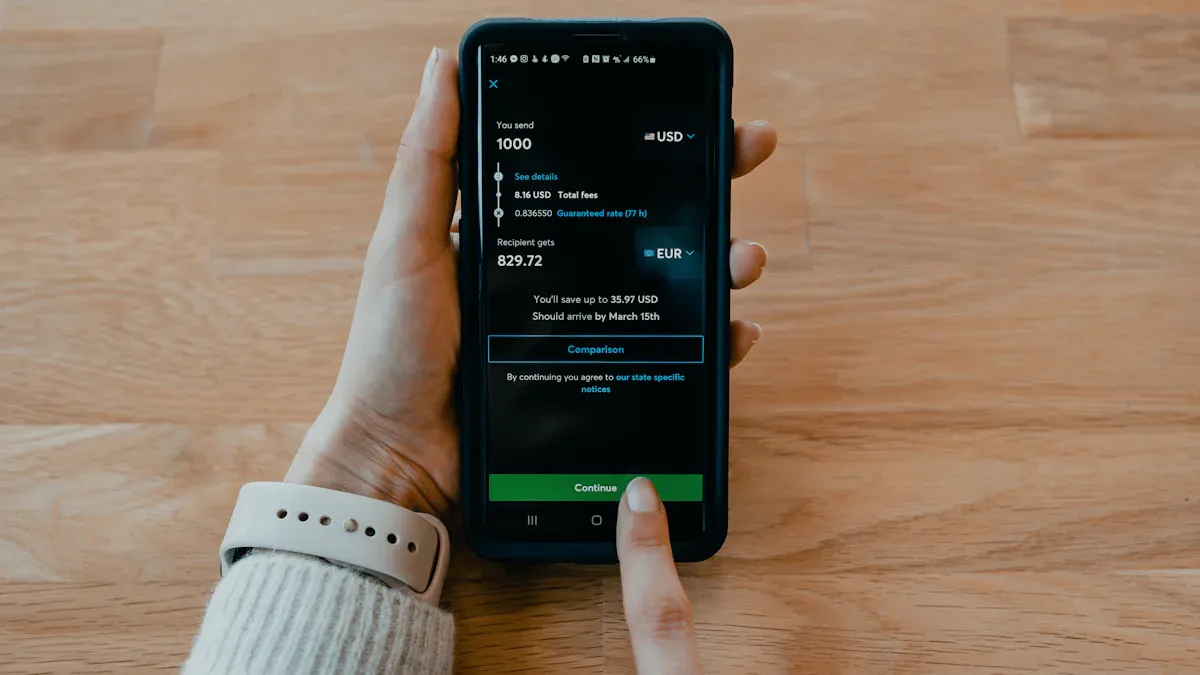

Comparison with SWIFT Code

When handling international remittances, you’ll encounter another important code: the SWIFT code. Its main difference from an ABA number is its scope. Simply put, ABA numbers are for U.S. domestic transactions, while SWIFT codes are for global transactions.

The following table clearly shows the key differences between them:

| Feature | ABA Number (Routing Number) | SWIFT Code |

|---|---|---|

| Geographic Scope | U.S. domestic transactions only | Global international transactions |

| Main Uses | ACH transfers, direct deposits, check processing | International wire transfers, interbank cross-border communication |

| Code Format | 9-digit numeric | 8 or 11-character alphanumeric combination |

| Code Composition | Identifies Federal Reserve region and specific bank | Identifies bank, country, city, and branch |

In summary, if you’re transferring or receiving money within the U.S., you need to provide an ABA number. If you’re sending money to another country or receiving funds from abroad into your U.S. account, you’ll need a SWIFT code.

Now, you should fully understand what an ABA number is: a nine-digit bank code critical for U.S. domestic transactions. You can easily find it on checks, online banking, or bank statements. Always verify carefully before providing it. Using the wrong number, especially confusing wire transfer and ACH numbers, could lead to transaction delays or even financial loss. Protect your account information like you would a key to ensure your funds arrive safely and quickly.

FAQ

Why Do Banks Use Different ABA Numbers for ACH and Wire Transfers?

Banks treat these two types of transactions as different processing channels. Wire transfers are typically used for urgent, large-sum transfers, while ACH is used for routine batch transactions. Using different numbers enhances processing efficiency and security. Therefore, you must confirm you’re using the correct number before initiating a transaction.

Do Savings Accounts Have ABA Numbers?

Yes, savings accounts also have ABA numbers. You’ll need to provide this number when setting up transfers to your savings account from other accounts or receiving direct deposits into it.

Tip: You can find it in online banking or on your bank statement, just like with a checking account number.

What Happens If I Use the Wrong ABA Number?

Using an incorrect ABA number can cause several issues, preventing your funds from arriving smoothly. Common consequences include:

- Transaction delays or outright failure

- Funds returned with potential additional fees

- Funds mistakenly sent to another bank

To avoid trouble, always double-check before transferring.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.